Magnetic Current Sensor Market Size, Share & Trends

Magnetic Current Sensor Market by Type (Hall-effect, Flux Gate, Anisotropic Magnetoresistance, Giant Magnetoresistance, Tunnel Magnetoresistance), Loop Type (Open-loop, Closed-loop), Industry (Renewable, Photovoltaic) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The magnetic current sensor market is projected to reach USD 3.51 billion by 2030 from USD 1.98 billion in 2025 at a CAGR 12.1% from 2025 to 2030. Magnetic current sensors are advanced devices that use magnetic fields to measure electrical current with high accuracy and isolation. The magnetic current sensor market is experiencing substantial growth, driven by the electrification of vehicles, the expansion of renewable energy systems, and increased adoption in industrial automation and smart grids. These sensors support precise current monitoring in critical applications such as electric vehicles (EVs), solar power installations, and industrial robotics, enabling improved energy management and system protection.

KEY TAKEAWAYS

-

BY TYPEBy type, the hall-effect technology segment is projected to register the highest growth due to its superior accuracy, compactness, and energy efficiency.

-

BY LOOP TYPEClosed-loop type is growing in magnetic current sensor due to superior precision, fast response, and excellent isolation characteristics, especially critical in automotive powertrains, industrial motor control, and grid infrastructure.

-

BY INDUSTRYAutomotive remains the leading industry segment, fueled by the rapid electrification of passenger and commercial vehicles, battery management needs, charging infrastructure expansion, and robust safety compliance requirements.

-

BY REGIONAsia Pacific is the fastest-growing market for magnetic current sensors with CAGR of 14.1%, driven by aggressive EV adoption, infrastructure modernization, manufacturing activity, and strong support from government initiatives in China, India, and Japan.

-

COMPETITIVE LANDSCAPEThe competitive landscape features major players such as Allegro MicroSystems, LEM International, Infineon Technologies, and Asahi Kasei Microdevices (AKM), who have adopted organic growth strategies such as product launches and technology upgrades.

The magnetic current sensor market is projected to expand rapidly over the next decade, propelled by innovations in sensor materials, miniaturization, and integration with advanced power electronics. Growing demand for energy-efficient motor drives, reliable battery management solutions, and safety-compliant automotive components is accelerating market adoption. The transition to smart infrastructure, such as intelligent grid systems and IoT-connected devices, further amplifies the need for real-time, high-accuracy current sensing and monitoring capabilities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot bets are the clients of magnetic current sensor providers, and target applications are the clients of magnetic current sensor providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hot bets, which will further affect the revenues of magnetic current sensor providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Significant focus on renewable energy expansion

-

High adoption of Hall-effect magnetic current sensors in advanced applications

Level

-

Declining average selling price due to intense pricing pressure

-

Degradation in sensor performance caused by electromagnetic interference

Level

-

Scaling IoT infrastructure

-

Increasing production of hybrid and electric vehicles

Level

-

Fluctuations in accuracy of magnetic current sensors over varying temperature ranges

-

Responding to market maturity with product diversification

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Significant focus on renewable energy expansion

The growing focus on renewable energy sources like solar, wind, and hydroelectricity drives the demand for magnetic current sensors that enable precise current monitoring in inverters, converters, and energy storage. This ensures stable power supply and improves energy efficiency, critical to decarbonization efforts. However, variability in renewable sources requires sensors with fast response and high accuracy to optimize Maximum Power Point Tracking (MPPT). Geopolitical and regulatory support, such as the EU's renewable energy targets and strong solar growth in India, further fuel adoption. A challenge is ensuring sensor durability and performance under harsh environmental conditions common in renewable projects.

