Graphene Market

Graphene Market by Type (Bulk Graphene and Monolayer Graphene), Source, Application, End-use Industry (Automotive & Transportation, Aerospace & Defense, Electrical & Electronics, and Construction) and Region - Global Forecast to 2030

OVERVIEW

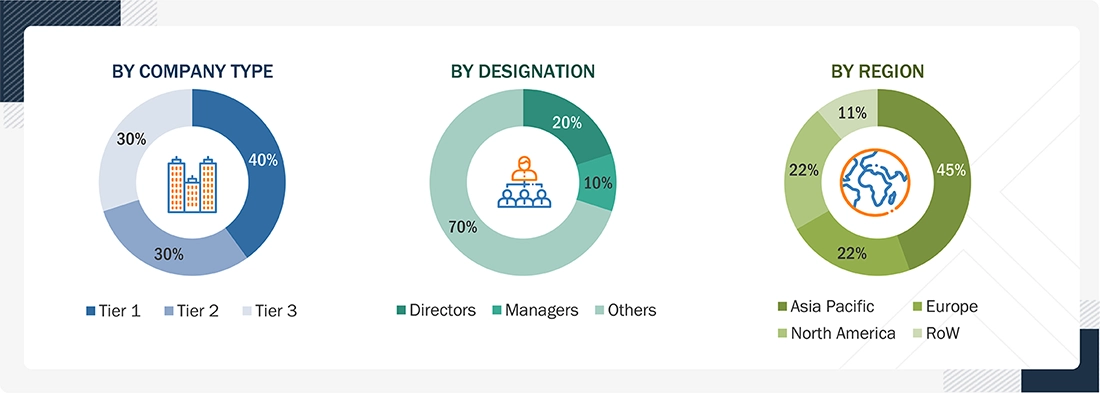

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The graphene market is projected to reach USD 3.58 billion by 2030 from USD 1.22 billion in 2025, at a CAGR of 24.0% from 2025 to 2030. Graphene is a single layer of carbon atoms arranged in a hexagonal lattice and is considered a fundamental building block for other carbon allotropes like graphite, carbon nanotubes, and fullerenes. Its market growth is fueled by rising demand across industries such as automotive, aerospace & defense, electronics, and construction, along with supportive government policies in major graphite-exporting countries to enhance graphene production and revenues.

KEY TAKEAWAYS

-

BY TYPEThe graphene market comprises bulk graphene and monolayer graphene, with bulk forms used widely in composites and coatings, and monolayer graphene playing a critical role in advanced electronics and sensor applications. Bulk graphene is expected to dominate the market during the forecast period due to its unique combination of extraordinary properties and potential applications across various industries.

-

BY SOURCEKey raw materials include graphite, graphite oxide, and reduced graphite oxide. These sources influence production methods and material quality, affecting end-use performance and cost efficiency. Graphite is the most widely used source of graphene. The large market share for this source is a result of the unique structural and chemical properties that facilitate the production of high-quality graphene.

-

BY APPLICATIONIncreasing demand for graphene in composites, energy harvesting & storage, paints, coatings & inks, and electronics is driven by graphene's superior mechanical, electrical, and thermal properties. Composites account for the largest share of the overall graphene market. This is attributed to the established applications of graphene in composite components. Weight reduction is a major challenge in various end-use industries, such as aerospace, automotive, and sporting goods. These industries are expected to drive the demand for graphene in the future in composite applications.

-

BY END-USE INDUSTRYBased on end-use industry, the graphene market has been segmented into automotive & transportation, aerospace & defense, electrical & electronics, construction, and other end-use industries. The automotive & transportation end-use industry is expected to grow at the highest CAGR during the forecast period owing to the rapid digitization and electrification of vehicles.

-

BY REGIONBy region, Asia Pacific is projected to register the highest CAGR of 25.2% during the forecast period. This high growth is fueled by rapid industrialization and strong research and development activities in countries like China, Japan, and India.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. NanoXplore Inc, Global Graphene Group, and Graphenea S.A. entered into a number of agreements and partnerships to cater the growing demand for graphene across innovative applications.

