Electromechanical Actuators in Aircraft Market Size, Share & Analysis, 2025 To 2030

Electromechanical Actuators in Aircraft Market by Application (Flight Control, Fuel distribution, Cabin Actuation, Door, Landing Gear), Mechanism Type (Linear, Rotary), Motor Torque (<25, 25-100,100-300,>300 Nm), Platform, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Global Electromechanical Actuators in Aircraft Market is estimated at USD 0.58 billion in 2025 and projected to reach USD 0.80 billion by 2030, at a CAGR of 6.9%. The procurement of electromechanical actuators in aircraft is projected to increase from 40.3 thousand units in 2025 to 58.8 thousand units by 2030. The Global Electromechanical Actuators in Aircraft Industry is driven by factors such as the shift toward more-electric aircraft, demand for lightweight and efficient systems, reduced hydraulic dependency, stricter safety regulations, and rising adoption in commercial, military, and UAV platforms to enhance reliability and performance.

KEY TAKEAWAYS

-

BY TYPEThe global electromechanical actuators in aircraft market is segmented by platform into narrow-body aircraft, wide-body aircraft, regional transport aircraft, business jets, commercial helicopters, and light & ultralight aircraft. Fleet modernization and efficiency targets to drive the demand for electromechanical actuators for the narrow-body aircraft segment.

-

BY AIRCRAFT TYPEThe global electromechanical actuators in aircraft market, by application, comprises Flight Control Surfaces, Fuel Distribution, Cabin Actuation, Doors, Landing Gear, and Others. The flight control surface segment is driven by increasing demand for precise, efficient, and lightweight electromechanical actuators that enhance maneuverability, reduce hydraulic reliance, and support next-generation more-electric aircraft architectures.

-

BY APPLICATIONThe global electromechanical actuators in aircraft market, by type, comprises linear actuators and rotary actuators, with linear actuators having the dominant share, primarily driven by the rising adoption of more-electric aircraft, demand for precise flight control, reduced hydraulic dependence, and enhanced efficiency in landing gear and braking systems.

-

BY REGIONBased on region, the market is divided into North America, Europe, the Asia Pacific, the Middle East & Africa, and Latin America. North America holds the largest market share due to its heavy regulations, high degree of technological innovation, the presence of prominent manufacturers, and strong infrastructure.

-

COMPETITIVE LANDSCAPEMajor players in the global electromechanical actuators in aircraft market have adopted both organic and inorganic strategies, including partnerships and acquisitions. For example, Honeywell and Liebherr collaborated to develop next-generation EMAs for flight control and landing gear systems.

The global electromechanical actuators in aircraft market was valued at USD 0.54 billion in 2024 and is projected to grow from USD 0.58 billion in 2025 to USD 0.80 billion by 2030, at a CAGR of 6.9% during the forecast period.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

A key trend in this market is the rising electrification in aviation, which has prompted designers to focus on electrically powered alternatives to replace hydraulic and pneumatic systems. Electromechanical actuators offer significant advantages in terms of energy efficiency, system integration, maintenance, and control.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing electrification of aircraft and R&D in more electric aircraft (MEA)

-

Rising demand of electromechanical actuators in drone industry

Level

-

Stringent government regulations

-

Design integration challenges with legacy airframe architecture

Level

-

Development of electric actuation architecture for urban air mobility (UAM)

-

Electrification of future aircraft platforms

Level

-

Technological complexities

-

Thermal management and power density constraints in compact airframe spaces

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing electrification of aircraft and R&D in more electric aircraft (MEA)

Electrification of aircraft and R&D in More Electric Aircraft (MEA) accelerate EMA adoption, offering lightweight designs, higher energy efficiency, reduced hydraulic reliance, and improved operational reliability across commercial, defense, and urban air mobility platforms.

Restraint: Stringent government regulations

Stringent government regulations and aerospace certification standards increase costs and development timelines, requiring extensive testing and validation, which limit faster commercialization and pose barriers for new entrants in the EMA market.

Opportunity: Development of electric actuation architecture for urban air mobility (UAM)

Electromechanical actuation systems present growth opportunities in Urban Air Mobility (UAM), where lightweight, digitally controlled actuators are vital for eVTOL aircraft, enabling advanced autonomy, precision, and safer next-generation air transport solutions.

