US eClinical Solutions Market Size, Growth, Share & Trends Analysis

US eClinical Solutions Market by Product (CDMS, EDC, CTMS, eCOA, RTSM, eTMF, RIMS, eConsent), Application (Collection, Operation, Analytics), Trial Phase, End User (CRO, Pharma, Biotech, Medtech) Regulatory, Al, Growth, Market Size - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

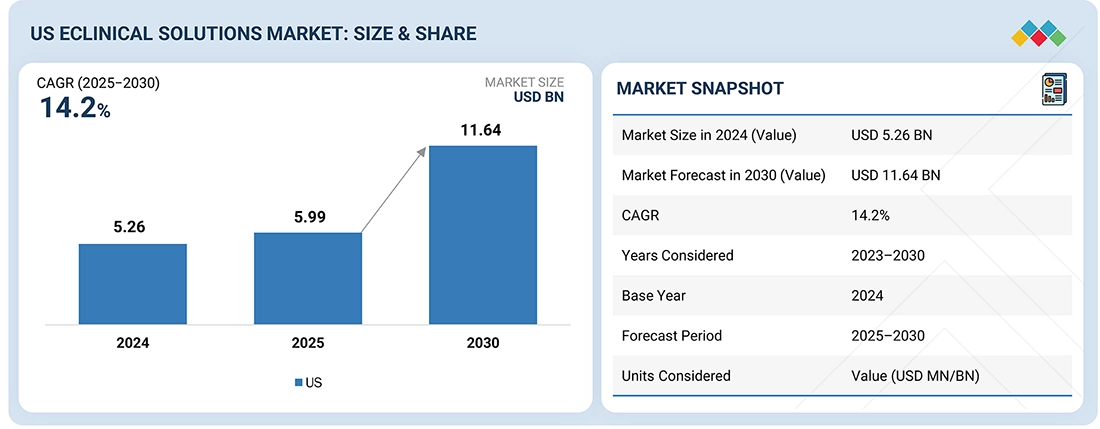

The US eClinical solutions market, valued at US$5.26 billion in 2024, stood at US$5.99 billion in 2025 and is projected to advance at a resilient CAGR of 14.2% from 2025 to 2030, culminating in a forecasted valuation of US$11.64 billion by the end of the period. The growth is driven by the rising number of clinical trials conducted across major research hubs, particularly in oncology, immunology, and rare diseases. Expanding trial pipelines place pressure on sponsors to manage larger datasets, coordinate multi-site operations, and ensure rapid study start-up, accelerating adoption of advanced EDC, remote-capture, and integrated clinical-data platforms.

KEY TAKEAWAYS

-

BY REGION-

-

By ProductBy product, the electronic clinical outcome assessment solutions segment is expected to register the highest CAGR of 16.5%.

-

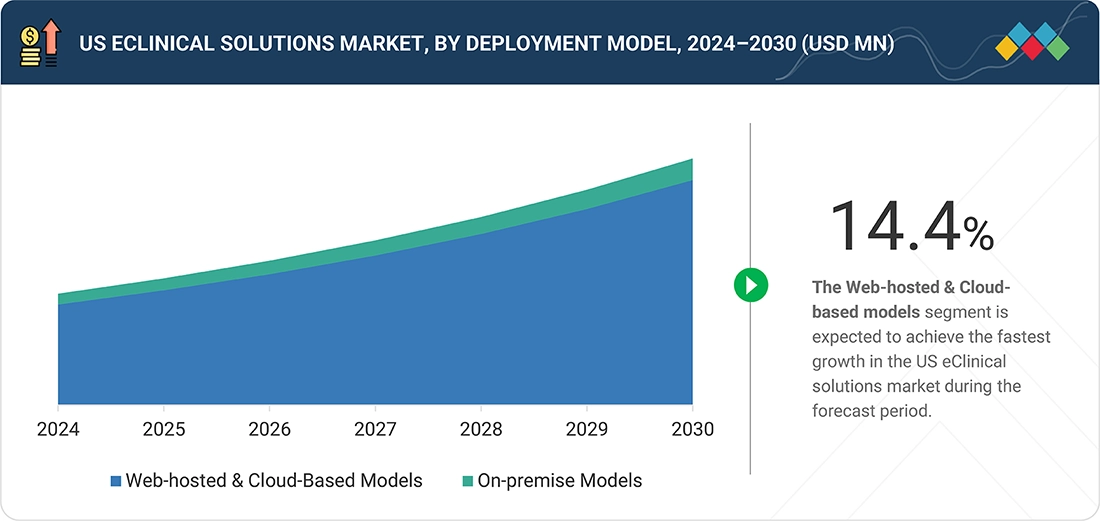

By Deployment ModelBy Deployment Model, the Web-Based & Cloud-Based Model segment held the largest share (90.4%) in the US eClinical solutions market.

