HVAC Linesets Market

HVAC Linesets Market by Material Type (Copper, Low Carbon, Other Material Types), Implementation (New Construction, Retrofit), End-use Industry (Commercial, Industrial, Residential), and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

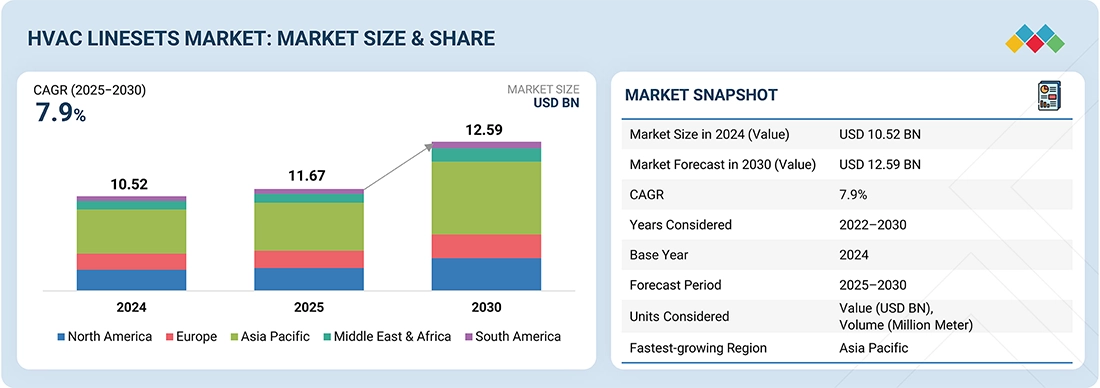

The HVAC linesets market is projected to reach USD 12.59 billion by 2030 from USD 11.67 billion in 2025, at a CAGR of 7.9% during the forecast period. The key growth drivers of the HVAC lineset market include the rising demand for energy-efficient HVAC systems, rapid urbanization, and expanding construction of residential and commercial buildings. Additionally, increasing adoption of environmentally friendly refrigerants and replacement of aging HVAC infrastructure further fuel market growth.

KEY TAKEAWAYS

-

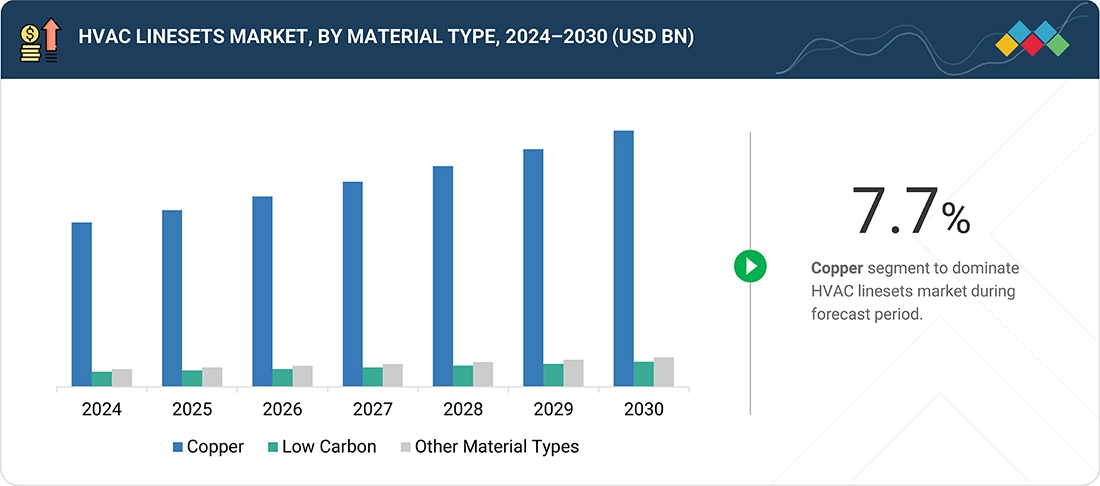

BY MATERIAL TYPEThe HVAC linesets market is segmented based on material type into copper, low carbon, and other material types. Copper has the highest market share owing to its high thermal conductivity, corrosion-resistant properties, and durability.

-

BY IMPLEMENTATIONKey implementations include new construction and retrofit. New construction is leading the HVAC linesets market due to urbanization and infrastructure projects requiring the new installation of HVAC systems.

-

BY APPLICATIONThe HVAC linesets market is segmented based on end-use industry into industrial, commercial, and residential. The commercial segment dominates the market due to the extensive use of HVAC systems in offices, malls, and hospitality, which require larger cooling systems.

-

BY REGIONThe HVAC linesets market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific has the largest market owing to rapidly increasing industrialization, population, and investment in infrastructure for smart buildings

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. Mueller Streamline Co. (US), Cerro Flow Products LLC (US), JMF Company (US), Zhejiang ICE Loong Environmental Sci-Tech Co. Ltd. (China), Feinrohren S.p.A (Italy), Daikin (Japan), Halcor (Greece), Hydro (Norway), KME SE (Germany), Inaba Deno (Japan), Diversitech Corporation (US), and Zhejiang Hailiang Co., Ltd (China) are the key players in HVAC linesets market.

