Satellite Ground Station Market Size, Share & Trends 2030

Satellite Ground Station Market by Platform (Fixed, Portable, Vehicle-mounted, Shipborne, Airborne, Container-mounted), Solution (Hardware, Software, Ground Station as a Service), Function, Frequency, Orbit, End User, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Satellite Ground Station Market is projected to reach USD 82.72 billion by 2030 from USD 40.99 billion in 2025 at a CAGR of 15.1% from 2025 to 2030. The growth is driven by the rapid expansion of multi-orbit satellite constellations, increasing demand for high-throughput connectivity, and accelerated adoption of cloud-integrated, software-defined ground systems.

KEY TAKEAWAYS

-

By RegionThe North American Satellite Ground Station market is estimtade to account for a 39.7% market share in 2025.

-

By PlatformBy platform, the fixed segment is expected to register the highest CAGR of 16.9%.

-

By End UserBy end user, the commercial segment is projected to grow at the fastest rate from 2025 to 2030, at a CAGR of 16.4%.

-

By FunctionBy function, the communication segment is expected to lead the market with a share of 42.5%.

-

By SolutionBy solution, the Ground Station as a Service (GsaaS) segment is projected to grow at the fastest rate during the forecast period, at a CAGR of 20.0%.

-

By FrequencyBy frequency, the Ku and Ka-band segment is expected to dominate the market, growing at the CAGR of 15.4%.

-

By OrbitBy orbit, the LEO segment is expected to dominate the market with a market share of 81.4%.

-

Competitive Landscape-Key PlayersRTX, General Dynamics Corporation, and L3Harris Technologies, Inc. have been identified as some of the star players in the satellite ground station market (global), given their strong market share and product footprint.

-

Competitive Landscape-StartupsDhruva Space Private Limited, Leaf Space, and Infostellar, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The growth of the Satellite Ground Station Industry is driven by the rapid expansion of LEO, MEO, and GEO satellite constellations that require dense, high-performance ground infrastructure for data relay, TT&C, and broadband backhaul. The rising demand for high-throughput connectivity across the aviation, maritime, government, and enterprise sectors is driving operators to adopt advanced Ka-band gateways, cloud-integrated baseband systems, and software-defined ground architectures.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumer business in the satellite ground station market stems from evolving connectivity expectations, where end users increasingly demand seamless, high-speed, and low-latency satellite services across mobility, residential, and enterprise applications. As LEO and MEO constellations expand, ground stations must support higher data throughput, more frequent satellite passes, and cloud-based data delivery, enabling improved broadband performance and wider service availability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High demand for satellite-based services

-

Growing adoption of cloud-integrated and virtualized ground infrastructure

Level

-

Stringent regulatory and certification requirements

-

High capital investment and maintenance costs

Level

-

Integration of optical and quantum communication technologies

-

AI-driven automation and intelligent network orchestration

Level

-

Increasing network complexity from multi-orbit and multi-constellation operations

-

Weather-related signal disruptions and environmental issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of cloud-integrated and virtualized ground infrastructure

The growing adoption of cloud-integrated and virtualized ground infrastructure is one of the most transformative drivers propelling the satellite ground station market. Cloud integration allows operators to virtualize core ground functions such as telemetry, tracking, and command (TT&C), data routing, and mission control, making them accessible as digital services through platforms like AWS Ground Station and Microsoft Azure Orbital. This model eliminates the need for expensive, site-specific infrastructure, enabling on-demand access to antenna networks, global coverage, and real-time data delivery.

Restraint: Stringent regulatory and certification requirements

Building and operating satellite ground stations require significant upfront capital expenditure in antenna systems, RF equipment, data processing infrastructure, and secure communication networks. Despite the rise of cloud-based and virtualized models, many operators, especially in emerging economies, continue to face cost barriers associated with site construction, frequency licensing, and integration with multi-orbit satellite constellations. The stringent regulatory landscape surrounding the space industry significantly impacts the pace of innovation in the satellite ground station market.

