Capnography Equipment Market Size, Growth, Share & Trends Analysis

Capnography Equipment Market by Product (Multiparameter, Standalone, Software, Accessories), Technology (Mainstream, Sidestream, Microstream), Application (Cardiac Care, Respiratory Monitoring), End User (Hospitals, ASC), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

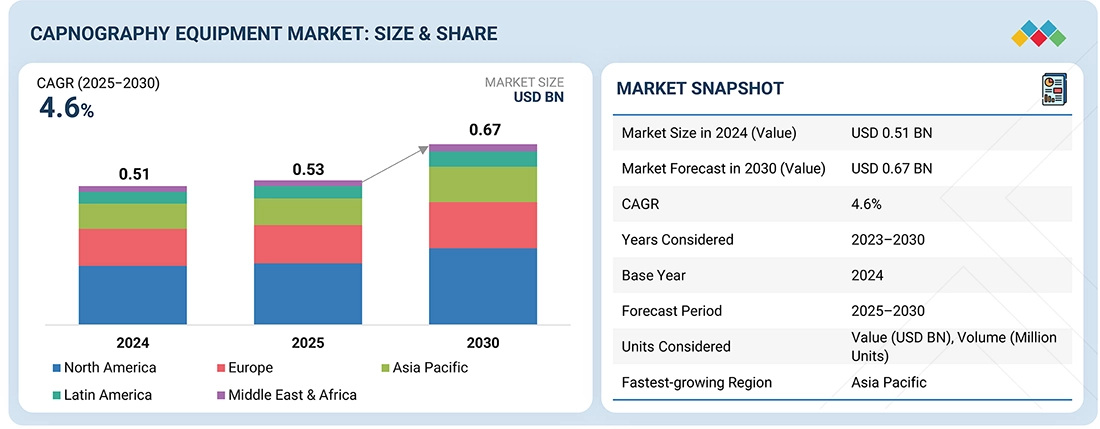

The global capnography equipment market is projected to reach USD 0.67 billion by 2030 from USD 0.53 billion in 2025, at a CAGR of 4.6% during the forecast period. The capnography equipment market is expanding due to the increasing prevalence of respiratory and cardiovascular disorders, a rise in surgical procedures, and a greater focus on patient safety through continuous monitoring. Additionally, technological advancements in sensors and portable systems, as well as the growing use of noninvasive monitoring in critical care and emergency settings, contribute to this market growth.

KEY TAKEAWAYS

-

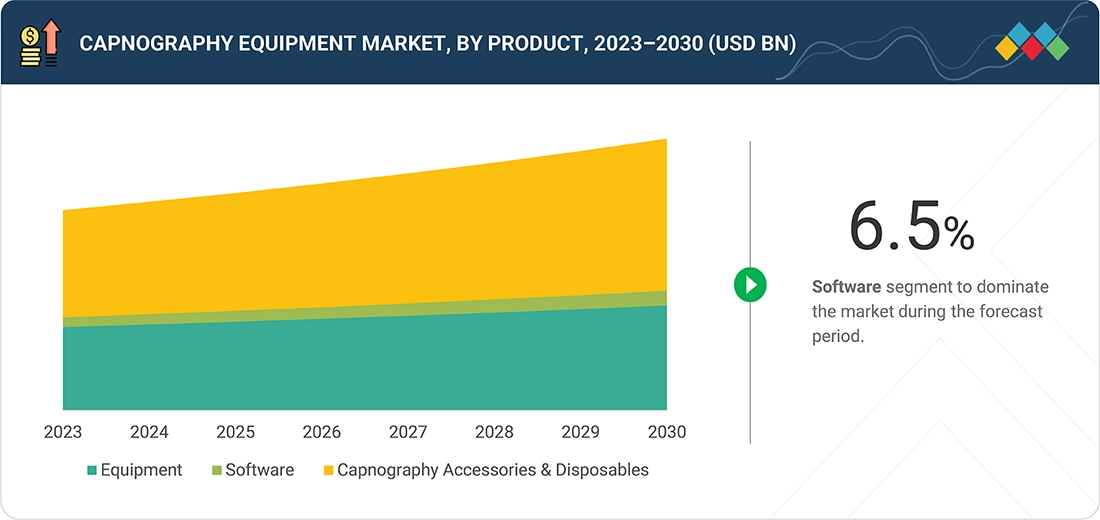

BY PRODUCTThe capnography equipment market is mainly divided into three categories: capnometers (which include both standalone and handheld devices), accessories, and software. Handheld capnometers are becoming increasingly popular because they are portable and easy to use in various clinical settings. Additionally, accessories such as sensors and sampling lines are crucial for the proper functioning of capnography systems, contributing to the growing demand for these items alongside the primary devices.

