Radiation Detectors Market Size, Growth, Share & Trends Analysis

Radiation Detectors Market by Technology (Scintillator, GM counter, Gas-filled, CZT detectors), Application (Dosimetry, Material characterization, Reactor monitoring), End User (Nuclear plant, Industrial, Env, Healthcare, Defense) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Radiation Detectors market, valued at US$2.32 billion in 2025, stood at US$2.53 billion in 2026 and is projected to advance at a resilient CAGR of 9.2% from 2026 to 2031, culminating in a forecasted valuation of US$3.94 billion by the end of the period. The market is growing as radiation-based technologies are becoming more deeply embedded in energy, industry & security workflows, and healthcare settings. Increased volumes of diagnostic imaging and radiotherapy procedures, continued operation and upgrading of nuclear power facilities, and wider use of industrial radiography and process gauges all increase the installed base and replacement demand for detectors. Increased focus on radiation protection and regulatory compliance is pushing facilities to deploy more comprehensive monitoring—spanning personal dosimeters, area monitors, and survey instruments—while geopolitical tensions and border-security needs are driving investment in portal and mobile detection systems. At the same time, advances in scintillation crystals and solid-state detector materials are enabling higher-performance, compact systems, which encourage technology refresh cycles and open new applications in environmental surveillance and field-deployable systems.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is projected to register the highest CAGR of 10.0%

-

BY TECHNOLOGYThe scitillation detectors segment is expected to register the highest CAGR of 8.3%.

-

BY END USERThe healthcare providers segment is expected to acquire the largest share of 42.0% in 2025.

-

BY APPLICATIONThe healthcare applications segment acquired the largest share of 42.0%.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSThermo Fisher Scientific, Inc. (US), Mirion Technologies, Inc. (US), and AMETEK, Inc. (US) are identified as some of the key players in the global radiation detectors market/radiation detection devices market, given their broad portfolios spanning personal dosimeters, handheld survey meters, fixed and portal monitors, and high-performance spectroscopy detectors, as well as sizeable installed bases across nuclear, industrial, medical, and security applications and strong global service networks.

-

COMPETITIVE LANDSCAPE - STARTUPSLudlum Measurements (US), Fuji Electric (Japan), Hamamatsu Photonics (Japan), IBA Worldwide (Belgium), Kromek Group (UK), and Polimaster Europe (Lithuania) have established a meaningful presence by supplying specialized detector modules, niche survey and contamination meters, medical and research detectors, and regionally focused monitoring solutions, underlining their role as important participants for competitive assessment.

The radiation detectors market/radiation detection devices market is witnessing a sustainable yet balanced growth as government and regulatory bodies and their mandates are increasing the adoption of detectors in monitoring systems. Regulatory bodies are progressively mandating continuous monitoring, digital documentation, and regular equipment upgrades. This trend is driving the substitution of outdated analog devices with advanced, networked detectors. Concurrently, the need for investments in emergency preparedness and resilience—fuelled by previous nuclear incidents, aging infrastructure, and fears related to radiological terrorism—encourages governments and operators to create redundancy in their monitoring systems and to install more detectors at and near critical facilities, leading to a broader increase in demand.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The trends and mappings in the diagram are directionally strong and align well with how radiation detectors create value across end-user segments. For defense & environmental agencies, the imperative “Fast response to radiological threats” paired with the outcome “Strengthening security” captures the move toward networked portal monitors, spectroscopic PRDs, and mobile systems that shorten detection-to-response time and reduce the likelihood of successful illicit trafficking or contamination events. For the industrial & energy sector, “Continuous plant safety” linked to “Higher uptime” and “License security” reflects regulatory pressure on nuclear and industrial licensees to maintain dense monitoring networks, avoid unplanned shutdowns due to radiological incidents, and demonstrate long-term compliance to regulators and the public. In healthcare, the “Optimized diagnostic delivery” → “Higher-quality care” chain matches hospital use of room monitors, dosimetry, and QA detectors to balance dose reduction initiatives with image quality and staff protection, which supports accreditation and patient satisfaction. For research & academia, “Radiation-compliant experiments” leading to “Reliable research outputs” is appropriate, since precision detectors and proper monitoring both enable high-quality data and ensure safe operation of test stands, reactors, and teaching labs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased security investments driving detector deployments

