Global Extruded Foam Market

Global Extruded Foam Market by End-use Industry (Building & Construction, Bedding & Furniture, Packaging, Automotive, Footwear, Sports & Recreational), and Region (Asia Pacific, Europe, North America, Middle East & Africa, South America) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

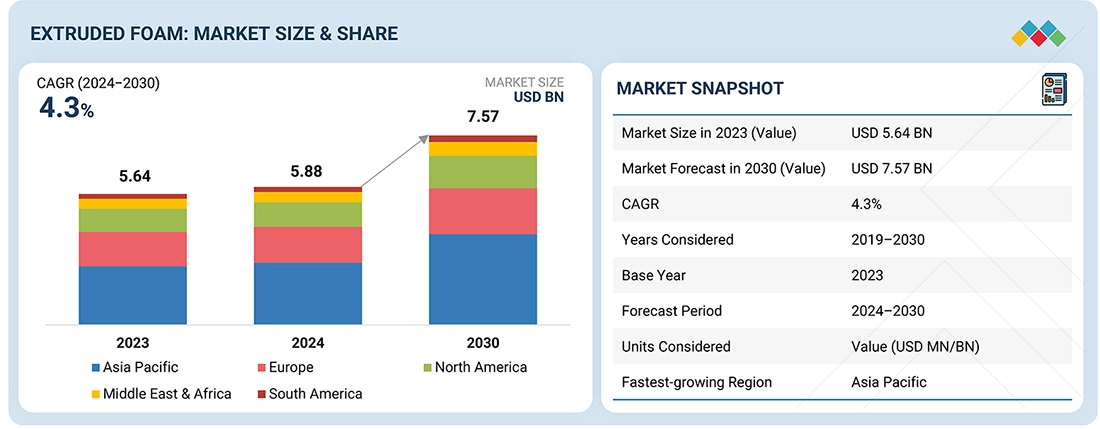

The global extruded foam market is expected to grow from USD 5.88 billion in 2024 to USD 7.57 billion by 2030, with a CAGR of 4.3% during the forecast period. This growth is driven by increasing demand for lightweight, durable, and energy-efficient materials in the construction, automotive, and packaging industries. Growing concerns about sustainable infrastructure and the implementation of strict insulation standards for buildings are key factors encouraging the use of extruded polystyrene (XPS), polyethylene (XPE), and polypropylene (XPP) foams for thermal and structural applications. The automotive sector is shifting toward electric and hybrid vehicles, leading to higher usage of lightweight foams to improve comfort, reduce noise, and boost energy efficiency. Additionally, investments in eco-friendly building projects and advancements in foam extrusion and recycling technologies have enhanced material performance and sustainability. The global extruded foam market, supported by rapid industrialization in the Asia Pacific and technological innovation in North America and Europe, is likely to experience steady growth during this period.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific was the largest market in 2023 and is expected to grow at a CAGR of 5.3%, in terms of value, between 2024 and 2030.