-

BY TECHNOLOGYCapnography devices utilize various technologies, including mainstream, sidestream, and microstream. Among these, sidestream capnography currently has the largest market share due to its versatility and reliability across different clinical settings. Microstream capnography is becoming more popular because of its compact size and suitability for portable applications. Meanwhile, mainstream capnography is typically used in hospital environments for real-time monitoring.

-

BY APPLICATIONCapnography equipment is used in various applications, including trauma and emergency care, cardiac care, and respiratory monitoring. Currently, trauma and emergency care applications dominate the market due to the necessity for rapid and accurate assessments of patients in critical conditions. Additionally, respiratory monitoring applications are important, particularly given the rising prevalence of respiratory diseases.

-

BY END USERThe main end users of capnography equipment are hospitals & clinics, followed by ambulatory surgery centers (ASCs) and home healthcare settings. Hospitals & clinics are the leading users due to the large number of patients needing continuous monitoring. However, the increasing trend toward home healthcare is driving the adoption of portable capnography devices, especially for patients with chronic respiratory conditions.

-

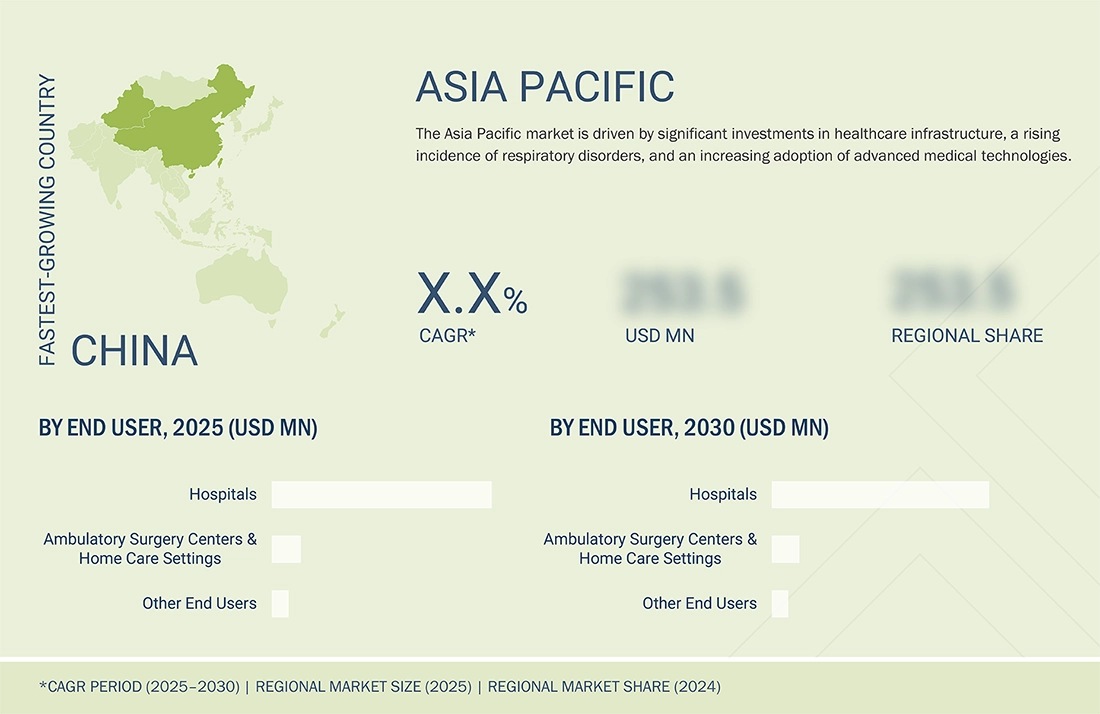

BY REGIONThe Asia Pacific region is anticipated to experience the highest CAGR in the capnography equipment market. This growth is driven by several factors, including the rising incidence of respiratory disorders, an increase in surgical procedures, and the enhancement of healthcare infrastructure in developing countries. Additionally, growing awareness about patient safety, a broader adoption of advanced monitoring technologies, and investments by global market players to strengthen their presence in the region are further contributing to rapid market growth.

-

COMPETITIVE LANDSCAPEThe major market players have employed both organic and inorganic strategies, including partnerships and collaborations. For example, Philips and Masimo announced an innovation partnership to advance access to patient monitoring measurement technologies.

The growth of the capnography equipment market is primarily driven by the increasing prevalence of respiratory and cardiovascular disorders, such as chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, and heart diseases, all of which require continuous patient monitoring. The rising number of surgical procedures and the widespread use of anesthesia and sedation also contribute to the demand for accurate CO2 monitoring. Technological advancements, including portable and non-invasive capnography systems, improved sensors, and integration with multiparameter patient monitoring platforms, enhance both clinical efficiency and reliability. Furthermore, the growing awareness of patient safety, stringent regulatory guidelines, and the adoption of capnography in emergency and critical care settings collectively serve as significant factors driving market growth.

