Automotive Suspension Market Size, Share & Analysis

Automotive Suspension Market by Architecture (MacPherson Strut, Double Wishbone, Multilink, Twist Beam, Leaf Spring, Air Suspension), System, Actuation, Component, Vehicle (ICE, Electric, Off-Highway, ATV), Aftermarket, & Region – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The automotive suspension market is projected to reach USD 42.43 billion by 2032 from USD 39.91 billion in 2025, at a CAGR of 0.9%. Market growth is driven by the shift toward electrification, ride comfort, and energy efficiency, prompting OEMs to adopt lightweight, electronically controlled, and adaptive suspension systems. EV platforms, in particular, demand weight-optimized and software-tunable suspensions to offset battery mass and improve range designs in North America. SUVs predominantly use MacPherson strut suspensions (over 80%) due to their compact and cost-efficient design, while premium SUVs adopt double wishbone fronts and multi-link rears (with 8–10% adoption) for improved handling, camber control, and ride articulation. Air suspension, though limited to high-end models, is gaining traction as OEMs prioritize comfort and adaptive damping, especially in premium ICE and EV SUVs. In pickup trucks, double wishbone (75–80%) and MacPherson (15–20%) dominate the front, while rear setups rely on leaf springs (>70%) and multilink (20–25%), a mix driven by growing demand for durability and ride comfort in light-duty applications.

KEY TAKEAWAYS

- By region, the Asia Pacific is expected to lead the automotive suspension market, accounting for a 57% share in 2025.

- By system type, the active suspension systems segment is expected to register the highest CAGR of 5.8%.

- By architecture, the air suspension segment is expected to grow at the fastest rate from 2025 to 2032.

- By electric vehicle type, the BEV segment is expected to dominate the market.

- By vehicle type, the buses segment is expected to register the fastest growth during the forecast period.

- By region, the Asia Pacific is expected to lead the automotive suspension market, accounting for a 57% share in 2025.

- Key players such as Continental AG (Germany), ZF Friedrichshafen AG (Germany), ThyssenKrupp AG (Germany), KYB Corporation (Japan), and Tenneco Inc. (US) are focusing on innovations in lightweight materials, active and adaptive damping technologies, NVH optimization, and manufacturing process improvements.

The automotive suspension market is rapidly evolving, driven by the shift toward electrified, connected, and premium vehicles. Advanced suspension systems, including active, air, and adaptive damping technologies, are becoming essential for improving ride comfort, handling precision, and energy efficiency. As electric vehicle (EV) architectures increase battery weight and alter chassis dynamics, original equipment manufacturers (OEMs) are investing in lightweight materials, electronically controlled systems, and modular suspension platforms to strike a balance between performance and range optimization. These innovations are transforming suspension design into a key differentiator in the development of next-generation vehicles.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in demand and emerging trends in the automotive suspension market directly impact OEMs and Tier-I suppliers. There is an increasing focus on lightweight, durable, and high-performance suspension systems, which enhance vehicle comfort, handling, safety, and energy efficiency. These shifts ripple throughout the value chain, affecting raw material suppliers, component manufacturers, and OEMs. As a result, they shape revenue streams and create growth opportunities for innovative solutions such as active damping, air suspensions, multilink architectures, and software-controlled adaptive systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong Premium SUV & Pickup Demand

-

Regulatory Pressure on Vehicle & Passenger Safety & Curb Emissions

Level

-

High System Cost vs. ROI in Non-Premium Segments

Level

-

Integration of Smart/Connected Suspensions with ADAS & SDVs

-

Local Manufacturing & Supply Chain Opportunities

Level

-

Balancing Suspension Weight and Range Efficiency in Electric Vehicles

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong Premium SUV & Pickup Demand

The global increase in SUVs and pickups, which now account for more than half of light vehicle sales, has heightened the demand for advanced suspension technologies. MacPherson struts are the most common worldwide due to their packaging efficiency and cost-effectiveness. In contrast, premium SUVs are increasingly adopting double wishbone and multi-link suspension systems to enhance handling and ride quality. Pickup trucks typically utilize double wishbone front suspensions, combined with either leaf or multi-link rear suspensions, to provide the necessary load durability. Additionally, air suspensions are gaining popularity in premium internal combustion engine (ICE) and electric SUVs, driven by rising expectations for adaptive comfort and dynamic performance.