-

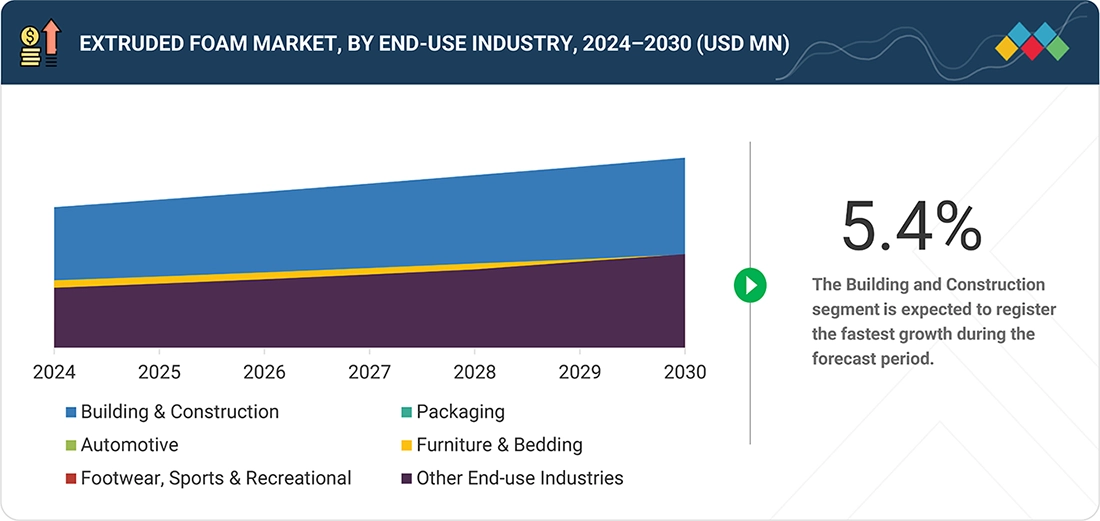

BY END-USE INDUSTRYThe building & construction industry led the global extruded foam market in 2023 and is expected to register a CAGR of 5.4% during the forecast period.

-

COMPETITIVE LANDSCAPEOwens Corning, Armacell, Kingspan Insulation, LLC, Zotefoams PLC, and Saint-Gobain were identified as some of the star players in the extruded foam market, given their substantial market share and product footprint.

-

COMPETITIVE LANDSCAPEJSP, Ravago, and Supreme Industries Ltd. were identified as SMEs in the extruded foam market, given their adoption of the latest production technologies and rapid organic growth.

The global extruded foam market is witnessing steady growth driven by the increased requirements of lightweight, durable, and energy efficient materials in the construction, automotive, and packaging industries. The growing emphasis for sustainable building practices and carbon emission reduction is encouraging the use of extruded polystyrene, polyethylene, and polypropylene foams for insulation and structural applications. Besides, the automotive industry’s transition to electric and hybrid vehicles is consuming lightweight foams for better performance and efficiency. Growing e-commerce and investments in eco-friendly packaging have further created new market opportunities. The global extruded foam market which has been facilitated by process technology and material recycling innovations is anticipated to have a steady growth throughout the forecast period.

