Europe Artificial Intelligence (AI) in Healthcare Market Size, Growth, Share & Trends Analysis

Europe Artificial Intelligence (AI) in Healthcare Market by Offering (Integrated), Function (Diagnosis, Genomic, Precision Medicine, Radiation, Telehealth, RPM, Immunotherapy, Supply Chain), Application (Clinical), End User (Hospitals) - Forecast to 2030

OVERVIEW

-in-healthcare-market-img-overview.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe Artificial Intelligence (AI) in Healthcare Market, valued at USD 4.20 billion in 2024, stood at USD 6.12 billion in 2025 and is projected to advance at a resilient CAGR of 39.0% from 2025 to 2030, culminating in a forecasted valuation of USD 31.72 billion by the end of the period. This growth is driven by strong regulatory support for digital transformation and the rising adoption of AI-enabled clinical workflows across European health systems.

KEY TAKEAWAYS

-

By CountryBy country, Germany accounted for the largest share of 28.1% of the Europe artificial intelligence (AI) in healthcare market in 2024.

-

By OfferingBy offering, the integrated solutions segment is expected to register the highest CAGR of 40.6% during the forecast period.

-

By FunctionBy function, the diagnosis & early detection segment is projected to grow at the fastest rate from 2025 to 2030.

-

By ApplicationBy application, the clinical applications segment accounted for the largest share of 77.7% of the Europe artificial intelligence (AI) in healthcare market in 2024.

-

By Deployment ModelBy deployment model, the cloud-based model segment is expected to grow at the highest rate during the forecast period.

-

By ToolBy tool, the machine learning segment is expected to dominate the market, growing at the highest CAGR.

-

By End UserBy end user, the healthcare providers segment accounted for the largest share of the Europe artificial intelligence (AI) in healthcare market in 2024.

-

Competitive LandscapeKoninklijke Philips N.V., Siemens Healthineers AG, and GE Healthcare were identified as the star players in the Europe artificial intelligence (AI) in healthcare market, given their strong market share and product footprint.

-

Competitive LandscapeCompanies such as Qure.ai and Healx have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The artificial intelligence (AI) in healthcare market in Europe is experiencing robust growth, driven by the increasing adoption of Al- enabled diagnostic tools, clinical decision support systems, and hospital automation solutions to enhance care quality, address workforce shortages, and improve operational efficiency. New deals and developments, including cross-border data-sharing initiatives, strategic collaborations between healthcare providers and AI technology vendors, and advancements in federated learning, medical imaging AI, and predictive analytics, are rapidly reshaping the region's digital health landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe artificial intelligence (AI) in healthcare market is experiencing significant disruption due to accelerated investment in AI-driven healthcare diagnostics, automation, and decision support in hospitals driven by chronic staffing shortages. Emerging technologies such as generative AI, federated learning, and real-time predictive analytics are transforming healthcare workflows and making it more feasible and safe to innovate in healthcare settings. A technology revolution of this magnitude in healthcare is pressuring healthcare players to transform healthcare operations and make more strategic partnerships.

-in-healthcare-market-img-disruption.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Europe AI Act accelerating demand for compliant radiology solutions

-

European Health Data Space (EHDS) boosting access to structured cross-border imaging data

Level

-

Complex European regulations increasing AI certification burdens

-

Fragmented national interpretations of GDPR and consent limiting pooled training datasets

Level

-

EHDS-enabled pan-EU validation studies and regulatory evidence generation

-

Procurement schemes favoring compliant AI vendors

Level

-

Performance variability across European scanners and sites

-

Regulatory/legal uncertainty about liability and clinical accountability across member states

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Europe AI Act accelerating demand for compliant radiology solutions

The European AI Act is emerging as a strong driver of market expansion. As one of the first complete regulatory guidelines available in the world for AI, this legislation imposes very strong requirements concerning transparency, quality, risk management, and performance requirements for high-risk medical AI systems. Tools in radiology, such as diagnostic support systems, triage algorithms, and image analysis systems, come under these high-risk medical AI systems. Due to these requirements, healthcare systems in Europe, along with healthcare service providers, are witnessing a surge in demand for AI solutions that are legislation-compliant and available under the guidelines of the European Union’s Medical Device Regulation (MDR). Therefore, a huge demand is being witnessed in Europe for trustworthy and auditable healthcare AI solutions offered by vendors. Furthermore, healthcare AI solutions such as AI product requirements for generating strong evidence, model interpretability, continuous monitoring systems, and strong solutions concerning healthcare AI safety are witnessing a surge in demand among healthcare buyers in Europe. Vendors satisfying these requirements are witnessing an increased demand for their solutions with increased adoption cycles. Therefore, in the coming years, European AI legislation will prove to be a huge catalyst in accelerating the expansion of AI in radiology, with increased healthcare AI safety in Europe becoming a global force in the coming years.

