Middle East & Africa Industrial Gearbox Market

Middle East & Africa Industrial Gearbox Market by Type (Planetary, Helical, Bevel, Spur, Worm), Design (Parallel, Angled), End User (Wind Power, Cement & Aggregates, Chemical, Rubber & Plastics, Construction), Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Middle East & Africa industrial gearbox market is projected to grow from USD 2.23 billion in 2025 to USD 2.68 billion by 2030, registering a CAGR of 3.8% during the forecast period. Market growth can be attributed to the rapid growth of infrastructure development in industrial products ranging from oil & gas, mining, power generation, cement, and wastewater treatment operations.

KEY TAKEAWAYS

-

BY TYPEGearbox types, such as planetary, helical, bevel, spur, and worm, are selected based on torque requirements, space constraints, and operational dynamics of specific end-use industries, such as oil & gas, mining, cement, water treatment, and manufacturing. The industrial gearbox shapes application suitability, performance efficiency, and cost optimization across sectors

-

BY DESIGNGearbox designs, such as parallel and angled, are engineered to meet specific torque, speed, and spatial requirements depending on the end-use application.The design of an industrial gearbox is pivotal in defining the operational efficiency, performance capabilities, and application adaptability of gear systems across diverse industrial sectors.

-

BY END USEKey end-use sectors include wind power, cement & aggregates, chemicals, rubber & plastics, construction, food & beverages, marine, material handling, metals & mining, transportation, automotive, energy, and other industries, such as agriculture, pharmaceuticals, textiles, and electronics. Each sector presents unique operational challenges and demands specific gearbox configurations, ranging from heavy-duty to hygienic, compact to energy efficient.

-

BY REGIONThe Middle East & Africa industrial gearbox market is experiencing steady growth due to the ongoing efforts to diversify economies, expand industrial sectors, and modernize infrastructure. Countries such as Saudi Arabia, the UAE, South Africa, and Egypt spearhead industrial development through major investments in manufacturing, energy, mining, transportation, and construction

-

COMPETITIVE LANDSCAPEThe competitive landscape of the Middle East & Africa industrial gearbox market is characterized by the presence of established players and regional manufacturers striving to strengthen their market positions through innovation, strategic collaborations, and geographic expansion. Leading companies, such as ABB, Siemens, Eaton, Schneider Electric, and General Electric, dominate the market with a strong focus on R&D to meet evolving grid and industrial demands.

The trend toward industry automation, the rising demand for electricity, and rapid urbanization are all compelling a need for power transmission systems utilizing mechanical solutions that compose a significant part of the power transmission system and utilize a minimized energy footprint. National governments across the region are still committed to large infrastructure, smart factories, and renewable energy developments, which continue to develop demand for reliable gearbox systems. In contrast, adopting renewable energy through wind and solar developments in the UAE, Saudi Arabia, Egypt, and South Africa has created substantial demand for gearbox systems for energy generation and storage applications. The growing inclination towards electric vehicles (EVs), interconnected equipment in automated production systems, and the continued need for low-maintenance and high-precision solutions have established a growing demand for advanced gearbox solutions. The integration of IoT and AI-based smart-diagnostics monitoring platforms and condition-based maintenance technologies are expected to continue to fuel the market for gearboxes, in which real-time fault detection, predictive maintenance technologies, or remaining equipment lifespan introduced into future designs will always come to compete.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Several trends and disruptions in the Middle East & Africa industrial gearbox market are significantly reshaping customer operations, particularly as industries prioritize operational efficiency, energy optimization, and localized production capabilities. The rapid pace of industrialization, growing investments in infrastructure and energy projects, and a renewed focus on manufacturing self-sufficiency drive the demand for durable and high-performance industrial gearboxes. The adoption of Industry 4.0 technologies is influencing gearbox innovation across the region. The integration of condition monitoring, predictive maintenance, and smart diagnostic features into gearboxes enables businesses to optimize asset performance and lower the total cost of ownership. IoT-enabled gearboxes with remote monitoring capabilities are increasingly deployed in critical sectors, such as oil & gas and power generation, where equipment failure can result in significant financial and operational losses.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of industrial automation solutions

-

Rise in renewable energy installations

Level

-

High initial costs

-

Availability of alternative technologies

Level

-

Increasing smart grid and power transmission projects

-

Mounting deployment of IoT-enabled and AI-based predictive maintenance technologies

Level

-

Influx of counterfeit and substandard gearboxes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of industrial automation solutions

The industrial gearbox market is witnessing robust growth, primarily driven by the increasing adoption of industrial automation across various industries. As companies worldwide transition toward Industry 4.0 and smart manufacturing, the demand for automated conveyor systems, robotic arms, and CNC machines has surged, necessitating the use of high-precision gearboxes. Automation is becoming a key focus in industries such as manufacturing, logistics, oil & gas, mining, and power generation, where gear-driven systems are vital in enhancing efficiency, precision, and operational reliability. The demand for high-performance gearboxes is rising as companies integrate automated conveyor systems, robotic arms, and CNC machines into their production lines to improve productivity and reduce manual labor dependency.