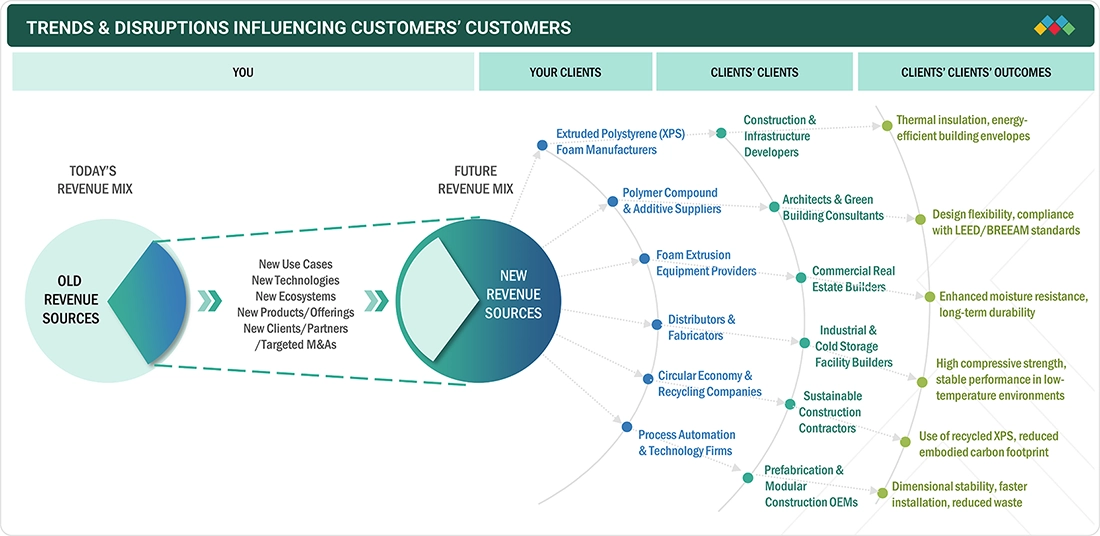

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global extruded foam market is currently experiencing a significant transformation driven by advances in material technology, sustainability, and performance optimization across industries such as construction, automotive, and packaging. Growing focus on energy-efficient buildings, the design of lightweight vehicles, and the development of recyclable packaging materials is accelerating the global adoption of extruded polystyrene (XPS), polyethylene (XPE), and polypropylene (XPP) foams. Key developments include the use of bio-based and low-emission feedstocks, the production of closed-cell formulations with enhanced thermal stability, and the integration of smart process automation in foam extrusion lines. Construction and infrastructure developers are increasingly choosing extruded foams for thermal insulation, dimensional stability, and lower embodied carbon footprints, while the automotive and logistics sectors prioritize weight reduction, acoustic performance, and impact resistance. Collaboration among foam manufacturers, additive suppliers, and modular construction OEMs is driving innovation in high-performance materials compatible with green building standards and circular economy principles. Together, these trends are revolutionizing value creation in the extruded foam market, positioning it as a sustainable material solution for the next generation of infrastructure and mobility applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in Green Construction and Infrastructure Projects

-

Increasing Demand for Energy-Efficient Insulation Materials

Level

-

Volatility in petrochemical feedstock prices

-

Environmental Regulations on Blowing Agents and Disposal

Level

-

Development of Bio-Based and Recyclable Extruded Foams

-

Expansion in Emerging Markets and Retrofitting Projects

Level

-

High Upfront Cost of Advanced Foam Materials

-

Competition from Traditional and Substitute Materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in Green Construction and Infrastructure Projects

The global extruded foam market is heavily affected by the growing emphasis on sustainable building practices and energy-efficient infrastructure. Governments and private developers are investing in projects that reduce the carbon footprint and energy use while improving building performance. Among various construction materials, extruded foams stand out due to their excellent thermal insulation, durability, and moisture resistance. Key regions such as Europe, North America, and the Asia Pacific are strongly supported by policies and regulations that are strict about building energy use. As a result, the use of these materials for insulation is increasing to achieve environmental goals. In Europe, there’s a particular increase in foam applications driven by investments in green building initiatives and efforts to upgrade buildings that have lost their original energy efficiency. All these developments reinforce the idea that extruded foams are ideal materials for constructing modern, energy-efficient, and environmentally safe infrastructure.

Restraint: Volatility in Petrochemical Feedstock Prices

The North American polymer foam market is greatly impacted by the fluctuating prices of petrochemical feedstocks like propylene, ethylene, and toluene. The prices of most foams, including polyurethane, polystyrene, and polyolefin, are directly tied to oil or gas because they are all derived from these sources. As a result, their production costs are heavily influenced by global energy prices. Unstable oil and gas prices—caused by factors such as supply chain disruptions, political conflicts, and inconsistent refinery output—affect manufacturers' profitability and pricing strategies. Rising energy costs and inflationary pressures are also making production more difficult, which could prevent foam manufacturers from maintaining profit margins and competitive prices. This situation also complicates long-term supply contracts and creates uncertainty for downstream sectors like automotive, construction, and packaging.

Opportunity: Development of Bio-Based and Recyclable Extruded Foams

The increasing emphasis on sustainability and environmentally friendly practices has become a key opportunity for the development of new bio-based and recyclable extruded foams. Manufacturers are steadily investing in research and development to create materials that rely less on fossil-based feedstocks while maintaining or even enhancing performance standards. The use of bio-based polymers, the application of carbon dioxide as a blowing agent, and the adoption of closed-loop recycling systems are gaining popularity as industries move toward more sustainable solutions. These trends are especially significant in regions like Europe and North America, where environmental regulations and corporate sustainability goals are accelerating the adoption of eco-friendly options. The push for recyclable and low-emission extruded foams aligns with global efforts to reduce construction and packaging waste and improve resource efficiency. Consequently, these technologies are maturing to become sources of new growth, enhance brand value, and bolster the long-term competitiveness of companies dedicated to sustainable innovation.

