Electronic Trial Master File (eTMF) Systems Market Size, Growth, Share & Trends Analysis

Electronic Trial Master File (eTMF) Systems Market by Offering (Integrated, Standalone), Function (Analytic, Compliance, Workflow, Audit), Therapeutic (Onco, Cardio, Neuro), End User (Pharma, Biotech, MedDevice), Phase, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global electronic trial master file (eTMF) systems market is projected to reach USD 2.49 billion by 2030, up from USD 1.36 billion in 2025, growing at a CAGR of 12.8% during the forecast period. Market growth is driven by increasing regulatory requirements (FDA, EMA, ICH-GCP), rising adoption of decentralized and hybrid clinical trials, growing demand for streamlined document management, and the shift toward cloud-based and automated eTMF solutions across pharmaceutical and biotech companies.

KEY TAKEAWAYS

-

BY OFFERINGBy offering, the software segment accounted for the largest share of the market in 2024, driven by the increasing adoption of cloud-based eTMF platforms, the growing need for centralized and compliant clinical document management, and the rising emphasis on real-time trial visibility and remote collaboration among sponsors, CROs, and regulatory authorities.

-

BY FUNCTIONALITYBy functionality, the analytics & reporting segment is the fastest-growing segment in the electronic trial master file (eTMF) systems market, driven by the increasing need for real-time insights into trial progress, growing focus on TMF quality metrics and compliance tracking, and rising adoption of data-driven decision-making to enhance trial efficiency and regulatory readiness.

-

BY DEPLOYMENTBy deployment, the cloud-based segment accounted for the largest share of the electronic trial master file (eTMF) systems market, driven by the growing demand for remote access to trial documents, cost-effective data storage solutions, seamless scalability, and enhanced collaboration between sponsors, CROs, and research sites across geographies.

-

BY THERAPEUTIC AREABy therapeutic area, the oncology segment accounted for the largest share of the electronic trial master file (eTMF) systems market, driven by the increasing number of cancer clinical trials, growing complexity of oncology studies requiring extensive documentation, and the rising adoption of eTMF solutions to streamline regulatory submissions and ensure data integrity in multi-site oncology research.

-

BY TRIAL PHASEBy trial phase, the Phase I segment is the fastest-growing segment in the electronic trial master file (eTMF) systems market, driven by the increasing number of early-stage clinical studies, growing focus on efficient trial start-up and document management, and rising adoption of digital TMF solutions to ensure compliance and accelerate first-in-human research processes.

-

BY END USERBy end user, the Contract Research Organizations (CROs) segment is the fastest-growing segment in the electronic trial master file (eTMF) systems market, driven by the rising trend of clinical trial outsourcing, increasing emphasis on efficient multi-sponsor document management, and growing adoption of cloud-based eTMF solutions to enhance collaboration, compliance, and operational efficiency across global trial sites.

-

BY REGIONBy region, the North America segment accounted for the largest share of the electronic trial master file (eTMF) systems market, driven by the strong presence of pharmaceutical and biotechnology companies, advanced clinical research infrastructure, stringent regulatory compliance requirements (such as FDA 21 CFR Part 11), and the rapid adoption of digital and cloud-based clinical trial management solutions.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Veeva Systems (US), Oracle (US), IQVIA (US) have entered into a number of agreements and partnerships to cater to the growing demand for electronic trial master file (eTMF) systems across innovative applications.