Restraint: Declining average selling price due to intense pricing pressure

Market growth is constrained due to falling average selling prices (ASP) caused by intense competition among many sensor suppliers. Though widespread adoption in automotive, telecom, healthcare, and consumer electronics boosts volume, pricing pressure compresses profit margins. Manufacturers increase R&D to create affordable MEMS- and IoT-compatible sensors to address cost sensitivity, but this intensifies competition. The challenge lies in balancing innovation with cost control, as lowering ASP affects supplier profitability and limits funds available for development. Efficient manufacturing, quality improvement, and cost streamlining remain critical to sustaining competitiveness amid commoditization.

Opportunity: Scaling IoT infrastructure

The rapid expansion of IoT networks drives large-scale demand for magnetic current sensors in smart devices, grid monitoring, transportation, and healthcare. With billions of connected devices forecasted by 2030, sensors enable accurate energy and operational monitoring, critical for real-time analytics and automation. This growth brings opportunity for sensor integration with AI and edge computing to enhance functionality and predictive maintenance. However, IoT deployment challenges include managing vast data volumes, ensuring sensor interoperability, and maintaining energy efficiency. Manufacturers must innovate compact, low-power sensors with high accuracy to thrive in this competitive IoT ecosystem.

Challenge: Fluctuations in accuracy of magnetic current sensors over varying temperature ranges

A key challenge for magnetic current sensors is maintaining accuracy across temperature variations typical in automotive and industrial environments. Open-loop sensors can handle high overloads but experience stability issues at temperature extremes. Closed-loop sensors offer better gain stability and transient handling but suffer from self-heating under high current, impacting accuracy and reliability. Sensor providers must innovate designs, balancing overload tolerance, thermal stability, and low power consumption. Failure to address these issues affects sensor performance, leading to false readings or device damage in critical systems. Reliable temperature compensation and material improvements are the urgent development areas to overcome this limitation.

Magnetic Current Sensor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hall-effect and TMR magnetic current sensor ICs for EVs, industrial automation, power tools, and consumer electronics | Highly accurate, galvanically isolated current sensing; robust to stray fields; smaller footprint; efficient for high-power and wide-bandgap (SiC, GaN) power devices; suitable for compact, fast, and reliable system integration |

|

Current sensors (Hall-effect and TMR) for electric drives, photovoltaic inverters, battery management, EV charging, and industrial automation | High precision and isolation, wide bandwidth, compact form factor, reduced power loss, SMD compatibility, and automotive-grade reliability with integrated overcurrent protection. |

|

Multi-Hall-array and TMR-based magnetic current sensors for electric vehicles, power management, and industrial applications | Wide dynamic range up to 2000A, contactless measurement, ISO26262 (ASIL B) automotive compliance, high accuracy, stray field robustness, and miniaturization |

|

Coreless current sensors for compact and efficient on-board EV chargers, traction inverters, and power modules | Ultra-fast (100 ns) response time, low heat, resilient to high-voltage and high-speed noise, optimal for next-gen SiC/GaN power modules, supports lightweight/downsized designs |

|

High-precision current transducers for energy infrastructure, EVs, rail, smart grid, and industrial automation | Accurate real-time monitoring, digital output, robust performance in electrification, next-gen TMR ICs for automotive, energy management, and industrial sectors |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The magnetic current sensor market ecosystem comprises key stakeholders working cohesively to drive innovation and adoption. Raw material suppliers provide essential magnetic materials and components that form the sensor foundation, ensuring quality and performance. Sensor and module manufacturers develop and produce magnetic current sensing devices using technologies such as Hall-effect and TMR, focusing on precision, miniaturization, and energy efficiency. System integrators embed these sensors into broader applications like electric vehicles, industrial automation, and smart grids to ensure seamless operation. Suppliers and distributors manage the supply chain logistics, facilitating timely delivery and market reach. End users span automotive, renewable energy, consumer electronics, and industrial sectors, driving demand for reliable and accurate current sensing solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Magnetic Current Sensor Market, By Type

Hall-effect magnetic current sensors are expected to dominate the market due to their versatility, cost-effectiveness, and widespread adoption across various applications. These sensors can detect both AC and DC currents with high accuracy, making them suitable for automotive systems, industrial automation, consumer electronics, and renewable energy solutions. Their compact size and ability to provide galvanic isolation further strengthen their position against traditional shunt-based methods. Additionally, advancements in Hall-effect technology are improving linearity, sensitivity, and temperature stability, driving their demand across power electronics and electric vehicle charging infrastructure.

