Biochips Market Size, Growth, Share & Trends Analysis

Biochips Market by Products & Services (Instruments, Software), Type (DNA Chips, Protein Chips, Lab-on-a-Chip), Application (High-throughput Screening, IVD, POC), Fabrication Technology (Microarrays, Microfluidics), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global biochips market, valued at US$12,907.5 million in 2024, stood at US$14,011.6 million in 2025 and is projected to advance at a resilient CAGR of 8.8% from 2024 to 2030, culminating in a forecasted valuation of US$21,356.4 million by the end of the period. The growth of the biochips market is driven by the rising demand for personalized medicine and precision diagnostics, increasing adoption of biochips in genomics, proteomics, and drug discovery, and continuous technological advancements in microfluidics and lab-on-chip systems.

KEY TAKEAWAYS

- The biochips market comprises instruments, consumables and software & services. Consumables was the largest segment because they are required for every test or assay, ensuring recurring demand. Their frequent use in research, diagnostics, and clinical applications drives consistent revenue and market dominance.

- By type, the biochips market is segmented into DNA Chips, Lab-on-a-Chip, protein Chips, Tissue Arrays, and Cell Arrays. The Lab-on-a-Chip segment is projected to witness the highest CAGR throughout the forecast period, as it enables rapid, cost-effective, and portable testing by integrating multiple laboratory functions on a single microfluidic platform. Its ability to deliver quick, accurate results with minimal sample volumes is driving adoption in point-of-care diagnostics, drug discovery, and personalized medicine.

- Key fabrication technologies include Microarrays and Microfluidics. The microarrays segment is expected to be the largest, mainly attributable to its wide usage in large-scale gene expression profiling, genotyping, and biomarker discovery. Its proven reliability, high throughput, and broad application in genomics and clinical research sustain its market dominance.

- In the biochips market, biotechnology and pharmaceutical companies lead in demand because they rely heavily on biochips for drug discovery, genomic analysis, and biomarker research, enabling faster and more precise development of targeted therapies, followed by hospitals and diagnostic centers, academic & research institutes, contract research organizations (CROs), and other end users.

- The biochips materials market covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the biochips market due to its robust biotechnology and pharmaceutical sector, advanced research infrastructure, and substantial investment in genomics and personalized medicine. The presence of leading market players and early adoption of innovative diagnostic technologies further strengthen its dominance.

- Major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Thermo Fisher Scientific Inc. (US), Illumina, Inc. (US), and Agilent Technologies, Inc. (US) have entered into several agreements and partnerships to advance biochip technologies, expand their product portfolios, accelerate innovation in genomics, proteomics, and personalized diagnostics, and meet the growing global demand for high-throughput and precise diagnostic solutions.

The biochips market is witnessing steady growth, driven by the increasing prevalence of cardiac arrhythmias, rising adoption of advanced diagnostic and therapeutic devices, and growing awareness of heart health. New developments, including innovations in catheter-based ablation technologies, wearable monitoring devices, and strategic collaborations between medical device companies and healthcare providers, are reshaping the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses in the biochips market arises from evolving healthcare needs, technological innovation, and the shift toward personalized medicine. Pharmaceutical, biotechnology, and diagnostic companies are the primary users of biochip solutions, focusing on high-throughput analysis, rapid diagnostics, and precision research. The growing demand for faster, data-driven insights and cost-effective testing has a direct influence on R&D efficiency and clinical outcomes. These factors, in turn, drive the adoption of advanced biochip technologies and integrated analytical platforms, shaping the market’s growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for personalized medicines

-

Technological advancements in microfluidics and AI integration

Level

-

High cost of biochip development and fabrication

-

Data management and standardization issues

Level

-

Expanding applications in point-of-care and decentralized diagnostics

-

Increasing government and private investments in genomics research

Level

-

Technical complexity and integration of multidisciplinary technologies

-

Regulatory and validation hurdles for clinical use

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for personalized medicines

The growing demand for personalized medicine is a key driver of the biochips market, as healthcare increasingly shifts toward tailored diagnostics and treatments based on individual genetic profiles. Biochips enable the rapid and high-throughput analysis of genes, proteins, and biomarkers, providing critical insights for personalized therapies and disease prevention. Their ability to support precise, data-driven decision-making in oncology, pharmacogenomics, and rare disease research is fueling widespread adoption across clinical and research settings.

