Small Satellite Market Size, Share, Trends & Analysis 2030

Small Satellite Market by Mass (1-10, 11-100, 101-1,200 kg), Frequency (L, S, C, X, Ku, Ka, Q/V/E, HF/VHF/UHF, Laser/Optical), Propulsion Technology (Chemical, Electric, Hybrid), Application, Customer, System and Region - Global Forecast to 2030

OVERVIEW

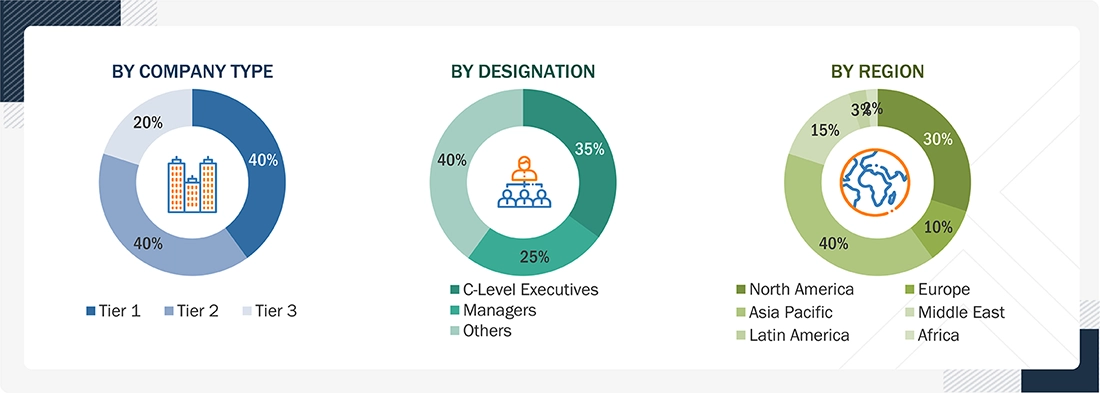

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The small satellite market is projected to grow from USD 9.35 billion in 2025 to USD 32.13 billion by 2030, with a CAGR of 28.0%. In terms of volume, it is expected to reach 5,092 units by 2030, from 2,793 units in 2025. The market is steadily growing as more organizations adopt low-cost satellites for communication, Earth observation, and space-based data services.

KEY TAKEAWAYS

-

BY REGIONNorth America accounted for a 42.2% market share in 2025.

-

By CustomerThe commercial segment is expected to record the highest CAGR of 31.0% during the forecast period.

-

By SystemSatellite bus is expected to be the largest segment during the forecast period.

-

By MassMini satellites are expected to dominate the market during the forecast period.

-

By FrequencyThe L-band segment is expected to grow at the fastest rate from 2025 to 2030.

-

By ApplicationThe communication segment is expected to lead the market during the forecast period.

-

By Propulsion TechnologyThe electric segment will grow the fastest during the forecast period.

-

COMPETITIVE LANDSCAPESpaceX, Airbus, MDA, China Aerospace Science and Technology Corporation, and Thales were identified as star players in the small satellite market, given their strong market share and product footprint.

The small satellite market is experiencing growth driven by increased demand for affordable space missions, more frequent launches, and expanded use in communications, Earth observation, and defense applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumer business in the small satellite market stems from changing customer expectations for improved connectivity and easier access to satellite data and communications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of LEO constellations for broadband and Earth observation

-

Increased government adoption for ISR, PNT, and tactical communications

Level

-

Limited on-orbit lifespan and higher replacement frequency

-

Spectrum and orbital slot congestion

Level

-

Rise of hosted payloads

-

Advent of in-orbit services for small satellites

Level

-

Supply chain constraints

-

Space debris and collision avoidance overhead

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of LEO constellations for broadband and Earth observation

Demand for small satellites capable of delivering high-volume broadband internet and multiple Earth observation opportunities is expected to grow as LEO satellite constellations expand.

Restraint: Limited on-orbit lifespan and higher replacement frequency

Small satellites typically have shorter lifespans compared to larger satellites because they have less propulsion and power. As a result, they need more replacements and incur higher operational and maintenance costs.

