Drone (UAV) Battery Market Size, Share & Analysis, 2025 To 2030

Drone (UAV) Battery Market by Technology (Lithium-based, Nickel-based, Fuel Cell, Sodium-ion), Platform (Commercial, Government & Law Enforcement, Military), Capacity (<5, 5-20, 20-50, >50), Point of Sale (OEM, Aftermarket) and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis<

The Drone (UAV) Battery Market is projected to reach USD 2.41 billion by 2030, growing from USD 1.59 billion in 2025 at a CAGR of 8.7%. The procurement of drone batteries is expected to increase from 1,592.6 thousand units in 2025 to 2,496.5 thousand units by 2030. Growth is driven by rising adoption of drones in delivery, agriculture, construction, and defense. The demand for long-lasting, fast-charging, and safer batteries is driving innovation in smart systems, hydrogen fuel cells, thin-film lithium-ion, and hybrid solutions, enabling greater efficiency and extended operations.

KEY TAKEAWAYS

- North America is expected to account for a 40.8% share of the drone battery market in 2025.

- By technology, the fuel cell segment is projected to grow at the fastest rate of 9.6% during the forecast period.

- By component, the battery management systems segment is projected to witness the fastest rate, registering a CAGR of 9.0%.

- By platform, the military segment is expected to account for the largest share of the drone battery market during the forecast period.

- DJI, EaglePicher Technologies, and RRC Power Solutions Gmbh were identified as some of the star players in the drone battery market, given their strong market share and product footprint.

- Kokam Battery, Denchi Group, and Troowin Power System Technology, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The future outlook for the drone battery industry indicates strong growth, supported by advancements in autonomous flying, BVLOS capabilities, and next-generation chemistries that deliver high energy density and improved safety. As industries scale drone deployment, the market will continue evolving toward more sustainable, intelligent, and performance-driven battery technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The drone battery market is shifting from conventional chemistries to advanced solutions, such as smart batteries, fuel cells, and swapping technologies. Driven by AI-enabled monitoring, strong investments, and wide adoption of batteries in the defense, logistics, agriculture, and commercial sectors, autonomy and electrification are set to power long-term growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis<

MARKET DYNAMICS

Level

-

Growing adoption of drones across diverse applications

-

Increasing demand for long flight times, quick charging, and safe battery performance

Level

-

High cost of energy-dense batteries

-

Restrictions on transport of lithium batteries

Level

-

Advancements in material sciences and battery technology

-

Innovations in hydrogen fuel cell technology

Level

-

Inadequate charging infrastructure

-

Lack of safety standards

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis<

Driver: Growing adoption of drones across diverse applications

The rising use of drones in the defense, agriculture, logistics, construction, and media sectors is fueling the demand for advanced batteries that offer longer flight times, higher payload capacity, and dependable performance. From intelligence and surveillance in defense to crop monitoring in agriculture and coastal security in maritime operations, drones are becoming essential for efficiency and cost savings, creating sustained need for lightweight, safe, and long-endurance power solutions.

Restraint: High cost of energy-dense batteries

Next-generation batteries, such as lithium-sulfur and lithium-metal, provide higher energy density and extended flight capabilities but remain costly due to limited production and early-stage development. This price barrier restricts their adoption for specialized applications, leaving most users reliant on standard lithium-ion batteries. Until these advanced options achieve cost efficiency and scale, their impact on mainstream market growth will remain limited.

Opportunity: Public and private sector investments in drone battery R&D and local manufacturing

Government initiatives and private R&D are accelerating the development of safer, more powerful, and long-lasting drone batteries. Public programs support local manufacturing and supply chain resilience, while private firms are investing in silicon-anode, solid-state, and hybrid technologies. These efforts are set to reduce costs, enhance energy density, and expand adoption, positioning the sector for long-term growth and innovation.

Challenge: Inadequate charging infrastructure

Slow charging times and the absence of widespread fast-charging infrastructure remain a major hurdle, especially for industrial drones that require frequent operations. Current charging solutions often take hours for limited flight durations, disrupting workflows in agriculture, defense, and logistics. Without scalable and efficient charging systems, drone operations face high costs, reduced efficiency, and limited potential for expansion.

