Pad-Mounted Switchgear Market

Pad-Mounted Switchgear Market by Type (Air, Gas, Solid Dielectric, Others), Voltage (Up to 15 kV, 15–25 kV, 25-38 kV), Application (Industrial, Commercial, Residential), Standard (IEC, IEEE), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global pad-mounted switchgear market is projected to reach USD 7.97 billion by 2030 from USD 6.13 billion in 2025, at a CAGR of 5.4%. Growth is driven by the rising demand for safe and compact underground distribution solutions across industrial, commercial, and residential sectors. Increasing investments in grid modernization, renewable energy integration, and urban infrastructure projects are accelerating adoption worldwide.

KEY TAKEAWAYS

-

BY TYPEThe gas-insulated pad-mounted switchgear segment is gaining popularity due to its compact design, reliability, and suitability for harsh environments such as coastal areas and urban underground networks. At the same time, the solid dielectric segment is emerging as a strong, sustainable alternative that is free of SF6, aligning with global efforts to reduce greenhouse gas emissions. Air-insulated switchgear continues to be adopted in cost-sensitive markets, particularly in rural and semi-urban applications.

-

BY VOLTAGEThe 15–25 kV segment is primarily used in urban distribution systems, commercial buildings, and utility projects. The 25–38 kV segment is experiencing significant growth because it supports large-scale industrial facilities, integrates renewable energy sources, and accommodates expanding manufacturing hubs. Meanwhile, the up to 15 kV category continues to serve smaller-scale distribution needs in residential areas and localized commercial applications.

-

BY APPLICATIONThe industrial sector is the leading market segment, driven by the demand for reliable, low-maintenance switchgear in industries such as oil and gas, mining, data centers, and manufacturing plants. The commercial sector is also experiencing rapid growth, with increasing installations in business parks, metro stations, hospitals, and shopping complexes, where the safety and aesthetics of underground distribution systems are crucial. Additionally, the residential segment is expanding as underground cabling projects in smart cities and housing complexes promote greater adoption.

-

BY STANDARDThe IEC standard segment is the largest and leads global adoption, particularly in Europe, Asia Pacific, and the Middle East, where adherence to international safety and performance benchmarks is a priority. In contrast, IEEE standards are strong in North America, bolstered by regional grid reliability and safety protocols.

-

BY REGIONEurope is the largest regional market, driven by stricter environmental regulations, strong renewable integration, and widespread adoption of SF6-free technologies. Utilities and municipalities in countries such as Germany, France, and the UK are leading adoption.

-

COMPETITIVE LANDSCAPEThe pad-mounted switchgear market is moderately consolidated, featuring major players like ABB, Eaton, Hubbell, G&W Electric, and S&C Electric, who are at the forefront of innovation. These companies are increasingly focusing on environmentally friendly technologies, such as SF6-free insulation and solid dielectric materials, as well as implementing digital monitoring systems to enhance their product offerings. Their strategic initiatives include expanding local manufacturing, forming alliances with utility companies, and investing in research and development for compact and eco-friendly designs to meet the changing needs of customers and regulatory standards.

The pad-mounted switchgear market is experiencing significant growth due to the increasing demand for reliable, safe, and compact solutions for medium- and low-voltage power distribution. This demand is driven by utilities, renewable energy sectors, data centers, and commercial infrastructure. Key developments shaping the market include strategic partnerships between switchgear manufacturers and EPC contractors, as well as technological innovations such as smart monitoring, IoT-enabled solutions, and arc flash mitigation. Additionally, investments in modular and eco-friendly designs are transforming the competitive landscape and facilitating the faster deployment of resilient power distribution networks.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses stems from customer trends and market disruptions. Key clients of pad-mounted switchgear technology providers are referred to as "hot bets," while target applications represent the clients of these hot bets. Changes in trends such as grid modernization, renewable energy integration, stricter environmental regulations, and the expansion of underground distribution networks will directly affect the revenues of end users. This impact on end users' revenues will, in turn, influence the revenues of the hotbeds, ultimately affecting the overall revenues and growth potential of pad-mounted switchgear technology providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging electricity consumption & electrification trends

