Pharmaceutical Manufacturing Software Market Size, Growth, Share & Trends Analysis

Pharmaceutical Manufacturing Software Market by Offering (AI-Integrated), Type (MES, SCADA, Quality Compliance, EPR, Track & Trace), Application (Biologics, Vaccine), End User (Pharma, Biotech, CDMO), Trend, Growth, Market Share - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

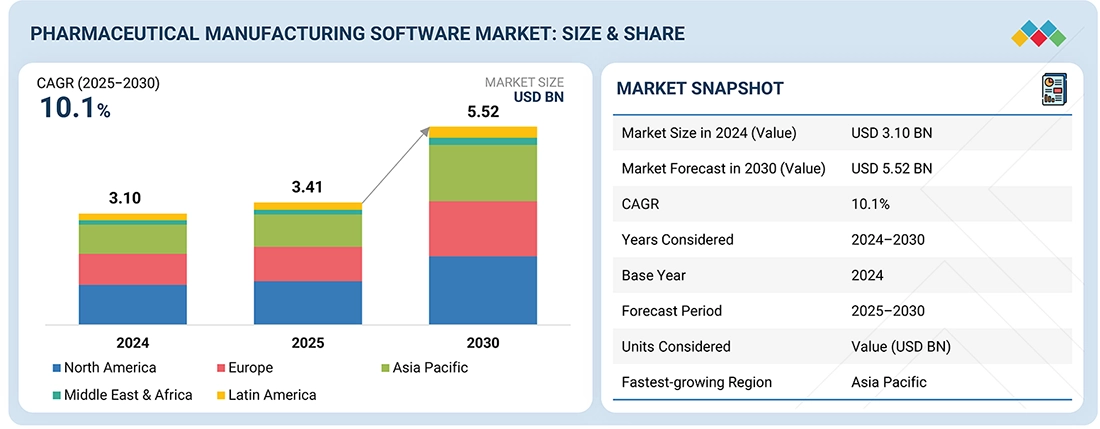

The global Pharmaceutical Manufacturing Software market, valued at US$3.10 billion in 2024, stood at US$3.41 billion in 2025 and is projected to advance at a resilient CAGR of 10.1% from 2025 to 2030, culminating in a forecasted valuation of US$5.52 billion by the end of the period. The development is largely predetermined by the rise in regulatory compliance and the need to use digital and automated manufacturing solutions, the necessity to provide data integrity and traceability, and the increased need to produce pharmaceuticals worldwide. Additionally, the transition to smart factories, cloud-based platforms that are validated and additional outsourcing to CMOs and CDMOs is further stimulating market adoption.

KEY TAKEAWAYS

-

BY REGIONThe North American pharmaceutical manufacturing software market accounted for a 36.0% revenue share in 2024.

-

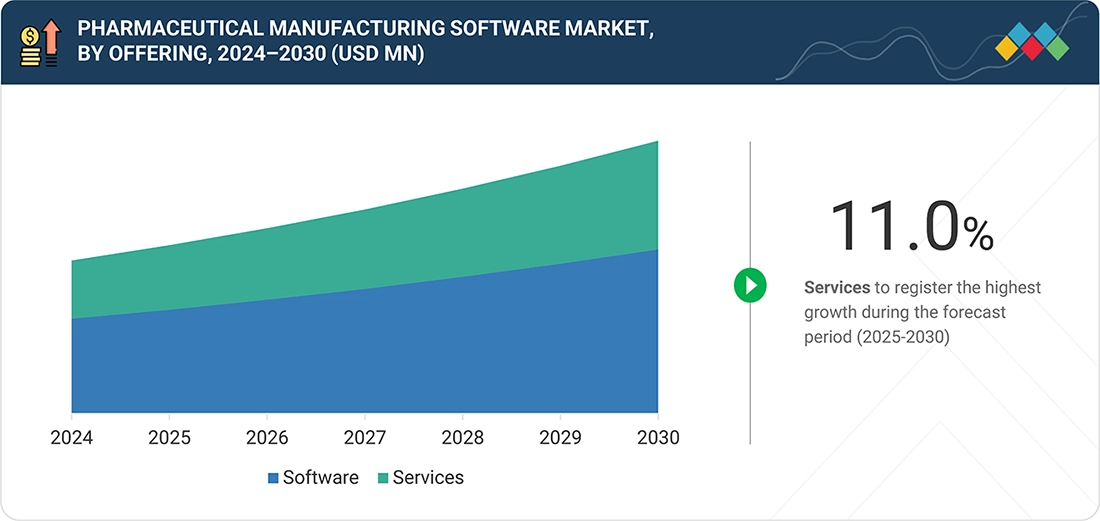

BY OFFERINGBy offering, the services segment is expected to register the highest CAGR of 11.0%.

