Europe Injectable Drug Delivery Market Size, Growth, Share & Trends Analysis

Europe Injectable Drug Delivery Market by Product (Device, Self Injection, Formulation, Solution, Emulsions), Formulation Packaging (Ampoules, Bottles), Therapeutic Application (Obesity, Diabetes, Cancer, Psoriasis), Usage Pattern - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe injectable drug delivery market, valued at US$166.13 billion in 2025, stood at US$178.87 billion in 2026 and is projected to advance at a resilient CAGR of 7.7% from 2026 to 2031, culminating in a forecasted valuation of US$259.49 billion by the end of the period. The increasing use of biologics, biosimilars, and long-acting injectables is driving market growth. There is an increasing demand for patient-centric delivery systems and self-administration in major healthcare markets. The need for advanced formulation capacity, device engineering expertise, and scalable sterile manufacturing capacity has accelerated more investment and innovations. The region is experiencing a strong oncology, immunology, diabetes, and specialty therapeutics pipeline. It is also witnessing a trend toward home care, integration of digital health, and smart connected delivery platforms.

KEY TAKEAWAYS

-

By CountryRest of Europe accounted for the largest share of 33.6% in 2025.

-

By ProductBy product, the formulations segment is expected to register the highest CAGR of 8.1%.

-

By Formulation PackagingBy formulation packaging, the ampoules segment is expected to dominate the market with a 44.7% share in 2025.

-

By Therapeutic ApplicationBy therapeutic application, the obesity segment is projected to grow at the fastest rate from 2026 to 2031.

-

By Usage PatternBy usage pattern, the curative care segment accounted for the largest share of 65.9%.

-

By Site of AdministrationBy site of administration, the dermal-based administration is expected to register the highest CAGR of 8.3%

-

By End UserBy end user, the hospitals & clinics segment dominated the market, with a share of 56.3% in 2025.

-

Competitive Landscape - Device Key PlayersBD (US), Baxter (US), and Gerresheimer AG (Germany) were identified as some of the star players in the Europe injectable drug delivery market, given their extensive global reach and comprehensive product portfolios.

-

Competitive Landscape - Formulation Key PlayersPfizer Inc. (US), Sanofi (France), and Novartis AG (Switzerland) were identified as some of the star players in the Europe injectable drug delivery market, given their large-scale manufacturing capacity and vast international presence.

In Europe, market demand for injectable drug delivery systems is progressing, aided by the expanding pipeline of biologics and biosimilars, rising demand for outsourced fill-finish, and a focus on patient-friendly administration in chronic and specialty conditions. Embedded innovations, including AI-enabled formulation tools, automation in aseptic manufacturing, and smart injector technologies, are also boosting the market. Strategic partnerships among pharmaceutical companies, device developers, and contract development and manufacturing organizations shape the competitive landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on businesses in the market for injectable drug delivery systems in Europe is driven by the changing landscape of healthcare services, increasing interest in biologics, and the development of combined pharmaceutical and medical devices. The major end users of injectable systems for the administration of drugs have been demanding accurate and reliable systems designed for cancer, immunological disorders, and infectious diseases. There is an ever-growing need to transform healthcare services to meet safety, compliance, and cost-effectiveness goals, thereby driving the adoption of next-generation injectable solutions, such as pre-filled syringes and wearable injectors, for self-administration and home healthcare.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift toward patient-centric and self-administration therapies

-

Aging population and high chronic disease burden

Level

-

Stringent regulatory frameworks

-

High cost of device development and sterile manufacturing

Level

-

Expansion of biosimilars and long-acting injectables

-

Growing preference for home-based care devices

Level

-

Complexities in developing wearable drug delivery systems

-

Lack of skilled personnel

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift toward patient-centric and self-administration therapies

Europe is experiencing rising adoption of self-injection devices such as auto-injectors, prefilled syringes, and wearable injectors. This is due to the increasing incidence of various chronic illnesses, as well as changes within the healthcare setting. Personalized medicine also significantly contributes to boosting the adoption rate of injectable devices.

