US Healthcare IT Market Size, Growth, Share & Trends Analysis

US Healthcare IT Market by Solution [Clinical (EHR, PHM, PACs & VNA, Telehealth, CDSS, mHealth, LIS), Non-clinical (Analytics, RCM, QMS, Interoperability), Service (Claim, Billing, Supply)], End User (Hospital, ASC, Pharmacy, Payer) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The US healthcare IT market, valued at USD 182.20 billion in 2024, stood at USD 206.47 billion in 2025 and is projected to advance at a resilient CAGR of 14.0% from 2025 to 2030, culminating in a forecasted valuation of USD 396.82 billion by the end of the period. The market is driven by the increasing digitization of healthcare delivery, the broad adoption of electronic health record (EHR) systems, rising investments in telehealth and remote monitoring solutions, and the heightened focus on revenue cycle optimization and interoperability.

KEY TAKEAWAYS

-

By Solution & ServiceBy solution & service, the healthcare provider solutions segment is expected to register the highest CAGR of 15.2% during the forecast period.

-

By ComponentBy component, the software segment is expected to register the highest CAGR of 14.8% during the forecast period.

-

By End UserBy end user, the healthcare providers segment held the largest share of 73.0% in 2024.

-

Competitive LandscapeGE HealthCare, Oracle, and McKesson Corporation are recognized a star players in the US healthcare IT market due to their strong market share and product offerings.

-

Competitive LandscapeArintra and PaxeraHealth have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The US healthcare IT market is expanding as healthcare organizations increasingly modernize their clinical and administrative systems. There is a significant demand for cloud-based platforms, interoperability solutions, cybersecurity tools, and AI-enabled applications. This demand is driving investments across hospitals, physician practices, and payer organizations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The US healthcare IT market is transitioning from outdated on-premise systems to innovative cloud- and AI-driven platforms. This change is occurring across sectors, including hospitals, ambulatory care centers, diagnostic & imaging providers, healthcare payers, and life science companies. The adoption of interoperability, automated coding, AI imaging, and claims automation is leading to faster care delivery, quicker reimbursements, improved diagnostics, and SaaS-based revenue models.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong government mandates and regulatory support for healthcare IT adoption in US

-

Growing use of big data and advanced analytics in healthcare systems

Level

-

High healthcare IT implementation costs across US

-

Stringent data privacy and cybersecurity regulations

Level

-

Expansion of AI-enabled clinical and administrative automation in US

-

Growing uptake of cloud-based EHR solutions

Level

-

Limited availability of skilled personnel

-

Integration challenges with healthcare IT systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong government mandates and regulatory support for healthcare IT adoption in US

Government mandates and legislative policies are significantly influencing the implementation of healthcare IT in the US. Various initiatives, such as those led by the Centers for Medicare & Medicaid Services, promote the adoption of electronic health records, enhance interoperability, and facilitate the exchange of data through digital means. These efforts are contributing to improvements in healthcare quality and the effectiveness of care delivery in the US. As a result, value-based care policies and standardized data requirements are pressuring healthcare providers to upgrade their systems and applications.

Restraint: High healthcare IT implementation costs across US

The high costs of implementing healthcare IT present a significant challenge in the US. This is largely due to the complexities involved in integrating innovative technology with existing legacy systems. Healthcare organizations incur substantial capital and operational expenses, such as licensing, customization, and training, in order to meet security and other regulatory standards. Additionally, the ongoing costs of maintaining and upgrading this technology create further barriers to implementation, particularly for small to medium-sized organizations.

Opportunity: Expansion of AI-enabled clinical and administrative automation in US

The increasing use of AI-driven clinical and administrative automation in the US market presents a significant growth opportunity for the healthcare IT industry. Healthcare providers are leveraging machine learning, natural language processing, and predictive analytics to automate various operations, including clinical documentation, decision support, patient access, scheduling, and revenue cycle management. The abundance of both structured and unstructured healthcare data, along with a robust digital infrastructure and a growing emphasis on operational efficiency and cost control, is driving the adoption of AI-enabled automation in healthcare across the US.

Challenge: Limited availability of skilled personnel

The shortage of qualified professionals remains a significant issue in the US healthcare IT industry. The rapid adoption of advanced digital, cloud, and AI systems is outpacing the capabilities of the existing workforce. There is a notable scarcity of qualified professionals in areas such as health informatics, data analysis, cybersecurity, interoperability, and the governance of AI model implementation and deployment in healthcare organizations and providers.

