Heavy Equipment Telematics Market

Heavy Equipment Telematics Market by Industry (Construction, Mining, Agriculture), Solution (Asset Navigation & Tracking, Fleet Performance, Diagnostics, Maintenance, Fleet Safety), Hardware, Connectivity, Form Factor and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The heavy equipment telematics market is projected to grow from USD 1.33 billion in 2025 to USD 3.21 billion by 2032, at a CAGR of 13.4%. Rising fuel costs, equipment failures, and equipment thefts are pushing equipment manufacturers/operators to adopt telematics into their fleets. Telematics services help manage fuel efficiency, reduce idle time, and improve uptime, ultimately leading to higher overall efficiency. Moreover, stricter safety regulations in construction and mining sites are making fleet safety and operator monitoring essential, propelling the growth of the market.

KEY TAKEAWAYS

-

BY CONNECTIVITYCellular connectivity will continue to dominate globally as the majority of OEMs offer cellular services in OE-embedded telematics, accounting for a major share of the telematics market. OEM telematics offerings, specifically in construction and agricultural equipment, support the growth of cellular connectivity.

-

BY SERVICENavigation and asset tracking represent the largest service segment during the forecast period. This dominance is driven by the need for real-time visibility, theft prevention, geofencing, and efficient fleet coordination across construction sites, farms, and mines.

-

BY CONSUMERGovernments, as the consumers for electric buses dominate the market, with more than 90% share across geographies. This is driven by large-scale subsidies, fleet mandates, and public transit electrification programs that prioritize municipal and state-run operators.

-

BY HARDWARESensors will lead the market by volume as different sensors are being integrated to collect data on temperature, pressure, proximity, vibrations, etc. TCU will be the most important component as it acts as the central hub for the telematics services.

-

BY INDUSTRYConstruction equipment will lead the market by volume. Mining equipment are estimated to have the highest penetration but lower sales, while agriculture equipment still lags in integrating telematics services.

-

BY REGIONThe Americas are estimated to dominate the global market in terms of OE embedded systems and services. The drive to better manage large, high-value fleets and support cost-efficiency pushes end users to adopt these systems and services on a greater scale than other regional markets.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, ORBCOMM, Autonomy, and Asset Management Group (AAMG) have expanded their partnership. This partnership will enhance AAMG’s capabilities in remote monitoring and automation of mining operations, leveraging ORBCOMM’s satellite connectivity and devices.

Growing fuel expenses, unexpected equipment breakdowns, and rising theft risks are driving manufacturers and operators to integrate telematics into their fleets. These solutions enhance efficiency by optimizing fuel use, cutting idle time, and boosting equipment uptime. At the same time, tighter safety regulations in construction and mining are making fleet safety and operator monitoring critical, further accelerating market adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions in the heavy equipment telematics market indicate the latest and upcoming market trends. They also indicate the trends that were responsible for past revenue generation, as well as upcoming trends that will impact future revenue. This section also highlights the factors that will drive the market growth of off-highway telematics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Enhanced equipment monitoring

-

Technological advancements

Level

-

High initial investment

Level

-

Expansion in emerging markets

-

Increasing adoption of mechanized farming and mining

Level

-

Connectivity issues in remote areas

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Enhanced equipment monitoring

Real-time equipment monitoring is a key driver of telematics adoption in off-highway heavy equipment. It provides contractors and fleet operators with deep visibility into machine operations by tracking location, engine performance, and fuel consumption. Telematics also helps identify inefficiencies such as idling, unauthorized use, and excessive fuel consumption. For instance, Kuchera (Germany), a mining contractor, partnered with ORBCOMM in 2024 to deploy dual-mode IoT terminals to reduce fleet fuel use from ~1,300 to <900 liters, improving uptime from 8.5 to 10 hours/shift, and boosting operator-driven efficiency. Similarly, a 2023 Association of Equipment Manufacturers case study highlighted a partnership between Trimble (US) and CNH telematics, which resulted in a 20% reduction in idling, saving 6,000 gallons of diesel and approximately USD 25,000 weekly, while also reducing CO2 emissions. Overall, telematics delivers lower costs, higher productivity, and greater accountability across off-highway fleets.

Restraint: High initial investment

The adoption of telematics in off-highway equipment is often limited by high upfront and recurring costs for hardware, software integration, and training, which can be a significant burden for medium- and small-fleet owners. The long ROI period further discourages investment, as financial benefits from efficiency and predictive maintenance are not immediate. Although major OEMs offer telematics services free for the first year, a large share of customers, especially single-equipment owners, do not renew paid subscriptions, opting instead for manual monitoring. As a result, only 60–70% of owners continue services after the first year, reflecting price sensitivity and the challenge of proving long-term value.

