Spare Parts Management (SPM) Market Size, Share, Opportunities & Latest Trends

Spare Parts Management (SPM) Market by Solutions (Spare Part Tracking & Automation, Inventory Management, Procurement & Order Management, Reporting & Analytics, Planning & Forecasting), Spare Part Management Services, Type - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The spare parts management market is projected to reach USD 1,820.2 million by 2030 from USD 1,021.3 million in 2025, at a CAGR of 12.3%. Growth in the spare parts management market is driven by expanding MRO operations, real-time inventory optimization needs, and the shift toward advanced service parts planning. Companies are adopting AI-enabled demand forecasting, predictive maintenance, and intelligent inventory control to improve parts availability, reduce service delays, and strengthen supply chain visibility across global service networks.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to emerge as the fastest-growing region in the spare parts management market, driven by industrial digitalization, expanding manufacturing bases, and rising demand for real-time parts visibility. India, Indonesia, Malaysia, and Vietnam are adopting cloud-based inventory management, predictive maintenance, and automated distribution.

-

By SOLUTIONBy solution, the inventory management segment is estimated to hold the largest share (30%) of the spare parts management market in 2025.

-

BY PROFESSIONAL SERVICEBy professional service, the support & maintenance segment is expected to register the highest CAGR of 17.6% during the forecast period.

-

BY VERTICALBy vertical, the healthcare & life sciences segment is projected to showcase the highest CAGR of 15.5% during the forecast period.

-

BY DEPLOYMENT MODEBy deployment mode, the cloud segment is expected to grow at a higher rate than the on-premises segment, driven by the rising adoption of SaaS-based spare parts management, real-time inventory visibility needs, scalable service operations, and integrated analytics for optimized parts planning.

-

BY TYPEBy type, the standalone SPM software segment is estimated to lead the market, driven by strong demand for focused planning tools, simplified deployment needs, flexible integration options, and efficient control of core spare parts operations.

-

BY ORGANIZATION SIZEBy organization size, SMEs are expected to witness a higher growth rate than large enterprises, driven by the rising adoption of affordable cloud-based spare parts management, simplified inventory control needs, faster deployment cycles, and stronger demand for real-time parts visibility.

-

COMPETITIVE LANDSCAPESyncron, PTC, IFS, Baxter Planning, and Fiix are among the major players in the spare parts management market, collaborating with manufacturers and service-intensive enterprises to deliver AI-enabled service parts planning, predictive maintenance analytics, automated replenishment, and real-time inventory visibility.

-

COMPETITIVE LANDSCAPERaseed, Upkeep, and Megaventory have distinguished themselves among startups and SMEs due to their robust product portfolios and effective business strategies.

The spare parts management market is witnessing steady growth, driven by industries moving toward smarter service operations and real-time parts availability. With a focus on zero-downtime maintenance, companies are adopting integrated spare parts inventory management systems with AI-driven demand forecasting, centralized parts catalogs for a unified view, and automated replenishment. These tools help prevent stock-outs and reduce extra carrying costs. As field service, aftermarket support, and global distribution come together, spare parts management is evolving into a unified supply chain intelligence system. This shift enhances operational resilience, improves service performance, and facilitates cost-efficient parts lifecycle optimization.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The section highlights the major shifts redefining customer strategies in the spare parts management market, emphasizing how real-time parts visibility, predictive maintenance, and AI-enabled planning are transforming service operations. It examines evolving requirements across manufacturing, transportation & logistics, as well as construction, as organizations adopt cloud-based service parts management, automated replenishment, and integrated field service logistics to reduce delays and improve asset uptime. It links these priorities to measurable outcomes such as optimized inventory levels, faster service resolution, lower maintenance costs, and enhanced operational reliability, positioning advanced spare parts management platforms as a core enabler of resilient, efficient, and digitally connected service supply chains.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Escalating unplanned downtime asset-hour costs