Magnetic Current Sensor Industry , By Loop Type

Closed-loop current sensors are projected to witness the highest growth rate as industries demand enhanced accuracy, fast response times, and better linearity in current measurement. Unlike open-loop systems, closed-loop sensors provide superior dynamic performance and precise current detection, critical in applications such as motor drives, industrial automation, and electric vehicles. Their ability to offer strong immunity against external magnetic fields makes them highly reliable in high-noise environments. With the growing penetration of renewable energy systems and the adoption of energy-efficient industrial equipment, closed-loop technology is set to gain significant traction in the coming years.

Magnetic Current Sensor Market, By Industry

The automotive industry is expected to hold the largest share of the current sensor market, fueled by rapid electrification and the growing adoption of advanced driver assistance systems (ADAS). Current sensors are vital in battery management systems (BMS), motor control, and power inverters in electric and hybrid vehicles. Their use in safety and infotainment systems further expands their application scope. The rising production of EVs and stringent regulations for energy efficiency and vehicle safety are driving demand for precise current monitoring. Automakers are increasingly integrating advanced current sensors to enhance performance and reliability.

REGION

Asia Pacific to be fastest-growing region in global magnetic current sensor market during forecast period

The Asia Pacific region is expected to be the fastest-growing market for current sensors, driven by rapid industrialization, expanding consumer electronics production, and accelerating adoption of electric vehicles (EVs). Countries such as India, China, Japan, and South Korea are leading in automotive electrification, renewable energy integration, and smart manufacturing, all of which rely on precise current measurement. The region is also a global hub for semiconductor manufacturing, further boosting the adoption of advanced sensor technologies. Government initiatives promoting clean energy and EV adoption, and rising demand for energy-efficient solutions, are creating strong growth opportunities for current sensor providers.

Magnetic Current Sensor Market: COMPANY EVALUATION MATRIX

In the magnetic current sensor market, Allegro MicroSystems (Star) leads with a strong presence and diverse product portfolio, driving widespread adoption across industries like automotive, consumer electronics, telecom & networking, and healthcare, among others, while continuously innovating to maintain its dominance. Texas Instruments Incorporated (Emerging Leader) is gaining traction due to its advanced sensor ICs offering high accuracy, integration, and low power consumption for diverse industrial and automotive applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.81 Billion |

| Market Forecast in 2030 (Value) | USD 3.51 Billion |

| Growth Rate | CAGR of 12.4% from 2025 to 2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Magnetic Current Sensor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| Industrial Automation Provider |

|

|

| Renewable Energy System Integrator |

|

|

| Consumer Electronics Manufacturer |

|

|

RECENT DEVELOPMENTS

- January 2025 : Allegro MicroSystems introduced two new current sensor ICs, the ACS37030MY and ACS37220MZ, designed for precise current sensing in compact, durable packages. These sensors offer a 40% smaller footprint compared to existing 16-pin packages, providing higher isolation and lower resistance to reduce power dissipation.

- November 2024 : LEM introduced the CDT series, the first automotive-grade Residual Current Monitoring (RCM) Type B sensors designed for bi-directional On-Board Chargers (OBCs). These sensors detect both AC and DC leakage currents, ensuring safety in Vehicle-to-Everything (V2X) applications, including Vehicle-to-Load (V2L) and Vehicle-to-Grid (V2G).

- July 2024 : Allegro MicroSystems unveiled two advanced magnetic current sensors, the ACS37220 and the ACS37041. These compact, integrated solutions are tailored for industrial, automotive, and clean energy applications, addressing the need for efficient and precise current sensing in space-constrained environments.