Opportunity: Expansion in emerging markets

Rapid infrastructure development across the Asia Pacific, the Middle East, Africa, and Latin America is driving demand for large off-highway equipment fleets, boosting the need for digital fleet management tools. Telematics enables operators to monitor fuel, machine health, and maintenance, also in maximizing uptime and efficiency. In response, many OEMs now ship equipment with embedded telematics and cloud platforms, giving customers real-time insights. Rising infrastructure spending combined with built-in connectivity reduces risks for fleet owners while creating growth opportunities for solution providers. For instance, ORBCOMM launched its OGx satellite IoT service in 2024, expanding hybrid telematics solutions for Africa and other remote markets.

Challenge: Connectivity issues in remote areas

A key challenge for off-highway telematics adoption is limited connectivity in remote worksites, such as mines, farms, and rural infrastructure projects, where unstable cellular networks hinder real-time data transfer, diagnostics, and tracking. This reduces the perceived value of telematics, making operators hesitant to invest. To overcome this, OEMs are adopting hybrid connectivity models that combine cellular with satellite links. Platforms such as Caterpillar’s VisionLink, John Deere’s Operations Center, and Komatsu’s KOMTRAX Plus ensure consistent data flow even in remote or mountainous regions. These solutions help enable fleets in remote, unexplored terrains and provide timely alerts. By blending cellular, satellite, and local data offloading, telematics providers are steadily removing connectivity barriers and expanding telematics adoption across remote geographies.

construction and heavy equipment telematics market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Kuchera Mining deployed ORBCOMM dual-mode IoT terminals within the teamUP platform for real-time monitoring of equipment metrics (fuel, load, distance, inclination) | Reduced idling (~30%), fuel savings (~400 liters per truck per shift), increased uptime (from 8.5 to 10 hours) |

|

Terex integrated ORBCOMM telematics to track equipment health, utilization, and location across fleets | Improved service scheduling, reduced downtime, increased customer satisfaction and aftersales revenue |

|

CNH Industrial used telematics to cut down non-productive idling and optimize fleet efficiency | Reduced idling by 20%, saving 6,000 gallons of diesel weekly, lowering CO2 emissions, and saving USD 25,000/week |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The figure outlines the automotive telematics ecosystem, with off-highway telematics encompassing equipment used in mining, construction, and agriculture. Utilizing hardware components such as control units, GPS, and sensors with cellular or satellite connectivity, these systems provide services including fuel management, asset tracking, maintenance, and safety monitoring to enhance efficiency, uptime, and compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Heavy Equipment Telematics Market, By Connectivity

Cellular systems are estimated to be the dominant channel for connectivity during the forecast period. Cellular connectivity currently powers most construction and agricultural equipment due to its wide availability, lower cost, and ability to support real-time data transfer for fuel monitoring, diagnostics, and asset tracking. OEMs today are increasingly integrating LTE/5G modules as standard, making cellular the backbone of large-scale deployments. However, satellite connectivity is gaining momentum, particularly in the mining industry, where operations often extend beyond cellular coverage. For remote quarries and open-pit mines, satellite links ensure uninterrupted data flow for all services.

Heavy Equipment Telematics, By Industry

Construction equipment is expected to dominate the telematics market for heavy equipment by industry during the forecast period. Today, equipment such as crawler excavators, wheel loaders, and graders has high OE installation rates of telematics. This is due to the rising demand for connectivity, asset tracking, and performance management at construction sites. Moreover, financial lending firms and insurance agencies have made it mandatory in various regions for construction equipment to be equipped with telematics. Mining equipment has higher adoption but lags overall sales, and agricultural equipment currently has the lowest adoption of telematics across industries.

Heavy Equipment Telematics, By Hardware

Sensors are poised to be the largest and fastest-growing hardware segment, as equipment relies on real-time data from fuel, pressure, vibration, and safety monitoring to enable predictive maintenance and enhance productivity. Supporting this, the telematics control unit (TCU) serves as the central hub, collecting data from multiple sources and seamlessly connecting it to cloud platforms. Meanwhile, GPS receivers remain critical for location tracking, geofencing, and navigation, especially in construction and agriculture. Together, these three components form the foundation of telematics systems.