The graphene market is projected to grow rapidly over the next decade, supported by advancements in nanomaterials & batteries and the shift towards sustainable, high-performance technologies. Industries are increasingly turning to graphene for its unmatched properties (lightweight, strong, and highly conductive), making it valuable in energy storage, electronics, composites, and coatings. Growing emphasis on renewable energy and eco-friendly solutions further strengthens its role as a breakthrough material, setting the foundation for broad industrial adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions affect consumers' businesses. These shifts influence the revenues of end users. As a result, the revenue changes for end users are likely to impact the revenues of graphene suppliers, which, in turn, affect the revenues of graphene manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand in key end-use industries

-

Supportive government policies in major graphite-exporting countries

Level

-

Difficulty in mass production

-

Lack of energy bandgap in graphene materials

Level

-

Rising demand in energy storage applications

-

Increasing adoption in next-generation electronics

Level

-

Lack of standardization

-

High production cost

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand in key end-use industries

Graphene is a versatile material with properties such as lightweight, high thermal conductivity, higher strength than diamond, steel, and carbon fibers, excellent heat and electrical conductivity, high flexibility, and optical transparency. These properties enable graphene to increase the quality of the end product. For instance, when a fraction of graphene is added to polymer materials, its yield strength can increase by up to 300 times and its heat transfer ability by up to 200 times. Graphene imparts lightweight property and high thermal and electrical conductivity to composite, paints & coatings, electronics, energy storage, and other applications.

Restraint: Difficulty in mass production

The manufacturing process of graphene is cost-intensive and time-consuming. Maintaining the quality and upscaling graphene production at the same time is difficult. In case of any defects in the graphene monolayer carbon network, the properties of graphene, such as electrical conductivity, transparency, thermal conductivity, and impermeability, are damaged, hampering the quality of graphene. The CVD process is used to produce high-quality monolayer and few-layer graphene, and it is difficult to perform mass production with the CVD process. These factors restrict the mass production of graphene and lead to higher production cost.

Opportunity: Rising demand in energy storage applications

Graphene’s high conductivity, large surface area, and lightweight properties make it a game-changer for energy storage solutions. The rising demand for efficient, long-lasting, and faster-charging energy storage devices is driving the interest of energy storage solution providers toward graphene-based solutions. Graphene can enhance the performance of lithium-ion batteries, supercapacitors, and graphene-based solar cells.

Challenge: Lack of standardization

The graphene industry is in its initial stage of development, and less development is done in terms of regulations and standards. Several companies are producing various types of graphene, causing much diversification and confusion in the industry. This has resulted in the introduction of fake graphene in the market, which is difficult to recognize at the product stage. This is leading to many cases of poor-quality graphene from suppliers and diminishing the trust among end users. Some institutes are developing methods for quality testing of graphene. For instance, researchers from the National University of Singapore (NUS) have developed a systematic and reliable method for establishing the quality of graphene at a global level.

graphene-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Fast-charging lithium-ion batteries with graphene-enhanced anodes for Model S/3/X vehicles | 5x faster charging speeds, 30% longer battery life, reduced thermal management issues |

|

Flexible OLED displays using graphene electrodes for Galaxy foldable smartphones | Ultra-thin bendable screens, 25% improved conductivity, enhanced durability for folding cycles |

|

Curved graphene supercapacitors for automotive start-stop systems and grid energy storage | 1 million charge cycles, 15-second charging, operates in -40°C to +65°C temperature range |

|

G+ graphene-enhanced tire compounds for Pirelli Formula 1 and consumer tire applications | 20% improved grip performance, reduced rolling resistance, enhanced wet weather traction |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The graphene ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users. The raw material suppliers are the source of raw materials like graphite and graphite oxide for the graphene manufacturers. The manufacturers use technologies such as Chemical Vapor Deposition (CVD) and exfoliation to produce graphene and graphene-based materials. The distributors and suppliers are the ones who establish contact between the manufacturing companies and end users to concentrate the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Graphene Market, By Source