Restraint: High cost of biochip development and fabrication

The high cost of biochip development and fabrication acts as a significant restraint on market growth. Producing biochips involves complex microfabrication processes, advanced materials, and precision instrumentation, all of which contribute to elevated manufacturing expenses. Additionally, high R&D costs, low yield rates, and the need for specialized infrastructure limit large-scale production and accessibility, particularly in emerging markets.

Opportunity: Expanding applications in point-of-care and decentralized diagnostics

Expanding applications in point-of-care and decentralized diagnostics present a significant opportunity for the biochips market. Lab-on-chip and microfluidic biochips enable rapid, accurate testing outside traditional laboratories, supporting real-time disease detection and monitoring in clinical, remote, and low-resource settings. Their portability, low sample requirements, and quick turnaround times are driving adoption in infectious disease testing, personalized medicine, and emergency care, aligning with the global shift toward accessible and preventive healthcare.

Challenge: Technical complexity and integration of multidisciplinary technologies

The technical complexity and integration of multidisciplinary technologies pose a key challenge in the biochips market. Developing functional biochips requires expertise in multiple disciplines, including microfluidics, nanotechnology, materials science, and bioinformatics, making the design and manufacturing process highly intricate. Ensuring seamless integration of biological, electronic, and analytical components while maintaining accuracy and reproducibility adds to development difficulty, often leading to longer timelines, higher costs, and scalability issues for commercial production.

Biochips Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes advanced microarray biochip technology designed for high-throughput genomic and transcriptomic analysis across research and clinical applications. | Enables parallel analysis of thousands of genes, enhances discovery efficiency, and supports large-scale genomic profiling with high reproducibility. |

|

Offers a robust microarray platform integrated with sequencing workflows for genome-wide association studies and complex trait analysis. | Provides exceptional data accuracy, supports comprehensive genotyping and expression profiling, and accelerates translational research in precision medicine. |

|

Employs microarray biochips to detect copy number variations, genetic mutations, and microRNA expression patterns with high resolution. | Facilitates precise genomic comparison and expression analysis, aids in identifying disease-associated variants, and improves diagnostic and oncology research accuracy. |

|

Provides lab-on-chip modules for sample preparation, amplification and detection of nucleic acids in decentralized settings. | Simplifies sample workflow, lowers operator dependency, and enables point-of-care or near-patient diagnostics. |

|

Leverages lab-on-a-chip microfluidic technology for automated sample handling, electrophoresis, and nucleic acid or protein analysis. | Streamlines laboratory workflows, minimizes sample and reagent use, and ensures rapid, high-precision analytical performance for research and quality control. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the biochips market comprises a dynamic network of stakeholders that collectively drive innovation, product development, and adoption across research and clinical applications. At the core are key manufacturers such as Thermo Fisher Scientific, Illumina, Agilent Technologies, and QIAGEN, which lead the development of advanced microarray, lab-on-chip, and microfluidic platforms. Supporting them are software and AI developers specializing in bioinformatics, data analytics, and automated interpretation, who often collaborate with biochip OEMs to integrate intelligent data processing and cloud-based solutions. Additionally, research institutions, pharmaceutical companies, and diagnostic laboratories play a vital role in validating and applying biochip technologies for genomics, proteomics, and personalized medicine.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Biochips Market, By Product & Service

As of 2024, consumables held the largest share of the biochips market because they are required for every test or experiment, ensuring consistent and recurring demand. These include reagents, substrates, and assay kits used in genomic, proteomic, and diagnostic applications. Their single-use nature, combined with the increasing volume of testing in research and clinical diagnostics, drives continuous consumption and revenue growth for manufacturers. Additionally, ongoing innovations in assay chemistry and customization for specific applications further strengthen their market dominance.

Biochips Market, By Type

In 2024, DNA Chips dominated the biochips market due to their widespread use in genomics, gene expression profiling, and genetic testing. They enable high-throughput analysis of DNA sequences, mutations, and polymorphisms, making them essential tools in research, diagnostics, and the discovery of new drugs. Their reliability, scalability, and cost efficiency have led to strong adoption across clinical and academic settings. Additionally, ongoing advancements in hybridization techniques and data analysis tools continue to enhance their performance and sustain market leadership.

