Cooling Fabrics Market

Cooling Fabrics Market by Type (Natural, Synthetic), Textile Type (Woven, Nonwoven, Knitted), Application (Sports Apparel, Lifestyle, Protective Wearing), and Region - Global Forecast to 2030

Updated on : December 16, 2025

COOLING FABRICS MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cooling Fabrics Market was valued at USD 2.70 billion in 2024 and is projected to reach USD 4.08 billion by 2030, growing at 7.1% cagr from 2024 to 2030. Global warming and climate change have increased the demand for temperature-regulating fabrics, especially in hot and humid climates. Rising sportswear and fitness industries have surged the demand for moisture-wicking and breathable textiles for improved athletic performance. Phase-change materials and smart textiles also add functionality to the fabrics. Growing applications in medical textiles and protective wear are significant in the health and occupational safety sectors. The ecologically conscious consumer will choose products that are good for them, environmentally friendly, and recycled fabrics: urbanization, lifestyle changes, and higher disposable incomes fuel demand for comfort and fashion. Higher affordability and technological integration have increased accessibility and adoption across all sectors. Advanced textile innovations and government initiatives boost the growth of the cooling fabrics market. These combined trends indicate robust growth in cooling fabric applications across sports, healthcare, lifestyle, and industrial domains.

KEY TAKEAWAYS

-

BY TypeThe cooling fabrics market comprises Natural cooling fabrics, Synthetic cooling fabrics. Synthetic cooling fabrics hold the largest market share because they offer better cooling performance, durability, and affordability than natural fabrics.

-

BY Textile TypeTextile Type includes Woven, Nonwoven, Knitted. Knitted cooling fabrics hold the largest market share because their flexible structure enhances breathability, comfort, and moisture management, making them ideal for activewear and sports applications.

-

By TechnologyTechnology includes Active Cooling Fabrics, Passive Cooling Fabrics. The growth of the cooling fabrics market is driven by increasing use of active cooling fabrics that regulate temperature through technology and passive cooling fabrics that improve airflow and heat release for better comfort.

-

BY ApplicationApplication includes Sports apparel, Lifestyle, Protective wearing, Other Applications. Sports apparel dominate the cooling fabrics market due to rising demand for high-performance, sweat-resistant clothing that enhances comfort and athletic performance.

-

BY REGIONCooling fabrics market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. North America holds the largest market share for cooling fabrics due to strong demand for advanced sportswear, high consumer awareness of performance textiles, and the presence of leading apparel brands.

The growth of the global cooling fabrics market is primarily driven by rising demand for advanced textiles that enhance comfort, regulate body temperature, and improve performance across various end-use industries. Synthetic cooling fabrics account for the largest share due to their superior durability, affordability, and ability to provide effective moisture management. Knitted fabrics dominate by textile type as their flexible structure allows for better breathability and comfort, making them ideal for sports and activewear. The sports apparel segment leads the market, supported by the growing popularity of fitness activities and consumer preference for high-performance clothing. Technological developments in both active and passive cooling fabrics are further driving innovation, with active fabrics providing temperature regulation through moisture or phase-change mechanisms, and passive fabrics improving ventilation and heat dissipation. North America remains the leading regional market, driven by high consumer awareness, technological advancements, and the strong presence of leading sportswear brands.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on end-user industries in the cooling fabrics market is being shaped by rapid innovation in textile technologies, rising consumer expectations for comfort and performance, and the growing emphasis on sustainable material development. Increasing demand for breathable, moisture-wicking, and temperature-regulating fabrics across sportswear, lifestyle apparel, and protective clothing is driving advancements in fiber engineering, fabric construction, and finishing techniques. End users are seeking materials that deliver enhanced cooling efficiency, durability, and comfort while aligning with eco-friendly manufacturing practices. At the same time, the adoption of smart and functional textiles integrating phase-change materials, nanotechnology, and bio-based fibers is expanding the application landscape. These trends are transforming competitive dynamics, encouraging collaboration between fiber producers, apparel brands, and technology providers, and creating new growth opportunities within the global performance and cooling textiles ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