-

Grid reliability and resilience modernization

Level

-

High capital investment for installation & maintenance

-

Operational and technical complexities

Level

-

Investments in upgrading and expansion of power distribution infrastructure

-

Automation and reduction of AT&C losses

Level

-

Synchronization of SF6 phase-out in hybrid networks

-

Retrofitting in legacy systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging electricity consumption & electrification trends

The increasing global demand for electricity, along with widespread electrification trends in residential, commercial, and industrial sectors, is a significant driver of the pad-mounted switchgear market. Utilities are increasingly implementing medium-voltage underground distribution systems to efficiently manage growing electrical loads and ensure reliable power delivery in urban areas. Furthermore, the electrification of sectors such as transportation, data centers, and manufacturing is driving the demand for compact, safe, and low-maintenance switchgear solutions that can seamlessly integrate into modern distribution networks.

Restraint: High capital investment for installation & maintenance

One of the main challenges for pad-mounted switchgear is the high upfront and operational costs associated with underground installations. Excavation, cabling, and compliance with strict safety and environmental standards significantly raise overall project expenses, making it difficult for smaller utilities and residential developers to adopt this technology. Additionally, the need for periodic maintenance and skilled technicians further increases the financial burden, particularly in regions where costs are a major concern.

Opportunity: Investments in upgrading and expansion of power distribution infrastructure

Increasing investments in the modernization and expansion of power distribution networks present significant opportunities for pad-mounted switchgear. Governments and utilities are increasingly funding smart grid projects, renewable energy integration, and EV charging infrastructure, all of which require safe and compact medium-voltage switchgear. Additionally, the push for automation and the reduction of AT&C losses is driving demand for intelligent, digitally enabled pad-mounted switchgear that improves grid visibility and operational efficiency.

Challenge: Synchronization of SF6 phase-out in hybrid networks

One of the significant challenges facing the market is the phase-out of SF6-based switchgear because of its high global warming potential. Utilities need to balance the shift toward environmentally friendly solid dielectric and vacuum-based alternatives while maintaining compatibility with existing SF6-based networks. This synchronization is especially complicated in hybrid systems, where retrofitting or replacing current assets necessitates customized solutions, higher costs, and technical adjustments. These factors slow down the adoption of new technologies in mature markets.

Pad-Mounted Switchgear Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Replacing old metal-clad switchgears serving a major US theme park; frequent outages due to component failures and animal intrusion. | Superior reliability and quality | Animal- and fault-resistant PME pad-mounted gear | Remote supervisory power operation and integrated SCADA for monitoring, load balancing, and fault detection | Improved aesthetics with compact design |

|

Aging SF6 pad-mount switchgears serving a retail mall (Strongsville, OH); leakage, environmental concerns, and complex site constraints. | Drop-in retrofit with solid-dielectric Elastimold MVS/MVI | Maintained single-sided cabinet, compact fit, and no new concrete/soil work needed | Eliminates SF6 leak risk | Environmental compliance | Reliable operation with self-powered controls |

|

Decarbonization initiative in UK DNO network with 63,000 substations; need to replace SF6 gear with safer alternatives. | Pilot and implementation of ABB SafePlus SF6-free switchgear | Utilizes dry air and AirPlus alternatives | Supports net-zero goals, reduces greenhouse emissions, and enhances network sustainability |

