Europe Dental Equipment Market Size, Growth, Share & Trends Analysis

Europe Dental Equipment Market by Product (Therapeutic (Dental Chairs, Dental Units, CAD/CAM, Dental Lasers, Nd:YAG Lasers, Carbon dioxide lasers), Diagnostic (Dental imaging, CBCT)), End User (Dental Hospitals & Dental Clinics) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

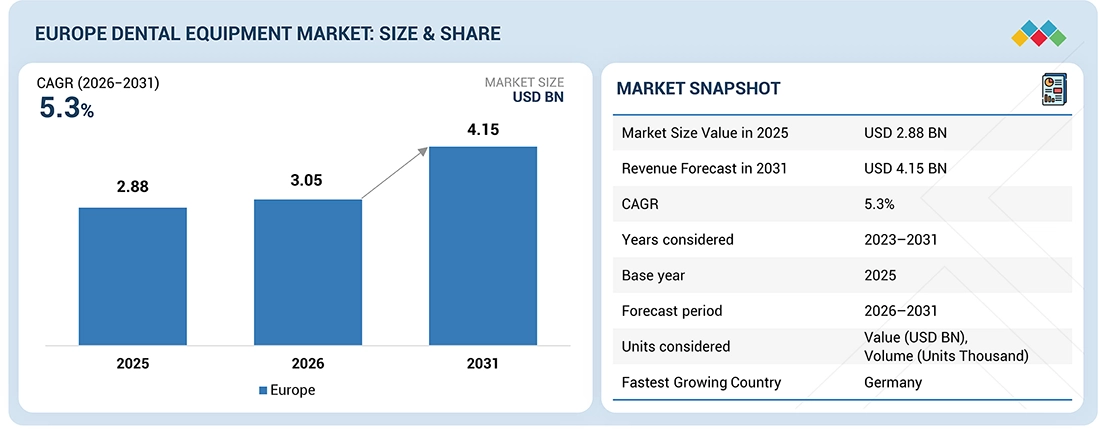

The Europe dental equipment market, valued at US$2.88 billion in 2025, stood at US$3.05 billion in 2026 and is projected to advance at a resilient CAGR of 5.3% from 2026 to 2031, culminating in a forecasted valuation of US$4.15 billion by the end of the period. Dental equipment comprises a broad range of medical technologies designed to support the diagnosis, treatment, and management of oral health conditions in dental practices. These devices include both therapeutic equipment, such as dental chairs, dental units, and diagnostic technologies like dental imaging systems, digital X-ray machines, and CBCT scanners. Depending on their purpose, dental equipment can range from routine tools used in everyday dental care to advanced systems that enable highly specialized procedures. These products are essential in dental hospitals and dental clinics for ensuring effective, safe, and high-quality patient care.

KEY TAKEAWAYS

-

By TYPEBy type, the Europe dental equipment market was dominated by the therapeutic dental equipment segment.

-

By END USERBy end user, the dental hospitals & clinics segment is expected to grow at the highest CAGR during the forecast period in the Europe dental equipment market.

-

By CountryBy country, Germany is expected to grow at the highest CAGR during the forecast period in the Europe dental equipment market.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSDentsply Sirona, Planmeca OY, and Align Technology, Inc. were identified as some of the star players in the Europe dental equipment market, given their strong market share and product/service footprint.

-

COMPETITIVE LANDSCAPE- STARTUPSCompanies such as Overjet and Bein-Air Dental, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The dental equipment market in Europe is driven by rapid advancements in digital and clinical dental technologies, coupled with a growing burden of oral health disorders. Increasing demand for cosmetic dental procedures and the expanding regional dental tourism landscape further support the adoption of modern diagnostic and therapeutic equipment across the country.