-

BY SOFTWARE TYPEBy software type, the manufacturing operations & control software segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY APPLICATIONSBy applications, the small molecules segment is expected to dominate the market.

-

BY END USERBy end user, the pharmaceutical & biotechnology companies accounted for the largest share of 68.0% in 2024.

-

COMPETITIVE LANDSCAPESAP SE, Dassault Systèmes, and Emerson Electric Co. are key leaders in the global pharmaceutical manufacturing software market, recognized for their extensive product portfolios, robust data integration capabilities, and strong presence across healthcare ecosystems.

The pharmaceutical manufacturing software market is rapidly growing, as investments in digital manufacturing grow, and the emphasis on regulatory compliance, data integrity, and operational efficiency in the pharmaceutical production increases in the US and EU. The development of MES, QMS, LIMS, automation, and real-time analytics enhances the traceability of batches, quality, planning of production, and the entire performance of the manufacturing process. Moreover, the growing trend in strategic collaboration among pharmaceutical companies, software providers, and automation vendors is driving innovation at a faster pace and creating more integrated, scalable, and compliant manufacturing environments.

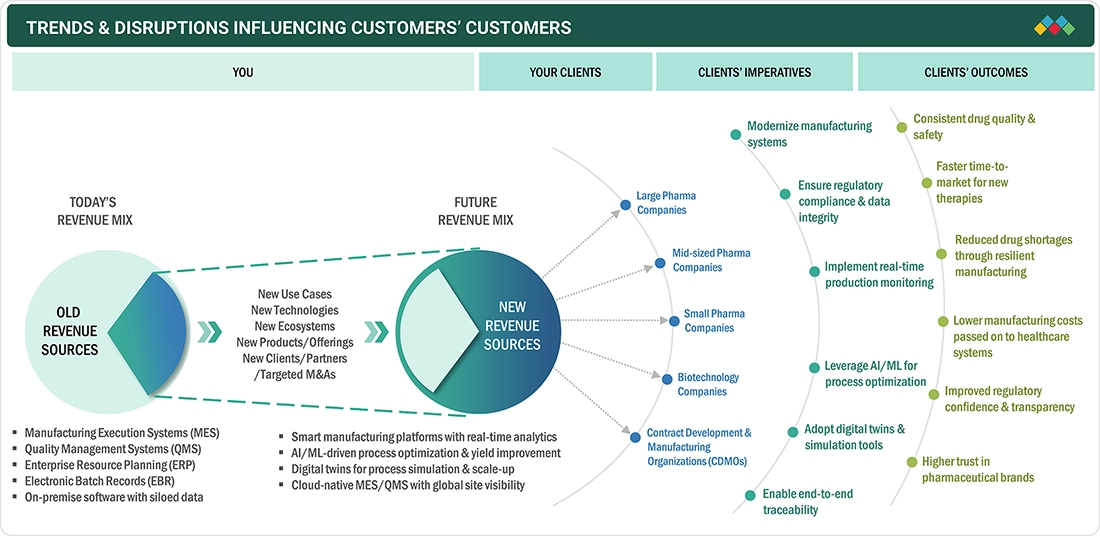

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the business of consumers in the pharmaceutical manufacturing software market is based on evolving regulatory needs, the rising complexity of manufacturing, and continuous digital transformation initiatives. The primary end users are pharmaceutical manufacturers, biopharma companies, and CMOs/CDMOs, whose operational and compliance requirements are the catalysts for the software adoption. The shifts in trends or interruptions like the increasing demands for MES, QMS, electronic batch records, real-time monitoring, and automation directly impact the manufacturing efficiency, quality results, and cost optimization, affecting the revenue growth and competitiveness of the pharmaceutical manufacturing software vendors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stronger regulatory enforcement & need for data integrity

-

Digital transformation/Industry 4.0 adoption (AI, IoT, digital twins)