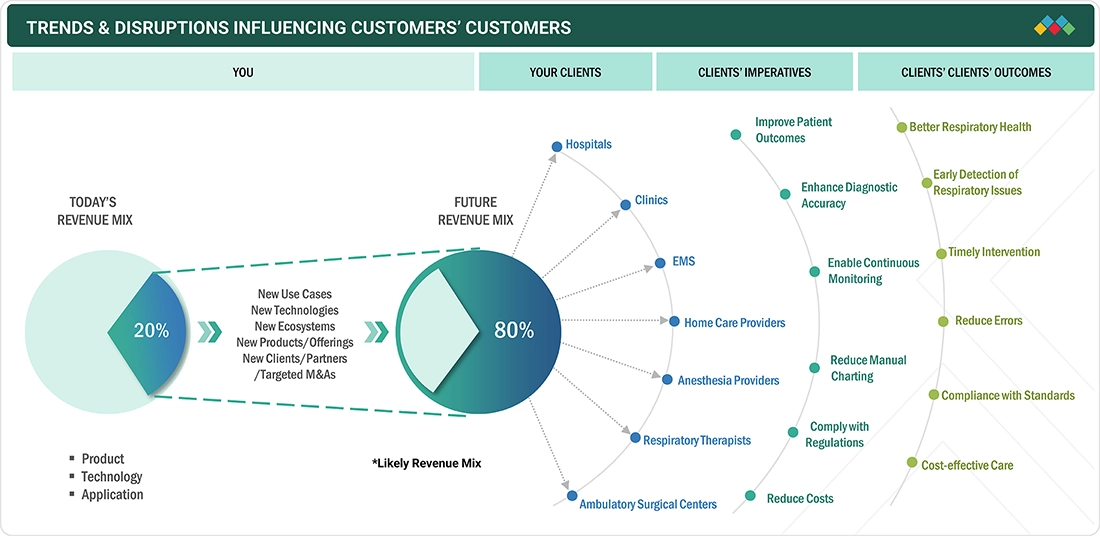

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The capnography equipment market is experiencing several key trends and disruptions that are transforming customer businesses and clinical practices. One significant trend is the increasing integration of capnography with multiparameter monitoring systems and electronic health records. This integration allows for real-time data analysis and enhances clinical decision-making. Another important trend is the rise in demand for portable and wireless capnography devices, which support point-of-care and home-based monitoring solutions. Advances in sensor accuracy, miniaturization, and noninvasive technology are also improving device efficiency and patient comfort. Additionally, the growing emphasis on value-based healthcare and patient safety standards is encouraging hospitals and clinics to adopt capnography more widely, particularly in surgical, emergency, and intensive care settings. Emerging disruptors such as digital connectivity, AI-driven analytics, and interoperability between devices are revolutionizing how healthcare providers monitor, interpret, and respond to patient respiratory data.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing prevalence of respiratory diseases

-

Clinical benefits of capnography over pulse oximetry

Level

-

Complex regulatory framework for approval of capnography equipment

-

High equipment and maintenance costs

Level

-

Increased availability of clinical research evidence

-

Growth opportunities for healthcare industry in emerging economies

Level

-

Lack of skilled technicians & specialized training to operate capnometers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of respiratory diseases

The rising prevalence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, and acute respiratory distress syndrome (ARDS), is a significant factor driving the capnography equipment market. These conditions often necessitate continuous monitoring of ventilation and gas exchange, making capnography an essential diagnostic and monitoring tool in both hospital and emergency settings. Increasing pollution levels, an aging population, and lifestyle changes are contributing to the growing burden of respiratory disorders worldwide. As a result, healthcare providers are adopting capnography systems more frequently to ensure early detection and effective management of respiratory issues. This trend is further supported by increased clinical awareness and the integration of advanced capnography technologies into critical care and surgical procedures.

Restraint: Complex regulatory framework for approval of capnography equipment

One of the major challenges in the capnography equipment market is the complex regulatory framework governing product approval and commercialization. Capnography devices, essential for patient monitoring, must meet strict safety, efficacy, and quality standards set by regulatory bodies such as the US FDA, the European Medicines Agency (EMA), and other regional authorities. The approval process often requires extensive clinical testing, detailed documentation, and ongoing post-market surveillance, all of which can be time-consuming and costly for manufacturers. Additionally, differences in regulatory requirements across countries complicate market entry and delay product launches. This complexity not only drives up development costs but also makes it difficult for smaller companies to compete effectively, ultimately slowing innovation and hindering overall market growth.