-

Improvement in fill-rate precision with AI demand forecasting

Level

-

Proprietary lock-ins and restricted data access

-

Inaccurate and inconsistent spare parts data

Level

-

Real-time IoT telemetry for inventory visibility

-

Shift toward servitization and uptime-based contracts

Level

-

Managing long-tail, low-turn spare parts complexity

-

Supplier lead-time volatility impacting fill rates

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Escalating unplanned downtime asset-hour costs

Rising unplanned downtime costs are accelerating the need for advanced spare parts management across asset-heavy industries. With firms facing substantial revenue losses due to equipment failures, organizations are prioritizing predictive maintenance, real-time parts visibility, and automated spare parts replenishment to protect their uptime. This shift is boosting the adoption of AI-driven parts planning, SKU criticality scoring, and integrated maintenance-to-inventory workflows, positioning spare parts management as a core driver of operational reliability and cost control.

Restraint: Inaccurate and inconsistent spare parts data

Data inaccuracy and disconnected field stock remain key restraints in the spare parts management market. Disorganized truck inventory, poor location visibility, and incorrect reorder points weaken demand forecasting, inventory optimization, and automated replenishment. These issues reduce first-time fix rates and increase costs. Since AI-driven planning and predictive maintenance require clean, unified data, vendors must focus on strong data governance and mobile inventory tracking to improve accuracy and overall SPM performance.

Opportunity: Real-time IoT telemetry for inventory visibility

The rise of IoT-enabled infrastructure is creating a significant opportunity for real-time spare parts visibility and predictive replenishment. Continuous asset telemetry over 5G supports IoT-driven inventory optimization, predictive maintenance analytics, and automated parts ordering. With IoT gateways and AI models converting sensor data into accurate forecasts, companies can improve uptime, cut carrying costs, and manage the spare parts lifecycle more efficiently.

Challenge: Managing long-tail, low-turn spare parts complexity

Managing long-tail, low-turn spare parts remains challenging because slow-moving SKUs increase costs, reduce inventory accuracy, and affect minimum downtime. Companies use AI-driven criticality scoring, predictive maintenance, and risk-based governance to identify essential parts. Modern inventory optimization tools help rationalize slow movers, improving asset uptime and lowering carrying costs.

spare-part-management-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Embraer successfully optimizes spare parts planning with Servigistics, saving more than USD 50 million | 12.5% reduction in inventory, cutting carrying costs by USD 25.5 million | Total cost savings exceeding USD 50 million | 35% improvement in inventory turns and enhanced service levels | 2.5% increase in profit (USD 26 million) | Greater planning agility and cross-team efficiency through a unified parts ecosystem |

|

Syncron enables Al Masaood Automobiles to enhance inventory efficiency and service performance | 15% reduction in national inventory and 20% in branch inventory | Increase in parts turnover from 1.89 to 2.50 turns | Reduction in stock order cycle from 61 days to 46 days | Decrease in manual order review from full intervention to 20–30% | First-pick availability improvement from 93% to 96% | 35% reduction in storage space and 15% decrease in manpower load | Enhanced supplier collaboration and sustained profitability with unchanged staff headcount |

|

eMaint streamlines spare parts management for Cerapedics through CMMS integration | Hundreds of labor hours saved through automated parts tracking and access | Rapid search capability enabling faster response during maintenance emergencies | Seamless synchronization between maintenance and procurement systems | Reduction in downtime and improved spare parts availability | Simplified purchase order generation and inventory forecasting | Enhanced operational visibility and decision-making through analytics |

|

ToolsGroup enables Lennox to optimize service parts planning and reduce stock-outs | Stock-outs reduced by more than half, from 9% to 4% | Improved forecast precision through advanced seasonality clustering and ML insights | Enhanced service levels while expanding distribution capacity by 30% | Balanced inventory allocation and reduced working capital requirements | Streamlined operational control with dynamic, automated inventory mix optimization |