Opportunity: Integration of optical and quantum communication technologies

The integration of optical and quantum communication technologies represents one of the most transformative opportunities for the satellite ground station, reshaping the way data is transmitted, secured, and processed between space and Earth. Optical communication, utilizing laser links instead of radio frequencies, offers enormous advantages: multi-gigabit per second data rates, reduced latency, and resistance to interference. This technology allows ground stations to downlink large volumes of high-resolution data in near-real time, unlocking new possibilities for Earth observation, defense surveillance, and broadband communication.

Challenge: Weather-related signal disruptions and environmental issues

Despite advancements in antenna design and link optimization, weather-related disruptions continue to pose a major challenge to ground station reliability, particularly for Ka-band, optical, and laser communication systems. Heavy rainfall, cloud cover, and atmospheric turbulence can significantly degrade signal strength, cause data loss, or delay downlink operations. This challenge becomes even more critical for real-time applications like Earth observation, defense monitoring, and broadband connectivity, where even short interruptions can impact mission outcomes.

Satellite Ground Station Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides secure TT&C and mission-control systems for national security satellites | Ensures resilient satellite operations with hardened ground infrastructure for defense users |

|

Delivers integrated ground networks, SATCOM gateways, and protected TT&C architectures | Enhances mission assurance with high-availability, multi-orbit ground systems for critical missions |

|

Supplies advanced RF, antenna, and command-and-control systems for government satellite programs | Improves signal reliability and operational agility across surveillance and communication missions |

|

Builds and integrates end-to-end ground segments for EO, navigation, and communication satellites | Enables fast data acquisition and seamless satellite operations through unified ground control |

|

Develops ground architectures supporting defense satellites, missile-warning systems, and multi-orbit operations | Strengthens operational resilience by providing secure, scalable ground infrastructure for complex missions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The key stakeholders in the satellite ground station market ecosystem are prominent companies, private and small enterprises, and end users. The collaborative network of manufacturers and service providers is driving innovation in satellite ground station technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Satellite Ground Station Market, By Platform

The fixed segment is projected to dominate the market in 2025, driven by the rapid expansion of GEO, MEO, and LEO constellations that require high-capacity, always-on gateway infrastructure. Fixed ground stations provide the stability, throughput, and redundancy essential for broadband, Earth observation, and secure government missions. Their ability to host large antennas, multi-band RF systems, and cloud-integrated baseband units strengthens long-term operational reliability.

Satellite Ground Station Market, By Function

The communication segment is expected to capture the leading market share owing to the rising demand for high-capacity satellite links that support broadband, mobility, and enterprise connectivity. The shift toward multi-orbit networks and increasing reliance on satellite-enabled communication for defense, aviation, and maritime operations is further accelerating ground-segment investments.

Satellite Ground Station Market, By Solution

The hardware segment is estimated to dominate the market in 2025, driven by sustained demand for high-performance antennas, RF systems, and baseband infrastructure required to support expanding satellite constellations. Upgrades to ground terminals and gateway infrastructure for multi-band, multi-orbit capability continue to account for the majority of near-term capital expenditure.

Satellite Ground Station Market, By Frequency

The Ku and Ka-band segment is estimated to dominate the market in 2025, driven by the rapid growth of broadband and mobility applications requiring higher throughput and efficient spectrum usage. Increasing deployment of HTS and VHTS satellites and the adoption of multi-band terminals further reinforce the dominance of Ku/Ka-band across both commercial and government ground-station architectures.

Satellite Ground Station Market, By Orbit

The LEO segment is expected to capture the largest market share during the forecast period, owing to the massive deployment of LEO broadband and Earth observation constellations. LEO satellites require numerous ground stations for high-speed handovers, low latency, and frequent TT&C contact points. This drives significant investment in distributed gateway networks and automated antenna systems worldwide. As commercial operators scale their fleets, the demand for LEO-compatible satellite ground station capacity continues to rise sharply.