Challenge: Technological complexities

Technological complexities in integrating EMAs for critical aircraft systems—such as torque management, redundancy, heat dissipation, and durability—demand significant R&D investments, advanced materials, and strong OEM-supplier collaboration to ensure safety and performance.

Electromechanical Actuators in Aircraft Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies electromechanical actuators for flight control surfaces and engine systems, enabling precise and efficient motion control | Improves fuel efficiency, reduces maintenance costs, and enhances reliability compared to hydraulic systems |

|

Provides EMAs for primary and secondary flight control systems in commercial and defense aircraft | Enhances safety and control, supports “More Electric Aircraft” architecture, and reduces system complexity |

|

Develops compact and lightweight actuators for braking, landing gear, and cabin applications | Enables weight savings, higher energy efficiency, and improved performance under demanding operating conditions |

|

Manufactures rugged electromechanical actuators for mission-critical military and aerospace applications | Offers high durability, extended service life, and resilience in extreme operating environments |

|

Designs EMAs integrated into landing gear and flight control systems for commercial and regional aircraft | Provides precision motion, reduced hydraulic dependency, and improved overall aircraft efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent players in the market include component manufacturers, subsystem integrators, MROs, and OEMs. Key stakeholders include EMA producers such as Moog, Parker, and Safran, as well as service providers and retrofit specialists supporting commercial and business aviation. End users include aircraft OEMs, airlines, eVTOL developers, and UAV manufacturers. These entities collectively shape the EMA ecosystem through product development, maintenance, and operational deployment.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electromechanical Actuators in Aircraft Market, By Platform

The global electromechanical actuators in aircraft market is segmented by platform into narrow-body aircraft, wide-body aircraft, regional transport aircraft, business jets, commercial helicopters, and light & ultralight aircraft. Efforts to retrofit and develop platforms have seen strong growth in narrow-body aircraft, with electromechanical actuators replacing traditoinal hydraulics in primary and secondary flight control areas.

Electromechanical Actuators in Aircraft Market, By Application

The global electromechanical actuators in aircraft market by application comprises flight control surfaces, fuel distribution, cabin actuation, doors, landing gear, and others. The flight control surface segment is driven by increasing demand for precise, efficient, and lightweight electromechanical actuators that enhance maneuverability, reduce hydraulic reliance, and support next-generation more-electric aircraft architectures.

Electromechanical Actuators in Aircraft Market, By Mechanism Type

The global electromechanical actuators in aircraft market by type comprises linear actuators and rotary actuators, with linear actuators having the dominant share, mainly driven by rising adoption of more-electric aircraft, demand for precise flight control, reduced hydraulic dependence, and enhanced efficiency in landing gear and braking systems.

Electromechanical Actuators in Aircraft Market, By Torque

Based on motor torque, the market is segmented into < 25 Nm, 25 - 100 Nm, 100 - 300 Nm, and > 300 Nm. The < 25 Nm segment will drive the market, with the growing adoption in UAVs, cabin actuation, and lightweight systems where compact, efficient, and precise electromechanical actuators enable energy savings and enhanced operational performance.

REGION

Latin America to be the fastest-growing region in global electromechanical actuators in aircraft market during forecast period.

The Latin American market is expected to grow at the highest CAGR, driven by the rising air traffic, demand for fleet modernization, the presence of low-cost carriers in LATAM countries, and investments in new generations of aircraft.

Electromechanical Actuators in Aircraft Market: COMPANY EVALUATION MATRIX

Participants have niche product/solution offerings that have started gaining a foothold in the market but lack strong business strategies. They require more time to gain significant market traction. Saab AB (Sweden), Hanwha Group (South Korea), Faulhaber Group (Germany), and TAMAGAWA SEIKI Co., Ltd. (Japan) are considered participants in this study.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Electromechanical Actuators in Aircraft Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.54 Billion |

| Market Forecast in 2030 (Value) | USD 0.80 Billion |

| Growth Rate | CAGR of 6.9% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Units (Thousand) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Electromechanical Actuators in Aircraft Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at the regional/global level to gain an understanding of the market potential of each country |

| Emerging Leader | Additional Company Profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted undertanding on the total addressable market |

RECENT DEVELOPMENTS

- May 2025 : Vertical Aerospace deepened its collaboration with Honeywell through a long-term agreement to certify key systems for its VX4 air taxi. The deal, potentially worth up to USD 1 billion over the next decade, focuses on aircraft management and flight control systems, including Honeywell’s compact fly-by-wire technology. These systems are being certified through the UK Civil Aviation Authority in coordination with the European Union Aviation Safety Agency.

