North America Human Microbiome Market Size, Growth, Share & Trends Analysis

North America Human Microbiome Market By Drug & Supplement (Drugs, Probiotics, Prebiotics), Disease (Infectious, Gastrointestinal, Endocrine & Metabolic Diseases), Type (BCT/FMT, LBP), End User (Hospitals, Clinics, Long-term Care) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North America Human Microbiome market, valued at US$0.43 billion in 2024, stood at US$0.78 billion in 2025 and is projected to advance at a resilient CAGR of 32.2% from 2025 to 2031, culminating in a forecasted valuation of US$4.15 billion by the end of the period. The North America human microbiome market growth is driven by improvements in novel microbiome-based products and therapeutic solutions due to partnerships between industry players and academic institutions. New startups in the US and Canada are driving innovation across microbiome therapeutics and diagnostics.

KEY TAKEAWAYS

-

By RegionThe US human microbiome market made up 86.6% of the North American market in 2024.

-

By ProductAmong product categories, microbiome drugs are expected to record the highest CAGR of 35.3%, largely due to a growing pipeline of microbiome-based therapeutics and greater funding for drug development.

-

By Route of AdministrationFrom a route-of-administration perspective, the rectal route is projected to grow the fastest from 2025 to 2031.

-

By DiseaseFrom a disease perspective, gastrointestinal disorders dominated the market in 2024, contributing 58.4% of total market.

-

Competitive LandscapeSeveral companies stand out as key players in the North America microbiome market, including International Flavors & Fragrances Inc., Seed Health, Inc., and Seres Therapeutics, all of which have built strong market presence and extensive product portfolios.

-

Competitive LandscapeAmong startups and SMEs, companies such as AOBiome, Vedanta Biosciences, Inc., and Synlogic are emerging as promising leaders by carving out strong positions in niche application areas.

The human microbiome market in North America keeps growing steadily owing to the collaboration among biotechnology companies, academic institutions, and clinical research centers. The partnerships drive innovation in microbiome-based products and treatments. The presence of startups and medium sized enterprises, in the region speeds up research, product development and commercialization particularly in microbiome therapeutics, diagnostics and consumer health.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The revenue growth in the North America human microbiome market is shifting from traditional diagnostic and probiotic-based solutions toward advanced, technology-driven offerings. Emerging drivers include AI-enabled microbiome analytics, metagenomic sequencing, microbiome-informed therapeutics, and personalized nutrition programs. Clients, including hospitals, clinics, specialty care centres, and diagnostic laboratories, are focusing on integrating multi-omics platforms, standardized workflows, and high-throughput sequencing. These innovations are expected to enhance predictive accuracy, reduce operational costs, improve patient stratification, and increase reproducibility, which is ultimately accelerating microbiome-based diagnostic and therapeutic development

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising prevalence of chronic and lifestyle-related diseases

-

Advancements in sequencing and bioinformatics technologies

Level

-

Lack of standardized protocols and regulatory challenges

-

High cost of microbiome-based therapies

Level

-

Increasing demand for personalized medicine

-

Emergence of postbiotics

Level

-

Slow patient adoption of microbiome-based therapies

-

Complexities involved in development of microbiome therapies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising prevalence of chronic and lifestyle-related diseases

In North America, there are rising rates of obesity, diabetes, autoimmune disorders, and inflammation of the bowel. All these medical conditions have been increasing over a decade. As a result, there is more focus on microbiome-based therapies. Medical researchers and practitioners have increasingly focused on the microbiome as a potential source of support for medical practice and disease prevention.

Restraint: Lack of standardized protocols and regulatory challenges

Limited protocol standardization appears to be one of the major challenges in the human microbiome within North America, as there are no standards and consistency that are applicable for the development of microbiome-based drugs. All procedures, from sample collection to processing as well as analysis, differ considerably, making it difficult for development and consistency. Moreover, standards on microbiome therapies appear to still be taking form. As a result, there appear to be considerable delays within companies seeking to capitalize on these developments.

Opportunity: Increasing demand for personalized medicine

The medical sector is increasingly shifting towards more personalized treatment, such as microbiome-based therapies. By knowing an individual’s particular microbiome profile, it becomes possible to personalize treatments to improve the prevention and treatment of disease. Personalized medicine leads to better responses with fewer side effects. There is more drive towards developing microbiome therapies for immune, metabolic, and gastrointestinal disorders.

Challenge: Slow patient adoption of microbiome-based therapies

The market growth of microbiome therapies remains slow, as many patients and some medical professionals are not aware of the therapy functions. Clinical data are still emerging, and inconsistencies exist with product formulations. Personalized therapies may have more complex treatment regimens, which could delay their general acceptance. All these considerations make it difficult for microbiome therapies to remain mainstream.

