Asia Pacific Dental Equipment Market Size, Growth, Share & Trends Analysis

Asia Pacific Dental Equipment Market by Type (Therapeutic [Dental Chairs, Dental Units, CAD/CAM, Dental Lasers, Nd:YAG Lasers, Carbon Dioxide Lasers], Diagnostic [Dental imaging, CBCT]), End User (Hospitals & Clinics) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

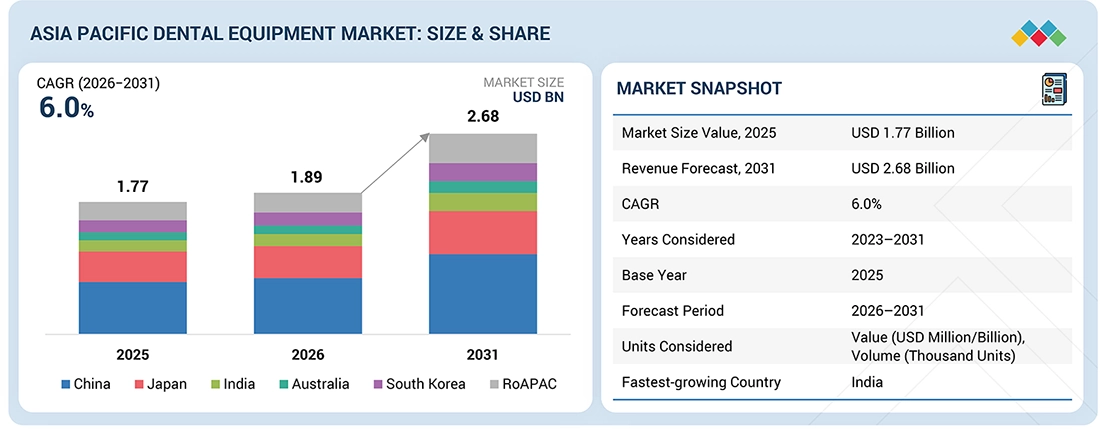

The Asia Pacific Dental Equipment market, valued at USD 1.77 billion in 2025, stood at USD 1.89 billion in 2026 and is projected to advance at a resilient CAGR of 6.0% from 2026 to 2031, culminating in a forecasted valuation of USD 2.68 billion by the end of the period. Dental equipment comprises a broad range of medical technologies designed to support the diagnosis, treatment, and management of oral health conditions in dental practices. These devices include both therapeutic equipment, such as dental chairs and dental units, as well as diagnostic technologies like dental imaging systems, digital X-ray machines, and CBCT scanners. Depending on their purpose, dental equipment can range from routine tools used in everyday dental care to advanced systems that enable highly specialized procedures. These products are essential in dental hospitals and dental clinics for ensuring effective, safe, and high-quality patient care.

KEY TAKEAWAYS

-

BY COUNTRYBy country, China accounted for the highest share of 39.6% in the Asia Pacific dental equipment market in 2025.

-

BY TYPEBy type, the Asia Pacific dental equipment market was dominated by the therapeutic dental equipment segment with 60.3%.

-

By END USERBy end user, the hospitals & clinics segment accounted for the largest share of the Asia Pacific dental equipment market.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSDentsply Sirona, Planmeca OY, and Align Technology, Inc. were identified as some of the key players in the Asia Pacific dental equipment market, given their substantial market share and product/service footprint.

-

COMPETITIVE LANDSCAPE- STARTUPSCompanies such as Zenyum and Medikabazaar, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The dental equipment market in Asia Pacific is driven by the rapid adoption of digital and advanced clinical dental technologies, supported by a rising prevalence of oral health disorders across both developed and emerging economies. Growing demand for cosmetic and restorative dental procedures, increasing awareness of preventive oral care, and the expansion of dental tourism hubs in countries such as India, Thailand, and South Korea are accelerating the uptake of modern diagnostic and therapeutic dental equipment across the region.

