Edge AI Software Market

Edge AI Software Market by Offering (Platform, Frameworks & Toolkits), Technology (Generative AI, Machine Learning, NLP, Computer Vision), Data Modality (Spatial Data, Temporal Data, Visual Data, Multimodal Data, Textual Data) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Edge AI Software market is projected to grow from USD 2.40 billion in 2025 to USD 8.89 billion by 2031, expanding at a CAGR of 24.4%. This growth reflects a fundamental shift in how enterprises process and act on data—moving intelligence closer to the source to enable real-time decision-making, latency reduction, and data sovereignty.Technology buyers are prioritizing edge-native AI platforms that offer scalability, interoperability, and hardware-agnostic deployment. Vendors are focusing on containerized AI runtimes, model optimization toolkits, and edge-to-cloud orchestration to support seamless integration and lifecycle management.

KEY TAKEAWAYS

- North America dominates the Edge AI Software market by 32.3% share in 2025.

- By offering, the platform segment is expected to dominate the market, and growing at fastest growth rate of 24.8%, during the forecast period.

- By data modality, the visual data segment dominates the market with 31.3% share in 2025.

- By technology, the generative AI segment is projected to be the fastest growing segment, during the forecast period.

- By end user, the manufacturing segment is expected to dominate the market.

- Microsoft, Google and AWS are identified as some of the star players in the Edge AI Software market, given their strong market share and product footprint.

- Axelera AI, Edge Impulse and Latent AI among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging leaders.

The Edge AI Software market is rapidly advancing as enterprises deploy AI at the edge to enable real-time analytics, predictive maintenance, autonomous operations, and intelligent monitoring. Key applications span industrial automation, smart manufacturing, autonomous vehicles, and IoT-enabled smart cities. Major growth drivers include The proliferation of IoT devices generating real-time data, Rising demand for low-latency, high-reliability decision-making, The need for secure, privacy-preserving on-device AI processing. Leading vendors such as Microsoft, NVIDIA, Google Cloud, and Nutanix are investing in edge-grade AI platforms, enabling scalable, low-latency, and high-performance deployments across industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Edge AI software market is rapidly growing as organizations adopt AI-driven intelligence on edge devices for real-time analytics, decision-making, and operational optimization. Growth is driven by IoT proliferation, autonomous systems, and industrial automation requiring low-latency, on-device AI processing. Enterprises use edge AI for predictive maintenance, anomaly detection, and sensor-based monitoring, improving reliability, privacy, and operational efficiency. Trends such as federated learning, TinyML deployment, and distributed inferencing address bandwidth, latency, and data sovereignty challenges. Increasing investments in scalable, secure, and energy-efficient edge AI platforms across automotive, manufacturing, healthcare, and smart city applications are accelerating market expansion.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Federated learning is emerging as a critical enabler of privacy-preserving AI at the edge

-

The rapid expansion of IoT ecosystems is fueling demand for real-time, edge-based intelligence.

Level

-

Scaling AI workloads across heterogeneous, distributed edge environments.

Level

-

The rise of TinyML—machine learning models optimized for microcontrollers and ultra-low-power devices

-

Emergence of Transformative Applications across industries

Level

-

Managing the extensive volume and heterogeneity of data generated at the edge

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Federated learning is emerging as a critical enabler of privacy-preserving AI at the edge

Federated learning is emerging as a transformative force in the Edge AI software market, enabling decentralized AI model training without transferring raw data to the cloud. This approach addresses critical concerns around Data privacy and security, Regulatory compliance (e.g., GDPR, HIPAA), Cross-device learning without centralization. Leading vendors such as Google and NVIDIA are integrating federated learning into their edge AI platforms, enabling use cases like Personalized healthcare diagnostics, Fraud detection in financial services, Smart device personalization. By allowing AI models to learn from distributed datasets while preserving user confidentiality, federated learning is becoming essential for privacy-sensitive edge deployments.

Restraint: Scaling AI workloads across heterogeneous, distributed edge environments.