The electronic trial master file (eTMF) systems market is experiencing robust growth, driven by increasing regulatory scrutiny, the need for streamlined clinical trial documentation, and heightened focus on patient safety and data integrity. Furthermore, the adoption of cloud-based and automated eTMF solutions, along with strategic collaborations between sponsors, CROs, and technology vendors, is enhancing trial efficiency, ensuring compliance, and enabling faster, more transparent clinical development processes.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of electronic trial master file (eTMF) solution providers, and target applications are clients of electronic trial master file (eTMF) solution providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of electronic trial master file (eTMF) solution providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising number of clinical trials

-

Regulatory compliance and inspection readiness

Level

-

High setup and licensing costs

-

Resistance to change from traditional paper-based systems

Level

-

AI-driven automation & risk-based document management

-

Predictive analytics for compliance & risk management

Level

-

Concerns regarding patient privacy /data security & cybersecurity risks

-

Interoperability issues with legacy systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising number of clinical trials

The electronic trial master file (eTMF) systems market is driven by the rising number of clinical trials being conducted globally, as pharmaceutical, biotechnology, and medical device companies seek to accelerate drug development and meet regulatory requirements. Sponsors and CROs are increasingly adopting digital platforms to manage the growing volume of trial documents, ensure compliance, and enhance transparency across multi-site studies. The shift toward decentralized and hybrid trials, along with the emphasis on audit readiness and risk-based monitoring, further fuels the demand for robust eTMF solutions that streamline workflows, reduce manual errors, and improve overall trial efficiency.

Restraint: High setup and licensing costs

The electronic trial master file (eTMF) systems market is restrained by the high setup and licensing costs of digital trial management platforms. The initial investment, along with expenses for system integration, staff training, and regulatory compliance, can be significant, particularly for small and mid-sized organizations. These costs may limit adoption and slow the transition from traditional paper-based or hybrid document management systems.

Opportunity: AI-driven automation & risk-based document management

The market presents significant opportunities through AI-driven automation and risk-based document management. Advanced artificial intelligence and machine learning capabilities can streamline document classification, indexing, and review, reducing manual effort and minimizing errors. Risk-based approaches enable sponsors and CROs to prioritize critical documents, improve audit readiness, and accelerate decision-making across multi-site trials. As organizations increasingly adopt decentralized and hybrid trial models, AI-enabled eTMF solutions offer enhanced efficiency, regulatory compliance, and overall productivity, creating strong growth potential in the market.

Challenge: Concerns regarding patient privacy /data security & cybersecurity risks

The market faces challenges related to data security and cybersecurity risks. As clinical trial documents are increasingly stored and shared digitally, organizations must safeguard sensitive patient information, proprietary study data, and regulatory submissions from unauthorized access and cyberattacks. Ensuring compliance with global data protection regulations, implementing robust encryption, and maintaining secure access controls require significant investment and ongoing vigilance. These concerns can slow adoption and necessitate additional resources to maintain trust, confidentiality, and regulatory compliance.

Electronic Trial Master File (eTMF) Systems Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cloud-based eTMF and clinical document management solutions for sponsors and CROs | Faster trial start-up, real-time document access, enhanced compliance, streamlined audits, improved collaboration across sites |

|

Integrated eTMF solution as part of Oracle Health Sciences suite for clinical trial management | Reduced manual errors, centralized trial documentation, faster regulatory submissions, improved oversight and transparency |

|

eTMF and clinical trial content management with analytics-driven workflow optimization | Greater data accuracy, efficient trial document lifecycle, faster site activation, risk-based monitoring support |

|

Cloud eTMF platform integrated with Rave CTMS and EDC for seamless trial operations | Shorter trial timelines, improved regulatory compliance, real-time reporting, better collaboration among sponsors and CROs |

|

Global eTMF services and cloud platform for managing clinical documents and translations | Enhanced global trial collaboration, consistent document quality, reduced audit findings, efficient multi-language support |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global electronic trial master file (eTMF) system market is evolving rapidly as pharmaceutical companies, CROs, and regulators increasingly adopt digital platforms to manage clinical trial documentation, compliance, and oversight. The ecosystem comprises cloud-based eTMF solutions, workflow automation tools, advanced analytics, and integration frameworks that streamline trial processes, enhance audit readiness, and ensure regulatory adherence. The incorporation of AI, automation, and risk-based monitoring is improving document accuracy, accelerating approvals, and enabling real-time decision-making across decentralized and hybrid trial models. Meanwhile, growing interoperability initiatives with CTMS, EDC, and safety systems are fostering connected trial ecosystems that support collaboration, transparency, and operational efficiency. Collectively, these advancements are shaping a dynamic eTMF ecosystem that underpins faster, more compliant, and patient-centric clinical research worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electronic Trial Master File (eTMF) Systems Market, By Offering