Heavy Equipment Telematics, By Services

Navigation and asset tracking represent the largest service segment in terms of value. This dominance is driven by the need for real-time visibility, theft prevention, and efficient fleet coordination across construction sites, farms, and mines. Alongside this, Maintenance and diagnostics are the other major service that plays a vital role in minimizing downtime through predictive insights. Other services, such as fleet management, fuel management, and fleet performance reporting, help reduce idle time, optimize consumption, and maintain fleet safety. Together, these services create a comprehensive telematics ecosystem that enhances uptime, efficiency, and safety in heavy-duty operations.

Heavy Equipment Telematics, By Form Factor

Embedded solutions lead the form factor market segment. Most construction and mining machines sold come with factory-installed telematics systems directly integrated by OEMs. These embedded units provide seamless data capture, better reliability, and enhanced compatibility with equipment diagnostics. In contrast, integrated or aftermarket solutions remain smaller and are gradually declining, as they primarily serve older fleets or mixed-equipment operators who retrofit telematics into existing assets.

REGION

Americas to be largest region in global heavy equipment telematics market during forecast period

North America is estimated to be the largest region for heavy equipment telematics, driven by a strong convergence of industry, technology, and customer demand. The region is home to leading OEMs such as Caterpillar, Deere & Company, and CNH Industrial Americas, which offer telematics solutions as standard in construction, mining, and agricultural fleets. It also hosts major telematics providers that integrate advanced platforms for fleet monitoring, maintenance, and safety management. The market dominance is further fueled by contractors and operators who run high-value fleets and seek to reduce operating costs, improve utilization, and comply with strict safety and emissions regulations. The widespread cellular coverage, rapid rollout of 5G, and strong adoption of data-driven fleet management are other major factors propelling market demand.

construction and heavy equipment telematics market: COMPANY EVALUATION MATRIX

The figure illustrates the competitive landscape of the global heavy equipment telematics market, positioning key players based on their market share and product footprint. In the heavy equipment telematics market matrix, Samsara Inc. (US) (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across major regions. ORBCOMM (US) (Emerging Leader) is gaining traction in the heavy equipment telematics market by partnering with OEMs to deliver factory-installed devices globally, enhancing its connectivity & analytics platform for heavy equipment to improve asset utilization and predictive maintenance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 1.33 Billion |

| Market Forecast in 2032 (Value) | USD 3.21 Billion |

| Growth Rate | 13.4% |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Units), Value (USD Million) |

| Report Coverage | Revenue forecast, Company Market Shares, Competitive Landscape, Growth factors, Trends & Disruption, and Industry wise penetrations |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, Americas |

WHAT IS IN IT FOR YOU: construction and heavy equipment telematics market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Construction Equipment OEM (Japan) |

|

|

| Mining Equipment Manufacturer (Australia) |

|

|

| Agricultural Machinery OEM (US) |

|

|

RECENT DEVELOPMENTS

- June 2025 : At the Beyond 2025 conference, Samsara launched several new AI-powered solutions to enhance safety and efficiency in physical operations. These innovations include the Samsara Wearable, a connected device designed to keep frontline workers safe in various environments. Additionally, the company introduced advanced routing and navigation capabilities for commercial fleets and AI-powered maintenance tools to simplify and minimize repairs.

- May 2025 : Trimble has launched Trimble Materials, an integrated software solution designed to streamline construction material procurement and management. As part of the Trimble Construction One suite, it provides comprehensive capabilities for purchasing, inventory management, and accounts payable. The platform connects field teams, office staff, warehouse personnel, and suppliers through both desktop and mobile applications, enabling real-time communication and centralized data management.

- May 2025 : Topcon has signed a Memorandum of Understanding (MoU) with Vemcon GmbH to broaden the availability of smart 2D-to-3D assist solutions for excavators across EMEA and international markets. This collaboration aims to enhance machine control accessibility, offering contractors more efficient and cost-effective pathways to adopt 3D construction technology.

- April 2025 : HCSS has integrated Samsara’s telematics data into its HCSS Telematics platform. This collaboration enables construction companies to manage their entire mixed fleet, comprising both heavy equipment and on-road vehicles from a single, centralized dashboard.

- April 2025 : ACTIA launched its Digital Ecosystem, a secure, end-to-end solution that optimizes the entire machine lifecycle, from manufacturing and testing to maintenance and operations. This ecosystem enables manufacturers to enhance machine performance, availability, and profitability while transforming their role from equipment suppliers to strategic, connected partners.

- March 2025 : Topcon launched its Capture Reality mass-data solution suite, featuring advanced laser scanners, modeling software, and real-time GNSS workflow tools. The company also highlighted its latest construction technologies, including the MC-Max systems for excavators and paving, the Layout Navigator and MC-Mobile for compact machines, as well as precision survey instruments such as the HiPer XR GNSS receiver and the GT robotic total station.