-

Regulated expansion of industrial and energy radiation use

Level

-

High cost and operational complexity

-

Technical limitations, maintenance needs, and supply constraints

Level

-

Digital, networked, and AI-enabled monitoring

-

Advanced materials and alternative neutron-detection technologies

Level

-

Workforce capability and training gaps

-

Data integration and workflow adoption

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased security investments driving detector deployments

Homeland security and border protection initiatives represent a persistent, policy-driven demand for radiation detectors. After 9/11, customs and security agencies worldwide began to deploy fixed radiation portal monitors, mobile systems, and handheld spectroscopic detectors at seaports, airports, and land borders to screen vehicles, cargo, and mail for illicit nuclear and radiological materials. These deployments are now entering a replacement and technology-upgrade phase, as installed systems reach the end of their service lives and are retrofitted with better isotope identification, networking, and data-analytics capabilities. Since 9/11, customs and border agencies have deployed thousands of radiation portal monitors and handheld detectors to screen cargo, vehicles, and mail for illicit nuclear or radiological material; in the US alone, more than 1,400 portal monitors were installed at ports of entry and are now entering replacement and upgrade cycles. In parallel, emerging security concerns around “dirty bombs” and illicit trafficking continue to justify new installations at critical infrastructure sites, logistics hubs, and large public events, supporting steady demand for both large-area and portable radiation detectors.

Restraint: Technical limitations, maintenance needs, and supply constraints

Technical limitations, maintenance needs, and supply constraints remain a structural restraint on the radiation detectors market. Many high-performance detector technologies have intrinsic engineering challenges that make them harder to deploy at scale. Semiconductor detectors may require cooling, strict temperature control, or very low-noise electronics to achieve their specified energy resolution and stability; when those conditions are not met, performance degrades and users lose confidence in the measurements. Scintillation detectors can be hygroscopic or mechanically fragile, so they need protective encapsulation and careful handling, which complicates field use. Large portal monitors and environmental stations are exposed to weather, vibration, and electromagnetic interference, and are therefore prone to drift, false alarms, or downtime if not calibrated and serviced regularly. Each of these issues translates into higher lifetime cost, more frequent call-outs for service, and the need for skilled technicians, which some regions lack.

Opportunity: Advanced materials and alternative neutron-detection technologies

The search for new scintillators, semiconductors, and neutron-detection schemes is creating another opportunity front. Research is accelerating on novel inorganic and organic materials that promise higher light yield, faster timing, better radiation hardness, or lower cost, which can translate into detectors with improved performance or new form factors for medical, industrial, and security uses. In neutron detection, the helium-3 shortage has catalyzed the development of alternatives based on boron-10, BF3, lithium-6, and solid-state converter technologies, enabling vendors that can industrialize these concepts to supply next-generation portals and field instruments without relying on constrained isotopic supply. Together, these advances create room for differentiation and replacement cycles as end users seek higher sensitivity, better discrimination, and more compact or rugged solutions.

Challenge: Workforce capability and training gaps

Many facilities struggle to recruit and retain staff with strong radiation-protection and instrumentation skills. Radiation safety officers, medical physicists, and nuclear engineers are in short supply in numerous countries, which limits the ability of hospitals, industrial sites, and smaller nuclear facilities to design monitoring programs, select appropriate detector technologies, and maintain equipment correctly. Without this expertise, organizations often under-specify their detector fleets, ignore advanced features (for example, spectroscopic analysis or networked alarming), or operate systems in ways that do not fully comply with regulatory expectations. This capability gap can also make buyers conservative, favoring familiar legacy instruments over newer detector platforms that would require re-training, thus slowing the adoption of innovative devices.