Restraint: Complex Europe regulations increasing AI certification burdens

The evolving European regulatory environment is making it increasingly complicated for vendors in the broader healthcare sector to achieve certifications in the AI technology space offered by companies. Medical AI systems need to abide by not only the EU’s Medical Device Regulation but also the upcoming European AI Act, which treats most of these healthcare AI solutions as high-risk technologies. Such two-fold regulations call for heavy documentation, thorough testing, constant surveillance, and sufficient algorithmic explainability. In most cases, most companies, especially start-ups, face an unusually high threshold of evidence and proof of safety, performance, and explanatory requirements in healthcare AI technology compared to other countries. Moreover, this challenge is worsened by the reduced capacity in most European countries. The notified bodies, which regulate the processing and certification of most medical devices incorporating AI technology in Europe, are overworked by existing MDR workloads.

Opportunity: EHDS-enabled pan-EU validation studies and regulatory evidence generation

The European Health Data Space (EHDS) offers a major impetus to improve AI validation and regulatory readiness in the healthcare industry. As a platform that allows access, sharing, and reuse of health information among member countries in the European Union, the EHDS will enable AI tech companies to access larger, more diversified, and better-quality imaging and clinical datasets for model validation. Such a requirement is critical in medical imaging and diagnostic AI because model performance strongly relies on exposure to a variety of patients with different demographic characteristics, different imaging devices, and different environments. Pan-European access rights will enable tech companies to undertake more widespread real-world studies to prove medical validity and satisfy the very challenging requirements of the European AI Act and MDR laws. The EHDS will improve healthcare provider and regulatory bodies' awareness and trust in AI solutions. As a result, AI vendors can deliver high-quality bundles of evidence to better represent a genuine European healthcare setting rather than a pilot project in isolation. The platform will improve AI model generalizability, overcome model bias risk, and fast-track safe and efficient AI solutions in healthcare systems. Collectively, the EHDS will make Europe a globally leading powerhouse in evidence-driven, ethics-driven medical AI, where a pro-innovation environment applies in conjunction with patient and healthcare system safety.

Challenge: Performance variability across European scanners and sites

The principal challenge to AI adoption within European healthcare is the huge variability in imaging equipment, protocols, and clinical practices from different hospitals across different countries. In Europe, the radiology landscape is highly heterogeneous; sites utilize scanners from several manufacturers, operating at a wide range of ages, resolutions, and maintenance levels. Imaging protocols, reconstruction settings, and workflow standards are also very diverse and continue changing, even within the same country. As such, any AI model trained on data from one environment will likely underperform when deployed in another, failing to deliver consistent accuracy, and therefore, less reliability, with higher requirements for localization or site-specific recalibration. Because this provides inconsistent performance, it further reduces the rate of hospital adoption and requires more substantial additional validation work by AI vendors. Such variability generally raises the operational burden on both developers and healthcare providers. AI vendors have to invest heavily in multi-site data collection, multi-vendor, multi-modality algorithm tuning, and post-market performance monitoring to assure that their tools generalize adequately across the Europe market. Meanwhile, on the hospital side, integration challenges include compatibility checks with different PACS systems and quality control processes to maintain stable model performance. These added complexities increase implementation costs, extend deployment timelines, and limit scalability. It is only by addressing this challenge through better standardization of imaging protocols and stronger pan-European datasets, a step necessary to ensure consistent AI performance across the continent, that meaningful progress can be made.

Europe Artificial Intelligence (AI) in Healthcare Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

-in-healthcare-market-philips.svg) |

AI-enabled radiology workflows, such as automated image triage and smart reporting. | Faster diagnosis, reduced radiologist workload, and improved imaging accuracy. |

-in-healthcare-market-siemens.svg) |

AI-powered CT/MRI reconstruction and decision support tools. | Higher image quality, lower scan time, and improved clinical confidence. |

-in-healthcare-market-nvidia.svg) |

AI model development platforms for hospitals & OEMs (Clara, BioNeMo). | Accelerates AI deployment, boosts model accuracy, and reduces R&D time. |

-in-healthcare-market-medtronic.svg) |

AI-integrated surgical systems and smart endoscopy (GI Genius). | Early polyp detection, improved surgical outcomes, and enhanced workflow safety. |

-in-healthcare-market-ge heathcare.svg) |

AI-driven imaging analytics, such as Critical Care Suite, and precision imaging. | Real-time alerts, reduced reporting time, and improved care triage. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe artificial intelligence (AI) in healthcare ecosystem is developing at a fast pace due to the effective teamwork of leading technology giants, startups in AI technology, and large hospital chains. The Europe AI in healthcare ecosystem is facilitated by government bodies such as the European Commission and EMA in order to create a proper compliance framework, which, in turn, leads to increased innovation at a faster pace with safety standards.