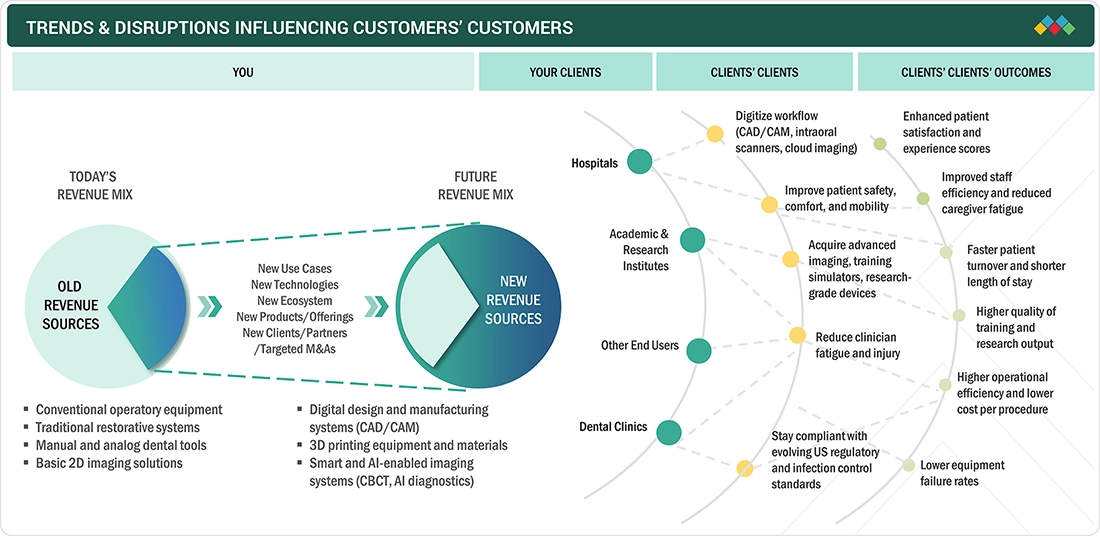

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Asia Pacific dental equipment market is undergoing a significant transformation as practices transition from conventional, manual systems to fully digital, automated, and integrated clinical workflows. Major Key trends include the rapid acceptance of CAD/CAM solutions, AI-enabled imaging platforms, and enhanced surgical CBCT systems, all aimed at increasing diagnostic accuracy and treatment predictability. Same-day restorations, custom aligners, surgical guides, and personalized prosthetics are facilitated by advanced 3D printing technologies using new biocompatible materials. Improvements in dental lasers, chairside milling units, and smart operatory equipment have led to increased efficiency, accuracy, and patient comfort. The development of technologies focused on increasing patient comfort, minimizing invasiveness, and shortening work timeframes is thereby fueling the demand for disruptive technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Development of technologically advanced solutions

-

Rise in oral health disorders

Level

-

High cost of dental imaging systems and lack of reimbursement for dental procedures

Level

-

Increasing number of dental laboratories investing in CAD/CAM technologies

Level

-

Dearth of trained dental practitioners

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Development of technologically advanced solutions

The dental industry has undergone significant evolution through the development of advanced dental materials and technologies. Concurrently, patient compliance has risen alongside a growing preference for minimally invasive procedures. Dental lasers, for instance, are increasingly utilized in surgical treatments such as gum lifting and teeth whitening to minimize blood loss and enhance patient comfort. Adhesive dentistry has also gained prominence, employing composite materials that improve both aesthetic appeal and tooth strength with minimal damage to tooth structures, thereby attracting a rising number of patients seeking such procedures. Moreover, digital innovations in dental diagnostics and treatments, such as digital radiology and CAD/CAM systems, have revolutionized workflows by providing precise, high-quality images that streamline diagnosis, treatment planning, and communication between practitioners and dental laboratories.

Restraint: High cost of dental imaging systems and lack of reimbursement for dental procedures

High costs associated with advanced dental imaging systems, such as CBCT scanners and 4D intraoral imaging apparatuses, stand as a major restraint for the Asia Pacific dental equipment market. These require huge capital investments, restricting small- to medium-scale dental clinics and laboratories from property acquisitions. The above factors are no longer sufficient for many patients, who are unwilling to consider opting for such high-end diagnostic and cosmetic treatments, as reimbursement is still insufficient for many dental procedures. These conditions hinder the rapid utilization of the most advanced dental equipment and slow growth in an otherwise developing market, poised to grow due to rising demand for precision diagnostics and minimally invasive procedures.