In 2024, the software segment held the largest share of the eTMF systems market. High adoption of cloud-based and AI-enabled eTMF solutions supports efficient document management, regulatory compliance, and streamlined clinical trial operations across sponsors, CROs, and study sites. Growth is driven by the development of integrated, real-time platforms, increasing demand for data-driven decision-making, and preference for automated, user-friendly tools that simplify trial documentation workflows. Rising regulatory requirements and the growing complexity of clinical trials further accelerate this segment’s adoption. Additionally, ongoing investments in advanced eTMF software solutions are expected to sustain long-term market growth.

Electronic Trial Master File (eTMF) Systems Market, By Functionality

In 2024, document management emerged as the leading functionality segment in the eTMF systems market, reflecting the central importance of organizing and maintaining trial-related documentation. Sponsors, CROs, and study sites increasingly rely on these solutions to ensure proper filing, version control, and regulatory compliance of essential trial records. The growth of this segment is fueled by the need to minimize errors, accelerate audits, and provide stakeholders with instant access to critical documents. Advanced features such as automated indexing, search capabilities, and secure cloud storage are driving adoption, enabling teams to collaborate efficiently and maintain high-quality data throughout the clinical trial lifecycle.

Electronic Trial Master File (eTMF) Systems Market, By Deployment

In 2024, cloud-based eTMF solutions dominated the market, reflecting a shift toward digital-first clinical trial management. Their popularity stems from the ability to provide instant access to documents for distributed teams, reduce IT maintenance overhead, and enable seamless system updates without downtime. Cloud deployment also supports integration with other trial management platforms, facilitates remote monitoring, and ensures robust data security and compliance. As pharmaceutical companies and CROs increasingly conduct multi-site and global trials, cloud-based eTMF systems offer the flexibility and scalability needed to manage complex workflows efficiently.

Electronic Trial Master File (eTMF) Systems Market, By Therapeutic Area

In 2024, the oncology segment accounted for the largest share of the electronic trial master file (eTMF) systems market, reflecting the growing volume and complexity of cancer-related clinical trials worldwide. Oncology studies typically involve large patient populations, multi-site coordination, and extensive regulatory documentation, driving the need for advanced eTMF solutions. These systems enable streamlined document management, real-time tracking of trial progress, and enhanced compliance with global regulatory standards. As pharmaceutical companies and research organizations continue to prioritize oncology drug development, the adoption of eTMF systems ensures efficient collaboration, improved data integrity, and accelerated submission timelines for cancer therapies.

Electronic Trial Master File (eTMF) Systems Market, By Trial Phase

In 2024, Phase III clinical trials accounted for the largest share of the eTMF systems market, driven by the high volume of documentation and stringent regulatory requirements associated with late-stage trials. These trials involve multiple sites, complex protocols, and extensive patient data, making efficient document management critical for compliance and audit readiness. eTMF solutions help sponsors and CROs maintain version control, track approvals, and provide real-time access to essential trial records, reducing delays and administrative bottlenecks. The increasing scale and complexity of Phase III studies, along with the need for accelerated approvals, continue to propel the adoption of advanced, technology-enabled eTMF platforms.

Electronic Trial Master File (eTMF) Systems Market, BY End User

In 2024, pharmaceutical and biotechnology companies represented the largest end-user segment of the eTMF systems market. These organizations conduct the majority of global clinical trials and manage large volumes of regulatory and trial documentation, creating a strong demand for efficient, secure, and compliant document management solutions. eTMF platforms enable these companies to centralize trial records, maintain audit readiness, and streamline collaboration across internal teams and external CROs. The growing complexity of clinical studies, coupled with increasing regulatory scrutiny, drives pharmaceutical and biotech firms to adopt advanced electronic Trial Master File (eTMF) solutions that enhance operational efficiency and ensure data integrity throughout the trial lifecycle.