Satellite Ground Station Market, By End User

The commercial segment is estimated to dominate the market in 2025, driven by the rapid growth of satellite broadband, mobility services, cloud connectivity, and multi-orbit commercial constellations. Enterprises, telecom carriers, and mobility operators increasingly depend on satellite ground station networks for high-throughput data, real-time analytics, and global coverage.

REGION

North America to be fastest-growing region in global satellite ground station market during forecast period

North America is projected to maintain a leading position in the satellite ground station market due to strong governmental investment, a mature space ecosystem, and the rapid expansion of commercial LEO and GEO constellations. The region benefits from major operators such as SpaceX, Amazon, OneWeb, and Telesat, all requiring dense gateway infrastructure and high-capacity Ka-band ground systems. Continuous modernization of defense TT&C networks and NASA/DoD deep-space ground assets further strengthens regional demand. Additionally, the adoption of cloud-integrated GSaaS platforms and private-sector innovation accelerates the deployment of next-generation virtualized ground stations across the US and Canada.

Satellite Ground Station Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the satellite ground station market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. General Dynamics leads the market with a strong product portfolio, manufacturing technologies, and broad customer base, while Honeywell is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Satellite Ground Station Market Companies

- General Dynamics Corporation (US)

- L3harris Technologies, Inc. (US)

- RTX (US)

- Airbus (Netherlands)

- Lockheed Martin Corporation (US)

- Elbit System Limited (Israel)

- Boeing (US)

- Aselsan A.S. (Turkey)

- Kongsberg (Norway)

- Northrop Grumman (US)

- GMV Innovating Solutions S.L. (Spain)

- Kratos Defense & Security Solutions (US)

- Mitsubishi Electric Corporation (Japan)

- Thales (France)

- SpaceX (US)

- Terma Group (Denmark)

- BAE Systems plc (UK)

- Leonardo S.p.A. (Italy)

- Indra Sistemas, S.A. (Spain)

- Amazon (US)

- Honeywell International Inc. (US)

- Exail (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 40.99 Billion |

| Market Forecast in 2030 (Value) | USD 82.72 Billion |

| Growth Rate | CAGR of 15.1% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, and Rest of the World |

WHAT IS IN IT FOR YOU: Satellite Ground Station Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Emerging Leader | Additional Company Profiles | Competitive information on targeted players to gain granular insights into direct competition |

RECENT DEVELOPMENTS

- July 2025 : RTX Corporation secured a major contract for the GPS Next Generation Operational Control System (GPS OCX) for the US Space Force. This contract covers ground station software development and operational control systems managing military GPS satellites, marking full operational acceptance after years of development.

- March 2025 : Kongsberg developed its MEOS Control software, a ground station development software product for integrating satellite ground station hardware and software. The solution enhances operational efficiency by providing a unified platform for monitoring and controlling multiple components from various vendors, reducing both complexity and operational costs for users.

- July 2025 : Kongsberg and Amazon Web Services (AWS) announced a collaboration to enhance solutions for space mission applications. The deal combines KSAT’s global ground station network with AWS’s cloud services to offer a more scalable and resilient service for space operators.

Table of Contents

- 4.1 INTRODUCTION

-

4.2 MARKET DYNAMICSDRIVERS- High demand for satellite-based services- Need for Earth observation imagery and analytics- Technological advancements in satellite ground stations- Increased use in remote sensing applications- Developments in space technologiesRESTRAINTS- Absence of unified regulations and government policies- Difficulty in raising funds for satellite ground construction and operation by commercial operatorsOPPORTUNITIES- 5G and networking- Growth of the small satellite market- Increased investments in space agenciesCHALLENGES- Bandwidth constraint- Criticality of electronic information security- Issues related to telemetry, tracking, and command- Rising cost of constructing and operating satellite ground stations