Restraint: High System Cost vs. ROI in Non-premium Segments

The high cost of advanced suspension systems continues to limit their global adoption, primarily to premium vehicle segments. Conventional setups such as MacPherson struts, multi-link, and double wishbone suspensions dominate passenger cars, SUVs, and light commercial vehicles (LCVs) due to their proven reliability, lower weight, and ease of integration. The typical cost of these conventional systems ranges from USD 200 to USD 1,500, making them suitable for high-volume production. In contrast, air and active suspension systems cost between USD 1,500 and USD 4,000 for light vehicles, and can reach up to USD 9,000 for heavy trucks. Although advanced suspension systems offer superior ride comfort and load management, the return on investment is largely justified only for premium models or fleets with high utilization.

Opportunity: Integration of Smart/Connected Suspensions with ADAS & SDVs

Software-defined vehicles are revolutionizing suspensions by turning them into intelligent systems. These systems integrate active damping and air suspension with advanced driver assistance systems (ADAS) to provide predictive ride quality and adaptive load management. OEMs such as GM, BMW, and Toyota are utilizing these advanced suspensions in their premium SUVs, electric vehicles (EVs), and pickups. Additionally, over-the-air (OTA) updates allow for post-purchase tuning, creating new revenue streams for manufacturers.

Challenge: Balancing Suspension Weight and Range Efficiency in Electric Vehicles

The increasing popularity of EVs around the world is prompting automakers to find a balance between suspension performance and efficiency. Adaptive air and multilink suspension systems can add 50 to 100 kg to a vehicle's weight, potentially reducing its driving range. Premium models often utilize reinforced suspension setups for enhanced comfort, whereas mass-market EVs tend to opt for simpler systems to maintain efficiency. Although lightweight materials and optimized dampers present opportunities for improvement, widespread adoption of these solutions remains limited.

automobile-suspension-systems-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Design and supply of suspension systems, including MacPherson strut, multilink, double wishbone, air, and active/semi-active suspensions | Enhance ride comfort, handling, safety, and NVH performance; enable integration with EV and ICE platforms |

|

Provide high-strength steel, aluminum, composites, and elastomers for suspension components | Reduce weight, improve durability, and support lightweight, energy-efficient suspension designs |

|

Integrate suspension systems into production vehicles, including EVs, PCs, SUVs, LCVs, and HCVs | Optimize ride quality, handling, and energy efficiency; differentiate vehicles in premium and mass-market segments |

|

Supply replacement suspension components and retrofit kits | Maintain vehicle performance, extend system lifespan, and offer cost-effective solutions for repairs and upgrades |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem mapping highlights various players in the automotive suspension market, mainly including raw material suppliers, component manufacturers, automotive OEMs, and aftermarket suppliers. The leading players in the automotive suspension market are Continental AG (Germany), ZF Friedrichshafen AG (Germany), ThyssenKrupp AG (Germany), KYB Corporation (Japan), and Tenneco Inc. (US), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Suspension Market, by System Type

The rising demand for improved ride quality and occupant comfort is driving the market for active suspension systems, especially in luxury cars, sports cars, and premium SUVs. Modern active suspension technologies, such as Mercedes-Benz’s Magic Body Control, Porsche’s PASM, and GM’s Magnetic Ride Control, tend to be high-cost but offer superior comfort and handling. The global growth of SUVs, particularly in the Asia Pacific region, where it accounted for over 55% of SUV sales in 2024, is further accelerating the adoption of active suspension systems, positioning this region as a leading market.

Automotive Suspension Market, by Architecture

The MacPherson strut remains a widely adopted front suspension architecture due to its low cost, reduced weight, and compact design, eliminating the need for a separate upper control arm. Its simplicity makes it the preferred choice for compact and mid-size passenger cars globally. Asia Pacific continues to lead adoption, with front MacPherson struts used in over 70% of vehicles, driven by high demand for cost-effective, space-efficient designs in markets like China, India, and Southeast Asian nations.

