Europe Personal Protective Equipment Market

Europe Personal Protective Equipment Market by Type (Hand & Arm Protection, Protective Clothing, Foot & Leg Protection), End-use Industry (Manufacturing, Construction, Oil & Gas, Healthcare, Transportation), and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe personal protective equipment market is projected to grow from USD 12.62 billion in 2025 to USD 16.02 billion by 2030, at a CAGR of 4.88%, during the same period. One of the primary reasons for the growth of the personal protective equipment market in Europe is the region's stringent workplace safety regulations and ongoing compliance requirements in manufacturing, healthcare, construction, and chemical industries. As companies focus on protecting their workers, invest in risk-reduction measures, and choose higher-quality protective gear, the demand for PPE continues to grow. Moreover, greater awareness of workplace dangers and the demand for better-quality, certified products are boosting market growth.

KEY TAKEAWAYS

-

BY TYPEThe hand & arm protection segment is projected to be the fastest-growing type of the Europe personal protective equipment market with a CAGR of 5.14% between 2025 and 2030

-

BY END-USE INDUSTRYThe healthcare industry is projected to register the highest CAGR of 6.12% during the forecast period.

-

BY COUNTRYGermany dominated the Europe personal protective equipment market in 2024, accounting for a 29.4% market share.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSProtective Industrial Products, Inc., 3M company, and Sioen Industries NV are identified as key players in the Europe personal protective equipment market. These companies have strong market presence and extensive product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSDrägerwerk AG & Co. KGaA, Avon Technologies PLC, and COFRA S.r.l., among other emerging players, have established solid positions in specialized niche segments, underscoring their potential to evolve into future market leaders.

The Europe personal protective equipment market is expected to grow steadily. This growth is supported by stringent workplace safety regulations, increased industrial activity, and a greater emphasis from employers on mitigating risks. Demand is rising in healthcare, manufacturing, construction, oil & gas, and other industrial sectors. Companies are prioritizing certified, high-quality protective gear to ensure worker safety and meet regulations. Continuous product innovation, improved material performance, and a shift toward proactive safety management are accelerating the adoption of PPE in the region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Healthcare providers, industrial manufacturers, construction firms, and chemical processors are key clients of personal protective equipment suppliers, who provide certified, high-quality PPE to meet compliance requirements and ensure worker safety. The target end-use industries are the customers of personal protective equipment manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further impact the revenues of manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strict EU Safety Regulations

-

Rising Industrial & Construction Activity

Level

-

High Cost of Certified PPE

-

Slow Replacement Cycles

Level

-

Sustainability in PPE Materials

-

Increasing Adoption in SMEs

Level

-

Supply Chain Disruptions

-

Price Competition From Low-Cost Imports

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strict EU Safety Regulations

The critical EU safety regulations are a significant market driver for the personal protective equipment market in Europe, as manufacturers must adhere to the extensive EN standards and EU OSHA requirements to conduct their activities legally and safely. Such rules have compelled employers to utilize certified PPE in all sectors, including manufacturing, construction, chemicals, and healthcare, thereby increasing the need to continually update and standardize personal protective equipment. As regulatory audits continue to rise, and the penalties associated with not complying with these standards become severe, organizations are spending more funds on high-quality PPE to achieve safety standards. This long-term compliance pressure has a significant effect on increasing demand for the product, making it premiumize, and ensures consistent market growth in the region.

Restraint: High Cost of Certified PPE

Certified PPE is very expensive, which constitutes a major constraint in the Europe market because EN-compliant products tend to use more complex materials, are multilayered, and adhere to high testing standards, all of which involve a high cost of production and acquisition. These increased unit costs put a strain on the budget of safety on the part of employers, particularly SMEs, and may restrict the use of superior protective equipment. Increased prices of raw materials and reliance on imported parts further increase total expenses, making it difficult for companies to constantly update their equipment. Consequently, certain industries postpone the process of change or use simple, less expensive PPE, which reduces the overall rate of market growth despite increasing regulatory requirements.

Opportunity: Sustainability in PPE Materials

The growing awareness of sustainability is creating growth opportunities for the PPE market in Europe. The industries are focusing on environmentally responsible safety solutions. Businesses are also considering recyclable respirators, reusable protective clothing, and bio-based or low-impact products to minimize waste. This change necessitates the development of new designs that are more protective and have minimal environmental impact. Those manufacturers that invest in circular product model development, material recovery programs, and long-lasting, low-waste PPE will have a competitive advantage. With sustainability set to become a key procurement requirement, it is likely to identify new sources of revenue and hasten the uptake of premium products in the region.

