Asia Pacific Food Encapsulation Market

Asia Pacific Food Encapsulation Market by Technology (Microencapsulation, Nanoencapsulation, Hybrid Technology), Method (Physical, Chemical, Physico-chemical), Shell Material (Polysaccharides, Proteins, Lipids, Emulsifiers), Core Material, Application, and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

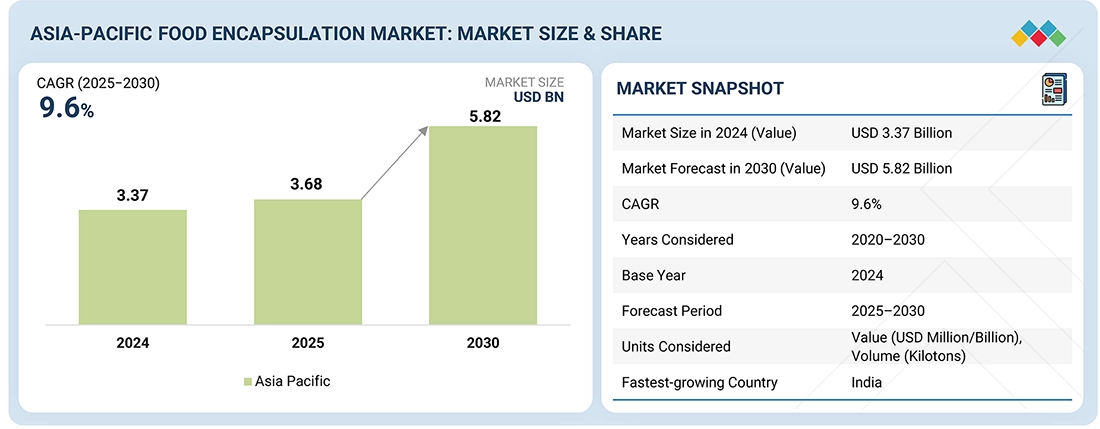

The Asia Pacific food encapsulation market is projected to be valued at USD 3.68 billion in 2025, and will grow to USD 5.82 billion by 2030, growing at a CAGR of 9.6%. The demand for Asia Pacific food encapsulation market is increasing, fueled by fortification and functional foods, an expanding middle class, and the increasing focus on preventive health care across the region. Encapsulation techniques are used primarily to fortify ingredient stability, improve shelf-life and preservation, and release sensitive food components like vitamins, minerals, probiotics, nutraceuticals, flavors, and organic acids. Major future markets for the technology will be China, Japan, South Korea, and India, where there are huge pools of consumers, more health concerns, and high growth in beverage, infant nutrition, dietary supplements, and bakery products.

KEY TAKEAWAYS

-

By CountryChina was the leading revenue-generating country in 2024, accounting for a 35.8% share of the total revenue.

-

By ApplicationThe dietary supplements segment is projected to experience the highest CAGR by 8.7%.

-

By TechnologyMicroencapsulation dominated in 2024, with a 72.5% share.

