Fishery By-products Market

Fishery By-products Market by Type (Protein & Protein Derivative, Fish Oil, Bioactives & Specialty Compound), Source (Marine, Aquaculture), End-user Industry (Food & Beverage, Animal Feed, Agriculture), Technology, & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The fishery by-products market is expected to grow from USD 26.34 billion in 2025 to USD 37.46 billion by 2030, at a compound annual growth rate of 7.3% during the forecast period. One of the main global drivers for the fishery by-products market is the increasing emphasis on sustainability and circular economy practices — i.e., converting fish processing waste (skins, bones, viscera, scales) into valuable products like fishmeal, fish oil, collagen, and enzymes rather than discarding it as waste.

KEY TAKEAWAYS

-

BY TYPEFishmeal remains the top type segment, capturing the largest share of global fishery by-products due to its high demand in aquaculture and animal feed industries. The steady nutritional profile and digestibility of fishmeal make it a key protein source in worldwide feed formulations.

-

BY END USEREnd-use industries now play a key role in changing the demand trends of the fishery by-products market. The animal feed sector remains the main user, relying on fishmeal and fish oil from by-products as important sources of protein and Omega-3s, especially in aquafeed and pet food products.

-

BY SOURCEMarine capture fisheries remain the leading segment within capture, driven by large-scale operations in Peru, Norway, and Russia. These countries have invested in processing facilities to turn trimmings, viscera, and whole fish into value-added ingredients.

-

BY REGIONThe market is expected to grow steadily, fueled by increasing demand for alternative protein sources and marine-based nutraceuticals. The Asia Pacific region, mainly China, India, and Southeast Asia, will contribute to this growth due to the abundance of raw materials and improved infrastructure for fish processing. Meanwhile, North America and Europe will focus on high-value applications such as biostimulants in agriculture, pet food, and biomedical uses.

-

COMPETITIVE LANDSCAPEThe fishery by-products market is highly competitive shaped by both global conglomerates and regional processors. Large integrated seafood firms leverage economies of scale, secured raw material access, and advanced extraction technologies to dominate bulk segments like fishmeal and fish oil. However, smaller specialized players thrive in high-value niches, offering bioactive peptides, collagen, and nutraceutical-grade omega-3s with superior purity and traceability.

The global fishery by-products market is experiencing steady growth, driven by the increasing use of waste streams from fish processing, such as heads, frames, viscera, skins, scales, and shells, to produce high-value products. These by-products are more frequently used in animal feed, pharmaceuticals, nutraceuticals, cosmetics, fertilizers, and industrial applications, with demand boosted by sustainability initiatives and the push for full resource utilization.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Supplements are becoming the fastest-growing revenue source, acting as a vital link between raw fishery by-products and products for consumers. Capsules and softgels, along with pet health, are increasing in importance as secondary growth drivers. These segments expand the customer base beyond just food and feed, reaching the growing markets for consumer wellness and pets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising awareness about livestock and pet health and nutrition

-

Increasing incorporation of fishmeal and fish oil in swine and poultry diets

Level

-

Unsustainable fishing practices by fishmeal and fish oil manufacturers

-

Surge in allergic and toxic reactions from consuming herring and anchovies

Level

-

Rising demand for organic fertilizers

-

Sustainable intensification of aquaculture

Level

-

Raw material, contamination, & traceability challenges

-

Rising incidence of animal-borne diseases

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising awareness about livestock and pet health and nutrition

The rise in pet humanization trends in Asia Pacific has boosted demand for premium pet food ingredients and products that offer multifunctional health benefits. Spending on health-focused pet food ingredients is increasing due to growing awareness and disposable income among pet owners. Fish oil products are also increasingly used in pet food to support pets' health, growth, development, and nutrition.

Restraint: Unsustainable fishing practices by fishmeal and fish oil manufacturers

Fishmeal and fish oil companies operating in the Asia Pacific region pose a serious threat to marine resources. Tons of fish caught through unsustainable fishing practices are emptying the region’s fish reserves, which are mainly used to produce fishmeal and fish oil products. As the income from fishmeal and fish oil products has risen steadily, unsustainable fishing practices, such as juvenile fishing, have increased significantly in India and other countries, posing a serious threat to fish stocks in recent years.