US HEALTHCARE IT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Healthcare IT platform delivering EHR modernization, revenue cycle management, clinical data integration, and analytics through cloud-native Oracle Health. | Improved interoperability, scalable cloud performance, reduced operational costs, and enhanced clinical and financial insights. |

|

Provides EHR and interoperability solutions for hospitals and ambulatory care in the US. | Enhances care coordination, clinical efficiency, patient engagement, and value-based care outcomes. |

|

Hospital IT solutions for pharmacy management, supply chain automation, and connected clinical systems. | Reduced medication errors, optimized inventory, and improved hospital IT efficiency. |

|

Supports pharmacy systems, supply chain, and revenue cycle management across US healthcare providers. | Improves medication safety, operational efficiency, cost control, and financial performance. |

|

AI-enabled healthcare IT solutions for revenue cycle optimization, clinical documentation, and analytics. | Higher coding accuracy, lower claims denials, and data-driven clinical and financial decisions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US healthcare IT market ecosystem includes key vendors (Optum, Oracle, and GE HealthCare), startups (PaxeraHealth and Arintra), regulatory bodies (Centers for Medicare & Medicaid Services and the US Department of Health and Human Services), and end users (healthcare providers, healthcare payers, and life science industries). These stakeholders collectively support accurate code assignment, compliance, and efficient claims processing across the healthcare system.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Healthcare IT Market, By Solution & Service

In 2024, the healthcare provider solutions segment held the largest share of the US healthcare IT market, encompassing both clinical (EHRs, clinical decision support, imaging IT, telehealth, and others) and non-clinical (revenue cycle management, administrative, analytics, and patient engagement) healthcare IT solutions. Providers generate large volumes of structured and unstructured clinical and financial data, requiring tightly integrated IT ecosystems to support care delivery, reimbursement, and regulatory compliance. The ongoing adoption of value-based care models, interoperability mandates, and digital transformation initiatives continues to drive sustained investment in provider-centric healthcare IT solutions across hospitals, physician groups, and ambulatory care settings in the US.

US Healthcare IT Market, By Component

In 2024, the services segment accounted for the largest share of the US healthcare IT market, supported by the complexity of healthcare IT environments and the high level of customization required for system deployment. In the US, healthcare organizations increasingly rely on professional and managed services for EHR implementation, system integration, data migration, interoperability enablement, cybersecurity, and regulatory compliance. In addition, continuous support for system upgrades, cloud optimization, analytics deployment, and AI model integration has driven sustained demand for services.

US Healthcare IT Market, By End User

In 2024, the healthcare providers segment held the largest share of the US healthcare IT market, supported by high IT spending from hospitals, health systems, and physician groups to comply with CMS mandates, interoperability rules, and value-based care programs. The widespread adoption of EHRs, cloud platforms, clinical analytics, and revenue cycle automation continues to drive provider-led demand as organizations seek to improve care coordination, reduce administrative burden, and strengthen financial sustainability.

REGION

US HEALTHCARE IT MARKET: COMPANY EVALUATION MATRIX

In the US healthcare IT market matrix, Oracle is recognized as a Star Player, with a strong presence supported by its cloud-native electronic health record (EHR) system, interoperability solutions, and revenue cycle platforms that seamlessly integrate clinical and administrative workflows. Dell Inc. is classified as an Emerging Leader, driven by its scalable cloud infrastructure and data platforms, as well as edge solutions that facilitate efficient healthcare data management and digital transformation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Epic Systems Corporation (US)

- Oracle (US)

- Koninklijke Philips N.V. (Netherlands)

- McKesson Corporation (US)

- GE HealthCare (US)

- Cognizant (US)

- athenahealth (US)

- eClinicalWorks (US)

- SAS Institute Inc. (US)

- Inovalon (US)

- Infor (US)

- Conifer Health Solutions (US)

- Nuance Communications, Inc. (Microsoft) (US)

- Solventum (US)

- Optum, Inc. (US)

- InterSystems Corporation (US)

- Dell. Inc. (US)

- Salesforce, Inc (US)

- CitiusTech Inc. (US)

- Merative (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 182.20 Billion |

| Market Forecast in 2030 (Value) | USD 396.82 Billion |

| Growth Rate | CAGR of 14.0% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Parent & Related Segment Reports |

Healthcare IT Market Pharmaceutical Manufacturing Software Market Medical Coding Market Asia Pacific Healthcare IT Market Europe Healthcare IT Market |

WHAT IS IN IT FOR YOU: US HEALTHCARE IT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Benchmarking of US healthcare IT and medical coding vendors by EHR integration, AI capabilities, compliance, and pricing. | Supports vendor selection, competitive positioning, and partnership decisions. |

| Regional Market Entry Strategy | Analysis of US reimbursement systems (Medicare/Medicaid), coding standards, regulations, and provider adoption trends. | Enables faster market entry and compliant go-to-market execution. |

| Local Risk & Opportunity Assessment | Assessment of compliance, cybersecurity, workforce, denial trends, and high-growth healthcare IT segments. | Improves risk mitigation and investment prioritization. |

| Technology Adoption by Region | Mapping adoption of AI coding, EHR-integrated workflows, cloud platforms, and analytics across the US. | Guides technology strategy and automation-led growth. |

RECENT DEVELOPMENTS

- November 2025 : GE HealthCare announced it will acquire medical imaging software provider Intelerad for about USD 2.3 billion, aiming to expand its presence in the outpatient and cloud-based imaging markets.