Biochips Market, By Fabrication Technology

As of 2024, microarrays held the largest share of the biochips market due to their extensive use in genomics, proteomics, and biomarker research. They enable simultaneous analysis of thousands of biological interactions, allowing rapid and high-throughput gene expression and mutation studies. Their proven accuracy, scalability, and cost-effectiveness have made them indispensable in both clinical diagnostics and life science research. Additionally, continuous improvements in detection technologies and data analytics are further enhancing their utility and sustaining their dominant market position.

Biochips Market, By End User

The biotechnology and pharmaceutical companies segment is expected to dominate the biochips market, as they rely heavily on these technologies for drug discovery, genomic analysis, and biomarker identification. Biochips enable high-throughput screening, target validation, and personalized drug development, accelerating R&D and reducing costs. Their ability to generate precise molecular insights supports innovation in precision medicine and therapeutic development. Additionally, increasing investments in genomics research and advanced diagnostics by pharma and biotech firms continue to strengthen this segment’s market dominance.

REGION

Asia Pacific to be fastest-growing region in global biochips market during forecast period

The Asia Pacific biochips market is expected to register the highest CAGR during the forecast period, driven by rapid advancements in biotechnology, expanding healthcare infrastructure, and increasing government investments in genomics and precision medicine. Rising healthcare awareness, a growing middle-class population, and the presence of emerging biotech hubs in countries like China and India are driving demand for advanced diagnostic and research tools. Additionally, collaborations between global biochip manufacturers and regional research institutions are accelerating the adoption of technology and driving market growth across the region.

Biochips Market: COMPANY EVALUATION MATRIX

In the biochips market matrix, Thermo Fisher Scientific Inc. (Star) leads with a substantial market share and an extensive product portfolio, driven by its advanced microarray, lab-on-chip, and next-generation sequencing platforms widely adopted across research, clinical, and diagnostic applications. The company’s dominance is reinforced by its continuous R&D investments, global distribution network, and strong presence in genomics and proteomics workflows. Bio-Rad Laboratories, Inc. (Emerging Leader) is gaining recognition for its innovative biochip solutions and integrated analysis platforms, which enhance precision, reproducibility, and data interpretation in molecular research. While Thermo Fisher leads through scale and comprehensive solutions, Bio-Rad shows strong potential to advance toward the leaders’ quadrant as demand for high-performance, data-driven biochip technologies continues to accelerate.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific Inc. (US)

- Illumina, Inc. (US)

- Agilent Technologies, Inc. (US)

- F. Hoffmann-La Roche Ltd (Switzerland)

- QIAGEN (Germany)

- Bio-Rad Laboratories, Inc. (US)

- Abbott (US)

- Standard BioTools Inc. (US)

- 10x Genomics (US)

- Cepheid (US)

- bioMérieux (France)

- Revvity (US)

- DiaSorin S.p.A. (Italy)

- Randox Laboratories Ltd. (UK)

- Oxford Gene Technology IP Limited (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12,907.5 Million |

| Market Forecast in 2030 (Value) | USD 21,356.4 Million |

| Growth Rate | CAGR of 8.8% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Biochips Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of leading biochip types: DNA Chips, Lab-on-a-Chip, Protein Chips, Tissue and Cell Arrays. DNA chips dominate due to their crucial role in genetic and genomic research, broad applicability in disease diagnostics, and continuous advancements improving hybridization efficiency and data accuracy. | Enables identification of product adoption shifts across care settings; Detects safety and compliance-related trends impacting purchasing. |

| Company Information | Key players: Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd and QIAGEN. Top 3-5 players market share analysis at APAC and European country level. | Provided insights on revenue transitions toward emerging applications such as personalized medicine, point-of-care testing, and drug discovery. |

| Geographic Analysis | Detailed analysis on Rest of APAC was provided to one of the top players. Client focused on ASEAN Market country level analysis for biochip adoption and localization strategies. | Supported country-level demand mapping to guide new product launches and regional manufacturing strategies. |

RECENT DEVELOPMENTS

- May 2025 : Agilent Technologies, Inc. opened its first India Solution Center at its LEED Platinum-certified Manesar office in Haryana. This new facility strengthens Agilent’s focus on India as a high-growth, innovation-driven market and will provide integrated solutions across the sectors it serves. The facility supports the development of analytical workflows, proof-of-concept demonstrations, collaborative research and development, and training.