The graphite segment accounted for the largest market share in 2024. Graphite is one of the most abundant natural carbon sources, thus easily sourced and processed. It is available in abundance to provide a constant supply for the influx of graphene technology to mass produce graphene. Graphite extraction and processing are mostly cheaper than other carbon sources. Graphite's abundance, cost-effectiveness, versatile production methods, high-quality output, and a long history of research make it the preferred source for deriving graphene across various industries.

Graphene Market, By Type

The bulk graphene segment dominated the overall graphene market in 2024. Bulk graphene is less expensive to produce compared to monolayer graphene. The production processes associated with bulk graphene, such as chemical reduction of graphene oxide or mechanical exfoliation, are generally more scalable and cost-effective. This makes bulk graphene a more appealing material for manufacturers in different industries, especially in applications where high purity and single-layer structures are not critical.

Graphene Market, By Application

In 2024, the composites segment accounted for the largest share of the overall graphene market. In industries such as automotive & transportation and aerospace & defense, the demand for lightweight materials is rapidly increasing, fuelled by the need for fuel efficiency and performance. Graphene-based composites can reduce the weight of vehicles by 10-15%, leading to an improvement in fuel efficiency of 6-10%. This trend aligns with the global efforts made to meet environmental regulations and reduce carbon footprints.

Graphene Market, By End-use Industry

The automotive & transportation industry held the largest share in 2024. Graphene's exceptional strength-to-weight ratio enhances fuel efficiency and vehicle performance, which is crucial for meeting stringent emission regulations and the growing demand for electric vehicles. Graphene improves battery performance, reduces overall vehicle weight, and supports technological advancements in composites and coatings used extensively in automotive applications.

REGION

Asia Pacific to be fastest-growing region in global graphene market during forecast period

The Asia Pacific graphene market is expected to register the highest CAGR during the forecast period, driven by rapid urbanization, industrialization, and substantial investments in the electronics, automotive, and aerospace sectors. Major manufacturers in countries like China, Japan, and South Korea are increasingly adopting graphene in applications such as touchscreens, LEDs, and lightweight automotive components due to its excellent conductivity and strength. The rising consumer demand and ongoing R&D initiatives in the region are fostering innovation and expanding graphene applications across industries.

graphene-market: COMPANY EVALUATION MATRIX

In the graphene market matrix, NanoXplore Inc. (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industries like automotive and electronics. Directa Plus S.p.A. (Emerging Leader) is gaining traction with sustainable graphene solutions in textiles, composites, and environmental applications. While NanoXplore dominates with scale, Directa Plus shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Graphenea S.A (Spain)

- First Graphene (Australia)

- NanoXplore Inc. (Canada)

- Avanzare Innovacion Technologica S.L. (Spain)

- Global Graphene Group (US)

- Directa Plus S.p.A (Italy)

- Haydale Graphene Industries Plc (UK)

- ACS Material (US)

- The Sixth Element (Changzhou) Materials Technology Co. Ltd. (China)

- Xiamen Knano Graphene Technology Co., Ltd. (China)

- Universal Matter, Inc. (Canada)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.00 Billion |

| Market Forecast in 2030 (Value) | USD 3.58 Billion |

| Growth Rate | CAGR of 24.0% from 2025 to 2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (Billion), Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: graphene-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Graphene Manufacturer |

|

|

| Graphene-Based Composites Manufacturer | Comprehensive list of composites customers with segmentation by industry/application - Benchmarking of adoption rates across aerospace, automotive, and construction - Analysis of switching barriers for customers |

|

| Battery Manufacturer |

|

|

| US-based Graphene Raw Material Supplier |

|

|

| Automotive Graphene Customer |

|

|

RECENT DEVELOPMENTS

- June 2024 : Avanzare and Tecnalia collaborated on the European Sunshine project to develop pioneering Safe and Sustainable by Design (SSbD) strategies for graphene production. In collaboration with Avanzare, Tecnalia has developed a digital twin comprising various sensors that are installed along an extraction cabin to mitigate operator exposure to graphene particles.