Restraint: High initial costs

High initial costs represent a significant restraint to the growth of the industrial gearbox market, particularly for small- and medium-sized enterprises (SMEs) operating in cost-sensitive environments. Industrial gearboxes—especially those tailored for demanding conditions such as high heat, abrasive dust, and heavy load applications in deserts, mines, and offshore facilities—must be manufactured using high-grade materials and precision engineering. This leads to elevated upfront costs associated with the procurement, customization, and installation of these gear systems. For SMEs with limited capital expenditure budgets, these high costs can act as a deterrent, forcing them to either delay modernization efforts or opt for lower-specification equipment that may not offer long-term reliability. In the Middle East & Africa, where industrial development varies widely across countries, the capital intensity of gearbox systems is a particularly notable challenge. Industries such as mining in Africa and oil & gas in the Middle East require gearboxes with enhanced corrosion resistance, thermal performance, and shock-load tolerance—features that drive up manufacturing and acquisition costs. Additionally, the lack of widespread local manufacturing facilities in some countries leads to reliance on imports, further escalating costs due to logistics, tariffs, and long lead times. These financial barriers slow down adoption, especially in sectors that are not supported by large-scale public or private investment.

Opportunity: Increasing smart grid and power transmission projects

The expansion of the power sector through smart grid and transmission network development is emerging as a major opportunity for the industrial gearbox market. As utilities modernize aging grid infrastructure and integrate more renewable energy sources, the need for reliable, high-performance mechanical components, such as gearboxes, increases significantly. Industrial gearboxes are crucial for various electromechanical operations in smart substations, switchgear assemblies, transformer tap changers, and high-voltage transmission equipment. This enables precision control, torque management, and mechanical actuation in power system automation.

Challenge: Influx of counterfeit and substandard gearboxes

The proliferation of counterfeit and substandard industrial gearboxes presents a substantial challenge to the Middle East & Africa industrial gearbox market. These low-quality units, primarily imported from unregulated, low-cost Asian manufacturers, pose serious operational, financial, and safety risks across critical industries, such as mining, oil & gas, cement, power generation, and general manufacturing. In several African markets, the combination of weak regulatory enforcement, limited customs oversight, and a strong demand for low-cost equipment has created a conducive environment for the influx of counterfeit gearboxes. Often lacking international quality certifications such as ISO or IEC, these products are typically sold at 30–50% lower prices than their certified counterparts. While initially cost-attractive to small and medium-sized enterprises (SMEs), these substandard products are prone to premature failure, unplanned downtime, and increased maintenance expenses, ultimately undermining productivity and inflating operational costs.

middle east africa industrial gearbox market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Tata Steel’s Port Talbot plant faced a critical gearbox failure that halted operations and risked extended downtime. Highfield Gears delivered a tailored repair solution, including precision machining, new liners, replacement of key components, and full reassembly with new bearings and seals, followed by rigorous testing to restore reliability. | Restored critical equipment functionality | Minimized production downtime | Improved operational reliability | Enhanced future resilience |

|

An agricultural equipment manufacturer faced a critical supply issue when a key right-angle gearbox was discontinued. Federal Group USA reverse-engineered the original gearbox using 3D scanning, created precise CAD models, and manufactured custom clockwise and counterclockwise units with advanced techniques, ensuring perfect fit without equipment modifications. | Maintained production continuity | Avoided costly equipment redesign | Delivered precision-engineered replacements | Ensured seamless integration |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis of the Middle East & Africa industrial gearbox market, ranging from suppliers and manufacturers of raw materials to regulators and standards organizations, distributors and end users, and manufacturers and assemblers of industrial gearboxes

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MIDDLE EAST & AFRICA INDUSTRIAL GEARBOX MARKET, BY TYPE

The helical segment holds the largest market share in 2024 primarily due to its high efficiency, durability, and ability to handle heavy loads with smooth and quiet operation. Helical gearboxes are widely adopted across industries such as cement, mining, and power generation because they offer superior torque transmission and reduced vibration compared to other types. Their versatility in both parallel and angled configurations makes them ideal for demanding applications in industrial environments, driving strong preference and sustained growth in this segment.