Automotive Suspension Market, by Electric Vehicle

Global EV adoption is accelerating, with sales surpassing 10?million units in 2024, driven by stricter emissions regulations and shifting consumer preferences. Most EVs retain front MacPherson struts, while rear multilink or air suspension systems are increasingly used in premium models, such as the BMW i5, Porsche Taycan Cross Turismo, and Lucid Air, to enhance ride comfort and handle heavier battery loads. The absence of an ICE allows flexible packaging, enabling optimized rear suspension layouts. Growing EV penetration, particularly in premium and high-performance segments, is expected to drive sustained demand for advanced multilink suspension systems globally.

Automotive Suspension Market, by Vehicle Type

Passenger cars continue to be the largest and fastest-growing segment in the automotive suspension market. This growth is primarily driven by rising production volumes, especially in China and India, as well as an increasing consumer demand for comfort and safety. Modern cars are increasingly adopting independent suspension systems, such as MacPherson strut, multilink, and air suspensions, to improve ride quality and handling. This shift reflects a broader trend of incorporating premium features into even mass-market vehicles.

REGION

Asia Pacific is expected to be the largest region in the global automotive suspension market during the forecast period

The Asia Pacific region is the largest automotive suspension market globally, driven by high vehicle production capacity, a strong presence of original equipment manufacturers (OEMs), and rapidly increasing vehicle sales in China, India, and Southeast Asia. Rising incomes among the middle class, urbanization, and shifting consumer expectations for comfort are driving demand for advanced suspension systems, including multilink and air suspensions. However, the high costs associated with these systems limit their widespread adoption. China remains the leader in this market due to its large passenger vehicle sector and strong production recovery following the pandemic. Meanwhile, India is the fastest-growing market, fueled by economic recovery and increasing demand for passenger vehicles. The dominance of the Asia Pacific region is further supported by cost advantages for OEMs, substantial local manufacturing capabilities, and a vast, diverse consumer base.

automobile-suspension-systems-market: COMPANY EVALUATION MATRIX

In the automotive suspension market matrix, ZF (Germany) (Star) leads with a strong global presence and a comprehensive portfolio spanning passive, semi-active, and active suspension systems across all vehicle types. Benteler (Austria) (Emerging Leader) is gaining traction with advanced electronically controlled dampers and lightweight suspension modules tailored for EVs and SUVs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ZF Friedrichshafen AG

- Tenneco Inc.

- Magna International Inc.

- HYUNDAI MOBIS

- Dana Incorporated

- Continental AG

- BWI Group

- KYB Corporation

- HL Mando Corporation

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | 39.91 BN |

| Market Forecast in 2032 (Value) | 42.43 BN |

| Growth Rate | CAGR of 0.9% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | • By Vehicle Type: Passenger Cars, Light Commercial Vehicles, Trucks, and Buses • By System: Passive, Semi-active, and Active • Architecture: MacPherson Strut, Double Wishbone, Multilink, Twist Beam/Torsion Beam, Leaf Spring, and Air Suspension • Active Suspension Market, by Actuation: Hydraulically Actuated and Electronically Actuated • Components (OE Market): Coil Springs, Air Springs, Shock Absorbers, Struts, Control Arms, Rubber Bushings, Leaf Springs, Link Stabilizers/Sway Bars, and Ball Joint • Components (Aftermarket): Shock Absorbers, Struts, Ball Joints, Leaf Springs, Control Arms, and Coil Springs • Electric & Hybrid Passenger Cars Suspension Market, by Architecture: MacPherson Strut, Double Wishbone, Multilink, Twist Beam/Torsion Beam, and Air Suspension • Electric & Hybrid HCVs Suspension Market, by Vehicle Type: Trucks and Buses • Off-highway Vehicles Suspension Market, by Application: Construction Equipment and Agricultural Tractors • ATV Suspension Market, by Region: Asia Pacific, Europe, and North America |

| Regional Scope | Asia Pacific, Europe, North America, and the Rest of the World |

| Driver | Strong Premium SUV & Pickup Demand |

| Restraint | High System Cost vs. ROI in Non-premium Segments |

WHAT IS IN IT FOR YOU: automobile-suspension-systems-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based EV OEMs & Tier-I Suppliers | Benchmarking of EV-specific suspension systems, including adaptive air suspensions, multilink architectures, and weight-optimized components | Identification of high-value differentiation opportunities in EV suspension design, such as lightweight materials, active damping strategies, and OTA-enabled tuning for ride comfort and energy efficiency |