- May 2024 : Infineon Technologies AG (Germany) acquired Swedish startup Imagimob (Sweden) to boost its TinyML edge AI capabilities on its microcontrollers and sensors. Imagimob's platform enables many use cases in embedded designs, from audio event detection, voice control, predictive maintenance, gesture recognition, and signal classification to material detection.

- February 2024 : Asahi Kasei Microdevices (AKM) launched a CZ39 series of coreless current sensors designed for electric vehicle (EV) applications. These sensors facilitate smaller, lighter, and more precise on-board charging systems in EVs.

Table of Contents

Methodology

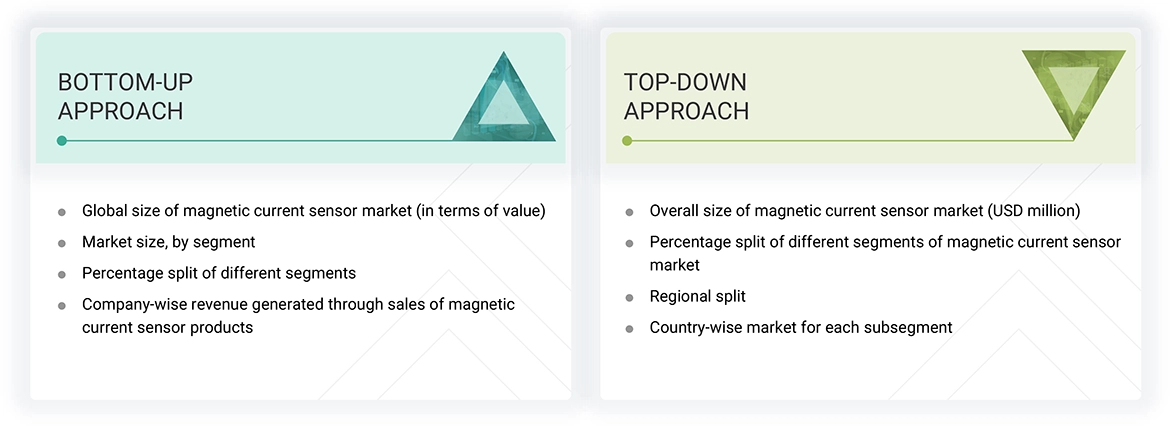

The study utilized four major activities to estimate the magnetic current sensor market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

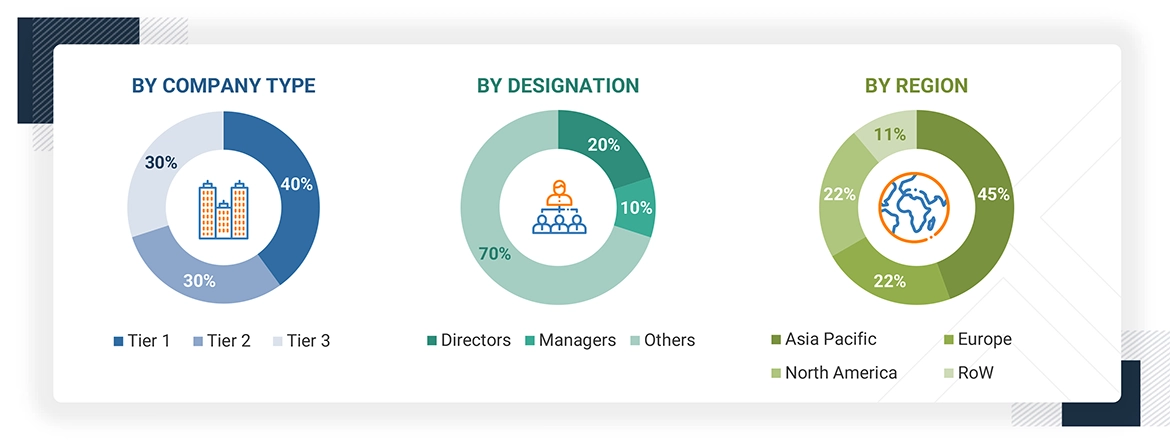

Secondary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, market size estimations, and forecasting. Additionally, primary research was used to comprehend various trends related to type, loop type, industry, and region. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using magnetic current sensor offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of magnetic current sensor, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