|

Triangle Tube enhances after-sales experience through 3D digital transformation with Partful | Improved order accuracy and reduced downtime across service operations | Enhanced customer experience through faster response times and more transparent communication | Increased operational efficiency and reduced dependency on manual parts lookup | Strengthened customer relationships through transparency and reliable support | Achieved better alignment between technology innovation and customer-centric service goals |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The spare parts management ecosystem consists of integrated stakeholders that ensure efficient, reliable, and data-driven aftermarket operations. Software providers deliver service parts planning tools, inventory optimization platforms, predictive maintenance analytics, and real-time visibility solutions. Service providers support parts fulfillment, logistics coordination, and outsourced supply chain operations that enhance availability and reduce downtime. Together, these players enable automated replenishment, accurate demand forecasting, and seamless multi-site inventory control, creating a connected ecosystem that drives operational resilience, cost efficiency, and higher asset uptime for enterprises.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Spare Parts Management Market, By Solution

By solution, spare parts tracking and automation are expected to experience the fastest adoption, driven by the need for real-time parts visibility, faster service responsiveness, and automated control of high-volume inventories. Organizations are increasingly relying on barcode/RFID tracking, IoT-enabled parts monitoring, and automation-led replenishment to eliminate manual errors, prevent stockouts, and minimize equipment downtime.

Spare Parts Management Market, By Professional Service

By professional service, the integration & implementation segment is expected to lead the market as companies work to connect new SPM systems with existing enterprise tools. These services help build an accurate spare parts catalog, align master data, and unify maintenance, supply chain, and warehouse workflows. They also configure inventory rules, parts usage logic, and multi-location operations for consistent control across all sites. As organizations focus on smooth rollouts, stable performance, and stronger visibility, integration & implementation services become essential to unlock the full value of spare parts management solutions.

Spare Parts Management Market, By Vertical

Manufacturing is estimated to capture the largest share of the spare parts management market, driven by high asset intensity, complex production lines, and the need to minimize equipment downtime. Manufacturers rely on real-time parts visibility, centralized inventory control, and accurate demand forecasting to prevent production disruptions and maintain stable output. The sector also emphasizes predictive maintenance alignment, efficient parts procurement, and multi-plant inventory synchronization to support continuous operations.

Spare Parts Management Market, By Deployment Mode

The on-premises segment is estimated to lead the market, driven by organizations that require strict control over operational data, secure infrastructure, and highly governed maintenance environments. Industries managing sensitive asset information favor on-premises systems for their ability to support localized inventory control, secure parts planning, and offer reliable order processing without external dependency. This deployment mode provides high system stability, faster in-house data processing, and consistent access to mission-critical spare parts workflows.

Spare Parts Management Market, By Type

Integrated SPM software is expected to witness a higher demand than standalone SPM software, driven by the shift toward unified platforms that consolidate planning, forecasting, inventory optimization, procurement, and analytics into a single system. These solutions eliminate data silos, improve real-time inventory visibility, and support AI-driven demand forecasting, predictive maintenance, and automated replenishment. By enabling higher asset uptime, stronger inventory accuracy, and reduced stock-outs and minimum equipment downtime, integrated SPM software has become the preferred choice for organizations seeking scalable, connected, and efficiency-focused spare parts management.

Spare Parts Management Market, By Organization Size

Large enterprises are expected to dominate the spare parts management market because they manage extensive asset fleets, operate across multiple locations, and must maintain robust service continuity. These organizations rely on centralized inventory control, enterprise-wide parts planning, and high parts availability to avoid service delays and expensive downtime. Large enterprises also focus on achieving real-time visibility, adhering to SLAs, and implementing standardized workflows across all sites.