| Global OEMs Exploring Premium SUVs | ||

| OEMs Expanding EV Lineups |

RECENT DEVELOPMENTS

- September 2025 : At IAA Mobility 2025, ZF presented its “Chassis 2.0” concept, a next-generation intelligent chassis approach integrating by-wire steering and braking with active and semi-active damping systems, electronic roll stabilization, and AKC rear axle steering. These suspension and chassis technologies are designed to be software-defined, enabling optimized driving dynamics, advanced ADAS functions, and automated driving capabilities.

- July 2025 : ZF introduced its new Smart Chassis Sensor, which is integrated directly into the ball joint of independent suspension systems. The sensor enables precise measurement of wheel-to-body motion, improving suspension control while reducing the need for separate sensors.

- July 2025 : DRiV, a Tenneco business group, introduced Monroe Air Suspension alongside Wagner HVAC Components, FP Diesel Starters & Alternators, and Wagner Sensors for the US and Canadian markets. The Monroe Air Suspension line includes air springs, air shocks, and air struts under Monroe, OESpectrum, and Monroe Restore brands, engineered for OE-style fit, reduced noise and vibration, and smooth ride performance, backed by a limited lifetime warranty.

- April 2025 : Monroe Ride Solutions recently launched the Monroe Intelligent Suspension CVSA2, a semi-active suspension system for SUVs, off-road vehicles, and luxury cars. Featuring steel-tube dampers with dual electro-hydraulic valves, it provides independent rebound and compression damping control for all four wheels, enabling high-resolution tunability, multiple driving modes, and enhanced ride comfort, handling, and vehicle stability across diverse road conditions.

- April 2025 : Thyssenkrupp Bilstein and Baolong Automotive have entered a strategic cooperation to deliver integrated suspension solutions for global OEMs. The partnership combines Bilstein’s expertise in shock absorbers with Baolong’s strength in air springs and ECAS components to offer bundled suspension systems, particularly targeting China and Europe. The joint offering focuses on semi-active and air suspension technologies, addressing growing demand for premium ride comfort, safety, and EV-ready suspension systems.

- December 2025 : Dana Incorporated has launched the new AdvanTEK 40 Pro axle system, the next generation of its 40,000-pound 6x4 tandem axle, designed for enhanced efficiency and improved fleet productivity. Featuring the fastest axle ratio of 2.05 for advanced engine downspeeding, it offers 18 total ratios, a high-capacity bearing system, increased weight capacity, and advanced coatings for longer drivetrain life.

Table of Contents

Methodology

The research study involved the extensive use of secondary sources, including company annual reports/presentations, industry association publications, magazines, directories, technical handbooks, the World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive suspension market. In-depth interviews were conducted with various primary sources—experts from related industry players, automotive suspension suppliers, and automotive OEMs—to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information on the automotive suspension market for this study. The secondary sources referred to for this research study include automotive industry organizations (such as Organisation Internationale des Constructeurs d'Automobiles (OICA), CAAM, JAMA, ACEA, etc.), automotive suspension manufacturers, Automotive Services Association (ASA), and automotive suspension suppliers, regulatory bodies, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and automotive associations. Secondary data have been collected and analyzed to determine the overall market size, which has been further validated through primary research.