Level

-

High validation, compliance burden, and legacy infrastructure complexity

-

Data security & privacy concerns

Level

-

Growing demand for biologics, personalized medicine, and contract manufacturing

-

Adoption of AI-driven analytics and validated cloud-based platforms

Level

-

Maintaining GxP compliance during digital transformation

-

Achieving interoperability across diverse manufacturing systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Stronger regulatory enforcement & need for data integrity

Increased regulatory compliance and the increasing demands for data integrity are major forces behind the pharmaceutical manufacturing software market. The stricter compliance requirements regarding Good Manufacturing Practice (GMP), electronic recordings, and audit readiness suggested by regulatory bodies in large areas are forcing pharmaceutical manufacturers towards the use of advanced digital solutions. The software manufacturing will contribute to better focus on gathering the right data, traceability, and real-time monitoring along with production processes, and help to avoid mistakes and failure to comply. Also, the emerging concern about the integrity of data, verification, and safe documentation is enhancing the transition of manual systems to automated manufacturing processes with the use of software.

Restraint: High validation, compliance burden, and legacy infrastructure complexity

Stringent validation rules, regulatory requirements, and the complexity associated with poor-quality legacy infrastructure are major restraints for the pharmaceutical manufacturing software market. The implementation process associated with the pharmaceutical manufacturing process is quite expensive and time-consuming, as pharma manufacturers need to complete a considerable amount of system validation, documentation, and auditing to meet strict regulatory requirements. The integration of new software with the existing legacy infrastructure system can be challenging, as it creates disruption in the smooth functionality associated with the system.

Opportunity: Growing demand for biologics, personalized medicine, and contract manufacturing

The increased demand for biologics and personalized medicine, as well as the contract manufacturing, is a major opportunity for the pharmaceutical manufacturing software market. Such complicated and expensive treatments demand a higher level of control of the process, real-time monitoring of the data, and adherence to quality standards, which promotes the necessity of highly developed manufacturing software. CMOs also tend to implement digital solutions that help to manage the multi-client operations, provide the appropriate traceability, and uphold the regulatory procedures. With the increasing specialization and flexibility of pharmaceutical production, software-based manufacturing systems are now needed to facilitate scalability and operational efficiency.

Challenge: Maintaining GxP compliance during digital transformation

Maintaining GxP compliance in digital transformation is one of the most significant issues the pharmaceutical manufacturing software market faces. With the transition of manufacturers to high-tech digital systems, paper-based and old systems, manufacturers have to guarantee that all procedures follow the high standards of GxP concerning data integrity, system validation, and audit readiness. Change management that does not disturb the controlled production settings is complicated and risky. Any compliance lapses at the time of system upgrade or integration may result in regulatory fines, delay in production, or expensive corrective actions.

PHARMACEUTICAL MANUFACTURING SOFTWARE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Industrial automation and manufacturing execution systems for pharmaceutical production environments. | Increased process reliability, improved throughput, and reduced operational risk. |

|

Quality management and manufacturing software supporting document control, training, audits, and regulatory compliance for pharmaceutical production. | Improved compliance readiness, reduced quality risks, and faster audit and validation processes. |

|

Digital manufacturing and MES solutions for pharma production, equipment monitoring, and process optimization. | Enhanced operational visibility, reduced downtime, and improved manufacturing accuracy. |

|

Enterprise software for pharmaceutical manufacturing integrating production planning, supply chain, and quality management. | Better coordination across operations, improved traceability, and increased manufacturing efficiency. |

|

Cloud-based quality, manufacturing, and regulatory software for life sciences organizations. | Faster compliance processes, improved collaboration, and streamlined manufacturing documentation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

SAP SE (Germany), Dassault Systèmes (France), Emerson Electric Co. (US), and Rockwell Automation (US) are the leading providers of the software market ecosystem in the pharmaceutical manufacturing industry and offer solutions such as MES, ERP, QMS, digital twins, and automation platforms to manufacture pharmaceuticals. To enhance efficiency, guarantee regulatory compliance, and enhance product quality, these companies employ real-time analytics and proven digital workflows. These solutions are being adopted by end users such as pharma manufacturers, biopharma companies, and CMOs/CDMOs to reduce operational risk, ensure integrity of data, and optimize production processes, and continuous cooperation between vendors and manufacturers leads to the transition to smart pharma factories.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pharma Manufacturing Software Market, By Offering

Based on offering, the pharmaceutical manufacturing software market includes services and software. The software segment accounted for the largest share. This is due to the growing use of MES, QMS, LIMS, and ERP solutions to maintain regulatory compliance, data integrity, and real-time visibility throughout manufacturing operations. There is also an increase in demand for automation, electronic batch records, and analytics-driven production optimization, which also enhances the leadership of the software segment.