RADIATION DETECTORS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides advanced radiation detection instruments and software solutions for nuclear power, medical, and security sectors. Their solutions enable precise measurement and compliance monitoring. | Enhanced accuracy in radiation measurement, regulatory compliance support, and improved safety protocols across industries. |

|

Offers comprehensive radiation detection and monitoring products, including personal dosimeters, area monitors, and analytical software used in healthcare, defense, and nuclear energy. | Real-time exposure tracking, improved worker safety, and efficient radiation risk management. |

|

Through subsidiaries, provides portable and fixed radiation detection systems utilized in industrial inspection, homeland security, and nuclear decommissioning. | Robust and reliable detection solutions that improve operational efficiency and security responsiveness. |

|

Supplies precision radiation monitoring instruments for medical imaging, nuclear facilities, and environmental monitoring applications. | Increased detection sensitivity, automated data collection, and enhanced environmental safety monitoring. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The radiation detectors market/radiation detection devices market operates within a broad ecosystem that links detector manufacturers, distributors, service providers, upstream material suppliers, and regulatory authorities. On the supply side, manufacturers design and assemble complete instruments and detector modules, including personal dosimeters, survey meters, fixed area monitors, and portal systems. Key players here include Thermo Fisher Scientific, Inc. (US), Fortive and related brands (US), Mirion Technologies, Inc. (US), Fuji Electric (Japan), Ludlum Measurements (US), and Polimaster Europe (Lithuania), which collectively provide a wide range of scintillation, gas-filled, and semiconductor-based solutions. Further, the raw material and component suppliers provide scintillation crystals, specialized glasses, detector-grade semiconductors, and photodetectors that determine the performance and cost structure of finished instruments; an example includes Saint-Gobain Crystals. Regulatory bodies and standard-setting organizations such as the US Nuclear Regulatory Commission (USNRC), the International Atomic Energy Agency (IAEA), regional nuclear-safety authorities, and international radiation-protection commissions define licensing requirements, monitoring standards.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Radiation Detectors/Detection Devices Market, By Technology

The radiation detectors market is categorized into gas-filled detectors, scintillation detectors, semiconductor (solid-state) detectors, and other detectors. When it comes to applications and consumption patterns, inorganic crystal scintillators find their application in medical imaging (gamma cameras, SPECT, PET, CT), security screening, oil-well logging, industrial non-destructive testing, and environmental monitoring, covering many of the highest-value detector applications. For nuclear medicine, environmental monitoring, nuclear physics, aerial survey, and well-logging applications, inorganic scintillators (Thallium-doped sodium iodide NaI(Tl)) are used on a large scale, which shows their higher market penetration. Organic scintillators (liquids and plastics) provide pulse-shape discrimination, allowing detectors to distinguish fast neutrons from gamma rays in the same field, which is critical for non-proliferation, safeguards, reactor monitoring, and SNM search.

Radiation Detectors/Detection Devices Market, By Application

By application, the radiation detectors market/radiation detection devices market is segmented into material characterization, reactor monitoring, diagnostic imaging and radiotherapy, forensic and environmental monitoring, homeland security applications, and other applications. The diagnostic imaging and radiotherapy as an application segment acquired the largest share in the market. Diagnostic imaging (like X-rays, CT, and PET scans) and radiotherapy are considered cornerstones of modern medicine. These non-invasive or targeted techniques allow physicians to visualize internal structures, identify abnormalities, and destroy cancer cells with precision, dramatically improving patient outcomes and quality of life. Hospitals remain the largest end users of this equipment due to high patient volumes and a broad range of imaging requirements. These factors help to contribute to a sizable demand for radiation detection devices in the diagnostic imaging and radiotherapy application segment, justifying its dominant share.

