Agricultural Global Warming Solutions Market

Agricultural Global Warming Solutions Market by Solution Type, Production System, and Region, covering carbon sequestration, emissions reduction, climate-smart farming, sustainable inputs, and carbon markets - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The agricultural global warming solutions market is projected to expand from USD 14.05 billion in 2025 to USD 25.47 billion by 2030, at a CAGR of 12.5% during the forecast period. Market growth is driven by the increasing impact of climate change on crop yields. With the global demand for food rapidly increasing, both federal and state governments are incentivizing sustainable farming practices. Farmers and producers, including the suppliers in the agricultural sector, are increasingly adopting precision agriculture technologies, carbon sequestration, and climate-resilient crops. Farmers and agribusinesses are also investing in renewable energy, efficient irrigation management, and regenerative practices to reduce greenhouse gas emissions. Increased regulatory pressures, collaborative commitments related to sustainability from agribusinesses, and consumer demand for sustainable food mean that the agricultural sector will continue to implement technology into climate-smart agriculture, as it is an increasingly viable option for addressing long-term food security.

KEY TAKEAWAYS

- North America dominated the agricultural global warming solutions market with a share of 31.7% in 2024.

- Climate-smart farming technologies are projected to experience the highest growth rate of 10.5% during the forecast period.

- Crop-based production was the largest production system segment in 2024.

- Leading companies such as Yara International, BASF, Corteva Agriscience, Syngenta AG, Bayer AG, UPL, Cargill, Deere & Company, Indigo Ag, and ICL hold strong positions with extensive solution portfolios and substantial market influence.

- Emerging companies, including Fasal, Regrow, AeroCares, Boonitra, Sencrop, Perennial, Plantix, Trapview, RoboCare, and farmB Digital Agriculture, are gaining traction through innovative digital agriculture platforms and high-potential climate-focused solutions.

As a result of early adoption of sustainable agricultural practices, commitments to R&D investment in the biological sector, and favorable regulatory frameworks that facilitate easy access to innovation, North America holds a significant market share in the agricultural global warming solutions market. The US Environmental Protection Agency (EPA) and provincial regulatory bodies have been increasingly prioritizing the support of biopesticides within their existing regulatory frameworks, and have developed streamlined instructions for biopesticide regulatory approval, leading to faster collaboration times from demonstrated research to commercialization. Major agricultural players, such as Bayer Crop Science, Corteva Agriscience, and UPL, have also been expanding their portfolios of biologicals through mergers, acquisitions, and strategic partnerships. Corteva acquired the Stoller Group in 2022, which has been a long-standing materials supplier to Corteva and will now contribute to Corteva’s biologicals segment. The rising demand for organic produce, along with government pressure to reduce and limit the use of chemical pesticides in agriculture, has positively impacted market conditions. As a result, North America has become a leader in the innovation, adoption, and commercialization of solutions to address global warming in agriculture.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The visual highlights how evolving market dynamics are reshaping revenue models across the agricultural value chain. It illustrates a shift from today’s revenue mix, where core offerings dominate, toward a future landscape in which new use cases, sustainable sourcing models, digital traceability, ecosystem innovation, and strategic partnerships drive a larger share of growth. Agri-tech companies, food and beverage manufacturers with sustainability commitments, and agri-input providers are responding to client imperatives such as deploying digital MRV platforms, promoting climate-smart farming, enabling low-emission supply chains, and integrating climate-smart crops and livestock practices. These actions aim to deliver outcomes for their customers’ customers, including verified carbon credits, improved food security, premium positioning of climate-friendly products, and stronger trust in ethical sourcing. The broader impact includes new carbon-market revenue opportunities, long-term farm productivity, enhanced biodiversity through regenerative practices, and greater alignment with global climate and sustainability goals.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising GHG Emissions from Agrifood Systems

-

Policy Alignment with Global Climate Goals

Level

-

Low Allocation of Climate Finance to Agrifood Systems

-

Fragmentation in Fund Distribution

Level

-

Expanding Green Bond and Blended Finance Models

-

Digital Agriculture and MRV Innovation

Level

-

Policy Incoherence Across Sectors

-

High Transaction Costs in Carbon Verification

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

DRIVERS: Policy Alignment with Global Climate Goals

The agricultural global warming solutions market is driven by robust policy and financial support worldwide. Governments are offering subsidies to support the implementation of sustainable solutions that eliminate agricultural emissions through renewable power irrigation systems and organic farming. Carbon credit programs incentivize farmers to adopt carbon sequestration techniques, such as cover cropping and agroforestry, providing opportunities for farmers to earn an additional income stream through carbon trading. Climate policies (e.g., European Green Deal, US Inflation Reduction Act) will help fund climate-smart agriculture projects at scale in addition to the international commitment made through the Paris Agreement to pressure nations to incorporate lower-carbon solutions into the agricultural sector, thus hastening the market adoption and growth.