The HVAC linesets market is driven by the growing demand for energy-efficient heating and cooling systems in residential and commercial buildings. Urbanization and the development of smart infrastructure are expected to boost manufacturers' installations of HVAC systems. Additionally, the transition to more environmentally friendly refrigerants, along with advancements in copper and aluminum tubing, will continue to support the growth of this market.

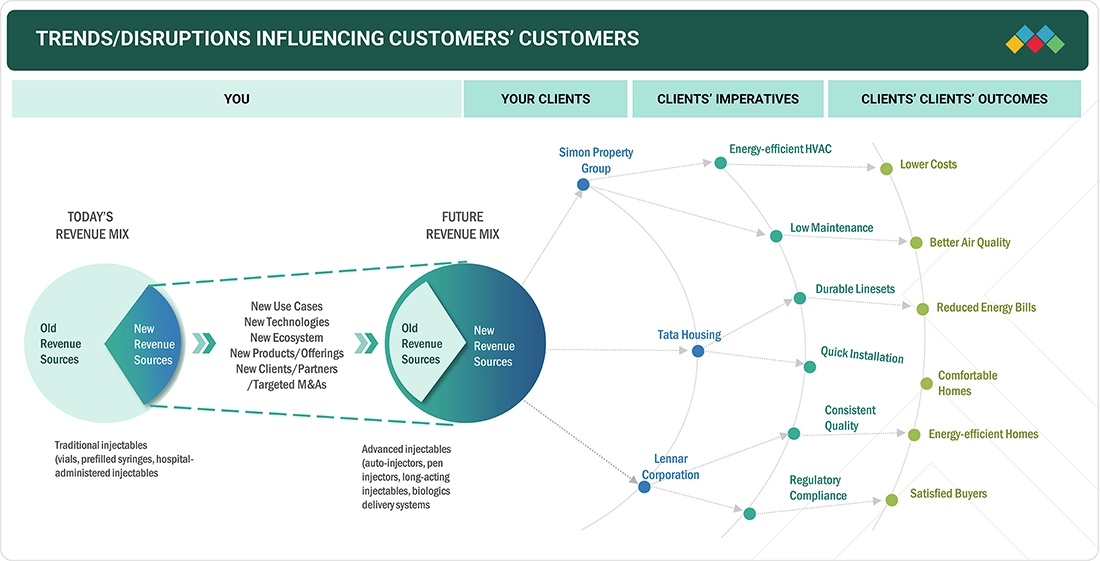

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on clients' businesses in the HVAC linesets market is influenced by changing priorities such as energy efficiency, sustainability, installation speed, and regulatory compliance. Leading companies like Simon Property Group, Tata Housing, and Lennar Corporation prioritize energy-efficient systems, durable and scalable solutions, and tenant or buyer satisfaction. These priorities lead to several beneficial outcomes, including reduced costs, improved comfort, increased property value, and compliance with regulations. This highlights the crucial role of innovation and quality in addressing the diverse demands of end users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Urbanization and increase in residential construction

-

Growing trend of smart homes

Level

-

High installation and maintenance costs of HVAC systems

-

Rising environmental concerns

Level

-

Rising global temperatures and heat islands

-

Combination of climate and income dynamics

Level

-

Passive cooling and free cooling solutions

-

Adoption of new refrigerants

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Urbanization and increase in residential construction

Urbanization and the rise in residential construction are key drivers for the HVAC linesets market because they directly increase the demand for efficient air conditioning and heating systems in homes and apartments. As urban areas expand, new housing projects and high-rise developments require HVAC installations to ensure indoor comfort and energy efficiency. This leads to greater consumption of linesets, which connect indoor and outdoor HVAC units. Additionally, modern residential projects emphasize sustainable and efficient climate control systems, further boosting demand for high-quality, pre-insulated copper and aluminum linesets to support reliable performance and reduced installation time.

Restraint: High installation and maintenance costs of HVAC systems

High installation and maintenance costs act as a major restraint for the HVAC linesets market because they increase the overall project expenditure, especially in residential and small commercial applications. Installing HVAC systems requires skilled labor, precise handling of linesets, and adherence to safety and environmental standards, which raise costs. Additionally, regular maintenance and potential refrigerant leak repairs add to long-term expenses. These high upfront and recurring costs discourage adoption in price-sensitive markets and delay replacement or retrofit projects. Consequently, budget constraints and cost-conscious consumers often opt for alternative or lower-capacity systems, limiting the market’s growth potential.

Opportunity: Rising global temperatures and heat islands

Rising global temperatures and the growing heat island effect present a significant opportunity for the HVAC linesets market. As cities experience higher average temperatures due to dense infrastructure and reduced vegetation, the demand for efficient cooling systems intensifies. This drives increased installation of air conditioners and heat pumps in both residential and commercial spaces, directly boosting the need for durable and high-performance HVAC linesets. Additionally, climate change-driven heat extremes encourage governments and builders to adopt energy-efficient HVAC solutions, further creating opportunities for manufacturers offering advanced, insulated, and corrosion-resistant linesets designed to enhance cooling efficiency and system reliability.

Challenge: Passive cooling and free cooling solutions

Passive cooling and free cooling solutions pose a challenge for the HVAC linesets market because they reduce dependence on conventional air conditioning systems that rely on refrigerant-based heat transfer. Techniques such as natural ventilation, thermal mass cooling, shading, and evaporative cooling lower indoor temperatures without mechanical HVAC systems, minimizing the need for linesets. As sustainability initiatives and green building standards gain traction, many developers are prioritizing low-energy cooling alternatives to cut operational costs and carbon emissions. This shift toward passive design and free cooling technologies can limit the demand for traditional HVAC installations, restraining lineset market expansion.