Drone Battery Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Replaced lithium-ion batteries with hydrogen fuel cells in its Sensus drone, designed for monitoring and inspection in oil & gas fields | The range doubled from 25 km to 50 km with 2L H2 tanks (up to 75 km with 3L tanks) and increased flight time from 30 minutes to 60–90 minutes, all without adding extra weight. |

|

Thales’ Stratobus required lightweight, high-density batteries for long-endurance pseudo-satellite missions. Sion Power provided Licerion-HE lithium metal batteries for this purpose. | Achieved energy density of 500 Wh/kg and 1000 Wh/L Powered Stratobus for 1,000 cycles with an estimated two more years of life, enabling lighter, longer-duration high-altitude operations |

|

Developed UFC FlashBattery technology to drastically reduce drone charging time compared to conventional lithium-ion batteries | Enabled 30 minutes of flight with just 5 minutes of charging (up to 18× faster), improving operational readiness. Limitation: reduced cycle life (150 → 30 cycles) |

|

Created intelligent lithium-ion batteries with integrated monitoring systems to ensure safety and reliability for agricultural drone applications | Improved operational safety by preventing overheating/fire risks Real-time monitoring system alerts users of faults, enhancing reliability and flight security |

|

Engineered custom lithium-ion battery packs optimized for UAVs to overcome limitations of standard off-the-shelf batteries | Delivered long flight durations, high payload efficiency, and reliability in extreme climates and high-altitude conditions, enhancing UAV performance and safety |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The drone battery market ecosystem includes battery manufacturers, drone manufacturers, SMEs, and end users. Battery makers develop chemistries like solid-state and lithium-sulfur, while drone producers integrate these solutions into diverse platforms. SMEs provide customization, and end users in defense, agriculture, logistics, and commercial sectors shape demand and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drone Battery Market, By Platform

The military sector accounts for the largest share, supported by significant defense investments in drones for surveillance, reconnaissance, and tactical missions. The requirement for reliable, high-capacity batteries capable of operating under extreme conditions is also a critical driver.

Drone Battery Market, By Technology

Lithium-based batteries dominate the market due to their high energy density, lightweight design, and cost efficiency. They remain the most widely deployed solution across defense and commercial applications, with ongoing R&D advancing safety, charging efficiency, and overall performance.

Drone Battery Market, By Component

Battery cells represent the largest share, as they fundamentally determine energy density, lifecycle, and efficiency. Continuous improvements in cell chemistry and architecture are enabling extended flight durations, enhanced thermal management, and scalability across diverse drone platforms.

Drone Battery Market, By Capacity

The 5–20 Ah capacity range segment holds the leading position, offering an optimal balance between weight and endurance for small to medium drones. These batteries are extensively utilized in delivery, agriculture, and tactical UAV applications where efficiency and sustained operations are essential.

Drone Battery Market, By Point of Sale

Original equipment manufacturers (OEMs) capture the majority of sales, as integrated battery systems provide superior compatibility, reliability, and compliance with operational standards. Their market leadership is further reinforced by large-scale defense contracts and commercial procurement programs emphasizing lifecycle support and performance assurance.

REGION

Asia Pacific to be fastest-growing region in global drone battery market during forecast period

Asia Pacific is estimated to be the fastest-growing drone battery market, fueled by rising defense investments; expanding use of drones in delivery, agriculture, and industrial sectors; and strong manufacturing bases in China and India. Additionally, government initiatives and advances in high-capacity, lightweight battery technologies further position the region as a key hub for production and consumption.

Drone Battery Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the drone battery market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. DJI is positioned as a leading player with a strong focus on advanced battery technologies, while Plug Power is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Drone (UAV) Battery Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.53 Billion |

| Market Forecast in 2030 (Value) | USD 2.41 Billion |

| Growth Rate | CAGR of 8.7% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, and Rest of the World |

WHAT IS IN IT FOR YOU: Drone Battery Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Drone Battery Market Study Update |

|

|

RECENT DEVELOPMENTS

- June 2025 : Sion Power Corporation installed a new large-format battery cell production line, developed in partnership with Mühlbauer Group.

- May 2025 : Intelligent Energy Limited signed an agreement with IBT to develop a 100 kW fuel cell generator. The new 100 kW fuel cell generator will be based on Intelligent Energy’s evaporatively cooled IE-DRIVE fuel cell technology.