- 4.3 UNMET NEEDS AND WHITE SPACE

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC OUTLOOKINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN THE SPACE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISINDICATIVE PRICING ANALYSIS OF SATELLITE GROUND STATION, BY REGION, 2024INDICATIVE PRICING ANALYSIS OF SATELLITE GROUND STATION, BY SOLUTION, 2024

- 5.6 VOLUME DATA

-

5.7 TRADE AND TARIFF ANALYSISEXPORT SCENARIOIMPORT SCENARIOTARIFF DATA

- 5.8 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.2 COMPLEMENTARY TECHNOLOGIES

-

6.3 TECHNOLOGY ROADMAPTECHNOLOGY ROADMAPEMERGING TECHNOLOGY TRENDS

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

-

6.6 IMPACT OF AI ON SATELLITE GROUND STATION MARKETTOP USE CASES AND MARKET POTENTIALCASE STUDIES OF AI IMPLEMENTATION IN THE SATELLITE GROUND STATION MARKETINTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERSCLIENTS’ READINESS TO ADOPT AI IN THE SATELLITE GROUND STATION MARKET

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

-

7.1 REGIONAL REGULATIONS AND COMPLIANCEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSINDUSTRY STANDARDS

-

7.2 SUSTAINABILITY INITIATIVESGLOBAL & REGULATORY SUSTAINABILITY INITIATIVESCORPORATE & INDUSTRY-LED SUSTAINABILITY PROGRAMS

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 MARKET PROFITIBILITY

- 9.1 INTRODUCTION

- 9.2 FIXED

-

9.3 PORTABLEHANDHELDBACKPACK/BAG MOUNTED

-

9.4 MOBILEVEHICLE-MOUNTED- Ground Vehicles- Shipborne- AirborneCONTAINER MOUNTED/TRAILER MOUNTED

- 10.1 INTRODUCTION

- 10.2 USE CASE ANALYSIS

-

10.3 DEFENSEARMYAIRFORCENAVY

-

10.4 GOVERNMENTPUBLIC SAFETY & CIVIL AGENCIESSPACE AGENCIES AND RESEARCH CENTERS

-

10.5 COMMERCIALSATELLITE & TELEPORT OPERATORSCARRIERS & SERVICE PROVIDERSENTERPRISE & MOBILITY

- 11.1 INTRODUCTION

- 11.2 USE CASE ANALYSIS

- 11.3 NAVIGATION

- 11.4 COMMUNICATION

- 11.5 EARTH OBSERVATION

- 11.6 SPACE RESEARCH

- 11.7 OTHERS (TTC & LAUNCH RANGE & LEOP SUPPORT)

- 12.1 INTRODUCTION

-

12.2 HARDWAREANTENNA SYSTEMRF SYSTEM & TIMING- Transmit RF System- Receive RF System- System ClockBASEBAND & RECORDING HARDWARESTORAGE AND NETWORKING UNITSPOWER & RACKS

-

12.3 SOFTWAREMISSION CONTROL & FLIGHT DYNAMICSBASEBAND / VIRTUAL MODEMS & WAVEFORMSCYBERSECURITY & KEY MANAGEMENTNETWORK M&C / ORCHESTRATION

- 12.4 GROUND STATION AS A SERVICE (GSAAS)

- 13.1 INTRODUCTION

- 13.2 X-BAND

- 13.3 C-BAND

- 13.4 S-BAND

- 13.5 L-BAND

- 13.6 KU AND KA-BAND

- 13.7 UHF-/VHF-/HF-BAND

- 13.8 OTHERS

- 13.9 OPTICAL/LASER

- 14.1 INTRODUCTION

- 14.2 LOW EARTH ORBIT

- 14.3 MEDIUM EARTH ORBIT

- 14.4 GEOSTATIONARY EARTH ORBIT

- 14.5 OTHERS (HEO/LUNAR/DEEP SPACE)