HVAC Lineset Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Copper HVAC linesets for residential, commercial, and industrial HVAC systems; pre-insulated and seamless tubing for refrigerant flow | High thermal conductivity, corrosion resistance, leak-proof joints, long service life, and efficient refrigerant transfer |

|

Aluminum and hybrid (Cu-Al) HVAC linesets for sustainable air-conditioning and heat pump systems | Lightweight, recyclable, cost-efficient, reduces carbon footprint, and supports next-gen HVAC designs |

|

Pre-insulated copper linesets for split and multi-split HVAC systems in residential and light commercial projects | Factory-insulated, easy installation, consistent quality, reduces field labor, and ensures system reliability |

|

Precision copper tubes and linesets for HVAC/R and refrigeration systems, customized for OEMs | High purity, precise dimensions, excellent heat transfer, customizable lengths, and optimized flow performance |

|

Copper and cupro-nickel linesets for HVAC and refrigeration applications, suitable for high-pressure refrigerants | Durable under high pressure, corrosion-resistant, superior mechanical strength, and compliant with EU efficiency standards |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

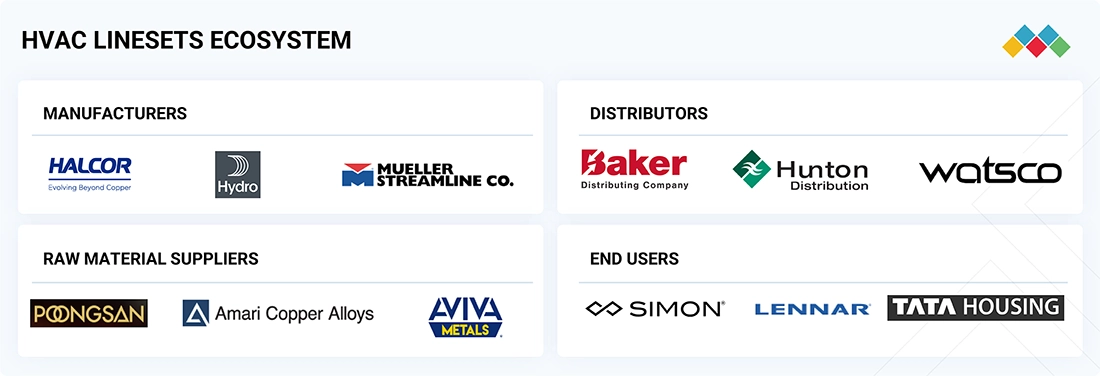

MARKET ECOSYSTEM

The HVAC linesets market ecosystem consists of raw material suppliers (Poongsan Corporation, Aviva Metals, Amari Copper Alloys), manufacturers (Halcor, Mueller Streamline Co., and Hydro), distributors (Baker Distributing Company, Hunton Distribution, Watsco), and end users (Simon Property Group, Tata Housing, Lennar Corporation). Raw material suppliers provide copper, aluminum, and specialty polymers used to produce durable and efficient HVAC linesets. Manufacturers design and produce linesets for residential, commercial, and industrial HVAC systems. Distributors manage inventory and logistics to ensure timely supply to contractors and system integrators. End users such as property developers, real estate firms, and construction companies install these linesets for effective climate control.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

HVAC Linesets Market, by Material Type

Copper dominates the HVAC linesets market due to its superior thermal conductivity, corrosion resistance, and durability, which ensure efficient refrigerant flow and long system lifespan. Its excellent formability allows easy bending and installation in complex HVAC layouts, reducing leakage risks. Additionally, copper’s compatibility with various refrigerants and proven reliability in extreme temperature conditions make it the preferred material among manufacturers and contractors, sustaining its leadership over alternative materials like aluminum and low-carbon alloys. Despite higher costs compared to alternatives like aluminum, its reliability, durability, and proven efficiency make copper the preferred material for premium and large-capacity HVAC systems.

HVAC Linesets Market, by Implementation

Retrofit is the fastest-growing implementation segment in the HVAC linesets market due to increasing replacement and upgradation of aging HVAC systems in existing residential, commercial, and industrial buildings. Rising energy efficiency regulations and sustainability goals are driving property owners to modernize old systems with advanced refrigerants and high-performance linesets. The growing focus on smart HVAC solutions, along with the cost advantages of retrofitting over complete system replacement, further boosts the growth of this segment. Additionally, expanding renovation activities in developed economies and demand for improved indoor comfort and energy savings contribute to the strong growth of retrofit HVAC lineset installations globally.

HVAC Linesets Market, by End-use Industry

The commercial end-use industry holds the largest share in the HVAC linesets market due to extensive HVAC installations in offices, shopping malls, hospitals, educational institutions, and hospitality facilities that require continuous temperature control and high system reliability. These buildings often feature complex, large-capacity HVAC systems that demand high-quality, durable linesets for efficient refrigerant flow. Rapid urbanization, rising construction of smart commercial spaces, and strict energy efficiency standards further drive demand. Additionally, ongoing retrofits and maintenance in existing commercial infrastructure sustain consistent replacement needs, making the commercial segment the dominant contributor to overall HVAC lineset consumption globally.