- March 2025 : Plug Power Inc. collaborated with Southwire, a global leader in hydrogen solutions, to introduce a clean hydrogen ecosystem in Texas.

- January 2025 : SES AI Corporation revealed a brand new AI-enhanced 2170 cylindrical cell designed for emerging humanoid robotics and drone applications at the 2025 CES Show, held at the Las Vegas Convention Center in Las Vegas, Nevada.

- September 2024 : H3 Dynamics partnered with Oxford’s Qdot Technology to develop a hydrogen-powered, long-range vertical takeoff and landing (VTOL) aircraft.

Table of Contents

Methodology

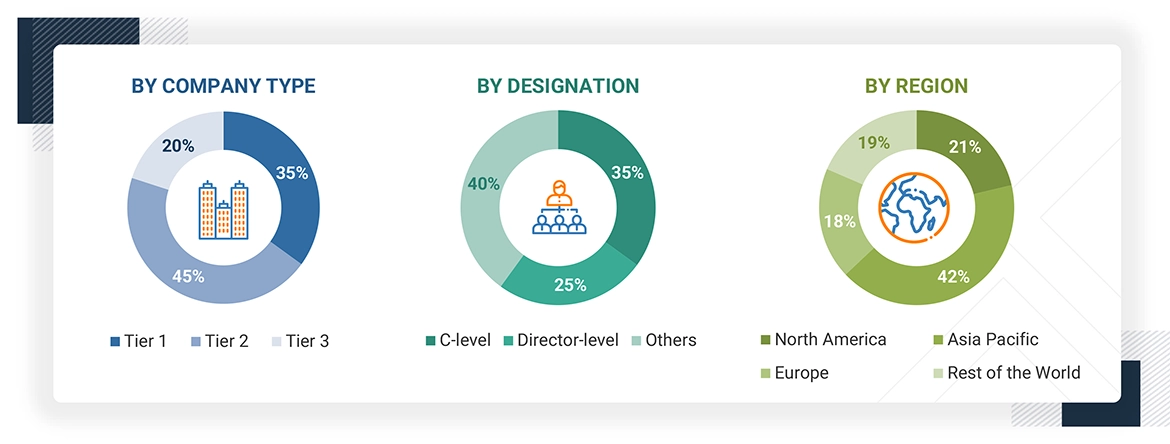

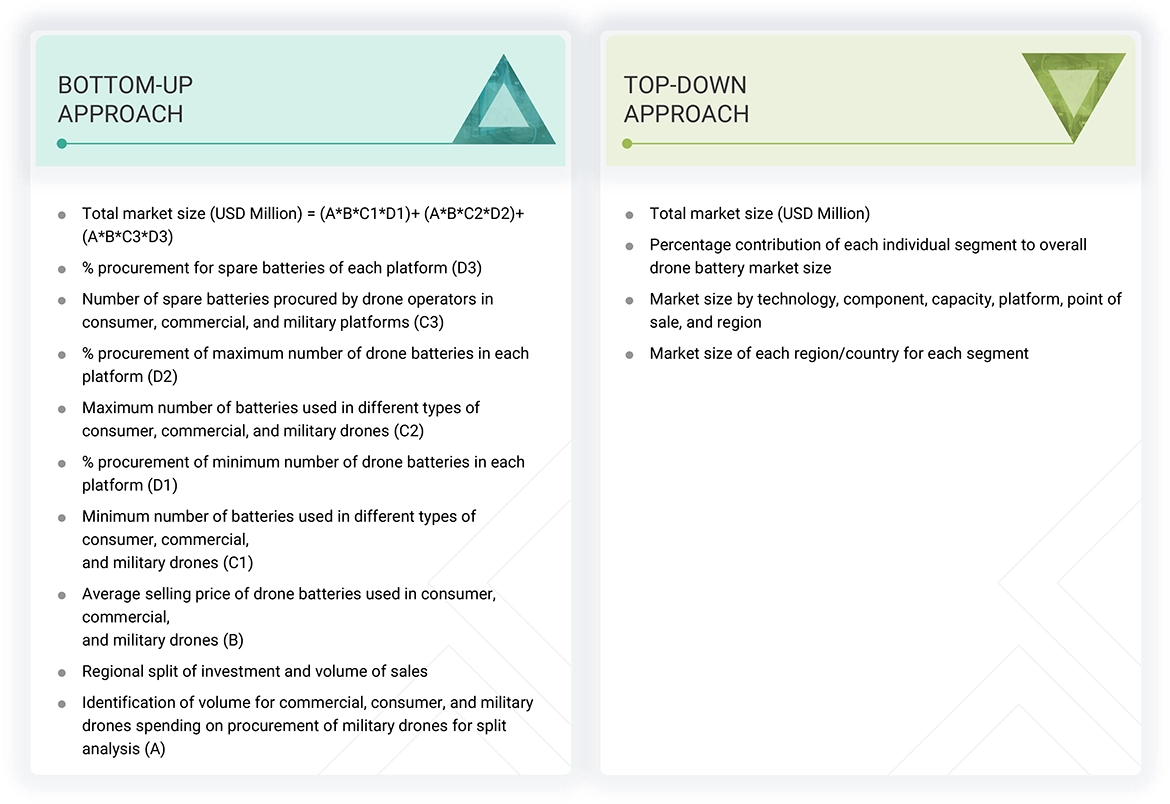

The research study on the drone battery market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market, as well as suppliers, manufacturers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews of various primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market and assess the market’s growth prospects. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the drone battery market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the drone battery market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note 1: Others include sales, marketing, and product managers.

Note 2: The tiers of companies have been defined based on their total revenue as of 2024.

Note 3: Tier 1 = > USD 1 billion; tier 2 = between USD 100 million and USD 1 billion; and tier 3 = USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the drone battery market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, and SMEs of leading companies operating in the drone battery market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the drone battery market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Drone Battery Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the drone battery market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The drone battery market size was also validated using the top-down and bottom-up approaches.

Market Definition

A drone battery is a device consisting of one or more electrochemical cells with external connections to store energy and supply power to the electric motors and other onboard electronic systems of drones. It typically comprises integrated modules, including cells, a battery management system (BMS), connectors, and enclosures. The configuration of the battery, such as series or parallel cell arrangements, is tailored to meet the specific power output and energy capacity requirements depending on the drone’s application, weight class, and mission duration. Drone