Opportunity: Sustainable intensification of aquaculture

Fishmeal and fish oil companies operating in the Asia Pacific region pose a serious threat to marine resources. Tons of fish caught through unsustainable fishing methods are depleting the region’s fish stocks, which are mainly used to produce fishmeal and fish oil products. As the income from these products has steadily increased, unsustainable fishing practices like juvenile fishing have also grown significantly in India and other countries, threatening fish populations in recent years.

Challenge: Raw material, contamination, & traceability challenges

A major challenge that threatens the reliability and scalability of fishery by-products markets is the inconsistency in raw material quality and contamination risk. Unlike conventional livestock processing, where waste streams are more uniform, fishery by-products are highly varied depending on species, fishing gear, seasonality, and location. This variability creates significant issues for processors trying to deliver consistent product specs to food, pharmaceutical, or cosmetic markets. For instance, by-products from small pelagic fish (like anchovy and sardine) have different protein and oil profiles compared to those from demersal species (such as cod and haddock), necessitating customized processing methods. In tropical countries, fluctuating microbial loads caused by warm climate, poor handling, and irregular cold storage further undermine quality and safety.

Fishery By-products Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of sustainable fishmeal and fish oil alternatives for aquaculture feed using advanced processing of by-products | Supports global aquaculture growth, reduces reliance on wild catch, enhances feed efficiency, and positions Scoular in circular economy solutions |

|

Production of marine collagen peptides and functional ingredients from fish scales and skins for nutraceuticals and cosmetics | Creates premium revenue streams in health and beauty, leverages Japan’s regulatory credibility, and strengthens sustainable innovation branding |

|

Extraction of tuna oil rich in omega-3s and bioactive compounds for infant formula, dietary supplements, and functional foods | Delivers clinically validated health benefits, taps into high-growth Omega-3 market, ensures traceability, and diversifies revenue beyond canned tuna |

|

Development of pharmaceutical-grade EPA products and specialty marine-derived bioactives from by-products | Positions Nissui in premium pharma and nutraceutical markets, builds IP-protected product pipeline, and enhances competitiveness with clinically backed ingredients |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the leading companies in this market include well-established and financially stable fishery by-product manufacturers. These companies have been operating for over a decade and feature diversified portfolios, the latest technologies, and robust global sales and marketing networks. Notable companies in this market include Pesquera Diamante Peru (Peru), Oceana Group Limited (South Africa), Scoular Company (US), Austevoll Seafood ASA (Norway), Maruha Nichiro Corporation (Japan), Nippon Suisan Kais (Japan), Sopropêche (France), and Thai Union Ingredients (Thailand).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fishery by-products Market, By Type

Fishmeal dominates the global fishery by-products market in total volume and revenue. Fishmeal has been the central feature of by-product utilization in the fishing industry for a very long time and continues to be very relevant today, particularly for aquaculture, livestock feed, pet food, and nutraceuticals. Fishmeal and fish oil are produced primarily from waste species of fish, which include heads, bones, viscera, and trimmings from fish processing, all of which are rendered to make high-protein fish meals and lipid-rich fish oil. Despite the rising popularity of more modern, high-value fishery ingredient products (e.g., collagen, gelatin, and chitin/chitosan), fishmeal and fish oil continue to dominate the market because of their traditional markets, established processing methods, and ongoing world demand. One notable trend that further strengthens the position of fishmeal is integration into aquafeeds, which represent more than 60% of fishmeal usage worldwide.

Fishery by-products Market, By End User

The animal feed industry, particularly aquafeed, is the largest end-use sector in the fishery by-products market. Aquaculture is the fastest-growing sector of global food production and relies on many nutrient-rich inputs, such as fishmeal and fish oil, which are sourced from fishery waste. This means that end-use applications account for more than half of all fishery by-products utilized worldwide, making it a core component of both weight and strategic importance. Besides aquafeed, fishery by-products are also used in feeds for poultry, swine, and pets, although these uses are limited.