REGION

Asia Pacific to be fastest-growing region in global HVAC linesets market during forecast period

Asia Pacific is the fastest-growing region in the HVAC linesets market due to rapid urbanization, expanding residential and commercial construction, and increasing adoption of air conditioning systems across densely populated countries like China, India, and Southeast Asian nations. Rising disposable incomes, improving living standards, and government initiatives promoting energy-efficient buildings are further fueling HVAC installations. The growth of industrial and data center infrastructure also boosts demand for reliable cooling systems. Additionally, the presence of leading HVAC manufacturers, cost-effective production, and expanding real estate investments position Asia Pacific as the key growth hub for HVAC linesets in the coming years.

HVAC Lineset Market: COMPANY EVALUATION MATRIX

Halcor is considered the star in the HVAC linesets market due to its strong global presence, extensive product portfolio of precision copper tubes, and advanced manufacturing capabilities ensuring high thermal efficiency and reliability. The company’s continuous innovation in eco-friendly and high-performance copper solutions strengthens its leadership across residential and commercial HVAC applications. Meanwhile, Hydro is emerging as a leader through its growing focus on sustainable aluminum linesets, leveraging its expertise in lightweight, recyclable materials. Its investments in energy-efficient HVAC solutions and partnerships with system manufacturers position Hydro as a key challenger driving innovation and competition in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 10.52 Billion |

| Market Forecast in 2030 (Value) | USD 12.59 Billion |

| Growth Rate | CAGR of 7.9% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Meter) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

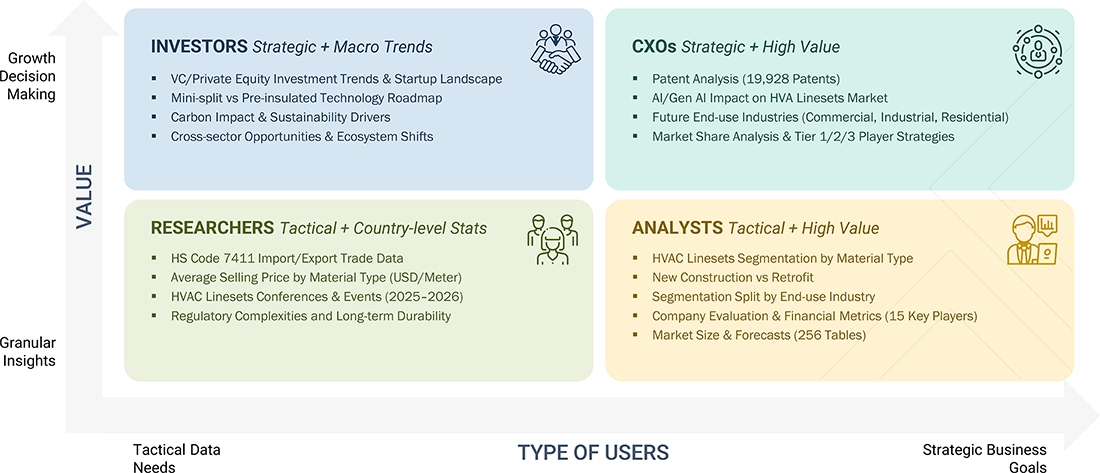

WHAT IS IN IT FOR YOU: HVAC Lineset Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| HVAC OEM | Supplier profiling of HVAC lineset manufacturers (copper, aluminum, hybrid) based on certifications, production capacity, and quality standards. | Benchmark supplier reliability and identify opportunities for long-term sourcing partnerships and supply chain optimization. |

| HVAC Lineset Manufacturer | Technical and cost-benefit comparison of insulation materials (elastomeric, polyethylene, PVC) and tube alloys for different refrigerants (R410A, R32, R290). | Support product development decisions and material substitution strategies for improved efficiency and cost reduction. |

| Raw Material Supplier | Regional mapping of copper and aluminum tubing production capacities and insulation material converters. | Identify high-growth HVAC manufacturing hubs and assess forward integration opportunities. |

| Retrofitting Contractor | Cost and lifecycle analysis of lineset replacement and upgradation in aging HVAC systems. | Quantify ROI and payback periods for retrofit projects while improving refrigerant efficiency and sustainability. |

RECENT DEVELOPMENTS

- April 2023 : PDM Corporation has expanded its facility by 20,000 square feet to enable more efficient and streamlined operations. With an investment of USD 18.5 million, the company has become the only fully integrated insulated copper tube manufacturer in the US. The new technology allows PDM to produce its own copper tubing in-house, utilizing exclusively American-made components throughout the manufacturing process.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Urbanization and increase in residential construction- Growing trend of smart homes- Rising demand for air conditioners- Increasing requirement for replacement and retrofitting HVAC systemsRESTRAINTS- Local cooling solutions- High installation and maintenance costs of HVAC systems- Rising environmental concernsOPPORTUNITIES- Rising global temperatures and heat islands- Combination of climate and income dynamicsCHALLENGES- Passive cooling and free cooling solutions- Adoption of new refrigerants

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSHVAC LINESET MANUFACTURERSDISTRIBUTORSHVAC SYSTEM MANUFACTURERSHVAC LINESET END USERS