-

By ApplicationBy application, the Data Analytics segment will grow the fastest during the forecast period at a CAGR of 15.2%.

-

By Clinical Trial PhaseBy Clinical Trial Phase, in 2024, the Phase III segment accounted for the largest share in the US eClinical solutions market.

-

By End userBy end user, in 2024, the Pharmaceutical & Biopharmaceutical Companies accounted for the largest share in the US eClinical solutions market.

-

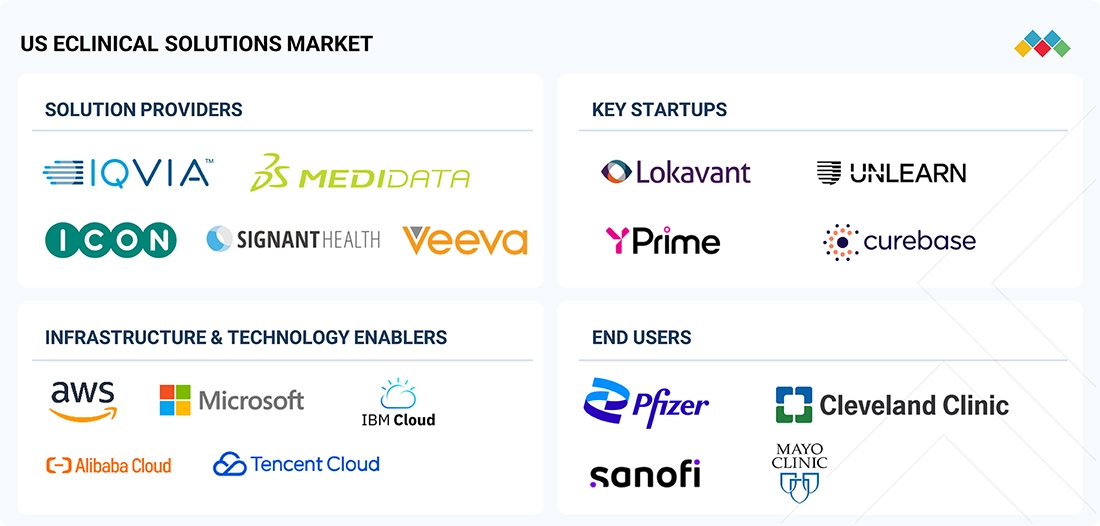

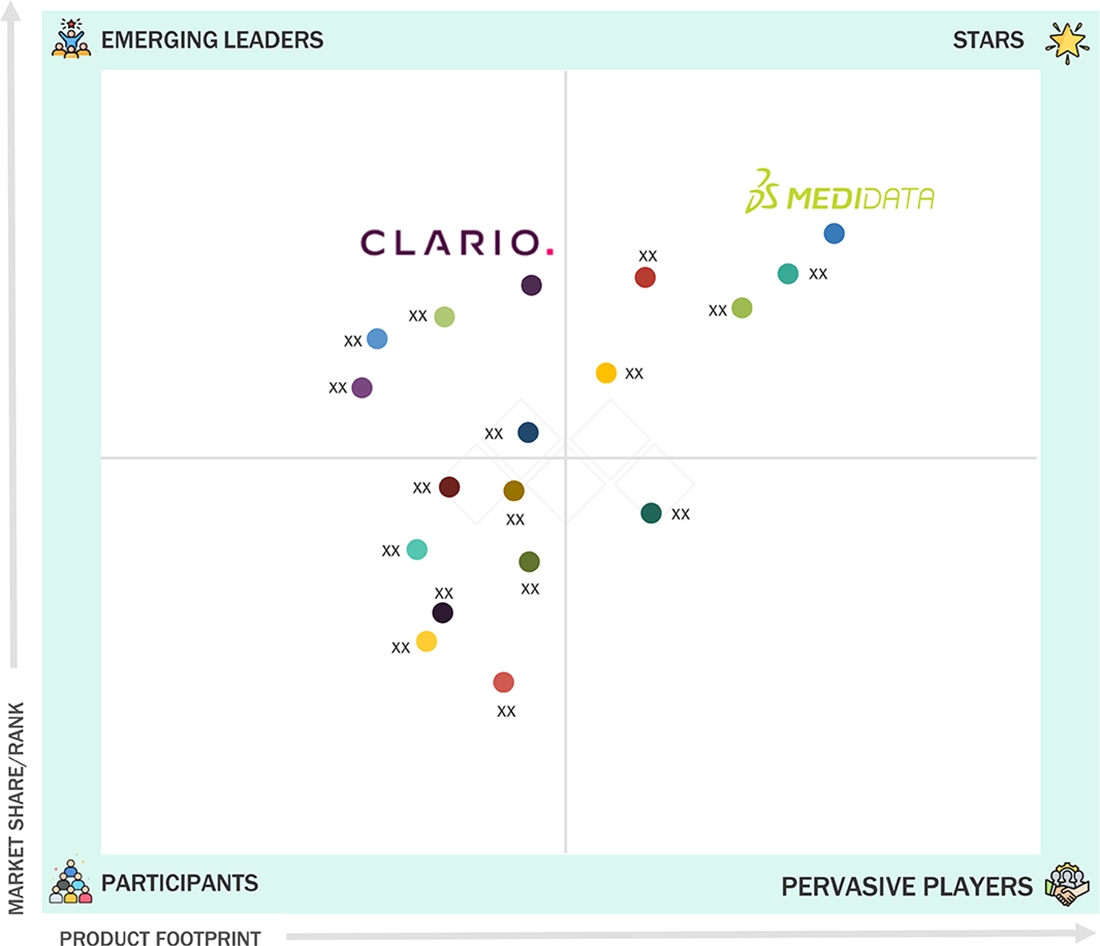

Competitive LandscapeMEDIDATA, ICON plc, Veeva Systems and IQVIA were identified as some of the star players in the US eClinical solutions market, given their strong market share and product footprint.

-

Competitive LandscapeLokavant, Unlearn.ai, Inc., and Y-Prime, LLC., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

Growing R&D expenditure in the US is reshaping clinical development priorities, with companies allocating larger budgets to digital trial infrastructure to support accelerated discovery and regulatory readiness. As investment intensifies across therapeutic areas, sponsors are shifting toward platforms that can rapidly scale studies, unify data flows and reduce operational bottlenecks, strengthening demand for modern eClinical technologies.