Fishery by-products Market, By Source

Capture fisheries involve harvesting wild fish from natural water bodies, including oceans (marine fisheries) and rivers, lakes, and reservoirs (inland fisheries). Due to the high biomass extraction and centralized processing facilities, capture fisheries have traditionally been the main source of fishery by-products. However, overfishing, environmental changes, and resource management issues are beginning to impact catch volumes and sustainability. Nonetheless, capture fisheries continue to be vital to the fishmeal and fish oil industries in countries with large pelagic fish catches.

REGION

Asia Pacific to be fastest-growing region in global fishery by-products market during forecast period

Asia Pacific is the leading market for fishery by-products because of its fast growth in aquaculture and livestock sectors. The rapid development of aquaculture is improving food supplies and creating jobs. The region holds a significant 48% share of the overall market. It has experienced notable growth and demand in the livestock industry, with consumption of meat steadily increasing. The expanding middle class and increasing awareness about animal health and nutrition have driven up demand for high-quality, premium, health-focused feed ingredients. This trend has greatly contributed to the growth of fishmeal and fish oil producers in the region.

Fishery By-products Market: COMPANY EVALUATION MATRIX

The Scoular Company (US) is a prominent player in the global fishery by-products market, leveraging its strong expertise in sustainable feed and protein solutions. Its leadership stems from investments in alternative protein, aquaculture nutrition, and circular economy models that convert by-products into high-value ingredients. Among startups, TripleNine Group (Denmark) is a leading European producer of fishmeal and fish oil, with a reputation built on sustainability and quality.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 24.68 Billion |

| Market Forecast in 2030 (value) | USD 37.46 Billion |

| Growth Rate | CAGR of 7.3% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (KT) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Fishery By-products Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Regional market sizing for fish oil, fishmeal, collagen, and bioactives | Detailed market estimates by region (NA, EU, APAC, SA, MEA) with growth drivers and trade flow analysis | Enables clients to identify regional demand hotspots and prioritize investments |

| Competitive benchmarking of key players (Scoular, Maruha Nichiro, Thai Union Ingredients, Nissui, TripleNine, FKS Multi Agro) | Profiling with financials, product portfolios, certifications, sustainability initiatives, and M&A activities | Helps clients position against competitors and refine go-to-market strategies |

| Pricing analysis for fishmeal, fish oil, and marine collagen | Historical and current price trends (USD/ton, USD/kg) with regional comparisons and volatility factors | Supports procurement strategy, contract negotiations, and pricing models |

| End-use application insights (feed, nutraceuticals, cosmetics, pharma, industrial) | Revenue split and growth potential by end-use, including emerging applications (bioactives, peptides, marine minerals) | Identifies diversification opportunities and high-margin segments |

RECENT DEVELOPMENTS

- January 2025 : Captain Fresh (India), a rapidly expanding seafood supply platform, completed a deal to acquire EU salmon processor Koral. This acquisition gives Captain Fresh broader access to salmon by-products processing in Europe, strengthening its position in value-added and by-product markets.

- February 2025 : Yumbah (Australia) proposed a merger with Clean Seas Seafood, aiming to consolidate two leading abalone producers and enhance scale, R&D, and market reach in shellfish aquaculture.

- July 2025 : Cermaq, a subsidiary of Mitsubishi Corporation, signed a definitive agreement to acquire Grieg Seafood ASA’s salmon farming operations in British Columbia, Newfoundland (Canada), and Finnmark (Norway) for approximately USD 1 billion. While primarily focused on aquaculture, this deal includes facilities that process fishery by-products like fish oil and meal, enhancing Cermaq’s capacity in the by-products market.

- June 2025 : Mowi (Norway), a leading global salmon producer, announced a strategic investment in a new processing facility in Norway to enhance the production of fish meal and fish oil from salmon by-products. The facility, with a daily capacity of processing 30 metric tons of precooked fish, focuses on sustainable technologies to reduce waste and improve yield efficiency.