-

5.5 RAW MATERIAL ANALYSISCOPPERLOW CARBON STEELALUMINUM

-

5.6 CASE STUDY ANALYSISOPTIMIZING HVAC&R EFFICIENCY WITH SMALLER DIAMETER COPPER TUBES USING MULTI-OBJECTIVE GENETIC ALGORITHMSADVANCING ENERGY EFFICIENCY IN RAC INDUSTRY WITH INNER GROOVED COPPER TUBES

-

5.7 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

-

5.8 TARIFFS, STANDARDS, AND REGULATORY LANDSCAPEREGULATIONS- EUROPE- US- OthersSTANDARDS- Occupational Safety and Health Act of 1970 (OSHA Standards)- European Committee for Standardization (CEN)- American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 TRADE ANALYSIS

-

5.10 TECHNOLOGY ANALYSISMINI-SPLIT SYSTEMSPRE-INSULATED LINESETSVARIABLE REFRIGERANT FLOWSMART HVAC INTEGRATION

-

5.11 ECOSYSTEM

-

5.12 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS IN LAST 10 YEARSINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS- Patents by Johnson Controls Tech Co- Patents by Honeywell Int Inc- Patents by Lennox Ind IncTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.13 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.14 PRICING ANALYSISAVERAGE SELLING PRICE BASED ON REGIONAVERAGE SELLING PRICE, BY KEY PLAYERS

- 5.15 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES

- 6.1 INTRODUCTION

-

6.2 COPPERRISING RESIDENTIAL CONSTRUCTION TO DRIVE MARKETADVANTAGES OF COPPER- Malleability- Easy to join- Durable- 100% recyclableAPPLICATIONS

-

6.3 LOW CARBONGROWTH IN COMMERCIAL SECTOR TO DRIVE DEMAND

- 6.4 OTHERS

- 6.5 COPPER VS. LOW CARBON

- 7.1 INTRODUCTION

-

7.2 RESIDENTIALRISE IN DEMAND FOR AIR CONDITIONING SYSTEMS TO DRIVE MARKET

-

7.3 COMMERCIALHIGH ADOPTION OF ENERGY EFFICIENCY REGULATIONS TO DRIVE MARKET

-

7.4 INDUSTRIALGROWING USE IN OIL & GAS AND PHARMACEUTICAL SECTORS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 NEW CONSTRUCTIONRAPID URBANIZATION AND ROBUST ECONOMIC GROWTH TO DRIVE SEGMENT

-

8.3 RETROFITGROWING DEMAND FOR COST-EFFECTIVE SYSTEMSTO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICCHINA- Urbanization and economic development to drive marketINDIA- Government initiatives and climatic conditions to drive marketJAPAN- Presence of leading HVAC system manufacturers to fuel marketSOUTH KOREA- Rising demand for air conditioners to drive marketREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAUS- Surge in construction activities to drive demand for HVAC systems and linesetsCANADA- New housing projects to boost marketMEXICO- Government initiatives to boost adoption of HVAC systems and linesets

-

9.4 EUROPEGERMANY- Surge in construction of residential infrastructure to boost marketUK- Government subsidies and schemes for HVAC systems to fuel marketFRANCE- Population growth and low interest rates to boost demand for HVAC linesetsITALY- Investments in residential buildings and construction projects to drive marketSPAIN- Demand for commercial air conditioning units to drive marketREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICASAUDI ARABIA- Investments in non-oil-based economy to drive marketUAE- Rise in industrial and construction activities to drive marketSOUTH AFRICA- Increasing investments in tourism infrastructure to drive marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICABRAZIL- Rapid industrial growth and presence of established manufacturers to drive marketARGENTINA- Rise in housing projects to fuel demand for HVAC linesetsREST OF SOUTH AMERICA

- 10.1 OVERVIEW

- 10.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS OF TOP PLAYERS

- 10.5 MARKET EVALUATION MATRIX

-

10.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTAR PLAYERSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 10.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 10.9 COMPANY REGION FOOTPRINT

- 10.10 STRENGTH OF PRODUCT PORTFOLIO

- 10.11 BUSINESS STRATEGY EXCELLENCE

-

10.12 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSHALCOR- Business overview- Products/Solutions/Services offered- MnM viewHYDRO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKME SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMUELLER STREAMLINE CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewCERRO FLOW PRODUCTS LLC- Business overview- Products/Solutions/Services offered- MnM viewLINESETS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPDM US- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZHEJIANG ICE LOONG ENVIRONMENTAL SCI-TECH CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewFEINROHREN S.P.A- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPTUBES, INC.- Business overview- Products/Solutions/Services offered- MnM viewDIVERSITECH CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFOSHAN SHUNDE LECONG HENGXIN COPPER TUBE FACTORY- Business overview- Products/Solutions/Services offered- MnM viewINABA DENKO AMERICA- Business overview- Products/Solutions/Services offered- MnM viewZHEJIANG HAILIANG CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJMF COMPANY- Business overview- Products/Solutions/Services offered- MnM viewGREAT LAKES COPPER LTD.- Business overview- Products/Solutions/Services offered- MnM viewHMAX- Business overview- Products/Solutions/Services offered- MnM viewICOOL USA, INC.- Business overview- Products/Solutions/Services offered- MnM viewCAMBRIDGE-LEE INDUSTRIES LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