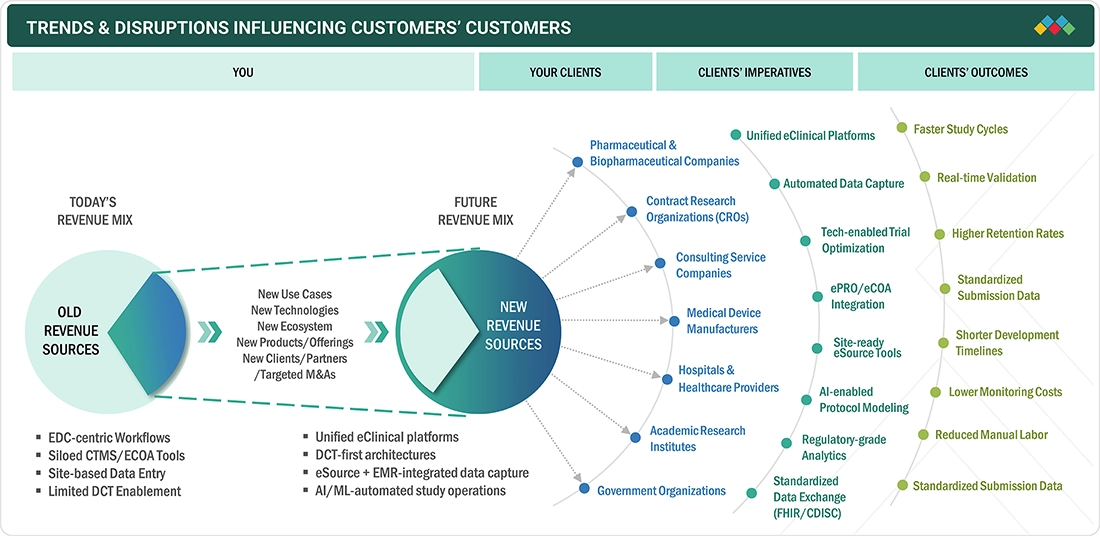

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The eClinical Solutions Market in US is experiencing rapid paradigm shifts with the acceleration of investments in digital clinical capabilities among sponsors, CROs, and research networks. Data capture, engagement, and analytics solutions continue to redefine the operational realities of clinical trials, with changes in FDA guidelines having an impact on technology adoption and compliance strategies. This provides new challenges to the industry, thereby creating an environment where innovation, maturation, and speed will dictate industry leadership.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Momentum of Decentralized and Remote Trial Models

-

Expanding R&D Investment and Growing Clinical Trial Activity

Level

-

High Implementation and Deployment Cost

-

Limited Availability of Skilled Professionals

Level

-

Growing Clinical Trial Outsourcing to CROs

-

Increasing Demand for Real-time Analytics and Intelligent Data Platforms

Level

-

Fragmented Healthcare Data Ecosystem Limiting Interoperability

-

Complex Reimbursement and Insurance Environment Impacting Real-World Data Use

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Momentum of Decentralized and Remote Trial Models

Momentum behind decentralized and remote trial models in the US is increasing as clearer regulation strengthens sponsor confidence in digital trial execution. The FDA issued final guidance in 2024 that supports remote assessments, telehealth visits, electronic informed consent, and in-home data collection while defining expectations for data integrity, oversight, and participant safety. This has encouraged sponsors and CROs to add decentralized components to existing studies and integrate virtual workflows into protocol designs. ClinicalTrials.gov shows a growing number of studies using terms such as remote, virtual, telehealth, or hybrid, indicating a shift toward digitally enabled methods. As regulators endorse these models and trial activity grows, adoption is rising for eConsent, ePRO, remote monitoring tools, and integrated EDC systems that support distributed data capture. As digital participation models expand, decentralized capabilities are becoming an important differentiator in the US eClinical solutions market.

Restraint: High Implementation and Deployment Cost

Implementation and deployment costs remain a key restraint in the US eClinical solutions market, especially for organizations running complex multi-site trials. Compliance with FDA rules, such as 21 CFR Part 11, raises time and resource needs during system onboarding. Smaller sponsors & investigator networks face added pressure from secure hosting needs and validated configurations with ongoing maintenance tied to FDA and HHS expectations. Federal guidance on cybersecurity risk management from HHS and CISA is also increasing cost pressure by requiring stronger security controls for sensitive clinical data. These factors extend procurement timelines and raise total ownership costs. As a result, advanced eClinical platforms remain less accessible for budget-constrained organizations. This continues to slow adoption among smaller biopharma companies and community-based research networks.

Opportunity: Growing Clinical Trial Outsourcing to CROs

Expanding clinical trial outsourcing to CROs presents a significant opportunity for eClinical solution providers in the US market. There has been an increasing trend of use of trials registered on ClinicalTrials.gov managed by CROs, particularly for trials relating to oncology or rare diseases that involve high degrees of complexity in relation to data. The growing reliance on CROs, particularly in relation to the increasing demand for trials that require higher degrees of digital capabilities for execution, creates an attractive market for solution providers. Regulatory expectations outlined in FDA guidance, particularly regarding decentralized elements and remote oversight, also encourage CROs to adopt more advanced digital capabilities. Vendors offering integrated EDC, CTMS, eCOA, and remote data capture solutions with validation support are well-positioned to embed platforms into CRO delivery models and capture long-term growth.

