Europe Telehealth & Telemedicine Market Size, Growth, Share & Trends Analysis

Europe Telehealth & Telemedicine Market by Function (Clinical Care, Teleconsult, RPM, Patient Engagement, Analytics), Application (TeleICU, Teleradiology, Telecardiology, Diabetes), Age (Adult, Pediatric), End User (Hospital, Payer) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe telehealth & telemedicine market, valued at US$22.01 billion in 2024, stood at US$24.76 billion in 2025 and is projected to advance at a resilient CAGR of 11.2% from 2025 to 2030, culminating in a forecasted valuation of US$42.04 billion by the end of the period. The growth of the Europe telehealth & telemedicine market is driven by the rising demand for remote healthcare services, increasing adoption of digital health platforms, and expanding broadband and mobile connectivity across the region. The growing emphasis on chronic disease management, combined with supportive government initiatives for virtual care, is further accelerating market expansion.

KEY TAKEAWAYS

-

By CountryThe Germany telehealth & telemedicine market accounted for a 26.4% revenue share in 2024. This growth reflects increasing adoption of remote care solutions, stronger digital-health infrastructure, and rising demand for virtual consultations across the country.

-

By ComponentBy component, the software segment is expected to register the highest CAGR of 11.8%. The segment’s strong momentum is driven by rising use of telehealth platforms, advanced virtual-care tools, and software that streamlines remote monitoring and clinical workflows across healthcare settings.

-

By FunctionBy function, the remote patient monitoring/patient monitoring segment is projected to grow at the fastest rate from 2025 to 2030. Rapid expansion is being fueled by increasing chronic disease burdens, growing use of connected health devices, and the need for continuous, real-time patient oversight beyond traditional clinical settings.

-

By ApplicationBy application, the specialty care segment is accounted for the largest share of 64.8% in 2024. Its dominance is supported by rising demand for remote access to specialists, improved virtual care pathways, and broader adoption of telemedicine across high-complexity therapeutic areas.

-

By Age GroupBy age group, adults segment dominated the market during the forecast period. The growth of this segment is largely driven by strong digital-health engagement among adults and their growing reliance on virtual care for routine and chronic condition management.

-

By End UserBy end user, the ambulatory surgery centers, ambulatory care ceneters, and other outpatient settings segment will grow the fastest during the forecast period. Growth in this segment is supported by expanding use of telehealth for pre- and post-operative care, greater focus on efficient outpatient workflows, and rising adoption of virtual consultations in ambulatory settings.

-

Competitive LandscapeMedtronic, Teladoc Health, Inc., Cisco Systems, Inc., were identified as some of the star players in the Europe telehealth & telemedicine market, given their strong market share and product footprint.

-

Competitive LandscapeCerebral, Inc., Kindbody, and Transcarent, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The telehealth & telemedicine market in Europe is growing as healthcare systems increasingly rely on digital platforms for remote consultations, virtual monitoring, and chronic disease management. Advancements in remote diagnostics, connected devices, and AI-assisted tools are improving care access and real-time decision-making. Rising government support, expanding digital infrastructure, and stronger collaborations between providers and technology companies are further accelerating the adoption of telehealth across the region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business in the Europe telehealth & telemedicine market is driven by rising expectations for convenient, accessible, and digitally enabled healthcare that improves patient engagement and care continuity. Hospitals, clinics, ambulatory centers, and virtual-care providers are the primary end users, and their growing need for remote consultations, digital triage, and integrated monitoring solutions directly influences market adoption. Increasing use of connected devices, real-time health data, and virtual care platforms is significantly enhancing workflow efficiency, broadening service reach, and strengthening performance for telehealth solution providers across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Aging population, chronic disease burden, and need for home-based care

-

Favorable EU regulations supporting digital health transformation

Level

-

High compliance costs due to GDPR and complex data protection requirements

-

Variability in telehealth reimbursement policies across countries

Level

-

Expansion of remote monitoring for elderly care and smart home healthcare

-

Rise of cross-border telemedicine enabled by EU digital health initiatives

Level

-

Fragmented healthcare ecosystem across EU member states

-

Limited digital skills among elderly and rural populations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Aging population, chronic disease burden, and need for home-based care

Europe’s aging population and the rising burden of chronic diseases are significant factors driving the growth of the telehealth and telemedicine market. The population of people aged 65 years and above in the EU-27 is projected to grow significantly from 90.5 million in 2019 to 129.8 million by 2050, increasing demand for continuous monitoring and long-term care. As more elderly patients seek convenient alternatives to frequent hospital visits, remote healthcare services become essential. Coupled with strong government support for digital health infrastructure, this demographic shift is driving substantial growth in the region’s telehealth and telemedicine market.