11.2 OTHER PLAYERSMM KEMBLAMANDEV TUBESUNIFLOW COPPER TUBESKOBELCO & MATERIALS COPPER TUBE CO., LTD.MEHTA TUBES LIMITEDKLIMA INDUSTRIES

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GWP VALUES OF REFRIGERANTS USED IN AIR CONDITIONERS

- TABLE 2 HVAC LINESET MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 MAJOR EXPORTING COUNTRIES – HVAC LINESET (USD MILLION)

- TABLE 6 MAJOR IMPORTING COUNTRIES– HVAC LINESET (USD MILLION)

- TABLE 7 HVAC LINESET MARKET: ECOSYSTEM

- TABLE 8 TOTAL NUMBER OF PATENTS

- TABLE 9 PATENTS BY JOHNSON CONTROLS TECH CO

- TABLE 10 PATENTS BY HONEYWELL INT INC

- TABLE 11 PATENTS BY LENNOX IND INC

- TABLE 12 TOP 10 PATENT OWNERS

- TABLE 13 HVAC LINESET MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 14 KEY PLAYERS: AVERAGE SELLING PRICE (USD/UNIT)

- TABLE 15 HVAC LINESET MARKET, BY MATERIAL TYPE, 2020–2022 (USD MILLION)

- TABLE 16 HVAC LINESET MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 17 HVAC LINESET MARKET, BY MATERIAL TYPE, 2020–2022 (MILLION METER)

- TABLE 18 HVAC LINESET MARKET, BY MATERIAL TYPE, 2023–2028 (MILLION METER)

- TABLE 19 GWP VALUES OF REFRIGERANTS USED IN AIR CONDITIONERS

- TABLE 20 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 21 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 22 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 23 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 24 HVAC LINESET MARKET, BY IMPLEMENTATION, 2020–2022 (MILLION METER)

- TABLE 25 HVAC LINESET MARKET, BY IMPLEMENTATION, 2023–2028 (MILLION METER)

- TABLE 26 HVAC LINESET MARKET, BY IMPLEMENTATION, 2020–2022 (USD MILLION)

- TABLE 27 HVAC LINESET MARKET, BY IMPLEMENTATION, 2023–2028 (USD MILLION)

- TABLE 28 HVAC LINESET MARKET, BY REGION, 2020–2022 (MILLION METER)

- TABLE 29 HVAC LINESET MARKET, BY REGION, 2023–2028 (MILLION METER)

- TABLE 30 HVAC LINESET MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 31 HVAC LINESET MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (MILLION METER)

- TABLE 33 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (MILLION METER)

- TABLE 34 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 35 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 36 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 37 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 38 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 39 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 40 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 41 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 42 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 43 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 44 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 45 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 46 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 47 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 48 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 49 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 50 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 51 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 52 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 53 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 54 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 55 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 56 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 57 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 58 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (MILLION METER)

- TABLE 61 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (MILLION METER)

- TABLE 62 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 65 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 66 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 68 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 69 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 70 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 71 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 72 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 73 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 74 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 75 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 76 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 77 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 78 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 79 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (MILLION METER)

- TABLE 81 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (MILLION METER)

- TABLE 82 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 83 EUROPE: HVAC LINESET MARKET BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 85 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 86 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 87 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 88 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 89 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 90 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 91 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 93 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 94 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 95 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 96 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 97 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 98 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 99 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 101 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 102 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 103 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 104 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 105 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 106 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 107 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 109 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 110 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (MILLION METER)

- TABLE 113 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (MILLION METER)

- TABLE 114 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 117 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY 2023–2028 (MILLION METER)

- TABLE 118 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 120 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 121 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 122 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 123 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 124 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 125 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 126 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 127 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 128 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 129 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 130 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 131 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 132 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 134 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 135 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 136 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (MILLION METER)

- TABLE 137 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (MILLION METER)

- TABLE 138 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 139 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 141 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 142 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 143 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 144 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 145 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 146 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 147 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 148 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 149 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 150 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 151 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (MILLION METER)

- TABLE 153 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (MILLION METER)

- TABLE 154 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 155 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 156 HVAC LINESET MARKET: DEGREE OF COMPETITION

- TABLE 157 HVAC LINESET MARKET: REVENUE ANALYSIS (USD BILLION)