REGION

North America to be largest region in global spare parts management market during forecast period

North America is expected to remain the largest region in the global spare parts management market, supported by strong adoption across the US and Canada. The US drives substantial demand through its large industrial equipment base, advanced aerospace sector, and digitized aftermarket service networks that rely on real-time parts visibility, parts lifecycle optimization, and predictive maintenance. Canada contributes through its growing transportation, mining, and heavy-equipment industries, where companies focus on maintaining inventory accuracy, ensuring critical parts availability, and reducing downtime. Together, these markets continue to expand the use of modern spare parts management platforms that enable multi-site operations, automated replenishment, and high service reliability for mission-critical assets.

spare-part-management-market: COMPANY EVALUATION MATRIX

PTC (Star) leads the spare parts management market with advanced service lifecycle platforms, AI-driven parts planning, and strong integration across PLM, IoT, and field service systems that depend on accurate, real-time parts data. ToolsGroup (Emerging Leader) is gaining momentum with probabilistic forecasting, autonomous replenishment, and strong traction in distribution-heavy sectors, improving inventory accuracy and service responsiveness. While PTC excels through scale, analytics strength, and end-to-end operational alignment, ToolsGroup is advancing toward the leaders’ quadrant by enhancing predictive planning, expanding multi-site optimization, and upgrading its SPM analytics capabilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Syncron (Sweden)

- IFS (Sweden)

- PTC (US)

- Baxter Planning US)

- Fiix (Canada)

- SAP (Germany)

- IBM (US)

- Oracle (US)

- Tavant (US)

- Dassault Systemes (France)

- Cryotos (India)

- eMaint (US)

- ERPAG (US)

- Megaventory (US)

- UpKeep (US)

- Infraon (US)

- ValueApex (China)

- MPulse Software (US)

- AntMyErp (India)

- Limble CMMS ( US)

- Fleataable (India)

- Verusen (US)

- Mastek (India)

- Raseed (India)

- PartsCloud (Germany)

- SPARTECH (Germany)

- Partful (England)

- Facilio (US)

- ToolsGroup (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 907.0 Million |

| Market Forecast in 2030 (Value) | USD 1,820.2 Million |

| Growth Rate | CAGR of 12.3% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Leading Region | Asia Pacific is expected to emerge as the fastest-growing region |

| Leading Segment | Support & maintenance segment is expected to register the highest CAGR of 17.6% |

| Growth Drivers | Escalating unplanned downtime asset-hour costs |

| Restraint | Inaccurate and inconsistent spare parts data |

WHAT IS IN IT FOR YOU: spare-part-management-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Manufacturing Giant (North America) | Regional Deployment Analysis: Evaluation of spare parts inventory models, stocking policies, and service coverage requirements for distributed plants, fleets, and field operations | Enhances regional service responsiveness, reduces stock-out risk, and improves availability for mission-critical assets |

| Logistics Service Provider (Asia Pacific) | Competitive Portfolio Mapping: Detailed analysis of SPM vendors across planning, forecasting, inventory control, and replenishment modules, tailored to sector-specific maintenance needs | Supports platform selection, improves capability alignment, and strengthens long-term ROI for service operations |

| Major Software Corporation (US) | Extra Vendor Profiling: Identification of regional and niche providers specializing in predictive maintenance analytics, IoT-driven parts visibility, and long-tail optimization solutions | Expands access to advanced capabilities, accelerates digital adoption, and improves lifecycle efficiency across diverse spare parts categories |

RECENT DEVELOPMENTS

- September 2025 : AVAIO Digital Partners collaborated with Schneider Electric to deploy high-performance UPS systems as part of four AI-ready data center campuses across the US. The partnership focuses on Schneider’s modular three-phase UPS architecture designed to support high-density AI and cloud workloads with low latency and energy efficiency. These UPS systems integrate predictive maintenance, condition-based monitoring, and EcoDesign principles to ensure long-term reliability, reduced carbon footprint, and optimized power continuity for AI-intensive environments.

- July 2025 : Syncron partnered with Trillium Digital Services to strengthen its aftermarket and spare parts management capabilities. The collaboration focuses on integrating AI-driven advisory, implementation, and supply chain optimization services to help OEMs enhance spare parts planning, improve asset utilization, and achieve greater operational efficiency and uptime across complex global service networks.