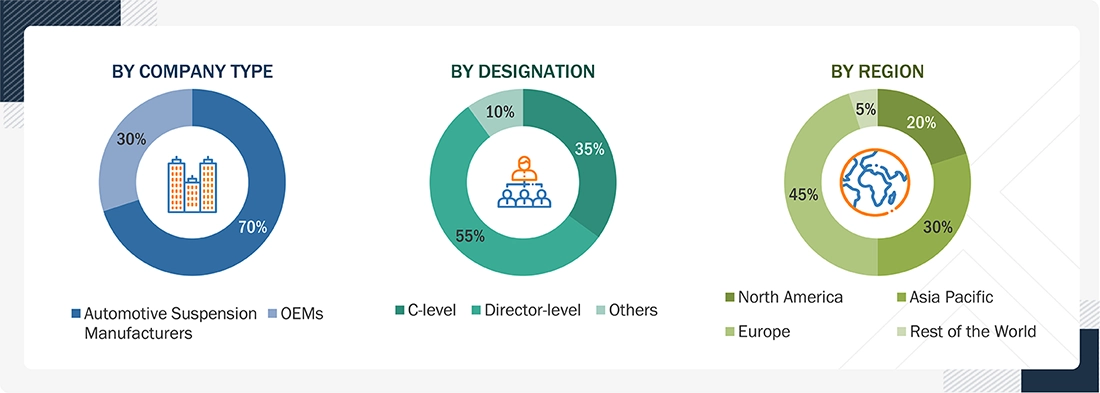

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive suspension market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand side (automotive OEMs) and the supply side (automotive suspension manufacturers and distributors), as well as players across four major regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 30% of primary interviews have been conducted from the demand side, and 70% from the supply side. Primary data has been collected through questionnaires, emails, and telephonic interviews.

In our survey of primaries, we have aimed to cover various departments within organizations, such as sales, operations, and administration, to provide a comprehensive viewpoint in our reports. After interacting with industry participants, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

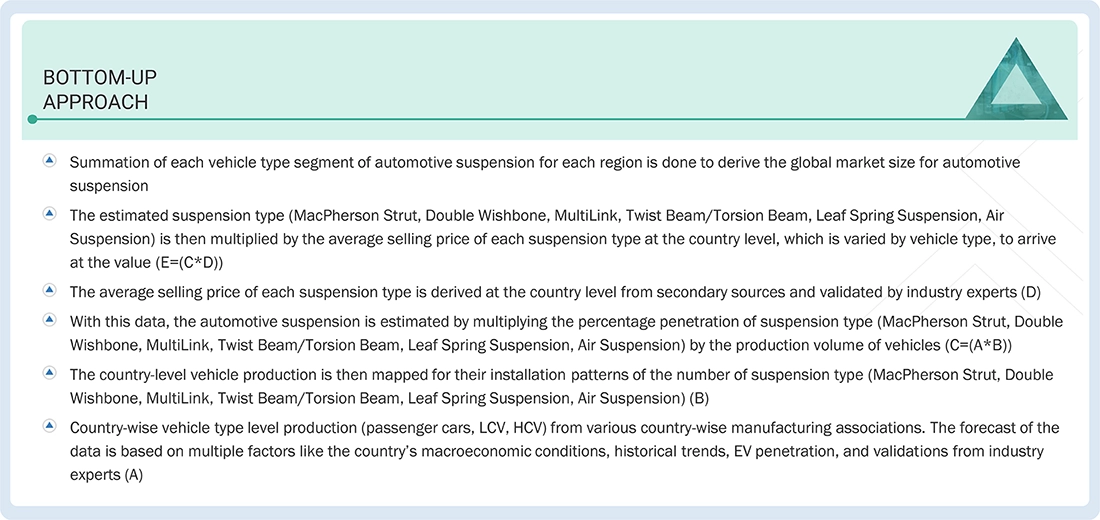

A detailed market estimation approach was followed to estimate and validate the size of the automotive suspension market and other dependent submarkets, as mentioned below:

- Key players in the automotive suspension market were identified through secondary research, and their global market share was determined through primary and secondary research.

- The research methodology included the study of identifying the percentage penetration of suspension type (MacPherson Strut, Double Wishbone, MultiLink, Twist Beam/Torsion Beam, Leaf Spring Suspension, Air Suspension) installed in passenger cars, LCVs, HCVs, and EVs.

- These percentage penetrations by each vehicle type are multiplied by the vehicle production to arrive at the total market size, by volume (million units)

- The market size, by value, is derived by multiplying the average selling price of MacPherson Strut, Double Wishbone, MultiLink, Twist Beam/Torsion Beam, Leaf Spring Suspension, and Air Suspension by the number of units.

- All major penetration rates, percentage shares, splits, and breakdowns for the component & vehicle type of the automotive suspension market were determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

Automotive Suspension Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data for the market by value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply participants.