Opportunity: Increasing number of dental laboratories investing in CAD/CAM technologies

In the Asia Pacific dental equipment market, a growing number of dental laboratories are increasingly investing in CAD/CAM technologies, driven by rising demand for digitally fabricated restorations, improved turnaround times, and consistent product quality. Rapid adoption of intraoral scanners, milling units, and dental design software is being supported by the expansion of dental tourism, the proliferation of large lab chains, and closer clinic–laboratory integration across key markets such as China, Japan, South Korea, and India. Additionally, declining equipment costs, improved financing options, and the availability of locally manufactured CAD/CAM systems are lowering entry barriers for mid-sized and small laboratories, enabling wider digital transformation and reinforcing sustained demand for advanced dental equipment across the region.

Challenge: Dearth of trained dental practitioners

In Asia Pacific, demand for preventive, restorative, and cosmetic dental services is rising steadily, driven by a growing aging population, increasing disposable incomes, rapid urbanization, and heightened awareness of oral health, particularly in metropolitan areas. The high prevalence of untreated dental caries and periodontal diseases across several emerging economies continues to push more patients toward dental clinics each year; however, the region faces a persistent shortage and uneven distribution of trained dentists, hygienists, and specialist practitioners, especially in rural and semi-urban areas. This imbalance between patient demand and provider availability results in limited access to care, longer waiting times, and mounting operational pressures on dental practices, which in turn constrains the adoption of advanced dental technologies, restricts productivity gains, and may moderate the long-term growth potential of the Asia Pacific dental equipment market.

APAC DENTAL EQUIPMENT MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced dental imaging systems, CAD/CAM solutions, and dental treatment units | High precision diagnostics | Improved treatment efficiency | Integrated digital workflows | Enhanced patient experience |

|

Comprehensive dental imaging solutions, including CBCT and 4D jaw motion tracking | Superior 3D imaging accuracy| Innovative jaw movement analysis, streamlined diagnostics, better treatment planning |

|

Clear aligner systems with integrated digital scanning and treatment planning | Non-invasive cosmetic correction | Improved patient compliance | Digital treatment customization | Faster results |

|

Wide range of dental equipment including imaging, handpieces, and orthodontic devices | Durable, high-performance equipment | Improved clinical outcomes | Ergonomic designs | Expanded treatment capabilities |

|

Digital dental imaging systems and practice management software | User-friendly imaging solutions | Enhanced image quality | Integrated practice workflows | Cost-effective operation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific dental equipment market comprises a diverse set of stakeholders across the value chain, including technology development, manufacturing, regulatory oversight, distribution, and clinical adoption. Leading global and regional manufacturers—such as Dentsply Sirona, Planmeca Oy, Envista, and emerging Asia-based players—develop and supply digital imaging systems, CAD/CAM solutions, treatment units, and minimally invasive dental technologies to improve diagnostic accuracy, workflow efficiency, and patient outcomes. Distribution is supported by a mix of multinational suppliers, regional distributors, and expanding e-commerce platforms that serve dental clinics, hospitals, laboratories, and academic institutions across both developed and emerging markets. Regulatory authorities, including agencies such as China’s NMPA, Japan’s PMDA, and India’s CDSCO, oversee product approvals and safety compliance. Market adoption is driven by dentists, oral surgeons, dental hygienists, and key opinion leaders, while professional dental associations and academic bodies promote clinical training, awareness, and best-practice guidelines across the region.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Dental Equipment Market, By Type