-in-healthcare-market-img-ecosystem.webp)

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

-in-healthcare-market-img-segment.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Artificial Intelligence (AI) in Healthcare Market, By Offering

Based on offering, the market is segmented into integrated solutions, niche/point solutions, AI technology, and services. Integrated solutions accounted for the major share in 2024 because such solutions bring together imaging, diagnostics, workflow management, and clinical decision support onto a single interoperable platform. Healthcare providers across Europe are now looking ahead with enterprise-wide AI deployments to simplify vendor management, achieve compliance with EU regulations, and enable seamless data exchange across hospital systems. Additionally holistic digital transformation impelled by national health authorities and the European Health Data Space is accelerating the movement toward comprehensive and end-to-end AI platforms rather than standalone tools.

Europe Artificial Intelligence (AI) in Healthcare Market, By Function

Based on function, the market is segmented into diagnosis & early detection, treatment planning & personalization, patient engagement & remote monitoring, post-treatment surveillance & survivorship care, pharmacy management, data management & analytics, and administrative functions. The diagnosis & early detection segment commanded the largest share in Europe due to strong advancements in imaging AI, widespread deployment of machine learning algorithms across radiology and pathology departments and increasing access to high-quality clinical datasets across European health systems. The rising demand for preventive and value-based care, driven by national healthcare initiatives, is further accelerating its adoption. Additionally, Europe's growing focus on reducing care variation and lowering healthcare costs is strengthening the role of AI in supporting earlier disease identification and more efficient treatment planning.

Europe Artificial Intelligence (AI) in Healthcare Market, By Application

Based on application, the market is divided into clinical applications and non-clinical applications. Clinical applications are expected to grow at the highest CAGR during the forecast period due to the rapid adoption of AI-driven diagnostics, imaging analytics, and clinical decision support tools across European hospitals. Growing pressure to alleviate clinician workload, improve care quality, and address workforce shortages, especially in radiology and pathology, is accelerating the demand for Al-enabled clinical workflows. Additionally, strong government-backed digital health initiatives, increased availability of structured health data, and advancements in generative and predictive Al models are further driving the expansion of clinical Al use cases across the region.

Europe Artificial Intelligence (AI) in Healthcare Market, By Deployment Model

Based on deployment model, the market is classified into on-premises model, cloud-based model, and hybrid model. The cloud-based model market is projected to record the highest CAGR during the forecast period, driven by the need for a cost-effective and efficient model to support AI workloads in European healthcare systems. The emergence of cross-border data sharing under the European Health Data Space initiative is expected to further boost cloud deployment, facilitating protected access to large datasets for developing AI algorithms. Moreover, cloud solutions have a faster implementation time, seamless integration with existing hospital systems, and better compliances for EU regulations, thus making them a preferable choice among healthcare service providers in Europe to update their digital systems.

Europe Artificial Intelligence (AI) in Healthcare Market, By Tool

Based on tool, the Europe artificial intelligence (Al) in healthcare market for machine learning is classified into deep learning, supervised learning, reinforcement learning, unsupervised learning, and other machine learning tools. In 2024, deep learning led in terms of market share in Europe due to its excellent capability of handling large amounts of unstructured medical information, such as EHRs, medical imaging, pathology images, and genomics, in Europe's fast-changing digital healthcare environments. Deep learning holds a prominent place in AI adoption in the European Union’s healthcare and medical realms in relation to imaging, oncology, cardiology, and population health management. With increased spending by European healthcare institutions, research bodies, and technology companies in diagnostic AI and predictive analytics, deep learning technology adoption in Europe is fueled further. With increased processing powers available in Europe and interregional datasets emerging in light of European projects such as the European Health Data Space initiative, deep learning technology is poised to fuel a new wave in Europe's developing healthcare ecosystem.

Europe Artificial Intelligence (AI) in Healthcare Market, By End User

Based on end user, the Europe artificial intelligence (AI) in healthcare market is classified into hospitals & clinics, ambulatory surgical centers, home healthcare agencies & assisted living facilities, diagnostic & imaging centers, pharmacies, and other healthcare providers. Of these, the largest share belonged to hospitals & clinics due to a major focus in this region on precise patient diagnosis, personalized treatment pathways, and an overhaul of conventional healthcare delivery in their respective healthcare systems. European hospitals have started embracing AI solutions for improving patient diagnostics, surgical assistance, and seamless connectivity with existing EHR and imaging systems.