- Januray 2025 : CalAmp is expanding its presence in Europe by opening a dedicated French subsidiary under its LoJack International business unit. This move brings advanced stolen-vehicle tracking technologies combining VHF, GSM, and GPS to France, aiming to enhance vehicle security and telematics solutions in a market facing rising vehicle and equipment theft.

Table of Contents

Methodology

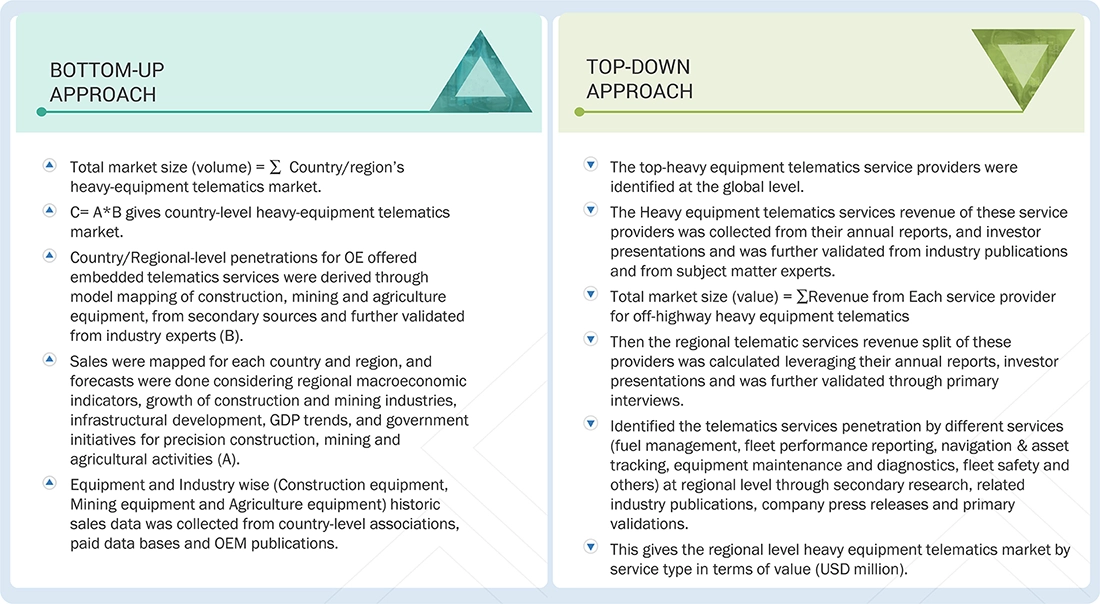

The study encompassed four primary tasks to determine the present and future scope of the heavy equipment telematics market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the supply chain corroborated and validated these findings and assumptions. The complete market size was estimated by using the bottom-up and top-down methodologies. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

Secondary sources for this research study included annual reports & investor presentations of key off-highway OEMs, press releases, news articles, industry associations and trade bodies, and financial reports of telematics providers. Secondary data were collected and analyzed to determine the total market size, which was further validated through primary research.

Primary Research

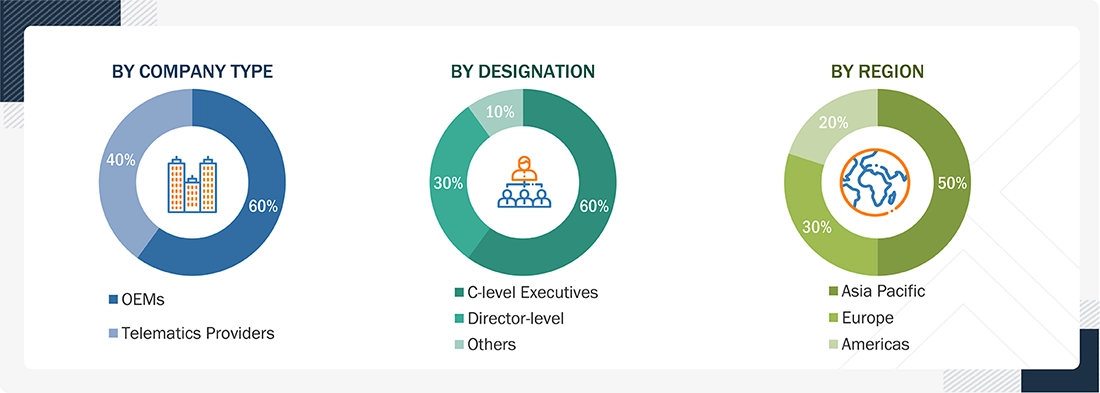

Extensive primary research was conducted following an understanding of the heavy equipment telematics market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs/operators) and supply (service providers) sides across major regions, namely Asia Pacific, Europe, and the Americas. Approximately 60% and 40% of primary interviews were conducted with the OEMs and telematics providers, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. During the canvassing of primaries, various departments within organizations, including sales, operations, and marketing, were covered to provide a holistic perspective in the report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, led to the findings described in the remainder of this report.

