Smart Water Meters Market

Smart Water Meters Market by Meter Type (Ultrasonic, Electromagnetic, Smart Mechanical), Application (Water Utilities, Industries), Technology (AMI, AMR), Component (Meters & Accessories, IT Solutions, Communications) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The smart water meters market is projected to reach USD 9.04 billion by 2030 from an estimated USD 4.61 billion in 2024, at a CAGR of 11.9% between 2024 and 2030. These smart water meters are expected to gain market share with the increasing investment in non-revenue water reduction, monitoring of consumption, and waste management. The market exhibits promising growth, given the increasing demand for water conservation, infrastructure modernization, and digitalization of utilities.

KEY TAKEAWAYS

-

BY METER TYPEUltrasonic meters consist of sensors that measure water velocity and convert it into the water flow rate, following it with an ultrasonic sound wave sent through a transducer that reads the velocity and volume of the water flowing through it. Ultrasonic meters offer a feature providing remote reading capability without any additional devices. This basically helps to shorten data collection time, provides better distribution of the resources, and saves the end user from wrong readings and follow-ups. This type of metering, of the three types analyzed in this study, is enjoying the most significant growth on account of its compatibility with communication and IoT and due to its high precision.

-

BY TECHNOLOGYAutomated Meter Reading (AMR), by technoloyg is fastest growing segment in the forecast period. Smart water meter by technology is segmented into two sub segment, advanced metering infrastructure (AMI) and automated meter reading (AMR). AMR offers a cost-effective solution for monitoring water consumption and conducting meter readings for suppliers. It links the digital water meters to a central management system by using a real-time wireless communication network. AMR reduces operational costs for water utilities by minimizing human intervention and optimizing maintenance. For an AMR system to function effectively, the water meter must have a connectivity feature, such as a pulse output, to which a radio transmitter can be attached.

-

BY APPLICATIONWater utilities dominate the largest share of global smart water meters market. The water grid used for the distribution of water is a key part of water utilities infrastructure. Of all the utilities, today water leakage remains to be the major problrm. This problem requires more effective leak detection and prevention processes. Smart metering of water is playing an integral part in this regard, enabling utilities to monitor consumption, detect early leakage systems, and become efficient overall. Given its continuous innovations with regard to smart metering technology, such a market is growing phenomenally, as more utilities are investing in modern versions to reduce water waste and improve their operations.

-

BY COMPONENTThe meters & accessories segment comprise flow meters, endpoints, encoders, registers, transmitters, radio modules, and antennas, important for accurate water consumption measurement. The size and type of meters vary according to the specific application and amount of water consumed among various residential, commercial, and industrial needs. Advanced metering infrastructure (AMI) permits real-time monitoring, automated data collection, and analytics that reduce labor and metering costs. In automation, R&D investments by manufacturers will tend to flourish as manual readings will be almost negligible. All these will transform and trigger innovations to move the segment.

-

BY REGIONThe Asia Pacific projected to have highest growth rate for the smart water metering market throughout the forecast period. Countries like China, Australia, Singapore, and India are actively developing the infrastructure for water consumption and supply. Such initiatives provide valuable opportunities for suppliers to expand their presence in the region, fueling growth in the market.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including expansions, sales contracts, acquisitions, agreements, investments, product launches, partnerships, and collaborations. For instance, Aclara partnered with Utilidata to integrate their distributed AI platform into Aclara's smart meters. This collaboration is intended to enhance grid operations and improve the management of water resources through advanced analytics and real-time data processing.

The rising urban population is creating opportunities for the development of smart cities, which ultimately is driving the demand for smart water metersing infrastructure development on a larger scale. The increasing urban population is opening up avenues for smart cities. In addition, several factors include NRW losses, including incorrect mechanical meters, manual meter reading, and unmetered consumption. Water loss mainly occurs due to leaks, theft, storage tank overflows, unauthorized usage, and the provision of free water to certain consumers. Governments and utilities across the globe are increasingly mandating advanced metering infrastructure as a strategic approach to sustainable water management, which is driving rapid adoption of smart water meters.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Utilities and industrial operators have shifted their focus from traditional water management toward the adoption of new digital technologies and increasing energy efficiency. They are focusing on decreasing their operating expenditure by reducing non-revenue water through the implementation of smart water management practices. The incorporation of AI, IoT, ML, and other technologies in smart water meters and the use of solutions for meter data management have assisted water utilities in acquiring leakage-related data at a lower cost and improving the performance of their distribution networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of smart water meters in US and Europe