-

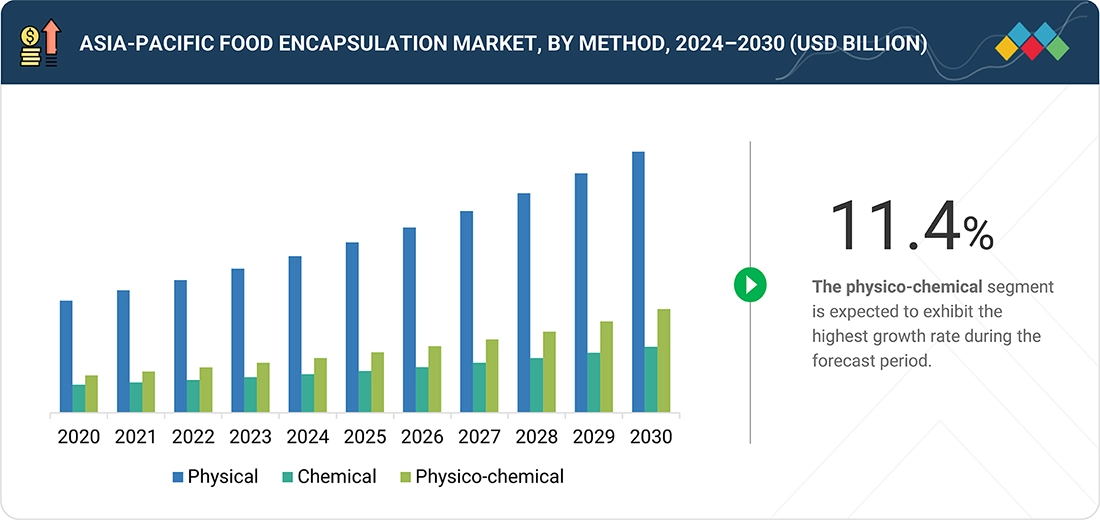

By MethodPhysico-chemical food encapsulation is set to emerge as the fastest-growing method.

-

By Core MaterialBy core material, food & beverage ingredients are projected to be the fastest-growing channel.

-

Competitive Landscape - Key PlayersKey players include Yakult Honsha Co., Ltd., Danone, Nestlé, Morinaga Milk Industry Co., Ltd., and Inner Mongolia Yili Industrial Group, supported by strong brand equity and regional distribution.

-

Competitive Landscape - StartupsCompanies such as Sanyuan Foods, Bright Dairy & Food, Sanzyme Biologics Pvt. Ltd., AceBiome, and By-Health Co., Ltd. are gaining traction through targeted food encapsulation solutions for functional foods, fortified dairy, and nutrition-focused products, emphasizing cost efficiency and local regulatory alignment.

The Asia Pacific food encapsulation market is projected to be worth USD 5.82 billion by 2030, growing at a CAGR of 9.6%. Rising consumption of functional foods, fortified beverages, and nutrition products targeting digestive health, immunity enhancement, and preventive health care should further spur market growth. Food encapsulation technologies are widely employed in food & beverage products, dietary supplements, infant nutrition, and animal nutrition so as to prevent ingredients from decaying because they have a longer shelf life, manipulate their flavor, and control the release of nutrients.