Pharma Manufacturing Software Market, By Software Type

Based on the software type, the manufacturing operations and control software segment holds a significant market share. This is because of the growing demand for real-time monitoring in production, electronically prepared batch records, automating processes, and regulatory compliance that will help pharmaceutical manufacturing companies to enhance the efficiency of the operations, quality of the products, and integrity of the data in the different manufacturing plants.

Pharma Manufacturing Software Market, By Application

Based on applications, the small molecules segment contributed significantly to the pharmaceutical manufacturing software market. This growth is driven by the large quantity of small-molecule drug synthesis, long-established manufacturing workflows, and the widespread use of manufacturing execution and quality management software as a guarantee of efficiency, consistency, and compliance with regulations throughout the large-scale manufacturing processes. Moreover, the existence of mature supply chains and the continuous need for generics also contribute to software adoption in this market.

Pharma Manufacturing Software Market, By End User

Based on the end users, the market is segmented into pharmaceutical & biotechnology companies and contract development and manufacturing organizations (CDMOs). Pharmaceutical and biotechnology companies hold a significant share of this market. That is because of their extensive manufacturing activities, high investment potential in digital and automated processes, and their concern with regulatory compliance, quality control, and data integrity. Also, branded and generic drugs production in-house leads to long-term profits in the manufacturing and quality management software business.

REGION

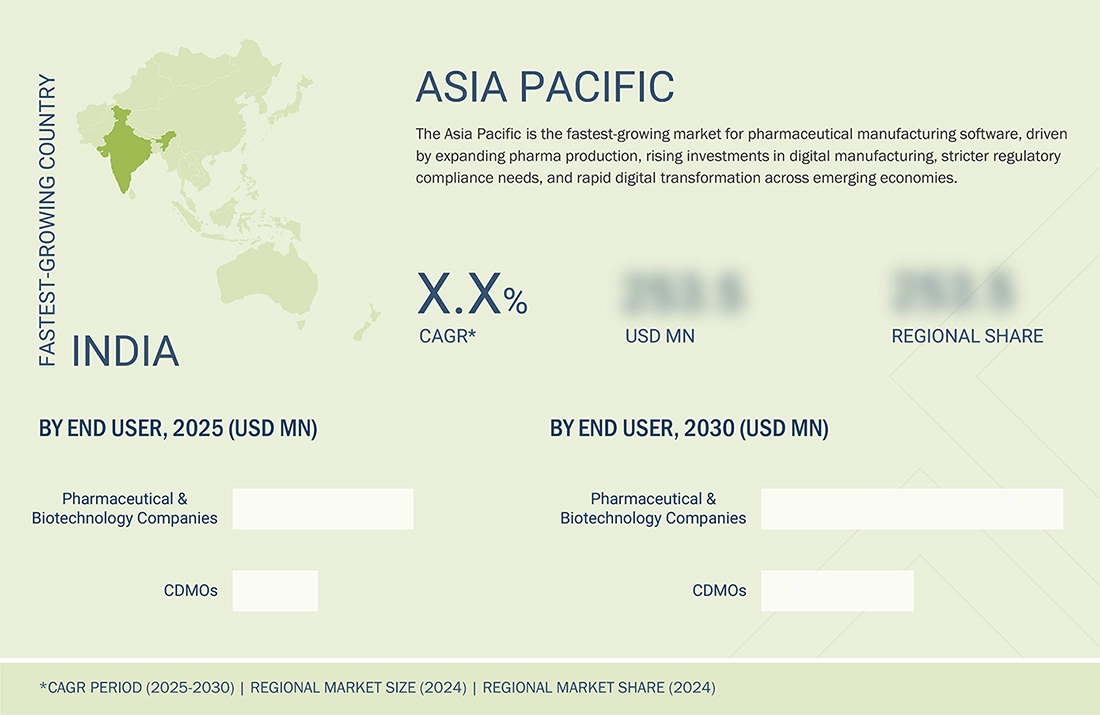

Asia Pacific to be fastest-growing region in global pharmaceutical manufacturing software market during forecast period

The Asia Pacific is expected to be the fastest-growing region in the pharmaceutical manufacturing software market during the forecast period. This development is driven by the expansion of pharmaceutical production plants, increasing investments in digital and automated production models, and the easing of regulatory constraints in China, India, and Japan. Additionally, the quick development of generic drug production, the increased role of CMOs and CDMOs, and favorable government support for smart manufacturing and digitalization are increasing the pace of uptake of high-end pharma manufacturing software in the region.