List of key secondary sources

|

Source |

Web Link |

|

International Society of Automation |

|

|

International Federation of Robotics |

|

|

International Electrotechnical Commission |

|

|

Organisation Internationale des Constructeurs d'Automobiles |

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, market size estimations, and forecasting. Additionally, primary research was used to comprehend various trends related to type, loop type, industry, and region. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using magnetic current sensor offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of magnetic current sensor, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Magnetic Current Sensor Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the magnetic current sensor market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both the top-down and bottom-up approaches.

Market Definition

A magnetic current sensor is a device that measures electric current by detecting the magnetic field generated around a current-carrying conductor. It operates using principles such as the Hall Effect, flux gate, or magnetoresistance to convert the magnetic field into a proportional electrical signal. This non-contact method allows for safe, accurate, and efficient measurement of both AC and DC currents without physically disrupting the circuit. Magnetic current sensors are widely used in applications that require real-time current monitoring, including electric vehicles, power supplies, industrial automation, and renewable energy systems, where precision, reliability, and compact integration are critical for performance and safety.

The report comprehensively analyzes the magnetic current sensor market based on type, loop type, industry, and region. A few key manufacturers of magnetic current sensors are Allegro MicroSystems, Inc. (US), Infineon Technologies AG (Germany), TDK Corporation (Japan), Asahi Kasei Corporation (Japan), LEM International SA (Switzerland), Melexis (Belgium), and TAMURA Corporation (Japan).

Key Stakeholders

- Raw material suppliers

- Component manufacturers and providers

- Manufacturers and providers of magnetic current sensors

- Original equipment manufacturers (OEMs)

- Magnetic current sensor suppliers and distributors

- Market research and consulting firms

- Associations, organizations, forums, and alliances related to the magnetic current sensor industry

- Technology investors

- Governments and financial institutions

- Venture capitalists, private equity firms, and start-ups

- End users

Report Objectives

- To describe and forecast the magnetic current sensor market size by type, loop type, industry, and region, in terms of value

- To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and RoW, in terms of value

- To describe and forecast the market for type, in terms of volume

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the markets

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the magnetic current sensor value chain

- To strategically analyze key technologies, average selling price trend, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, key stakeholders and buying criteria, and case studies pertaining to the market under study

- To strategically profile key players in the magnetic current sensor market and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with R&D in the magnetic current sensor market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the magnetic current sensor market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the magnetic current sensor market.

Key Questions Addressed by the Report

Which companies are leading the magnetic current sensor market, and what strategies are they using to strengthen their market presence?

The major companies in the magnetic current sensor market include Allegro MicroSystems, Inc. (US), Infineon Technologies AG (Germany), TDK Corporation (Japan), Asahi Kasei Corporation (Japan), and LEM International SA (Switzerland). Their significant strategies include product launches & developments, collaborations, acquisitions, and expansions.

Which region has the highest potential in the magnetic current sensor market?

The Asia Pacific region is projected to record the highest CAGR during the forecast period.

Which product will dominate the magnetic current sensor market during the forecast period?

The hall-effect segment is expected to dominate the magnetic current sensor market during the forecast period.

What key strategies do established players employ in the magnetic current sensor market?

Product launches, partnerships, acquisitions, and collaborations remain major strategies key players adopt to grow in the magnetic current sensor market.

Which major end users of magnetic current sensors are expected to drive market growth in the next five years?

The significant users of magnetic current sensors are automotive and industrial.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Magnetic Current Sensor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Magnetic Current Sensor Market