-

Non-revenue water (NRW) loss in distribution systems

Level

-

Short battery life of smart water meters

-

Lack of government initiatives

Level

-

Replacement of aging infrastructure

-

Modernization and digitalization of water industry operations

Level

-

Maintenance, security, and integrity of smart water meters

-

Signal transmission issues in locations with weak connectivity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of smart water meters in US and Europe

The adoption of smart water meters is very important for efficient water use, waste reduction, and correct billing. These water meters bolster sustainability and smart city activities and provide an avenue for utilities to ease distribution in a way that ensures continuous water supply while reducing operational costs. Across the US, states, cities, and private companies have multiple projects to replace traditional water meters with smart technology. For instance, in October 2022, Governor Hochul of New York issued USD 31.3 million to improve water infrastructure statewide. In September 2022, Saint-Gobain put in place a smart water meter system and modernized equipment at its siding plant in Social Circle, Georgia, thus reducing its water consumption by over two million gallons a year.

Restraint: Short battery life of smart water meters

Water utilities develop smart water management (SWM) solutions with the help of advanced metering infrastructure (AMI) or automated meter reading (AMR) technologies. These encompass smart water meters that are typically digital and require a battery to function. Since these batteries perform various functions in the smart meters, their average life is a decisive factor in ensuring the effective operation of systems in the long run. To take full advantage of AMI and AMR for functions such as hourly meter readings, monthly billing, etc., these batteries should last anywhere between 10 and 20 years before replacement is needed. However, the first generation of smart water meters has an average battery life of only seven to eight years, which is relatively short. The battery may cost less, but the price of frequent replacement is high because annual inspections are required for regular maintenance, which is taken up by technicians. This consequently raises labor costs and travel expenses. These added costs, plus the aspect of ongoing maintenance, have inhibited the adoption of smart water meters by water utilities.

Opportunity: Replacement of aging infrastructure

The replacement of aging water infrastructure presents significant opportunities for the smart water meters market. As traditional water systems deteriorate, utilities are increasingly adopting advanced metering technologies to enhance efficiency and reduce water loss. For instance, in August 2024, TPG secured a 10-year contract with Southeast Water to manage and connect one million smart water meters in Victoria, Australia, marking the country's largest smart meter rollout. These digital meters, equipped with 4G connectivity, provide detailed water usage analytics and leak detection, eliminating the need for manual readings. In September 2023, Yorkshire Water (UK) was set to exchange 1.3 million existing water meters with smart meters designed to provide service improvements, enhance customer support, and reduce leakage.

Challenge: Maintenance, security, and integrity of smart water meters

The designing of smart water meters is complex, thus exacerbating complications in installation and maintenance. These meters require the product to be subjected to service center repairs and maintenance. Big data generation and transmission by smart water meters to utility providers, system integrators, and service providers makes it imperative to secure this information against cyber threats. Attackers can gain access to vital data through connected smart meters, thereby posing substantial risks to enterprises. Therefore, for smart water management systems to operate efficiently, the assurance of the integrity and reliability of the devices is to be ensured throughout their lifecycle. This is one of the big challenges that the utilities face, including the inadequately skilled workforce in water utilities in the area of ICT. In addition, the lack of knowledge with respect to career opportunities and development within the sector further inhibits the development of this market.

Smart Water Meters Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Western Municipal Water District needed to modernize its meter reading infrastructure and improve operational efficiency for its 24,000 retail customer accounts, which traditionally relied on manual drive-by meter reading methods | The district conducted a pilot study with Neptune's LoRaWAN® equipped technology, testing remote meter reading capabilities by installing 100 smart meters. The pilot demonstrated an impressive reading success rate of more than 99 percent, paving the way for future automated metering infrastructure (AMI) implementation. The project aligns with Western Water's goal of empowering customers with near real-time water usage data and improving operational efficiency through technological innovation |

|

Yorkshire Water, a prominent UK water utility serving 5.5 million customers, confronted significant challenges in water resource management and infrastructure efficiency. The primary problem was the substantial water loss through undetected leaks, inefficient consumption tracking, and limited real-time insights into water distribution networks. To address these critical issues, the company strategically awarded a £47 million smart water metering contract to Netmore Group, targeting comprehensive digital transformation of their water management infrastructure. | The solution involved deploying 1.3 million LoRaWAN-enabled smart water meters across the Yorkshire region, designed to provide hourly consumption data, enable immediate leak detection, and offer granular insights into water usage patterns. By implementing this advanced metering infrastructure, Yorkshire Water aims to dramatically reduce non-revenue water losses, enhance operational efficiency, and support their ambitious sustainability goals of halving network leakage by 2050. The smart metering initiative represents a significant technological leap, transforming traditional water management approaches through real-time data analytics, network monitoring, and proactive infrastructure maintenance. |