Opportunity: Increased availability of clinical research evidence

An important opportunity in the capnography equipment market lies in the growing availability of clinical research evidence supporting the effectiveness of capnography in improving patient outcomes. Numerous studies have demonstrated its value in early detection of respiratory depression, enhanced anesthesia safety, and reduced incidences of postoperative complications. This expanding body of evidence is driving wider clinical acceptance and reinforcing its inclusion in patient monitoring standards across hospitals and ambulatory care settings. As research continues to validate the benefits of capnography across new applications such as procedural sedation, emergency care, and noninvasive monitoring, healthcare providers are increasingly recognizing its importance, creating significant growth opportunities for manufacturers to expand adoption globally.

Challenge: Lack of skilled technicians & specialized training to operate capnometers

A significant challenge in the capnography equipment market is the lack of skilled technicians and specialized training required to operate capnometers effectively. Proper use and interpretation of capnography data are essential for accurate patient monitoring, particularly in critical care, anesthesia, and emergency settings. However, in many healthcare facilities, especially in developing regions, there is a shortage of adequately trained staff who can handle the equipment, calibrate sensors, and interpret CO2 waveforms correctly. This skill gap often leads to underutilization or misuse of capnography devices, reducing their clinical effectiveness. Limited training programs, inadequate awareness of capnography’s diagnostic value, and the need for continuous skill development further exacerbate this challenge, hindering optimal adoption and performance of these devices in healthcare practice.

Capnography Equipment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Continuous patient monitors are advanced monitoring systems designed to provide real-time measurement of multiple vital signs, including CO2 levels, heart rate, SpO2, blood pressure, and respiratory rate across critical, surgical, and general care settings. | Enable continuous assessment of patient status, support early detection of respiratory or cardiac distress, and improve patient safety and clinical decision-making. |

|

Capnography systems are specialized devices that measure and display the concentration or partial pressure of exhaled CO2 to assess ventilation and airway integrity during anesthesia, sedation, and critical care. | Ensure accurate monitoring of respiratory function, enable early detection of hypoventilation or airway obstruction, and enhance patient safety during surgical and emergency procedures. |

|

Airway adapters are disposable or reusable connectors that link the patient’s breathing circuit to the capnography sensor for CO2 measurement during ventilation. | Provide a secure and accurate interface for gas sampling, minimize leakage, and ensure reliable CO2 readings for both intubated and non-intubated patients. |

|

Capnography sensors are a core component of capnography systems, which detect and analyze CO2 levels from exhaled breath using infrared spectroscopy or similar technologies. | Deliver precise, real-time CO2 readings, improve diagnostic accuracy, and enhance the effectiveness of patient monitoring in both mainstream and sidestream configurations. |

|

Integrated software processes and visualizes CO2 waveform data, enabling clinicians to monitor trends, set alerts, and analyze ventilation performance remotely or locally. | Enhance clinical workflow efficiency, enable data-driven decisions through trend analysis, and support interoperability with hospital information systems for better patient management. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The capnography equipment market operates within a complex ecosystem that includes device manufacturers, healthcare providers, regulatory bodies, and suppliers of consumables and accessories. Key manufacturers, such as Medtronic, Philips, Dräger, Nihon Kohden, and Masimo, develop capnography devices, including handheld monitors, multiparameter monitors, and capnometers. These devices are essential for monitoring carbon dioxide levels in patients' respiratory gases. Supporting components, such as disposable sampling lines, filters, connectors, and calibration gases, ensure accurate measurements and maintain hygiene. The demand for capnography equipment is driven by healthcare providers in hospitals, ambulatory surgical centers, and home care settings, influenced by clinical needs, technological advancements, and reimbursement policies. Regulatory standards also guide the safety and performance of these devices. Geographically, North America leads the market due to its advanced healthcare infrastructure, while the Asia Pacific region is experiencing rapid growth due to increased healthcare access and rising awareness of respiratory health. This ecosystem aims to improve patient monitoring and clinical outcomes.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Capnography Equipment Market, By Product

In the capnography equipment market, the capnography accessories & disposables product segment holds a dominant position. This segment includes essential components such as nasal/oral CO2 cannulas, airway adapters, sampling lines, filters, connectors, and calibration gases, which are critical for the accurate functioning of capnography devices. The high demand for these consumables is driven by their single-use nature, which ensures hygiene and prevents cross-contamination in clinical settings. Additionally, frequent replacement cycles in hospitals, intensive care units, and surgical centers contribute to sustained market growth. The rising number of surgical procedures, growing awareness of respiratory monitoring, and stringent infection control protocols further reinforce the dominance of this segment, making accessories and disposables a key revenue generator in the capnography equipment ecosystem.