Table of Contents

Methodology

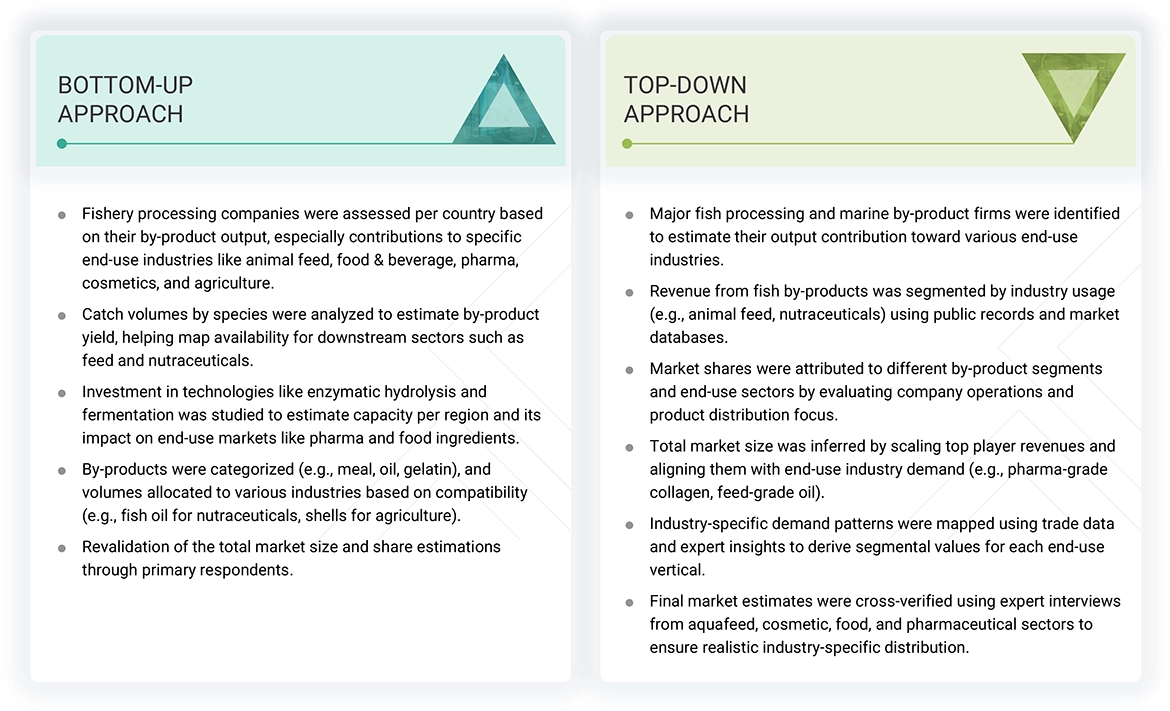

The study involved two major approaches in estimating the current size of the fishery by-products market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