|

Oneida, Tennessee, was experiencing severe water infrastructure challenges, with 51% water loss from its annual water production of approximately 400 million gallons (equivalent to ~1,500 million liters). This massive water loss was costing the municipal council around $186,000 annually and forcing the water treatment plant to operate 12-14 hours daily to meet demand. | The town partnered with Kamstrup to implement an Advanced Metering Infrastructure (AMI) with Acoustic Leak Detection (ALD) system. By installing 4,600 Kamstrup meters and 12 collectors, Oneida was able to dramatically reduce water loss. In just three months, they decreased water loss from 51% to 38%, reduced water treatment plant operations by three hours per day, and began systematically repairing infrastructure leaks |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The smart water meters market ecosystem is changing rapidly as part of the broader transition to smart technologies and digital infrastructure. Key stakeholders in this ecosystem include component suppliers, smart water meter manufacturers, service/solution providers, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Water Meters Market, By Meter Type

The electromagnetic meters segment hold the second largest share, by meter type. An electromagnetic meter is a non-mechanical meter mainly used in urban systems or wastewater and industrial systems. It is also known as a mag flow meter. Technically, it is a velocity-type water meter, except that it uses an electromagnetic system for determining the water flow velocity. It requires electricity from a power line or battery to control the electromagnets.

Smart Water Meters Market, By Application

The water utilities segment, by application, is expected to be the fastest growing segment of the smart water meter market. As a crucial component of the water meter value chain, water utilities benefit significantly from smart water meters in various operational areas. A vital part of their infrastructure is the water grid used for distribution. The major issue concerning water utilities today is leakage detection and prevention since the loss of water is still a major issue. With these facts, most water utilities around the world are investing in the upgrade of the antiquated conventional water networks and development of advanced smart water meter systems, which reduce waste, improve grid management, and integrate renewable energy sources into water grids more effectively. In addition, they are seeking to increase their customer base for smart water meters. For example, Britain's water companies have ambitious plans for the installation of smart water meters over the 2025-2030 period to save more water and augment infrastructure efficiency.

Smart Water Meters Market, By Technology

The AMI segment, by Technology, is expected to be the larget market during the forecast period. There is immense growth in the segment of technology, driven by high reliability of ami communication infrastructure. AMI enables utility personnel to collect and analyze water usage while also facilitating two-way communication with metering devices, either on demand or on a set schedule. These meters can deliver the collected information through commonly accessed fixed networks which include BPL, PLC, fixed RF networks, and public networks like landline, cellular, and paging. With increasing cost competitiveness in advanced meters relative to one-way meters, increasing numbers of water utilities are finding this technology relevant. AMI also minimizes the requirement of manual labor to a considerable degree, hence a reduction in costs of operation and, as an outcome, AMI is experiencing high market penetration.

Smart Water Meters Market, By Component

IT Solutions segment, by component, is expected to be the fastest in market during the forecast period.The smart water meter market is divided into three main components: meters and accessories, IT solutions, and communications. With the rise of IoT sensors and data management software, water utilities can now analyze potential causes of water loss and take preventive measures. As the water industry rapidly embraces digital technologies, the IT solutions segment is experiencing significant growth in smart water meter market.

REGION

North America to be largest region in global smart water meters market during forecast period

The North American smart water metering market is the largest in 2023. The dominance of the region is mainly due to the high installation rate of smart water meters by North American water utilities. The region is also the highest consumer of water in the world. According to the EPA, an average American family consumes more than 300 gallons of water per day at home. This leads to more demand for smart water metering in the region to manage water consumption and reduce water wastage. Smart water meter suppliers are focusing on expanding their offerings in the North American region to help customers reduce their water bills. Smart water meters can detect water leakages and turn off the supply in case of water loss. Ultrasonic meters are gaining more preference among North American water utilities because of their higher efficiency and better accuracy rates.

Smart Water Meters Market: COMPANY EVALUATION MATRIX

Badger Meter Inc. leads the Smart Water Meters market with a strong presence and an extensive technology portfolio, placing it in the "Star" quadrant of the market matrix. The company's global leadership is rooted in its century-long history of innovation in flow measurement, water quality, and pressure monitoring solutions for utility, municipal, and industrial customers.??