- 15.1 INTRODUCTION

- 15.2 HARDWARE-DEFINED

- 15.3 HYBRID

- 15.4 CLOUD-NATIVE / VIRTUALIZED

- 16.1 INTRODUCTION

-

16.2 NORTH AMERICAUSCANADA

-

16.3 EUROPEUKGERMANYFRANCERUSSIAREST OF EUROPE

-

16.4 ASIA PACIFICJAPANINDIACHINASINGAPOREREST OF ASIA PACIFIC

-

16.5 REST OF THE WORLDMIDDLE EAST & AFRICALATIN AMERICA

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 17.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2024

- 17.4 REVENUE ANALYSIS 2021–2024

- 17.5 BRAND COMPARISON

- 17.6 COMPANY VALUATION AND FINANCIAL METRICS

-

17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT, KEY PLAYERS, 2024- COMPANY FOOTPRINT- REGION FOOTPRINT- PLATFORM FOOTPRINT- SOLUTIONS FOOTPRINT- END-USER FOOTPRINT

-

17.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: START-UPS/SMES, 2024- DETAILED LIST OF KEY STARTUPS/SMES- COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

17.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 18.1 INTRODUCTION

-

18.2 KEY PLAYERSRAYTHEON TECHNOLOGIESELBIT SYSTEMSTHE BOEING COMPANYASELSAN ASGENERAL DYNAMICS CORP.AIRBUSL3HARRIS TECHNOLOGIESNORTHROP GRUMMAN CORP.LOCKHEED MARTIN CORP.- SAAB AB- SPACEX- KONGSBERG- LEONARDO S.P.A.- ECA GROUP- INDRA COMPANY- ELECNOR- AMAZON (AWS)- MICROSOFT (AZURE)

- 18.3 OTHER PLAYERS

-

19.1 RESEARCH DATASECONDARY DATA- KEY DATA FROM SECONDARY SOURCESPRIMARY DATA- KEY DATA FROM PRIMARY SOURCES- KEY PRIMARY PARTICIPANTS- BOTTOM-UP APPROACH

-

19.2 MARKET SIZE ESTIMATION

- TOP-DOWN APPROACH- SUPPLY SIDE

-

19.3 MARKET FORECAST APPROACH

- DEMAND SIDE

- 19.4 DATA TRIANGULATION

- 19.5 FACTOR ANALYSIS

- 19.6 RESEARCH ASSUMPTIONS

- 19.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

- 20.6 ANNEXURE: COMPANY LONG LIST

Methodology

This research study involves the use of extensive secondary sources, directories, and databases (e.g., Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the satellite ground station market. Primary sources include several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, IP vendors, standards, and organizations related to all the segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as to assess the prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; articles from recognized authors; and websites, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the market’s value chain, major players, market classification, and segmentation according to the industry trends to the bottommost level, geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the satellite ground station market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, the Asia Pacific, the Middle East, and the Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