REGION

Asia Pacific to be fastest-growing Region in electronic trial master file (eTMF) systems market during forecast period

The Asia Pacific region is projected to be the fastest-growing segment in the global electronic trial master file (eTMF) systems market during the forecast period. This growth is driven by increasing clinical trial activities in countries like China, India, and Japan, supportive government initiatives promoting digitalization, rising adoption of cloud-based solutions, and expanding healthcare infrastructure. Additionally, the region's large patient population, cost advantages for outsourcing trials, and improving regulatory frameworks are accelerating the adoption of eTMF systems for efficient, compliant, and streamlined clinical trial management.

Electronic Trial Master File (eTMF) Systems Market: COMPANY EVALUATION MATRIX

In the eTMF market matrix, Veeva Systems (Star) leads with a strong market presence and a robust cloud-based platform that delivers real-time visibility, regulatory compliance, and seamless global collaboration for clinical trials. Its scale, ecosystem integration, and proven reliability make it the preferred choice for top pharma and biotech companies. Ennov (Emerging Leader) is rapidly gaining traction with its flexible, modular eTMF solutions that offer user-friendly interfaces, configurable workflows, and cost-efficient deployment for mid-sized sponsors and CROs. While Veeva dominates through enterprise-grade capabilities, Ennov shows strong potential to advance toward the leaders’ quadrant as demand for agile, interoperable, and compliant solutions grows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.21 Billion |

| Market Forecast in 2030 (Value) | USD 2.49 Billion |

| Growth Rate | CAGR of 12.8% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Electronic Trial Master File (eTMF) Systems Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiles of key regional players, including market share, revenue, product portfolio, and strategic initiatives | Supports healthcare organizations with benchmarking, vendor selection, and strategy to meet national quality standards and accreditation |

| Regional Market Entry Strategy | Country- or region-specific go-to-market strategy including barriers, regulations, and competitive landscape | Reduces market access risks, accelerates product deployment, and adapts solutions to fit reimbursement and regulatory models in each region |

| Local Risk & Opportunity Assessment | Identification of regional risks, barriers, and untapped opportunities by market or sector | Enables proactive compliance, risk mitigation, and strategic investment in emerging models and unmet patient needs |

| Technology Adoption by Region | Insights on local adoption of key software (Standalone eTMF Software, Integrated eTMF Software) | Guides R&D focus, go-to-market planning, and organizational investment decisions to improve outcomes and operational efficiency |

RECENT DEVELOPMENTS

- July 2025 : Sitero (US) acquired Axiom Real-Time Metrics, a seasoned eClinical solutions provider, thereby expanding Sitero’s global footprint and bolstering its technology-enabled, full-service clinical operations through integration of Axiom’s proprietary eClinical platform and decades of trial-execution experience.

- April 2025 : BSI Life Sciences (Switzerland) launched BSI CTMS / eTMF Version 25.1, an enhanced eClinical platform featuring an expanded feasibility assessment portal, dynamic monitoring-module questionnaires, a new sponsor portal for improved CRO-sponsor collaboration, and extended configurability across the clinical trial lifecycle.

- February 2025 : Flourish Research (US), a multi-site clinical trial organization specializing in cardiovascular, metabolic, neuroscience, and infectious disease therapeutic areas, acquired Diablo Clinical Research, a distinguished multi-therapeutic clinical research facility based in Walnut Creek, California. Established in 1995, Diablo has conducted over 1,000 trials across various therapeutic areas, including endocrinology, cardiovascular, and metabolic studies. This strategic acquisition expands Flourish Research’s geographic footprint and adds additional therapeutic coverage, enhancing its ability to deliver high-quality data, diverse participant enrollment, and exceptional patient experiences. With Diablo’s experienced investigators and proximity to Silicon Valley, Flourish is well-positioned to drive innovation across pharmaceuticals, emerging biotechs, and medical device studies.

