Drug Device Combination Products Market Size, Growth, Share & Trends Analysis

Drug Device Combination Products Market by Type (Injectable, Transdermal Patch, Infusion Pump, Drug-eluting Stent, Inhaler), Application (Diabetes, Oncology, Pain, Opthamology), End User (Hospital, Home Care), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The drug device combination products market is projected to reach USD 379.17 billion by 2030, from USD 243.02 billion in 2025, at a CAGR of 9.3% during the forecast period. Globally, the increasing burden of chronic diseases like diabetes and obesity, along with a rising aging population, is expected to accelerate the demand for drug-device combination products, further boosting their adoption. Additionally, the growing emphasis on patient-centric design and government initiatives to improve affordability and accessibility are likely to drive market growth. Furthermore, increased investments in new product development and the rising adoption of home care settings and self-administration, driven by the benefits they offer, are anticipated to support the growth of the drug-device combination products market during the forecast period.

KEY TAKEAWAYS

-

BY PRODUC TYPEBased on product type, the market is segmented into injectable drug delivery devices, drug-eluting stents, inhalers, infusion pumps, transdermal patches, drug-eluting balloon catheters, and other drug-device combination products. Injectable drug delivery devices hold the largest share in the drug-device combination products market, as they offer precise, fast, and efficient drug administration, which is critical for treatments such as diabetes, cancer, and autoimmune diseases.

-

BY APPLICATIONBased on application, the drug device combination products market is segmented into diabetes management, respiratory diseases, ophthalmology, infectious diseases, cardiovascular disease, autoimmune diseases, oncology, obesity management, pain management, and other applications. Diabetes management is witnessing a significant growth rate in the drug-device combination market due to increasing prevalence of diabetes, rising demand for convenient self-administration solutions, and advancements in integrated drug delivery technologies.

-

BY END USERBased on the end user, the drug device combination products market has been classified into hospitals and clinics, ambulatory surgery centers, long-term care facilities, home care settings, and other end users. Home care settings, as an end user, are experiencing high growth in the market, driven by the increasing preference for at-home treatments, convenience, and patient-centric care solutions.

-

BY REGIONThe APAC region is poised for high growth of 11.7%, driven by increasing healthcare expenditure, expanding access to advanced medical technologies, and rising awareness of innovative treatment options.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships and collaborations. For instance, in March 2024, Novo Nordisk received the US Food and Drug Administration (FDA) approval for a label expansion for Wegovy based on a supplemental New Drug Application (sNDA) for the indication of reducing risks of major adverse cardiovascular events (MACE).

The drug-device combination products market is expected to experience steady growth over the coming decade, driven by the rising prevalence of chronic diseases and the growing emphasis on personalized and integrated treatment solutions. Technological advancements are enabling the development of more precise, user-friendly, and automated combination products, enhancing treatment efficacy and patient adherence. Furthermore, the incorporation of smart features such as real-time monitoring, data connectivity, and digital health integration is improving clinical outcomes and supporting the broader shift toward connected, patient-centric healthcare solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The drug device combination products market is being transformed by the convergence of pharmaceuticals, medtech, and digital health. Patients and healthcare providers now expect connected, intelligent delivery systems that go beyond traditional administration to enable continuous monitoring, personalized dosing, and real-time feedback. Advances in smart injectors, digital inhalers, and wearable pumps combined with AI-driven analytics and real-world evidence are improving adherence, therapeutic precision, and patient engagement. Meanwhile, the rise of remote care and digital therapeutics is shifting the focus from product performance to integrated health outcomes, driving a move toward data-enabled, patient-centric, and outcomes-based treatment ecosystems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising prevalence of chronic diseases

-

Growing biologics market

Level

-

Stringent regulatory policies and compliance hurdles

-

Increased focus on alternative drug delivery

Level

-

Increase in preference for minimally invasive products

-

High growth opportunities in emerging economies

Level

-

Product malfunction and wastage of drugs

-

Lack of skilled professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising prevalence of chronic diseases

The rising rate of chronic diseases is expected to boost demand for drug-device combination products. Factors like an aging population, poor nutrition, obesity, and sedentary lifestyles are fueling this trend. According to the International Diabetes Federation, the number of adults with diabetes is projected to grow from 588.7 million in 2025 to 853 million by 2050, with diabetes alone causing 3.4 million deaths and USD 1.015 trillion in global healthcare costs in 2024. Similarly, the World Health Organization reports that over 1 billion people are classified as obese, with an estimated 167 million expected to face health issues from overweight or obesity by 2025. These conditions, including asthma, COPD, and obstructive sleep apnea, highlight the increasing need for advanced drug delivery options. Products such as insulin pens, autoinjectors, inhalers, and wearable delivery systems are becoming more important, aiding in targeted therapy, enhancing patient adherence, and improving clinical outcomes. Consequently, the market for drug-device combination products is set for significant growth in the coming years.