MIDDLE EAST & AFRICA INDUSTRIAL GEARBOX MARKET, BY DESIGN

The parallel design segment holds the largest market share in 2024 due to its ability to deliver high torque transmission with compact and robust configurations, making it ideal for heavy-duty industrial applications. Parallel shaft gearboxes are widely preferred in sectors such as cement, mining, and material handling because they offer superior load-bearing capacity, ease of maintenance, and cost-effectiveness compared to angled designs. Their adaptability to large-scale machinery and continuous operations in harsh environments further drives demand, reinforcing their dominance in the Middle East & Africa industrial gearbox market.

MIDDLE EAST & AFRICA INDUSTRIAL GEARBOX MARKET, BY END USE

The energy segment, by end use holds the largest market share in 2024, driven by the region’s growing focus on power generation and renewable energy projects. Industrial gearboxes play a critical role in wind turbines, hydroelectric plants, and other energy infrastructure by ensuring efficient torque transmission and reliable performance under continuous operation. Rising investments in wind power and grid modernization, coupled with the need for durable and high-capacity gear systems to support large-scale energy projects, are fueling demand in this segment across the Middle East & Africa

REGION

Saudi Arabia to be fastest-growing country in Middle East & Africa industrial gearbox market during forecast period

Saudi Arabia is the biggest Middle East & Africa industrial gearbox market because of its huge industrialization, infrastructure, and energy diversification investments, fuelled by its Vision 2030 strategic drive. The nation is heavily developing major industries like oil & gas, petrochemicals, mining, power generation, water treatment, cement, and steel, which are all heavily dependent on industrial gearboxes for efficient, high-torque power transmission. Such mega projects as NEOM, the Red Sea Project, and the mass development of smart cities and industrial areas further fuel demand for heavy-duty, dependable gearbox systems. Moreover, Saudi Arabia is moving into renewable energy, including wind and solar, where specific gearboxes are needed. Its superior manufacturing capacity, government-sponsored industry programs, and strategic position as a regional energy and logistics hub all position it collectively as the leading and fastest-developing marketplace for industrial gearboxes in MEA.

middle east africa industrial gearbox market: COMPANY EVALUATION MATRIX

In the Middle East & Africa industrial gearbox market matrix, ABB (Star) stands out as the top player in the Middle East & Africa industrial gearbox market due to its advanced technology portfolio, strong presence in energy and heavy industries, and consistent focus on innovation and reliability. Johnson Electric Holdings Limited (Emerging Player) is a key player in the Middle East & Africa industrial gearbox market due to its focus on innovative motion solutions and expanding presence in energy and industrial automation sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.15 Billion |

| Market Forecast in 2030 (Value) | USD 2.68 Billion |

| Growth Rate | CAGR of 3.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Region Covered | Middle East & Africa |

WHAT IS IN IT FOR YOU: middle east africa industrial gearbox market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Separate report focused on GCC region with country-specific insights and companies. | Created GCC Industrial Gearbox Market report with GCC-specific market size, growth drivers, segmentation, and competitive landscape featuring regional players. | Provided targeted analysis for GCC countries, enabling clients to make region-specific strategies and identify local opportunities. |

| Separate report focused on Africa region with country-specific insights and companies. | Developed Africa Industrial Gearbox Market report with Africa-specific market trends, segmentation, and profiles of key African players. | Delivered actionable insights for African markets, helping clients understand regional dynamics and investment potential. |

RECENT DEVELOPMENTS

- December 2024 : Siemens (Germany) announced its agreement to acquire California-based Trayer Engineering Corporation (Trayer), a leader in designing and manufacturing medium-voltage secondary distribution switchgear suitable for outdoor and below-ground applications.

- November 2024 : ABB (Switzerland) acquired Aurora Motors (US), a global provider of vertical pump motors. This strategic move aims to enhance ABB's NEMA Motors Division by expanding its product portfolio and supply chain. With operations in Shanghai and a distribution center in California, Aurora Motors brings a well-regarded product lineup and a strong customer base across 30 countries. The acquisition aligns with ABB's strategy to drive profitable growth in its Motion business area.

- February 2024 : Flender (Germany), a drive manufacturer, partnered with renewable energy provider ECO2GROW to directly purchase green electricity from wind and solar power plants. This initiative is part of Flender's sustainability strategy to become carbon-neutral by 2030. The selected wind farm, which uses Flender gearboxes, and a solar farm cover approximately 12% of Flender's electricity needs for its German sites, saving over 7,500 tons of CO2 annually.