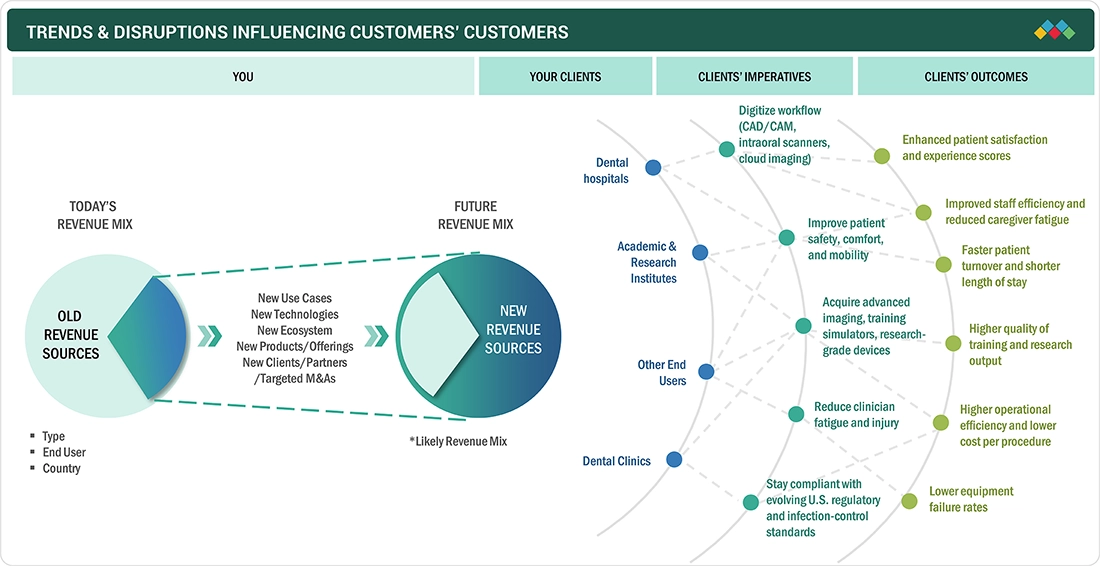

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In Europe, changing revenue models across hospitals, dental clinics, laboratories, and academic and research institutions, combined with the rising adoption of advanced diagnostic equipment, are reshaping the dental equipment market. Furthermore, the growing number of practicing dentists and the ongoing expansion of dental clinics and laboratories are expected to present significant growth opportunities for companies in the dental equipment industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Development of technologically advanced solutions

-

Rise in oral health disorders

Level

-

High cost of dental imaging systems and lack of reimbursement for dental procedures

Level

-

Impact of Dental Service Organizations (DSOs) on dental industry

-

Increasing number of dental laboratories investing in CAD/CAM technologies

Level

-

Dearth of trained dental practitioners

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Development of technologically advanced solutions

The dental industry has evolved over the years with the development of new dental materials. Patient compliance has increased with a sharp rise in the demand for minimally invasive procedures. Dental lasers are increasingly used in surgical procedures, such as gum lifting and teeth whitening, to eliminate or minimize blood loss and reduce patient discomfort. Adhesive dentistry is another area that has gained attention. It uses composite materials to improve aesthetics and strengthen teeth with minimal damage to tooth structures. As a result, the number of people opting for such procedures is increasing. An emerging aspect of cosmetic dentistry is the use of advanced technologies, such as intraoral cameras, to capture images of the smile. Intraoral images help patients decide which cosmetic dentistry treatments to opt for. This has resulted in a greater emphasis on using 4D imaging scanners for monitoring jaw movements. Advancements in dental materials and procedures have made it possible to replicate the properties of natural teeth. One popular procedure is cosmetic tooth whitening, which is preferred for in-office cosmetic dental treatments. Therefore, the focus on developing new technologies and dental materials is expected to create new opportunities for participants in the dental equipment market.

Restraint: High cost of dental imaging systems and lack of reimbursement for dental procedures

The high cost of advanced dental imaging systems, such as CBCT scanners and 4D intraoral imaging devices, remains a major restraint for the dental equipment market in Europe. These systems require significant capital investment, making them less accessible for small and mid-sized dental clinics and laboratories. Additionally, the lack of adequate reimbursement for many dental procedures limits patients’ willingness to opt for high-end diagnostic and cosmetic treatments. Together, these factors constrain the widespread adoption of advanced dental equipment, slowing market growth despite rising demand for precision diagnostics and minimally invasive procedures.

Opportunity: Impact of Dental Service Organizations (DSOs) on dental industry

The growing adoption of Dental Service Organizations (DSOs) presents a strong opportunity for the Europe dental equipment market. DSOs streamline non-clinical and administrative functions for dental practices, enabling dentists to dedicate more time to patient care and invest in advanced technologies that improve clinical efficiency. As seen in the US, where DSO affiliation is rising, particularly among younger dentists, these models have contributed to expanded access to high-quality dental services and increased demand for modern equipment. With similar trends emerging globally, Europe is well-positioned to benefit as DSOs scale across the region. Their emphasis on operational efficiency, centralized purchasing, and standardized clinical workflows encourages bulk procurement of digital dentistry tools, imaging systems, and other high-end dental equipment. Additionally, by reducing the administrative burden on clinicians and improving profitability, DSOs create a favorable environment for continuous technology upgrades. As European dental practices increasingly adopt DSO-supported models, the resulting shift toward modernization and digital transformation is expected to drive significant growth in the region’s dental equipment market.

