Europe Human Microbiome Market Size, Growth, Share & Trends Analysis

Europe Human Microbiome Market by Drug & Supplement (Drugs, Probiotics, Prebiotics, Synbiotics), Disease (Infectious, Gastrointestinal, Endocrine & Metabolic Disease), Type (BCT/FMT, LBP), End User (Hospitals, Clinics, Long-term Care) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe Human Microbiome Market, valued at US$0.22 billion in 2024, stood at US$0.29 billion in 2025 and is projected to advance at a resilient CAGR of 28.6% from 2025 to 2031, culminating in a forecasted valuation of US$1.31 billion by the end of the period. The growth of the Europe human microbiome market is driven by increased awareness of personalized health, the adoption of microbiome-based therapies, and advancements in sequencing technologies and bioinformatics.

KEY TAKEAWAYS

-

By RegionThe UK human microbiome market had a share of 24.9% in 2024.

-

By ProductThe microbiome supplements segment is projected to have the highest CAGR of 29.9% among all product segments.

-

By Route of AdministrationBy route of administration, the oral administration segment is anticipated to be the most rapidly expanding one from 2025 to 2031, since it has the highest patient acceptance, and is the most suitable for the majority of microbiome-based products, e.g., probiotics, postbiotics, and live biotherapeutics.

-

By DiseaseBy disease, the gastrointestinal diseases segment had been the leading contributor to the human microbiome market with a 74.2% revenue share in 2024. The increase in the segment is due to many kinds of drugs involved in the clinical trials and human microbiome products, such as probiotics, prebiotics, and synbiotics that target gut microbiota.

-

Competitive LandscapeFerring B.V., OptiBiotix Health PLC, and BioGaia eere the top companies identified in the Europe human microbiome market, according to their market share and product footprint.

-

Competitive LandscapeSNIPR BIOME, Mikrobiomik Healthcare Company S.L, and OxThera, among others have identified as the upcoming leaders of the market and the future trends of the industry.

The human microbiome market in Europe is experiencing consistent expansion, which is primarily influenced by factors such as the general awareness of personalized health, the use of microbiome-based therapies, and innovations in sequencing technologies and bioinformatics. Consumers in Europe look for personalized solutions to improve their microbiome makeup; thus, the demand for direct-to-consumer microbiome products providing detailed analysis and personalized recommendations has increased.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The European human microbiome market is undergoing a major change where the growth is moving away from the traditional diagnostic and probiotic products to more advanced, technology-driven solutions. The upshot of this transition is due to several cutting-edge tools, including AI-enabled microbiome analytics, metagenomic sequencing, microbiome-informed therapeutics, and personalized nutrition programs. The customers such as hospitals, clinics, specialty care centers, and diagnostic laboratories are using a premium on multi-omics platform integration, workflow standardization, and high-throughput sequencing. These innovations are anticipated to bring forth a bundle of benefits: they will increase prediction accuracy, lower operational costs, improve patient stratification, and raise reproducibility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing burden of chronic & metabolic diseases

-

Advancements in sequencing, multi-omics

Level

-

Stringent regulatory requirements under IVDR and EMA

-

High cost of developing clinically validated microbiome therapies

Level

-

Rising demand for precision nutrition and personalized medicine solutions

-

Growth of next-generation probiotics/postbiotics and digital-health integrated microbiome platforms

Level

-

Complex validation and standardization of microbiome-based therapies

-

Slow patient and clinician adoption

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing burden of chronic & metabolic diseases

The significant rise of chronic and metabolic disorders in Europe, such as obesity, diabetes, inflammatory bowel diseases, and cardiovascular conditions, is the main factor in the rapid increase in demand for solutions based on the microbiome. Medical care systems and policymakers are putting more emphasis on early detection, prevention, and personalized care models. This trend leads to increased use of microbiome diagnostics, therapeutics, and precision nutrition interventions; thus, the microbiome sector becomes a key player of the EU health care innovation strategy in the long run.