RESTRAINTS: Low Allocation of Climate Finance to Agrifood Systems

Limited allocation of climate finance to agrifood systems continues to act as a significant restraint on market progress, restricting the scale and speed at which sustainable farming practices, climate-smart technologies, and resilience-building interventions can be adopted. Despite the sector’s central role in emissions reduction and climate adaptation, funding flows remain disproportionately low compared with other climate-critical industries. This gap limits investment in regenerative agriculture, digital monitoring platforms, low-emission inputs, and climate-resilient supply chains, slowing the transition toward more sustainable production systems. Without expanded financing mechanisms, many stakeholders—particularly smallholder farmers and emerging agri-tech companies—face challenges in deploying climate-aligned solutions at scale.

OPPORTUNITIES: Digital Agriculture and MRV Innovation

With the combination of AI, IoT, and data, the agricultural global warming solutions market can leverage opportunities through data awareness for real-time decision-making for climate-smart farming. AI-based predictive models can provide insight into weather patterns and help determine when to plant in relation to projected temperature increases. Internet of Things sensors and other technologies can monitor crop and soil information (soil moisture, nutrient levels, and crop health) to reduce the waste of these inputs. Data analytics can provide simple and digestible information, helping farmers make timely and accurate decisions to produce higher yields by optimizing inputs, leading to greater efficiency and a reduction in total carbon emissions. For example, the use of smart, implemented irrigation technologies reduces water use by as much as 30%, and precision-based nutrient implementation cuts the GHG emissions associated with fertilizer applications. Technological iterations like these improve productivity, sustainability, and resilience to climate change impacts.

CHALLENGES: High Transaction Costs in Carbon Verification

The initial costs associated with acquiring climate-smart technologies present a major barrier to entry in the agricultural global warming solutions market, especially for small and medium-scale farmers. Equipment for precision irrigation, AI-built monitoring, renewable energy installations, and carbon capture solutions often requires a sizable initial financial commitment, ranging from thousands to millions of dollars, depending on farm size. There are additional barriers, as access to fairly cheap financing and credit facilities is limited in rural areas. Although their paybacks can be fairly quick in some cases, or even generate long-term cost savings or environmental benefits, these technologies often take years to pay back, reducing incentives to adopt them. Without subsidies, low-interest loans, or leasing models designed to enhance access to technologies, the market may remain slow to adopt.

agricultural-global-warming-solutions-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of sustainable fertilizers and nutrient management solutions to reduce emissions and improve soil health. | Lower greenhouse gas emissions, enhanced soil fertility, improved crop yields with reduced environmental impact. |

|

Climate-smart sourcing programs integrating regenerative farming practices across supply chains. | Stronger supply chain resilience, improved farmer income, enhanced sustainability positioning with buyers. |

|

Deployment of precision agriculture machinery and smart farming technologies to optimize input use. | Reduced resource wastage, higher efficiency in farm operations, support for low-carbon agriculture. |

|

Introduction of biologicals, digital platforms, and climate-resilient seeds for crop protection. | Increased resilience to climate change, reduced chemical dependency, better productivity outcomes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The agricultural global warming solutions value chain encompasses a large number of players, ranging from established giants to the newest breed of innovators. The demand side is primarily driven by food producers, agribusinesses, and government agencies seeking to reduce greenhouse gas emissions across agricultural value chains. Large food corporations such as Nestlé, Unilever, and Danone are actively sourcing climate-smart ingredients and requiring Scope 3 emissions reporting from suppliers. Consumer preferences are also shifting toward sustainably grown produce, prompting retailers and processors to invest in traceable, low-carbon sourcing practices. In addition, government bodies and international development agencies are increasingly mandating climate-resilient agriculture in subsidy and procurement frameworks. Emerging markets, particularly in Southeast Asia, Sub-Saharan Africa, and Latin America, are exhibiting strong demand for irrigation efficiency, carbon farming incentives, and climate-resilient crop inputs due to heightened exposure to climate-related shocks. The supply side includes technology providers, input manufacturers, monitoring and verification platforms, and renewable energy solution providers. Companies such as Pivot Bio, UPL Ltd., and Yara International offer sustainable agri-inputs, including biofertilizers and enhanced-efficiency fertilizers, that reduce emissions. Meanwhile, digital agriculture and MRV platforms like Regrow Ag and SustainCERT are key enablers in measuring the impact of low-carbon practices, facilitating access to climate finance. Solar irrigation and off-grid processing providers like SunCulture and Claro Energy are also critical suppliers, addressing mitigation and adaptation simultaneously. Start-ups, SMEs, and climate-focused funds are actively scaling region-specific solutions to service smallholder-dominated regions, especially in Africa and South Asia, where infrastructure limitations require decentralized innovation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