Managing AI workloads across heterogeneous, distributed edge nodes presents significant scalability challenges. Unlike centralized cloud systems, edge deployments must contend with Varying compute and memory capabilities, Limited bandwidth and intermittent connectivity, Complex orchestration across thousands of devices. These challenges are particularly acute in industrial IoT, autonomous systems, and smart cities, where real-time performance and low-latency coordination are non-negotiable. To address these issues, vendors are investing in Lightweight AI models, Dynamic workload balancing, End-to-end orchestration frameworks.

Opportunity: The rise of TinyML—machine learning models optimized for microcontrollers and ultra-low-power devices

The rise of TinyML—ultra-compact, energy-efficient machine learning—presents a major opportunity for Edge AI software vendors. TinyML enables Real-time inference on microcontrollers and low-power devices, Offline AI processing for remote or bandwidth-constrained environments, Enhanced privacy by keeping data on-device. Key applications include Healthcare: Wearables and remote monitoring, Agriculture: Smart irrigation and crop health analytics, Environmental monitoring: Air quality sensors and wildlife tracking. TinyML is accelerating the adoption of scalable, secure, and responsive edge AI solutions across industries.

Challenge: Managing the extensive volume and heterogeneity of data generated at the edge

Edge environments generate vast amounts of structured, unstructured, and semi-structured data from sensors, machines, and embedded systems. Key challenges include Limited compute and storage capacity at the edge, Real-time processing requirements, Data synchronization and consistency across distributed nodes. These issues are particularly complex in industrial, automotive, and smart city deployments, where latency, data integrity, and system reliability are critical. Solutions include Hybrid edge-cloud architectures, Advanced data orchestration frameworks, Edge-native data compression and filtering.

Edge AI Software Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

GlobalSense, in partnership with Edge Impulse, used the Edge Impulse platform to overcome traditional automotive diagnostics challenges by deploying an edge AI-powered audio analysis solution for real-time fault detection. | GlobalSense achieved faster, more accurate fault detection, reduced diagnostic costs, enhanced data privacy, and improved scalability through Edge Impulse’s on-device AI processing and efficient development framework. |

|

Perfetti Van Melle, in collaboration with Siemens and automation partner Marchiani, modernized its packaging line using Siemens Industrial Edge to enhance real-time data processing and integration with existing systems. | Perfetti Van Melle achieved enhanced real-time monitoring, improved production efficiency with reduced waste, and seamless integration with existing management and operational systems. |

|

A major US airport partnered with Gorilla Technology to deploy an advanced edge AI-powered surveillance system. Solution integrates facial recognition, vehicle analytics, and real-time monitoring to strengthen security and enable rapid incident detection and response. | The U.S. airport enhanced real-time monitoring, optimized passenger and vehicle flow, and improved threat detection and response, ensuring safer, more efficient operations through AI-powered surveillance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

This section highlights the edge AI software ecosystem, which comprises software providers by type, software providers by data modality, software providers by deployment mode, technologies used by providers, and business end-use. This segmented ecosystem works collaboratively to drive the transition toward more efficient workflows and output generation, leveraging technology and data to achieve goals.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Edge AI Software Market, By Software Type

The Edge AI platform segment is the fastest-growing software category, driven by the need for Standardized development environments, Modular architectures compatible with diverse edge hardware, Seamless integration with IoT ecosystems. These platforms enable organizations to Deploy, manage, and scale AI models across distributed edge devices, Support real-time inferencing, federated learning, and device orchestration, Monitor and optimize performance across heterogeneous edge infrastructures. Vendors are focusing on low-latency, interoperable platforms that streamline deployment and enhance compute efficiency in manufacturing, transportation, and smart city applications.

Edge AI Software Market, By Deployment Mode

On-premises deployment is gaining traction, especially in industries with stringent requirements for Data privacy and regulatory compliance, Low-latency analytics, Full infrastructure control. Sectors such as manufacturing, energy, and defense are adopting on-premise edge AI for Predictive maintenance, Real-time sensor data processing, Operational automation. Vendors are offering modular, scalable edge AI stacks with integrated monitoring, orchestration, and inferencing capabilities, enabling secure, reliable deployments in mission-critical environments.