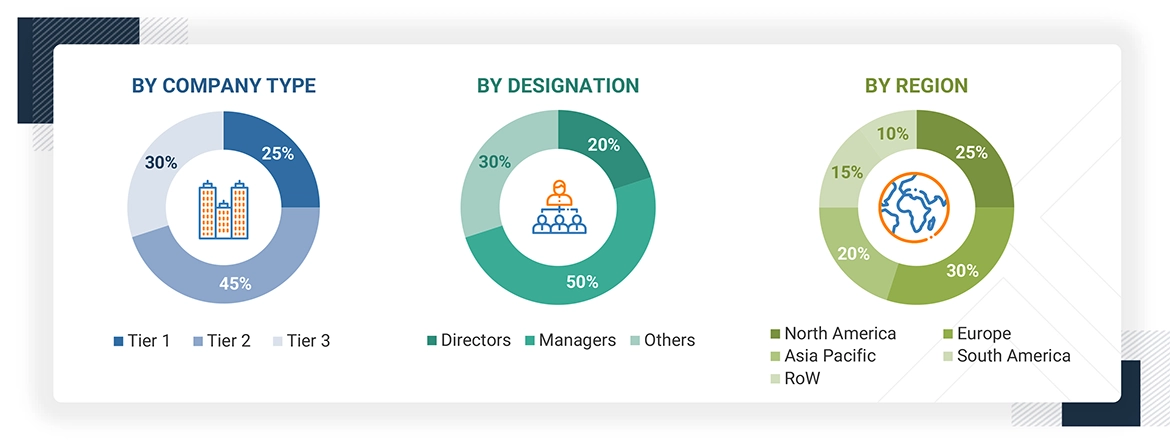

Primary Research

Extensive primary research was conducted after obtaining information regarding the fishery by-products market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to fishery by-products type, end-user industry, and region. Stakeholders from the demand side, such as livestock rearing flocks, dairy farms, and the poultry industry, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of fishery by-products and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024,

as per the availability of financial data: Tier 1: Revenue >USD 1 billion; Tier 2: USD 100 million = Revenue = USD 1 billion;

Tier 3: Revenue

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY |

DESIGNATION |

|

Thai Union Ingredients (Thailand) |

General Manager |

|

Sopropêche (France) |

Sales Manager |

|

Pesquera Diamante Peru (Peru) |

Manager |

|

Oceana Group Limited (South Africa) |

Head of processing department |

|

Austevoll Seafood A (Norway) |

Marketing Manager |

|

Maruha Nichiro Corporation (Japan) |

Sales Executive |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the fishery by-products market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Fishery By-products Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall fishery by-products market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to FAO, fishery by-products refer to the non-edible or secondary components of fish and aquatic animals generated during processing or harvesting. These include heads, bones, skins, viscera, blood, scales, shells, and frames, which are commonly repurposed for animal feed, fertilizers, pharmaceuticals, collagen, gelatin, and bioactive compounds.

Stakeholders

- Fishmeal & fish oil manufacturers

- Fishmeal & fish oil traders, distributors, and suppliers

- Fish farmers

- Government and research organizations

- Associations and industry bodies

- Agricultural universities

- Intermediate suppliers such as retailers, wholesalers, and distributors

- Raw material suppliers

- Technology providers

- Industry associations

-

Regulatory bodies and institutions:

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- Compound Livestock Feed Manufacturers Association of India (CLFMA)

- International Feed Industry Federation (IFIF)

- American Feed Industry Association (AFIA)

- Animal Feed Manufacturers Association (AFMA)

- Organization for Economic Cooperation and Development (OECD)

- Marine Ingredients Organisation (IFFO)

- European Market Observatory for Fisheries and Aquaculture Products

- Logistics providers & transporters

-

Research institutes and organizations

- Consulting companies/consultants in the agricultural technology sector

Report Objectives

- To determine and project the size of the fishery by-products market based on type, end-user industry, and region in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the fishery by-products market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe fishery by-products market into key countries.

- Further breakdown of the Rest of Asia Pacific fishery by-products market into key countries.

- Further breakdown of the Rest of South America fishery by-products market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the fishery by-products market?

The fishery by-products market is estimated to be USD 26.34 billion in 2025 and is projected to reach USD 37.46 billion by 2030, registering a CAGR of 7.3% during the forecast period.

Which are the key players in the market, and how intense is the competition?

The major market players include Pesquera Diamante Peru (Peru), Oceana Group Limited (South Africa), Scoular Company (US), Austevoll Seafood A (Norway), Maruha Nichiro Cor (Japan), Nippon Suisan Kais (Japan), Sopropêche (France), and Thai Union Ingredients (Thailand). Competition in the fishery by-products market is quite intense, driven by a range of global players, evolving demand trends, environmental concerns, and growing adoption of biotechnologies.

Which region is projected to account for the largest share of the fishery by-products market?

Asia Pacific dominates the global aquaculture industry, with Southeast Asian countries like Indonesia, Vietnam, the Philippines, and Thailand being major producers. The expansion of aquaculture provides a steady and reliable supply of fish, which in turn generates more by-products.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the fishery by-products market?

The market for fishery by-products is growing due to the focus on sustainability and marine waste management. Bioactive compounds from fish, collagen, and other marine-derived ingredients are highly sought after in the cosmetics industry.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fishery By-products Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Fishery By-products Market