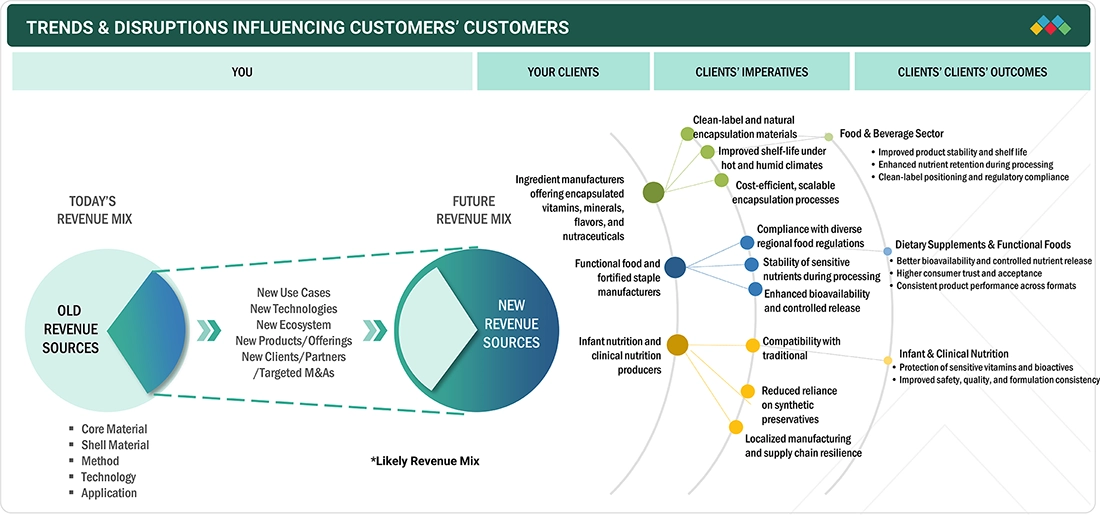

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Asia Pacific market is experiencing significant changes due to shifting consumer expectations, evolving regulatory standards, and new performance priorities throughout the food & beverage value chain. Food manufacturers are increasingly adopting encapsulation technologies to enhance product stability and improve digestibility, particularly in tropical climates. This shift is largely driven by rising consumer demand for functional foods, fortified beverages, and nutrition-enriched products. Consumers are opting for clean-label products made from natural ingredients like polysaccharides and proteins, seeking alternatives to synthetic preservatives. Major growth objectives within the food industry are focused on meeting these consumer demands for non-refrigerated, long-lasting products while also enhancing the bioavailability of vitamins, minerals, and bioactive compounds. This focus is particularly important in high-volume markets such as China, India, Indonesia, and Southeast Asia. At the consumer level, both retailers and consumers are looking for safer, more stable, nutritionally balanced, and clearly labeled food products that are also flavorful and consistent. Additionally, sustainability has become a key factor influencing purchasing decisions, significantly affecting long-term branding within the Asia Pacific food sector. As the market continues to evolve, issues such as waste reduction and efficient resource conservation will play an increasingly crucial role in shaping the future landscape of food and beverage offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for fortified and functional food products

-

Expansion of packaged and processed food consumption

Level

-

High production cost of encapsulation technologies

-

Limited technical expertise among small food manufacturers

Level

-

Growing adoption of encapsulated nutraceutical ingredients

-

Increasing investment in food processing infrastructure

Level

-

Maintaining stability under diverse climatic conditions

-

Regulatory variation across Asia Pacific countries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for fortified and functional food products

The Asia Pacific region is witnessing increasing demand for fortified and functional foods due to increased health awareness, urbanization, and changing dietary habits. Some of the countries, such as China, India, Japan, and South Korea, are reporting greater consumption of foods fortified with vitamins, minerals, probiotics, and omega-3 fatty acids. Encapsulation within foods enables the protection of the sensitive ingredients from heat, moisture, and oxidation, while also allowing for controlled release and improved bioavailability. This is more significant in the case of processed foods, dairy products, beverages, and infant nutrition, where nutrient stability directly affects product quality and consumer trust.

Restraint: High production cost of encapsulation technologies

In the Asia Pacific region, food encapsulation technologies are restricted by high capital and operational cost factors related to their recent advances, such as spray drying, fluidized bed coating, and nanoencapsulation. Not many small-scale and medium-scale food manufacturers in these countries, especially in the Asia Pacific developing economies, have access to specialized equipment, and they lack the optimum experience in formulation technology. This has therefore kept the encapsulated ingredient penetration pretty patchy across the region and, despite a sizable increase in demand, has limited market growth.

Opportunity: Growing adoption of encapsulated nutraceutical ingredients

Rapid-growing nutraceutical and dietary supplement sectors within the Asia Pacific region bring a perfect opportunity for food encapsulation, allowing bioactive ingredients like probiotics, polyphenols, carotenoids, and omega-3 oils to be loaded effectively into mainstream food products without degradation of taste and stability. Demand for such foods is being driven by increasing outlay on preventive health and aging populations in markets like Japan, China, and Australia.

Challenge: Regulatory variation across Asia Pacific countries

Manufacturers in the Asia Pacific are often faced with challenging circumstances involving extreme environmental conditions, such as high temperatures and high humidity, which impact the performance of encapsulated ingredients during storage and distribution. There are varied food regulations, permissions for ingredients, and labeling requirements in each country, which further add to the compliance challenge. Maintaining identical consistency of product performance, while adhering to country-specific regulations, is therefore an important operational challenge for food providers in the region.