- January 2024 : NanoXplore Inc. announced that it had increased the production capacity of its St-Clotilde, QC plant to meet an existing customer’s need for increased graphene-enhanced SMC parts in an active program.

- June 2023 : Directa Plus and Candiani developed a G+ enhanced fabric, which is made of both Directa Plus’s patented technology, Graphene Plus, which enhances the fabric with antimicrobial and thermal features, and Candiani Denim’s KikotexPolymer, which substitutes liquid plastic in fabric production processes.

- January 2022 : First Graphene signed an agreement with global construction chemicals manufacturer Fosroc, Inc. to develop PureGRAPH graphene-enhanced cement additives or grinding aids. The agreement is a key step in First Graphene’s strategy to help the cement and concrete industries, responsible for up to 8% of global carbon dioxide emissions, achieve 25% emissions reduction by 2030.

Table of Contents

Methodology

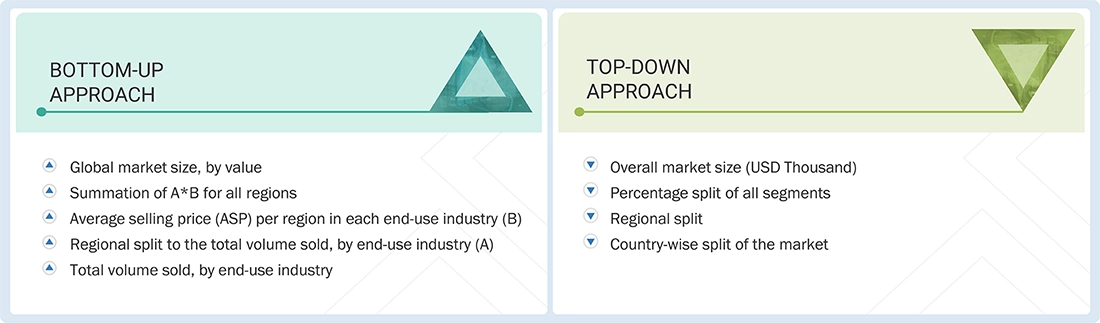

The study involves two major activities in estimating the current market size for the graphene market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering graphene services and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry's value chain, the total pool of key players, market classification, and segmentation according to industry trends, to the bottom-most level, and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the graphene market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the graphene market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from graphene industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to materials, source, technology, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using graphene technologies, were interviewed to understand the buyer's perspective on the suppliers, products, component providers, and their current usage of recycled materials and future outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the graphene market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in graphene in different industries at a regional level. Such procurements provide information on the demand aspects of graphene and graphene-based materials for each application. For each material, all possible segments of the graphene market were integrated and mapped.

Graphene Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Graphene is a one-atom-thick allotrope of carbon that is incredibly flexible, strong, and lightweight. It is the best electricity & heat-conducting material in its purest form. Graphene represents a different class of materials, called 2D (two-dimensional) materials. The properties of graphene depend on the layers of carbon. It is a two-dimensional material due to its single-atom thickness. Graphene's unique set of properties (thinness, lightweight, and excellent heat and electricity conduction) makes the material ideal for various applications that could potentially revolutionize several industries.

Key applications of graphene include plastics, composite materials, electronics, and energy storage. The main commercial forms of graphene include functionalized graphene and graphene oxide. With improved affordability and availability of graphene, its application scope is anticipated to expand in various industries.

Key Stakeholders

- Graphene Companies

- Government and Research Organizations

- National and Local Government Organizations

- Institutional Investors

- Graphite Suppliers

- End Users

Report Objectives

- To define, describe, and forecast the graphene market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global graphene market by type, source, application, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Customization Options

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the graphene market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Graphene Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Graphene Market