Capnography Equipment Market, By Technology

In the capnography equipment market, mainstream capnography devices dominate the technology segment, holding the largest market share due to their established reliability, ease of use, and broad clinical adoption. These devices measure carbon dioxide directly at the airway, providing real-time, accurate monitoring of patients’ respiratory status, which is crucial during anesthesia, intensive care, and emergency procedures. Their widespread use can be attributed to healthcare professionals' familiarity with them, a lower risk of sampling errors compared to sidestream devices, and compatibility with existing monitoring systems. While newer technologies like sidestream and microstream capnography are emerging, mainstream systems remain the preferred choice in hospitals and surgical centers worldwide. This preference significantly contributes to the overall growth and stability of the capnography equipment market.

Capnography Equipment Market, By Application

In the capnography equipment market, the cardiac care application segment stands out as the leader. Continuous monitoring of respiratory gases is crucial for patients with cardiovascular conditions. Capnography provides real-time measurements of carbon dioxide levels, which allows for early detection of respiratory issues, cardiac arrest, and complications during cardiac surgeries or interventions. Its use in cardiac care units, operating rooms, and emergency settings enables clinicians to make timely decisions, optimize ventilation, and improve patient outcomes. The high prevalence of cardiovascular diseases, along with the emphasis on patient safety during complex cardiac procedures, drives the demand for capnography devices in this segment, establishing cardiac care as a dominant area in the market.

Capnography Equipment Market, By End User

In the capnography equipment market, hospitals are the primary end users due to their high patient volumes, complex clinical procedures, and critical care needs. Tertiary care centers and specialized surgical facilities depend heavily on capnography devices to monitor patients during anesthesia, in intensive care, and during emergency interventions. These devices are essential for ensuring patient safety and for the timely detection of respiratory complications. The preference for hospitals stems from their need for continuous and accurate monitoring, the ability to integrate with other patient monitoring systems, and compliance with strict regulatory and clinical standards. Furthermore, the increasing number of surgical procedures, the rising prevalence of respiratory disorders, and a focus on improving clinical outcomes all contribute to the dominance of hospitals as end users, making them a significant driver of growth in the capnography equipment market.

REGION

Asia Pacific to be fastest-growing region in global capnography equipment market during forecast period

The Asia Pacific region is projected to be the fastest-growing market for capnography equipment. This growth can be attributed to several factors, including the expansion of healthcare infrastructure, an increasing prevalence of respiratory diseases, a rising number of surgical procedures, and heightened awareness of patient monitoring. Additionally, the adoption of advanced medical technologies and portable monitoring solutions, combined with supportive government initiatives aimed at improving healthcare access, is further boosting market growth in the region. Countries such as China, India, and Japan are at the forefront of this expansion, establishing the Asia Pacific as a key driver of the global capnography equipment market.