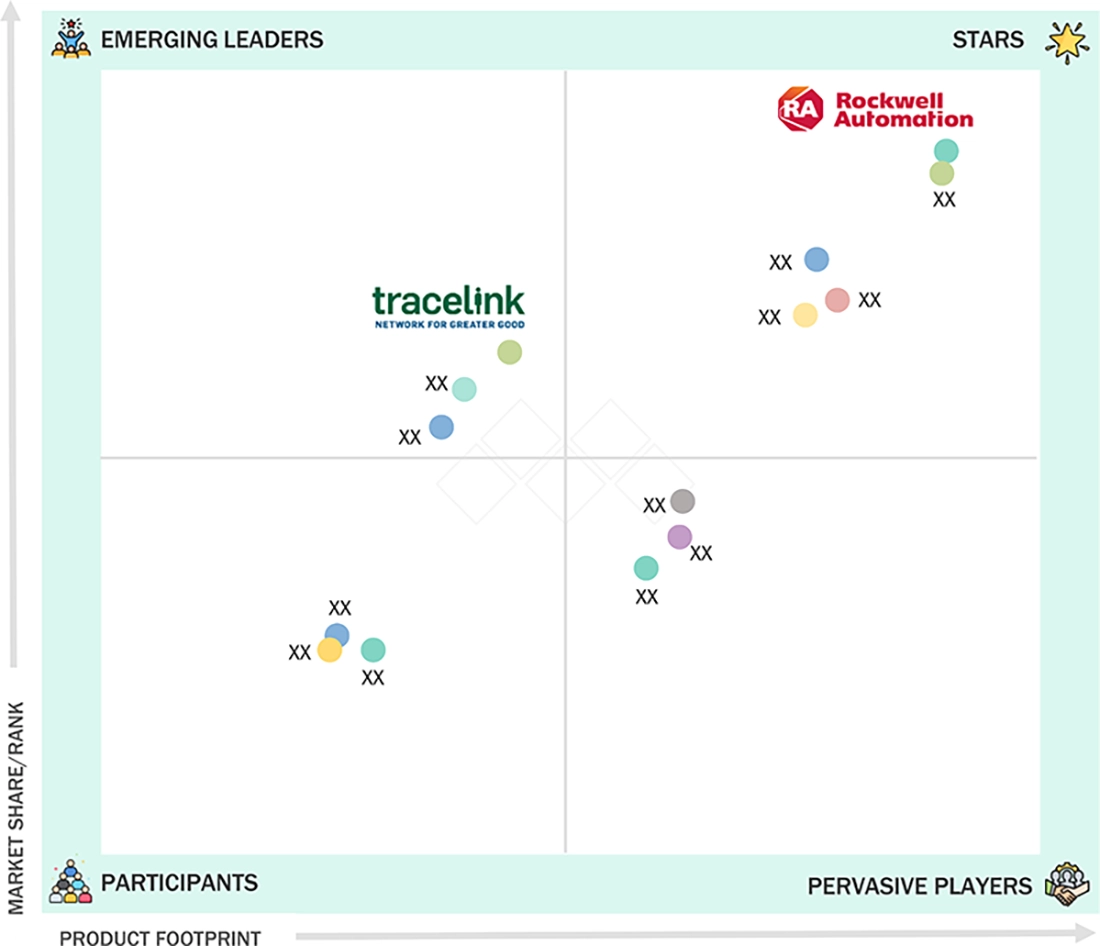

PHARMACEUTICAL MANUFACTURING SOFTWARE MARKET: COMPANY EVALUATION MATRIX

Rockwell Automation (Star) is among the market leaders in the pharmaceutical manufacturing software industry because of its robust industrial automation knowledge, full-fledged MES and control hardware, and pervasiveness in the manufacturing processes with a high level of compliance and operational idealism. TraceLink Inc. (Emerging Leader) is essential as it facilitates cloud-based, secure digital solutions that facilitate end-to-end traceability, regulatory compliance, and real-time data sharing in the pharmaceutical manufacturing and supply chains.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Rockwell Automation (US)

- Körber AG (Germany)