Challenge: Dearth of trained dental practitioners

The demand for dental care services is expected to rise steadily due to changing demographics, growing awareness of oral health, sedentary lifestyles, and the increasing prevalence of dental diseases such as caries and periodontal disorders. As populations age and urbanization continues, more individuals are seeking preventive, restorative, and cosmetic dental treatments. However, a shortage of trained dental professionals in many countries presents a significant challenge, limiting access to care and slowing the adoption of advanced dental technologies. This gap between rising demand and available workforce can impact the efficiency of dental practices and constrain the growth of the dental equipment market globally.

EUROPE DENTAL EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced dental imaging systems, CAD/CAM solutions, and dental treatment units | High precision diagnostics| Improved treatment efficiency| Integrated digital workflows| Enhanced patient experience |

|

Comprehensive dental imaging solutions including CBCT and 4D jaw motion tracking | Superior 3D imaging accuracy| Innovative jaw movement analysis| Streamlined diagnostics| Better treatment planning |

|

Clear aligner systems with integrated digital scanning and treatment planning | Non-invasive cosmetic correction| Improved patient compliance| Digital treatment customization| Faster results |

|

Wide range of dental equipment, including imaging, handpieces, and orthodontic devices | Durable, high-performance equipment| Improved clinical outcomes| Better ergonomic designs| Expanded treatment capabilities |

|

Digital dental imaging systems and practice management software | User-friendly imaging solutions| Enhanced image quality| Integrated practice workflows | Cost-effective operation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe dental equipment market operates within a complex ecosystem involving multiple stakeholders across product development, manufacturing, regulation, distribution, and clinical adoption. Manufacturers such as Dentsply Sirona, Planmeca OY, and Envista develop advanced technologies, including digital imaging systems, CAD/CAM solutions, and treatment units, aimed at enhancing diagnostic accuracy, treatment efficiency, and patient outcomes. These companies prioritize innovation to support minimally invasive procedures and enhance the overall quality of dental care. Distributors, including specialized dental suppliers like Henry Schein and major retailers, ensure broad product availability by leveraging extensive supply chains and e-commerce platforms. Their role is essential in connecting manufacturers with dental clinics, hospitals, laboratories, and academic institutions. Regulatory authorities, such as the European Medicines Agency (EMA), oversee product approvals, classification, and safety compliance, ensuring reliability and patient safety. Additionally, reimbursement policies and insurance coverage significantly impact the affordability and adoption of advanced dental equipment. Healthcare providers—including dentists, oral surgeons, and dental hygienists—serve as key influencers by prescribing, recommending, and integrating these technologies into patient care, driving market adoption. Furthermore, professional associations and advocacy groups contribute by raising awareness, establishing clinical guidelines, and promoting best practices, which further support market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

