Predictive Clinical Biomarkers Market Size, Growth, Share & Trends Analysis

Predictive Clinical Biomarkers Market by Product & Service (Consumable, Software), Technology (NGS, PCR), Disease (Cancer, Infectious), Application (Clinical Diagnostics)-Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

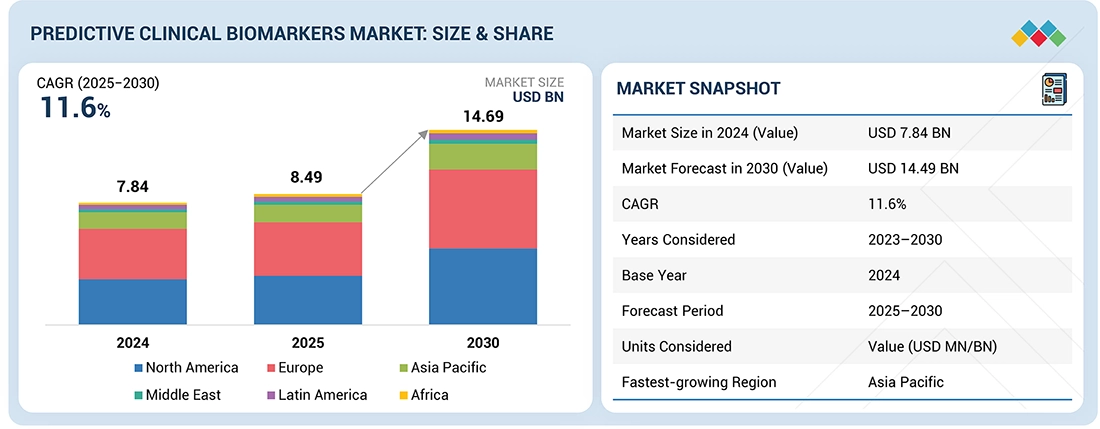

The predictive clinical biomarkers market, valued at US$7.84 billion in 2024, stood at US$8.49 billion in 2025 and is projected to advance at a resilient CAGR of 11.6% from 2025 to 2030, culminating in a forecasted valuation of US$14.69 billion by the end of the period. Predictive biomarkers are biological indicators that identify individuals likely to benefit from a specific therapy or to experience adverse effects. These biomarkers guide treatment selection, enabling personalized medicine by predicting patient response to targeted therapies. This market includes the consumables, instruments, and specialized services required for genomic biomarker discovery and validation.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific predictive clinical biomarkers market was the fastest growing segment with CAGR 13.2% in 2024.

-

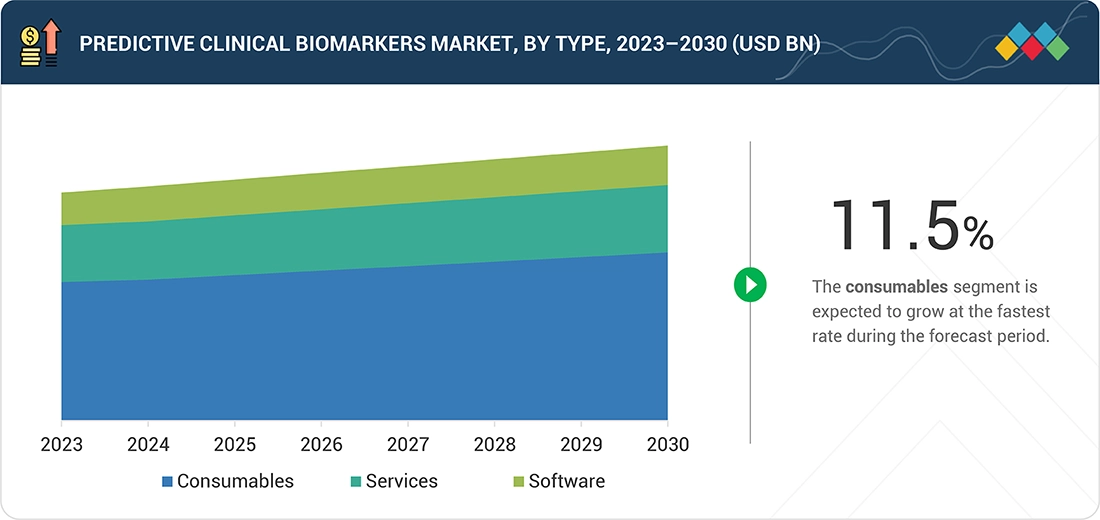

BY OfferingsBy type, the consumables segment is expected to dominate the market by revenue share.