Restraint: Stringent regulatory policies and compliance hurdles

Stringent regulatory frameworks continue to pose a significant obstacle to the development and commercialization of drug-device combination products (DDCPs). These frameworks limit market growth due to complex compliance standards, extended approval timelines, and increased financial risks. Regulatory agencies, such as the FDA and EMA, require conformity to both drug and device regulations, often through overlapping pathways. For example, the FDA’s Office of Combination Products determines whether a DDCP is primarily classified as a drug, device, or biologic, which in turn influences whether a New Drug Application (NDA) or Premarket Approval (PMA) is required. According to the FDA’s 2023 Annual Report, nearly 30% of submissions experience delays because of classification disputes, adding 12–18 months to approval times. The absence of global regulatory harmonization further complicates the process, as manufacturers must navigate varying standards from the EU’s MDR, China’s NMPA, and India’s CDSCO. These strict requirements continue to hinder innovation and slow down patient access to new DDCPs.

Opportunity: High growth opportunities in emerging markets

Emerging economies such as China, India, and Brazil present significant growth opportunities for drug-device combination products. In China, an aging population and increasing demand for chronic disease management are driving investments in integrated medical solutions. Similarly, India is experiencing higher healthcare spending and a focus on precision disease management, creating a favorable market for innovative combination products. These markets are also benefiting from expanding healthcare infrastructure, growing awareness of advanced treatments, and reduced production costs, making them attractive investment destinations. In the coming years, these trends are expected to speed up the development, adoption, and distribution of advanced drug-device combination solutions across the region.

Challenge: Product malfunction and wastage of drugs

Drug-device combination products (DDCPs) face significant challenges related to malfunctions and waste, which can impact patient safety, treatment efficacy, and healthcare costs. According to BD's white paper, “The Value of an Integration System for Combination Products,” these issues often arise from the poor integration of drug and device components, design flaws, and usability errors. Devices such as prefilled syringes and autoinjectors can lead to incomplete dosing, leakage, or blockages, with 5–10% of the drug volume potentially lost, increasing the need for additional supplies and raising contamination risks. Mechanical failures like autoinjector clogs or needle retraction issues and unreliable drug delivery mechanisms (e.g., stents or inhalers) further compound the problem. User errors, especially among elderly or inexperienced patients, add to the risk. Financially, manufacturers may incur high costs due to recalls, replacements, and liability claims, while hospitals face increased expenses for procurement and waste management. Regulatory scrutiny, particularly from the FDA, can also prolong approval timelines. To address these challenges, manufacturers must prioritize robust design, seamless integration of drugs and devices, and comprehensive user training to ensure reliability, enhance patient safety, and maintain commercial viability.

Drug Device Combination Products Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Broad portfolio in cardiovascular care and diabetes management; includes drug-eluting stents, drug-coated balloons, and integrated diagnostics | Enhanced patient outcomes through advanced therapy delivery, improved chronic disease management, global reach |

|

Extensive combination therapies: drug-eluting stents, implantable infusion pumps, smart insulin pens. Innovation-driven, strong global footprint | Improved care for chronic conditions, innovation in minimally invasive therapies, global healthcare access |

|

Develops minimally invasive drug-device products, especially in cardiac and vascular fields (e.g., drug-eluting stents) | Greater procedural efficacy, reduced complications, competitive portfolio in therapeutic delivery |

|

Digital drug delivery (e.g., smart insulin pens), bespoke injection solutions for diabetes and biologics | Increased medication adherence, digital engagement, innovation for chronic disease management |

|

Integrated pharmaceuticals and devices, focusing on chronic disease therapies (oncology, diabetes, etc.) | Personalized treatment options, enhanced therapy effectiveness, focus on next-generation products |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The DDCP market is a complex ecosystem involving manufacturers, end-users, and regulatory agencies. Manufacturers, including pharmaceutical companies and medical device firms, develop drugs and delivery systems such as smart injectors, insulin pens, implantable pumps, and connected inhalers. End-users, primarily hospitals, clinics, and healthcare providers, utilize these products to manage chronic diseases, enhance patient adherence, and deliver personalized therapy. Regulatory agencies, such as the FDA and EMA, oversee safety, efficacy, and compliance, ensuring that drug-device products meet stringent standards. The ecosystem is increasingly boosted by digital health, AI-driven dosing, and wearable technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drug Device Combination Products Market, By Product Type