- October 2024 : QIAGEN announced that the US FDA has cleared the QIAstat-Dx Respiratory Panel Mini for clinical use. The panel is designed to assist in diagnosing upper respiratory infections in outpatient settings, covering five common viral causes: influenza A, influenza B, human rhinovirus, respiratory syncytial virus (RSV), and SARS-CoV-2.

- April 2024 : Illumina, Inc. announced that DRAGEN Array, a bioinformatics software suite for analysis of Infinium microarray data, enhanced its functionality by enabling high-throughput and quantitative reporting of quality control (QC) metrics for Infinium methylation arrays.

Table of Contents

Methodology

This research study extensively utilized both primary and secondary sources. It involved analyzing various factors influencing the industry to identify segmentation types, industry trends, key players, the competitive landscape, key market dynamics, and strategies employed by key players.

Secondary Research

This research study utilized a variety of comprehensive secondary sources, including directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet, white papers, annual reports, company house documents, investor presentations, and SEC filings from various companies. Secondary research was employed to gather information crucial for an in-depth, technical, market-oriented, and commercial analysis of the biochips market. This approach also helped identify key players in the industry and allowed for classification and segmentation based on emerging trends at the most detailed level. Furthermore, significant developments pertaining to both market and technological perspectives were documented. A database of primary industry leaders was created as part of this secondary research.

Primary Research

In the primary research process, we interviewed a range of sources from both the supply and demand sides to gather qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the biochips market. Primary sources from the demand side include researchers in biotechnology and pharmaceutical companies, healthcare professionals from hospitals and diagnostic centers, academic & research institutes and contract research organizations.

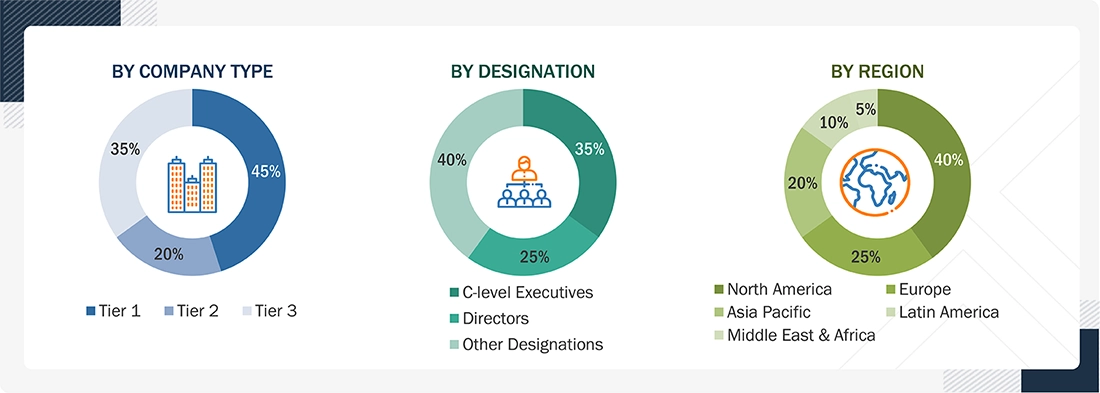

A breakdown of the primary respondents is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Other designations include sales, marketing, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the biochips market was determined after data triangulation from three approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

The biochips market refers to miniaturized analytical platforms integrating biological probes or microfluidic components that allow simultaneous or rapid analysis of DNA, RNA, proteins, metabolites, or tissues. They are fabricated as microarrays, microfluidic cartridges, or tissue arrays and used in diagnostics, genomics, proteomics, drug discovery, and pathology research. These biochips enable high-throughput screening, providing faster, more efficient testing methods, and are critical in applications such as personalized medicine, disease detection, and environmental monitoring. With advances in technology, biochips are becoming increasingly versatile, supporting the development of novel diagnostics and therapeutic solutions across multiple sectors.

Stakeholders

- Pharmaceutical Companies

- Biotechnology Companies

- Research Institutes

- Academic Institutes

- Contract Research Organizations

- Research and Consulting Companies

- Biochip Manufacturers and Distributors

- DNA & Gene Chip Manufacturers and Distributors

- Protein Microarray Manufacturers and Distributors

- Lab-on-a-Chip Manufacturers and Distributors

- Cell & Tissue Array Manufacturers and Distributors

Report Objectives

- To define, describe, segment, and forecast the biochips market by products & services, type, fabrication technology, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall biochips market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the biochips market in five main regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the biochips market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Biochips Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Biochips Market