COOLING FABRICS MARKET DYNAMICS

Level

-

Increasing demand for comfortable clothing

-

Rapid urbanization and improved standard of living

Level

-

High cost compared to regular fabrics

-

Limited consumer awareness

Level

-

Increasing use in medical and healthcare sectors

-

Development of sustainable and recyclable cooling fabrics

Level

-

Low market penetration

-

Competition from alternative technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for sportswear clothing and urbanization and surge in standard of living

Athletes need clothing to manage their body temperatures during athletic, outdoor, or exercise activities. The first benefit of cooling fabrics is control of body temperature. They allow the body to allow heat to exit, enhancing comfort and cooling one's body. These fabrics have a moisture-wicking ability, wherein sweat is drawn away from the skin and evaporates rapidly. Such action helps keep the body dry, preventing its wet and unpleasant condition and avoiding the chances of irritation or chafing due to excessive moisture. These fabrics are also highly permeable; they facilitate air penetration. This is crucial for ventilation and smooth air movement in warm, humid conditions. Improved breathability prevents sweat and odor buildup, leaving the wearer cool and dry. Therefore, body temperature regulation, moisture level control, and ventilation in cooling materials make them an excellent alternative to conventional fibers in terms of comfort and highly appealing to end-users, resulting in the growth of the cooling fabrics market. The increasing standard of living and surge in urbanization may be positive drivers for the cooling fabrics market. According to the United Nations, the global human population reached 8.0 billion in mid-November 2022, an increase from approximately 2.5 billion individuals in 1950, with an additional 1 billion people added since 2010 and 2 billion since 1998. This growth can mainly be attributed to urbanization and accelerated migration, which enhance the living standards. As living standards improve, disposable income is increased. This can be used on lifestyle products, which include apparel. Consumers spend money on high-quality, functional, comfortable clothing- such as cooling fabric items. The People Research on India's Consumer Economy, more loosely known as the PRICE survey, relies on primary data to claim that the middle class is the fastest-growing major category of Indians in both percentage and absolute terms. It is thus expected to emerge as the largest of the consumer groups capable of those highest expenditure levels. The middle-class population grew by 6.3% between 1995 and 2021. The middle class comprises more than 31% of the population, expected to rise to 38% in 2031 and reach 60% in 2047. This growth trend will help raise consumer purchasing power, which may induce further investment and job creation for the country's overall economic growth. With the assistance of more money, there can be a high demand for cooling fabrics along with expensive technological clothing.

Restraint: High price of cooling fabrics compared to regular fabrics

The cost of cooling fabrics varies depending on the type of fabric, technology applied, manufacturing processes, consumer preferences, global trade patterns, and market demand. Most cooling fabric manufacturers need help to achieve a sustainable profit margin because of fluctuating raw material prices, which affects their financial performance. Oil prices play a critical role in the price dynamics of petroleum products globally. Excess supply or scarcity of crude oil influences its prices, causing market instability to the extent that many producers try to cut back on production to maintain the price of the raw materials. Polyester, the chemical derivative of petroleum used for cooling fabric, provides 75% of the fabric value in India and around 55% in countries such as the US, Japan, and Germany. According to Goldman Sachs, the oil price is expected to rise to over USD 107 per barrel by the end of 2023 from about USD 84 per barrel during the first quarter. This would push up the input cost for finished products, which may be passed on to the customers or lower the profit margin. In this regard, efficiency in supply chain management is a challenge in controlling the surge in input prices. Consequently, oil price fluctuations create an interlocking effect on final product prices. Normal cooling fabrics generally possess moisture-wicking and breathable properties, making them slightly costlier than the other advanced cooling technologies. The basic cooling fabrics are primarily used for sportswear, activewear, and casual wear. The price is moderate and slightly higher than that of the usual fabrics, as this depends on the brand and market competition. On the other hand, cooling fabrics that apply advanced technologies, such as phase change material or microencapsulation, are usually more expensive. These materials offer better cooling efficiency and longer thermal control. Special materials, technologies used in the manufacturing process, and patents explain their high prices. Cooling fabrics are often used in specialty products, including high-performance sports and medical textiles for particular outdoor equipment. Since their price is much higher than that of standard fabrics, it may be out of range for many customers. Overcoming cost barriers and enhancing the cost-effectiveness of cooling fabrics will be necessary for broader market penetration.