The injectable drug delivery devices segment is the fastest-growing segment of the DDCP market. This growth is fueled by the precision, quick response, and targeted delivery that injectables offer, which are essential for advanced biologics and therapies that are unstable or less effective when taken orally. Devices like autoinjectors, prefilled syringes, and pen injectors are gaining popularity because they are easy to use, portable, and require minimal clinical administration. The increasing rates of chronic conditions such as cancer, rheumatoid arthritis, and diabetes are further boosting demand. Self-administration benefits patients by offering greater convenience and easing pressure on healthcare systems. Innovations like needle safety features, accurate dosing, and connected smart injectors help improve adherence, reduce user errors, and enhance the overall patient experience. Furthermore, the aging global population, rising use of biologics, and regulatory support for patient-focused designs are driving market growth. These devices are set to play a key role in the future of personalized and effective healthcare delivery.

Drug Device Combination Products Market, By Application

Diabetes management is the largest segment in the application market. This is due to the widespread prevalence of diabetes and the increasing need for accurate, convenient, and self-administered drug delivery. Devices such as insulin pens, prefilled syringes, and smart injectors enable precise dosing, better glycemic control, and improved patient adherence. The integration of connected technologies and digital health platforms further enhances real-time monitoring and personalized treatment. It reduces the number of clinical visits, making diabetes a leading segment in the DDCP market.

Drug Device Combination Products Market, By End User

The DDCP market is divided by end users into hospitals and clinics, ambulatory surgery centers, long-term care facilities, home care settings, and other end users. The home care segment is growing rapidly, driven by patients with chronic conditions like diabetes, asthma, and cancer choosing to self-administer treatments at home to save time and lower healthcare costs from frequent hospital visits. Recent innovations include user-friendly, portable, and connected devices such as autoinjectors, insulin delivery wearables, and smart inhalers that enable effective home-based treatment. Additionally, an aging population and rising healthcare demands in institutional settings have increased the need for personalized and patient-centered healthcare options. Factors like increased patient comfort, better adherence to treatment plans, and improved quality of life make home-based therapies more attractive. Consequently, home care is becoming a key and expanding part of the drug-device combination products market.

REGION

Asia Pacific to be fastest-growing region in global drug device combination products market during forecast period

The Asia Pacific drug device combination products market is projected to achieve the highest CAGR globally during the forecast period. The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions in the region mainly drives this growth. The growing aging population also boosts demand for advanced, patient-friendly drug delivery systems. Heavy investments in healthcare infrastructure in countries such as China and India support the expansion of hospitals, clinics, and home-based care services, thereby encouraging the adoption of these products. Moreover, supportive government policies and initiatives that promote patient-centered care, self-administration, and digital health integration are aiding market growth.

Drug Device Combination Products Market: COMPANY EVALUATION MATRIX

In the drug device combination products market matrix, Abbott (Star) leads with a strong global presence, a comprehensive portfolio of drug-device combination products, and advanced technologies that improve patient adherence and treatment outcomes. This leadership encourages widespread adoption across hospitals, clinics, and home-based care settings. Terumo (Emerging Leader) is gaining momentum with innovative and cost-effective drug delivery solutions, focusing on emerging markets and expanding its role in chronic disease management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 224.70 Billion |

| Market Forecast in 2030 (Value) | USD 379.17 Billion |

| Growth Rate | CAGR of 9.3% from 2025-2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Drug Device Combination Products Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | In-depth assessment of drug device combination products (e.g., injectables, inhalers, transdermal patches, auto-injectors, prefilled syringes, etc.) | Trends in connected drug delivery, patient-centric designs, and digital health integration |

| Company Information | Comprehensive profiles of major players such as: Medtronic, Abbott, BD, Novartis | Identification of strategic partnerships, M&A activities, and licensing opportunities |

| Geographic Analysis |

|

Regional market outlook with detailed growth opportunities, regulatory updates, adoption trends, and competitive positioning across major countries and healthcare settings |

RECENT DEVELOPMENTS

- March 2025 : Terumo Europe received MDR approval for an expanded indication of its Ultimaster Nagomi and Ultimaster Tansei sirolimus-eluting coronary stent systems.? This new approval covers patients at high bleeding risk, including those eligible for dual antiplatelet therapy (DAPT) for as short as one month.