- May 2025 : Moog entered into an agreement with Lynden Air Cargo to upgrade its fleet of Hercules aircraft. The collaboration focused on enhancing the performance and reliability of the aircraft through the use of advanced actuation solutions, thereby contributing to improved operational efficiency.

- Dec 2024 : Woodward signed a definitive agreement to acquire Safran’s North America electromechanical actuation business—including IP, ops assets, talent, and long-term customer agreements for Horizontal Stabilizer Trim Actuation (HSTA) systems used on the Airbus A350, plus other EMA and ECU products. The transaction is expected to close in mid-2025.

- July 2024 : Electra.aero chose Honeywell to supply flight control computers and electromechanical actuators for its nine-passenger hybrid-electric short take-off and landing (eSTOL) aircraft. Honeywell’s compact fly-by-wire systems and high-power-density actuators will enable efficient, hydraulics-free operations. Additionally, Honeywell made a strategic investment in Electra to support the program’s development.

- July 2024 : At the Farnborough International Airshow, Moog announced a strategic ten-year collaboration with Finnair and Finnair Technical Services Limited. This partnership focuses on providing support and services for Finnair’s aircraft, enhancing maintenance capabilities and operational efficiency.

Table of Contents

Methodology

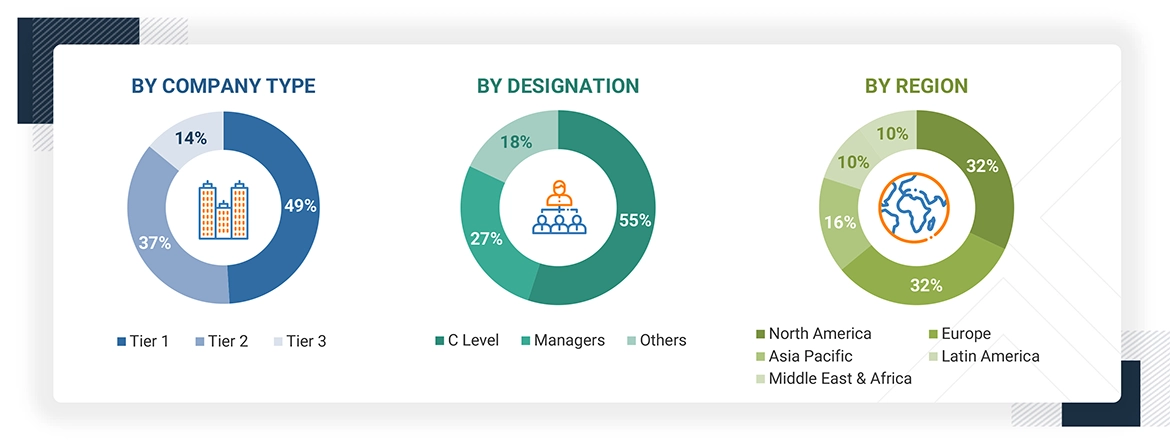

The study involved four major activities in estimating the current size of the electromechanical actuators in aircraft market. Exhaustive secondary research collected information on the market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the electromechanical actuators in aircraft market.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. The secondary sources included government sources, such as SIPRI; corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after secondary research was acquired on the electromechanical actuators in aircraft market scenarios. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, which includes Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

