LEO (Satellite) PNT Market Size, Size, Share & Trends 2030

LEO PNT Market by Hardware (GNSS Module, Time Synchronization, Backhaul Module, Navigation Signal Generation, Signal Transmission Module), End Use (Government & Defense and Others), Frequency, Satellite Mass and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The LEO PNT Market is estimated to be USD 0.07 billion in 2025 and USD 0.57 billion by 2030, at a CAGR of 53.9% during the forecast period. The market, in terms of volume, is expected to grow from 31 units in 2025 to 299 units in 2030. The LEO PNT market is witnessing strong growth globally, fueled by the rising need for secure, resilient, and high-precision navigation solutions as traditional GNSS faces vulnerabilities such as jamming, spoofing, and signal degradation.

KEY TAKEAWAYS

-

BY HARDWAREGrowth in the this segment is fueled by advanced hardware that ensures high-precision timing, resilient navigation, and secure transmissions, with LEO-based payloads offering lower latency, enhanced anti-jamming capability, and cost efficiency compared to traditional GEO satellite systems, making them attractive for defense and commercial adoption.

-

BY FREQUENCYThe frequency segment is led by the adoption of higher frequency bands, high-capacity, and low-latency navigation across diverse and dynamic operating environments.

-

BY END USELEO PNT solutions are increasingly aligned with end-user priorities, offering anti-jamming resilience, precise low-latency navigation, reliable synchronization, and enhanced accuracy for operational efficiency and continuity in GNSS-challenged environments.

-

BY REGIONRegional adoption of LEO PNT is shaped by distinct strategic priorities, with increasing emphasis on defense resilience, regulatory-backed precision services, driving rapid commercialization through smart infrastructure and mobility programs, and emerging markets leveraging cost-efficient constellations to bridge navigation gaps.

-

COMPETITIVE LANDSCAPEMajor players in the LEO PNT market have adopted both organic and inorganic strategies, including partnerships and investments. Thales Alenia Space's strategy is to leverage its expertise in satellite navigation and secure communications to develop resilient LEO-based constellations and payloads that enhance PNT services.

The future growth of the LEO PNT Industry is likely to be driven by increasing adoption across defense, aviation, telecom, and critical infrastructure, supported by government-led space initiatives and commercial investments. The rising demand for high-precision navigation services are expected to expand deployments, while integration into autonomous systems, smart mobility, and secure communication networks accelerates commercial adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customer trends or disruptions impact consumer business. Several LEO PNT startups and manufacturers are seeking venture capital investments, partnerships, collaborations, and joint ventures to develop advanced payload technology. This, in turn, is expected to aid in vital improvements in positioning and accuracy and increase the customer base for PNT services.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in demand for GPS-independent navigation systems

-

Need for low-latency, secure positioning in modern warfare

Level

-

Technology lock-in with legacy GNSS infrastructure

-

Orbital congestion and spectrum regulation challenges

Level

-

Commercialization of LEO PNT-as-a-Service

-

Expansion into denied/degraded environments

Level

-

Long development cycles and uncertain ROI

-

Cybersecurity and signal integrity vulnerabilities

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in demand for GPS-independent navigation systems

Dependence on GNSS systems like GPS and Galileo exposes industries to risks of jamming, spoofing, and latency. LEO-based PNT offers stronger signals, faster refresh rates, and lower latency due to closer orbital elevations. This makes it ideal for mission-critical applications, providing high-precision, resilient, and fault-tolerant navigation solutions as nations adopt layered navigation architectures.

Restraint: Orbital congestion and spectrum regulation challenges

LEO PNT growth faces issues from orbital congestion, RF interference, and spectrum overlap. Regulatory hurdles, lack of global standards, and fragmented frequency bands increase risks for scalability, making reliable, interference-free, and long-term service delivery difficult across global operations.

Opportunity: Commercialization of LEO PNT-as-a-Service

LEO PNT-as-a-Service creates revenue opportunities by delivering secure, resilient, and high-accuracy positioning with anti-jam features. Cloud APIs and encrypted services enable automation and anomaly detection, positioning providers to support critical sectors like telecom, aviation, energy, and finance with scalable service-based infrastructure.