Note: Company tiers are based on the supply chain; company revenue is not considered. OEMs include major

off-highway OEMs serving the construction, agriculture, and mining industries, and Telematics Providers comprise key suppliers of telematics services.

*Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the heavy equipment telematics market and other dependent submarkets. The bottom-up and top-down approaches were used to estimate and validate the size of the heavy equipment telematics market.

Market Size Estimation Methodology- Top-down approach

Global heavy equipment telematics service providers were identified, and their revenue data was sourced from annual reports, investor presentations, industry publications, and expert interviews. Based on this, the total market size was calculated by combining off-highway heavy equipment telematics revenue from each service provider.

Regional revenue splits were determined using company financials and validated through primary research, which gave the regional telematics market. Further telematics penetration by service type (e.g., fuel management, fleet performance, navigation, diagnostics) was mapped at the country/regional level using both secondary and primary sources. This provides the country/region level market size for heavy equipment telematics by service type in USD million.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach is used to analyze the heavy equipment telematics market by industry & form factor segments. Country-wise historical sales data by equipment types within construction, mining, and agriculture was sourced from country/regional level associations, paid databases, OEM publications, and other secondary sources. These sales were forecasted based on macroeconomic indicators, industry growth, GDP trends, and government initiatives per region. Furthermore, the penetration rates for embedded & integrated telematics services were derived and validated through a mapping of construction, mining, and agricultural equipment markets. Multiplication of country-level equipment sales with embedded & integrated adoption rate would give the country-level heavy equipment telematics market, by industry & form factor, in terms of volume. The summation of this derived country-level market gave the regional and global demand for telematics by industry and by form factor.

Heavy Equipment Telematics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall size of the equipment that complies with telematics through the aforementioned methodology, the market was divided into several segments and subsegments. Data triangulation is a research technique used to increase the validity and reliability of findings by cross-validating data from multiple sources or methods. This technique involves the use of multiple data sources, such as surveys, interviews, observations, and secondary data, to confirm and corroborate the findings obtained from each source. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the supply and demand sides.

Market Definition

Telematics services in heavy off-highway equipment refer to the use of GPS, sensors, wireless networks, and onboard computing systems to collect, transmit, and analyze real-time data from heavy machinery. These services enable operators and fleet managers to monitor machine location, fuel use, engine health, safety conditions, and productivity, while also supporting predictive maintenance and compliance. By combining telecommunications with data analytics, telematics provides actionable insights that help optimize fleet performance, reduce downtime, improve safety, and maximize the return on high-value equipment investments.

Stakeholders

- Off-Highway Equipment Telematics Software Suppliers

- Companies Operating in the Telematics Ecosystem

- Off-Highway Equipment Manufacturers

- Off-highway Equipment Telematic service providers

- Hardware providers

- Fleet operators & rental companies

- Internet service providers

- Associations, Forums, and Alliances Related to Off-Highway Equipment

- Off-Highway Industry Investors

- Government Agencies and Policy Makers

Report Objectives

-

To segment and forecast the heavy equipment telematics market size in terms of volume & value:

- By Industry (Construction Equipment, Mining Equipment, Agriculture Equipment)

- By hardware (telematics control units, GPS receivers, and sensors)

- By form factor (embedded and integrated)

- By connectivity (satellite and cellular)

- By equipment category (new sales and existing fleet)

- By service (fuel management, fleet performance reporting, navigation & asset tracking, equipment maintenance and diagnostics, fleet safety, and others)

- By region (Americas, Europe, and Asia Pacific)

- To provide detailed information about the major factors influencing market growth (drivers, challenges, restraints, and opportunities).

- To track and analyze competitive developments, including product launches, mergers and acquisitions, and other key activities by industry participants.

- To strategically analyze the market with supply chain analysis, revenue analysis, and regulatory analysis in the heavy equipment telematics market.

- To examine the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Heavy equipment telematics market, by service at the country level (for countries covered in the report)

- Fuel management

- Fleet performance reporting

- Navigation & asset tracking

- Equipment maintenance and diagnostics

- Fleet safety

- Others

Company Information

- Profiles of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Heavy Equipment Telematics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Heavy Equipment Telematics Market