REGION

The UK is expected to be the fastest-growing country in Europe artificial intelligence (AI) in healthcare market during forecast period

The UK market is expected to register the highest CAGR during the forecast period. This growth is driven by strong government backing for Al adoption through initiatives such as the NHS AI Lab, coupled with significant investments in digital health infrastructure and clinical workflow automation. Additionally, the mature health data ecosystem and active collaboration between the NHS, AI startups, and global technology partners are accelerating large-scale deployment of AI solutions across care delivery in the UK.

-in-healthcare-market-img-region.webp)

Europe Artificial Intelligence (AI) in Healthcare Market: COMPANY EVALUATION MATRIX

In the Europe artificial intelligence (AI) in healthcare market matrix, Koninklijke Philips N.V., a star player, leads with a dominant market presence and is leveraging its extensive clinical ecosystem, strong hospital partnerships, and broad portfolio of imaging AI, workflow automation, and remote patient monitoring solutions that are widely adopted across Europe. Its deep integration within national health systems and continuous investment in advanced analytics and generative AI further reinforce its leadership position. Amazon Web Services, Inc., an emerging leader, is gaining momentum with its powerful cloud infrastructure as well as scalable AI platforms and compliance-focused health data solutions tailored to European regulatory requirements. While Philips maintains a clear advantage through clinical depth and established adoption, AWS shows significant potential to ascend toward the leaders quadrant as cloud native AI deployment and interoperability become increasingly critical across the region's digital health landscape.

-in-healthcare-market-img-evaluation.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Koninklijke Philips N.V. (Netherlands)

- Microsoft Corporation (US)

- Siemens Healthineers AG (Germany)

- NVIDIA Corporation (US)

- Epic Systems Corporation (US)

- GE Healthcare (US)

- Medtronic (Ireland)

- Oracle (US)

- BenevolentAI (UK)

- Merative (US)

- Google (US)

- Johnson & Johnson (US)

- Amazon Web Services, Inc. (US)

- SOPHiA GENETICS (Switzerland)

- Cognizant (US)

- Tempus (US)

- Solventum (US)

- Ada Health GmbH (Germany)

- Infermedica (Poland)

- Viz.ai, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.20 Billion |

| Market Forecast in 2030 (Value) | USD 31.72 Billion |

| Growth Rate | CAGR of 39.0% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, France, UK, Italy, Spain, Rest of Europe |

| Parent & Related Segment Reports |

Artificial Intelligence (AI) in Healthcare Market US Artificial Intelligence (AI) in Healthcare Market AI in Clinical Workflow Market AI Agents in Healthcare Market AI in Hospital Operations Market Stroke AI Market |

WHAT IS IN IT FOR YOU: Europe Artificial Intelligence (AI) in Healthcare Market REPORT CONTENT GUIDE

-in-healthcare-market-img-content.webp)

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-level AI adoption insights | Detailed analysis across the UK, Germany, France, the Nordics, Italy, and Spain | Enabled clients to prioritize high-growth markets and refine regional go-to-market strategies |

| Regulatory landscape assessment | Mapping of EU AI Act, GDPR, and MDR/IVDR compliance impact | Improved regulatory readiness and reduced market-entry risk |

| Competitive intelligence on European AI vendors | Profiling of 25+ startups and established players with benchmarking | Helped identify partnership targets and evaluate competitive positioning |

| Quantitative modeling and forecasting | Country-wise TAM, SAM, SOM, and 2025–2030 growth projections | Supported investment planning and long-term revenue forecasting |

| Use case segmentation across clinical workflows | Breakdown of AI applications in imaging, triage, RPM, and hospital automation | Allowed clients to align solutions with highest-value clinical demand areas |

RECENT DEVELOPMENTS

- February 2025 : Koninklijke Philips N.V. (Netherlands) partnered with Medtronic (US) to educate and train cardiologists and radiologists in India on advanced imaging techniques for structural heart diseases. This partnership aims to upskill over 300 clinicians in multi-modality imaging, including echocardiography (ECHO) and Magnetic Resonance Imaging (MRI), particularly for patients with End-Stage Renal Disease (ESRD).

- January 2024 : Siemens and Amazon Web Services (AWS) collaborated to democratize generative AI in software development, integrating Amazon Bedrock into Siemens' Mendix low-code platform. This collaboration aimed to empower domain experts across industries to create and enhance applications easily using advanced generative AI.

