Crane Rental Market

Crane Rental Market by Type (Fixed Cranes, Mobile Cranes), Weightlifting Capacity (Low, Low to Medium, Heavy, Extremely Heavy), End-use Industry (Building & Construction, Infrastructure, Other End-use Industries), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The crane rental market is projected to reach USD 68.04 billion by 2030 from USD 53.12 billion in 2025, at a CAGR of 5.1% from 2025 to 2030. The growth of the crane rental market is driven by an increasing number of large-scale construction and infrastructure projects worldwide. The increasing demand for lifting equipment in emerging economies is due to rapid urbanization and industrialization.

KEY TAKEAWAYS

-

BY TYPEThe crane rental market by type includes mobile cranes and fixed cranes. Mobile cranes dominates the market in terms of demand, because of their mobility, versatility, and robust lifting capabilities.

-

BY WEIGHTLIFTING CAPACITYThe crane rental market by weightlifting capacity includes low, low to medium, heavy, and extremely heavy. Low is the largest segment, due to increasing construction activities.

-

BY END-USE INDUSTRYThe crane rental market by end-use industry includes building & construction, infrastructure, oil & gas, energy & power, marine & offshore, mining & excavation, transportation, and other end-use industries. Building & construction is the fastest-growing segment due to increasing investments in infrastructure development projects.

-

BY REGIONAsia Pacific is expected to register the fastest CAGR of 5.5%, driven by rapid urbanization and industrialization in countries like China and India.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic product launches, acquisitions, partnerships, agreements, and expansions from leading players such as Liebherr (Germany), United Rentals Inc. (US), PALFINGER AG (Austria), Sarens NV (Belgium), Mammoet (Netherlands), and The Manitowoc Company, Inc. (US). These companies are exploring geographic diversification strategies to achieve growth.

The use of cranes is increasing due to government investment in transportation, energy, and smart cities. The move toward renting rather than ownership assists companies in cutting down the cost of capital as well as the cost of maintenance. Due to the increased growth of renewable energy sources such as wind and solar farms, heavy-lift cranes are in demand. Fuel-efficient and hybrid cranes are also being introduced due to the trend of sustainability. Moreover, the increased cooperation between the manufacturers and the rental companies is boosting the availability of fleets and services.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer preferences for adaptable rental business models and online fleet management are transforming business strategies. Unpredictable economic conditions and sustainability trends are compelling firms to use fuel-efficient and hybrid cranes. Consequently, rent providers are working on technology integration, predictive maintenance, and customized service contracts to fit changing customer needs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in construction and infrastructure projects

-

Expansion of industrial and energy sectors

Level

-

Elevated maintenance and operational expenses for rental providers

-

Demand fluctuations driven by economic cycles

Level

-

Rapid infrastructure growth across emerging markets

-

Integration of digital technologies and telematics solutions

Level

-

Heightened market competition and pricing pressures

-

Instability in raw material and fuel costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in construction and infrastructure projects

The growing number of commercial, public, and residential infrastructure projects worldwide is driving a high demand for crane rental services. Governments are investing heavily in transportation systems, smart cities, and renewable energy projects. This surge in development will lead to a greater need for the flexible and cost-effective lifting solutions that rental companies offer.

Restraint: Elevated maintenance and operational expenses for rental providers

The mechanical complexity of cranes makes maintenance and repairs expensive for crane rental companies. Frequent inspections, adherence to safety standards, and the need for an experienced workforce all contribute to operating costs. These expenses can affect profitability, especially during fluctuations in demand or periods of increased competition.

Opportunity: Rapid infrastructure growth across emerging markets

Countries in Asia, the Middle East, and Africa are experiencing rapid growth in infrastructure development. Projects such as highways, metro systems, and industrial parks are driving the increased demand for crane rentals. This trend offers rental companies an opportunity to expand their fleets and reach new territories.

Challenge: Heightened market competition and pricing pressures

The crane rental market is seeing an influx of both local and international competitors. This increased competition has led to price wars, which in turn are reducing the profit margins for service providers. In response, companies are focusing on differentiation by enhancing the quality of their services, adopting advanced technology, and ensuring the reliability of their fleets.