Restraint: High compliance costs due to GDPR and complex data protection requirements

The stringent data protection rules in Europe, particularly the General Data Protection Regulation (GDPR), act as a significant restraint on the telehealth and telemedicine market. Healthcare providers and digital health companies face high compliance costs due to complex requirements for data security, patient consent, storage, and cross-border data handling. These regulatory obligations often demand substantial investments in cybersecurity infrastructure and specialized legal oversight, creating barriers for both new entrants and smaller providers. As a result, the overall pace of telehealth adoption may be slowed, despite strong demand for remote healthcare services.

Opportunity: Expansion of remote monitoring for elderly care and smart home healthcare

The growing focus on remote monitoring technologies and smart home healthcare presents a strong opportunity for the telehealth and telemedicine market in Europe. As the region’s elderly population grows, demand for continuous, home-based health support is increasing rapidly. Remote monitoring devices, smart sensors, and connected home-health platforms enable early detection of health issues, reduce hospital readmissions, and support independent living for seniors. With increasing investments in digital infrastructure and smart home innovations, this trend is creating significant growth potential for telehealth providers across the region.

Challenge: Fragmented healthcare ecosystem across EU member states

The fragmented healthcare ecosystem across EU member states presents a major challenge for the telehealth and telemedicine market. Each country follows its own regulatory frameworks, reimbursement rules, digital health standards, and technological maturity, creating inconsistencies that hinder cross-border scalability. This lack of harmonization increases operational complexity for providers and slows the adoption of unified telehealth solutions. As a result, companies must adapt to diverse national requirements, limiting the market’s ability to grow evenly across Europe.

Europe Telehealth & Telemedicine Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Remote patient monitoring and connected device solutions for chronic disease management across Europe. | Improved ongoing care, reduced readmissions, and stronger patient involvement in self-management. |

|

Telehealth platforms offering virtual consultations, mental health services, and chronic care programs for European providers. | Expanded care access, reduced waiting periods, and enhanced efficiency for healthcare systems. |

|

Secure telemedicine infrastructure with high-quality video conferencing and remote collaboration tools for hospitals. | Reliable virtual consultations, better communication, and strong data protection. |

|

Integrated telehealth solutions for remote monitoring, virtual ICU support, and chronic disease oversight. | Earlier detection of health issues, improved clinical coordination, and better patient outcomes. |

|

Cloud-based telehealth communication platform supporting virtual visits, specialist consultations, and care coordination. | Easy adoption, scalable deployment across regions, and secure provider-patient interactions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe telehealth and telemedicine market ecosystem includes key players such as Medtronic, Teladoc Health, Inc., and Cisco Systems, Inc., offering advanced solutions for remote monitoring, virtual consultations, and secure digital communication. These technologies enhance care accessibility, facilitate real-time clinical decision-making, and streamline remote service delivery. Cloud and connectivity partners enhance scalability, while hospitals, clinics, and virtual care providers rely on these platforms to expand digital healthcare. Strengthening cross-industry collaboration continues to drive innovation across the region.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Telehealth & Telemedicine Market, By Component

By component, the software segment is expected to register the highest CAGR in 2024, which is attributed to the growing adoption of teleconsultation platforms, remote monitoring software, and integrated digital health solutions across healthcare systems. Increasing demand for interoperable platforms that support real-time communication, data sharing, and patient management is further driving its growth. Additionally, continuous advancements in AI-driven analytics, user-friendly interfaces, and cloud-based solutions are boosting the expansion of the software segment in the region.

Europe Telehealth & Telemedicine Market, By Function

By function, the clinical care management segment accounted for the largest share in 2024, driven by the rising need for efficient coordination of patient care, particularly in chronic disease management and post-acute care monitoring. Telehealth platforms that support clinical workflows, treatment planning, and continuous patient monitoring are being increasingly integrated into healthcare systems. Additionally, the shift toward value-based care models and improved patient outcomes has strengthened demand for advanced clinical care management tools across Europe.

Europe Telehealth & Telemedicine Market, By Application

By application, the specialty care segment accounted for the largest share in 2024, primarily due to the growing use of telehealth in areas such as cardiology, dermatology, mental health, and endocrinology, where remote consultations and continuous monitoring significantly enhance care delivery. The rising burden of chronic and complex conditions has increased demand for specialist access, particularly in rural and underserved regions. Moreover, telemedicine platforms are enabling faster diagnosis, improved specialist collaboration, and reduced wait times, supporting the strong uptake of specialty care services across Europe.