-

BY TechnologyBy technology, the PCR segment dominate the predictive clinical biomarkers market.

-

BY APPLICATIONBy application, the cancer segment is expected to dominate the predictive clinical biomarkers market.

-

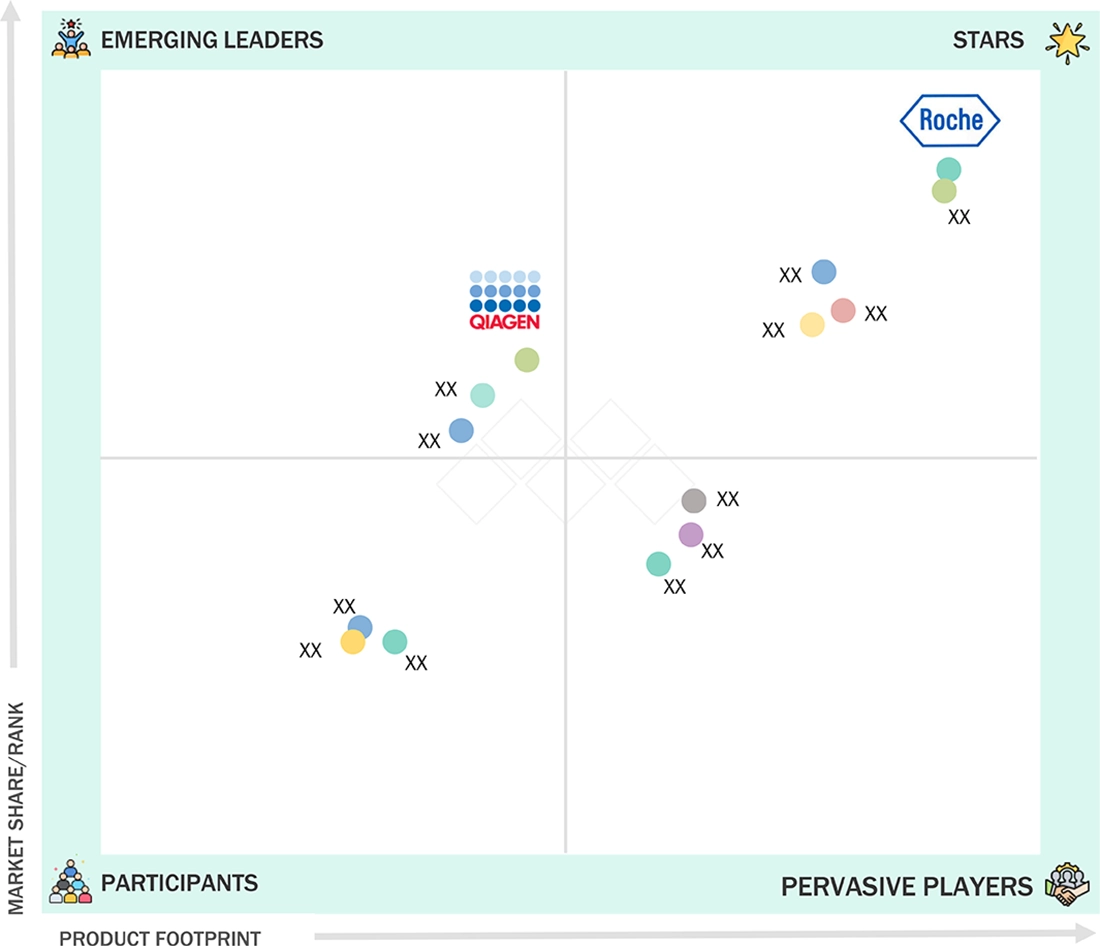

COMPETITIVE LANDSCAPEThermo Fisher Scientific, Roche, and QIAGEN were identified as some of the star players in the predictive clinical biomarkers market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPEGenomic Health, Inc., PerkinElmer, and CENTOGENE NV have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The predictive clinical biomarkers market is expanding rapidly, driven by the mainstreaming of precision medicine, broader reimbursement for tests that predict disease risk and treatment response, and the accelerating adoption of multi-omic panels and advanced analytics across oncology and chronic disease management.

