Military (Mil-Spec) Connectors Market Size, Share & Trends 2030

Military (Mil-Spec) Connectors Market by Shape {Circular [Mil-DTL-(38999,26482,5015)], Rectangular [MIL-DTL-(24308, 83513, 55302)]}, Type (Power, Signal, Data, RF & Microwave, Fiber Optic, Hybrid), Platform, Point of Sale and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Military Connectors Market is expected to grow from USD 1.99 billion in 2025 to USD 2.20 billion by 2030, registering a CAGR of 2.0%. Military connectors are specialised products designed to offer safe, reliable, and ruggedised data and electrical transmission in critical defense operations.

KEY TAKEAWAYS

- North America is expected to account for a 68.3% share of the Military Connectors Industry in 2025.

- By shape, the rectangular segment is expected to register the highest CAGR of 4.1%.

- By type, the hybrid connectors segment is projected to grow at the fastest rate from 2025 to 2030.

- By platform, the land segment is expected to dominate the market.

- Amphenol Corporation, TE Connectivity, and ITT Inc. were identified as star players in the military connectors market due to their strong market share and extensive product footprint.

- Airborn LLC, Samtec, and LEMO, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Future growth will significantly expand as innovation in defense electronics, communication, and power distribution technologies accelerates. Ruggedized connectors are increasingly adopted by militaries for use in land, naval, and aircraft platform-based mission-critical functions, ensuring secure and hassle-free performance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Military connector manufacturers depend on defense hotbeds and target applications as their main clients. Changes in end-user demand or disruptions directly influence their revenues. Any revenue shifts at the end-user level ripple through to impact connector suppliers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Modernization of defense electronics

-

Elevated demand for SWaP-C optimization

Level

-

High cost of ruggedized military connectors

-

Complex and lengthy qualification process

Level

-

Digitization of military platforms and shift toward network-centric warfare

-

Increased defense budgets in Asia Pacific and Middle East

Level

-

Risk of counterfeit components

-

Stringent export control regulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Accelerating Defence Modernization Programs

Defense modernization programs increase demand for connectors used in C4ISR, radars, and digital soldier systems. The high costs of ruggedized connectors restrict their adoption, especially in budget-sensitive platforms. The rising need for high-speed hybrid connectors opens doors for compact, EMI-shielded, application-specific solutions.

Restraint: High Cost of Ruggedized Military Connectors

Ruggedized military connectors are five to ten times more expensive than COTS options due to strict MIL specifications and testing. High costs burden low-cost platforms and emerging markets, leading to procurement delays and making it harder for smaller OEMs to meet increasing ruggedness requirements.

Opportunity: Creation of High-Speed Data and Power Hybrid Connectors

The shift to network-centric warfare is increasing demand for hybrid connectors that integrate data, power, and signals in compact, EMI-shielded designs. MIL-DTL-38999 Series III hybrids demonstrate this trend, supporting durable, high-speed transmissions for soldier systems and UAVs.

Challenge: Strict Export Control Regulations

High-speed hybrid connectors are increasingly used as defense systems need compact, EMI-shielded solutions for data, power, and signal transfer. MIL-DTL-38999 Series III hybrids support durable, real-time transmission in UAVs and soldier platforms.

Military Connectors Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplied MIL-DTL-38999 Series III connectors for NATO tactical radios and vehicle-mounted systems. | Offers high-speed transfer, EMI shielding, corrosion resistance, a wide temperature range, and quick-disconnect for field use. |

|

Deployed MULTIGIG RT 2-R and ARINC 836A connectors in UK’s MIV program (2024), enabling compact high-voltage, data, and signal integration. | Enables seamless power/data integration with rugged, high-speed connectors supporting modular upgrades and reduced downtime. |

|

Supplied QMA RF connectors and cabling for Japan’s destroyer radar upgrade (2023), ensuring EMI protection, corrosion resistance, and reliability in harsh marine conditions. | Provides IP68 sealing, EMI protection, and corrosion-resistant coaxial design for long-lasting, reliable naval radar operations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The military connectors market ecosystem includes OEMs, distributors, and end users, all of whom contribute to product demand and deployment. OEMs design and incorporate ruggedized connectors into platforms, while distributors act as intermediaries by maintaining stock availability and ensuring compliance. End users, primarily defense forces and government agencies, establish technical requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Military Connectors Market, By Shape

The circular segment is estimated to hold the largest share of the military connectors market in 2025 because it is widely used in ground vehicles, air, and naval defense vehicles. Circular connectors are chosen for their small size, durability, and ease of connection in mission-critical applications.