- February 2023 : Bonfiglioli S.p.A (Italy) acquired Selcom Group S.p.A. (Italy), a company specializing in designing, producing, and selling electronic boards, products, and software solutions for various sectors, including industrial, biomedical, automotive, and home-appliance automation. This acquisition aimed to strengthen Bonfiglioli's electronic capabilities, enhancing its development capacity and competitiveness.

Table of Contents

Methodology

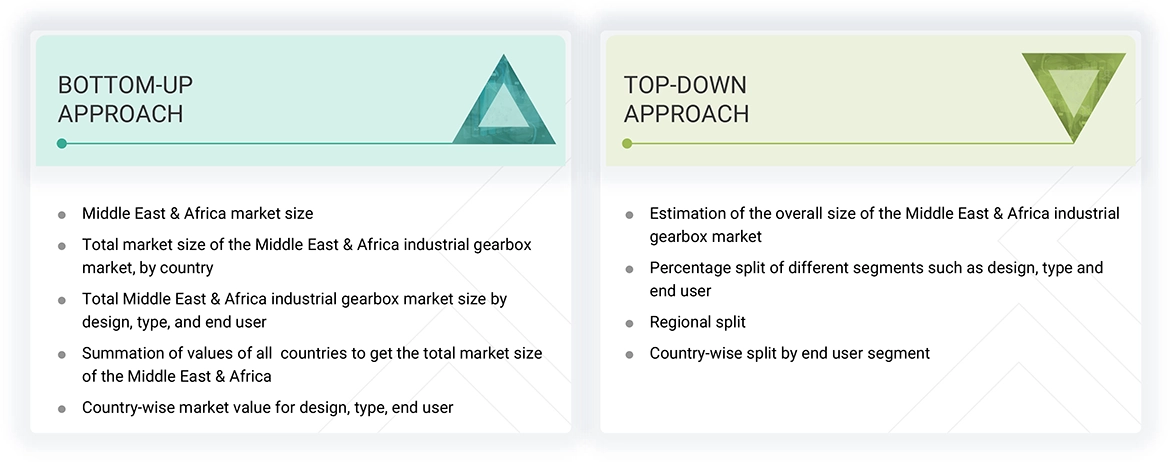

The study involved major activities in estimating the current size of the Middle East & Africa industrial gearbox market. Exhaustive secondary research was done to collect information on the peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the Middle East & Africa industrial gearbox market.