Edge AI Software Market, By Data Modality

The auditory data segment is emerging as a high-growth area, driven by the need for real-time sound analysis in Industrial automation (e.g., equipment anomaly detection), Automotive systems (e.g., driver monitoring, acoustic diagnostics), Security and surveillance (e.g., gunshot detection, intrusion alerts). Edge AI software processes auditory signals locally, enabling Low-latency acoustic event detection, Predictive maintenance in noisy environments, Human-machine interaction through voice and sound cues. Vendors are delivering TinyML-optimized models, auditory inference pipelines, and on-device sound recognition capabilities for scalable, real-time decision-making.

Edge AI Software Market, By End User

The automotive industry is rapidly adopting edge AI to support Connected vehicle technologies, Autonomous driving systems, In-cabin intelligence and infotainment. Automakers are deploying edge AI for Real-time sensor fusion, Driver behavior monitoring, Predictive maintenance, Vehicle-to-everything (V2X) communication. Growth is further supported by regulatory safety mandates and the demand for low-latency, AI-enabled decision-making in vehicles. Vendors are delivering automotive-grade AI platforms with integrated sensors and real-time inferencing capabilities.

REGION

Asia Pacific to be the fastest-growing region in the Edge AI Software Market during the forecast period

Asia Pacific is emerging as the fastest-growing region in the Edge AI software market, driven by rapid adoption of IoT-enabled devices, smart manufacturing, and on-device AI processing. Countries such as China, Japan, India, and Singapore are leading the integration of edge AI in industrial automation, autonomous vehicles, and smart city applications, leveraging real-time inferencing, TinyML, and edge gateways. Growth is supported by government-backed AI initiatives, expanding 5G infrastructure, and demand for low-latency, privacy-preserving analytics. The region’s momentum positions it as a hub for edge AI innovation, with vendors investing in localized solutions for industry-specific deployment.

Edge AI Software Market: COMPANY EVALUATION MATRIX

In the Edge AI software market matrix, Microsoft (Star) leads with a robust presence and a comprehensive portfolio of edge AI solutions, including real-time inferencing, TinyML deployment, edge gateways, and on-device analytics, enabling large-scale adoption across manufacturing, automotive, and smart city applications. Nutanix (Emerging Leader) is gaining traction with its AI-driven edge orchestration, distributed compute management, and low-latency data processing capabilities, supporting enterprises in deploying scalable edge AI workloads. While Microsoft dominates through platform integration, enterprise adoption, and end-to-end edge AI solutions, Nutanix demonstrates strong growth potential, steadily moving toward the star quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.92 Billion |

| Market Forecast in 2030 | USD 8.89 Billion |

| Growth Rate | CAGR of 24.4% during 2025-2031 |

| Years Considered | 2020-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Delivered competitive profiling of additional vendors, brand comparative analysis, and a drill-down of country-level segmentation across key markets. | Enabled competitive positioning insights, product differentiation clarity, and multi-country market intelligence, supporting go-to-market strategy refinement and stakeholder alignment. |

| Leading Solution Provider (Europe) | Provided competitive profiling, brand benchmarking, and segmentation analysis across additional geographies. | Delivered in-depth market insights, comparative brand positioning, and segment-level intelligence, empowering strategic decision-making and regional growth planning. |

RECENT DEVELOPMENTS

- April 2025 : Sutherland and Google Cloud expanded their partnership to accelerate enterprise-wide adoption of generative AI and edge AI solutions. By integrating Google Cloud’s Gemini models, Vertex AI, and Customer Engagement Suite with Sutherland’s applied AI expertise, the collaboration aims to optimize real-time data processing, edge inferencing, and AI-driven customer lifecycle management from strategy to operations.

- March 2025 : IBM and NVIDIA collaborated to enhance AI adoption across edge and cloud environments by integrating NVIDIA’s AI and data platform technologies into IBM’s watsonx AI platform. Leveraging NVIDIA GPUs, AI Enterprise software, and networking solutions, the partnership strengthens edge AI inferencing, distributed training, and enterprise-scale AI deployments.

- February 2025 : Anduril and Microsoft partnered to advance the US Army’s Integrated Visual Augmentation System (IVAS). Anduril oversees development and production, using Microsoft Azure as its preferred cloud for AI. The collaboration delivers AI-enabled situational awareness, edge inferencing, and augmented reality for real-time battlefield decision-making and enhanced combat effectiveness.