RADIATION DETECTORS MARKET: COMPANY EVALUATION MATRIX

The company evaluation matrix for the radiation detectors market/radiation detection devices market shows a landscape where a few global vendors combine strong market share with broad product footprints, while a wider group of specialists occupy emerging-leader and participant positions. In the “stars” quadrant, Thermo Fisher Scientific (US) stands out with a comprehensive portfolio of electronic personal dosimeters, survey meters, fixed area and stack monitors, and radiation portal systems that serve nuclear, industrial, security, and healthcare customers worldwide, supported by an extensive service and distribution network.A second cluster of pervasive players includes Mirion Technologies (US) and AMETEK/ORTEC (US), which offer deep product lines in site-wide monitoring, dosimetry, and high-performance spectroscopy systems, and Fortive (US), whose instrumentation brands participate in selected detector and monitoring niches. In the “emerging leaders” area, manufacturers such as Ludlum Measurements (US), Fuji Electric (Japan), Polimaster Europe (Lithuania), IBA Worldwide (Belgium), Kromek Group (UK), and Trivitron Healthcare (India) provide focused portfolios of survey meters, electronic dosimeters, medical and security detectors, and OEM modules that address specific application segments or regional markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.32 Billion |

| Market Forecast in 2031 (value) | USD 3.94 Billion |

| Growth Rate | CAGR of 9.2% during 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

WHAT IS IN IT FOR YOU: RADIATION DETECTORS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Biopharmaceutical Companies |

|

|

RECENT DEVELOPMENTS

- September 2024 : Mirion Technologies, Inc. finalized a USD 45.0 million acquisition of Advanced Measurement Technology, strengthening its continuous air-monitoring capabilities and broadening its presence across the Asia Pacific region.

- August 2024 : Thermo Fisher Scientific, Inc. obtained FDA 510(k) clearance for its AI-enabled radiopharmaceutical quality-control system, achieving a significant reduction in manual assay time.

- June 2024 : Thermo Fisher Scientific, Inc. introduced the NetDose Pro digital dosimeter, a small, wearable device designed to monitor radiation exposure for personnel across various industries, including healthcare. This tool helps organizations comply with strict regulatory standards.

Table of Contents

Methodology

The study has used primary and secondary sources; the research involved investigating different factors influencing the industry to examine segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player approaches.

Secondary Research

Secondary research extensively uses secondary sources such as directories, databases (e.g., Bloomberg Businessweek, D&B Hoovers, Factiva), white papers, annual reports, company house documents, investor presentations, and SEC filings attached to companies. The secondary research assistance is used to source and collate general and technical data related to the market study and commercial analysis of the radiation detectors market. It also acquired vital data relating to the key players, market taxonomy, and segmentation per industry trend as far as the base level and key developments related to market and technology perspectives. Secondary research has also prepared a database of key industry leaders.

Primary Research

Varied sources from the supply and demand sides have been interviewed in the primary research process to gather qualitative and quantitative information for this report. Supply-side primary sources include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other major executives from various key companies and organizations in product therapy markets. Some primary sources on the demand side include medical OEMs, analytical instrument OEMs, CDMOs, and other service providers. The purpose of primary research is to validate the market segmentation, discover major players in the market, and gain insight into key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

The market size for radiation detection, monitoring & safety is determined in this report based on revenue estimates of significant market players. The scope included identifying the major players and determining their revenues from the market business through several insights gathered from the primary and secondary research phases. Secondary research involved looking into the annual and financial reports of leading players in the market. Primary research includes interviews with key opinion leaders such as CEOs, directors, and marketing executives.

This process calculated segmental revenues to arrive at the global market value using revenue mappings from major solution/service providers. This process involved the following steps:

- Establishing a list of major global players in the environmental testing products market.

- Mapping the annual revenues from the environmental testing products market (or nearest reported business unit/product category) generated from the major global players.

- Revenue mapping of key players to cover a major global market share as of 2023.

- Extrapolating the global value of the Radiation Detectors Market.