By Solution Type (Carbon Sequestration Solutions, Emissions Reduction Technologies, Climate-smart Farming Technologies, Sustainable Inputs & Practices, and Carbon Markets & MRV Platforms)

The market for agricultural global warming solutions is witnessing growing adoption of carbon sequestration methods, emission reduction technologies, and climate-smart farming practices. Sustainable inputs such as biofertilizers and organic amendments are gaining momentum due to regulatory support and consumer demand for eco-friendly produce. Additionally, digital carbon markets and MRV (Monitoring, Reporting, and Verification) platforms are enabling transparency and incentivizing farmers. The trend is toward integrated solutions, combining technology, sustainable practices, and financial tools to maximize both environmental and economic benefits.

Production System (Crop-based Production Systems, Livestock and Animal Production Systems, and Aquatic & Agroforestry Systems)

Crop-based production systems are increasingly incorporating regenerative practices such as cover cropping, conservation tillage, and precision irrigation. Livestock and animal production systems are focusing on methane reduction technologies, alternative feed, and improved manure management. In aquatic and agroforestry systems, carbon storage potential and biodiversity enhancement are key drivers. Technological innovation, including precision monitoring and biotechnology, is aligning with climate adaptation goals. The shift is toward diversified, resilient production systems that improve productivity while mitigating emissions and enhancing ecosystem sustainability.

REGION

Asia Pacific to be fastest-growing region in agricultural global warming solutions market during forecast period

North America and Europe are leading the adoption of agricultural global warming solutions due to strict climate regulations, strong policy frameworks, and advanced technological infrastructure. Asia Pacific is emerging as a high-growth region, driven by its large agricultural bases, government sustainability initiatives, and increasing climate vulnerability. Latin America is leveraging agroforestry and carbon markets, particularly in Brazil. The Middle East and Africa show gradual adoption, with a focus on water-efficient farming and adaptation practices. Regional disparities highlight opportunities for technology transfer and investment.

agricultural-global-warming-solutions-market: COMPANY EVALUATION MATRIX

The matrix illustrates the competitive landscape of the agricultural global warming solutions market, categorizing companies by market share/rank and product footprint. Firms positioned as Stars, such as Cargill, demonstrate both extensive product offerings and strong market leadership, reflecting their dominant role in advancing climate-smart solutions. Emerging Leaders, like AGCO, are strengthening their presence through innovation and technology-driven strategies, though their overall market share remains moderate. Pervasive Players exhibit wide product portfolios but limited market dominance, while Participants are smaller firms with narrower offerings and lower share. This framework highlights strategic positioning, growth opportunities, and the evolving dynamics of competition.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Indigo Ag, Inc. (US)

- dsm-firmenich (Switzerland)

- Syngenta (Switzerland)

- Bayer Crop Science (Germany)

- Corteva Agriscience (US)

- UPL OpenAg (India)

- Koppert Biological Systems (Netherlands)

- Soil Capital (Belgium)

- Biosfera (US)

- Agreena (Denmark)

- Nori (US)

- CIBO Technologies (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.85 BN |

| Market Forecast in 2030 (Value) | USD 25.47 BN |

| Growth Rate | 12.5% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and RoW |

WHAT IS IN IT FOR YOU: agricultural-global-warming-solutions-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Regional outlook on Asia Pacific |

|

|

| Competitive benchmarking of key players | Detailed profiling of major players, including Yara, Bayer, Corteva, Syngenta, Deere, Nutrien, Cargill, covering revenue streams, climate-smart technology portfolios, carbon initiatives, partnerships, and M&A activities |

|

RECENT DEVELOPMENTS

- June 2025 : Bayer & Kimitec launched two next-gen biologicals—Ambition Complete Gen2 and Ambition Secure Gen2—enhancing nutrient uptake and crop resilience, under review to boost regenerative agriculture solutions globally.

