Peracetic Acid Market

Peracetic Acid Market by Grade (<5% Grade, 5-15% Grade, >15% Grade), Application (Disinfectant, Sterilant, Sanitizer), End-use Industry (Healthcare, Food & Beverage, Water Treatment, Pulp & Paper, Other End-use Industries (Agriculture, Wineries, Breweries, Laundry)), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The peracetic acid market is projected to reach USD 1,679.1 million by 2030 from USD 1,117.0 million in 2025, at a CAGR of 8.49% from 2025 to 2030. Peracetic acid, also known as peroxyacetic acid or PAA, is an organic chemical solution widely used as a biocide. It is produced by the chemical reaction of two primary raw materials: acetic acid and hydrogen peroxide, in the presence of an acidic catalyst. It is normally a colorless liquid with a pungent odor. The global peracetic acid market is growing due to its rising preference as an eco-friendly disinfectant that delivers strong antimicrobial efficacy without leaving harmful residues.

KEY TAKEAWAYS

-

BY GRADEThe 5–15% grade segment is projected to dominate the global market and be the fastest-growing segment due to its strong demand in the healthcare and food & beverage sectors.

-

BY APPLICATIONThe disinfectant application is estimated to account for the largest market share, driven by its broad-spectrum efficacy against pathogens and increasing demand across food processing, healthcare, and water treatment amid stricter global hygiene standards.

-

BY END-USE INDUSTRYThe food & beverage industry is estimated to account for the largest market share of global peracetic acid market due to the strict hygiene related regulations and water treatment industry is projected to grow at 10.58% CAGR, which is highest among the end-use industry segments.

-

BY REGIONEurope is projected to have the largest share of the global peracetic acid market. The major reason for this is the stringent regulatory frameworks emphasizing hygiene and sanitization across industries such as healthcare, food & beverage, and water treatment.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including expansion, collaborations, acquisitions, and investments. Solvay and Aquatic Concept Group (ACG) signed an agreement to collaborate in pursuit of sustainable growth in their worldwide aquaculture operations. Aquatic is a Norway-based leading supplier of solutions in the food industry. It manufactures products in the fields of hygiene, processing equipment, professional cleaning, and consultancy. This partnership has helped the companies expand the distribution channel for peroxide products.

The market for peracetic acid is expanding steadily as more industries use it as a highly efficient, sustainable, and safe oxidizing and disinfecting agent. Its increasing use in food & beverage processing to guarantee product safety, its growing use in healthcare for sterilizing instruments, and its increasing demand as a chlorine-free substitute in water treatment are some of the major trends. Its adoption across end-use sectors is also being strengthened by the move toward environmentally friendly chemicals and stricter global hygiene and environmental regulations. All these elements work together to make peracetic acid an essential alternative for preserving sustainability, safety, and compliance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

An emerging application of peracetic acid in healthcare is its use in low-temperature sterilization systems for heat-sensitive medical devices. Hospitals are increasingly adopting this approach as an alternative to ethylene oxide, as it provides faster cycle times, reduced toxicity, and reliable microbial inactivation. Its suitability for sterilizing endoscopes and surgical instruments makes it a valuable solution for modern infection control practices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advantages of peracetic acid over substitute biocides

-

Favorable government regulations in Europe and North America

Level

-

High cost and low awareness about benefits

Level

-

High growth potential in Asia Pacific

-

Emerging applications across various industries

Level

-

High reactivity and corrosiveness of product

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advantages of peracetic acid over substitute biocides

Disinfectants, sanitizers, chemical sterilants, and other biocidal solutions are vital for controlling microbial growth, with peracetic acid increasingly recognized as an eco-friendly alternative to chlorine in wastewater treatment, bleaching, and disinfection. Its superior performance compared to conventional biocides—supported by advantages such as longer shelf life, effective antimicrobial action, safe by-products, and stability—has made it one of the most innovative solutions in the biocide industry. Growing awareness of these benefits is accelerating their adoption across diverse applications, driving demand in multiple end-use industries.

Restraint: High cost and low awareness about benefits

Peracetic acid's relatively high cost and low end-user awareness of its benefits are limiting the market's growth. Due to financial limitations and ignorance of the chemical's long-term advantages, many industries are still hesitant to adopt it, despite its potent antimicrobial efficacy and environmentally beneficial qualities. Wider market penetration becomes difficult as a result, especially in areas and industries where costs are high.