NORTH AMERICA HUMAN MICROBIOME MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Ostia Sciences announced a collaboration with Expert’Biome (a CDMO by Lallemand) to support process development and clinical-grade production for an oral care probiotic program | Demonstrated incremental build-out of capacity via CDMO partnerships instead of investing in new facilities | Accelerated time to clinic by leveraging an established GMP partner |Reduced upfront capital burden for smaller biotech players |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North America human microbiome market ecosystem consists of manufacturers (ExeGi Pharma, SeedHealth, ResBiotic, Seres Therapeutics), regulatory bodies (U.S. FDA, Government of Canada), raw material suppliers (ATCC, ADM, OpenBiome), and end users (Duke Health, Boston Children’s Hospital, Cambridge University Hospitals). Microbial strains, culture media, and reagents are developed into therapeutics, probiotics, and diagnostics. End users drive demand for innovative, personalized microbiome-based solutions, while manufacturers and suppliers provide high-quality products. Collaboration across the ecosystem supports research, clinical translation, and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Human Microbiome Market, By Product

In 2024, microbiome supplements led the North America human microbiome market fueled by consumer interest in probiotics, prebiotics and synbiotics targeting digestive health, immune support and general well-being. These items are readily available over the counter, bolstered by increasing recognition of gut health connections and trends in care.

North America Human Microbiome Market, By Route of Administration

The oral form of administration was the leading form present within the North America human microbiome drugs and supplement market in 2024. The oral form comes in various forms, such as capsules, powders, and liquids, which are convenient and more affordable modes of consumption. Moreover, they provide an easier alternative for the administration of probiotics and prebiotics.

North America Human Microbiome Market, By Disease

In 2024, the market for the human microbiome in North America is driven by gastrointestinal disorders due to the predominant link shown between an imbalance of gut microbiomes and gastrointestinal disorders. The gastrointestinal disorders.

REGION

US to be fastest-growing country in North America Human Microbiome Market during forecast period

The US human microbiome market is expected to register the highest CAGR during the forecast period driven by companies and research initiatives, the increasing prevalence of chronic diseases, government initiatives and growing investments in developing microbiome-based therapeutics. Leading firms such as BIOHM Health, Seed Health, Inc., Seres Therapeutics, Inc., and Vedanta Biosciences, Inc. are developing advanced therapies and health solutions based on microbiome science.

NORTH AMERICA HUMAN MICROBIOME MARKET: COMPANY EVALUATION MATRIX

In the human microbiome market matrix, International Flavors & Fragrances Inc. leads with a strong market presence and comprehensive product portfolio, demonstrating a strong commitment to advancing microbiome health solutions globally. Pendulum is gaining traction with specialized solutions and expanding footprints, particularly in gut-health and overall well-being.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- International Flavors & Fragrances Inc. (US)

- Seed Health, Inc. (US)

- Seres Therapeutics (US)

- Pendulum (US)

- BioHM Health Inc. (US)

- Resbiotic (US)

- Infinant Health Inc. (US)

- ExeGi Pharma LLC (US)

- Finch Therapeutics Group, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.43 Billion |

| Market Forecast in 2031 (Value) | USD 4.15 Billion |

| Growth Rate | CAGR of 32.2% from 2025-2031 |

| Years Considered | 2023-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US, Canada |

| Parent & Related Segment Reports |

Human Microbiome Market Europe Human Microbiome Market Human Microbiome Manufacturing Services Market Asia Pacific Human Microbiome Market Human Microbiome Drugs Market |

WHAT IS IN IT FOR YOU: NORTH AMERICA HUMAN MICROBIOME MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America Human Microbiome Market, By Distribution Channel | Market size & forecast for human microbiome market based on type of distribution - Prescription-based Products and OTC Products | Split of Supplements into clinical (prescription/FSMP/medical foods) vs. consumer OTC (wellness probiotics, synbiotics) |

| North America Human Microbiome Diagnostics Market, By Type | Market size & forecast for human microbiome market based on type of diagnostics - microbiome test and companion diagnostics | Diagnostic TAM assessment |

RECENT DEVELOPMENTS

- February 2025 : GluCare Health collaborated with Pendulum Therapeutics to evaluate the impact of Pendulum Glucose Control, a probiotic, on blood sugar levels, weight management, and overall metabolic health

- October 2024 : BIOHM Health, Inc. partnered with ADM to launch Vivifem, a data-driven microbiome formulation for women aged 40-65. Developed using BIOHM's Symbiont platform, the formula combines prebiotics, probiotics, and postbiotics to target microbiome imbalances associated with aging