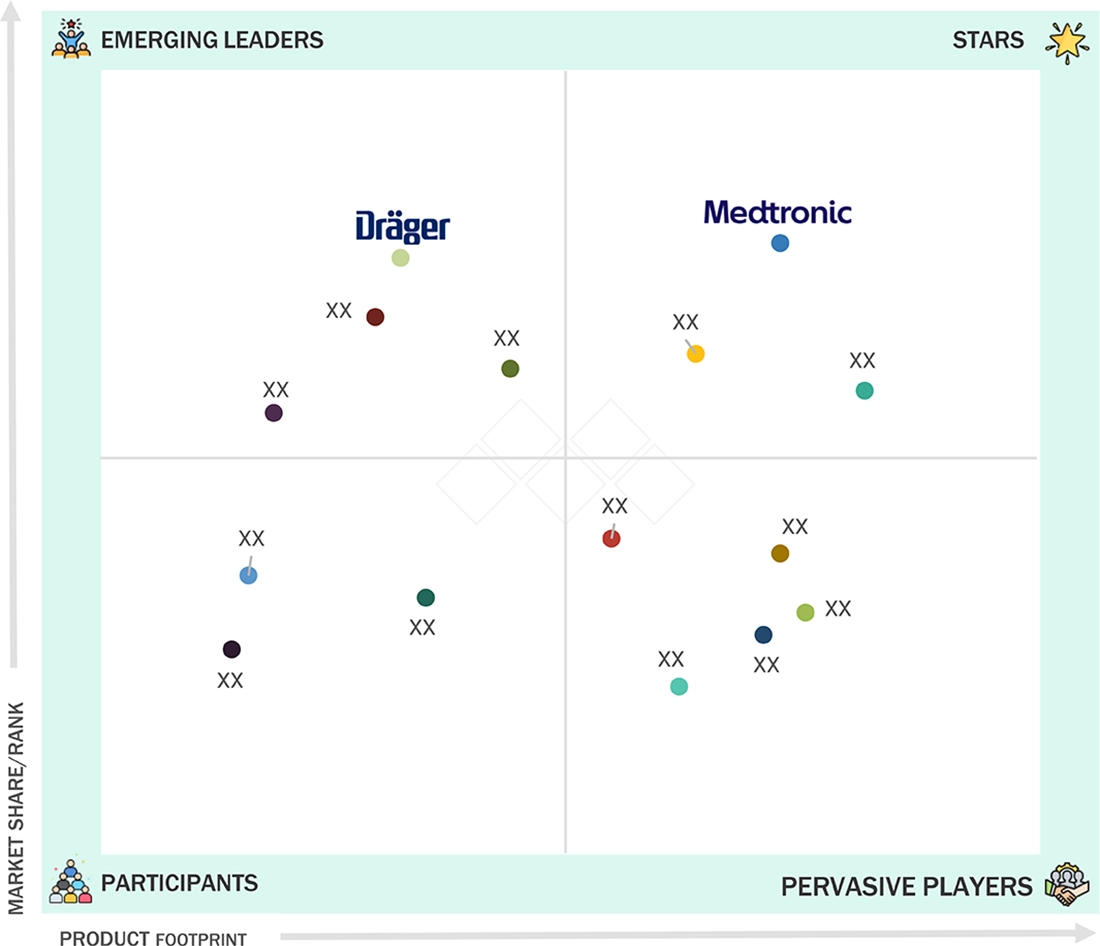

Capnography Equipment Market: COMPANY EVALUATION MATRIX

In the capnography equipment market, Medtronic holds a leading position due to its large-scale, extensive distribution network and comprehensive range of monitoring solutions. Dräger, identified as an Emerging Leader, is gaining traction by offering innovative capnography devices that enhance clinical accuracy, improve patient safety, and facilitate efficient respiratory monitoring. While Medtronic dominates the market with its global reach and established presence, Dräger’s emphasis on technological innovation positions it for rapid growth toward the leadership quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Becton, Dickinson and Company (US)

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (US)

- Drägerwerk AG & Co. KGaA (Germany)

- Nihon Kohden Corporation (Japan)

- Masimo (US)

- ICU Medical, Inc. (US)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- ZOLL Medical Corporation (US)

- EDAN Instruments, Inc. (China)

- Hamilton Medical (Switzerland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.51 Billion |

| Market Forecast in 2030 (Value) | USD 0.67 Billion |

| Growth Rate | CAGR of 4.6% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

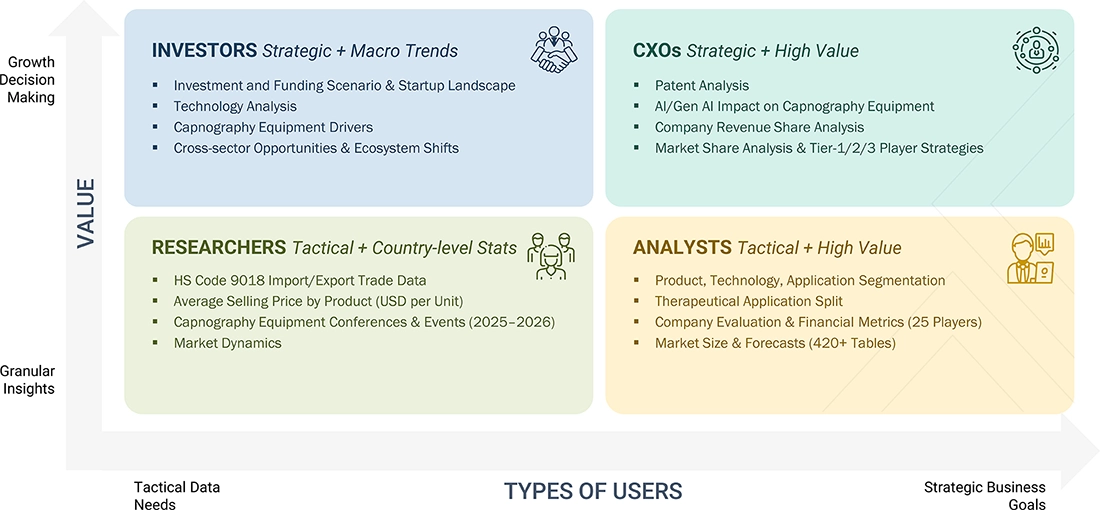

WHAT IS IN IT FOR YOU: Capnography Equipment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of top capnography equipment: multiparameter capnometers, standalone capnometers, capnography software, capnography accessories & disposables |

|

| Company Information |

|

Insights on revenue shifts towards emerging therapeutic applications and device innovations |

| Geographic Analysis |

|

Country-level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- September 2025 : Philips and Masimo formed a strategic partnership focused on enhancing access to patient monitoring technologies. This collaboration aims to integrate Philips’ advanced patient monitoring platforms with Masimo’s innovative non-invasive monitoring systems. As a result, hospitals and healthcare providers will benefit from more accurate, real-time patient data. The partnership is designed to improve clinical decision-making and patient outcomes, especially in critical care and surgical environments.