Europe Telehealth & Telemedicine Market, By Age Group

By age group, the adults segment accounted for the largest share in 2024, which is primarily driven by the higher utilization of digital health tools among working-age populations who prefer convenient and time-efficient healthcare solutions. Adults are increasingly relying on teleconsultations, remote monitoring, and mobile health applications to manage chronic conditions and receive routine care. Additionally, greater digital literacy and widespread smartphone adoption within this group have further accelerated telehealth usage across Europe.

Europe Telehealth & Telemedicine Market, By End User

By end user, the healthcare providers segment accounted for the largest share in 2024, primarily due to the rapid integration of telehealth platforms into hospitals, clinics, and primary care settings, which enhances patient access, streamlines workflows, and improves care coordination. Providers are increasingly adopting remote monitoring tools, virtual consultation systems, and digital patient management solutions to address the rising volume of patients and their chronic care needs. Additionally, supportive government initiatives and investments in digital health infrastructure have further strengthened adoption among healthcare providers across Europe.

REGION

UK to be fastest-growing country in Europe telehealth & telemedicine market during forecast period

The UK telehealth and telemedicine market is expected to register the highest CAGR during the forecast period, driven by strong national digital health initiatives and the rapid adoption of virtual care across the NHS and private healthcare providers. Hospitals, clinics, and ambulatory centers are increasingly leveraging telehealth for remote consultations, chronic disease management, and real-time patient monitoring. Continued investment in digital infrastructure, supportive government policies, and rising demand for accessible, patient-centric care are driving the acceleration of adoption and sustaining robust market growth.

Europe Telehealth & Telemedicine Market: COMPANY EVALUATION MATRIX

In the Europe telehealth and telemedicine market matrix, Koninklijke Philips N.V. (Star) leads with its advanced virtual-care platforms, remote monitoring solutions, and strong integration capabilities that enhance connected care across healthcare systems. Its broad digital-health portfolio and deep hospital partnerships solidify its regional dominance. Cisco Systems, Inc. (Emerging Leader) is gaining traction with secure communication networks and scalable telehealth infrastructure that enable real-time virtual consultations and seamless care coordination, positioning it as a rising innovator in Europe’s digital health landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Medtronic

- Teladoc Health, Inc.

- Cisco Systems Inc.

- Koninklijke Philips N.V.

- Zoom Communications, Inc.

- GE Healthcare

- Epic Systems Corporation

- Oracle

- Doctolib

- American Well

- Siemens Healthineers AG

- Push Dr

- AMC Health

- TeleSpecialists

- Walgreen Co.

- Caregility

- Infermedica

- Doctor Care Anywhere

- Docplanner

- Zava

- Kry

- TeleClinic

- HealthHero

- eConsult Health

- Doktor.Se

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 22.01 Billion |

| Market Forecast in 2030 (Value) | USD 42.04 Billion |

| Growth Rate | CAGR of 11.2% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, France, UK, Italy, Spain, Rest of Europe |

| Parent & Related Segment Reports |

Telehealth and Telemedicine Market Asia Pacific Telehealth & Telemedicine Market US Telehealth & Telemedicine Market |

WHAT IS IN IT FOR YOU: Europe Telehealth & Telemedicine Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Profiles of key European telehealth players (e.g., Kry/Livi, Babylon, Doctolib, TeleClinic, Amwell, Teladoc) covering virtual consultations, remote monitoring, chronic-care platforms, and cross-border service capabilities. | Supports competitive benchmarking, identifies differentiation in service models and digital workflows, and informs partnership and market-positioning strategies. |

| Market Entry & Growth Strategy | Country-level assessment of digital health funding, reimbursement frameworks, eHealth initiatives (e.g., EU Digital Health Strategy), and adoption across public and private healthcare systems. | Reduces entry risk, guides prioritization of high-value countries, and supports scalable expansion and localization planning. |

| Regulatory & Risk Analysis | Evaluation of EU and national regulations on telemedicine practice, cross-border care rules, data privacy (GDPR), medical licensing, and digital prescription requirements. | Enhances regulatory alignment, builds compliance readiness, and mitigates operational risks for telehealth delivery. |

| Technology Adoption Trends | Insights into uptake of video consultation tools, AI-enabled triage, remote patient monitoring, integrated EHR workflows, and IoMT-based virtual care pathways. | Supports product roadmap refinement, strengthens competitive differentiation, and drives targeted investment in high-demand digital-care capabilities. |

RECENT DEVELOPMENTS

- January 2025 : Medtronic announced the FDA approval and launch of the MyCareLink Smart Monitor, the world's first app- based remote monitoring system for pacemaker patients.