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 4.14 BN |

| Market Forecast in 2030 (Value) | USD 9.04 BN |

| Growth Rate | 11.9% |

| Years Considered | 2020–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa and South America |

WHAT IS IN IT FOR YOU: Smart Water Meters Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- November 2024 : Diehl acquired PREVENTIO GmbH, a Germany-based technology startup specializing in leakage management and predictive maintenance. This investment is set to enhance Diehl Metering's capabilities in real-time leak detection and complement its Analytics & Services portfolio.

- October 2024 : Bmeters srl launched the HYDRODIGIT-M1, a new smart digital multi-jet water meter.

- October 2023 : Iskraemeco introduced the Iskrasonic IW, an advanced ultrasonic water meter that represents a significant technological leap. This product offers enhanced accuracy, longevity, and improved data connectivity, signaling a transition from traditional mechanical meters to more sophisticated digital solutions.

- March 2024 : Diehl Metering strategically expanded its manufacturing capabilities by inaugurating a new production unit in Bazanowice, Poland.

- March 2024 : Kamstrup set up its new North American headquarters and manufacturing facility in Forsyth County, Georgia.

Table of Contents

Methodology

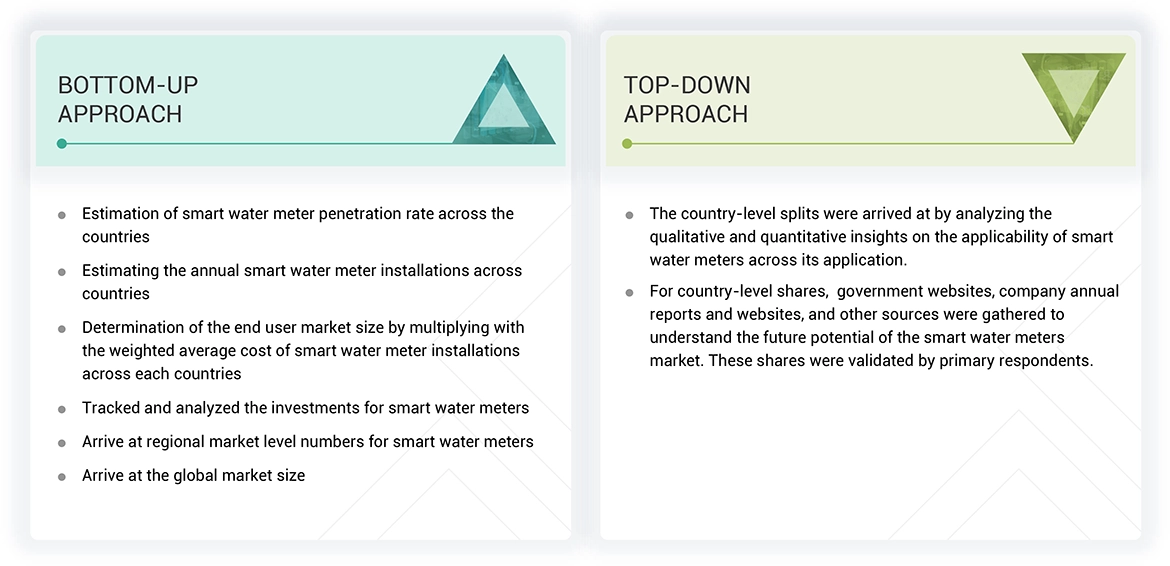

This study consisted of four major phases in estimating the current size of the smart water meters market. Extensive secondary research was done to extract information from the market, peer markets, and parent markets. The next stage was the validation of these data from secondary findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were incorporated in estimating the entire size of the market. Then, the market break-down and data triangulation were done for estimating the market size of the segments and sub-segments.

Secondary Research

The research study on smart water meters market included maximum utilization-or-indirect utilization-of directories, databases, and secondary sources, including Hoovers, Bloomberg, Businessweek, UN Comtrade Database, Factiva, International Energy Agency, International Monetary Fund, United Nations Conference on Trade and Development, US Energy Information Administration, European Commission, US Energy Information Administration, Smart Energy International, among others, to identify and gather relevant information helpful for preparing the technical, market-oriented and commercial study. Other secondary sources included white papers, articles by renowned authors, annual reports, press releases & investor presentations of companies, recognized publications, manufacturer associations, trade directories, and databases.