- December 2024 : OpenClinica (US) (eClinical / EDC vendor) bought BuildClinical (patient recruitment / matching platform). The acquisition expands OpenClinica’s clinical operations stack a move that increases interoperability needs between EDC/CTMS and eTMF and is therefore relevant to eTMF market dynamics.

- August 2024 : Valsoft (Canada), a firm specializing in vertical market software, acquired Anju Software, which provides life sciences solutions including eClinical systems and TrialMaster (which is used in TMF/eTMF contexts).

- March 2024 : Ideagen (UK) acquired InPhase, enhancing its compliance capabilities by integrating InPhase’s cloud applications for oversight, reporting, and improvement, enabling seamless, real-time compliance solutions for frontline professionals.

Table of Contents

Methodology

This market research study primarily relied on secondary sources, directories, and databases to gather information for the technical, market-oriented, and financial analysis of the Electronic Trial Master File (eTMF) Systems market. In-depth interviews were conducted with various primary respondents, including key industry players, subject-matter experts (SMEs), C-level executives from major market companies, and industry consultants, among others, to collect and verify essential qualitative and quantitative data and evaluate market prospects. The size of the Electronic Trial Master File (eTMF) Systems market was estimated using multiple secondary research methods and validated with input from primary research to determine the final market size.

Secondary Research

The secondary research process involved extensively using secondary sources, including directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), the Organization for Economic Co-operation and Development (OECD), Healthcare Information and Management Systems Society (HIMSS), Centers for Disease Control and Prevention (CDC), ClinicalTrials.gov, expert interviews, and MarketsandMarkets analysis.

Secondary research was conducted to gather information for the detailed, technical, market-focused, and commercial analysis of the Electronic Trial Master File (eTMF) Systems market. It was also used to collect key information about major players, market classification, and segmentation based on industry trends, down to the most detailed level, along with significant developments related to market and technology perspectives. Additionally, a database of leading industry players was compiled using secondary research.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Primary sources mainly include industry experts from core and related industries, preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations involved in all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of leading market players, and industry consultants, among other specialists, to obtain and verify critical qualitative and quantitative information, as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics, including drivers, restraints, opportunities, challenges, and strategies adopted by key players.

After completing the market engineering process- which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation- extensive primary research was carried out. This research aimed to gather information and verify the key numbers obtained during the market analysis. Additionally, primary research was used to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of Electronic Trial Master File (eTMF) Systems offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market players.

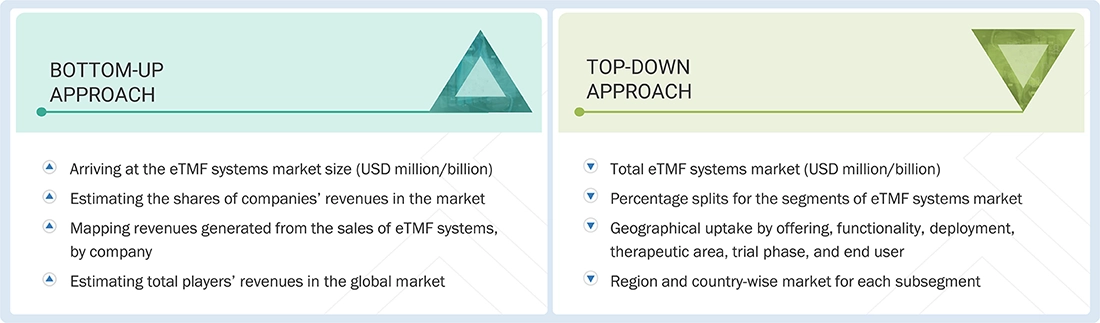

In the detailed market engineering process, both top-down and bottom-up approaches, along with various data triangulation methods, were widely used to estimate and forecast the market segments and subsegments outlined in this report. Thorough qualitative and quantitative analysis was performed on the entire process to identify key information and insights throughout the report.