Challenge: High Upfront Cost of Advanced Foam Materials

The high initial production costs for advanced and eco-friendly extruded foam materials remain a major challenge for manufacturers and end-users. Producers of environmentally friendly foam must invest heavily in research, adapting production processes, and upgrading technology. These factors make manufacturing more expensive than producing conventional foams. Additionally, the primary environmental regulations in Europe and North America are constantly changing, requiring specialized equipment and certification processes that add to operational costs. Smaller companies often cannot absorb these extra expenses, which limits the release of new products and reduces their market competitiveness. Although long-term operational savings and sustainability benefits are clear, the high upfront costs still act as a barrier to adopting technology that benefits the planet—especially in markets where price sensitivity is critical, making the market very responsive to cost.

GLOBAL EXTRUDED FOAM MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops extruded polystyrene (XPS) and polyurethane foam insulation systems under its Styrodur line, used in walls, roofs, and foundations across residential, commercial, and industrial buildings. | Enhances thermal efficiency and energy savings; supports green building standards and lowers operational carbon emissions. |

|

Produces extruded polystyrene (XPS) and polyethylene foams for HVAC, roofing, and mechanical systems in commercial and industrial construction. | Reduces heat loss and condensation; improves durability, energy efficiency, and building performance. |

|

Manufactures extruded polyethylene and elastomeric foams for HVAC, industrial, and building insulation applications. | Provides strong thermal and acoustic insulation; offers lightweight, low-carbon solutions for sustainable construction. |

|

Produces extruded polyolefin and phenolic foam panels for roofs, walls, and floors in modern construction | Delivers thermal stability and moisture control; supports recyclability and net-zero construction targets. |

|

Develops cross-linked extruded polyolefin foams under the AZOTE and T-FIT ranges for structural, acoustic, and vibration control uses. | Enhances acoustic and thermal performance; increases material resilience and supports circular economy goals. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