batteries are commonly built using Lithium-ion, Lithium-Polymer, Lithium-Metal, Nickel-based chemistries, Sodium-ion, and fuel cells, particularly for long-endurance platforms. These batteries support various drone applications, including inspection and monitoring, surveying and mapping, agriculture, cargo transport, passenger air mobility, and military operations. They are used across various drone architectures and serve consumer, commercial, government, and defense sectors.

Key Stakeholders

- Battery Manufacturers

- Drone OEMs

- Battery Management System Providers

- Raw Material & Cell Suppliers

- End Users (Commercial, Government, Military, Consumer)

- Regulators & Certification Bodies

- Distributors & Retailers

- R&D Institutions

Report Objectives

- To define, describe, and forecast the size of the market based on platform, technology, component, point of sale, and capacity

- To forecast the size of various market segments within five regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the regulatory landscape with respect to drone detection regulations across regions

- To analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies adopted by leading market players, such as product launches, contracts, and partnerships

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

Customization Options

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of up to five additional market players

Key Questions Addressed by the Report

What is the current size of the drone battery market?

The drone battery market, in terms of value, is estimated at USD 1.59 billion in 2025.

Who are the winners in the drone battery market?

The winners in the drone battery market are Epsilor-Electric Fuel Ltd. (Israel), EaglePicher Technologies (US), RRC Power Solutions GmbH (Germany), Shenzhen Grepow Battery Co., Ltd. (China), and Tadiran Batteries (US).

What are the factors driving the market?

Key driving factors include: Extensive use of drones in industries like delivery, farming, construction, and defense Need for longer flight time, faster charging, and safer battery performance Growth in advanced drone technologies like BVLOS and autonomous systems Increased demand for smart battery management systems

Which region is estimated to hold the largest share of the global drone battery market in 2025?

North America is estimated to hold the largest share of 40.8% of the global drone battery market in 2025.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Drone (UAV) Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Drone (UAV) Battery Market