ASIA PACIFIC FOOD ENCAPSULATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Encapsulated bioactive ingredients in fermented food & beverage formulations to improve stability during processing and distribution | Enhanced ingredient stability, consistent functional performance, improved shelf life |

|

Encapsulation of vitamins, minerals, and functional lipids in dairy and plant-based functional foods | Improved nutrient protection, uniform dispersion, clean-label fortification |

|

Encapsulated micronutrients and flavors for fortified foods, infant nutrition, and ready-to-consume products | Better nutrient retention, controlled release, sensory consistency |

|

Use of encapsulated nutrients in dairy-based functional foods to maintain efficacy under heat and storage conditions | Improved product stability, enhanced bioavailability, longer shelf life |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific food encapsulation market ecosystem is critically structured around a combination of a company-ingredient producer-technology developer trio, together with food processors, regulatory sectors, and a distribution network. The likes of Ajinomoto, Morinaga, and Lonza are all valued within the industry due to the formulation capabilities offered and the availability of suitable carriers and processing technologies to enhance the stability and controlled release of various ingredients. On the demand side, encapsulation companies such as Yakult, Amul, Danone, and Nestlé underpin their food processing cases through the creation of functional foods, dairy products, and nutritional formulations using ingredients that have been encapsulated according to traditional eating habits within the respective regions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Food Encapsulation Market, by Core Material

Vitamins and minerals make up a significant portion of the food encapsulation market in the Asia Pacific region, particularly micronutrients. These elements are commonly used for fortifying foods, food supplements, and infant nutrition. Governments in India, China, Indonesia, and throughout Southeast Asia are promoting programs focused on preventing micronutrient deficiencies, including those for iron, iodine, vitamin D, and vitamin A. Encapsulating these sensitive nutrients protects them from heat, moisture, and oxidation during food processing and storage. This process helps maintain the quality of the nutrients and ensures their effective delivery in food products. Leading food manufacturers are increasingly using encapsulation technologies to produce neutral-tasting foods that meet nutrient content claims. As urban areas in Asia increasingly rely on fortified cereal products, supplements, and functional foods, the demand for encapsulated vitamin and mineral systems has grown. With a heightened awareness of nutritional ingredients, fortified micronutrients provide a long-lasting solution that complies with strict regulations. This approach supports the needs of large vegetarian populations across the region.

Asia Pacific Food Encapsulation Market, by Shell Material

Shells and related polysaccharides hold a significant share in the Asian food encapsulation market due to their natural properties, cost efficiency, and regulatory compliance. The compatibility of these ingredients with specific food types ensures that chosen starches, gums, alginates, and cellulose derivatives effectively represent natural or plant-based materials in recipes. Originally utilized as polysaccharides, shells also serve to protect food from environmental factors and extend the localized release of ingredients at controlled times. These characteristics make them ideal for enriched food formulations and biologically active products or functional ingredients. Additionally, the use of local agricultural resources enhances convenience, providing scalability similar to what is found in countries like China, India, and across Southeast Asia. Since these polysaccharide shells integrate easily into existing food processing methods and align with the preferences of modern consumers who favor clean labeling, their popularity is further enhanced. It is therefore predicted that, alongside these two trends, the expanding clean-label and plant-based food markets will significantly support the adoption of products made from polysaccharide shells.

Asia Pacific Food Encapsulation Market, by Method

Among physical encapsulation techniques, the most commonly used methods in the Asia-Pacific market are favored for their industrial scalability, cost-efficiency, and versatile applications across various food categories. Local food processors prefer these methods because they can be easily automated with minimal infrastructure modifications. High-potential applications include the large-scale production of encapsulating innovations such as vitamins, minerals, controlled fats, antioxidants, flavors, and bioactives, all of which enhance yield and stability. For many cost-conscious developing countries in the Asia Pacific region, physical encapsulation methods represent the best compromise between effectiveness and cost. This helps manufacturers achieve significantly longer shelf lives, with improved uniformity and dosage consistency in fortified and functional food items like dietary supplements. These techniques demonstrate great potential across a wide range of solid and semi-solid food products. Clearly, the demand for production lines tailored to these effective physical encapsulation methods far exceeds that of other techniques, as they offer better efficiency and scalability.