Restraint: Stringent regulatory frameworks

The Europe injectable market struggles with intricate and frequently changing regulatory processes associated with EMA, MDR, and other compliance requirements. Overall, these processes result in prolonged product development cycles. Organizations find it very expensive and challenging to enter the market with new drug-device combination products.

Opportunity: Expansion of biosimilars and long-acting injectables

The growth of biosimilars and long-acting injectables is a major opportunity in the Europe injectable drug delivery market. Long-acting formulations are becoming increasingly popular in chronic diseases, such as cancer, immunology, and metabolic disorders, where they can reduce the frequency of dosing, thereby improving patient adherence. As a result of this trend, various sectors of the European healthcare industry are increasingly demanding advanced delivery devices, prefilled systems, and formulation expertise.

Challenge: Complexities in developing wearable drug delivery systems

There are challenges associated with developing wearable biologics drug-delivery systems, as the manufacturers must focus on drug-delivery mechanisms, biocompatibility components, and patient usability. Biologics drug-delivery systems have to incorporate sensor technologies, micro-electronics, and fluid control components. All these aspects must be ensured to be sterile and meet regulatory norms. Biologics drug-delivery systems have added complexities associated with reliability, and R&D costs are high for Europe.

europe-injectable-drug-delivery-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces glass and polymer pre-filled syringes, vials, ampoules, and drug-device combination components for biologics and vaccines | Ensures high sterility, biologics compatibility, and scalable supply for pharmaceutical injectables |

|

Provides high-precision glass containers, polymer syringes, and ready-to-use sterile packaging for injectable formulations | Enhances container integrity, reduces filling defects, and improves regulatory compliance |

|

Develops reusable and disposable self-injection systems, including autoinjectors, pen injectors, and connected injection devices | Enables patient self-administration, improves adherence, and supports chronic therapy delivery |

|

Offers large-scale production of prefilled syringes, safety syringes, autoinjectors, and needle-free systems across therapeutic segments | Reduces dosing errors, enhances injection safety, and supports mass-market deployment |

|

Produces injectable biologic formulations and pen-based delivery systems for diabetes, obesity, and chronic care | Strengthens therapy outcomes with user-friendly self-injection systems and highly stable formulations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of injectable drug delivery in Europe comprises a huge network of stakeholders working together for innovations within the drug-device integration and outsourced development activities. Some of the key players include pharmaceutical companies and device manufacturers offering formulation, aseptic fill-finish, packaging, and combination product engineering services. These companies collaborate closely with biotechnology firms, research institutes, and hospitals in their search for advanced delivery platforms and scalable sterile manufacturing. Technology partners, including developers of digital health solutions, automation providers, and AI formulation tools, are supporting design optimization, real-time monitoring, and production efficiency. This ecosystem helps speed up the development, regulatory alignment, and commercialization of next-generation injectable solutions in the European healthcare market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Injectable Drug Delivery Market, By Product

In 2025, formulations represented the largest share of the injectable drug delivery in Europe due to the demand for biologics, biosimilars, vaccines, and injectables. This was mainly due to chronic diseases that are highly dependent on specialized formulation development in Europe. R&D investments, stringent quality standards, and an increasing number of products in the oncology, immunology, and metabolic therapy are also driving the market.

Europe Injectable Drug Delivery Market, By Formulation Packaging

In 2025, ampoules held the largest share because they are widely used in hospitals and clinics in Europe. They are used to store vaccines, antibiotics, analgesics, and emergency injectables. They have low production costs and can store multiple drug types without any chemical reactions. This makes them a good choice for biologics storage. Well-established filling and packaging infrastructure across the region also supports the continued high adoption of ampoules.