In the Asia Pacific dental equipment market, the segmentation by type includes therapeutic dental equipment and diagnostic dental equipment, with the therapeutic dental equipment segment accounting for the largest share in 2025. This dominance is mainly due to the high and increasing number of cases of dental caries, periodontal diseases, and tooth decay in both developed and emerging economies in the region. Therapeutic dental equipment is closely associated with clinical dental practice; thus, it comprises major devices such as dental chairs, handpieces, dental lasers, and instruments used for restorative procedures, root canal treatments, and fillings. Poor oral hygiene, dietary changes, and lifestyle-related risk factors have substantially increased the prevalence of oral diseases, especially in countries with high population density. Meanwhile, the upsurge in the awareness of preventive and corrective dental care, coupled with the enhancement of healthcare infrastructure and the rise of private dental clinics, is leading to the rapid adoption of therapeutic equipment. As a result, manufacturers are putting more emphasis on innovation that not only enhances procedural precision but also improves workflow efficiency and patient comfort, to meet the evolving clinical and economic demands in the Asia Pacific dental equipment market.

Asia Pacific Dental Equipment Market, By End User

In Asia Pacific, the dental equipment market by end user is segmented into dental hospitals & clinics, academic & research institutes, and other end users, including dental service organizations (DSOs) and dental laboratories. The dental hospitals & clinics segment is expected to register the highest CAGR during the forecast period. This is primarily due to the region's emerging role as a global dental tourism hub and the expanding access to private dental care. Nations like India, Thailand, Malaysia, and South Korea are, to a great extent, the top choices of international patients who are looking for affordable but high-quality dental treatments, resulting in hospitals and clinics upgrading their facilities with the latest and high-capacity dental equipment. Besides catering to medical tourists, dental hospitals and clinics are still the main point of care for the region's vast domestic patient pool. They provide a wide range of services from preventive dental check-ups to complex restorative and surgical procedures. The growing number of private dental chains, multispecialty hospitals, and specialized dental clinics, together with the support of improved healthcare infrastructure and increasing patient volumes, is thus further driving the demand for dental equipment in the Asia Pacific market.