Asia Pacific Food Encapsulation Market, by Technology

In the entire Pacific Rim, conventional encapsulation technologies dominate the market. Over time, these technologies have proven to be reliable and mostly biocompatible, backed by substantial manufacturing capabilities in Europe. The application of micronutrients—along with stabilizers for flavors and functional ingredients—in processed foods and nutritional products is one of the most common uses for these technologies. Older food encapsulation methods are preferred due to their predictability, lower validation costs, and compliance with food safety standards recommended by various Asia Pacific countries. Additionally, these technologies offer excellent flexibility and compatibility with different food matrices and varying climatic conditions, which is especially valuable in tropical, humid regions. While a few organizations are exploring innovative advancements in this field, the commercial landscape is largely skewed in favor of adopting well-established systems that ensure quality control while optimizing costs. Given the strong market potential for developing fortified and functional foods, traditional encapsulation effectively meets the need for scalable technology, stability, and adherence to regulatory constraints in bulk food production.

Asia Pacific Food Encapsulation Market, by Application

Encapsulation leads the functional food landscape, slightly ahead in Asia Pacific. Market growth is associated with increasing health awareness and consumption of fortified nutrition. Presently, heightened health awareness has led to an increase in demand for regular food products with added benefits to nutrition, such as immunity, digestive health, and maintenance of a metabolic balance. With encapsulation, sensitive additives are added to functional foods without any deterioration of presentation, texture, or shelf-life. Rapidly growing urban middle-class consumers in China, India, Japan, and Southeast Asia are driving demand for fortified staples, dairy products, and nutritionally enriched snacks. Variability in flavor, thickness, coloring, shelf-life, price, nutrient ratio, label declaration, and function within intervention attributes is seen among functional foods. Functional foods surpass dietary supplements by being consumed more frequently. Fortification of food carriers fosters the frequency since every time one consumes food, one is supplemented with capsules of nutritional value. The market is in a growth spurt and is heading mobile, predominantly on account of an easy-on-wallet habit of healthy eating in this part of the world that is never going to perish easily.

REGION

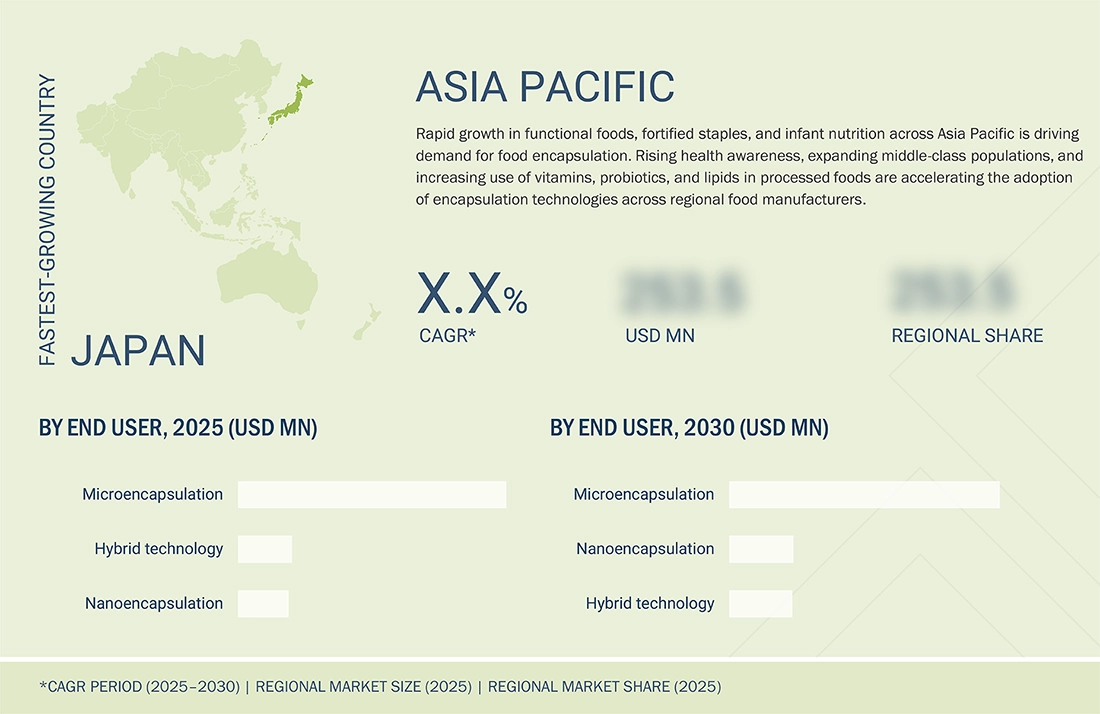

Japan is set to be the fastest-growing country Asia Pacific food encapsulation market