- Siemens Digital Industries (Germany)

- Veeva Systems (US)

- IQVIA (US)

- SAP SE (Germany)

- Dassault Systèmes (France)

- Emerson Electric Co. (US)

- Honeywell International Inc. (US)

- ABB (Switzerland)

- Merative (US)

- TraceLink Inc. (US)

- Oracle (US)

- IBM (US)

- MasterControl (US)

- eschbach (Germany)

- Microsoft (US)

- BatchMaster Software Pvt. Ltd. (US)

- Sage Group Plc (UK)

- Aptean (US)

- Benchling (US)

- Bigfinite Inc., dba Aizon (US)

- Tulip Interfaces, Inc. (US)

- Apprentice (US)

- Inductive Automation, LLC. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.10 Billion |

| Market Forecast in 2030 (Value) | USD 5.52 Billion |

| Growth Rate | CAGR of 10.1% from 2025-2030 |

| Years Considered | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Parent & Related Segment Reports |

Healthcare IT Market Medical Coding Market Asia Pacific Healthcare IT Market US Healthcare IT Market Europe Healthcare IT Market |

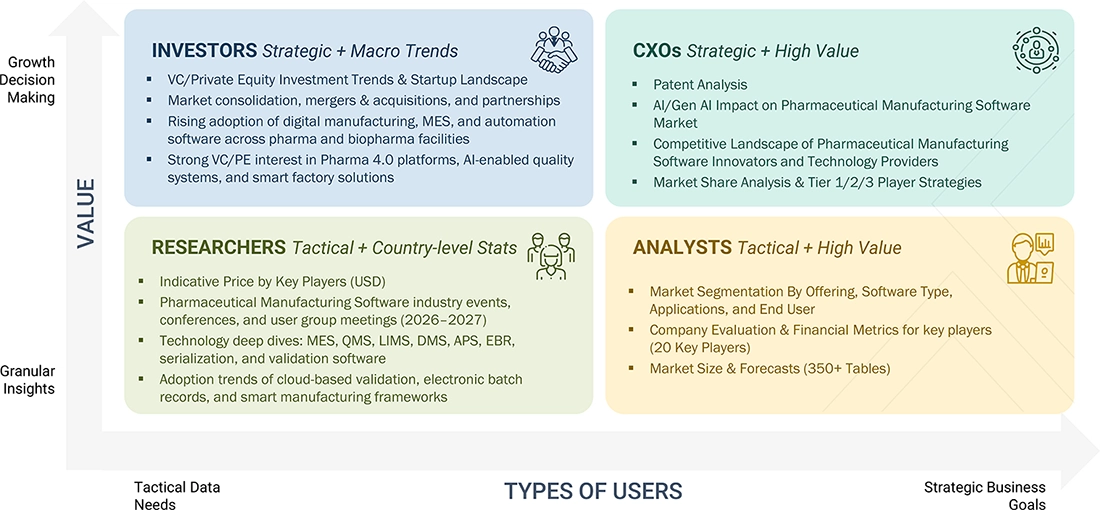

WHAT IS IN IT FOR YOU: PHARMACEUTICAL MANUFACTURING SOFTWARE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Profiles of the most popular pharma manufacturing software (e.g., SAP, Siemens, Rockwell Automation, Oracle, Dassault Systèmes) of MES, QMS, ERP, LIMS, and serialization. | Facilitates benchmarking of vendors, determines differentiation between compliance and automation facilities, and aids in partnership and vendor selection. |

| Market Entry & Growth Strategy | Dissection of adoption in branded and generic pharma, CMOs/CDMOs, geographical manufacturing centers, and digital transformation (Industry 4.0). | Eliminates market-entry risk, helps prioritize high-growth customer segments, and helps with scalable commercialization strategies. |

| Regulatory & Operational Risk Analysis | Risk assessment of compliance requirements such as FDA 21 CFR Part 11, GMP, GAMP 5, data integrity (ALCOA+), and global serialization requirements. | Enhances regulatory preparedness, lessens audit and compliance risk, and boosts plausibility with regulators and manufacturers. |

| Technology Adoption Trends | The understanding of adoption of cloud-enabled MES, Al driven quality analytics, digital twins, predictive maintenance, and end-to-end manufacturing visibility. | Informs the product roadmap, enhances competitive positioning, and justifies dedicated investment in state-of-the-art manufacturing software. |

RECENT DEVELOPMENTS

- May 2025 : Rockwell Automation launched the modified version of the manufacturing execution system known as FactoryTalk Pharma Suite 12.00, which is aimed at regulated manufacturing of pharmaceutical and biopharmaceutical products. Its release is aimed at making systems easier to manage, providing deployments that are both secure and scalable, as well as enhancing the production efficiency of compliance-oriented environments.