|

Southeast England network reliability and energy security; transition to SF6-free HV substations for safe, efficient supply. | Deployed first-in-world GE G3 SF6-free 420 kV GIS line | Enhanced grid reliability, increased capacity (ElecLink project), regulatory compliance, reduced global warming impact, and operational resilience in a major transmission corridor |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pad-mounted switchgear market operates through close collaboration among raw material suppliers, manufacturers, distributors, and end users to ensure safe and sustainable medium-voltage power distribution. Companies like BASF, Huntsman, and Saint-Gobain provide essential insulation and composite materials that enhance the reliability and fire safety of these systems. Leading manufacturers such as Eaton, G&W Electric, and ABB utilize these materials to produce pad-mounted switchgear employing advanced technologies, including air, gas, and solid dielectrics, to meet the needs of industrial, utility, and commercial sectors. Distributors like Leistung Energie, HICO America, and MindCore Technologies play a vital role in ensuring product availability and providing after-sales support across global markets. End users, including Enel in renewable energy, SNCF Groupe in railways, and JR Central in transportation, rely on pad-mounted switchgear for dependable and eco-friendly grid modernization and power distribution.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pad-mounted Switchgear Market, By Type

The gas-insulated segment captured the largest share of the market in 2024. Gas-insulated pad-mounted switchgear is known for its compact design, high reliability, and enhanced safety features, making it ideal for urban, commercial, and industrial underground installations. Its sturdy construction ensures low maintenance, environmental safety, and long-term durability, which aligns with stricter safety regulations and sustainability initiatives. This has led to its widespread adoption across utility companies and industrial sectors.

Pad-mounted Switchgear Market, By Voltage

In 2024, the 25–38 kV segment held the largest market share. High-voltage pad-mounted switchgear is commonly used in large industrial facilities, utility grids, and renewable energy projects because it can safely and efficiently manage higher power loads. Its strong performance guarantees reliable power distribution, compliance with grid integration standards, and operational stability even under demanding conditions. The rapid pace of industrialization, urban infrastructure development, and investments in high-capacity distribution networks are driving its adoption.

Pad-mounted Switchgear Market, By Application

In 2024, the industrial segment accounted for the largest share of the market. Industries such as oil and gas, chemicals, manufacturing, and data centers depend heavily on pad-mounted switchgear for safe, reliable, and low-maintenance medium-voltage distribution. The robust design, fire safety features, and compact size of this equipment ensure operational reliability in challenging industrial environments. Growth in this segment is driven by expanding industrialization, urban infrastructure projects, and stricter safety regulations.

Pad-mounted Switchgear Market, By Standard

In 2024, the IEC segment held the largest market share. IEC-compliant pad-mounted switchgear is widely used across Europe, the Asia Pacific, and the Middle East, where adherence to international safety and performance standards is essential. Its compatibility with global utility practices and strict regulatory requirements makes it the preferred choice for reliable, standardized, and safe medium-voltage distribution systems.

REGION

Europe to be the largest region in the global Pad-Mounted Switchgear market during the forecast period

Europe holds the largest share of the global pad-mounted switchgear market and continues to lead due to robust regulatory frameworks, advanced infrastructure, and a high adoption of eco-friendly technologies. This regional dominance is driven by widespread grid modernization, the integration of renewable energy sources like wind and solar, and significant investments in underground distribution networks. Countries such as Germany, France, the UK, and Italy are heavily investing in safe, reliable, and low-maintenance medium-voltage distribution systems to meet stringent safety, environmental, and performance standards.

Pad-Mounted Switchgear Market: COMPANY EVALUATION MATRIX

In the pad-mounted switchgear market matrix, ABB (Star) stands out with a significant market presence and an extensive product portfolio. The company is facilitating large-scale adoption across industrial facilities and renewable energy projects by providing solutions that emphasize gas-insulated, solid dielectric, and hybrid technologies. On the other hand, Powell Industries (Emerging Leader) is gaining momentum with its innovative medium- and high-voltage pad-mounted solutions. This growth is supported by increasing demand in North America, Europe, and the Asia Pacific. Furthermore, Powell's commitment to customized, eco-friendly, and digitally enabled switchgear enhances its position as a rising competitor in the global market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.85 Billion |

| Market Forecast in 2030 (Value) | USD 7.97 Billion |

| Growth Rate | CAGR of 5.4% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Pad-Mounted Switchgear Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End User & Application Segmentation | Comprehensive list of customers with segmentation by industrial, commercial, and residential applications | Insights on revenue growth areas across industrial, commercial, and residential segments |

RECENT DEVELOPMENTS

- June 2025 : Eaton and Siemens Energy entered into a partnership to deliver standardized modular power systems for data centers, with a focus on supporting AI-driven workloads and grid-independent energy solutions. Both companies will integrate their technologies, including medium-voltage switchgear, into scalable, prefabricated power modules capable of supporting up to 500 MW of data center capacity.