Japan has witnessed substantial growth in the Asia Pacific food encapsulation market, attributed to its advanced food processing ecosystem and a pronounced consumer focus on health and longevity. The country comprises a robust framework for functional and fortified foods, which nurtures innovation in nutrition through effective regulatory practices. Japanese food companies are actively investing in encapsulation technologies to enhance ingredient protection, ensure precise delivery, and standardize product characteristics. The increasing elderly demographic, coupled with an elevated awareness of preventive health care, is propelling the demand for improved nutritional offerings. This cultural dedication to quality, safety, and scientific validation has resulted in the widespread acceptance of encapsulated food ingredients. Furthermore, research initiatives from domestic firms are expanding; many are collaborating with ingredient suppliers to devise application-specific solutions. These dynamics position Japan as a pivotal growth driver within the Asia Pacific food encapsulation market.

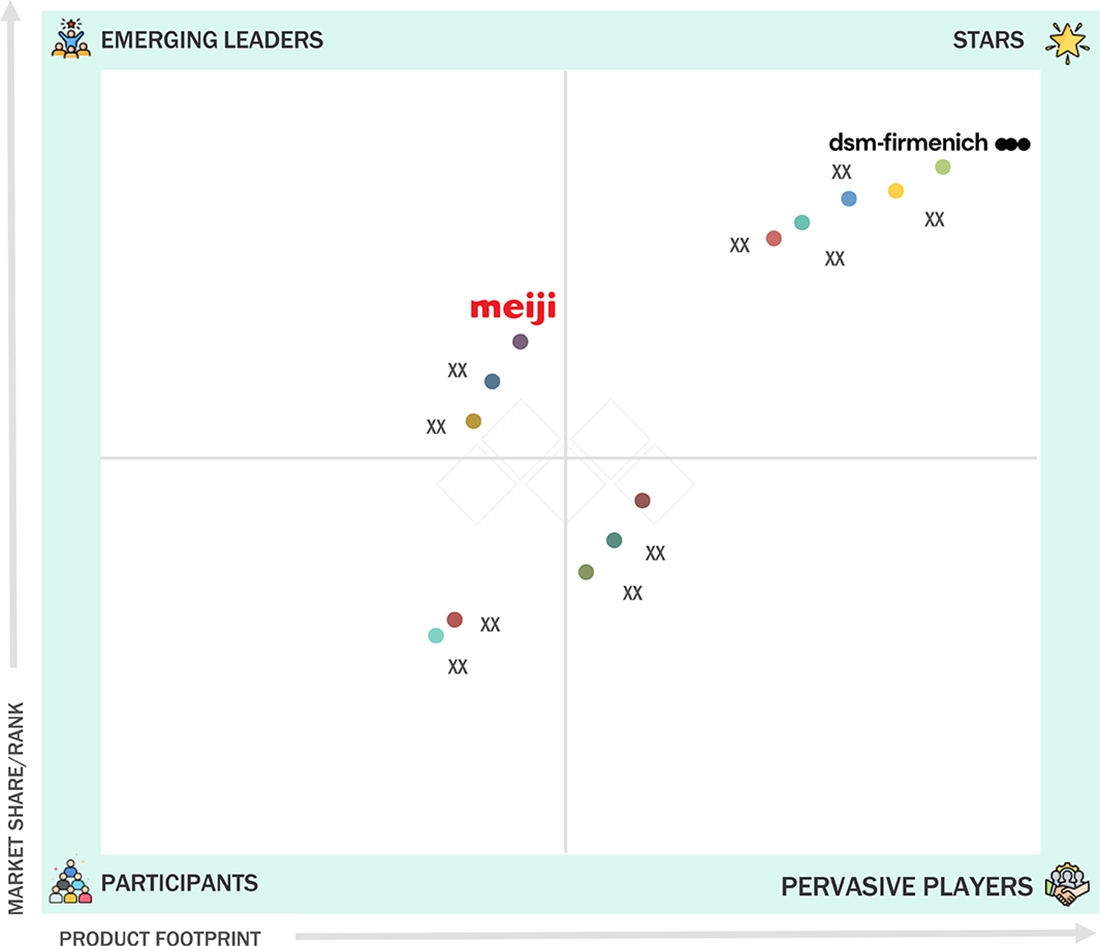

ASIA PACIFIC FOOD ENCAPSULATION MARKET: COMPANY EVALUATION MATRIX

The Asia Pacific food encapsulation market operates within a consolidated environment characterized by limited differentiation among key players due to their respective product footprints and market shares. Prominent market participants, recognized as "Stars," possess global significance, as they lead in both commodities and technology within this domain, with substantial penetration in the region. The encapsulation technologies are witnessing various transformations, facilitating high-volume manufacturing and encompassing a wide spectrum of applications, ranging from functional foods and dietary specifications to infant nutrition. Such advancements enable these organizations to yield significant returns by investing in niche areas of product formulation science, shelf-life enhancement, and