- December 2023 : Nantworks AirStrip entered into an agreement with GE HealthCare to commercialize integrated solutions for patient monitoring and cardiac data visualization in healthcare systems. This collaboration allows hospitals to utilize unified platforms for real-time monitoring of patients and their cardiac conditions, thereby enhancing workflow efficiency and patient management. By integrating AirStrip's mobile data technologies with GE HealthCare's monitoring devices, the partnership supports seamless visualization of patient data across various care settings.

- July 2023 : Mindray DS USA acquired DiaSys Diagnostic Systems to consolidate its operations under the Mindray brand. This acquisition strengthens Mindray's global presence in in vitro diagnostics. DiaSys is well-regarded for its expertise in clinical chemistry and immunoturbidimetric reagents. By utilizing DiaSys's advanced diagnostic technologies and manufacturing capabilities, Mindray aims to provide a broader range of diagnostic solutions worldwide, thereby expanding both its product offerings and international reach.

- July 2023 : Dräger received FDA 510(k) clearance for its Evita V600, V800, and Babylog VN800 ventilators. This clearance permits Dräger to market these devices in the US, confirming that they meet established safety and performance standards. The approval enables the use of these advanced ventilators in intensive care and neonatal units, enhancing respiratory support and monitoring capabilities for critically ill patients.

- June 2023 : Philips announced that it received FDA clearance for several advanced features on its IntelliVue MX750 and MX850 patient monitors. These features include SedLine Brain Function Monitoring, Regional Oximetry (O3), and CO2 measurements. By incorporating these capabilities, the monitors provide enhanced real-time monitoring of neurological status, oxygen levels, and respiratory function, ultimately improving patient safety and clinical efficiency. Hospitals can now utilize these comprehensive monitoring solutions for surgical and critical care patients, supporting better health outcomes.

- January 2023 : In January 2023, NantWorks, AirStrip, and GE HealthCare announced their collaboration to commercialize integrated patient monitoring and cardiac data visualization solutions. This announcement laid the groundwork for their formal agreement in December 2023. It underscores the increasing emphasis on digital and interoperable patient monitoring platforms that enable healthcare providers to effectively manage patient data across various systems.

Table of Contents

Methodology

The study used an extensive amount of both primary and secondary sources to conduct an all-around study of forces affecting the industry. This methodology included market segmentation analysis, industry trends, finding prominent players, competitive landscape analysis, key market dynamics, and the strategies used by the prominent companies.

Secondary Research

This secondary research used D&B Hoovers, Bloomberg Businessweek, Factiva, white papers, annual reports, company filings, investor presentations, and SEC filings to create a comprehensive database of the leading participants in the industry. The database combined key data from leading companies, market segmentation at multiple levels, industry trends by segment, major mergers and acquisition activity, and the role played by technology progressions in the capnography equipment market.

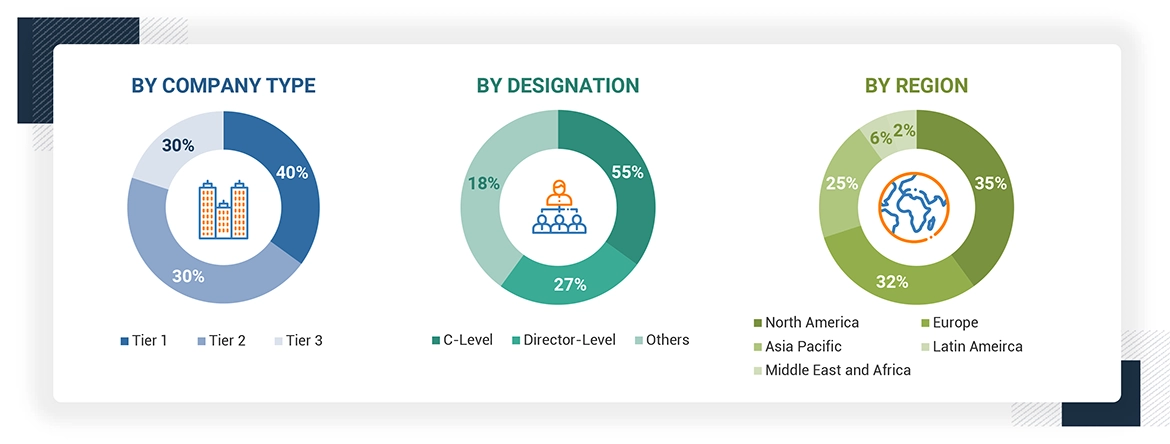

Primary Research

The primary research was a qualitative and quantitative investigation through comprehensive interviews with the participants in both the demand and supply sides of the market. Supply side involved high-level executives including CEOs, VPs, marketing and sales directors, regional sales managers, and even the technology and innovation directors in leading companies and organizations in the product therapy markets. Through interviews of professionals - clinicians, procurement managers, purchase managers, department heads and experts from hospitals, diagnostic centers, pharmaceutical and biotechnological firms, and research and academic institutes, the market segmentation, the key players and the related trends and dynamics that are encouraging the growth of this market can be understood.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