- April 2023 : The US Food and Drug Administration approved VOWST (live-brpk), which is the first fecal microbiota transplant product meant to be taken orally. VOWST has been given the green light for preventing Clostridioides difficile (C. difficile) Infection recurrence in individuals aged 18 and above, following antibacterial treatment for recurrent CDI

Table of Contents

Methodology

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the North America Human Microbiome Market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative & quantitative information and assess the growth prospects of the market. The North America market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used primarily to identify & collect information for the extensive, technical, market-oriented, and commercial study. The secondary sources used for this study include World Health Organization (WHO), Human Microbiome Project (HMP), Organisation for Economic Co-operation and Development (OECD), National Institutes of Health (NIH), Food and Drug Administration (FDA), ClinicalTrials.gov, Annual Reports, SEC Filings, Investor Presentations, Research Journals, Press Releases, and financial statements. These sources also obtained key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative & quantitative information and assess the prospects of the market. Various primary sources from both the supply & demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

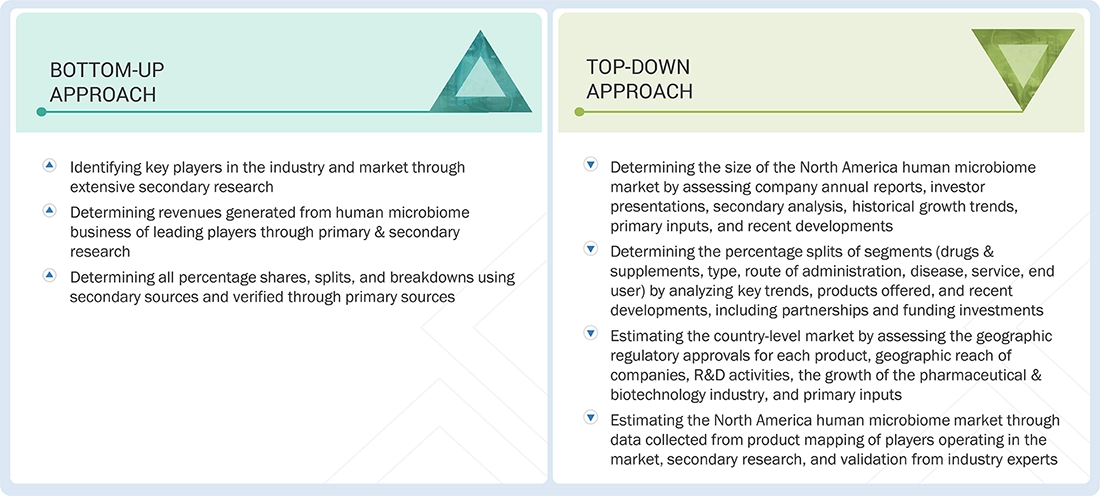

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate & validate the total size of the North America Human Microbiome Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The total market was split into several segments and subsegments after arriving at the overall market size from the estimation process. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The human microbiome encompasses the collective genetic material of diverse microorganisms residing within the human body, known as the metagenome. This includes bacteria, fungi, protozoans, non-living viruses, and various single-celled organisms. These microorganisms play a crucial role in human physiology, influencing metabolic and immune functions. Found within human tissues, the microbiome is a focal point of research for medical advancements and analytical techniques. It is applied in probiotics, prebiotics, pharmaceuticals, and therapeutic systems to address conditions such as diabetes, obesity, and cancer, as well as a range of metabolic, gastrointestinal, neurological, central nervous system, and autoimmune disorders.

The study provides an in-depth analysis of the North America Human Microbiome Market based on contemporary market trends and developments, and its potential growth from 2025 to 2031. It includes detailed market trends, the competitive landscape, market size, forecasts, and the analysis of the key Human Microbiome service providers.

Stakeholders

- Manufacturers and Distributors of Human Microbiome Products

- Pharmaceutical and Biotechnology Companies

- Market Research and Consulting Firms

- R&D Centers

- Researchers and Scientists

- Academic & Research Institutes

- Hospitals & Clinics

- Long-term Care Centers

- Specialty Care Centers

- Outpatient Care Centers

Report Objectives

- To define, describe, and forecast the North America Human Microbiome Market based on products, disease, drugs & supplements type, drugs & supplements route of administration, end user, manufacturing services and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall North America Human Microbiome Market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players in the North America Human Microbiome Market and comprehensively analyze their core competencies and market rankings

- To track and analyze competitive developments such as product launches, acquisitions, expansions, agreements, partnerships, and collaborations in the North America Human Microbiome Market

- To benchmark players within the North America Human Microbiome Market using the ‘Company Evaluation Matrix' framework, which analyzes market players based on various parameters within the broad categories of business and product strategy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Human Microbiome Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Human Microbiome Market