Military Connectors Market, By Type

Signal connectors are estimated to hold the largest share in 2025 due to their critical role in ensuring the safe and secure transfer of data and communication signals in modern defense platforms. As defense systems undergo increased digitization, with further integration of sensors, radars, avionics, and command-and-control networks, there is a growing emphasis on high-speed, interference-resistant signal transfer.

Military Connectors Market, By Platform

The significant growth in the land segment is driven by the need for durable connectivity on armored vehicles, tactical gear, and soldier equipment. Military ground forces are increasingly relying on electronic systems for communications, power management, navigation, and battlefield awareness, all of which depend on EMI-shielded, shock- and vibration-resistant, rugged connectors.

Military Connectors Market, By Point of Sale

The aftermarket segment holds the largest share of the military connectors market because defense platforms such as aircraft, naval vessels, and tanks have long lifecycles, typically over 30 years. Connectors in these platforms are exposed to wear, harsh conditions, and repeated upgrades, requiring constant replacement and retrofit orders.

REGION

Europe to be fastest-growing region in the global military connectors market during forecast period

Europe leads the military connectors market, driven by high defense spending, regional security priorities, and strong industrial bases. Upgrades in land, naval, and air systems, along with digital soldier and autonomous platform programs, sustain strong demand for rugged interconnects.

Military Connectors Market: COMPANY EVALUATION MATRIX

In the company evaluation matrix for the military connectors market, Amphenol Corporation (Star) leads with a strong market share and an extensive product portfolio, supporting a wide range of defense and aerospace applications that demand ruggedized interconnect solutions. Meanwhile, Nicomatic (Emerging Leader) is gaining traction with innovative, compact, and high-performance connector designs tailored for avionics, space, and soldier systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

List of Top Military (Mil-Spec) Connectors Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 1.90 Billion |

| Market Forecast, 2030 (Value) | USD 2.28 Billion |

| Growth Rate (2025–2030) | 2.10% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Unit Considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Shape: Circular and Rectangular; By Type: Power, Signal, Data, Hybrid, RF & Microwave, and Fiber Optic; By Platform: Air, Land, Naval, and Space; By Point of Sale: OEM and Aftermarket |

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Military Connectors Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segmental breakdown for countries | Additional country-level market sizing for segments/sub-segments covered at regional/global levels to gain understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for better understanding of total addressable market |

RECENT DEVELOPMENTS

- May 2025 : Fischer Connectors launched the UltiMate USB-C RLS for defense, UAV, and rail markets, offering 10 Gbps data transfer, IP68 sealing, 360° EMC shielding, and high vibration and shock resistance. It is designed for rugged, high-speed applications in pre-cabled configurations.

- May 2026 : Smiths Interconnect introduced Cat5e and Cat6A modules for its modular connector range. These modules offer IEEE 802.3 gigabit transmission, EMI shielding, and performance from -55°C to +125°C. They are designed for hostile environments with 100,000 mating cycles.

- January 2025 : Eaton expanded its global distribution agreement with Mouser to include EMI/RFI backshells and UTSX circular connectors for military platforms. The move improves Eaton’s access to military-grade connector components.