Opportunity: Rising applications of cooling fabrics in the medical and healthcare sector

Cooling fabrics have recently registered a sharp hike in their usage in the medical and healthcare sectors, mainly due to their multiplicity of uses. The cooling fabrics are placed inside those wound dressings to cool out the parts of the human skin affected by burn, fire, or any other form of skin damage. Cooling fabrics provide a pleasant cooling experience that can significantly eradicate agony and pains, inflammation, etc., besides generally speeding up the curing process. Using cooling fabrics dressing can be the most effective in case of burn. It provides much-needed relief from the scorching heat of burns and helps individuals with proper pain management even after being cured. Cooling fabrics manufacture medical gowns and other types of health clothes. These new-age materials play a vital role in keeping the body cool for the patients and the doctors, mainly when surgeries occur or hours are spent in protective clothing. The reduction of overheating and discomfort is significantly reduced, making the comfort of the patients as well as doctors. Therefore, healthcare professionals can focus more on their essential tasks without getting distracted by the discomfort caused by heat buildup. Hence, in the medical and healthcare sectors, cooling fabrics are specifically used to improve patients' comfort, help them actively heal, and ultimately result in high-quality care. Thus, cooling fabrics possess properties that make them capable of creating a cooling effect, efficient moisture management, and temperature control; all these aspects play important roles in enhancing the comfort and recovery of patients in diverse healthcare environments.

Challenge: Limited market presence

It makes it challenging for consumers to genuinely appreciate all that many cooling fabrics provide them, specifically for those consumers who need more information in decision-making. Instead, such a specialty use tends towards such favors by cooling fabrics. However, most of its positioning would, by all means, restrict this reach toward reaching a much larger pool and more likely consumers, but not actually. To effectively address and conquer this limitation, there will be a need to develop further and advance their educational and awareness content, as well as the various activities presented, depicting the numerous benefits and different applications of cooling fabrics. To achieve that, strategic partnerships with other companies will help augment their presence in physical stores and online e-commerce platforms. Similarly, social media channels can help influence people to spread the word, or conversely, creating suitable and enjoyable educational material will educate and inform would-be consumers about the benefits of cooling fabrics. When well instituted and then appropriately executed, this system will provide consumers with the type of assistance they will need to make well-informed and educated decisions that can guide them toward acquiring these modern, innovative, and beneficial textile products.

Cooling Fabrics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops patented chemical-free cooling fabric technologies that enhance moisture transportation, moisture evaporation, and regulated drying. The company supplies performance fabrics for sportswear, workwear, and medical textiles, offering sustainable temperature-regulation solutions. | Provides chemical-free, long-lasting cooling performance, enhances wearer comfort, and supports sustainable textile manufacturing through energy-efficient processes. |

|

Manufactures functional cooling and moisture-management fabrics made from advanced polyester and nylon blends. The company integrates fiber-level cooling technologies for sportswear, outdoor apparel, and industrial textiles, serving major global brands. | Ensures durability, breathability, and superior cooling efficiency, while offering cost-effective large-scale production for high-performance applications. |

|

Produces high-performance fiber-based materials used in apparel and technical textiles, with a focus on sustainable cooling solutions using natural and synthetic fiber blends. Its nonwoven and specialty fabrics enhance airflow and temperature regulation. | Delivers enhanced breathability and thermal comfort, reduces environmental footprint, and supports eco-friendly cooling fabric innovation. |