- January 2025 : Eli Lilly and Company received approval from the US Food and Drug Administration (FDA) for Omvoh (mirikizumab-mrkz) for the treatment of moderately to severely active Crohn's disease in adults.

- July 2024 : AbbVie received European Commission approval for SKYRIZI (risankizumab) for the treatment of adult patients with moderately to severely active ulcerative colitis (UC)

- May 2024 : Abbott launched the XIENCE Sierra Everolimus-Eluting Coronary Stent System in India. As the latest in the XIENCE family, it offers advanced safety and effectiveness for treating blocked coronary arteries, particularly in complex cases.

Table of Contents

Methodology

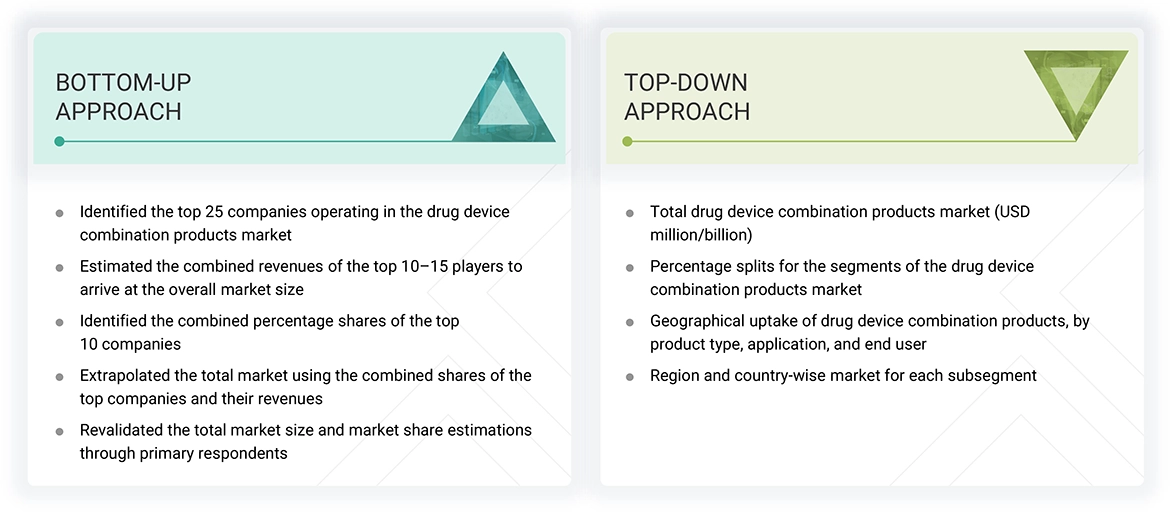

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, SEC filings of companies, and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), European Federation of Pharmaceutical Industries and Associations (EFPIA), American Journal of Drug Delivery and Therapeutics, International Diabetes Federation (IDF), American Association of Diabetes Educators (AADE), Asian Association for the Study of Diabetes (AASD) and Parenteral Drug Association (PDA) were referred to identify and collect information for the global drug device combination products market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the drug device combination products market. The primary sources from the demand side include hospitals & clinics and home care settings. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