Europe Injectable Drug Delivery Market, By Therapeutic Application

In 2025, autoimmune diseases accounted for the largest share owing to the increasing prevalence of diseases in Europe. Rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease require injectable therapies for a long period. The growing utilization of biologics and biosimilars for immunology indications accelerates demand for innovative injectable delivery systems. Increasing adoption of treatments, expansion of the specialty care infrastructure, and continued growth in the biologics pipeline ensure the dominance of autoimmune applications.

Europe Injectable Drug Delivery Market, By Usage Pattern

Curative care represented the largest share in 2025 because a sizable proportion of injectable therapies in Europe is dispensed primarily for acute and chronic medical conditions that require direct therapeutic intervention, rather than prophylactic measures. Strong demand for curative settings arises from high utilization in oncology, infectious diseases, autoimmune conditions, and metabolic disorders. Protocol-driven treatment by hospitals and the need for rapid and effective drug delivery strengthen the dominance of curative care in general usage trends.

Europe Injectable Drug Delivery Market, By Site of Administration

Dermal-based administration had the largest share in 2025 due to increased adoption of microneedle patches, transdermal systems, and minimally invasive delivery. They are easy to use, resulting in reduced pain and improved patient compliance. These systems enable a self-administration format and are suitable for vaccines, biologics, and therapies for chronic diseases. The increasing innovation in dermal technologies and growing interest in needle-free solutions continue to drive the significant growth of these devices.

Europe Injectable Drug Delivery Market, By End User

The largest share is held by hospitals & clinics. Most of the acute, chronic, and specialty treatments requiring injectable administration are conducted in these facilities. They have advanced infrastructure, trained medical personnel, and proficiency in managing complex biologics and high-risk injectables. Steady patient influx, government funding, and centralized treatment pathways reinforce the dominant role that these facilities play in injectable drug usage.

REGION

Germany to be fastest-growing country in the Europe injectable drug delivery market during forecast period

Germany is expected to have the highest CAGR due to a robust pharmaceutical manufacturing base, well-advanced biologics infrastructure, and high funding for drug-device innovation. The country has strong healthcare spending, a large patient population suffering from chronic diseases, and increasing acceptance of self-administration and specialty injectable therapies. The collaboration between industry, research institutions, and CDMOs will benefit from favorable regulatory frameworks and an export-oriented production capacity.

europe-injectable-drug-delivery-market: COMPANY EVALUATION MATRIX

In the Europe injectable drug delivery market matrix, Pfizer Inc. (Star) offers an extensive biologics and injectable portfolio, bulk manufacturing capabilities, and elaborate expertise in specialty therapies. It focuses on robust R&D investments, advanced formulation capabilities, and long strategic partnerships across healthcare systems, device developers, and CDMOs in Europe. Novo Nordisk A/S (Emerging Leader) is currently gaining visibility with a growing injectable therapeutics franchise, particularly in diabetes, obesity, and metabolic disorders, which relies on significant investments in self-injection technologies and patient-centric delivery platforms.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 166.13 BN |

| Market Forecast in 2031 (Value) | USD 259.49 BN |

| Growth Rate | CAGR of 7.7% from 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, UK, France, Italy, Spain, Netherlands, Belgium, Switzerland, Rest of Europe |

| Parent & Related Segment Reports |

Injectable Drug Delivery Market US Injectable Drug Delivery Market APAC Injectable Drug Delivery Market MEA Injectable Drug Delivery Market |

WHAT IS IN IT FOR YOU: europe-injectable-drug-delivery-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis |

|

Enabled understanding of technology maturity, user needs, and product positioning, supporting partner selection, portfolio planning, and investment in next-generation delivery platforms |

| Company Information |

|

Provided insights into partnership potential, biologic–device integration trends, and innovation areas shaping smart injectors and connected delivery systems |

| Geographic Analysis |

|

Supported regional strategy planning by identifying high-growth countries for expansion, localization opportunities, and collaboration hubs across Europe |

RECENT DEVELOPMENTS

- April 2025 : F. Hoffmann-La Roche Ltd received approval from the European Commission for COLUMVI, an indication for elapsed or refractory (R/R) diffuse large B-cell lymphoma (DLBCL) in adults.