Challenge: Supply Chain Disruptions

Supply chain disruptions are one of the greatest challenges facing the Europe market for personal protective equipment, as the region has been heavily reliant on imports to obtain key products such as respirators, gloves, and specialty protective fabrics. Raw material availability can be easily disrupted by global shocks, whether geopolitical tensions, pandemics, and logistics bottlenecks, which cause extended lead time and drive rapid price swings. This weakness compels employers and distributors to take a more aggressive approach to inventory risks, which can result in either a stockout or an expensive emergency purchase. There is also a lack of domestic manufacturing capability that will constrain the stabilization of supply in Europe during a crisis, which will ultimately affect the reliability of procurement and slow down market growth.

EUROPE PERSONAL PROTECTIVE EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of hygiene-focused PPE, including disposable gloves, hairnets, aprons, and chemical-resistant cleaning PPE in manufacturing plants | Better contamination control | Improved food-safety compliance | Enhanced audit readiness | Operational hygiene |

|

Deployment of high-visibility clothing, fall-protection gear, and dust-resistant masks across large infrastructure projects | Reduced site accidents| Improved compliance with EU construction safety norms | Higher project uptime |

|

Integration of cut-resistant gloves, chemical-resistant suits, and smart PPE for machinery-intensive operations | Lower injury rates | Enhanced productivity | Improved regulatory readiness and safety audits |

|

Use of flame-retardant coveralls, gas-detection wearables, and anti-static protective gear in refineries and offshore sites | Strong hazard mitigation | Fewer operational disruptions | Higher worker confidence and safety performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the Europe personal protective equipment market comprises a well-established network of manufacturers, distributors, certification bodies, and end-use industries operating under stringent regulatory oversight. Product development is driven by compliance with EU safety standards, while distributors ensure wide market access across various sectors, including healthcare, manufacturing, construction, and chemicals. End users influence demand through evolving safety needs and procurement requirements, creating a highly regulated and performance-driven ecosystem focused on quality, reliability, and worker protection.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Personal Protective Equipement Market, By Type

The hand & arm protection segment is projected to be the fastest-growing type of the Europe personal protective equipment market, during the forecast period. Tighter safety standards are being imposed on the industries in terms of handling equipment, chemicals, and other hazardous materials, and as such, the reliability of hand and arm protection is in demand. The increasing number of hand injuries in the workplace, combined with the growing use in manufacturing, construction, and healthcare, is driving the need to look beyond standard cut-resistant, durable gloves and sleeves and demand high-tech, cut-resistant, chemical-resistant, and heat-resistant gloves and sleeves. As employers pay increased attention to improved safety compliance and better protection of workers, this segment is expected to experience excellent and stable growth during the forecast period.

Europe Personal Protective Equipement Market, By End-use Industry

The manufacturing sector was the largest in the Europe personal protective equipment market in 2024 due to the high percentage of exposure to industrial hazards like machinery, chemicals, noise, and particulate matter. Considering the presence of stringent requirements when it comes to regulatory compliance and the overall focus on the safety of the workers, manufacturers regularly invest in a large variety of PPE, such as protective clothing, gloves, eyewear, as well as respiratory equipment. The size of the sector and the variety of risks concern it, as well as the future modernization efforts, make it the most promising demand generator in the regional PPE environment.

REGION

Germany to be the fastest-growing country in Europe PPE market during the forecast period

Germany is predicted to be the fastest-growing Europe market of PPE due to the developing industrial landscape, the rapid implementation of automation, and the reconsideration of workforce safety in the high-risk industries. Additional demand is being reinforced by the increasing number of workplace audits, the enhanced enforcement of the national safety laws, and the increase in investment in high-quality, certified PPE. Also, the current infrastructure improvements in Germany and its status as a leading manufacturing centre are likely to hasten the acquisition of innovative protective measures, which will lead to the country gaining a leading position in terms of growth rate during the forecast period

EUROPE PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

In the Europe personal protective equipment market matrix, Protective Industrial Products, Inc. (Star) leads with a strong market share and broad product portfolio, underpinned by its advanced protective equipment that caters to manufacturing, healthcare, construction, oil & gas, and other industries. Its ability to deliver high-performance, sustainable, and regulatory-compliant solutions has positioned it as a preferred partner for global brand owners and converters. Sioen Industries NV (Emerging Leader) is gaining traction with its cost-competitive formulations and expanding presence in the Europe personal protective equipment market. While Protective Industrial Products, Inc. dominates through scale, regional reach, and innovation-driven offerings, Sioen Industries NV demonstrates strong potential to advance toward the leaders’ quadrant as demand for region-specific, high-performance, and value-driven personal protective equipment accelerates.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.09 BN |

| Market Size in 2030 (Value) | USD 16.02 BN |

| Growth Rate | CAGR of 4.88% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Europe |

WHAT IS IN IT FOR YOU: EUROPE PERSONAL PROTECTIVE EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe Personal Protective Equipment – Technology & Product Trends |

|

|

| Customer Intelligence on Key End-use Industries | Delivered insights on buying patterns, price sensitivity, and key selection criteria from major customer groups | Enables client to tailor product positioning and pricing strategies to match customer expectations |

RECENT DEVELOPMENTS

- May 2025 : Protective Industrial Products (PIP) acquired Honeywell’s personal protective equipment business, which encompasses renowned brands such as UVEX, North, and Miller. This acquisition will enhance PIP’s global footprint and product offerings.