compatibility with diverse clean matrices and encapsulation systems. DSM-Firmenich is a star player in this market. The second quadrant delineates regional food manufacturers that have evolved into substantial global entities in the field of encapsulation. These companies are expanding their capabilities and organizing networks around their increasingly extensive functional food portfolios while progressively adopting advanced delivery systems. Organizations—regardless of their size—positioned within the developmental sector predominantly concentrate on niche products or adhere to country-specific operational strategies, often employing cost-effective bulk encapsulation methods. Conversely, the alignment with the other column reflects a notable shift towards highly valuable encapsulation solutions within the Asia Pacific region. In this context, attributes such as technological profundity, scalability, and application diversity are emerging as critical factors that define the competitive landscape, moving beyond mere quantitative volume considerations. Meiji is an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Yakult Honsha Co., Ltd. (Japan)

- Morinaga Milk Industry Co., Ltd. (Japan)

- Meiji Holdings Co., Ltd. (Japan)

- Ajinomoto Co., Inc. (Japan)

- Kirin Holdings Company, Limited (Japan)

- Danone Asia Pacific (Regional)

- Nestlé Asia Pacific (Regional)

- Inner Mongolia Yili Industrial Group Co., Ltd. (China)

- China Mengniu Dairy Company Limited (China)

- By-Health Co., Ltd. (China)

- H&H Group (China / Hong Kong)

- Amul (Gujarat Cooperative Milk Marketing Federation) (India)

- Sanzyme Biologics Pvt. Ltd. (India)

- Lactalis Asia (Regional)

- FrieslandCampina Asia (Regional)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.37 Billion |

| Market Forecast in 2030 (Value) | USD 5.82 Billion |

| Growth Rate | CAGR of 9.6% from 2025–2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Country Covered | China, India, Japan, Australia & New Zealand, Rest of Asia Pacific |