Market Definition

A suspension is the arrangement of shock absorbers, springs, tires, and linkages that connect a vehicle to its wheels and allows movement between the wheel and suspension components. The suspension system in a vehicle minimizes shocks received by the body of the vehicle while moving on a surface. It makes the ride comfortable and keeps the tires in constant contact with the surface, regardless of contours. A suspension needs to keep the wheel in contact with the road surface to maintain the driver’s control of the vehicle.

Key Stakeholders

- Automotive Suspension Manufacturers

- Automotive Raw Material Suppliers

- Automotive OEMs

- Research & Development (R&D) Centers

- Associations, Forums, and Alliances Related to Automobiles

- Automobile Organizations/Associations

- EV Component Manufacturers

- EV Manufacturers

- Government Agencies and Policymakers

- Traders and Distributors of Automotive Suspension

Report Objectives

-

To segment and forecast the size of the automotive suspension market in terms of volume (million units) & value (USD million) from 2021 to 2032

- To define, describe, and forecast the automotive suspension market in terms of volume & value (USD million)

- To define, describe, and forecast the global automotive suspension market based on system, vehicle type, architecture, OE component, EV type, off-highway vehicles, ATV, and region

- To segment and forecast the market size of the automotive suspension market by architecture (MacPherson Strut, Double Wishbone, Multilink, Twist Beam/Torsion Beam, and Air Suspension)

- To segment and forecast the market size of the automotive suspension market by vehicle type (ICE) (passenger car, light commercial vehicle, and heavy commercial vehicle)

- To segment and forecast the market size of the electric & hybrid passenger cars suspension market, by architecture (MacPherson Strut, Double Wishbone, Multilink, Twist Beam/Torsion Beam, and Air Suspension)

- To segment and forecast the market size of the electric & hybrid HCVs suspension market, by vehicle type (trucks and buses)

- To segment and forecast the market size of the off-highway vehicles suspension market, by application (construction equipment and agricultural tractors)

- To segment and forecast the market size of the ATV suspension market, by region (Asia Pacific, Europe, and North America)

- To forecast the market size with respect to key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World.

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

-

To study the following with respect to the market:

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- HS Code Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Conferences and Events

- Key Stakeholders and Buying Criteria

- Investment and Funding Scenario

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To track and analyze competitive developments such as product developments, deals, and others undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations tailored to the company’s specific needs.

- Front Suspension by architecture (Passenger Cars, LCVs, HCVs)

- Rear Suspension by Architecture (Passenger Cars, LCVs, HCVs)

- Passive, Semi-active, and Active Suspension, by Architecture (Country-level)

- Electric & Hybrid Vehicles (Regional Level)

- Off-highway, by Type and Region (Regional Level)

Company Information

- Profiling of Additional Market Players (Up to 6)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Suspension Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Automotive Suspension Market

Richard

Jun, 2022

How do emerging markets offer revenue expansion opportunities in Automotive Suspension Market?.

User

Aug, 2019

I am interested to get the report for Vietnam manufacturer air suspension market and how many registered car user with car brand in Vietnam market. .

User

Aug, 2019

What are the sources used for the market figures and a segmentation between OEMs and Aftermarket?.

User

Aug, 2019

I need to get information such as graph with numerical values for the size of global automotive suspension part market. .

User

Aug, 2019

Hello! i am about to provide suspension parts to Indian automobile vehicles as a vendor. I want to know various suspension segments that are available in the industry within different countries. .

User

Aug, 2019

I would like to understand 1) Market share of the biggest companies, 2) Market size with respect to technology (Active/Semi-Active/Passive).

User

Aug, 2019

I need to understand suspension market for Electric quadricycles, Electric three wheelers , L7 vehicles, L6 vehicles and L5 vehicles .

User

Aug, 2019

Global market share of suspension by system(passive, semiactive, active) and supplier (Sachs, KYB, Mando, etc). Is this report contain this information?.

User

Jul, 2019

In which vehicles in general are air suspension compressors to find? In which vehicles worldwide can they be installed? (types, quantity, not only OEMs) Data about air suspension compressors on the commercial vehicle market in China: Trucks, agricultural vehicle Is there a tendency, that EVs use air suspension compressors regulary?.