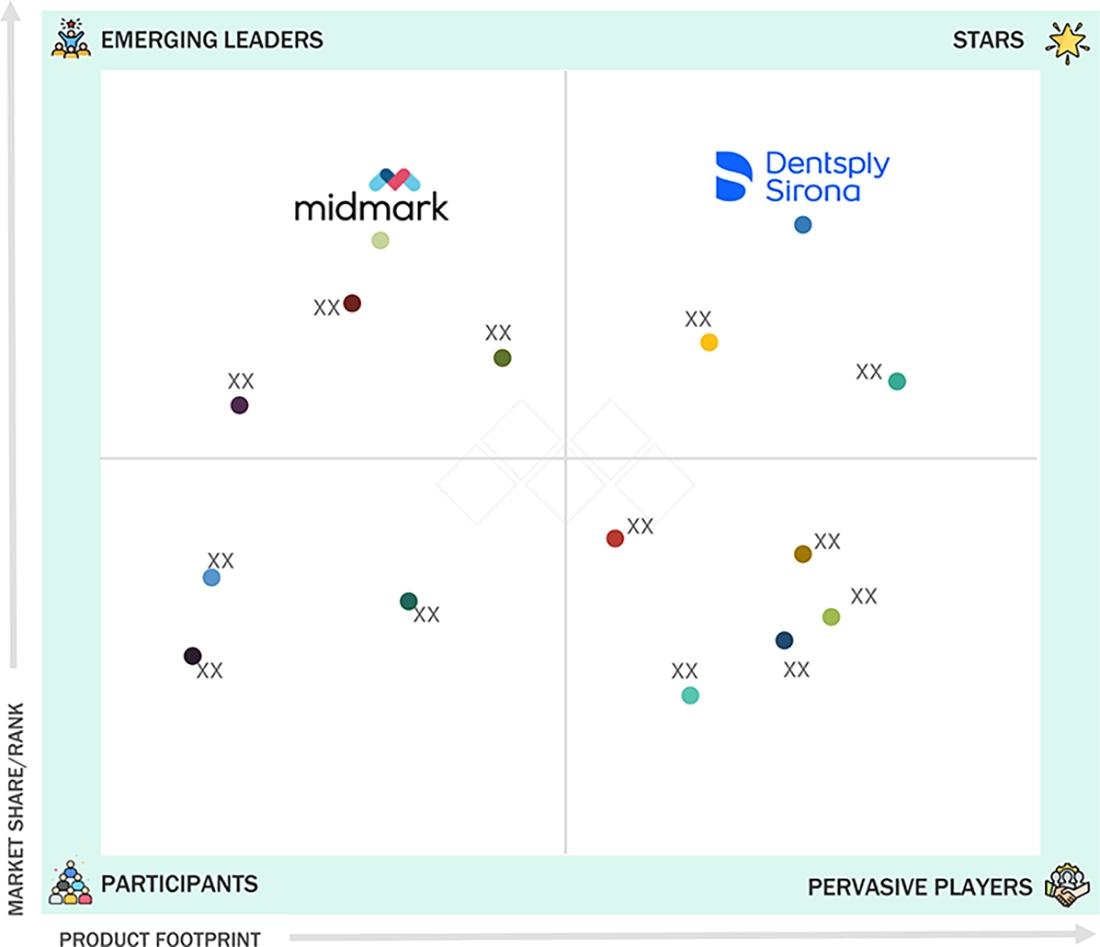

ASIA PACIFIC DENTAL EQUIPMENT MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMPANY EVALUATION MATRIX

In the Asia Pacific dental equipment market matrix, Dentsply Sirona (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Midmark Corporation (Emerging Leader) is gaining momentum with innovative products and packaging technologies. While Dentsply Sirona dominates through reach, Midmark Corporation's innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Dentsply Sirona (US)

- Planmeca Oy (Finland)

- Envista (US)

- Align Technology Inc. (US)

- A-dec Inc. (US)

- J. MORITA CORP. (Japan)

- GC Corporation (Japan)

- Midmark Corporation (US)

- Institut Straumann AG (Switzerland)

- Solventum (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 | USD 1.77 Billion |

| Market Forecast, 2031 | USD 2.68 Billion |

| Growth Rate | CAGR of 6.0% from 2026 to 2031 |

| Years Considered | 2023–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type: Therapeutic Dental Equipment, Diagnostic Dental Equipment I By End User: Hospitals & Clinics, Academic & Research Institutes, Other End Users |

| Countries Covered | China, Japan, India, South Korea, Australia, Rest of Asia Pacific |

| Parent & Related Segment Reports |

Dental Equipment Market US Dental Equipment Market Europe Dental Equipment Market MEA Dental Equipment Market North America Dental Equipment Market |

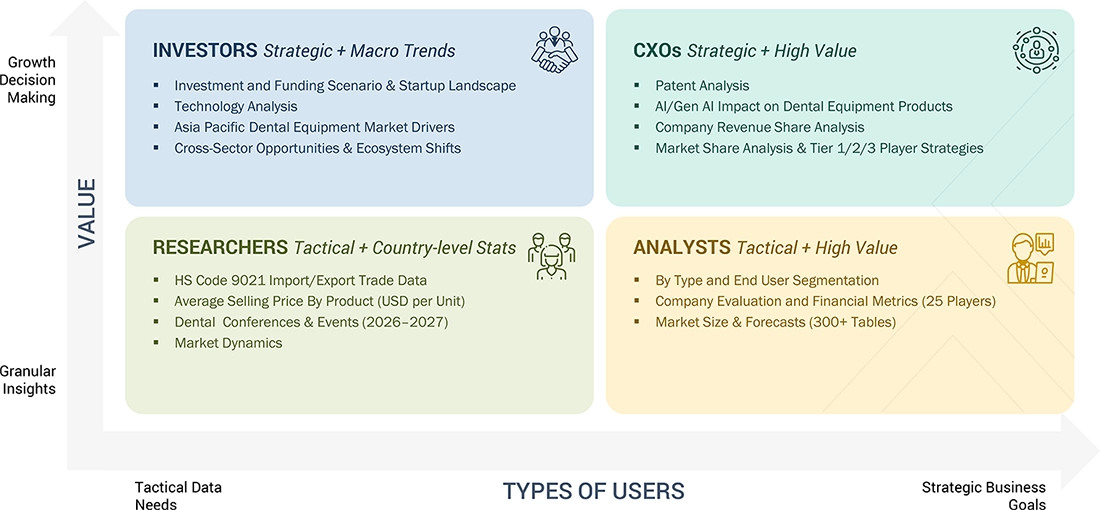

WHAT IS IN IT FOR YOU: ASIA PACIFIC DENTAL EQUIPMENT MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for dental equipment used in the dental ecosystem |