|

A leading manufacturer of premium nylon 6.6 fibers featuring advanced thermal technologies such as NILIT Breeze for cooling and NILIT Heat for insulation. These fibers are widely used in activewear, intimate apparel, and outdoor performance wear. | Offers lightweight, durable, and temperature-responsive fibers that provide consistent cooling comfort and improved wearer performance. |

|

A global leader in performance textiles known for its proprietary innovations such as Polartec Delta, designed to optimize moisture dispersal and cooling during exertion. The company also emphasizes sustainable production through recycled materials. | Provides effective temperature regulation and rapid moisture evaporation, ensuring comfort in active conditions while supporting sustainability and durability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

COOLING FABRICS MARKET ECOSYSTEM

An ecosystem map depicts the network of enterprises operating in a particular market, such as cooling fabric producers, distributors, and end-user industries involved in the distribution and supply of cooling fabrics. The entities in the ecosystem map mutually impact one another, resulting in rivalry and collaboration that is vital for existence.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

COOLING FABRICS MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cooling Fabrics market, By Application

Protective wearing is the fastest-growing product in the global cooling fabrics market as the demand for heat stress management and worker safety surges across various industries. Most industrial and construction employees will be exposed to high-temperature conditions, which makes protection provided through cooling fabrics in this wear preventive to heat-stress illnesses. These have higher breathability and moisture-wicking properties. This improves comfort and reduces fatigue brought about by prolonged heat exposure. An increase in construction, mining, and manufacturing industries that have staff exposed to harsh climatic conditions has increased demand for cooling protective clothing materials. Moreover, legal enforcement and concerns over safety concerning worker protection are pushing companies to invest in sophisticated temperature-control textiles. It is increasingly used to introduce cooling fabrics into PPE, especially in the military and emergency response fields, where protection against the sun may play an important role in combat and disaster missions. Concern for employee health and growing awareness of protective apparel add further growth impetus to the market. New technologies that brought the phase change materials to fabrics were incorporated, getting to the limelight cool clothing that effectively brought up protective wear. With increasing work wear that provides a means of reducing or offsetting occupational hazards, these specific fabrics are gaining momentum and thus fueling rapid growth in the cooling fabrics market for protective wearing.

Cooling Fabrics market, By Type

Over the forecast period, natural cooling fabrics will be the fastest-growing segment of the cooling fabrics market due to increased consumer demand for eco-friendly and sustainable products. Often comprised of cotton, linen, and bamboo fibers, these fabrics come with superior breathability and moisture-wicking properties that are the best way to keep anyone comfortable in elevated temperatures. The growing environmental awareness among consumers, who demand products to be biodegradable and renewable, has seen the demand for natural cooling fabrics increase. Technology in textiles concerning natural fibers has developed so much that these now compete with their synthetic counterparts in terms of durability and efficiency in cooling. An increasing interest in health and wellness, coupled with growing requirements for lightweight and skin-sensitive fabrics, is driving growth in this market segment. Incrementally, the sportswear, casual apparel, and home textile industries are incorporating natural cooling fabrics in reaction to consumer demand for comfort and sustainability. Also, favorable government policies to reduce carbon emissions promote this industry. The growth in disposable incomes and the shift in lifestyle trends in developing regions co-occur, making premium, natural-based cooling fabrics unavoidable. These factors, combined with constantly improving manufacturing technologies, call for natural cooling fabrics to create market expansion for the overall market in cooling fabrics.