Challenge: Fragmented Healthcare Data Ecosystem Limiting Interoperability

The fragmented nature of the US healthcare data ecosystem remains a major challenge for eClinical adoption. The Office of the National Coordinator for Health IT (ONC) reports that EHR adoption, while widespread, is divided across multiple vendors with limited standardization, which complicates real-time data exchange between healthcare providers and research systems. The fragmented use of EHR solutions in healthcare providers' environments presents challenges in terms of varying data formats, as well as varying API maturity in relation to easy integration with EDC/eSource and analytics solutions. ClinicalTrials.gov data illustrates the scale of multi-site studies operating across diverse care settings, amplifying the complexity of harmonizing data feeds from disparate EHR systems, laboratories, and digital health technologies. This fragmentation increases the reconciliation workload and slows study start-up, complicating compliance with FDA expectations for data provenance and traceability. Addressing interoperability gaps is essential to unlock the full value of digital trial execution in the US market.

US ECLINICAL SOLUTIONS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Unified Rave platform integrating EDC, eCOA, RTSM, and DCT capabilities to streamline study execution and digital patient engagement | Faster trial start-up| Reduced site burden| Improved patient retention, real-time data visibility |

|

Cloud-native Veeva Vault Clinical Suite connecting CTMS, eTMF, and Study Start-Up for end-to-end digital trial management | Higher operational efficiency| Seamless cross-functional collaboration| Inspection readiness |

|

AI-powered eClinical solutions integrating eSource, EHR-to-EDC automation, and predictive analytics for risk-based study oversight | Reduced monitoring costs| Enhanced data quality| Accelerated decision-making |

|

|

OneSource and Firecrest solutions enabling remote data capture, site training, and hybrid/decentralized trial operations | Improved site performance| Reduced protocol deviations| Enhanced patient-centric workflows |

|

Oracle Clinical One platform unifying data capture, randomization, supply management, and safety analytics in a single cloud ecosystem | Simplified trial orchestration| Scalability across global studies| Faster database lock |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US eClinical ecosystem is anchored by a closely integrated network of technology vendors, CROs, sponsors, sites, and regulators that drive digital transformation across clinical development. Core platforms, such as EDC, CTMS, eCOA, RTSM, and DCT solutions, are becoming unified through cloud, AI, and real-time data orchestration. Pharma and biotech companies rely on these systems for trial acceleration, while CROs operationalize digital workflows at scale. Academic centers, sites, and SMOs supply data with oversight from the FDA, NIH, and ONC. Interoperability, decentralization, and automation are forming the basis of new value creation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US eClinical Solutions Market, By Product

By product, the electronic data capture and clinical data management solutions segment held the largest share of the US eClinical solutions market in 2024, driven by the scale and complexity of FDA-regulated studies and the need for secure, traceable, inspection-ready datasets. The US sponsors are increasingly adopting advanced EDC and eSource platforms to orchestrate large oncology, immunology, and rare-disease trials that generate high-frequency, multisource data. The expansion of decentralized and hybrid trial models further accelerates reliance on systems capable of real-time data capture, automated validation, and centralized review. These capabilities are essential for meeting stringent 21 CFR Part 11 and Good Clinical Practice expectations in the US environment.

US eClinical Solutions Market, By Deployment model

By deployment model, the web-hosted and cloud-based solutions segment is expected to grow at the fastest rate in the US eClinical Solutions Market, supported by the industry’s shift toward scalable, low-maintenance digital infrastructure. US sponsors and CROs increasingly prefer cloud environments to accelerate study start-up, enable remote team access, and maintain continuous system updates without an on-site IT burden. The model aligns with FDA expectations for secure and validated electronic records with audit-ready data trails. As decentralized and hybrid trials expand in the US, cloud delivery becomes essential for integrating EDC, eSource, ePRO, and real-time analytics across dispersed sites and participants.

US eClinical Solutions Market, By Application

By application, data collection accounted for the largest share of the US eClinical solutions market in 2024 as trial sponsors expanded their use of digital tools to capture standardized, high-quality patient and site data across geographically dispersed research networks. Growth is driven by the increasing complexity of protocols in US studies and the need for reliable electronic source documentation. Sponsors also require real-time visibility into site performance to improve trial control. Data collection platforms integrate laboratory systems, imaging sources, and patient-reported inputs. This integration allows consolidation of multiple data streams into a unified environment that improves oversight and speeds downstream analysis.