Opportunity: Rise of hosted payloads

Hosted payloads enable multiple customers to share a single satellite. This lowers costs and accelerates mission deployment. It also improves overall asset utilization.

Challenge: Supply chain constraints

Limited availability of key components delays satellite production. Delivery setbacks impact launch schedules. This raises costs and execution risks.

SMALL SATELLITE MARKET SIZE, SHARE, TRENDS & ANALYSIS 2030: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deploys small satellite constellations for broadband connectivity and data services. Supports commercial customers with frequent launch access and in-house satellite production. | Fast deployment timelines and lower launch costs. Scalable coverage for global connectivity and data delivery. |

|

Provides small satellite platforms for commercial imaging services. Supports monitoring applications across land and maritime sectors. | High-quality imaging and repeat coverage. Enables reliable data for commercial analytics and monitoring services. |

|

Designs and manufactures small satellites for Earth observation, communication, and scientific missions. | Reliable mission performance with proven satellite platforms. Enables high-resolution data, secure communications, and long-term operational stability for diverse applications. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Key stakeholders in the small satellite ecosystem include prominent companies, private and small enterprises, and end users. The collaborative network of component manufacturers, subsystem integrators, space agencies, and commercial operators is driving innovation in small satellite technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Small Satellite Market, By Mass

The mini satellite segment is expected to hold the largest market share due to its high payload capacity. These satellites support complex commercial and government missions. They deliver better performance at a controlled cost, which drives wider adoption across space programs.

Small Satellite Market, By Customer

The commercial segment is expected to lead the market during the forecast period because of increasing demand for data services. Small satellites enhance communication and Earth observation requirements. They allow for quicker service deployment.

Small Satellite Market, By Application

The communication segment is expected to hold the largest share due to rising demand for satellite connectivity. Small satellites aid in expanding broadband and enhancing network coverage. This, in turn, boosts market demand.

Small Satellite Market, By System

The satellite bus segment is projected to account for a large share due to its core system role. It manages power control and stability. Reliable bus platforms improve mission success.

Small Satellite Market, By Frequency

The Ku–band segment is expected to hold the largest market share due to its high data capacity. It supports high-speed communication services. As bandwidth needs increase, demand rises, maintaining market leadership.

Small Satellite Market, By Propulsion Technology

The electric segment is projected to account for the largest market share due to higher efficiency. It supports a longer mission life and improves orbit control, which reduces overall mission costs.

REGION

North America to be largest market for small satellites during forecast period

North America is expected to be the largest market during the forecast period, driven by increasing demand for space-based data in both commercial and defense sectors. Moreover, the presence of leading satellite manufacturers and launch providers is fueling the market.

SMALL SATELLITE MARKET SIZE, SHARE, TRENDS & ANALYSIS 2030: COMPANY EVALUATION MATRIX

The company evaluation matrix for the small satellite market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. SpaceX (US) leads the small satellite market with a strong product portfolio, manufacturing technologies, and a broad customer base, while Lockheed Martin Corporation (US) is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SpaceX (US)

- MDA Space (Canada)

- Airbus Defense and Space (France)

- Thales Alenia Space (France)

- China Aerospace Science and Technology Corporation (China)

- Lockheed Martin Corporation (US)

- Northrop Grumman (US)

- L3Harris Technologies, Inc. (US)

- Surrey Satellite Technology Ltd (UK)

- Planet Labs PBC (US)

- Maxar Technologies (US)

- GomSpace (Denmark)

- Mitsubishi Electric Corporation (Japan)

- BAE Systems (UK)

- RTX (US)

- OHB SE (Germany)

- The Aerospace Corporation (US)

- Millennium Space Systems, Inc. (US)

- Kuiper Systems LLC (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.09 BN |

| Market Forecast in 2030 (value) | USD 32.13 BN |

| Growth Rate | 28.0% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Rest of the World |

WHAT IS IN IT FOR YOU: SMALL SATELLITE MARKET SIZE, SHARE, TRENDS & ANALYSIS 2030 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Emerging Leader | Additional Company Profiles | Competitive information on targeted players to gain granular insights on direct competition |

RECENT DEVELOPMENTS

- October 2025 : Thales (France), Airbus (France), and Leonardo (Italy) have signed a Memorandum of Understanding (MoU) to merge their respective space activities into a new company. This aims to strengthen Europe’s strategic autonomy in space, supporting critical infrastructure and services related to telecommunications, global navigation, Earth observation, science, exploration, and national security.