Table of Contents

Methodology

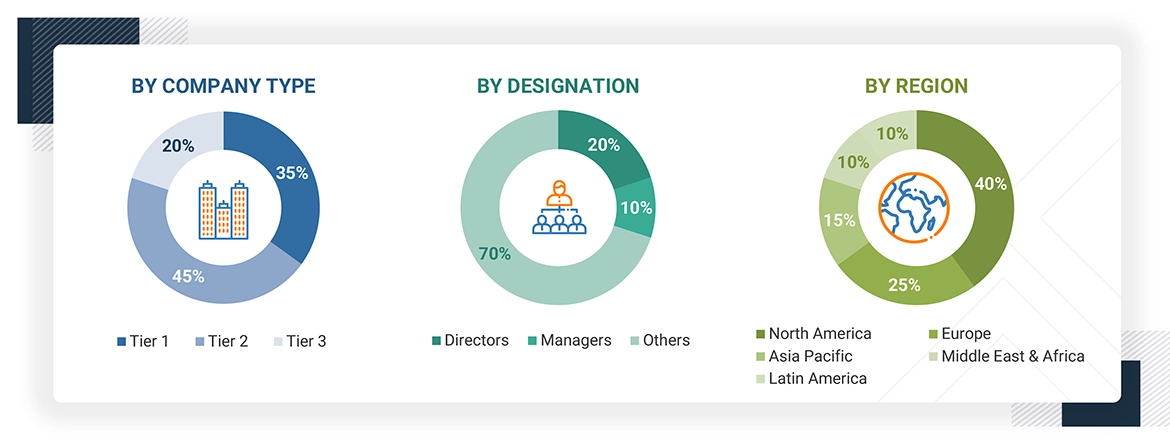

The research study on the military connectors market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market, as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews of various primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market and assess the growth prospects of the market. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the military connectors market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the military connectors market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note 1: The tiers of companies have been defined based on their total revenue as of 2024. Tier 1 = >USD 1 billion; Tier 2 = between USD 100 million and USD 1 billion; and Tier 3 = USD 100 million.

Note 2: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the military connectors market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, and subject matter experts of leading companies operating in the military connectors market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the military connectors market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Military Connectors Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the total market size of the military connectors market through the process of market size estimation discussed above, the total market was segmented into various segments and sub-segments. The data triangulation and market breakdown methodologies discussed below were utilized wherever possible to finalize the overall market engineering process and arrive at the precise numbers for different segments and sub-segments of the market. The data were triangulated by reviewing multiple factors and trends on both the supply and demand sides. The size of the market was validated using top-down and bottom-up strategies.

Market Definition

Military connectors are specialized electrical or fiber optic connectors designed to meet the rigorous demands of military and aerospace applications. These connectors ensure reliable, secure, and durable connections in harsh environments such as battlefields, aircraft, naval vessels, and defense systems.

Key Stakeholders

- OEMs

- System Integrators & Defense Primes

- Armed Forces & Defense Ministries

- Standards & Regulatory Bodies

- Testing & Certification Agencies

- Distributors & Supply Chain Players

- Research & Technical Bodies

Report Objectives

- To define, describe, and forecast the size of the military connectors market based on shape, type, platform, and point of sale

- To forecast the size of various market segments within five regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies adopted by leading market players, such as acquisitions, contracts, partnerships, and product launches

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis and revenue analysis of key players

Customization Options

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of up to five additional market players

Key Questions Addressed by the Report

What is the current size of the military connectors market?

The military connectors market, in terms of value, is estimated at USD 2.05 billion in 2025.

Who are the winners in the military connectors market?

The winners in the military connectors market are Amphenol Corporation (US), ITT Inc. (US), TE Connectivity (Ireland), Glenair, Inc (US), and Fisher Connectors SA (Switzerland).

What are the factors driving the market?

Key driving factors include:

- Growing need for high-reliability connectors in mission-critical defense systems

- Expansion of unmanned and autonomous military platforms

- Rising defense budgets focused on C4ISR and electronic warfare upgrades

Which region is estimated to hold the largest share of the global military connectors market in 2025?

North America is estimated to hold the largest share of 66.09% of the global military connectors market in 2025.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Military (Mil-Spec) Connectors Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Military (Mil-Spec) Connectors Market