- April 2025 : Indigo Ag announced that Microsoft purchased 60,000 soil carbon credits from Indigo’s largest issuance, reinforcing regenerative agriculture and scaling soil carbon sequestration across 20 million acres in 15 countries.

- October 2024 : Bayer unveiled the Bayer Rice Carbon Program in India, issuing up to 250,000 tonnes of carbon credits from farmers adopting direct-seeded rice and alternate wetting/drying techniques.

- March 2025 : Syngenta and Planet expanded their multi-year collaboration to integrate high-resolution satellite imagery into Syngenta’s Cropwise digital platform, enhancing precision farming globally.

Table of Contents

Methodology

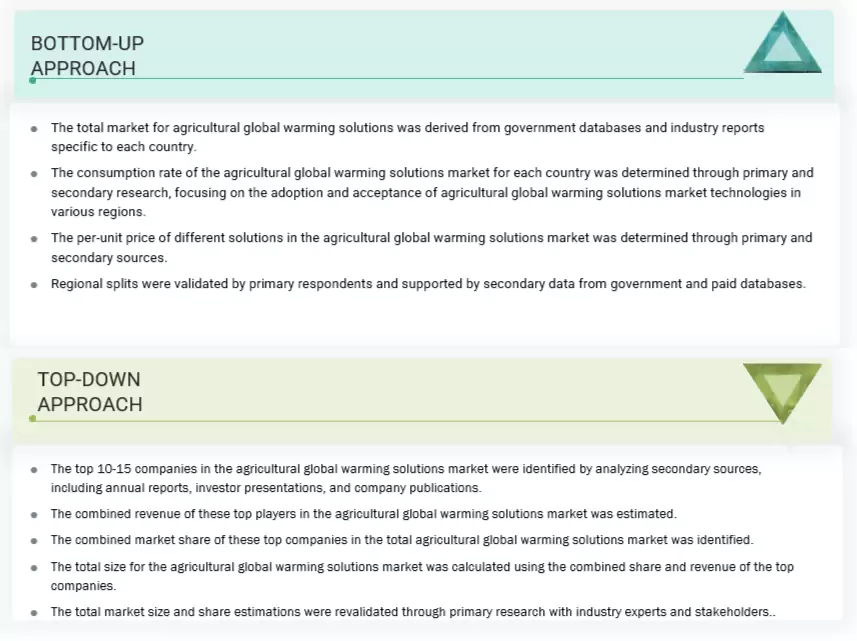

The study involved two major approaches in estimating the current size of the agricultural global warming solutions market. Exhaustive secondary research was conducted to gather information on the market, peer markets, and parent markets. The next step involved validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