US eClinical Solutions Market, By Clinical Trial Phase

By clinical trial phase, Phase III held a significant share of the US eClinical solutions market in 2024 due to the scale and cost of late-stage studies. These trials require a robust digital infrastructure to manage large patient populations and complex endpoints across multiple sites. US sponsors use integrated EDC, eSource, and centralized oversight tools to track deviations, monitor performance, and prepare databases. The importance of Phase III outcomes for FDA submissions is driving the adoption of platforms that improve data quality, traceability, and inspection readiness.

US eClinical Solutions Market, By End User

By end user, pharmaceutical and biotechnology companies held the largest share of the US eClinical solutions market in 2024 due to extensive development pipelines and high operational demands. These companies run multi-arm studies that require tight coordination across multiple investigative sites. This scale drives demand for advanced platforms that streamline data intake, protocol compliance, and site performance oversight. Rising investment in cell and gene therapies is increasing reliance on systems that manage complex data and long-term follow-up. As a result, pharma and biotech firms remain the leading adopters of advanced eClinical technologies in the US.

REGION

US ECLINICAL SOLUTIONS MARKET: COMPANY EVALUATION MATRIX

In the US eClinical solutions market, Medidata (Star) stands out due to its unified Rave platform and deep sponsor penetration. Its data assets support end-to-end digital trial orchestration with AI-driven optimization and enterprise-scale delivery. Integration with Dassault’s modeling ecosystem strengthens its advantage in complex trials. Clario (Emerging Leader) is gaining momentum through expertise in eCOA, cardiac safety, imaging, respiratory endpoints, and digital biomarkers. Its investments in decentralized trial enablement and advanced endpoint technologies are increasing its influence. This progress gives Clario a strong upward trajectory in digital clinical innovation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Medidata (A Dassault Systèmes Company) (France)

- Veeva Systems (US)

- IQVIA Inc. (US)

- Icon Plc (Ireland)

- Signant Health (US)

- Clario (US)

- Eclinical Solutions LLC (US)

- Oracle (US)

- Clinion (US)

- Maxisit (US)

- 4gGClinical (US)

- Fountayn (US)

- Saama (US)

- Crscube Inc. (South Korea)

- Advarra (US)

- Caidya (US)

- Openclinica, LLC (US)

- Evidentiq (Germany)

- Castor (US)

- Medrio (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.26 BN |

| Market Forecast in 2030 (Value) | USD 11.64 BN |

| Growth Rate | 14.20% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US |

| Parent & Related Segment Reports |

eClinical Solutions Market Asia Pacific eClinical Solutions Market Europe eClinical Solutions Market |

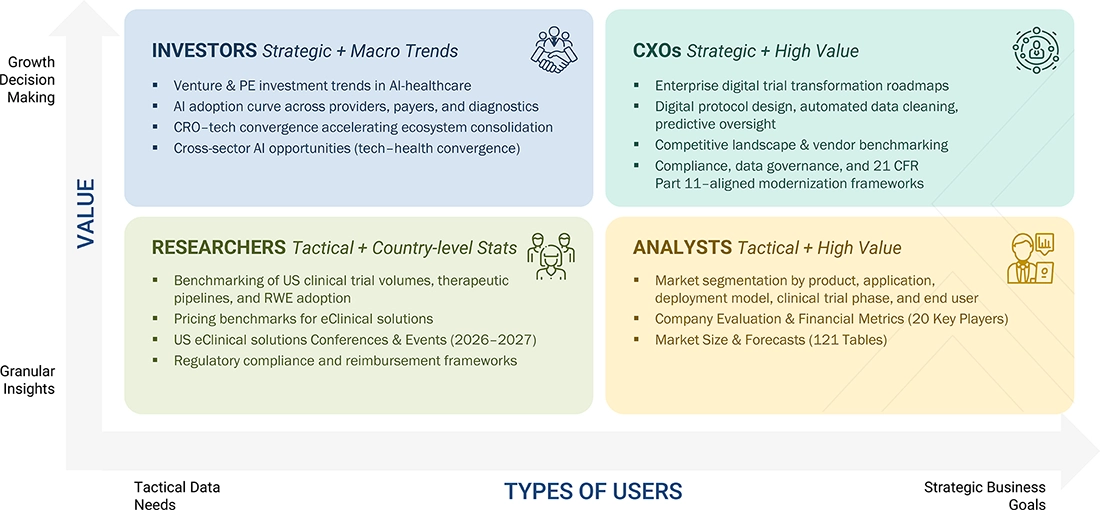

WHAT IS IN IT FOR YOU: US ECLINICAL SOLUTIONS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Clarity on FDA rules for digital and decentralized trials | Mapped FDA DCT guidance, 21 CFR Part 11, and data-integrity expectations | Improved compliance readiness and reduced regulatory risk |