- TABLE 158 MARKET EVALUATION MATRIX

- TABLE 159 DEALS, 2019 –2023

- TABLE 160 OTHER DEVELOPMENTS, 2019–2023

- TABLE 161 HALCOR: COMPANY OVERVIEW

- TABLE 162 HALCOR: PRODUCT OFFERED

- TABLE 163 HYDRO: COMPANY OVERVIEW

- TABLE 164 HYDRO: PRODUCTS OFFERED

- TABLE 165 HYDRO: DEALS

- TABLE 166 HYDRO: OTHER DEVELOPMENTS

- TABLE 167 KME SE: COMPANY OVERVIEW

- TABLE 168 KME SE: PRODUCTS OFFERED

- TABLE 169 KME SE: DEALS

- TABLE 170 MUELLER STREAMLINE CO.: COMPANY OVERVIEW

- TABLE 171 MUELLER STREAMLINE CO.: PRODUCTS OFFERED

- TABLE 172 MUELLER STREAMLINE CO.: DEALS

- TABLE 173 CERRO FLOW PRODUCTS LLC: COMPANY OVERVIEW

- TABLE 174 CERRO FLOW PRODUCTS LLC: PRODUCTS OFFERED

- TABLE 175 LINESETS INC.: COMPANY OVERVIEW

- TABLE 176 LINESETS INC.: PRODUCT OFFERINGS

- TABLE 177 LINESETS INC.: PRODUCT LAUNCHES

- TABLE 178 LINESETS INC.: OTHER DEVELOPMENTS

- TABLE 179 PDM US: COMPANY OVERVIEW

- TABLE 180 PDM US: PRODUCTS OFFERED

- TABLE 181 PDM US: OTHER DEVELOPMENTS

- TABLE 182 ZHEJIANG ICE LOONG ENVIRONMENTAL SCI-TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 183 ZHEJIANG ICE LOONG ENVIRONMENTAL SCI-TECH CO., LTD.: PRODUCTS OFFERED

- TABLE 184 FEINROHREN S.P.A.: COMPANY OVERVIEW

- TABLE 185 FEINROHREN S.P.A.: PRODUCTS OFFERED

- TABLE 186 FEINROHREN S.P.A.: OTHER DEVELOPMENTS

- TABLE 187 PTUBES, INC.: COMPANY OVERVIEW

- TABLE 188 PTUBES, INC.: PRODUCTS OFFERED

- TABLE 189 PTUBES INC.: OTHER DEVELOPMENTS

- TABLE 190 DIVERSITECH CORPORATION: COMPANY OVERVIEW

- TABLE 191 DIVERSITECH CORPORATION: PRODUCTS OFFERED

- TABLE 192 DIVERSITECH CORPORATION: DEALS

- TABLE 193 FOSHAN SHUNDE LECONG HENGXIN COPPER TUBE FACTORY: COMPANY OVERVIEW

- TABLE 194 FOSHAN SHUNDE LECONG HENGXIN COPPER TUBE FACTORY: PRODUCTS OFFERED

- TABLE 195 INABA DENKO AMERICA: COMPANY OVERVIEW

- TABLE 196 INABA DENKO AMERICA: PRODUCTS OFFERED

- TABLE 197 ZHEJIANG HAILIANG CO., LTD.: COMPANY OVERVIEW

- TABLE 198 ZHEJIANG HAILIANG CO., LTD.: PRODUCTS OFFERED

- TABLE 199 ZHEJIANG HAILIANG CO., LTD.: DEALS

- TABLE 200 ZHEJIANG HAILIANG CO., LTD.: OTHER DEVELOPMENTS

- TABLE 201 JMF COMPANY: COMPANY OVERVIEW

- TABLE 202 JMF COMPANY: PRODUCTS OFFERED

- TABLE 203 GREAT LAKES COPPER LTD.: COMPANY OVERVIEW

- TABLE 204 GREAT LAKES COPPER LTD.: PRODUCTS OFFERED

- TABLE 205 HMAX: COMPANY OVERVIEW

- TABLE 206 HMAX: PRODUCTS OFFERED

- TABLE 207 ICOOL USA, INC.: COMPANY OVERVIEW

- TABLE 208 ICOOL USA, INC.: PRODUCTS OFFERED

- TABLE 209 ICOOL USA: PRODUCT LAUNCHES

- TABLE 210 CAMBRIDGE-LEE INDUSTRIES LLC: COMPANY OVERVIEW

- TABLE 211 CAMBRIDGE-LEE INDUSTRIES LLC: PRODUCTS OFFERED

- TABLE 212 CAMBRIDGE-LEE INDUSTRIES LLC: DEALS

- FIGURE 1 HVAC LINESET MARKET: RESEARCH DESIGN

- FIGURE 2 HVAC LINESET MARKET SIZE ESTIMATION

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND SIDE)

- FIGURE 6 HVAC LINESET MARKET: DATA TRIANGULATION

- FIGURE 7 COPPER SEGMENT TO DOMINATE MARKET BY 2028

- FIGURE 8 COMMERCIAL SEGMENT TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 9 RETROFIT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO LEAD HVAC LINESET MARKET BETWEEN 2023 AND 2028

- FIGURE 11 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 12 LOW CARBON TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 NEW CONSTRUCTION TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 14 HVAC LINESET MARKET IN EMERGING COUNTRIES TO GROW AT FASTER RATE

- FIGURE 15 CHINA TO LEAD HVAC LINESET MARKET DURING FORECAST PERIOD

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HVAC LINESET MARKET

- FIGURE 18 DEMAND FOR AIR CONDITIONERS IN US FROM 2019 TO 2021

- FIGURE 19 HVAC LINESET MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 OVERVIEW OF VALUE CHAIN OF HVAC LINESET MARKET

- FIGURE 21 HVAC LINESET ECOSYSTEM

- FIGURE 22 TOTAL NUMBER OF PATENTS REGISTERED IN 10 YEARS (2012–2022)

- FIGURE 23 NUMBER OF PATENTS YEAR-WISE FROM 2012 TO 2022

- FIGURE 24 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 25 TOP JURISDICTION – BY DOCUMENT