- October 2025 : Optum launched an AI-powered real-time claims processing and reimbursement platform that connects payers and providers, enables instant coverage validation, reduces administrative errors, and accelerates claims adjudication.

- August 2025 : GE HealthCare and Ascension entered a multi-year partnership to deploy advanced imaging and digital technologies across Ascension’s US hospitals, aiming to improve diagnostic accuracy, clinical efficiency, and patient care outcomes.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

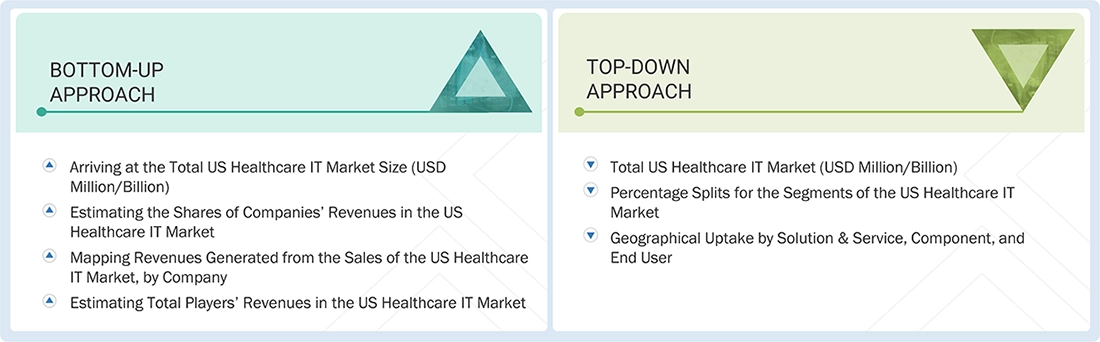

Methodology

The study involved five major activities to estimate the current size of the US Healthcare IT market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of US Healthcare IT market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

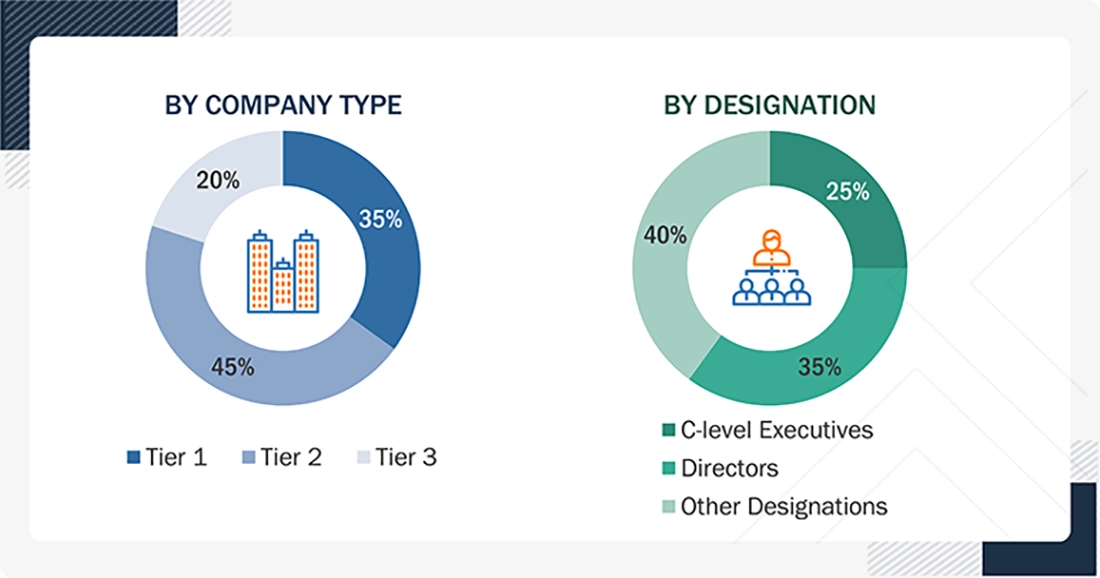

Extensive primary research was conducted after acquiring basic knowledge about the US Healthcare IT market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across the US Healthcare IT market. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the US Healthcare IT market. These methods were also used extensively to estimate the size of various subsegments in the market.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the US Healthcare IT market.

Market Definition

Healthcare Information Technology (HCIT) involves designing, developing, creating, using, and maintaining information systems related to the healthcare industry. Healthcare IT digitizes existing paper-based healthcare systems, ensuring effective care and patient safety. The solutions encompass the use of software, or infrastructure to record, store, protect, and retrieve clinical, administrative, or financial information by healthcare providers, payers, or other end users.

Stakeholders

- Healthcare IT solution providers

- Healthcare IT vendors

- Healthcare IT service providers

- Healthcare payers

- Academic research institutes

- Government institutes

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the US Healthcare IT market based on solution & service, component, end user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth in the US Healthcare IT Market

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall US Healthcare IT market

- To analyze opportunities in the US Healthcare IT market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile of the key players of the US Healthcare IT market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, agreements, sales contracts, and alliances in the US Healthcare IT market during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Healthcare IT Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Healthcare IT Market