Cranes Rental Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Executed the installation of two 7MW wind turbine generators in the Netherlands using an LR11350-P1800 crawler crane equipped with a PowerBoom attachment. The 378-ton nacelle, measuring 18m x 8m x 8m, was lifted to a 120m height in a single operation. This approach eliminated the need for multiple smaller lifts and reduced the complexity of assembling components at great heights. | Improved operational efficiency and reduced installation time. Enhanced safety by minimizing high-altitude assembly work. Demonstrated heavy-lift precision and engineering capability in large-scale wind energy projects. |

|

Mammoet, a global leader in engineered heavy lifting and transport, successfully executed lifts totaling 7,000 tons using its SK350 crane, one of the largest cranes in its fleet with a lifting capacity of up to 7,700 metric tons. The project involved lifting individual modules weighing up to 4,200 tons each, demanding advanced engineering, precise coordination, and meticulous planning. | Demonstrated exceptional heavy-lift capability and engineering excellence. Enhanced operational efficiency and safety in handling ultra-heavy modules. Strengthened Mammoet’s position as a global frontrunner in complex, large-scale lifting and transport projects. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The crane rental market ecosystem consists of equipment manufacturers, rental service providers, contractors, construction companies, and the end-use market, including the infrastructure, energy, and manufacturing sectors of the economy. Manufacturers provide cranes and technology solutions, which rental companies lease on short—or long-term projects. This networked system guarantees effective use of equipment, cost savings, and easy access to state-of-the-art lifting equipment.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Crane Rental Market, by Type

Mobile cranes have emerged as the most important segment of the crane rental market as of 2024 due to their flexibility and ease of movement. Their portability allows them to be deployed quickly at various locations, making them ideal for construction and industrial work. Additionally, they are capable of performing a wide range of lifting tasks, which increases their applicability across various industries. Due to such benefits, mobile cranes will dominate the market until 2025.

Crane Rental Market, by Weightlifting Capacity

In 2024, the crane rental market was primarily driven by cranes with low weight-lifting capacities, largely due to the high demand from small and medium-scale construction projects. These cranes are economical, easy to operate, and well-suited for urban and residential construction sites. Their relatively small size allows them to function effectively in limited spaces. As a result, rental companies are increasingly offering low-capacity cranes to meet the rising demand for light-duty lifting jobs.

Crane Rental Market, by End-use Industry

The crane rental industry within the construction sector is expected to experience growth in 2024, driven by a surge in infrastructure, residential, and commercial projects. Urbanization and the development of smart cities are accelerating, creating a greater need for lifting equipment. Renting cranes has become a popular choice for construction companies, as it allows them to save on initial investments. Furthermore, ongoing investments in real estate and state infrastructure continue to increase the demand for crane rental services.

REGION

Asia Pacific to be fastest-growing region in global crane rental market during forecast period

The crane rental market in the Asia Pacific region is expected to experience the highest growth rate during the forecast period. This growth is driven by a high rate of urbanization and ongoing infrastructure development programs. The increasing demand for cranes stems from the rising investments in the construction, transportation, and renewable energy sectors. Market expansion is further supported by the ongoing industrialization in countries such as China, India, and Indonesia. Additionally, the crane rental business is growing in the region due to government initiatives aimed at enhancing community infrastructure and developing smart cities.

Cranes Rental Market: COMPANY EVALUATION MATRIX

In the crane rental market matrix, Liebherr (Star) leads with its strong global presence and wide product portfolio. Action Construction Equipment Ltd. (Emerging Leader) is gaining visibility with its affordable crane solutions and expanding footprint.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 50.56 Billion |

| Market Forecast in 2030 (Value) | USD 68.04 Billion |

| Growth Rate | CAGR of 5.1% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Cranes Rental Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based Crane Rental | Detailed company profiles of crane rental competitors (financials, product portfolios, production capacity) I End-use industry mapping (building & construction, marine & offshore, others) | Identified & profiled 20+ crane rental producers across Asia Pacific I Mapped demand trends across high-growth segments (building & construction, marine & offshore, oil & gas) |

RECENT DEVELOPMENTS

- April 2025 : LIEBHERR and Real Guindastes entered into a partnership under which Real Guindastes added LIEBHERR’s 1000 EC-H tower crane to its growing fleet. The crane will support Vale’s S11D mining complex in Para, Brazil.

- March 2024 : United Rentals expanded its product line by acquiring Yak Access, LLC, Yak Mat, LLC, and New South Access & Environmental Solutions, LLC for USD 1.1 billion. This acquisition enhanced United Rentals' specialty rental business and introduced a new segment, "Matting Solutions," strengthening its presence in a large and growing market.

- July 2021 : The Manitowoc Company, Inc. announced its firm commitment to acquire the crane business of H&E Equipment Services, Inc., a significant player in the US rental equipment industry. Manitowoc plans to finance the acquisition, valued at approximately USD 130 million, through a combination of existing cash reserves and available debt. The completion of the transaction is contingent upon meeting customary closing conditions and obtaining regulatory approvals, with expectations set for finalization in the fourth quarter of 2021.