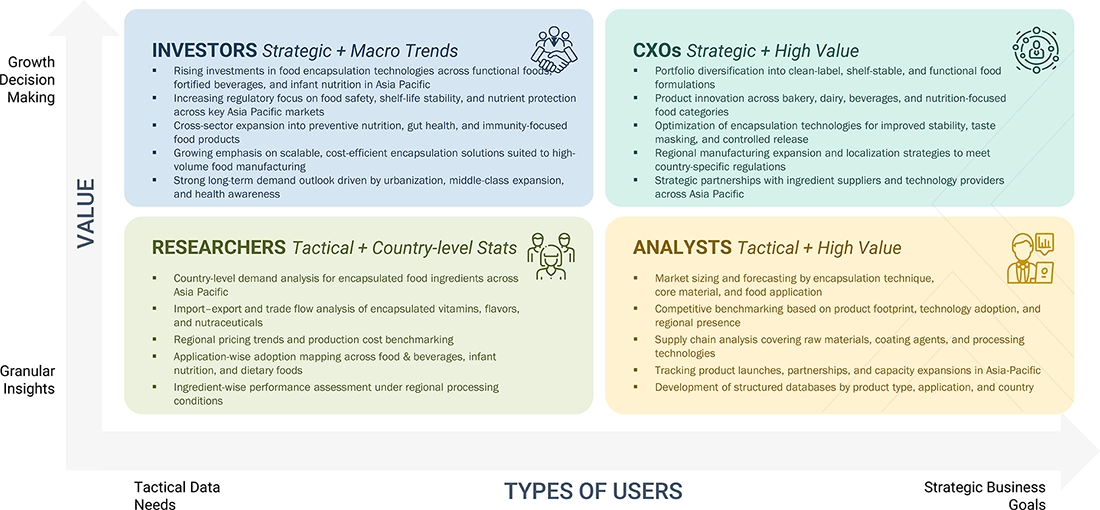

WHAT IS IN IT FOR YOU: ASIA PACIFIC FOOD ENCAPSULATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Food Encapsulation Ingredients Market | Competitive benchmarking of food encapsulation solution providers across core materials (vitamins & minerals, nutraceuticals, flavors & aromas) | Identified high-efficiency encapsulation technologies suitable for functional foods |

| Functional Foods Market | Mapping of encapsulated ingredient usage across functional foods, fortified staples, and processed foods | Analysis of physical vs chemical encapsulation methods used in Asia Pacific |

| Food Processing & Fortification Applications | Benchmarking adoption of encapsulation in bakery, dairy alternatives, confectionery, and staple food fortification | Assessment of cost–performance trade-offs across encapsulation technologies |

RECENT DEVELOPMENTS

- October 2025: Yakult Singapore, Launch of Y1000 concentrated probiotic drink Asia Pacific consumer product using encapsulation for enhanced viability and digestive health positioning.

- August 2025: Ajinomoto Co., Inc. introduced a new encapsulation ingredient line for nanoemulsified carotenoid complexes designed for improved absorption in fortification applications.

- July 2025: Kerry Group & FMC Corporation formed a strategic partnership for marine omega-3 encapsulation—joint development of sustainable, heat-stable nanoencapsulated omega-3 oils for food fortification in Asia.

- May 2025: Cargill, Inc. (Food Ingredients Division) Greenfield facility was expanded in Asia Pacific, with increased production lines for encapsulated food ingredients to address the rising functional food demand.

- April 2025: Amul (Gujarat Cooperative, India) launched a functional nutrition product using encapsulated vitamins/minerals optimized for Asian diets.

- March 2025: IFF (DuPont Nutrition & Biosciences)–India Partnership Regional technology co-creation program involved collaborative research with universities on improved encapsulation carriers for plant-based protein applications.

- January 2025: DSM-Firmenich expanded the Asia R&D hub, a dedicated research center to accelerate formulation and encapsulation technology development tailored for APAC functional food markets.

- December 2024: Lonza Group (APAC Functional Ingredients) launched nanoencapsulated botanical ingredients, with specialty plant extracts delivered via nanocarrier systems for digestive wellness products.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources—directories and databases such as the Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the Asia Pacific Food Encapsulation Market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the Asia Pacific Food Encapsulation Market.

Secondary Research

In the secondary research process, various sources such as website information, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Asia Pacific Food Encapsulation Market.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific Food Encapsulation Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Asia Pacific Food Encapsulation Market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All macroeconomic and microeconomic factors affecting the growth of the Asia Pacific Food Encapsulation Market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for food encapsulation on the basis of core phase, application, shell material, method, technology and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyse the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyse the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyse their market position and core competencies.

- To analyse the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the Asia Pacific Food Encapsulation Market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Food Encapsulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Food Encapsulation Market