Opportunity: High growth potential in Asia Pacific

The peracetic acid market has significant growth potential in the Asia Pacific region due to a combination of industrial development, economic growth, and growing awareness of hygiene. Peracetic acid is being used more by the rapidly expanding food & beverage processing industries for efficient sanitation and safety assurance, and healthcare facilities throughout the region are incorporating it into sterilization and disinfection procedures to adhere to higher hygiene standards. Demand has also been fueled by the increase in urbanization and population growth, which has increased the need for effective and sustainable water treatment methods. Peracetic acid adoption is facilitated by the emphasis on eco-friendly chemicals and sustainable practices by governments and industries in countries like China, India, and Southeast Asia.

Challenge: High reactivity and corrosiveness of product

The high reactivity and corrosive nature of peracetic acid, which complicates handling, storage, and transportation, is one of the main issues facing the market. Although it is very effective at disinfecting and sterilizing, its potent oxidizing qualities can also endanger worker safety if improperly handled. To guarantee safe use, specialized tools and safeguards are needed, which raises end users' operating expenses. Furthermore, peracetic acid is not appropriate for all systems or infrastructure due to its corrosive nature, which restricts its compatibility with specific materials. These elements frequently deter adoption, especially in areas with little technical know-how or in cost-sensitive industries. To allay these worries, producers and distributors need to invest in creating safer formulations, sturdy packaging, and thorough user training.

Peracetic Acid Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Sanitizing production lines, tanks, and packaging | Improves shelf life and food safety |

|

Sterilization of surgical instruments, endoscopes, and dental tools | Broad antimicrobial action (bacteria, viruses, spores) |

|

Disinfection of municipal wastewater | Rapid disinfection without harmful byproducts |

|

Slimicide for controlling biofilm in paper mills | Controls slime and microbial growth sustainably |

|

Disinfection of textiles (linens, uniforms, towels) | Broad-spectrum kill of bacteria, fungi, spores, and viruses |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The peracetic acid market ecosystem involves a diverse set of stakeholders that contribute to its production and utilization. At the base are the raw material suppliers providing the key inputs such as peracetic acid, hydrogen peroxide, stabilizers, catalysts, and additives, which are critical for the synthesis and formulation of peracetic acid. Manufacturers then convert these raw materials into peracetic acid using specialized chemical processes, and then the distributors, bridging the gap between the end-users and the manufacturers. The end-use industries represent the final segment of the market ecosystem, where peracetic acid is being used in various applications like food and beverage disinfection, healthcare surface sterilization, breweries and wineries, and various other applications. This interconnected ecosystem ensures a steady supply, efficient distribution, and broad industrial adoption of peracetic acid solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Peracetic Acid Market, by Grade

The peracetic acid market's >15% grade segment is estimated to be the second-fastest-growing category, due to its efficacy in demanding applications like industrial water treatment, bleaching pulp and paper, and specialized healthcare sterilization. This grade is a preferred option where strict performance and hygiene requirements are needed because of its high oxidative strength, which guarantees excellent microbial control and process efficiency. Industries continue to use the >15% grade because of its dependability and capacity to produce consistent results in crucial applications, even though its high reactivity necessitates careful handling.

Peracetic Acid Market, by Application

The market for peracetic acid is projected to grow at the highest CAGR in the sterilant application due to its growing use in the food processing, pharmaceutical, and healthcare sectors. It is a preferred substitute for conventional sterilants due to its broad-spectrum effectiveness against bacteria, spores, fungi, and viruses as well as its environmentally friendly breakdown into innocuous byproducts. Peracetic acid is becoming a major growth driver in the application segment due to the growing need for safe and efficient solutions to satisfy strict hygiene and regulatory standards.

Peracetic Acid Market, by End-use Industry

The food & beverage industry has the largest share of the peracetic acid market's end-use segment since the peracetic acid is widely used in processing facilities, equipment, and packaging lines for sanitation, disinfection, and hygiene management. The efficiency of peracetic acid against bacteria, molds, and yeasts, as well as its eco-friendliness and quick breakdown into innocuous byproducts, make it a popular option for maintaining food safety and prolonging product shelf life. Peracetic acid's dominance in the market is maintained by the industry's adoption of the chemical due to strict regulations in food processing and growing consumer awareness of hygiene standards.