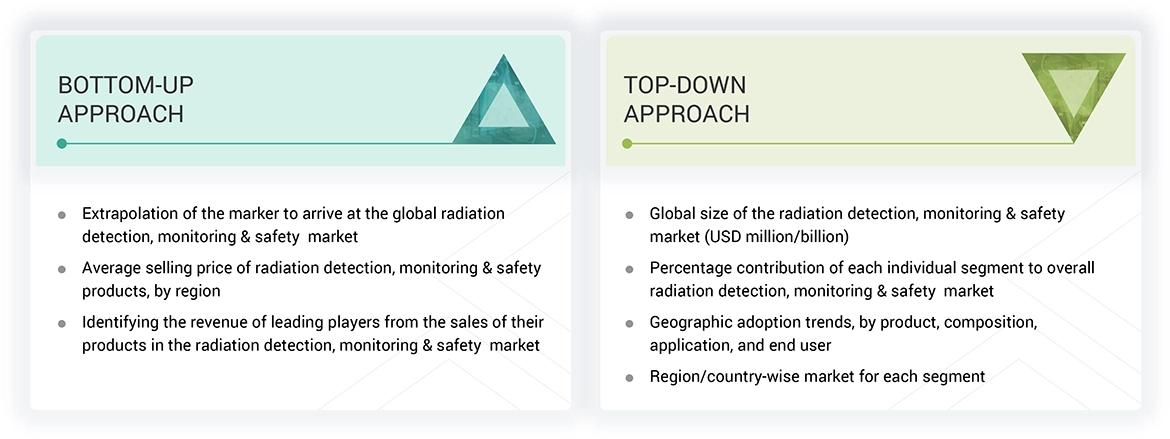

Radiation Detectors Market : Top-Down and Bottom-Up Approach

Data Triangulation

After deriving the total market size from the aforementioned sizing process, the radiation detectors market was subdivided into segments and subsegments. Data triangulation and market breakdown methodologies were employed to complete the market engineering process and to derive the exact market numbers for all segments and subsegments. The data was triangulated by analyzing several parameters and trends, including demand and supply. In addition, the radiation detectors market was validated via combined top-down and bottom-up approaches.

Market Definition

The radiation detectors market includes technologies and devices for measuring and protecting against harmful radiation across various industries, such as healthcare, nuclear power, defense, and environmental monitoring. Key products include radiation detectors, dosimeters, area monitors, and safety equipment that ensure regulatory compliance and safety for workers, patients, and the public. Market growth is driven by the rising use of radiation in medical imaging, advancements in nuclear energy, concerns about nuclear threats, and strict regulations. Innovations in real-time radiation monitoring and AI-based detection further propel this market forward.

Stakeholders

- Manufacturers and distributors of radiation detection, monitoring, and safety detectors & monitors

- Healthcare institutions

- Research institutions

- Research and consulting firms

- Medical device suppliers, distributors, channel partners, and third-party suppliers

- Clinicians and healthcare professionals

- Global and national health agencies

- Academic medical centers and universities

- Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

- Academic medical centers and universities

- Market research and consulting firms

- Clinical research organizations

- Group Purchasing Organizations (GPOs)

- Academic Medical Centers and Universities

- Accountable Care Organizations (ACOs)

Report Objectives

- To define, describe, and forecast the radiation detectors market on product, composition, and application.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To profile the key market players and comprehensively analyze their market shares and core competencies.

- To forecast the revenue of the market segments concerning five main regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (GCC Countries and Rest of Middle East & Africa)

- To track and analyze competitive developments such as new product launches and approvals; agreements, partnerships, expansions, acquisitions; and collaborations in the radiation detectors market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the present global environmental testing products market.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top eleven companies.

Geographic Analysis as per Feasibility

- Further breakdown of the Rest of European radiation detectors market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, Portugal, and other Rest of European countries

- Further breakdown of the Rest of Asia Pacific radiation detectors market Singapore, Taiwan, New Zealand, the Philippines, Malaysia, and other Rest of Asia Pacific countries

- Further breakdown of the Rest of the World radiation detectors market Latin America, the Middle East, and Africa

Company Information

- Detailed analysis and profiling of additional market players (up to 11)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Radiation Detectors Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Radiation Detectors Market