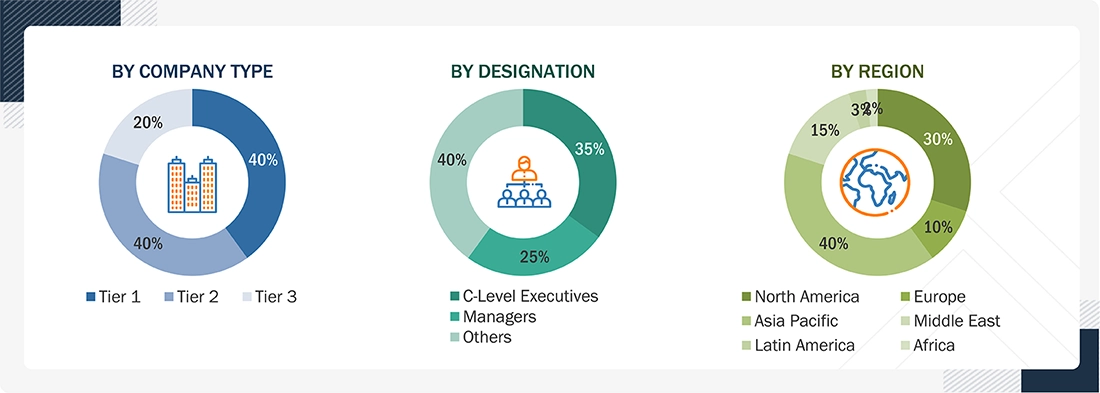

Breakdown of Primaries

Note: Tiers of companies are based on their revenue in 2024. Tier 1: company revenue greater than USD 1 billion; Tier 2: company revenue between USD 100 million and USD 1 billion; and Tier 3: company revenue less than USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

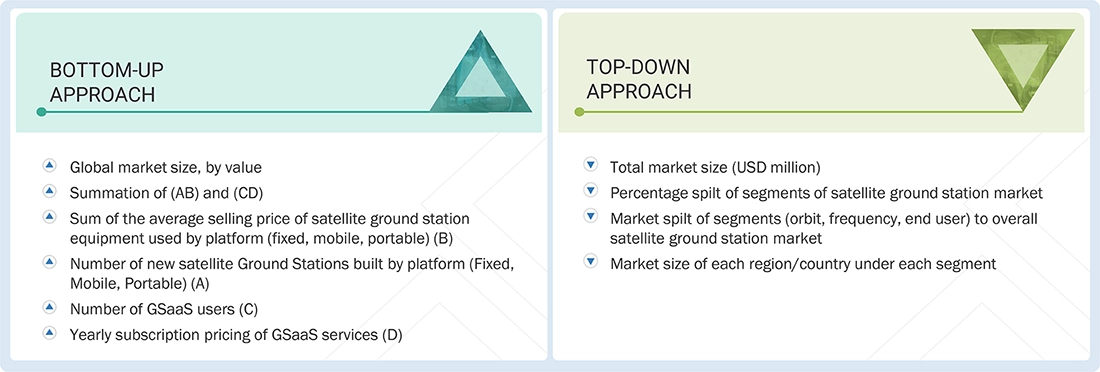

Both the top-down and bottom-up approaches were used to estimate and validate the size of the satellite ground station market.

The research methodology used to estimate the market size also included the following details:

- Key players in the market were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews with industry experts who are knowledgeable about satellite ground stations.

- The top-down and bottom-up approaches were used to estimate and validate the size of the global market and the dependent submarkets in the overall market.

Market Size Estimation Methodology: Bottom-up Approach and Top-down Approach

Data Triangulation

After arriving at the overall size of the satellite ground station market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the satellite ground station market size was validated using the top-down and bottom-up approaches.

Market Definition

A satellite ground station is a facility equipped with antennas, receivers, transmitters, and control systems that enable communication between satellites in orbit and systems on Earth. It serves as the terrestrial interface for sending commands to satellites, receiving data such as imagery or telemetry, and routing signals to end users or networks. They are widely used to collect and process data for a wide range of applications, such as television broadcasting, communication, mapping & navigation, surveillance & security, scientific research & exploration, and space observation, among others, across defense, civil, commercial, and government verticals.

Stakeholders

- Satellite Ground Station Manufacturers

- Satellite Ground Station Service Providers

- Government and Civil Organizations

- Satellite Ground Station Operators

- Meteorological Organizations

- Component Suppliers

- Technologists

- Research Institutions

Report Objectives

- To define, describe, segment, and forecast the size of the satellite ground station market based on platform, function, solution, orbit, frequency, end user, and region

- To forecast sizes of various segments of the market with respect to major regions: North America, Europe, the Asia Pacific, the Middle East, and the Rest of the World, along with major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the regulatory landscape with respect to satellite ground station regulations across regions

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis and revenue analysis of key players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Satellite Ground Station Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Satellite Ground Station Market