- June 2025 : Japan Airlines adopted IFS Service Parts Management as part of a broader IFS Cloud deployment to streamline maintenance logistics and parts control. The collaboration enhances component traceability, automates replenishment cycles, and centralizes spare parts planning for aircraft maintenance, ensuring greater operational reliability and optimized inventory utilization across its maintenance network.

- June 2025 : Sol Distribution announced the addition of Legrand’s uninterruptible power supply (UPS) solutions to its power infrastructure portfolio. The partnership enables Sol’s channel partners, including MSPs and VARs, to access Legrand’s scalable UPS technology to enhance power resilience and uptime for hybrid work, edge computing, and critical IT environments.

- June 2025 : PwC collaborated with Oracle to enhance spare parts management within field-service operations by integrating automated parts tracking, warranty-linked replenishment, and predictive repair workflows. The collaboration focused on optimizing spare parts availability, minimizing excess and obsolete inventory, and ensuring accurate allocation of parts for repair and warranty processes through Oracle’s connected service and inventory platforms.

- April 2025 : Fiix, through its parent company Rockwell Automation, partnered with AWS to make its computerized maintenance management system available on AWS Marketplace as part of Rockwell’s FactoryTalk Hub expansion. The collaboration enables Fiix users to leverage AWS’s cloud infrastructure for improved spare-parts visibility, automated inventory management, and real-time maintenance insights through enhanced data integration and scalability.

Table of Contents

Methodology

This research study on the spare parts management market involved extensive secondary sources, including directories, IEEE Communication-Efficient: Algorithms and Systems, and the International Journal of Innovation and Technology Management, as well as paid databases. Primary sources were mainly industry experts from core and related industries, preferred spare parts management providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to gather and verify critical qualitative and quantitative information, as well as assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the spare parts management spending of various countries was extracted from the respective sources.

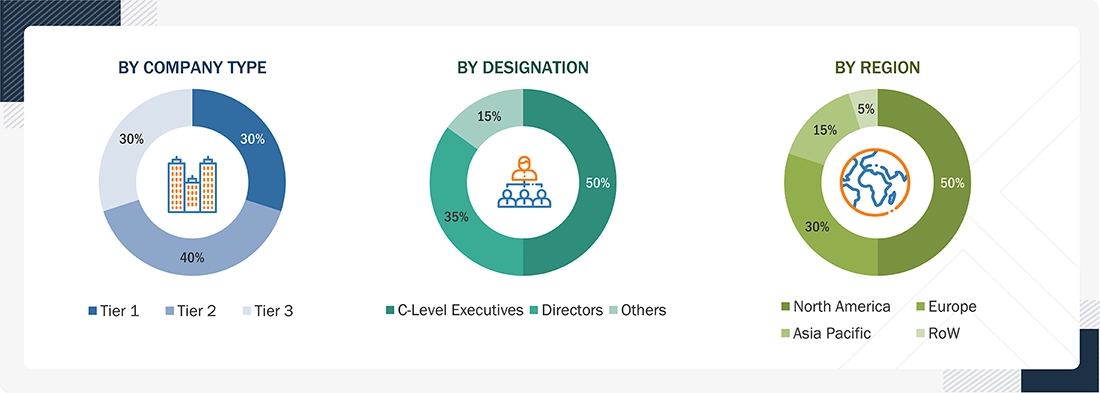

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), and directors specializing in business development, marketing, and spare parts management services. It also included key executives from spare parts management vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion. Other designations include sales, marketing, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