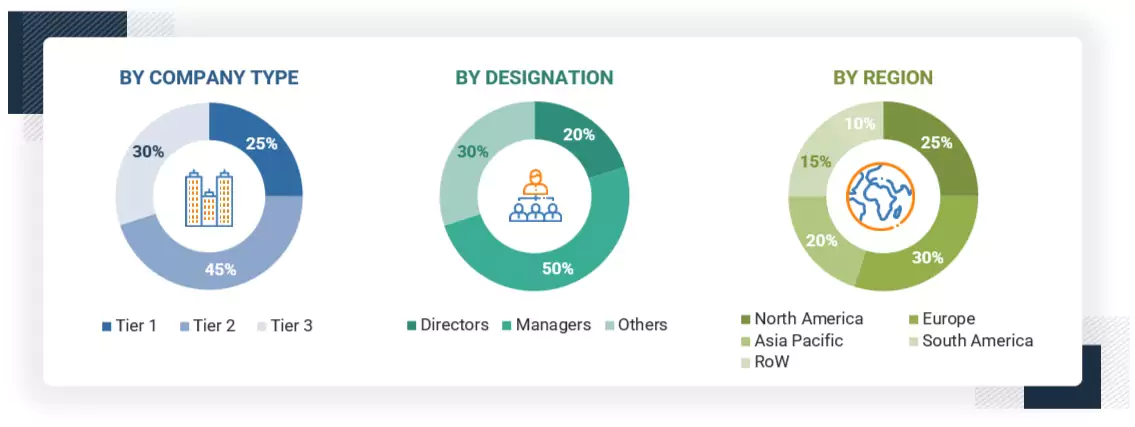

Extensive primary research was conducted after obtaining information regarding the agricultural global warming solutions market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief executive officers (CEOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and key opinion leaders. Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to solution type, production system, and region. Stakeholders from the demand side, including research institutions, universities, and third-party vendors, were interviewed to understand the buyer’s perspective on the services, the current usage of agricultural global warming solutions, and their outlook for the business, which will impact the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per the availability of financial data: Tier 1: Revenue >USD 1 billion; Tier 2: USD 100 million ≤ Revenue ≤ USD 1 billion; Tier 3: Revenue USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Corteva Agriscience (US) |

R&D Expert |

|

Indigo Ag, Inc. (US) |

Sales Manager |

|

DSM-Firmenich (Switzerland) |

Manager |

|

Syngenta (Switzerland) |

Sales Manager |

|

Bayer Crop Science (Germany) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural global warming solutions market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size included the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Agricultural Global Warming Solutions Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall agricultural global warming solutions market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The agricultural global warming solutions market refers to the ecosystem of technologies, products, and practices aimed at mitigating the effects of climate change within agriculture, while improving productivity and sustainability. It encompasses innovations such as precision farming, carbon-smart fertilizers, bio-stimulants, regenerative agricultural practices, renewable energy integration, water conservation technologies, livestock emission reduction methods, and carbon capture approaches. This market addresses rising concerns over greenhouse gas emissions, soil degradation, biodiversity loss, and extreme weather events, providing solutions that enhance crop yield resilience, reduce environmental footprint, and align with global sustainability targets.

Stakeholders

- Agricultural technology companies

- Climate-focused startups and innovators

- Sustainable farming organizations

- Carbon offset and trading firms

- Farmers and agricultural cooperatives

- Environmental non-governmental organizations (NGOs)

- University and research institutions

- Water management and irrigation technology providers

- Government agencies focused on agriculture and climate change

- Financial institutions and green investment funds

- Associations and industry bodies (national/international agricultural associations)

- Concerned government authorities, commercial R&D institutions, and other regulatory bodies

-

Regulatory bodies such as -

- United States Environmental Protection Agency (EPA)

- Food and Agriculture Organization (FAO)

- European Environment Agency (EEA)

- Global Alliance for Climate-Smart Agriculture (GACSA)

Report Objectives

- To determine and project the size of the agricultural global warming solutions market with respect to the solution type, production system, and region in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the agricultural global warming solutions market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product/Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of European agricultural global warming solutions market into key countries

- Further breakdown of the Rest of Asia Pacific agricultural global warming solutions market into key countries

- Further breakdown of the Rest of South American agricultural global warming solutions market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the agricultural global warming solutions market?

The agricultural global warming solutions market is projected to expand from USD 14.05 billion in 2025 to USD 25.47 billion by 2030, at a CAGR of 12.5% during the forecast period.

Which are the key players in the market, and how intense is the competition?

The report profiles key players such as Indigo Ag, Inc. (US), dsm-firmenich (Switzerland), Syngenta (Switzerland), Bayer Crop Science (Germany), Corteva Agriscience (US), UPL OpenAg (India), Koppert Biological Systems (Netherlands), Soil Capital (Belgium), Biosfera (US), Agreena (Denmark), Nori (US), CIBO Technologies (US), Regrow Ag (US), CarbonSpace (Ireland), and Planet Labs (US).

Which region is projected to account for the largest share of the agricultural global warming solutions market?

North America is projected to hold the largest market share, driven by strong government support, significant agri-tech investment, supportive sustainable agriculture infrastructure, combined public–private funding, and rapid adoption of smart farming technologies, making the region a global leader in sustainable agriculture solutions.

What kind of information is provided in the company profiles section?

Company profiles include a comprehensive business summary, covering business segments, financial performance, geographic presence, revenue distribution, and business revenue breakdown. They also highlight product portfolios, key milestones, and expert analyst insights.

What are the factors driving the agricultural global warming solutions market?

Key growth drivers include rising food demand, climate change impacts, advancements in AI- and IoT-enabled sensing technologies, expanding precision farming/CSA practices, government incentives, and the need for sustainable, resource-efficient agricultural practices that boost productivity while reducing environmental impacts.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Agricultural Global Warming Solutions Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Agricultural Global Warming Solutions Market