Challenge: Cybersecurity and signal integrity vulnerabilities

LEO PNT systems face major cybersecurity risks, including spoofing, data injection, and timing corruption. Incidents like mass GNSS spoofing in 2022 highlight vulnerabilities. Despite higher resilience than GPS, new vulnerabilities arise through authentication, APIs, and third-party use.

LEO PNT Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Resilient, jam-resistant LEO PNT services for defense, aviation, telecom, and infrastructure are provided. | Secures navigation in GNSS-denied areas, enhancing reliability and mission-critical operations |

|

LEO-based STL services provide secure, GPS-independent timing for telecom, data centers, and utilities. | Delivers encrypted synchronization indoors, reducing spoofing and outage risks |

|

Miniaturized atomic clocks provide precise, power-efficient timing for CubeSats and LEO navigation platforms. | Provides nanosecond accuracy and stable signals for defense, commercial, and research uses |

|

SDR-based LEO payloads deliver flexible regional PNT augmentation for underserved or GNSS-limited regions. | Enables cost-effective sovereignty, disaster resilience, and scalable navigation infrastructure through CubeSat-based deployments |

|

Fuses GNSS with LEO signals to provide redundant positioning in urban or obstructed environments | Greater resilience to jamming, multipath, signal blockage, or outages |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The LEO PNT market ecosystem involves payload and component manufacturers producing atomic clocks, antennas, GNSS receivers, and transmit modules; niche firms developing secure, anti-jam, mission-critical technologies; and end users like defense, government, and commercial operators driving demand through requirements for high-redundancy, precision, and resilient PNT services.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

LEO PNT Market, By Hardware

The signal transmission module segment leads the LEO PNT market due to its role in delivering secure, precise, and low-latency signals. Strong demand from defense, aviation, telecom, and autonomous systems, coupled with advances in anti-jam and modulation technologies, ensures its dominance in mission-critical applications.

LEO PNT Market, By Frequency

The L-band segment is set to dominate the LEO PNT market due to its reliability, low atmospheric interference, and ability to penetrate clouds, vegetation, and urban areas. Widely used in military, aviation, marine, and telecom applications, L-band’s resilience and established infrastructure ensure scalability and sustained market leadership.

LEO PNT Market, By Satellite Mass

The SmallSat segment dominates the LEO PNT market, driven by cost efficiency, rapid deployment, and flexibility for diverse missions. These satellites enable mega constellations, improving coverage, accuracy, and resilience. The density of rideshare and dedicated launch opportunities has lowered barriers to orbit by a huge margin for SmallSat operators, which has spurred their use in defense, aviation, and critical infrastructure domains.

LEO PNT Market, By End Use

The government & defense segment leads the LEO PNT market, fueled by demand for secure, jam-resistant, and high-precision navigation solutions. Defense agencies rely on LEO constellations for resilient operations in contested environments, supporting military communications, surveillance, and mission-critical positioning, making it the largest and most influential end user segment.

REGION

North America to be fastest-growing region in global LEO PNT Market during forecast period

North America is emerging as the fastest-growing LEO PNT market, supported by strong government spending, defense modernization programs, and early adoption of advanced satellite navigation technologies. The presence of leading market players, rising demand for resilient PNT solutions amid GNSS vulnerabilities, and expanding commercial applications are further propelling regional growth.

LEO PNT Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the LEO PNT market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. Thales Alenia Space leads the LEO PNT market with a strong product portfolio, advanced payload technologies, and broad defense and commercial applications, while Rakon Limited is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top LEO PNT Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 0.07 Billion |

| Revenue Forecast in 2030 | USD 0.57 Billion |

| Growth Rate | CAGR of 53.9% from 2025 to 2030 |

| Actual data | 2025-2030 |

| Estimated year | 2025 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and Middle East |

WHAT IS IN IT FOR YOU: LEO PNT Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Comprehensive LEO PNT market analysis with a focus on sub-component breakdown |

|

|

RECENT DEVELOPMENTS

- July 2025 : Xona’s Pulsar-0, the first production-class satellite in its LEO navigation constellation, entered orbit testing, transmitting encrypted, authenticated PNT signals to validate high-accuracy (~10 cm), interference-resistant navigation performance and demonstrate groundwork for forthcoming commercial operations.