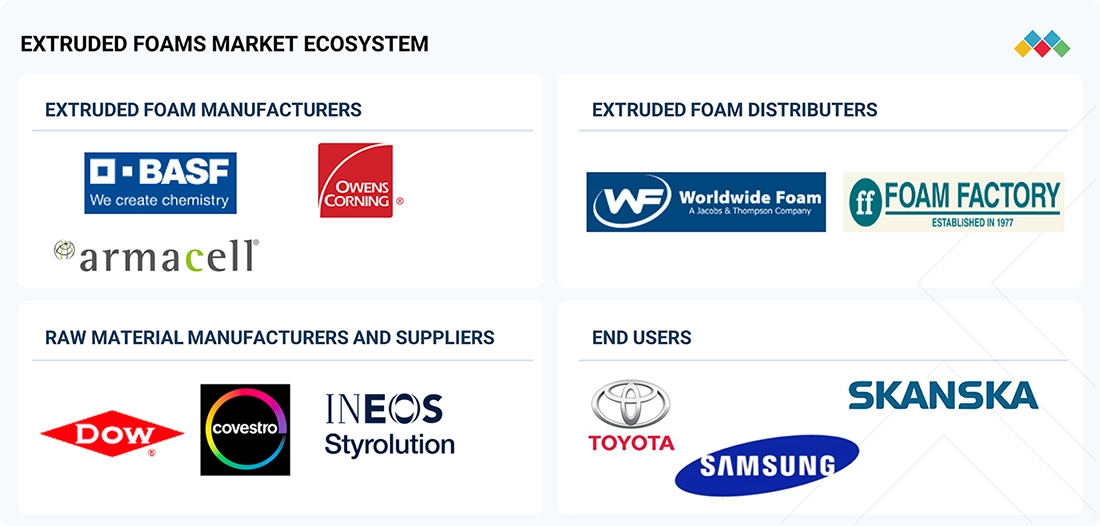

MARKET ECOSYSTEM

The global extruded foam market ecosystem is characterized by the strong interconnectedness of the various participants, including raw material suppliers, manufacturers, distributors, and end customers. This creates a highly integrated value chain that supports a wide range of industrial applications. Leading companies like BASF, Owens Corning, and Armacell continue to produce top-quality extruded polystyrene, polyethylene, and polyurethane foams, which have significant markets in construction, automotive, packaging, and industrial sectors. These major foam producers rely on large raw material suppliers such as Dow, Covestro, and INEOS Styrolution, which provide essential materials like polystyrene resins, polyols, and isocyanates for advanced foam manufacturing. The distribution network, operated by firms like Worldwide Foam and Foam Factory, offers customized product conversion, efficient supply chain logistics, and market expansion in key regions. Major end users include companies like Toyota, Samsung, and Skanska, which utilize extruded foam materials for lightweight structural components, thermal insulation, packaging, and energy-efficient building systems. This global ecosystem highlights the industry’s focus on technological innovation, sustainable materials, and circular economy principles, promoting low-carbon, high-performance foams worldwide in the ongoing transition.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Extruded Foam Market, By End-use Industry

The building and construction sector is expected to hold the largest share of the extruded foam market during the forecast period. This dominance is mainly due to the global trend toward more energy-efficient infrastructure, sustainable building practices, and better insulation performance. Polystyrene and polyethylene extruded foams are used in walls, roofs, and foundations because they offer excellent thermal resistance, moisture protection, and compressive strength. Stricter energy regulations are being enforced in Europe, North America, and Asia, which has accelerated the adoption of foam insulation in both residential and commercial projects. Additionally, activities like green construction, building renovations, and infrastructure modernization support this trend. Moreover, the increasing demand for lightweight, recyclable, and low-carbon materials encourages the use of extruded foams in creating eco-friendly buildings, making the construction sector the leading user of foams worldwide.

REGION

Asia Pacific will hold the largest market share during the forecast period for the global extruded foam market.

The APAC is projected to hold the largest share of the extruded foam market during the forecast period. The main drivers for this growth are rapid urbanization, increased investment in infrastructure, and rising construction activity in major economies like China, India, Japan, and South Korea. Government initiatives aimed at reducing energy consumption and carbon emissions in the real estate sector are boosting demand for energy-efficient building and insulation materials. China and India are experiencing significant development in residential, commercial, and industrial projects that use extruded polystyrene and polyethylene foams for thermal insulation and moisture control. Additionally, the region’s growing automotive manufacturing sector and strong packaging industry positively impact foam consumption.

GLOBAL EXTRUDED FOAM MARKET: COMPANY EVALUATION MATRIX

BASF SE holds the top spot in the market thanks to its extensive range of extruded polystyrene and polyurethane foam insulation products designed to maximize energy efficiency, structural durability, and environmentally friendly performance. Its Styrodur line of extruded foams features some of the highest compressive strength, moisture resistance, and thermal stability, continually meeting increasingly strict low-carbon and recyclability standards. Saint-Gobain (Emerging Leader) is expanding its global reach through innovation in sustainable insulation solutions, leveraging its extensive expertise in building materials and high-performance plastics. The company's main focus areas include eco-friendly production, lightweight foam structures, and durable insulation systems, which have enhanced its competitiveness across Europe and Asia-Pacific. Both BASF and Saint-Gobain are heavily investing in research and sustainable product development, driving the creation of high-performance extruded foams that meet the construction industry's demands for energy-efficient, low-emission materials and circular economy solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF (Germany)

- Owens Corning (US)

- ARMACELL (Luxembourg)

- Kingspan Insulation, LLC (Ireland)

- Zotefoams plc (UK)

- Saint-Gobain (France)

- JSP. (Japan)

- KANEKA CORPORATION (Japan)

- Ravago. (Luxembourg)

- Dow (US)