- April 2025 : Eaton acquired Fibrebond, a leading modular electrical and data center infrastructure provider. This strategic move enhances Eaton’s capabilities in delivering engineered-to-order enclosures that integrate power distribution and backup systems. The acquisition strengthens Eaton’s position in the data center, utility, and industrial markets, aligning with its focus on resilient, scalable, and protected power solutions.

- August 2024 : ABB officially completed its acquisition of SEAM Group, a US-based company specializing in energized asset management and advisory services for industrial and commercial buildings. This strategic move enhanced ABB’s service capabilities in the US market, enabling it to better support utility, industrial, and commercial clients in improving safety, operational efficiency, and sustainability.

- December 2023 : Hubbell acquired Systems Control, which specializes in control and relay panels, as well as turnkey substation control solutions, which are critical components in electrical transmission and distribution infrastructure, including switchgear systems. This acquisition strengthened Hubbell's position in the utility solutions market by expanding its capabilities in grid modernization and enhancing its offerings in high-voltage switchgear and substation automation.

- June 2022 : ABB expanded its medium-voltage switchgear manufacturing plant in Vietnam, marking a strategic move to meet the increasing regional demand for reliable and sustainable power distribution solutions. The facility is capable of producing air-insulated switchgear (AIS) and supports ABB’s goal of localizing production, reducing delivery times, and improving customer service in Southeast Asia.

Table of Contents

Methodology

The study involved key activities in estimating the current size of the pad-mounted switchgear market. Extensive secondary research was conducted to gather information on related markets. The next step was to validate these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to determine the overall market size. Then, market breakdown and data triangulation were applied to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referenced for this research include annual reports, press releases, and investor presentations from companies; white papers; certified publications; articles by reputable authors; and databases from various companies and associations. Secondary research primarily aimed to gather essential information about the industry’s supply chain, the total number of key players, market classification, and segmentation based on industry trends down to the regional level, as well as key developments from both market and technology perspectives.

Primary Research

The primary research for this report involved interviews with sources from both the supply and demand sides to gather qualitative and quantitative insights. Supply-side sources included industry experts such as CEOs, VPs, and marketing directors from companies in the pad-mounted switchgear market.

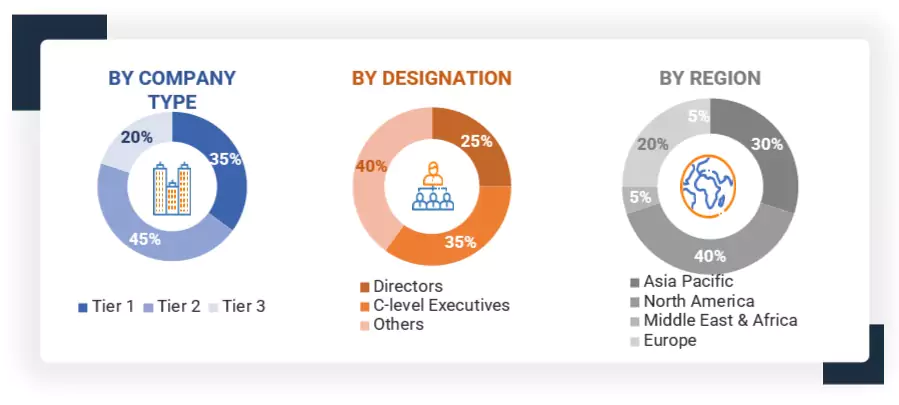

In the comprehensive market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to estimate market sizes and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and identify key information and insights throughout the report. The following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2024: Tier 1 = > USD 1 billion,

Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were employed to estimate and verify the size of the pad-mounted switchgear market. These methods were also extensively used to estimate the size of various subsegments within the market. The research methodology utilized to estimate the market size includes the following:

Pad–Mounted Switchgear Market : Top-Down and Bottom-Up Approach

Data Triangulation

After estimating the overall market size using the process explained below, the market was divided into several segments and subsegments. Data triangulation and market breakdown methods were used, where applicable, to complete the overall market analysis and determine precise statistics for all segments and subsegments. The data was triangulated by examining various factors and trends from both the demand and supply sides. The market size was confirmed through top-down and bottom-up approaches.