Cooling Fabrics market, By Textile Type

The knitted fabrics segment in the cooling fabrics market would grow at the highest compound annual growth rate during the forecast period with superior properties and broad applicability. Knitted fabrics are known to be soft, flexible, and highly breathable, making them a perfect choice for all applications requiring comfort and performance. Structural design improves air and moisture passage, further strengthening the cooling effects and making them popular in activewear, sportswear, and outdoor apparel. The primary stimulus driving the acceptance of knitted cooling fabrics is increased requirements for light and high-performing materials by the fitness and sports industries. Technological advances in knitting technologies also create further avenues for introducing cooling agents and functional fibers, enhancing performance. In addition, knitted fabrics are relatively inexpensive and cheap to manufacture, further increasing the market's growth. An increasing awareness of sustainable and innovative textile usage, whether for casual wear or medical purposes, poses a challenge to the industry. Increasing participation in sports activities and other modern fitness trends in developing economies has hugely increased the demand for such fabric necessities. Consumer demand for knitted apparel's comfort and functionality has contributed positively to the rise in textile demand. Knitted clothes represent highly versatile and all-elusive elements that can fuel this industry further. Thus, growth in the need for clothing that emphasizes comfort and performance under different environmental conditions could worsen this trend.

REGION

Asia Pacific region will register the fastest CAGR during the forecast period for the global cooling fabrics market.

Several emerging factors are expected to register the fastest CAGR in the global cooling fabrics market during the forecast period in the Asia Pacific region. Rapid industrialization and urbanization in countries such as China, India, and Southeast Asia create a strong demand for cooling fabrics in workwear and uniforms, especially in high-temperature industries. The growing interest in sports and fitness-related activities in the region fuels the adoption of cooling textiles in sportswear and activewear. Also, an expanding middle class with enhanced disposable incomes across the region leads to increased demand for premium, high-performance textiles. The scorching and sweltering climate of several areas of Asia adds to the urgency of cooling solutions in most outdoor activities and everyday apparel. The growing e-commerce websites in Asia have allowed consumers to reach cooling fabrics from urban and rural backgrounds. Moreover, sustainability and innovation regarding clothes in countries like Japan and South Korea are becoming critical for governments. Governments are encouraging the production and consumption of cooling materials. Moreover, increased awareness of heat stress among the public and the requirement for guard clothing in industries are pushing this market. The region is experiencing fast-paced growth in cooling fabric technology due to increased investment in textile manufacturing and technological developments. In addition to the above factors, another boost for cooling fabrics is the impact of fashion trends in the leading markets such as China, Korea, and India seeking modern and multi-functional clothes.

Cooling Fabrics Market: COMPANY EVALUATION MATRIX

In the cooling fabrics market, Ahlstrom (Star) holds a leading position with its advanced portfolio of fiber-based materials engineered for thermal comfort, breathability, and sustainability. Leveraging its expertise in specialty fibers and eco-friendly manufacturing, Ahlstrom delivers high-performance cooling fabrics that cater to sportswear, outdoor, and technical textile applications. The company’s strong R&D foundation and commitment to sustainable innovation have solidified its reputation as a trusted global supplier in performance textiles. HeiQ Materials AG (Emerging Leader) is rapidly expanding its market presence through its proprietary textile finishing technologies, including HeiQ Smart Temp and HeiQ Cool, which provide dynamic cooling and moisture management. By combining material science with scalable commercialization, HeiQ is strengthening its foothold across activewear, athleisure, and medical textile segments. Other prominent players are focusing on expanding production capacities, integrating sustainable materials, and developing hybrid cooling technologies to meet the growing global demand for high-performance, temperature-regulating fabrics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