- June 2025 : Safran (via Syrlinks) received a contract to provide payload equipment for the Airbus-built Eutelsat LEO satellite constellation. The equipment will be used to enhanced positioning, navigation, and timing capabilities for the constellation.

- February 2025 : Xona secured a contract under the STAR.FISH Program to demonstrate and mature its resilient commercial PNT service, Pulsar, as a complementary navigation solution for DoD missions.

- January 2025 : L3Harris received a contract from the US Space Force's Space Systems Command to develop Phase 0 ideas for the Resilient-GPS (R-GPS) LEO SmallSat constellation.

- March 2024 : Thales Alenia Space was selected by ESA to deliver one of two European LEO-PNT orbit demonstrators, including a five-satellite constellation, ground, and user segments. This program aims to provide centimeter-level accuracy, low latency, and resilience against jamming and spoofing.

Table of Contents

Methodology

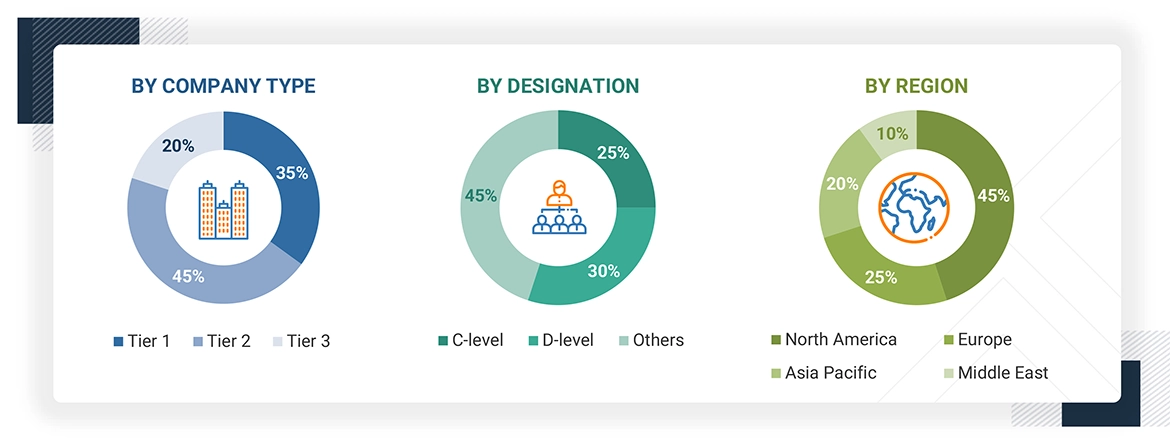

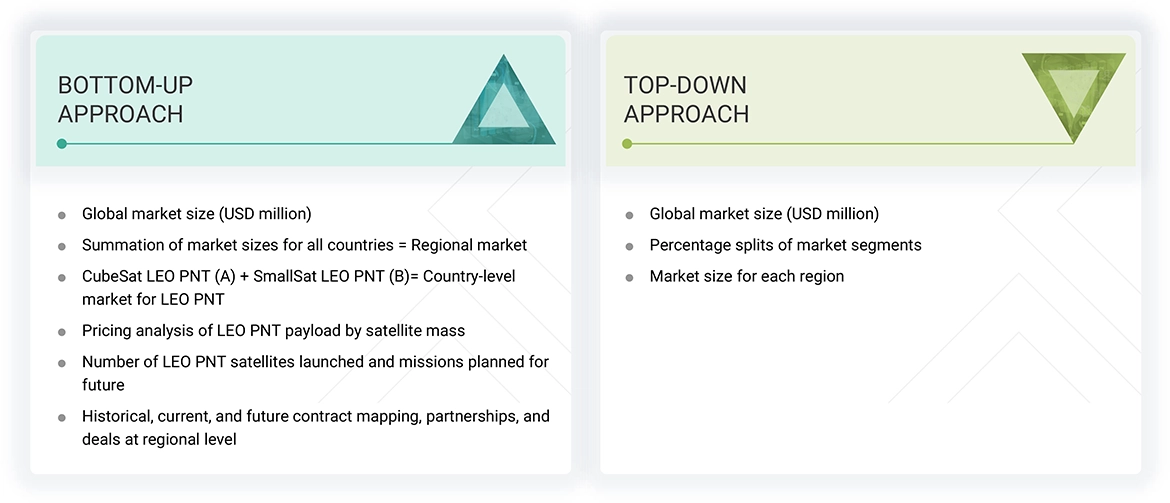

The research study conducted on the LEO PNT market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market, as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews of various primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market and assess the market's growth prospects. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the LEO PNT market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the LEO PNT market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephone interviews.

Note 1: Others include sales, marketing, and product managers.

Note 2: The tiers of companies have been defined based on their total revenue as of 2024.Tier 1 = >USD 1 billion; tier 2 = between USD 100 million and USD 1 billion; and tier 3 = USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the LEO PNT market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, space experts, and subject matter experts of leading companies operating in the LEO PNT market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the LEO PNT market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

LEO PNT Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the total size of the LEO PNT market through the market size estimation process explained above, the total market was segmented into various segments and sub-segments. The data triangulation and market breakdown methodologies were utilized wherever possible to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying different factors and trends from both the demand and supply sides. The size of the market was validated using top-down and bottom-up strategies.

Market Definition