- January 2025 : Johnson & Johnson received approval from the European Commission for RYBREVANT in combination with LAZCLUZE for adults with advanced Non-Small Cell Lung Cancer (NSCLC).

- December 2024 : Gerresheimer AG acquired Blitz LuxCo Sarl, the parent company of Bormioli Pharma. Bormioli Pharma represents a range of pharmaceutical packaging with a focus on glass and plastic containers and offers complementary business with Gerresheimer in closure solutions, accessories, and dosing devices.

Table of Contents

Methodology

This study extensively used both primary and secondary sources. The research process involved studying various factors affecting the industry to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the europe injectable drug delivery market. It was also used to identify key players in the market and classify and segment the industry based on trends to the most detailed level. Additionally, significant developments related to market and technology perspectives were noted. A database of the primary industry leaders was also created using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the europe injectable drug delivery markets. Primary sources from the demand side include healthcare professionals from hospitals, nursing care facilities, long-term health centers, and ambulatory surgical centers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

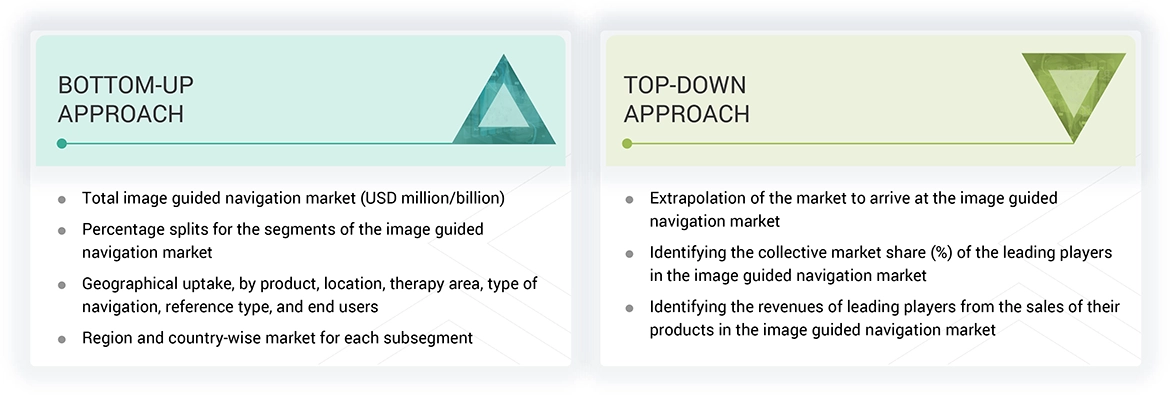

The total size of the europe injectable drug delivery market was determined after data triangulation from three approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

The europe injectable drug delivery market encompasses products, technologies, and services involved in the administration of drugs through injections. It includes a broad range of devices such as conventional syringes, auto-injectors, pen injectors, prefilled syringes, and wearable injectors, as well as various formulations like solutions, suspensions, and emulsions specifically designed for injections. This market addresses the delivery of biologics, vaccines, insulin, cancer therapies, and other treatments requiring precise and rapid drug absorption. It caters to diverse settings, including hospitals, clinics, home care, and ambulatory centers.

Stakeholders

- Injectable Drug and Device Manufacturing Companies

- Pharmaceutical & Injectable Drug Manufacturing Companies

- Healthcare Institutions (Hospitals & Outpatient Clinics)

- Distributors and Suppliers of Injectable Drugs & Devices

- Research Institutes

- Health Insurance Payers

- Market Research and Consulting Firms

Report Objectives

- To define, describe, segment, and forecast the europe injectable drug delivery market by product, therapeutic application, usage pattern, site of administration, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall europe injectable drug delivery market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players in the europe injectable drug delivery market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Injectable Drug Delivery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Injectable Drug Delivery Market