Restraint: Stringent regulatory requirements under IVDR and EMA

Europe's microbiome market is highly regulated under IVDR and EMA, resulting in numerous challenges. These structures demand very strict requirements in terms of confirmation, cobbling up evidence, and quality of microbiome-based tests and drug provision. However, on the other hand, all these prescriptions increase development time, compliance cost, and market entry delay, posing a substantial challenge to new companies and restricting the pace of clinical adoption in EU member states.

Opportunity: Rising demand for precision nutrition and personalized medicine solutions

The major shift towards precision nutrition and personalized medicine in Europe provides a significant opportunity for the microbiome sector to develop innovations that meet consumer demand. The demand for personalized interventions based on individual microbiome profiles from consumers, clinicians, and digital health platforms is the main driver of metabolism, gastrointestinal, and immune health. Advanced microbiome analytics, customized dietary programs, and integrated digital-drug-based health are the channels to meet the demand and have the momentum of the providing companies to be scientifically validated and clinically actionable microbiome-driven solutions.

Challenge: Complex validation and standardization of microbiome-based therapies

A key challenge limiting market growth in Europe is the complexity involved in validating and standardizing microbiome-based therapies. Variability in patient microbiome composition, differences in laboratory methodologies, and the absence of unified performance standards across European Union EU) markets hinder consistent clinical outcomes. These scientific and operational hurdles complicate regulatory submissions, slow the clinical adoption process, and create uncertainty for stakeholders. Addressing these challenges will require coordinated efforts across industry, regulatory bodies, and research institutions.

Europe Human Microbiome Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

MRM Health uses its proprietary CORAL platform to design and manufacture live-microbial consortium therapeutics. Its lead candidate, MH002 , a defined consortium of commensal gut bacteria, is being developed for treatment of inflammatory bowel diseases (ulcerative colitis, pouchitis) and other chronic inflammatory or metabolic indications | Provided a scalable, standardized manufacturing process for complex microbial consortia | Demonstrated clinical translation of microbiome-based therapy |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe human microbiome market ecosystem includes manufacturers (BioGaia, OptiBiotix Health, MaaT Pharma), regulatory bodies (European Medicines Agency, European Food Safety Authority, UK Government), raw material suppliers (ProDigest, Novonesis, Lesaffre), and end users (NHS, Karolinska University Hospital, Institut Pasteur). Manufacturers develop probiotics, microbiome-based therapeutics, and research tools by using microbial strains, fermentation inputs, and specialized substrates supplied by raw material providers. Regulatory authorities regulate the approval pathways, safety standards, and clinical evaluation in the entire region. Thus, patients, hospitals, research institutes, and public health systems, as end users, through their demand for advanced microbiome solutions, enable the implementation of such solutions in clinical care and translational research.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Human Microbiome Market, By Product

The Europe human microbiome market was mainly led by microbiome supplements in 2024, which is a result of the strong consumer demand for probiotics, prebiotics, and synbiotics that are mostly used for digestive health, immunity, and general wellness. These products are very popular as they do not require a prescription and are backed by increasing awareness of the gut health links and the trend of preventive healthcare.

Europe Human Microbiome Market, By Route of Administration

Most of the human microbiome drugs & supplements in Europe were taken via the oral route in 2024, which was the main reason for the patient convenience and widespread acceptance. Oral formulations like capsules, powders, and liquids are easy for patients to consume, are relatively cheaper to produce, and are the most suitable form for the delivery of probiotics, prebiotics, and live biotherapeutics, which target gut health.

Europe Human Microbiome Market, By Disease

In 2024, the human microbiome market in Europe was largely influenced by gastrointestinal diseases, a result of the strong association between gut microbiome imbalance and gastrointestinal disorders.