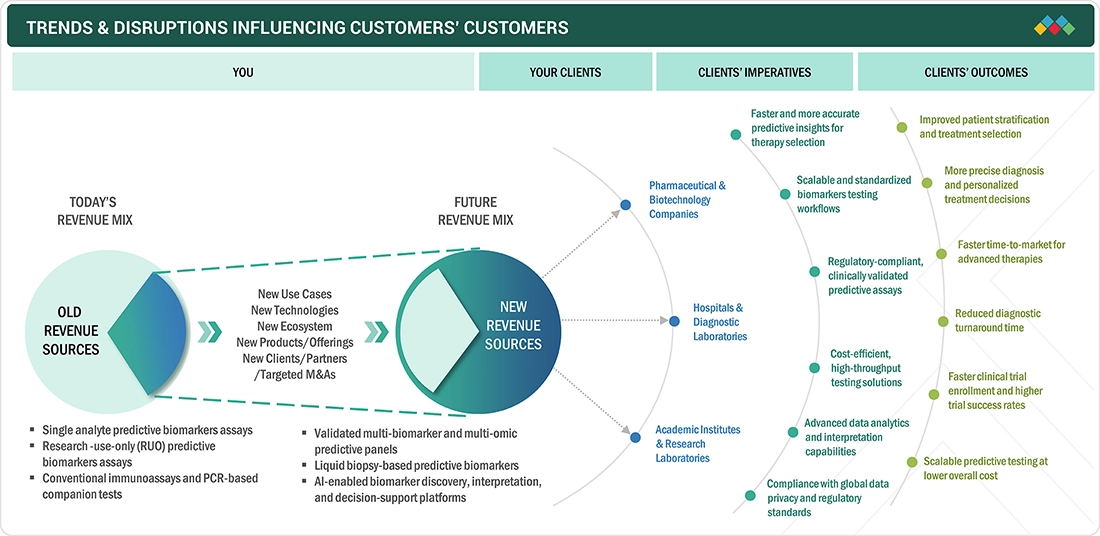

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The market for predictive clinical biomarkers is growing rapidly as the healthcare industry shifts toward personalized and predictive medicine. Researchers and clinicians are now using biomarker signatures to predict which individuals are likely to progress to a disease, which patients may respond to a specific therapeutic approach, and which may relapse and/or experience adverse effects. There is increasing use of high-throughput platforms and multiple disease panels, which further stimulates demand for standardized and validated predictive tests that yield predictive risk profiles and optimize therapeutic decisions for clinicians.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of targeted therapies and immunotherapies

-

Integration of biomarkers into clinical trial design

Level

-

High cost of biomarker development and validation

Level

-

Expansion of companion diagnostic pipelines

Level

-

Biological complexity and limited clinical translation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of targeted therapies and immunotherapies

The growing use of targeted drugs and immuno-oncology therapies in cancer and autoimmune diseases is increasing the need for predictive clinical biomarkers that can identify likely responders, monitor treatment benefit, and guide timely therapy switches.

Restraint: High cost of biomarker development and validation

Extensive discovery work, multi-phase clinical validation, and regulatory-grade assay development make predictive biomarker programs costly and time-consuming, limiting participation to well-funded centers and large industry sponsors.

Opportunity: Expansion of companion diagnostic pipelines

Pharma and biotech companies are expanding their portfolios into companion diagnostics for innovative targeted and immunotherapy treatments, thereby driving demand for partners with the capability to co-develop, validate, and commercialize predictive biomarker tests with new drugs.

Opportunity: Biological complexity and limited clinical translation

Varying methodologies for handling samples, platforms used in assays, and outcome measures could lead to diverse study results, making it difficult to standardize tests and adopt them in treatment guidelines

PREDICTIVE BIOMARKERS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cobas companion diagnostics (e.g., cobas EGFR, cobas PIK3CA) are used as predictive biomarker tests to determine which patients with lung, breast, or colorectal cancer are eligible for specific targeted therapies. | Directly links mutation status to approved drugs, helping oncologists select effective therapies faster and reducing exposure to treatments unlikely to work. |

|

TruSight Oncology panels and associated CDx collaborations supply NGS-based predictive biomarker assays for solid tumors, used by large cancer centers and reference labs. | Delivers standardized, regulator-ready NGS workflows that support multi-gene predictive testing, accelerate lab validation, and expand access to precision oncology services. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The predictive clinical biomarker market operates within a tightly connected network of test developers, platform and sequencing providers, diagnostics companies, pharma sponsors, service partners, and end users. Companies design validated predictive assays and risk-score panels, while hospital and reference labs use them to stratify patients, forecast treatment response, and monitor disease course. Pharma, CROs, and biomarker service providers use these tests in clinical trials and companion diagnostics, and distributors, payers, and health-IT vendors work to ensure these predictive tools are reimbursed, accessible, and embedded in routine precision-medicine pathways.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Predictive Clinical Biomarkers Market, By Offering