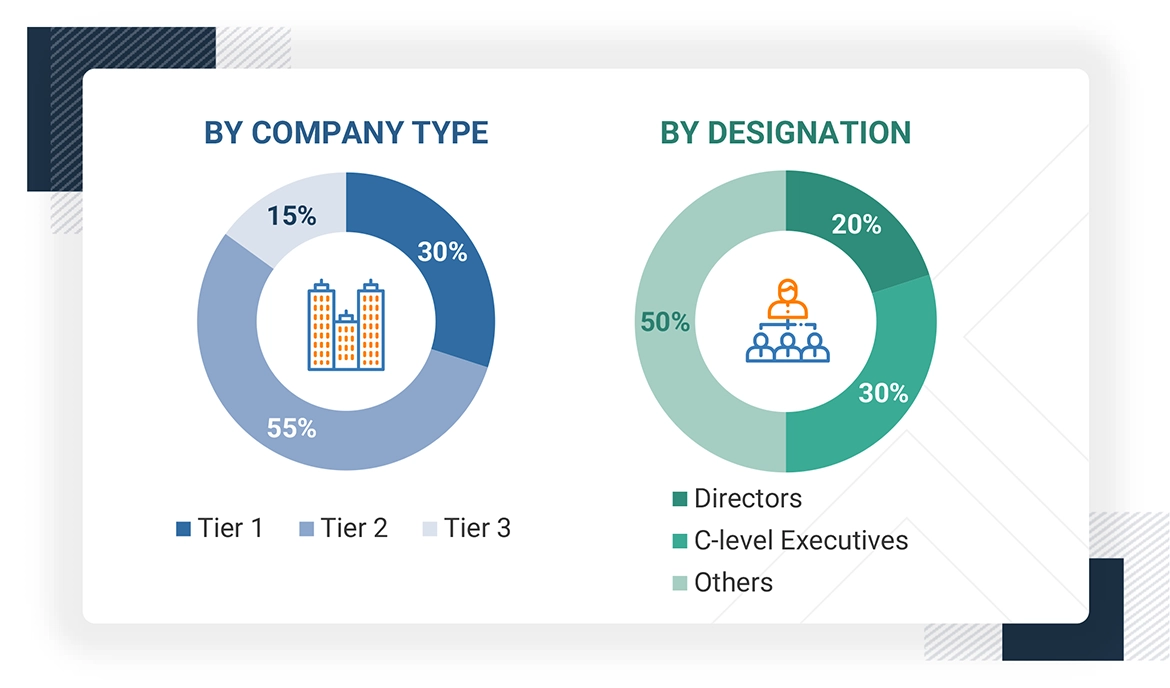

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. The following is the breakdown of primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Middle East & Africa industrial gearbox market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Middle East & Africa Industrial Gearbox Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

An industrial gearbox is a piece of mechanical equipment used to transmit power and affect torque and speed between a driving source (e.g., electric motor) and the output system in manufacturing applications. An industrial gearbox is made up of a series of gears arranged in certain configurations to control movement, optimize efficiency, and ensure the smooth operation of machinery. Industrial gearboxes are built to withstand high levels of torque, carry out extreme operating conditions, and provide optimal performance for heavy and continuous use applications. Industrial gearboxes are used in manufacturing, power generation, mining, construction, oil & gas, and material handling. These industrial gearbox applications are typically placed in critical machinery or equipment such as conveyors, turbines, pumps, compressors, and heavy-duty vehicles. Industrial gearboxes can come in various types ranging from helical, planetary, bevel, worm, and spur gearboxes, each with unique advantages based on different torque requirements, efficiency, and the amount of load. The desire for automation, energy efficiency, and rapid material handling have increased the use of industrial gearboxes across multiple industries.

Stakeholders

- Government & research organizations

- Institutional investors

- Investors/Shareholders

- Environmental research institutes

- Manufacturers’ associations

- Industrial gearbox manufacturers, dealers, and suppliers

- End-user Industries

- Organizations, forums, alliances, and associations

- Renewable Energy Firms

- State and national regulatory authorities

- Venture Capital firms

Report Objectives

- To define, describe, segment, and forecast the Middle East & Africa industrial gearbox market by design, type, and end user in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, Porter’s five forces analysis, and regulations pertaining to the Middle East & Africa industrial gearbox market

- To analyze opportunities for stakeholders in the Middle East & Africa industrial gearbox market and draw a competitive landscape for market players

- To strategically analyze the ecosystem, regulations, patents, and trading scenarios pertaining to the Middle East & Africa industrial gearbox market

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players with respect to their market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, partnerships, and collaborations, in the Middle East & Africa industrial gearbox market

- To study the impact of AI/Gen AI on the market under study, along with the global macroeconomic outlook

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What is the size of the Middle East & Africa industrial gearbox market in 2024?

The Middle East & Africa industrial gearbox market was valued at USD 2.15 billion in 2024.

What are the major drivers for the Middle East & Africa industrial gearbox market?

Key growth factors for the industrial gearbox market in the Middle East & Africa are industrialization, infrastructure development, and continuing growth in the energy and manufacturing sectors, as nearly all components rely on equipment with industrial gearboxes that provide mechanical power transmission.

Which is the largest market for Middle East & Africa industrial gearbox during the forecast period?

Saudi Arabia is anticipated to be the biggest market for industrial gearboxes in the Middle East & Africa during the forecast period, as the country is experiencing swift industrial growth along with considerable investment in the oil & gas, mining, cement, power generation, water treatment, and manufacturing industries due to its Vision 2030 initiative.

Which parallel segment is expected to be the largest in the Middle East & Africa industrial gearbox market during the forecast period?

The parallel shaft gearbox category is projected to dominate the Middle East & Africa industrial gearbox market throughout the forecast period due to the excellent efficiency, size, and load handling capacity at various levels of torque, which makes parallel gearboxes ideal for applications in oil & gas, mining, cement, and power generation industries, which are experiencing development across the regions.

Which end user segment is expected to be the largest in the Middle East & Africa industrial gearbox market during the forecast period?

During the forecast period, the energy segment is expected to be the largest end user in the Middle East and Africa industrial gearbox market, which can be attributed to the region's increased investments in power generation infrastructure. Energy infrastructure investments include conventional energies, which consist of oil, gas, and thermal power, as well as investments where renewable energy projects will play a role with wind and solar power.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Middle East & Africa Industrial Gearbox Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Middle East & Africa Industrial Gearbox Market