Primary Research

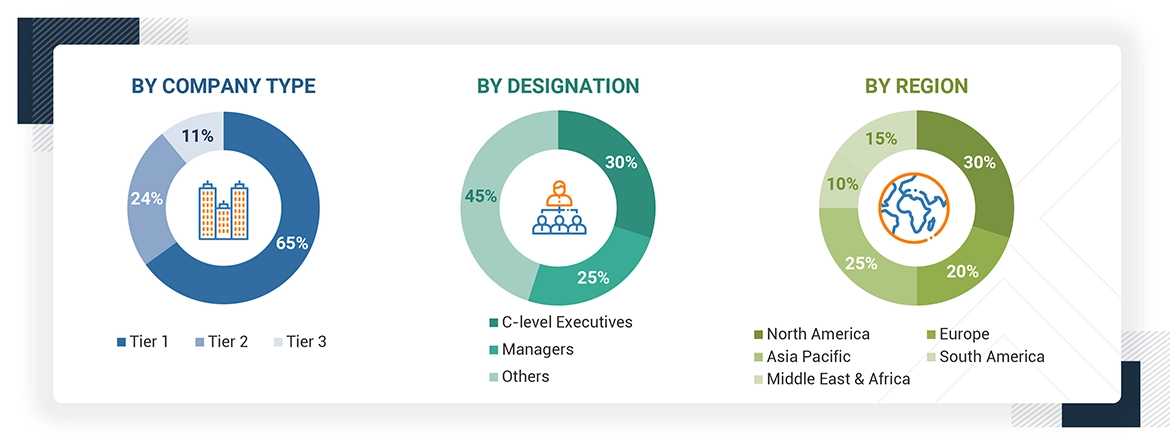

Amidst primary sources mentioned are various industry experts from core and allied industries, smart meter providers, IoT, cloud-based solution providers, and utility provider in all segments of these industries' value chain. Several primary sources on both the supply side and demand sides of this market had been interviewed to gather qualitative and quantitative information. In the canvassing of primaries, several departments within organizations namely sales, engineering, operations, and managers were covered in order to provide an all-sided viewpoint in our report The primary respondents' breakdown is provided.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the web content management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of WCM products.

Market Size Estimation Methodology- Top-down approach

Both the top-down and bottom-up approaches were used to estimate and validate the size of the smart water meters market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the smart water meters market.

Smart Water Meters Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

Smart water meters are devices that monitor and transmit water usage data between consumers and providers, enabling efficient water management and accurate billing. These meters are equipped with an electronic computing unit (ECU), which facilitates easier communication between the meter and the supplier. Smart meters detect and track water consumption more precisely than traditional mechanical water meters through ultrasonic or electromagnetic sensors. Although advanced water meters can be manufactured with conventional metals like brass or copper, many OEMs rely on specialty polymers for water management systems to replace metals and promote the use of lightweight material and increased durability.

Stakeholders

- Government and research organizations

- Institutional investors and investment banks

- Investors/shareholders

- Environmental research institutes

- Consulting companies in energy & power sector

- Raw materials and component manufacturers

- Manufacturers’ associations

- Manufacturing industry

- Energy efficiency consultancies

- Original equipment manufacturers (OEMs) and system integrators

- Engineering, procurement, and construction (EPC) contractors

- Standardization and testing firms

- Meter data management software providers

- Meter manufacturing companies

- Water-intensive industries

- Water utilities

Report Objectives

- To define, describe, analyze, and forecast the size of the smart water meter market, by meter type, technology, component, and application, in terms of value

- To forecast the market size for five major regions?North America, Europe, Asia Pacific, South America, Middle East & Africa?along with their key countries

- To forecast the smart water meter market, by region, in terms of volume

- To provide detailed information about the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the smart water meter market

- To provide detailed information on the market map, value chain, case studies, technologies, market ecosystem, tariff & regulatory landscape, Porter’s Five Forces, and trends/disruptions impacting customers’ businesses that are specific to the smart water meter market

- To analyze market opportunities for stakeholders in the smart water meter market and draw a competitive landscape for market players

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business excellence and strength of product portfolio

- To compare key market players with respect to market share, product specifications, and end users

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2

- To analyze competitive developments in the smart water meter market, such as expansions, product launches, and acquisitions

- To study the impact of AI/gen AI on the market under study, along with the macroeconomic outlook for each region.

Note: 1. Core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the smart water meters market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the smart water meters market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Water Meters Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smart Water Meters Market