In 2024, consumables dominated the predictive clinical biomarkers market due to their repetitive application in high-volume clinical tests and research. Reagents, assay kits, cartridges, and sample-preparation materials are indispensable in everyday biomarker analysis of clinical trials and diagnostic workflows, thereby catering to steady and repeat demand.

Predictive Clinical Biomarkers Market, By Application

Clinical diagnostics formed the largest application segment due to increasing usage of predictive biomarkers in hospitals and reference laboratories for treatment selection and therapy monitoring. The increased adoption in routine clinical settings, driven by a greater reliance on biomarker-guided decision-making in oncology and other chronic diseases, remains supportive.

Predictive Clinical Biomarkers Market, By Technology

Immunoassays remained among the most widely used technologies for predictive biomarker testing because of their relatively low cost, fast turnaround time, and compatibility with automated laboratory systems. Their suitability for targeted assays in routine clinical labs makes them the preferred modality for many predictive testing applications.

Predictive Clinical Biomarkers Market, By Disease Indication

Cancer had the highest share, due to rapid advances in tumor profiling, testing for minimal residual disease, and liquid biopsy-based approaches. Targeted therapies and immunotherapies are being used, thereby driving up the demand for predictive biomarkers that can be used to select treatments and monitor responses.

Genomics Biomarkers Market, By End User

Hospitals and diagnostic laboratories had highest share due to the increasing integration of predictive biomarkers into routine patient testing and clinical decision-making. The detection of biomarkers in such settings can play a vital role in each phase of the drug development life cycle, from patient stratification to monitoring treatment response