- March 2025 : Emerson acquired all the outstanding shares of Aspen Technology, Inc., which now operates as a subsidiary of Emerson. The purchase enriched Emerson's software and digital strengths and broadened its portfolio of sophisticated process optimization and industrial software in regulated industries, such as pharmaceutical manufacturing.

- March 2025 : Dassault Systèmes and its Medidata brand announced a strategic investment in Click Therapeutics through a Series C round. The investment enhances co-innovation between the companies to create further digital therapeutics capacity and utilize real-world data, increasing patient interaction and insights on information across the life sciences ecosystem.

Table of Contents

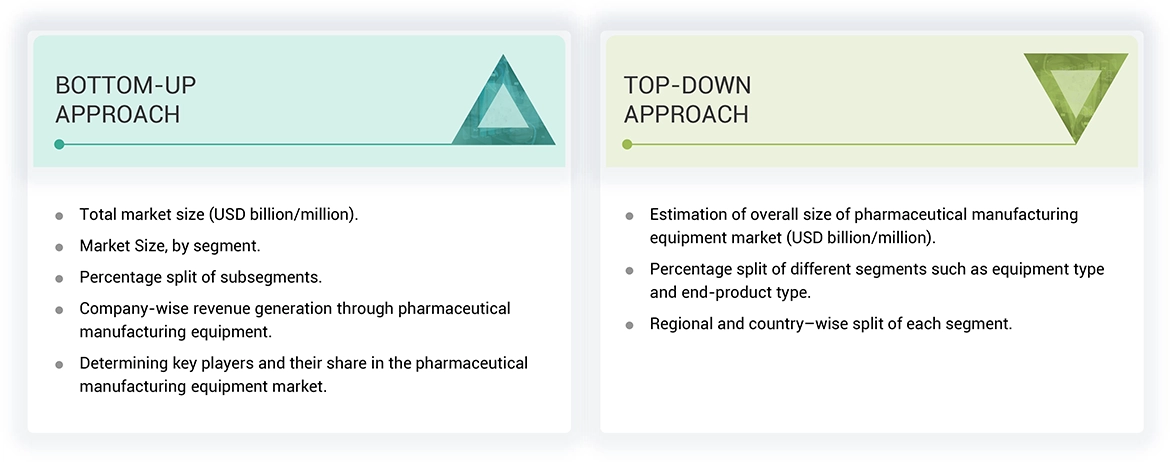

Methodology

The study involved major activities in estimating the current market size for the pharmaceutical manufacturing software market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the pharmaceutical manufacturing software market.

Secondary Research

The market for the companies offering pharmaceutical manufacturing software is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the pharmaceutical manufacturing software market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of World. Approximately 30% of the primary interviews were conducted with the demand-side respondents, while approximately 70% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches wete used to estimate and validate the total size of the pharmaceutical manufacturing software market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Pharmaceutical Manufacturing Software Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Pharmaceutical manufacturing software refers to the machinery and instruments used to manufacture pharmaceutical products. Various equipment are used to produce pharmaceutical drugs and solutions, including mixers and blenders, extruders, milling equipment, tablet compression presses, inspection equipment, and packaging machines.

Key Stakeholders

- End users

- Government bodies, venture capitalists, and private equity firms

- Pharmaceutical manufacturing software manufacturers

- Pharmaceutical manufacturing software industry associations

- Professional service/solution providers

- Research institutions and organizations

- Standards organizations and regulatory authorities

- System integrators

- Technology consultants

Report Objectives

- To describe and forecast the pharmaceutical manufacturing software market, in terms of value, based on equipment type and end-product type

- To forecast the size of the pharmaceutical manufacturing software market in terms of volume

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the RoW (Rest of the World)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the pharmaceutical manufacturing software ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2

- To analyze the major growth strategies implemented by key market players, such as agreements, acquisitions, product launches, expansions, and partnerships

- To study the impact of AI on the market under study, along with macroeconomic outlook for each region

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pharmaceutical Manufacturing Software Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pharmaceutical Manufacturing Software Market