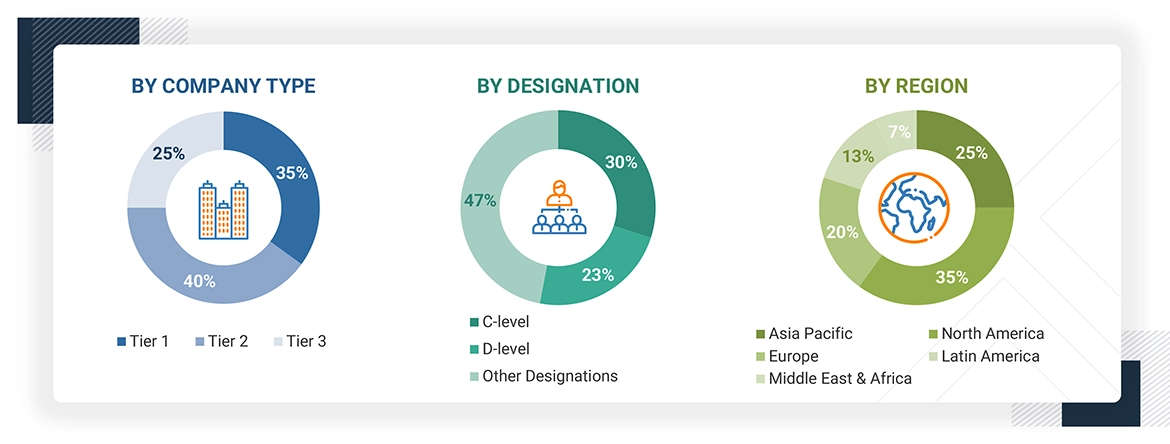

A breakdown of the primary respondents is provided below:

*C-levels include CEOs, CFOs, COOs, and VPs.

*Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global drug device combination products market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players (who contribute at least 70–75% of the market share at the global level). Also, the global drug device combination products market was split into various segments and sub-segments based on:

- List of major players operating in the drug device combination products market at the regional and/or country level

- Product mapping of various drug device combination product manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from drug device combination products (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 70–75% of the global market share as of 2024

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global point-of-care diagnostics market

Market Size Estimation (Bottom-up approach and Top-down approach)

Data Triangulation

After arriving at the overall size of the global drug device combination products market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

A combination product is defined as any amalgamation of a drug and a device, a biological product and a device, a drug and a biological product, or a triad comprising a drug, device, and biological product. This category encompasses products that consist of two or more regulated entities—such as drug/device, biologic/device, drug/biologic, or drug/device/biologic—that are integrated or formulated as a single entity through various physical, chemical, or other methodologies. Moreover, combination products may also refer to distinct components that are packaged either as a single unit or as a collaborative assembly of biological and drug compounds, device-to-device pairings, or drug and device integrations.

Stakeholders

- Drug device combination products manufacturers and distributors

- Healthcare institutions (hospitals, medical schools, and outpatient clinics)

- Research institutes

- Contract manufacturing organizations (CMOs)

- Market research and consulting firms

- Venture capitalists and investors

- Market research and consulting firms

- Government Bodies/Municipal Corporations

- Regulatory Bodies

- Medical Research Institutes

- Business Research and Consulting Service Providers

Report Objectives

- To define, measure, and describe the global drug device combination products market by product type, application, end user, and region

- To provide detailed information about the major factors influencing market growth (drivers, restraints, challenges, and opportunities)

- To strategically analyze the regulatory analysis, pricing analysis, value chain analysis, supply chain analysis, ecosystem analysis, technology analysis, Porter’s Five Forces analysis, and patent analysis

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically analyze the market structure, profile the key players in the global drug device combination products market, and comprehensively analyze their core competencies

- To track and analyze company developments such as acquisitions, partnerships, expansions, and product launches and approvals in the drug device combination products market

- To track and analyze competitive developments such as mergers and acquisitions, new product developments, partnerships, agreements, collaborations, and expansions in the global drug device combination products market

Key Questions Addressed by the Report

What are the drivers for the drug device combination products market?

The increasing incidence of chronic diseases like diabetes, a favorable reimbursement climate, and a focus on developing technologically advanced drug-device combination products are expected to drive market growth during the forecast period.

Which therapy segment in the drug device combination products market provides the most opportunity for growth?

The diabetes segment offers the most growth opportunity due to rising diabetes prevalence, an aging population, government initiatives, and increased patient awareness. This drives demand for insulin and GLP-1 drug-device combination products.

Which end-user segment is expected to show strong growth?

The home care setting segment is expected to grow significantly, driven by an aging population, technological advancements, patient preference for self-administration, cost-effectiveness, favorable reimbursement, and government support.

What are the main vendors present in this sector?

Key vendors include Abbott (US), Boston Scientific Corporation (US), Medtronic (Ireland), Becton, Dickinson and Company (US), Novartis AG (Switzerland), Novo Nordisk A/S (Denmark), Sanofi (France), Eli Lilly and Company (US), Merck KGaA (Germany), and AbbVie Inc. (US).

Which region is expected to witness significant demand for the drug device combination products market in the coming years?

The Asia Pacific region, especially China and India, is expected to see significant demand due to rising chronic disease prevalence, improved healthcare infrastructure, increased awareness of diabetes care, and advancements in self-administered combination products.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Drug Device Combination Products Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Drug Device Combination Products Market