- Supreme Industries Ltd. (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 5.64 Billion |

| Market Forecast in 2030 (Value) | USD 7.57 Billion |

| Growth Rate | CAGR of 4.3 from 2024−2030 |

| Years Considered | 2019–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Middle East & Africa, South America |

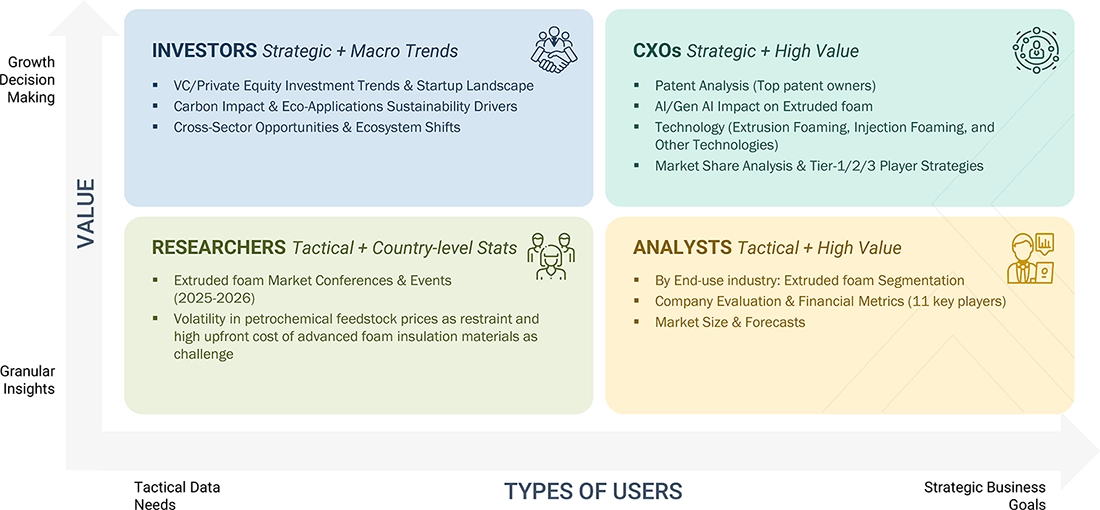

WHAT IS IN IT FOR YOU: GLOBAL EXTRUDED FOAM MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Construction & Insulation Companies | Provide detailed benchmarking of extruded polystyrene (XPS) and polyethylene (XPE) foams for wall, roof, and foundation insulation. Evaluate compliance under LEED, BREEAM, and national energy-efficiency codes. | Supports architects, contractors, and developers in improving thermal performance, ensuring code compliance, and advancing low-carbon building initiatives. |

| Furniture & Bedding Manufacturers | Assess comfort, density, and durability of extruded foam materials in seating, mattresses, and upholstered products. Benchmark emission levels under indoor air quality standards. | Enhances comfort, resilience, and product sustainability, aligning with eco-certified furniture and bedding standards. |

| Packaging & Logistics Companies | Evaluate cushioning, recyclability, and mechanical performance of extruded polyethylene and polypropylene foams for protective and cold-chain packaging. | Enables lightweight, reusable, and recyclable packaging solutions that lower logistics costs and support circular economy goals. |

| Automotive & Transportation OEMs | Benchmark extruded polypropylene (XPP) and polyethylene foams for vehicle interiors, sound absorption, and thermal insulation applications. Develop lifecycle and recyclability analyses for EV and ICE components. | Helps OEMs achieve weight reduction, improved cabin comfort, and emission compliance, while supporting sustainability certifications in automotive manufacturing. |

| Footwear, Sports & Recreational Brands | Benchmark cross-linked extruded polyethylene foams for footwear midsoles, protective gear, and sports mats. Assess rebound, flexibility, and energy absorption performance. | Supports performance-driven product design, enhances material circularity, and promotes eco-friendly manufacturing in footwear and sporting goods. |

| Industrial & HVAC System Providers | Map thermal, vibration, and acoustic insulation properties of extruded foams used in industrial pipelines, HVAC ducts, and acoustic barriers. | Improves energy efficiency, noise reduction, and system longevity, aiding industrial compliance with efficiency standards. |

| Regulatory & Sustainability Teams | Develop circularity frameworks and recycling infrastructure mapping for extruded foams. Conduct comparative analysis of bio-based vs. conventional foam materials for policy and ESG compliance. | Strengthens environmental reporting, lifecycle transparency, and emissions management, supporting net-zero and circular economy strategies. |