REGION

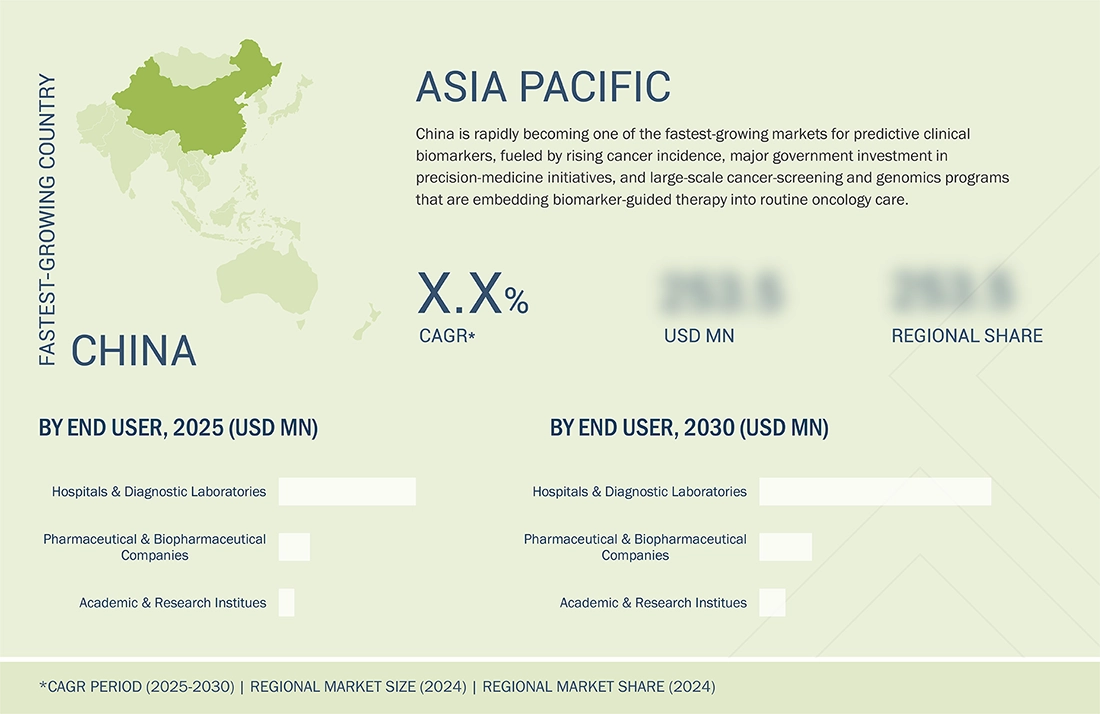

Asia Pacific to be fastest-growing region in the market during forecast period

In 2024, the Asia Pacific region emerged as one of the fastest-growing markets for predictive clinical biomarkers, as health systems shifted toward earlier intervention and risk-stratified care. Rising cancer and chronic-disease burdens, national precision-medicine programs, and broader coverage for risk-based testing are driving hospitals and labs to adopt multi-analyte panels and clinical risk scores for treatment selection and relapse monitoring.

PREDICTIVE BIOMARKERS MARKET: COMPANY EVALUATION MATRIX

The predictive clinical biomarkers market matrix positions Roche as a star player, leveraging its extensive cobas companion diagnostics portfolio and long history of co-developing predictive tests with pharma for oncology and chronic disease care. QIAGEN is emerging as a leading contender, using its therascreen and NGS-based CDx assays, digital PCR tools, and growing network of pharma partnerships to offer flexible, targeted biomarker tests that help labs predict treatment response, resistance, and relapse risk across cancer and other complex diseases.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- THERMO FISHER SCIENTIFIC INC. (US)

- QIAGEN (Germany)

- F. HOFFMANN-LA ROCHE LTD (Switzerland)

- BIO-RAD LABORATORIES, INC. (US)

- Merck KgaA(Germany)

- Abbott (US)

- Pac Bio(US)

- ILLUMINA, INC. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.84 Billion |

| Market Forecast in 2030 (Value) | USD 14.69 Billion |

| Growth Rate | CAGR of 11.6% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

| Parent & Related Segment Reports |

Biomarkers Market North America Biomarkers Market Europe Biomarkers Market Asia Pacific Biomarkers Market Genomic Biomarkers Market Neurological Biomarkers Market Digital Biomarker Market EPO Biomarkers Market |

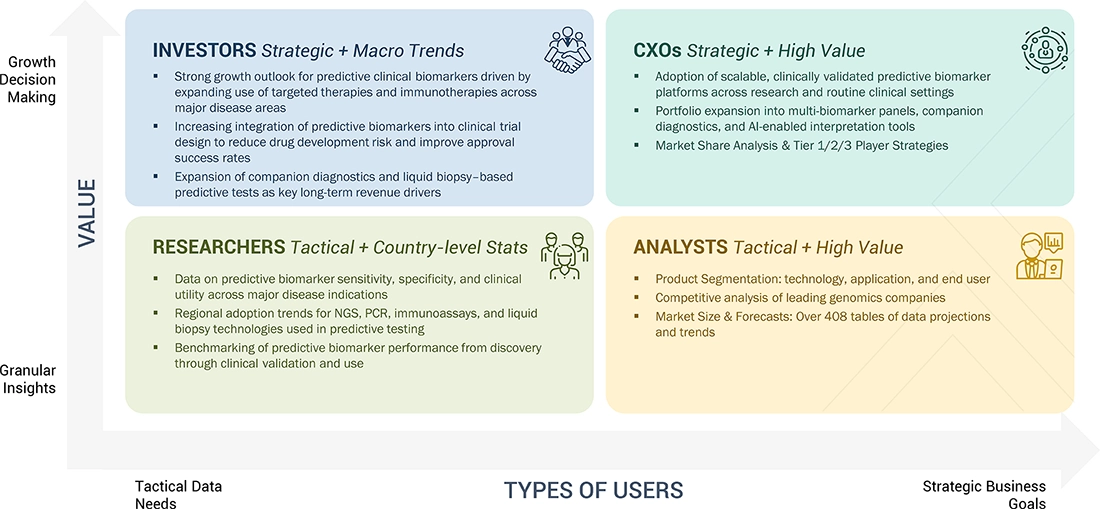

WHAT IS IN IT FOR YOU: PREDICTIVE BIOMARKERS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Technology and platform selection for predictive biomarker programs | Compared performance, cost, scalability, and clinical utility of NGS, PCR, immunoassays, and liquid biopsy platforms for predictive biomarker testing across key disease areas. | Helps clients optimize technology investments and portfolio positioning based on clinical relevance, cost efficiency, and market demand. |

| Regional adoption and market entry strategy for predictive biomarkers | Analyzed country-level adoption patterns, regulatory environments, reimbursement dynamics, and competitive intensity across major regions. | Enables companies to prioritize high-growth markets and tailor go-to-market strategies for predictive biomarker solutions. |