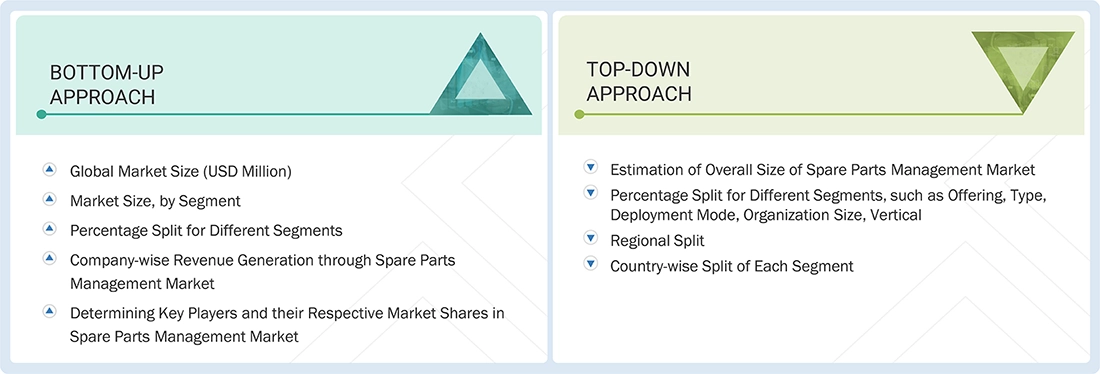

Multiple approaches were adopted to estimate and forecast the spare parts management market. The first approach involved estimating the market size by companies’ revenue generated through the sale of spare parts management products.

Market Size Estimation Methodology: Top-down Approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the spare parts management market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on offering, type, deployment mode, organization size, vertical, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology: Bottom-up Approach

The bottom-up approach identified the adoption rate of spare parts management products across different verticals in key countries, considering the regions that contribute the most to the market share. For cross-validation, the adoption of spare parts management products among enterprises and other use cases for their regions was identified and extrapolated. Use cases identified in different areas were weighed for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the spare parts management market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major spare parts management service providers, and organic and inorganic business development activities of regional and global players were estimated.

Spare Parts Management (SPM) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down approach to estimate the size of other individual markets by applying percentage splits to the market segmentation.

Market Definition

MarketsandMarkets defines the spare parts management (SPM) market as the set of software platforms, digital tools, and services that enable organizations to plan, forecast, procure, store, track, and optimize spare parts across asset-intensive operations. These solutions support key functions such as demand forecasting, procurement and order management, inventory planning, multi-echelon optimization, warehouse automation, real-time tracking, and analytics.

The market covers standalone SPM software and integrated SPM solutions, deployed through cloud-based and on-premises models. SPM tools are used by large enterprises and SMEs across industries, including manufacturing, transportation and logistics, construction, healthcare, energy and utilities, IT & telecom, and oil & gas.

SPM solutions help organizations minimize equipment downtime, reduce excess inventory, improve service levels, and align spare parts availability with maintenance strategies. With growing asset complexity, global supply-chain volatility, and the rise of predictive maintenance, SPM has become essential for ensuring operational continuity and cost-efficient service operations.

Key Stakeholders

- SPM Software Providers

- OEM Aftermarket Divisions (Automotive, Industrial, Machinery, etc.)

- Spare Parts Distributors and Authorized Dealers

- System Integrators and Digital Supply Chain Solution Providers

- Maintenance, Repair, and Operations (MRO) Service Providers

- Logistics & Warehousing Providers

- Government Organizations, Regulatory Bodies, and Standards Organizations

- Industry Associations (Manufacturing, Logistics, Asset Management)

- End Users

Report Objectives

- To define, describe, and forecast the spare parts management market based on offering (solutions [planning & forecasting, procurement & order management, inventory management, spare parts tracking & automation, reporting & analytics, others], professional services [training & consultation, integration & implementation, support & maintenance]), type (standalone SPM software, integrated SPM software), deployment mode (on-premises, cloud), organization size (large enterprises, SMEs), and vertical (manufacturing, transportation & logistics, construction & real estate, healthcare & life sciences, energy & utilities, IT & telecom, oil & gas, other verticals [BFSI, retail & consumer goods])

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents, innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches, and partnerships & collaborations, in the market

Customizations Options

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis based on feasibility

- Further breakup of the North American spare parts management market

- Further breakup of the European spare parts management market

- Further breakup of the Asia Pacific spare parts management market

- Further breakup of the Middle East & Africa spare parts management market

- Further breakup of the Latin American spare parts management market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Spare Parts Management (SPM) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Spare Parts Management (SPM) Market