Table of Contents

Methodology

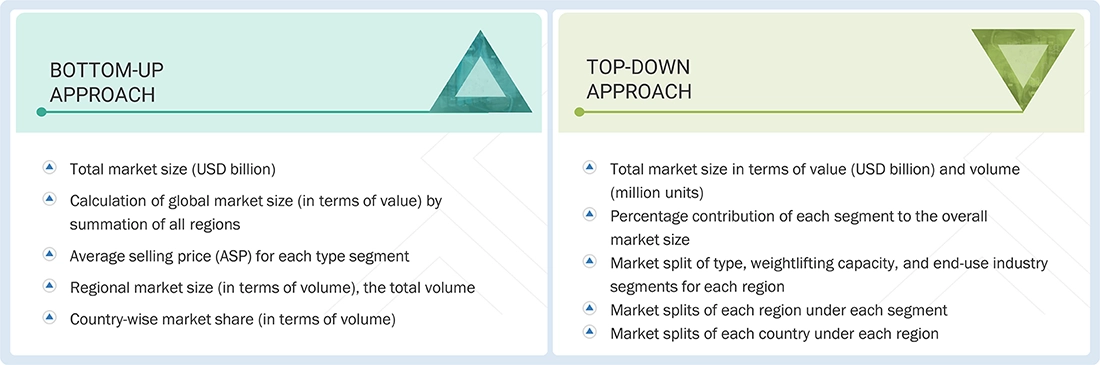

The study involved four major activities to estimate the current size of the global crane rental market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of crane rental through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the crane rental market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments of the market.

Secondary Research

The market for companies offering crane rental is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. For this study, various secondary sources, such as Business Standard, Bloomberg, the World Bank, and Factiva, were referred to identify and collect information on the crane rental market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of crane rental vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the crane rental market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at.

Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of crane rental offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

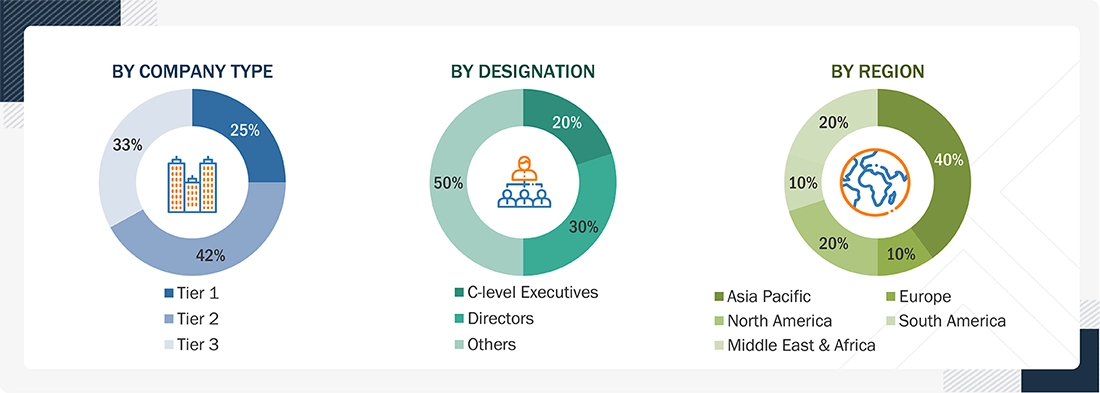

The following is the breakdown of primary respondents:

Note: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global crane rental market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Crane rental involves the leasing of cranes for temporary use across various industries such as building & construction, infrastructure, and others. Rather than purchasing cranes, which entail substantial capital investment, maintenance, and storage costs, companies can rent them for specific projects or durations. This approach enables businesses to access modern, high-performance lifting equipment without the financial and operational responsibilities of ownership. The primary objective of crane rental is to offer flexible and cost-efficient lifting solutions for projects with short-term or specialized requirements. By opting for rentals, companies can minimize expenses related to purchase, insurance, and depreciation while maintaining operational efficiency.

Stakeholders

- Crane Rental Companies

- Crane Manufacturers and Suppliers

- Maintenance and Service Providers

- Technology Providers

- Operators and Workforce

- Government and Regulatory Bodies

- Insurance Companies

- Investors and Financial Institutions

- End Customers

Report Objectives

- To define, describe, and forecast the size of the global crane rental market, by type, weightlifting capacity, and end-use industry, in terms of value and volume

- To forecast the market size of segments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective countries, in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as product launches, expansions, acquisitions, and partnerships in the crane rental market

- To provide the impact of AI/Gen AI on the market

- To provide the macroeconomic outlook for each region covered under the study, and the impact of the 2025 US tariff on the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Crane Rental Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Crane Rental Market