- February 2025 : Mercedes-Benz and Google Cloud expanded their partnership to enhance the MBUX Virtual Assistant with advanced conversational AI and edge capabilities. Powered by Google Cloud’s Automotive AI Agent and Gemini on Vertex AI, the assistant delivers real-time, personalized navigation and POI recommendations, leveraging edge inferencing and Google Maps Platform data.

- February 2025 : Veea and Vapor IO partnered to offer turnkey AI-as-a-Service (AIaaS) to enterprises and municipalities, reducing heavy infrastructure costs. Combining Veea’s Edge Platform with Vapor IO’s Zero Gap AI, the solution enables edge AI inferencing, federated learning, AI-driven cybersecurity, and low-latency real-time analytics.

Table of Contents

Methodology

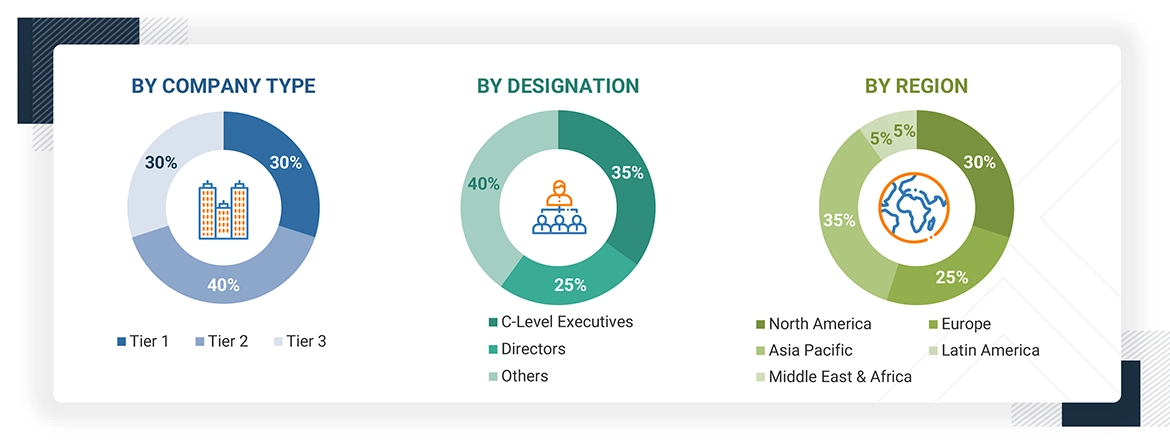

This research study on the edge AI software market involved extensive secondary sources, directories, IEEE Communication-Efficient Edge AI: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred edge AI software providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the edge AI software spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and edge AI software. It also included key executives from edge AI solution vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between

USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

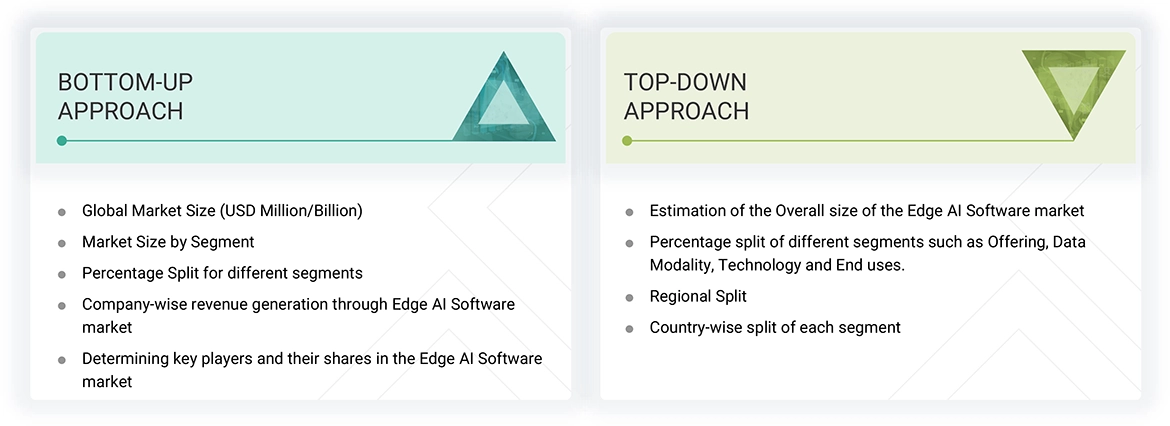

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the edge AI software market. The first approach involved estimating the market size by companies’ revenue generated through the sale of edge AI software products.