Market Definition

A pad-mounted switchgear is a fully enclosed, weather-resistant, and tamper-proof system housed within a steel or aluminum cabinet and installed on a concrete pad at ground level. It is mainly designed for underground distribution networks, providing safe, reliable, and compact medium-voltage switching and protection solutions. These systems usually include key components such as load break switches, circuit breakers, isolators, fuses, voltage sensors, current transformers, and grounding switches, all integrated into a single enclosure. Pad-mounted switchgear allows fault isolation, circuit protection, load switching, and sectionalizing of electrical distribution circuits without exposing energized parts, making them ideal for public or high-traffic areas like residential neighborhoods, commercial complexes, industrial facilities, and institutional campuses. They come in various insulation types (air, solid dielectric, SF6, or vacuum) and voltage ratings (typically from 5 kV to 38 kV).

Stakeholders

- Pad-mounted switchgear manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Switchgear manufacturers, distributors, and suppliers

- Switchgear original equipment manufacturers (OEMs)

Report Objectives

- To describe and forecast the pad-mounted switchgear market in terms of value, by type, application, voltage, standard, and region, in terms of value

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the pad-mounted switchgear market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the pad-mounted switchgear market

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the pad-mounted switchgear market

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as contracts, agreements, expansions, product launches, investments, and acquisitions, in the pad-mounted switchgear market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What is the size of the pad-mounted switchgear market in 2024?

The pad-mounted switchgear market was valued at USD 5.85 billion in 2024.

What are the major drivers for the pad-mounted switchgear market?

The main drivers for the pad-mounted switchgear market include increasing electricity demand driven by rapid urbanization and industrial development, higher investments in underground power distribution networks, and the need for a reliable and safe power supply across residential, commercial, and industrial sectors. Furthermore, the integration of renewable energy sources and the growth of electric vehicle infrastructure are boosting the adoption of compact, weather-resistant, and tamper-proof switchgear solutions to meet modern grid needs.

What is the largest pad-mounted switchgear market during the forecast period?

Europe is expected to be the largest market for pad-mounted switchgear during the forecast period, driven by widespread underground power distribution, strict energy efficiency regulations, and strong investments in grid modernization. The region’s emphasis on renewable energy integration, urban infrastructure updates, and the need for reliable electricity in densely populated areas further increases demand for compact and secure switchgear systems.

Which type of pad-mounted switchgear is expected to hold the largest market share during the forecast period and why?

Gas-insulated pad-mounted switchgear is expected to hold the largest market share during the forecast period. This is because of its superior insulation capabilities, compact design, and minimal maintenance needs. It is especially suitable for tough and space-limited environments, including urban, industrial, and utility settings. Its sealed construction provides better protection against environmental factors like moisture, dust, and corrosive elements, making it a favored choice for long-term reliability and safety. Additionally, the increasing demand for high-reliability power distribution in critical infrastructure supports its widespread use.

Which application will account for the largest market share in the coming years?

The industrial sector is expected to hold the largest market share in the coming years. This growth is driven by increasing demand for continuous and reliable power in energy-intensive industries such as oil & gas, mining, chemicals, manufacturing, and automotive. These sectors need sturdy medium-voltage distribution systems that can handle harsh environments, operate nonstop, and maintain safety. Pad-mounted switchgear is perfect for such uses because of its compact design, protective features, and easy integration with underground power networks.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pad-Mounted Switchgear Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pad-Mounted Switchgear Market