REGION

Asia Pacific to be the fastest growing region and Europe to be the largest region in global peracetic acid market during forecast period

Europe is projected to continue to be the largest market for peracetic acid on a global scale, due to its well-established industrial and healthcare infrastructure, strict hygiene regulations, and broad use of environmentally friendly disinfectants across a range of industries. At the same time, Asia Pacific is the fastest-growing market due to the region's fast industrialization, growing food & beverage processing, rising healthcare infrastructure investments, and growing need for environmentally friendly water treatment methods. Established players and new entrants can benefit greatly from the global dynamics of the peracetic acid market, which are highlighted by the combination of mature demand in Europe and high growth potential in Asia Pacific.

Peracetic Acid Market: COMPANY EVALUATION MATRIX

In the peracetic acid market matrix, Solvay (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industry. Jubilant Life Sciences (Emerging Leader) is gaining traction with peracetic acid solutions like sterilizing and disinfecting, across the industries. While Solvay Company dominates with scale, Jubilant Life Sciences shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 1,033.7 Million |

| Market Forecast, 2030 (Value) | USD 1,679.1 Million |

| Growth Rate | CAGR of 8.49% from 2025 to 2030 |

| Years Considered | 2020−2030 |

| Base Year | 2024 |

| Forecast Period | 2025−2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, South America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Peracetic Acid Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Peracetic Acid Manufacturer |

|

|

| Asia Pacific-based Peracetic Acid Manufacturer |

|

|

RECENT DEVELOPMENTS

- December 2021 : Arxada acquired EnviroTech Chemical Services. This was the second strategic deal by Arxada, formerly known as Lonza Specialty Ingredients (LSI), in its first six months as an independent company. The acquisition would create a new, complementary business line in Arxada’s Microbial Control Solutions (MCS) business.

- September 2021 : EnviroTech Chemical Services introduced PeraGuard, the world’s first and only dry peracetic acid (PAA) floor and equipment sanitizer. It could be used in wineries, cheese, beverage & dairy processing plants, packaging rooms, milking barns, hatcheries, refrigerated trucks, forklift and foot traffic lanes, poultry and meat operations, transport vehicles, kennels, animal laboratories, animal care facilities, poultry litter bedding, pharmaceutical plants, kitchens, and restaurants.

Table of Contents

Methodology

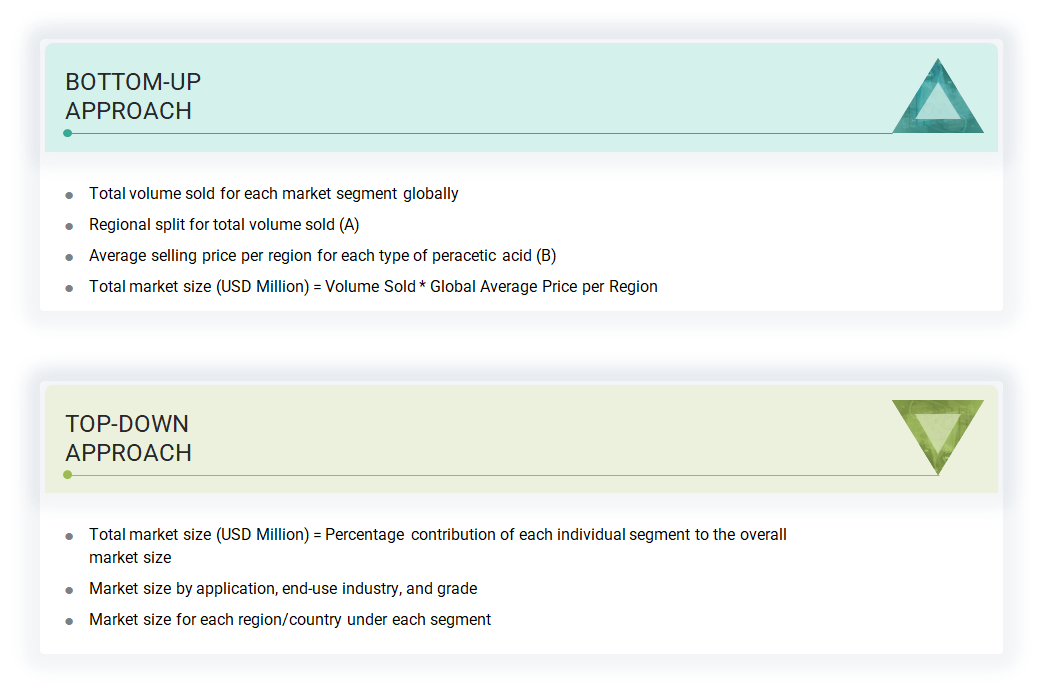

The study involved four major activities to estimate the current size of the peracetic acid market. Exhaustive secondary research was conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva, and publications and databases from associations.