LEO PNT (positioning, navigation, and timing) refers to the delivery of location, guidance, and precise time from low Earth orbit satellites. As these satellites fly closer than GNSS, their signals are stronger and refresh faster, improving accuracy and resilience to jamming/spoofing. The LEO PNT market comprises a payload designed to connect users on Earth using a specialized payload that supports wireless network technologies. The PNT payload handles tasks like receiving, processing, and transmitting signals using specific frequencies. It includes antennas, RF transmit chain (amplifiers, frequency converters, RF switches), navigation signal generators, and other hardware. These payloads enable coverage and navigation services in remote or underserved areas, supporting commercial, government, and military end users.

Key Stakeholders

- Satellite Component Manufacturers

- Satellite Manufacturers

- Satellite Integrators

- Launch Service Providers

- Government and Civil Organizations

- Small Satellite Companies

- Payload Suppliers

- Scientific Institutions

- R&D Staff

Report Objectives

- To define, describe, segment, and forecast the size of the LEO PNT market based on hardware, frequency, satellite mass, end use, and region

- To forecast the size of market segments with respect to four regions: North America, Europe, Asia Pacific, and the Middle East, along with key countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To provide an overview of the tariff and regulatory landscape in the market across various regions

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying industry trends

- To profile key players and comprehensively analyze their market shares and core competencies

- To analyze the degree of competition in the market by identifying growth strategies, such as acquisitions, agreements, contracts, collaborations, partnerships, and product launches, adopted by key players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Customization Options

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of up to five additional market players

Key Questions Addressed by the Report

What is the current size of the LEO PNT market?

The LEO PNT market, in terms of value, is estimated at USD 0.07 billion in 2025.

Who are the winners in the LEO PNT market?

The winners in the LEO PNT market are GMV Innovating Solutions S.L. (Spain), Safran (France), Thales Alenia Space (France), Xona Space Systems, Inc. (US), and TrustPoint, Inc. (US)

What are the factors driving the market?

Key driving factors include:

- Surge in demand for GPS-independent navigation systems

- Need for low-latency, secure positioning in modern warfare

- Integration of LEO PNT into autonomous and connected systems

Which region is estimated to hold the largest market share of the LEO PNT market in 2025?

Asia Pacific is estimated to hold the largest share of 91.7% of the LEO PNT market in 2025.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the LEO PNT Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in LEO PNT Market