RECENT DEVELOPMENTS

- September 2024 : Armacell is investing in expanding ArmaGel XG production capacity in Pune (India), next to one of its largest and advanced plants worldwide. It also announced that this new manufacturing facility will reinforce the company’s aerogel capacity by adding 1 million square metres per annum to meet the rapidly increasing demand for aerogel-based insulation.

- May 2024 : Zotefoams signed a Global Alliance Agreement with Suzhou Shincell New Materials Co., Ltd. This agreement involves sharing Shincell’s technology, collaborating on product development for the foaming industry, and jointly marketing Shincell’s products alongside Zotefoams’ offerings. By adding Shincell’s technologies, Zotefoams can create a broader range of products, enter new markets, and develop improved future products.

- December 2022 : Kingspan Insulation, LLC acquired Dyplast Products LLC. Dyplast Products will join the North American region of Kingspan's Insulation Division. This acquisition will serve as a platform for Kingspan to develop a technical insulation business in North America that combines Dyplast's firm foundation with the advanced capabilities Kingspan has globally.

- August 2020 : Owens Corning announced a new product line: FOAMULAR NGX. The proprietary blowing agent in this new line of extruded polystyrene (XPS) foam products can reduce global warming potential (GWP) without sacrificing product performance.

Table of Contents

Methodology

This research study involves the extensive use of both primary and secondary data sources. Various factors affecting the industry, including the regulatory landscape; competitive scenario; historical data; current market trends; upcoming technologies; and market drivers, restraints, opportunities, and challenges, have been researched and analyzed in this report.

Global Extruded Foam Market Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; directories and databases such as D&B, Bloomberg, Chemical Weekly, and Factiva; white papers and articles from recognized authors; and publications and databases from associations, such as the Molecular Diversity Preservation International and Multidisciplinary Digital Publishing Institute (MDPI), European Phenolic Foam Association (EPFA), and British Plastics Federation (BPF). Secondary research has also been used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders has also been prepared using secondary research.

Global Extruded Foam Market Primary Research

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of foam manufacturing companies, and suppliers and distributors. The primary sources from the demand side include industry experts such as directors of end-use industries and related key opinion leaders.

Global Extruded Foam Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the foam market in various end-use industries in each region. The research methodology used to estimate the market size includes the following steps:

- The key players in the market have been identified in the respective regions through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined through secondary sources and verified through primary sources.

- All possible parameters that affect the market and submarkets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. The data has been consolidated, supplemented with detailed inputs and analysis from the MNM data repository, and presented in this report.

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all the segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches; it has then been verified through primary interviews. Hence, for every data segment, there are three sources-the top-down approach, the bottom-up approach, and expert interviews. The data was assumed to be correct only when the values arrived at from the three sources matched.

Global Extruded Foam Market Objectives of the Study

- To define, describe, and forecast the size of the foam market, in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To forecast the market size by foam type and end-use industry

- To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze foam market with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product development, mergers & acquisitions, investment & expansion, and joint ventures, agreements & partnerships

- To strategically profile the key players and comprehensively analyze their market shares and core competencies1

Note: Core competencies of companies are determined in terms of the key developments, and key strategies adopted by them to sustain in the market.

Global Extruded Foam Market Report Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Global Extruded Foam Market Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Global Extruded Foam Market Regional Analysis

- Further breakdown of the foam market, by country

Global Extruded Foam Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Global Extruded Foam Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Global Extruded Foam Market