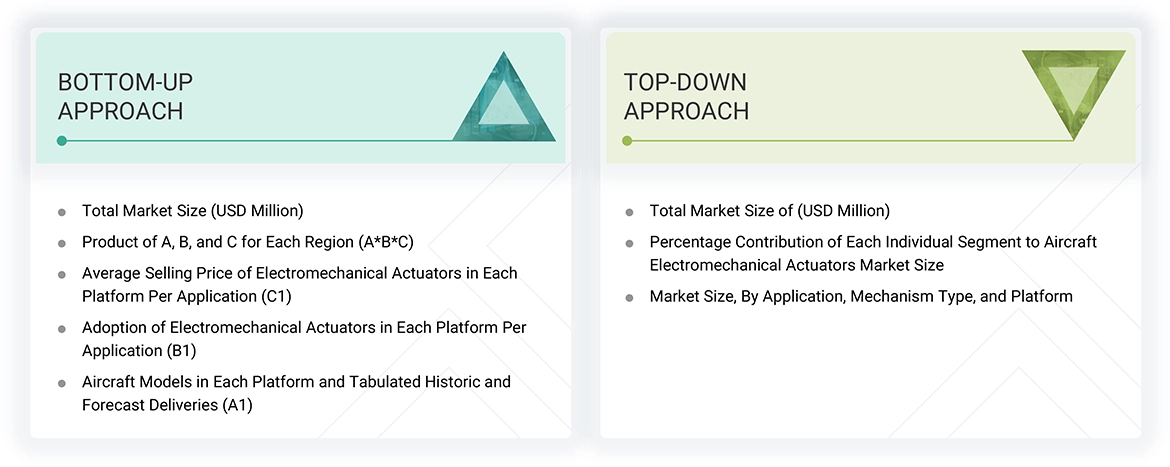

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the electromechanical actuators in aircraft market. The research methodology used to estimate the market size included the following details.

- Key players in the electromechanical actuators in aircraft market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders, such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the electromechanical actuators in aircraft market.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Electromechanical Actuators in Aircraft Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

The electromechanical actuators in aircraft market is designed to carry combat infantry squads to battlefields and provide them with direct fire support. They offer a high level of protection to defense personnel against Improvised Explosive Devices (IEDs), land mines, and indirect enemy fire. These vehicles may be equipped with weapons of different types, calibers, and ranges.

The Electromechanical Actuators in Aircraft Market includes producing and procuring missiles within APAC countries for strategic and tactical applications. The market is segmented by type, component, speed, end user, and region. By type, the Asia-Pacific (APAC) market is divided into surface-to-surface, surface-to-air, air-to-air, air-to-surface, and subsea-to-surface segments.

Key Stakeholders

- Manufacturers of Electromechanical Actuators for Aircraft

- Actuator Component Manufacturers

- Aircraft Manufacturers

- Distributors of Actuators

- Aircraft Actuator Subcomponent Manufacturers

- Technology Support Providers

- Related Research Bodies

- Aircraft Actuators System Integrators

- Research Organizations

- Investors and Venture Capitalists

- R&D Companies

Report Objectives

- To define, describe, and forecast the size of the electromechanical actuators in aircraft market based on platform, application, mechanism type, motor torque, and region

- To forecast the size of the various segments of the electromechanical actuators in aircraft market based on following regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets1 concerning individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies, such as acquisitions, product launches, contracts, partnerships, expansion, and agreements adopted by key players in the market

- To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies2

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the electromechanical actuators in aircraft market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the electromechanical actuators in aircraft market

Key Questions Addressed by the Report

Which are the major companies in the electromechanical actuators in aircraft market? What are their major strategies?

Key players in the market are Honeywell International Inc. (US), AMETEK, Inc. (US), Curtiss-Wright Corporation (US), and Liebherr Group (Germany). These players have resorted to contracts to strengthen their market presence.

What are the drivers and opportunities for the electromechanical actuators in aircraft market?

Key drivers of the electromechanical actuators (EMA) market include the aerospace industry’s shift toward more electric aircraft, demand for lightweight and energy-efficient systems, reduced maintenance requirements, increased UAV adoption, and environmental regulations pushing hydraulic system replacements with cleaner, all-electric alternatives across defense, commercial aviation, and industrial automation sectors.

What are the emerging trends in electromechanical actuators in aircraft market?

An emerging trend is a key transition from hydraulic to electric actuation systems, driven by the industry’s pursuit of More Electric Aircraft (MEA) to enhance efficiency and reduce maintenance. Additionally, advancements in materials and miniaturization are enabling the development of lighter, more compact actuators, which contribute to overall weight reduction and improved fuel economy. Integrating smart technologies, such as embedded sensors and IoT connectivity, facilitates real-time health monitoring and predictive maintenance, thereby increasing reliability and operational uptime. Moreover, the growing demand for electric and hybrid-electric aircraft, including urban air mobility solutions, is accelerating the adoption of EMAs due to their compatibility with electric power systems.

Which region is projected to account for the largest share in the next five years?

North America is projected to account for the largest share from 2025 to 2030, showcasing strong demand for electromechanical actuators in aircraft market in the region. .

What is the projected CAGR of the electromechanical actuators in aircraft market?

The electromechanical actuators in aircraft market is projected to grow at a CAGR of 6.9% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electromechanical Actuators in Aircraft Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electromechanical Actuators in Aircraft Market