REGION

Germany to be fastest-growing country in Europe Human Microbiome Market during forecast period

The human microbiome market in Germany is expected to register the highest CAGR during the forecast period, driven by the increasing demand for microbiome analysis in research and clinical applications. Additionally, the government has made substantial investments in innovative technologies and research infrastructure, particularly in microbiome research.

europe-human-microbiome-market: COMPANY EVALUATION MATRIX

In the Europe human microbiome market matrix, Ferring B.V. emerges as the star, driven by its strong clinical focus, extensive R&D investment, and leadership in developing microbiome-based therapeutics across gastrointestinal, reproductive, and maternal health domains, reinforcing its dominant position in the region. Infant Bacterial Therapeutics AB is rapidly becoming an emerging leader, supported by its specialized focus on early-life microbiome development, an expanding clinical pipeline in Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Ferring B.V. (Switzerland)

- Actial Farmaceutica SRL (Italy)

- OptiBiotix Health Plc (UK)

- BioGaia (Sweden)

- Maat Pharma (France)

- Infant Bacterial Therapeutics AB (Sweden)

- OxThera (Sweden)

- Nexbiome (France)

- Enterome SA (France)

- SNIPR BIOME (Denmark)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.22 Billion |

| Market Forecast in 2031 (Value) | USD 1.31 Billion |

| Growth Rate | CAGR of 28.6% from 2025-2031 |

| Years Considered | 2023-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, UK, France, Italy, Spain, Rest of Europe |

| Parent & Related Segment Reports |

Human Microbiome Market North America Human Microbiome Market Human Microbiome Manufacturing Services Market Asia Pacific Human Microbiome Market Human Microbiome Drugs Market |

WHAT IS IN IT FOR YOU: europe-human-microbiome-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe Human Microbiome Market, By Distribution Channel | Market size & forecast for human microbiome market based on type of distribution - Prescription-based Products and OTC Products | Split of Supplements into clinical (prescription/FSMP/medical foods) vs. consumer OTC (wellness probiotics, synbiotics) |

| Europe Human Microbiome Diagnostics Market, By Type | Market size & forecast for human microbiome market based on type of diagnostics - microbiome test and companion diagnostics | Diagnostic TAM assessment |

RECENT DEVELOPMENTS

- March 2024 : OptiBiotix Health announced that it signed a partnership agreement with Morepen Laboratories Ltd. (India) to sell SlimBiome-containing products in India under the Dr Morepen brand.

- November 2022 : Ferring Pharmaceuticals announced that the US Food and Drug Administration (FDA) has approved REBYOTA (a fecal microbiota, live biotherapeutic product), a first-in-class microbiota-based live biotherapeutic. It is indicated for the prevention of recurrence of Clostridioides difficile infection (CDI) in individuals 18 years of age and older, following antibiotic treatment for recurrent CDI.

- August 2022 : BioGaia opened a new pilot plant in Eslov. The plant is designed to manufacture traditional lactobacilli as well as sensitive new bacterial strains. This facility aims to enhance development capabilities, support clinical studies, refine processes, and launch innovative probiotic products. This move reinforces BioGaia's leadership in the field of probiotics.

Table of Contents

Methodology

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the European human microbiome market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative & quantitative information and assess the growth prospects of the market. The Europe market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used primarily to identify & collect information for the extensive, technical, market-oriented, and commercial study. The secondary sources used for this study include World Health Organization (WHO), Europe Human Microbiome Project (HMP), Organisation for Economic Co-operation and Development (OECD), National Institutes of Health (NIH), Food and Drug Administration (FDA), ClinicalTrials.gov, Annual Reports, SEC Filings, Investor Presentations, Research Journals, Press Releases, and financial statements. These sources also obtained key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative & quantitative information and assess the prospects of the market. Various primary sources from both the supply & demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