Primary Research

Extensive primary research was carried out after gathering information about the peracetic acid market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the peracetic acid market. Primary interviews were conducted to obtain information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated with grade, application, end-use industry and region.

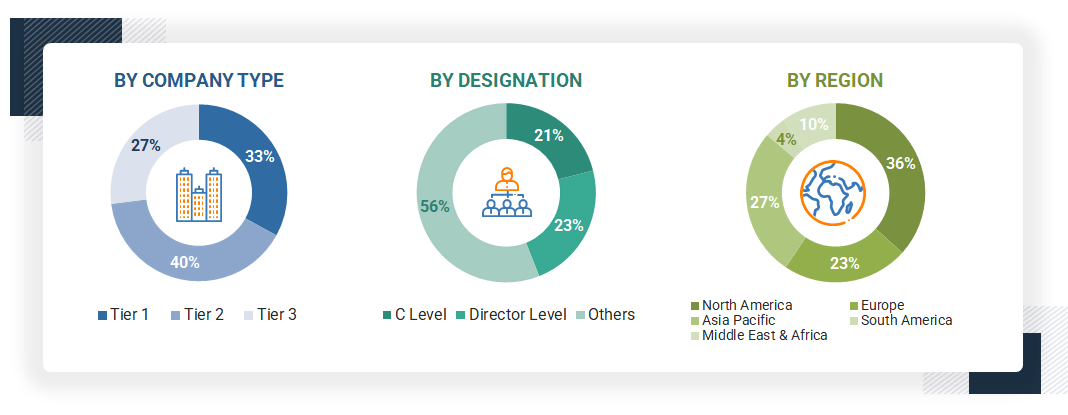

Breakdown of Primary Interviews

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Solvay | Sales Manager | |

| Evonik Industries AG | Project Manager | |

| MITSUBISHI GAS CHEMICAL COMPANY, INC. | Individual Industry Expert | |

| Ecolab Inc. | Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the peracetic acid market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Peracetic acid (PAA), also known as peroxyacetic acid, is a colorless, pungent-smelling organic compound widely used as a powerful biocide and oxidizing agent. It is produced through the reaction of acetic acid and hydrogen peroxide in the presence of an acidic catalyst. Available in concentrations ranging from below 5% to 35%, it is extensively used in food & beverage sanitation, healthcare sterilization, water treatment, and pulp & paper industries. Known for its strong antimicrobial efficacy and environmentally friendly decomposition into acetic acid, water, and oxygen, peracetic acid is considered a superior disinfectant, aligning well with sustainability goals and stringent regulatory standards.

Stakeholders

- Peracetic Acid Manufacturers

- Raw Material Suppliers

- Manufacturing Technology Providers

- Industry Associations

- End Users such as Healthcare, Water Treatment, Food, and Pulp & Paper Sectors

- Traders, Distributors, and Suppliers of Peracetic Acid

- Government and Research Agencies and Regional Organizations

Report Objectives

- To analyze and forecast the size of the global peracetic acid market in terms of value and volume

- To provide detailed information about the important drivers, restraints, challenges, and opportunities influencing market growth

- To define, describe, and segment the market based on grade, application, end-use industry, and region

- To forecast the size of the market segments based on regions such as Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, partnerships & collaborations, mergers & acquisitions, agreements, and product launches in the market

- To strategically profile the key companies and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What are the driving factors of the peracetic acid market?

The use of peracetic acid as a disinfectant is the major driving factor for its market.

What are the major grades of peracetic acids?

The major grades of peracetic acid are less than 5% grade, 5–15% grade, and greater than 15% grade.

What are the major end-use industries of peracetic acid?

The major end-use industries of peracetic acid are healthcare, food and beverage, water treatment, and pulp and paper.

Who are the major manufacturers?

Solvay (Belgium), Evonik Industries AG (Germany), Ecolab Inc. (US), MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan), and Enviro Tech Chemical Services (US) are some of the leading players in the global peracetic acid market.

Which is the largest regional market for peracetic acid?

Europe is the largest regional market for peracetic acid.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Peracetic Acid Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Peracetic Acid Market