- September 2024 : Delta Plus introduced innovative personal protective equipment designed to enhance worker safety and comfort. Its irritant- and toxic-substance-free PPE eliminates materials such as latex, silicone, dimethyl fumarate (DMF), phthalates, and azo dyes, reducing the risk of skin reactions and environmental impact. Additionally, Delta Plus has developed heat-resistant PPE incorporating graphene fibers, which regulate body temperature by dispersing and conducting heat, improving thermal comfort for workers in high-temperature environments.

- July 2024 : Lakeland Industries Inc. acquired LHD Group Deutschland GmbH and its subsidiaries in Australia and Hong Kong. This strategic acquisition enhances Lakeland’s presence in the Europe PPE market by integrating LHD’s premium firefighter turnout gear and Total Care services, including maintenance and repair.

- March 2022 : Sioen Industries NV launched the Tormi and the Keibu flame-retardant and anti-static protective clothing for women. These long johns and T-shirts with long sleeves are comfortable and nicely fitted for female workers.

Table of Contents

Methodology

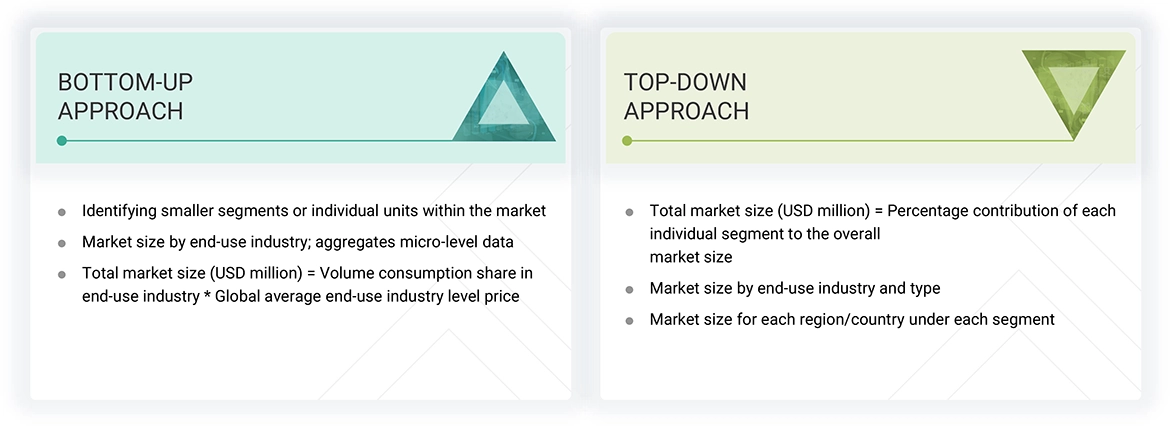

The study involved four major activities in estimating the market size for the Europe Personal Protective Equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The Europe Personal Protective Equipment market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the Europe Personal Protective Equipment market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Honeywell International Inc. | Senior Manager | |

| 3M Company | Innovation Manager | |

| DuPont de Nemours, Inc. | Vice-President | |

| Ansell Limited | Production Supervisor | |

| MSA Safety Incorporated | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Europe Personal Protective Equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Europe Personal Protective Equipment Market: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Europe Personal Protective Equipment industry.

Market Definition

According to the International Safety Equipment Association, Personal Protective Equipment (PPE) is worn to minimize exposure to hazards that can cause serious injuries. PPE protects workers from life-threatening hazards such as chemical burns, explosions, contamination, and falls from heights. It includes gloves, safety glasses and shoes, respirators, earplugs, hard hats, coveralls, and full-body suits. PPE is mainly used in healthcare, manufacturing, construction, oil & gas, mining, transportation, food, and firefighting sectors.

Stakeholders

- Europe Personal Protective Equipment manufacturers

- Europe Personal Protective Equipment distributors

- Raw material suppliers

- Service providers

- Government and research organizations

Report Objectives

- To define, describe, and forecast the market size for Europe Personal Protective Equipment in terms of value

- To provide detailed information about drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and forecast the Europe Personal Protective Equipment market by type and end-use industry

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To track and analyze recent developments, such as product launches, deals, and other developments, in the market

- To analyze the opportunities for stakeholders in the market and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Personal Protective Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Personal Protective Equipment Market