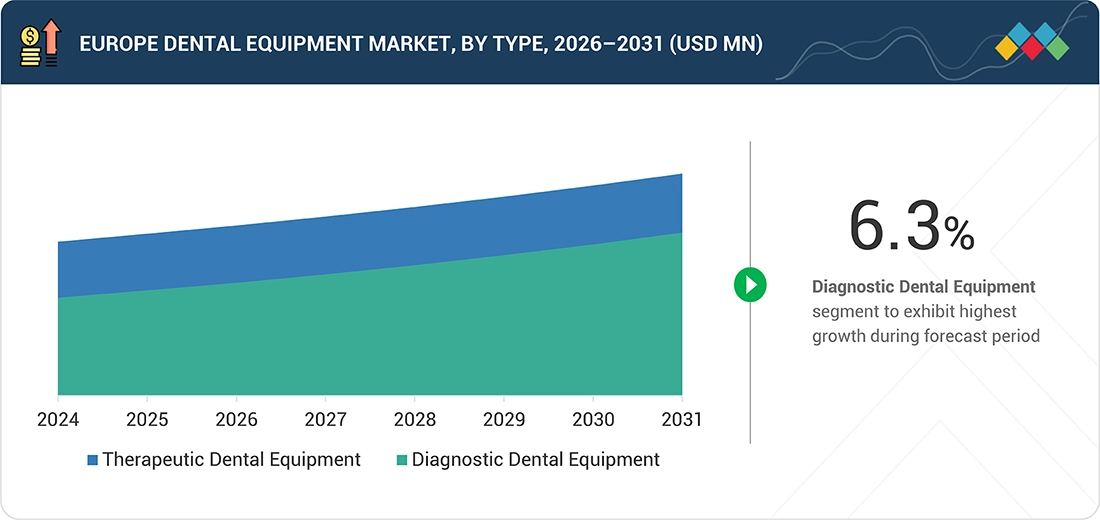

Europe Dental Eqipment Market, By Type

The Europe dental equipment market by type is segmented into therapeutic dental equipment and diagnostic dental equipment on the basis of type. In 2025, the therapeutic dental equipment segment dominated due tot eh increasing incidences of dental ailments like cavities, periodontal diseases, and tooth decay worldwide. This substantial share reflects a growing demand for advanced tools and technologies designed to effectively treat these prevalent oral health issues. Therapeutic dental equipment encompasses a wide array of devices crucial for dental procedures, including dental lasers, dental chairs, handpieces, and specialized instruments for procedures such as root canal treatments and dental fillings. The rise in these conditions is attributed to factors such as poor oral hygiene, dietary habits, and lifestyle changes across populations globally. As dental health awareness grows and healthcare infrastructures improve, there is a heightened emphasis on preventive and corrective dental care, further boosting the therapeutic equipment market. Manufacturers are innovating to meet these evolving needs, focusing on enhancing precision, efficiency, and patient comfort in dental treatments. The therapeutic dental equipment segment's dominance underscores its pivotal role in addressing the increasing burden of dental diseases and improving overall oral health outcomes worldwide.

Europe Dental Eqipment Market, By End User

The Europe dental equipment market by end user is segmented into dental hospitals & clinics, dental academic & research institutes, and other end users (DSO, dental laboratories). The dental hospitals & clinics segment is expected to grow at the highest CAGR during the forecast period of the Europe dental equipment market. This growth trajectory is propelled by several key factors, notably the rising phenomenon of dental tourism. Increasingly, patients are opting to travel internationally for dental treatments due to their cost-effectiveness and the promise of high-quality care. This trend is driving the demand for dental hospitals and clinics that are well-equipped with advanced dental equipment to cater to both local patients and international visitors. Dental hospitals and clinics play a critical role as primary hubs for dental care delivery, offering a range of services from routine check-ups to complex dental procedures. The expansion of dental facilities in response to growing patient volumes and the need for specialized care is further bolstering market growth.

EUROPE DENTAL EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

In the Europe dental equipment market matrix, Dentsply Sirona (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Midmark Corporation (Emerging Leader) is gaining momentum with innovative products and packaging technologies. While Dentsply Sirona dominates through reach, Midmark Corporation's innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- DENTSPLY SIRONA (US)

- Planmeca OY (Finland)

- Envista (US)

- Align Technology Inc. (US)

- A-dec Inc. (US)

- J. MORITA CORP. (Japan)

- Ivoclar Vivadent (Germany)

- GC Corporation (Japan)

- Midmark Corporation (US)

- Institut Straumann AG (Switzerland)

- Solventum (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 2.88 Billion |

| Revenue Forecast in 2031 | USD 4.15 Billion |

| Growth Rate | CAGR of 5.3% from 2026–2031 |

| Actual data | 2023–2031 |

| Base year | 2025 |

| Forecast period | 2026–2031 |

| Units considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Parent & Related Segment Reports |

Dental Equipment Market US Dental Equipment Market MEA Dental Equipment Market North America Dental Equipment Market APAC Dental Equipment Market |