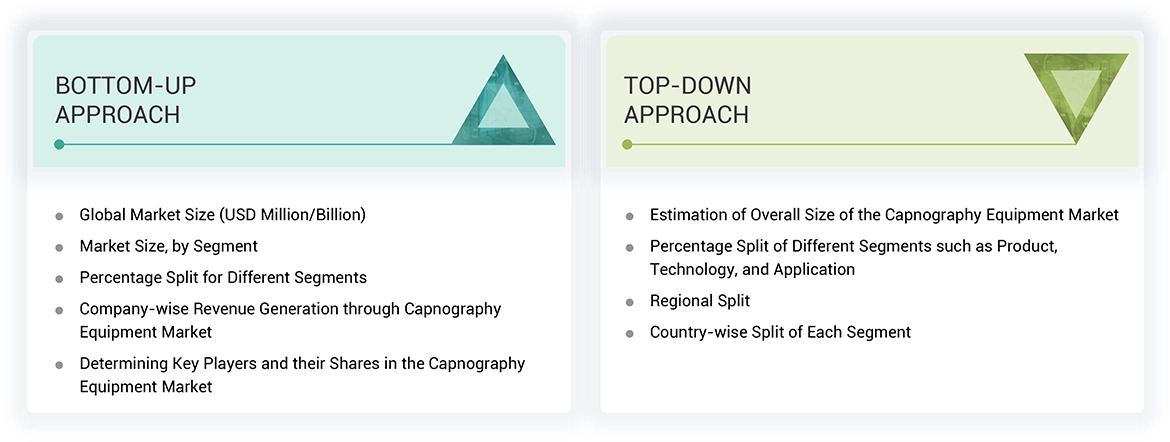

Market Size Estimation

This report is a deep analysis of the market for the capnography equipment. It involves the identification of the main market players through a combination of primary and secondary research. The secondary research is conducted based on annual and financial reports from the leading market players, while the primary research is composed of extensive interviews with key opinion leaders who included CEOs, directors, and senior marketing executives.

- To estimate the global market value, a segment-based methodology was adopted. This methodology involves gathering revenue data of major solution and service providers. The process includes: - Identification of key players in the global market for capnography equipment.

- Charting their announced annual revenues, either from capnography equipment specifically or from their overall business unit/product.

Data Triangulation

The research methodology undertaken included segmenting the global capnography equipment market into different categories and subcategories. The data triangulation and segmentation processes helped ensure that accurate data were available for the various market segments. Various analyses were done to understand all the factors and trends related to both the demand and supply sides of the market. The detailed integration between the top-down and bottom-up approaches provided a comprehensive overview of the capnography equipment market.

Market Definition

Capnography is defined as the medical monitoring technique that measures the amount of carbon dioxide (CO2) exhaled with every breath. The capnography equipment like a capnograph is applied for monitoring the patient's respiratory status, ventilation, and circulation. With its wide applicability in any field of health such as in hospitals, intensive care units, and operating rooms, capnography helps healthcare providers assess the effectiveness of ventilation, early detection of respiratory problems, and adjustment of treatment accordingly.

Stakeholders

- Healthcare institutions (hospitals and Home care)

- Healthcare institutions (hospitals)

- Research institutions

- Clinical research organizations

- Academic medical centers and universities

- Reference laboratories

- Accountable Care Organizations (ACOs)

- Research and consulting firms

- Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

- Academic medical centers and universities

- Market research and consulting firms

- Group Purchasing Organizations (GPOs)

- Medical Research Laboratories

- Academic Medical Centers and Universities

Report Objectives

- Market analysis can be made on various dimensions like product types, technologies, applications, end-users, and regional areas.

- Explore any opportunity for stakeholders and carry out a fine scrutiny of the competitive landscape along with key players.

- Provide in-depth insights into the key drivers influencing market growth.

- Analyze the growth trend of the individual, their potential contribution to the micro-markets' overall market.

- Competitive responses such as new product launches, approvals, agreements, partnerships, expansions, acquisitions, and collaborations in the capnography equipment market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Capnography Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Capnography Equipment Market