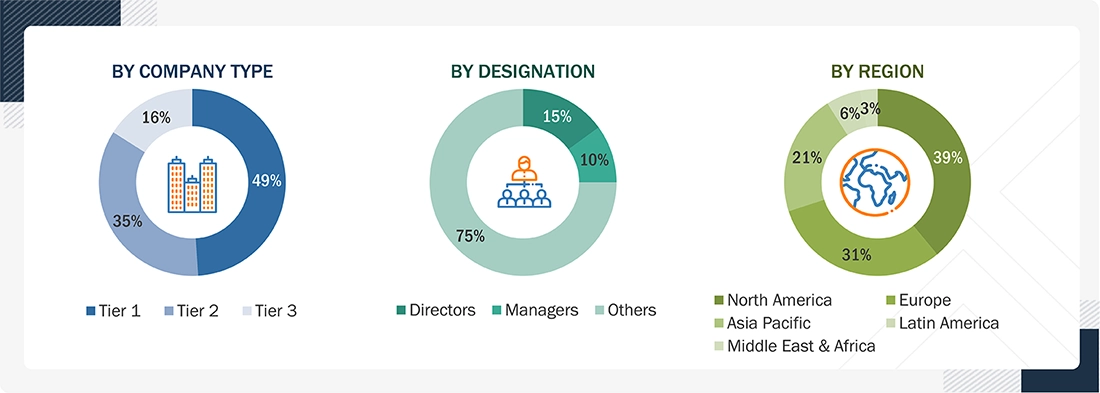

Breakdown of Primary Interviews

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2024: Tier 1 = > USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts in this study are based on a combination of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (evaluation of utilization, adoption, and penetration trends by offering, functionality, deployment, therapeutic area, trial phase, end user, and region).

Data Triangulation

After determining the overall market size from the estimation process described above, the market was divided into various segments and subsegments. To finalize the overall market analysis and obtain accurate statistics for all segments and subsegments, data triangulation and market breakdown techniques were used whenever applicable. The data was cross-verified by examining different factors and trends from both the demand and supply sides of the Electronic Trial Master File (eTMF) Systems market.

Market Definition

The Electronic Trial Master File (eTMF) Systems Market refers to the industry focused on providing technology platforms and software solutions that facilitate the electronic management of clinical trial documentation. These systems enable sponsors, CROs, and clinical trial sites to collect, organize, store, and securely share trial documents in a compliant and audit-ready manner, adhering to regulatory standards such as ICH-GCP, FDA 21 CFR Part 11, and EMA guidelines. Electronic Trial Master File (eTMF) Systems streamline workflows, enhance collaboration among stakeholders, ensure inspection readiness, and improve overall efficiency in clinical trial operations.

Stakeholders

- eTMF solution vendors

- Pharmaceutical and biotechnology companies

- Clinical Research Organizations (CROs) managing outsourced trials

- Clinical trial sites (hospitals, clinics, academic medical centers conducting trials)

- Regulatory bodies (e.g., FDA, EMA, ICH, MHRA)

- R&D departments within life sciences organizations

- Health IT and digital platform integrators

- Data management and analytics providers

- Investors and venture capital firms focused on life sciences technology

- Contract manufacturing organizations (CMOs) and other partners involved in clinical trial supply chains

- Auditors and inspection agencies responsible for compliance verification

- AI and software developers

Report Objectives

- To define, describe, and forecast the market by offering, functionality, deployment, therapeutic area, trial phase, end user, and region

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast market sizes in five main regions (and their respective countries): North America, Europe, the Asia Pacific, the Middle East & Africa, and Latin America

- To provide key industry insights, such as supply chain, regulatory, patent, and recession impact analysis

- To profile the key players in the market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches & upgrades, collaborations, partnerships, acquisitions, investments, contracts, agreements, alliances, mergers, funding, and expansions of the leading players in the market

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electronic Trial Master File (eTMF) Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electronic Trial Master File (eTMF) Systems Market