RECENT DEVELOPMENTS

- August 2024 : Illumina, Inc. announced FDA approval for its in vitro diagnostic (IVD) TruSight Oncology (TSO) Comprehensive test along with two companion diagnostic (CDx) indications. This approval underscores Illumina’s pivotal role in predictive biomarker development by enabling precise genomic profiling of tumors

- June 2022 : F. Hoffmann-La Roche Ltd collaborated with Nordic Bioscience to strengthen the development of biomarkers for chronic diseases.

Table of Contents

Methodology

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the Predictive Biomarkers Market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the Predictive Biomarkers Market. The secondary sources used for this study include American Society of Clinical Oncology (ASCO), Canadian Alliance for Healthy Hearts and Minds (CAHHM), Canadian Institute for Health Information (CIHI), Central Drugs Standard Control Organization (CDSCO), Center for Disease Evaluation and Research (CDER), Centers for Disease Control and Prevention (CDC), Chinese Medical Journal, Clinicaltrials.gov.in, European Medicines Agency (EMA), Food and Drug Administration (FDA), GLOBOCAN, International Agency for Research on Cancer (IARC), National Cancer Institute (NCI), National Center for Biotechnology Information (NCBI), National Institutes of Health (NIH), National Comprehensive Cancer Network (NCCN), Organization for Economic Co-operation and Development (OECD), Population Health Research Institute (PHRI), PubMed, World Bank, World Health Organization (WHO), Corporate and Regulatory Filings, Annual Reports, Sec Filings, Investor Presentations, and Financial Statements; Business Magazines & Research Journals; Press Releases, MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the Predictive Biomarkers Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (personnel from pharmaceutical & and biotechnology companies, hospitals & diagnostic laboratories, academic & research institutes, and other end users) and supply side (C-level and D-level executives, product managers, and marketing and sales managers of key manufacturers, distributors, and channel partners, among others, across six major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. Approximately 70% of primary interviews were conducted with supply-side representatives, while demand-side participants accounted for the remaining share. This preliminary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Predictive Biomarkers Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Market Definition

A biomarker is a measurable indicator of a biological condition or process, often used to diagnose diseases, predict disease progression, and evaluate treatment response. Biomarkers can be molecular, histologic, radiographic, or physiological characteristics that provide valuable insights into normal and pathological processes. The Predictive Biomarkers Market encompasses a broad range of products and services that support biomarker discovery, validation, and application in clinical and research settings. This includes offerings such as consumables (assay kits, reagents, and instruments), software tools, and related services that facilitate biomarker analysis. The market report analyzes biomarker usage across multiple applications, including clinical diagnostics, drug discovery and development, personalized medicine, and clinical research. It also studies the adoption of biomarkers across key research areas, such as oncology, neurology, cardiology, infectious diseases, and metabolic disorders. Furthermore, the report segments the market by type of biomarkers, including safety, efficacy, and validation biomarkers. The study also considers regional trends, end-user adoption, and technological advancements shaping the biomarker landscape.

Stakeholders

- Academic & Research Institutes

- Biomarkers Assays and Reagents Manufacturers, Vendors, and Distributors

- Contract Research Organizations (CROs)

- Biomarkers Service & Software Providers

- Diagnostics Companies

- Market Research and Consulting Firms

- Pharmaceutical and Biotechnology Companies

- Regulatory Agencies

- Venture Capitalists

- Forensics Labs

- Government organizations

- Private research firms

- Contract development and manufacturing organizations (CDMOs)

- Hospitals and Diagnostic Laboratories

Report Objectives

- To define, describe, and forecast the Predictive Biomarkers Market based on offering, type, research area, technology, disease indication, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments in six regions: North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa

- To profile the key players in the Predictive Biomarkers Market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations in the Predictive Biomarkers Market

- To benchmark players in the Predictive Biomarkers Market using the “Company Evaluation Matrix” framework, which analyzes market players based on various parameters, including product portfolio, geographic reach, and market share

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Predictive Clinical Biomarkers Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Predictive Clinical Biomarkers Market