|

| Company Information |

|

Insights on revenue shifts toward emerging innovations |

RECENT DEVELOPMENTS

- May 2024 : Dentsply Sirona partnered with Google to launch medical-grade 3D printing solutions with integrated end-to-end workflows for dental practices and labs.

- February 2024 : A-dec and Dentsply Sirona expanded their collaboration by integrating the Dentsply Sirona Primescan Connect intraoral scanner with A-dec 500 and A-dec 300 delivery systems.

- January 2024 : Planmeca OY launched the Planmeca Viso G3, a multifunctional CBCT device covering all extraoral imaging needs from 2D to 3D.

- January 2024 : Align Technology, Inc. launched the iTero Lumina intraoral scanner, featuring a 3X wider field of capture in a 50% smaller and 45% lighter wand for faster scans, higher accuracy, superior visualization, and improved patient comfort.

Table of Contents

Methodology

This study involved four major activities in estimating the current Asia Pacific Dental Equipment Market size. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the Asia Pacific Dental Equipment Market. It was also used to obtain important information on key players, market classification, segmentation aligned with industry trends to the bottom-most level, and key developments from market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources on the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and other key executives from leading companies and organizations operating in the Asia Pacific Dental Equipment Market. The primary sources on the demand side included industry experts, purchasing & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

Market Size Estimation

For the global market value, annual revenues were calculated using revenue mapping for major product manufacturers and OEMs active in the Asia Pacific Dental Equipment Market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. Also, the Asia Pacific Dental Equipment Market was split into various segments and subsegments based on the:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various dental equipment manufacturers at the regional and/or country level

- Mapping of annual revenues generated by listed major players from dental equipment (or the nearest reported business unit/product category)

- Revenue mapping of major players covered

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the Asia Pacific Dental Equipment Market

Data Triangulation

After determining the overall size of the Asia Pacific Dental Equipment Market using the above-mentioned methodology, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, as applicable, to complete the overall market engineering process and obtain exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand- and supply-side participants.

Market Definition

Dental equipment encompasses the tools and instruments used to diagnose and treat a range of dental diseases and disorders. These supplies are utilized by dentists, dental hygienists, and dental laboratories. The category includes a variety of dental equipment, such as diagnostic tools and therapeutic instruments.

Key Stakeholders

- Manufacturers and distributors of medical devices

- Dental equipment manufacturers

- Contract manufacturers of dental equipment

- Distributors of dental equipment

- Research and consulting firms

- Raw material suppliers of dental equipment

- Dental hospitals and clinics

- Dental laboratories and associations

- Dental practitioners

- Dental laboratory technicians

- Healthcare institutions

- Diagnostic laboratories

- Academic institutions

- Research institutions

- Government associations

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the Asia Pacific Dental Equipment Market based on type, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Asia Pacific Dental Equipment Market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players and comprehensively analyze their market shares and core competencies in the Asia Pacific Dental Equipment Market

- To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, product launches, agreements, and other developments in the Asia Pacific Dental Equipment Market

- To benchmark players within the Asia Pacific Dental Equipment Market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offerings

Available customizations:

Based on the given market data, MarketsandMarkets offers customizations tailored to your company’s specific needs. The following customization options are available for the report:

GEOGRAPHIC ANALYSIS

- Further breakdown of the Rest of Europe Dental Equipment Market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific Dental Equipment Market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin America Dental Equipment Market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia Dental Equipment Market into Malaysia, Singapore, New Zealand, and others

COMPETITIVE LANDSCAPE ASSESSMENT

- Market share analysis, by region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa), which provides market shares of the top 3–5 key players in the Dental Equipment Market

- Company Evaluation Matrix framework for established players in the US.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Dental Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Dental Equipment Market