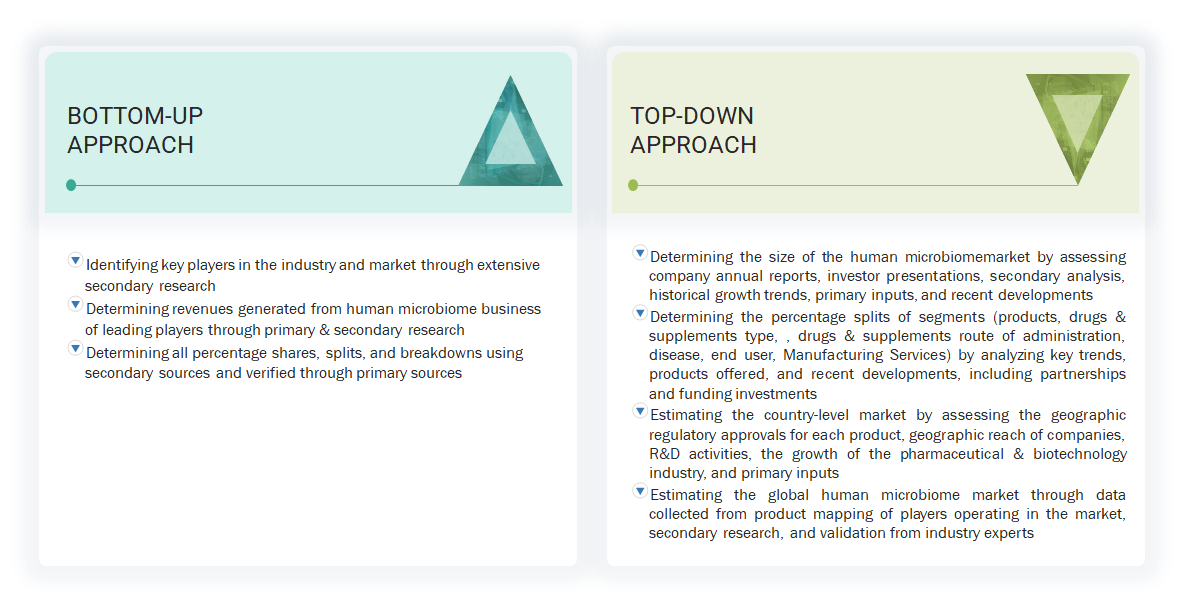

Both top-down and bottom-up approaches were used to estimate & validate the total size of the europe human microbiome market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The total market was split into several segments and subsegments after arriving at the overall market size from the estimation process. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The human microbiome encompasses the collective genetic material of diverse microorganisms residing within the human body, known as the metagenome. This includes bacteria, fungi, protozoans, non-living viruses, and various single-celled organisms. These microorganisms play a crucial role in human physiology, influencing metabolic and immune functions. Found within human tissues, the microbiome is a focal point of research for medical advancements and analytical techniques. It is applied in probiotics, prebiotics, pharmaceuticals, and therapeutic systems to address conditions such as diabetes, obesity, and cancer, as well as a range of metabolic, gastrointestinal, neurological, central nervous system, and autoimmune disorders.

The study provides an in-depth analysis of the Europe human microbiome market based on contemporary market trends and developments, and its potential growth from 2025 to 2031. It includes detailed market trends, the competitive landscape, market size, forecasts, and the analysis of the key Europe human microbiome service providers.

Stakeholders

- Manufacturers and Distributors of Human Microbiome Products

- Pharmaceutical and Biotechnology Companies

- Market Research and Consulting Firms

- R&D Centers

- Researchers and Scientists

- Academic & Research Institutes

- Hospitals & Clinics

- Long-term Care Centers

- Specialty Care Centers

- Outpatient Care Centers

Report Objectives

- To define, describe, and forecast the Europe human microbiome market based on products, disease, drugs & supplements type, drugs & supplements route of administration, end user, manufacturing services and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Europe human microbiome market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players in the europe human microbiome market and comprehensively analyze their core competencies and market rankings

- To track and analyze competitive developments such as product launches, acquisitions, expansions, agreements, partnerships, and collaborations in the Europe human microbiome market

- To benchmark players within the Europe human microbiome market using the ‘Company Evaluation Matrix' framework, which analyzes market players based on various parameters within the broad categories of business and product strategy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Human Microbiome Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Human Microbiome Market