Market Size Estimation Methodology: Top-down Approach

In the top-down approach, an exhaustive list of all the vendors offering products in the market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on offering, data modality, technology, end user, and region. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology: Bottom-up Approach

In the bottom-up approach, the adoption rate of edge AI software products among different verticals in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of edge AI software products among enterprises, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the edge AI software market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major edge AI software providers, and organic and inorganic business development activities of regional and global players were estimated.

Edge AI Software Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Edge AI software enables aggregation, processing, computation, and analysis of data present near or on edge devices by leveraging AI and IoT technologies. The software helps to process data on edge nodes, even in remote and decentralized networks, without cloud connectivity. Integrating AI with IoT in edge devices helps enterprises minimize latency, reduce bandwidth, reduce threats, avoid duplication, improve reliability, and maintain compliance.

Stakeholders

- Edge AI software vendors

- Edge AI service vendors

- Managed service providers

- Support and maintenance service providers

- System integrators (SIs)/migration service providers

- Value-added resellers (VARs) and distributors

- Independent software vendors (ISVs)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the edge AI software market by offering, data modality, technology, end user, and region

- To describe and forecast the market, in terms of value, by region: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as mergers and acquisitions, partnerships, collaborations, product launches and enhancements, and ongoing research and development (R&D) in the market

- To provide the illustrative segmentation, analysis, and projection of the main regional markets

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American Market

- Further breakup of the European Market

- Further breakup of the Asia Pacific Market

- Further breakup of the Middle East & Africa Market

- Further breakup of the Latin American Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is edge AI software?

Edge AI software refers to artificial intelligence solutions deployed directly on edge devices. This eliminates the reliance on centralized cloud infrastructure, reducing latency, improving data privacy, and offering real-time analytics. It is mainly applied in applications such as IoT devices, autonomous vehicles, and smart manufacturing systems.

Which region is expected to have the largest share in the edge AI software market?

North America is expected to lead the edge AI software market, driven by the burgeoning e-commerce sector, technological advancements, and changing consumer expectations. The expansion of digital shopping platforms has also been a growth factor for the market.

Which end users are adopting edge AI software?

Enterprises adopting edge AI software products include manufacturing, retail, healthcare & life sciences, BFSI, automotive, smart cities, energy & utilities, telecommunication, transportation & logistics, and consumer devices & electronics, among others.

What are the key drivers supporting the edge AI software market?

The key drivers of the edge AI software market include the rapid growth in the number of intelligent applications, the exponential growth of data volume and network traffic, the increasing use of IoT, and the rise in adoption of 5G network technology.

Who are the major players in the edge AI software market?

The major players in the global edge AI software market include Microsoft (US), IBM (US), Google (US), AWS (US), Nutanix (US), Synaptics (US), Gorilla Technologies (UK), Intel (US), VEEA (US), Infineon Technologies (Germany), Intent HQ (UK), Baidu (China), NVIDIA (US), Alibaba Group (Singapore), Bosch Global Software Technologies (India), Azion (US), Blaize (US), Clearblade (US), Johnson Controls (US), Midokura (Japan), Tredence (US), Cognex (US), HPE (US), Tata Elxsi (India), Siemens (Germany), Axelera AI (Netherlands), Edge Impulse (US), Latent AI (US), Roboflow (US), Striveworks (US), Teraki (Germany), Ekkono (Sweden), Spectro Cloud (US), Barbara (Spain), Envision AI (US), Horizon Robotics (China), Kneron (US), Advian (Finland), Xenonstack (UAE), and Akira AI (India).

What is the global Edge AI software market’s current valuation and projected growth?

The global Edge AI software market is valued at USD 2.40 billion in 2025 and is projected to reach USD 8.89 billion by 2031, growing at a compound annual growth rate (CAGR) of 24.4% during the forecast period.

What is the expected CAGR for the edge AI software market in Asia Pacific from 2025 to 2031?

The Asia Pacific edge AI software market is expected to grow at a compound annual growth rate of 26.8% during the forecast period leading up to 2031.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Edge AI Software Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Edge AI Software Market