COOLING FABRICS MARKET PLAYERS

COOLING FABRICS MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 2.48 BN |

| Market Forecast in 2030 | USD 4.08 BN |

| CAGR (2025–2030) | 7.10% |

| Years considered | 2017–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | The report defines, segments, and projects the cooling fabrics market based on type, textile type, technology, application and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles cooling fabric manufacturers, comprehensively analyses their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions, partnerships, and new product launches. |

| Segments Covered | Type (Natural, Synthetic) |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Cooling Fabrics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Sports Apparel Manufacturers | Conduct detailed performance benchmarking of cooling fabric technologies based on moisture management, breathability, and thermal regulation under varying activity levels. | Enables brands to select optimal fabric blends for enhanced athletic comfort and endurance. |

| Lifestyle Apparel Brands | Develop comparative analysis of cooling performance across natural, synthetic, and blended fabrics tailored for casual wear. | Enhances comfort-driven design and supports new product development in everyday apparel. |

| Protective Clothing Manufacturers | Evaluate cooling fabric applications in industrial, military, and medical protective wear for temperature management and safety. | Improves worker comfort, reduces heat stress, and enhances productivity. |

RECENT DEVELOPMENTS

- November 2024 : Noble Biomaterials, a company specializing in producing antimicrobial and conductivity solutions tailored for soft surface applications, will unveil CoolPro alongside Coolcore. CoolPro represents an innovative fabric technology that synergistically integrates Coolcore's cooling fabrics with Noble's Ionic+ Pro antimicrobial yarns, marking the first collaboration at the Functional Fabric Fair in Portland. This adaptive and dyeable fabric offers long-lasting cooling and antimicrobial benefits without chemicals, enhancing durability and performance

- June 2024 : OYSHO, the sport and leisure leader, in collaboration with LYCRA COOLMAX EcoMade, unveiled a soccer collection featuring technical tees and shorts to provide the best athletes. The garments' moisture-wicking comfort would ensure athletes do not deviate from their attention and maintain concentration in playing; the lightweight breathability of the fabric would allow for free movement during sessions.

- March 2024 : brrr° collaborated with Dillard's, an American department store chain, to provide cooling fabric technology in the Alex Marie collection of women's apparel. The range of adaptable, easy-care clothes from cotton poplin and brrr°'s cooling fabric offers exceptional comfort.

- February 2021 : AKAS Tex increased its knitting capacity by 35% to meet the growing demand for cooling materials used in face masks and surgical gowns. Five new high-speed specialized knitting machines have increased annual production from 375,000 to 575,300 pounds. These machines will focus on proprietary fabrics like ProCool, Zorb, and TransWick. Fifty percent of the output will be sold in the United States, and the remaining production will be sold to international markets.