- November 2023 : Koninklijke Philips N.V. collaborated with Vestre Viken Health Trust in Norway to deploy its AI Manager platform, enhancing radiology workflows. The AI-enabled bone fracture application streamlined diagnoses, allowing radiologists to focus on complex cases. This initiative, spanning 30 hospitals and serving around 3.8 million people, marked Philips' most extensive AI deployment in Europe, contributing to improved patient care and accelerated diagnostic processes.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

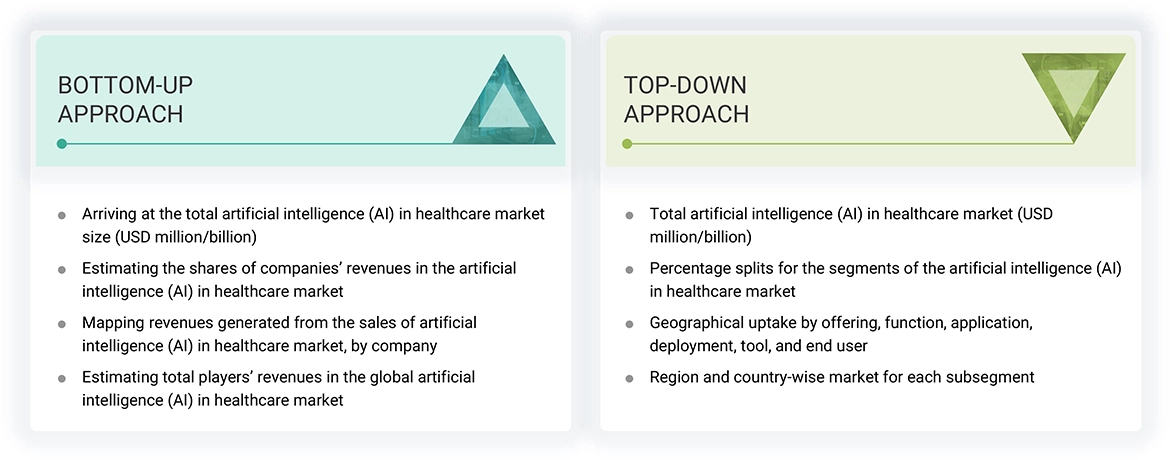

The study involved significant activities in estimating the current size of the Europe Artificial Intelligence (AI) in Healthcare market. Exhaustive secondary research was done to collect information on the Europe Artificial Intelligence (AI) in Healthcare market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Europe Artificial Intelligence (AI) in Healthcare market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for the companies offering Europe Artificial Intelligence (AI) in Healthcare solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Various secondary sources were referred to in the secondary research process to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of Europe Artificial Intelligence (AI) in Healthcare vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends by offering, function, application, deployment, tool, end user, and region).

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Europe Artificial Intelligence (AI) in Healthcare market.

Market Definition

Artificial Intelligence (AI) in Healthcare encompasses the application of artificial intelligence technologies, such as machine learning, natural language processing, computer vision, and robotics, to improve healthcare delivery, enhance operational efficiencies, and provide personalized care. These solutions address a wide range of use cases, including diagnostic imaging, predictive analytics, drug discovery, patient engagement, remote monitoring, and administrative workflows, enabling healthcare providers, payers, and pharmaceutical companies to drive innovation and improve outcomes.

Stakeholders

- Europe AI in Healthcare software vendors

- Europe AI in Healthcare service providers

- Independent software vendors (ISVs)

- Platform providers

- Technology providers

- System integrators

- Cloud service providers

- Healthcare IT service providers

- Hospitals and surgical centers

- Diagnostic imaging centers

- Academic institutes and research laboratories

- Forums, alliances, and associations

- Government organizations

- Institutional investors and investment banks

- Investors/Shareholders

- Venture capitalists

- Research and consulting firms

Report Objectives

- To define, describe, and forecast the Europe Artificial Intelligence (AI) in Healthcare market based on offering, function, application, deployment, tools, end user, and region

- To provide detailed information regarding the factors influencing the growth of the market (such as the drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Europe Artificial Intelligence (AI) in Healthcare market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies in the market

- To track and analyze competitive developments such as product & service launches, expansions, partnerships, agreements, and collaborations; and acquisitions in the Europe Artificial Intelligence (AI) in Healthcare market

- To benchmark players within the Europe Artificial Intelligence (AI) in Healthcare market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Artificial Intelligence (AI) in Healthcare Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Artificial Intelligence (AI) in Healthcare Market