- FIGURE 26 TOP 10 PATENT APPLICANTS

- FIGURE 27 HVAC LINESET PRICES IN DIFFERENT REGIONS, 2021

- FIGURE 28 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE END-USE INDUSTRY SEGMENTS

- FIGURE 29 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES

- FIGURE 30 LOW CARBON TO BE FASTEST-GROWING MATERIAL TYPE DURING FORECAST PERIOD

- FIGURE 31 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 32 RETROFIT SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 INDIA TO REGISTER HIGHEST GROWTH BETWEEN 2023 AND 2028

- FIGURE 34 ASIA PACIFIC: HVAC LINESET MARKET SNAPSHOT

- FIGURE 35 EUROPE: HVAC LINESET MARKET SNAPSHOT

- FIGURE 36 COMPANIES ADOPTED ACQUISITION/ JOINT VENTURE/COLLABORATION AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2023

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN HVAC LINESET MARKET, 2022

- FIGURE 38 HVAC LINESET MARKET SHARE, BY COMPANY (2022)

- FIGURE 39 HVAC LINESET MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 40 HVAC LINESET MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS AND SMES, 2022

- FIGURE 41 HALCOR: COMPANY SNAPSHOT

- FIGURE 42 HYDRO: COMPANY SNAPSHOT

Methodology

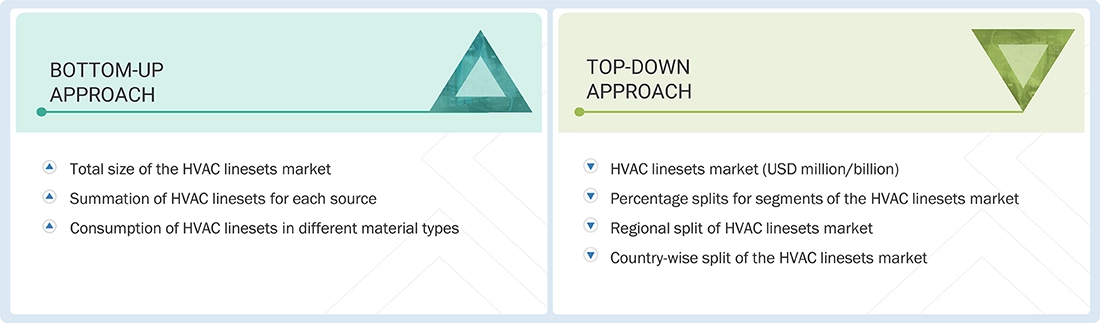

The study involved four major activities for estimating the current size of the global HVAC linesets market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of HVAC linesets through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the HVAC linesets market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study on the HVAC linesets market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, databases, and articles by recognized authors, regulatory bodies, and trade directories.

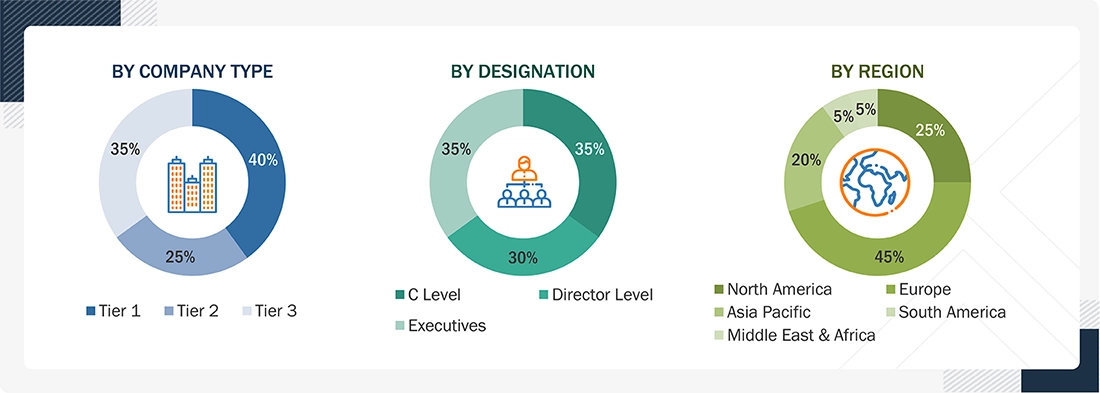

Primary Research

The HVAC linesets market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the HVAC linesets market. Primary sources from the supply side include associations and institutions involved in the HVAC linesets market, key opinion leaders, and processing players.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the HVAC linesets market by material type, implementation, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the HVAC linesets market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The HVAC linesets market refers to the industry that manufactures and supplies pre-insulated copper or aluminum tubing assemblies used to connect outdoor condensers and indoor evaporator units in heating, ventilation, and air conditioning systems. These linesets consist of a suction line and a liquid line that transport refrigerant between system components, ensuring efficient heat exchange and system performance. They are essential for both residential and commercial HVAC installations, supporting energy-efficient operation and leak prevention. The market encompasses various material types, insulation designs, and applications, driven by growing construction activities and the shift toward eco-friendly refrigerants and sustainable cooling technologies.

Stakeholders

- HVAC Lineset Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the HVAC linesets market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on material type, implementation, end-use industry, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific, South America, and the Middle East & Africa,—along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments such as product launches, expansions, and deals in the HVAC linesets market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the HVAC Linesets Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in HVAC Linesets Market