- April 2024 : Philips partnered with smartQare to integrate advanced wearable biosensors with patient monitoring platforms, improving continuous monitoring both in and out of hospitals.

- December 2023 : OU Health and Siemens Healthineers successfully established a 10-year value partnership to enhance healthcare in Oklahoma. The partnership included advanced imaging and laboratory equipment, such as the 7-t Tesla MRI scanner and photon-counting CT system, improving diagnostic capabilities. The partnership extended to the use of Siemens Healthineers' mobile technology for preventive screenings and diagnostics, especially benefiting rural and underserved communities.

Table of Contents

Methodology

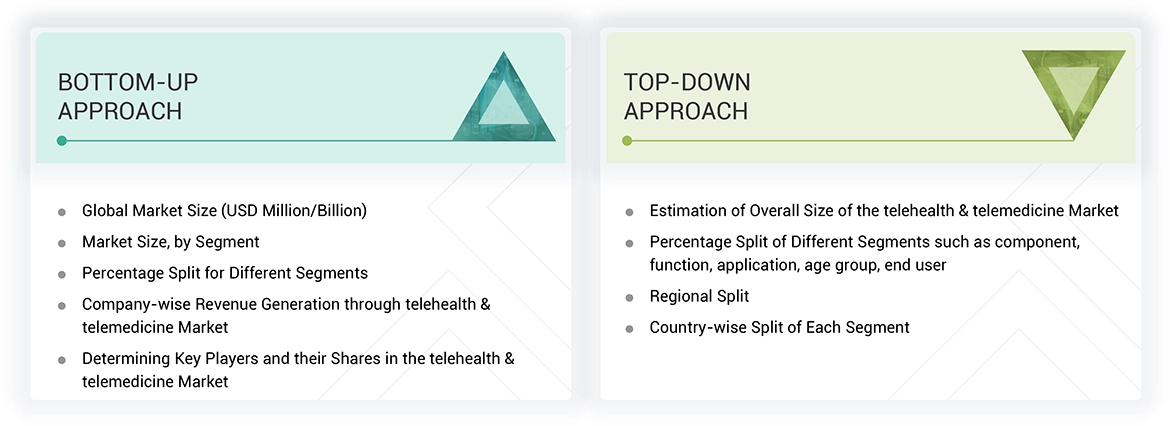

The study involved significant activities to estimate the current size of the Europe telehealth & telemedicine market. Exhaustive secondary research was done to collect information on the Europe telehealth & telemedicine market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Europe telehealth & telemedicine market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for the companies offering telehealth & telemedicine solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Various secondary sources were referred to in the secondary research process to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of Europe telehealth & telemedicine vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Europe telehealth & telemedicine market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of Europe telehealth & telemedicine solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Europe telehealth & telemedicine market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Telehealth - Telehealth represents a broad group of healthcare services that are made possible through various digital communication technologies. This comprises care, education, and other health services facilitated by telecommunications equipment like video conferencing, mobile applications, devices for remote monitoring of patients, and wearable health technologies. Telehealth offers a wide range of services, including preventive care, chronic disease management, mental health support, and virtual consultations.

Telemedicine - Telemedicine is a type of telehealth which focuses on the remote delivery of clinical services. It includes diagnosing, treating, and monitoring patients using digital communication tools, which frequently fill a gap in communities with limited access to healthcare facilities. Examples include online consultations, virtual follow-ups, and electronic transmission of medical imaging for diagnostic purposes.

Stakeholders

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Technology and AI Companies

- Regulatory Authorities

- Hospitals and Healthcare Providers

- Patients and Patient Advocacy Groups

- Clinical Trial Investigators and Site Coordinators

- Data Management and Analytics Firms

- Academic Institutions and Research Organizations

- Investors and Venture Capital Firms

- Clinical Trial Software Providers

- Ethics Committees and Institutional Review Boards (IRBs)

- Insurance Companies

- Telehealth software providers

- Remote Patient Monitoring (RPM) Solutions

- Healthcare IT Service Providers

Report Objectives

- To define, describe, and forecast the Europe telehealth & telemedicine market based on component, function, application, age group, end user, and region.

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players and comprehensively analyze their market sizes and core competencies.

- To track and analyze competitive developments such as acquisitions, collaborations, agreements, mergers, product launches & updates, partnerships, expansions, and other recent developments in the market globally.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Telehealth & Telemedicine Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Telehealth & Telemedicine Market