- July 2025 : Airbus (France) was selected by Spanish operator Hisdesat to develop and manufacture two advanced PAZ-2 radar Earth observation satellites for Spain’s Ministry of Defence. These small radar spacecraft will deliver continuous all-weather imagery for both defense and civilian purposes.

- March 2025 : SpaceX (US) launched a new batch of Starlink small satellites using its Falcon 9 launch vehicle. The mission supported the expansion of the LEO constellation. It enhanced broadband capacity and network coverage across North America.

Table of Contents

Methodology

This research study involves the use of extensive secondary sources, directories, and databases (e.g., Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the small satellite market. Primary sources include several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, IP vendors, standards, and organizations related to all the segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as to assess the prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; articles from recognized authors; and websites, directories, and databases. Secondary research has mainly been used to obtain key information about the industry’s supply chain, the market’s value chain, major players, market classification, and segmentation according to the industry trends to the bottommost level, geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

Extensive primary research has been conducted after obtaining information about the current scenario of the small satellite market through secondary research. Several primary interviews have been conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East, and the Rest of the World. This primary data has been collected through questionnaires, emails, and telephonic interviews.

Note: Tiers of companies are based on their revenue in 2024. Tier 1: company revenue greater than USD 1 billion; Tier 2: company revenue between USD 100 million and USD 1 billion; and Tier 3: company revenue less than USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the small satellite market.

The research methodology used to estimate the market size also includes the following details:

- Key players in the market have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This includes a study of annual and financial reports of the top market players and extensive interviews with industry experts.

- The top-down and bottom-up approaches were used to estimate and validate the size of the global market and the dependent submarkets.

Small Satellite Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the small satellite market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the small satellite market size was validated using the top-down and bottom-up approaches.

Market Definition

Small satellites are any satellite with a mass from approximately 1 to 1,200 kg. These satellites are engineered to perform space missions similar to larger satellites but are constructed using smaller, lighter, and commercially available components. Based on their mass, they are classified into the following subcategories: small, mini, micro, and nano. The small satellite typically leverages advancements in the miniaturization of technology and is launched independently or as a secondary payload, allowing for cost-effective access to space and opportunities for high-frequency mission updates and constellation deployment. These satellites are mainly used by businesses and governments for various applications, including communications, Earth observation, and scientific research.

Key Stakeholders

- Satellite Manufacturers

- Satellite Integrators

- Space Agencies and Government Bodies

- System Manufacturers

- Research Institutions

- Component and Subsystem Suppliers

Report Objectives

- To define, describe, segment, and forecast the size of the small satellite market based on mass, system, application, frequency, customer, propulsion technology, and region

- To forecast the sizes of various market segments with respect to five regions, namely North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the regulatory landscape with respect to small satellite regulations across regions

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share and revenue analyses of key players

Available customizations:

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Small Satellite Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Small Satellite Market

User

Feb, 2020

Hi Team, kindly provide market intelligence on commercial space transportation. Thanks.

User

Feb, 2020

Hi Team, Kindly provide intelligence on space platforms and products such as Göktürk-1, earth observation satellite, Göktürk-2 (launched 2012), earth observation satellite, Göktürk-3 satellite, Türksat 6A, communications satellite. Thanks, Turkish aerospace. .

Oliver

May, 2019

Looking into the current small satellite quantitative trend over the past few years (mainly micro/mini satellite size) and any future predictions..

Colon

Aug, 2019

VACCO builds small propulsion systems for several prime contractors. We are evaluating investing in additional B&L and M&E to support this product line and would like to understand how large is the market place, key suppliers, and timeline with the technology. Cgardner@vacco.com .

Guido

Apr, 2019

Looking to estimate the potential market for much lower-cost liquid propellant rocket engine; scalable across a wide range of thrusts for boost, sustain, orbital, and planetary ascent applications..