| Insight into US EHR and data-exchange compatibility | Analyzed interoperability gaps and vendor integration capabilities | Faster deployment and better platform selection |

| Understanding of US competitive landscape | Built profiles of major US vendors and emerging players | Sharper vendor evaluation and partnership decisions |

| Assessment of site readiness for digital trial models | Evaluated site infrastructure, workflow maturity, and adoption barriers | Better targeting for site enablement and product rollout |

| Review of cloud, security, and hosting needs in US | Benchmarked SOC2, HITRUST, and PHI-handling requirements | Stronger security posture and cleaner IT procurement |

RECENT DEVELOPMENTS

- September 2025 : IQVIA Inc. (US) launched its AI-driven Clinical Trial Financial Suite to automate site and participant payments, streamline financial workflows, and create a unified financial backbone for complex US clinical programs.

- August 2025 : Veeva Systems (US) and IQVIA Inc. (US) have formed a long-term partnership that enables the integrated use of Veeva Clinical Suite with IQVIA’s data and services, enhancing trial build efficiency and end-to-end execution.

- May 2025 : Medidata (a Dassault Systèmes Company) (France) introduced its AI-based Protocol Optimization solution, which utilizes historical trial data to model enrollment and operational risks, thereby improving feasibility assessments and reducing amendments for data-driven study design.

Table of Contents

Methodology

This research study involved the extensive use of both primary and secondary sources. It involved the analysis of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study extensively utilized secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, as well as white papers, annual reports, and companies' house documents. The aim of the secondary research was to gather and analyze information for a comprehensive and commercially focused study of the US eClinical Solutions Market, encompassing technical aspects and market dynamics. It also facilitated the identification of key players, market classification, industry trends, geographical markets, and significant market-related developments. Additionally, a database of prominent industry leaders was compiled through secondary research.

Primary Research

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the US eClinical Solutions Market. Primary sources from the demand side included personnel from pharmaceutical & biotechnology companies, government organizations, research institutes and hospitals (small, medium-sized, and large hospitals).

Market Size Estimation

The total size of the US eClinical Solutions Market was determined after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

The size of the US eClinical Solutions Market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below: -

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the US eClinical Solutions Market were gathered from secondary sources to the extent available. In certain cases, shares of eClinical solutions businesses have been ascertained after a detailed analysis of various parameters including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

- The total revenue in the US eClinical Solutions Market was determined by extrapolating the market share data of major companies.

Market Definition

eclinical solutions are the software/platform that changes the paper-based clinical research model into an electronic form. Such technologies help the researcher in facilitating the process of data collection, its transmission, and surveillance of the clinical trial process and provide enhanced options for better planning and execution of a clinical trial. eClinical technologies fast-track the study by reducing the risk and maximizing resources.

Key Stakeholders

- Healthcare IT Service Providers

- eClinical Solution Vendors

- Clinical Research Organizations

- Pharmaceutical/Biopharmaceutical Companies

- Research and Development (R&D) Companies

- Business Research and Consulting Service Providers

- Medical Research Laboratories

- Government agencies

- Healthcare startups, consultants, and regulators

- Academic Medical Centers/Universities/Hospitals

Objectives of the Study

- To define, describe, and forecast the US eClinical Solutions Market based on product, deployment model, application, clinical trial phase, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall US eClinical Solutions Market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, and collaborations in the overall US eClinical Solutions Market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific US eClinical Solutions Market into Australia, Taiwan, New Zealand, Thailand, Singapore, Malaysia, and other countries

- Further breakdown of the Rest of Europe US eClinical Solutions Market into Russia, Austria, Finland, Sweden, Turkey, Norway, Poland, Portugal, Romania, Denmark, and other countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US eClinical Solutions Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US eClinical Solutions Market