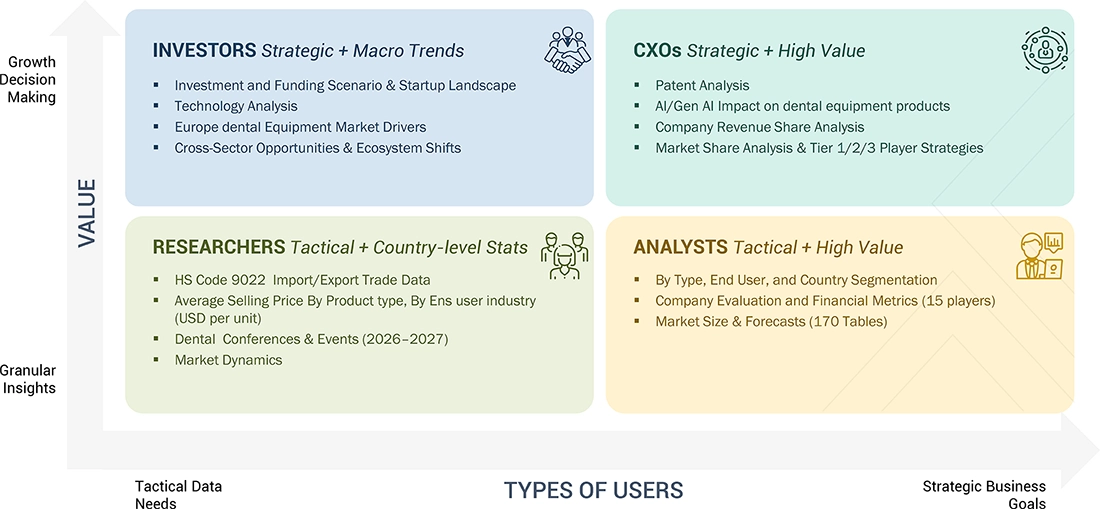

WHAT IS IN IT FOR YOU: EUROPE DENTAL EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Assessed the Europe dental equipment market. Comprehensive evaluation of the periodontal treatment product pipeline, emphasizing late-stage developments and emerging innovative therapies. | Identify interconnections and potential supply chain blind spots within the dental ecosystem |

| Company Information | Key players: Dentsply Sirona (US), Planmeca OY (Finland), Envista (US), Align Technology Inc (US), A-dec Inc (US) | Insights on revenue shifts towards emerging innovations |

RECENT DEVELOPMENTS

- March 2023 : Straumann Group unveiled a range of new solutions at the International Dental Show (IDS) in Cologne, including advanced digital implantology innovations and enhanced features under its ClearCorrect brand. These launches featured the Straumann Falcon navigation system for implant procedures, the Smilecloud smile design platform, and ClearCorrect’s first mobile app and collaboration tools to support more complex orthodontic cases.

- September 2022 : Align Technology, Inc. announced the official opening of its first regional manufacturing facility serving the Europe market. Located in Wroclaw, Poland, the new facility marks a strategic expansion of the company’s global manufacturing footprint, enhancing production capacity, improving supply chain efficiency, and supporting the growing demand for Align’s orthodontic solutions across the EMEA region. The investment underscores Align Technology’s commitment to strengthening its regional presence and accelerating service delivery to customers in key international markets.

Table of Contents

Methodology

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Europe Dental Equipment Market . It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Europe Dental Equipment Market . Primary sources from the demand side included hospitals, clinics, researchers, lab technicians, purchase managers etc, and stakeholders in corporate & government bodies.

Market Size Estimation

The market size for Europe Dental Equipment Market was calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for Europe Dental Equipment Market was calculated using data from four distinct sources, as will be discussed below:

Data Triangulation

The entire market was split up into several segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of dental equipments. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Dental equipment encompasses the tools and instruments used to diagnose and treat a range of dental diseases and disorders. These supplies are utilized by dentists, dental hygienists, and dental laboratories. The category includes a variety of dental equipment, such as diagnostic tools and therapeutic instruments.

Key Stakeholders

- Manufacturers and distributors of medical devices

- Dental equipment manufacturers

- Contract manufacturers of dental equipment

- Distributors of dental equipment

- Research and consulting firms

- Raw material suppliers of dental equipment

- Dental hospitals and clinics

- Dental laboratories and associations

- Dental practitioners

- Dental laboratory technicians

- Healthcare institutions

- Diagnostic laboratories

- Hospitals and clinics

- Academic institutions

- Research institutions

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Objectives of the Study

- To define, describe, and forecast the Europe Dental Equipment Market based on by type, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall Europe Dental Equipment Market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players and comprehensively analyze their market shares and core competencies in the Europe Dental Equipment Market

- To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, service launches, agreements, and other developments in the Europe Dental Equipment Market

- To benchmark players within the Europe Dental Equipment Market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offerings

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Dental Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Dental Equipment Market