Table of Contents

Methodology

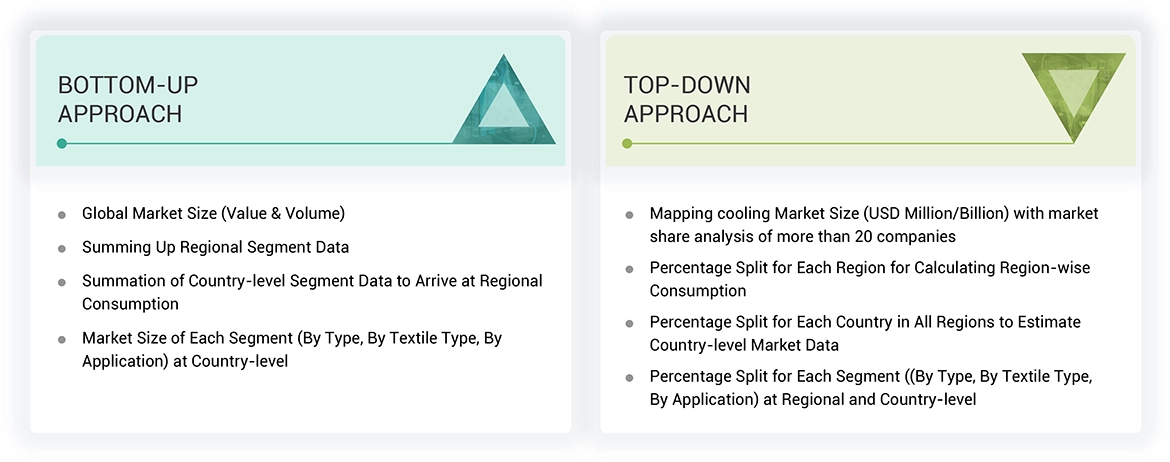

Four key tasks were carried out as part of the research on cooling fabrics: market size was estimated by the use of secondary research with the addition of the peer market and the parent market, an arbitrary number of choices was done to validate the findings, assumptions, and sizes with the industry experts whose positions spread along the value chain of cooling fabrics. Not only did we use the top-down approach, but also we did a market bottom-up analysis to estimate the whole market size. Afterward, using this method and data triangulation, the market size of the segments and sub-segments of the market was estimated.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. BusinessWeek, Factiva, World Bank and Industry Journals, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

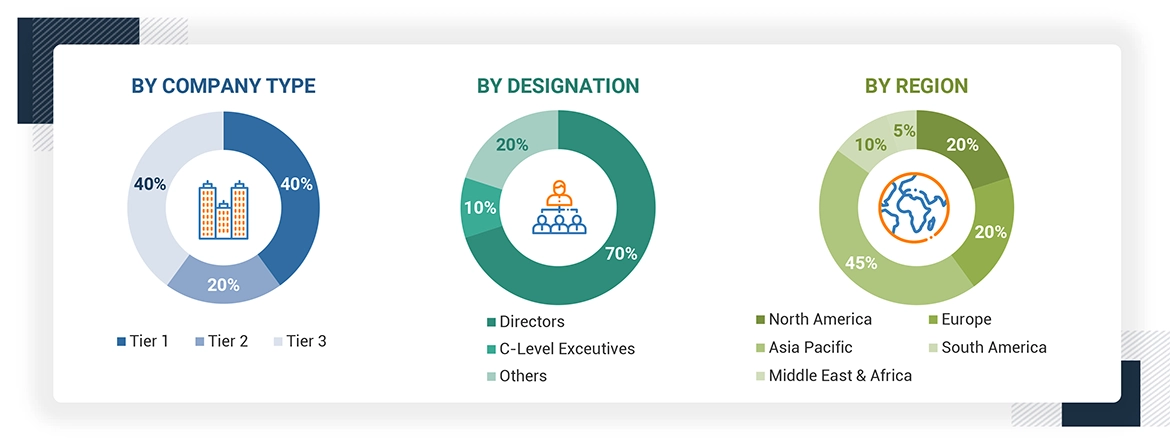

Primary Research

The cooling fabrics market comprises several stakeholders, such as raw material suppliers, importers & exporters of textiles, cooling fabrics manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the cooling fabrics market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the cooling fabrics market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the cooling fabrics market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Cooling Fabrics Market Size: Bottom-Up & Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the textile sector's demand and supply sides.

Market Definition

Cooling textiles, also called cooling fabrics, are specially designed textiles that aid the wearer's body in cooling. Cooling fabrics work under various technologies and innovations in material design to create their cooling properties. Such applications are found widely in athletic and sportswear, outdoor clothing, and bedding. In essence, cooling provides a much more comfortable thermally regulated environment for people involved in physical activities or who travel to hot climates, helping them feel calm or perform better regardless of activity level.

Several cooling fabric types, combined with natural and synthetic, are on the market. Determined by the kind of textile, these fabrics are divided into woven, nonwoven, and knitted cooling materials. Specifically, applications include sports apparel, personal protective wear, towels, knee wraps, caps, and bandanas.

Stakeholders

- Manufacturers, Suppliers, and Distributors of Cooling Fabrics

- Regulatory Bodies, Government Agencies, and NGOs

- Research & Development (R&D) Institutions

- Importers and Exporters of Textiles

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of cooling fabrics in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global cooling fabrics market based on type, textile type, application, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective key countries

- To track and analyze the competitive developments, such as new product launches, acquisitions, partnerships, investments, and expansions, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cooling Fabrics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Cooling Fabrics Market

Jack

Jul, 2022

Need information on cooling fabrics market by application.