North America IoT Technology Market Size, Share & Analysis, 2030

North America IoT Technology Market by Node Component (Sensor, Memory Device, Connectivity Ic, Processor, Logic Devices), Software Solution (Remote Monitoring, Data Management), Platform, Service, End-Use Application, and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

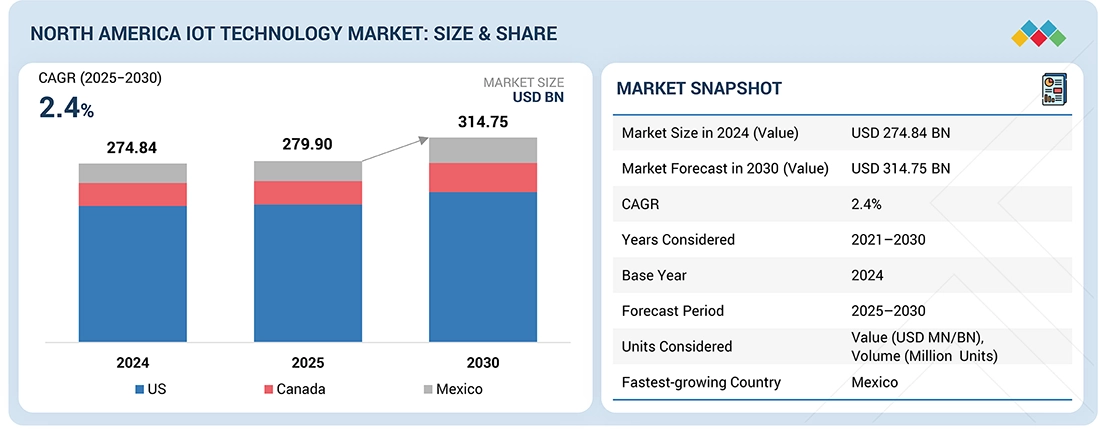

The North America IoT Technology market is projected to reach USD 314.75 billion by 2030 from USD 279.90 billion in 2025, at a CAGR of 2.4% from 2025 to 2030. The market is experiencing strong growth, driven by the early adoption of advanced digital technologies across various industries. Increased investments in smart manufacturing, smart cities, healthcare IoT, and connected vehicles are accelerating market expansion. Additionally, the widespread deployment of 5G and the development of strong cloud and AI ecosystems are further supporting IoT adoption in the region.

KEY TAKEAWAYS

-

By CountryThe US has the largest market share of 76.4% in 2024.

-

By IoT Software SolutionBy IoT software solution, remote monitoring is expcted to have the the growth rate of 5.8% from 2025 to 2030.

-

By IoT PlatformBy IoT platform, network management held 48.1% of the market in 2024.

-

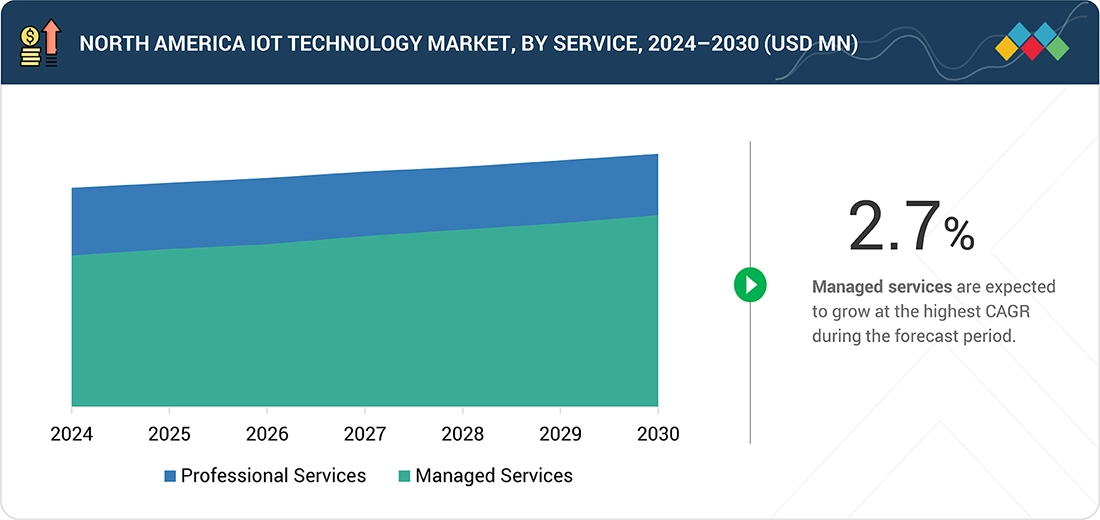

By IoT ServiceBy IoT service, managed services are projected to grow at the highest CAGR during the forecast period.

-

By IoT Node ComponentBy IoT node component, processors registered the largest market share in 2024.

-

By End Use ApplicationConsumer applications are expected to account for a sizeable market share during the forecast period.

-

Competitive LandscapeIntel Corporation (US) and Qualcomm (US) are recognized as key players in the IoT technology market, due to their significant market share and extensive product portfolios.

-

Competitive LandscapeSoluLab (US) and ClearBlade (US) have distinguished themselves among startups and SMEs by securing strong footholds in specialised niche areas, underscoring their potential as emerging market leaders.

The IoT technology market is experiencing rapid growth due to the increasing adoption of connected devices across industries. Advancements in cloud computing, AI, and 5G networks are enabling real-time data analytics and scalable IoT deployments. Growing use cases in smart homes, industrial automation, healthcare, and transportation continue to drive market expansion in North America.

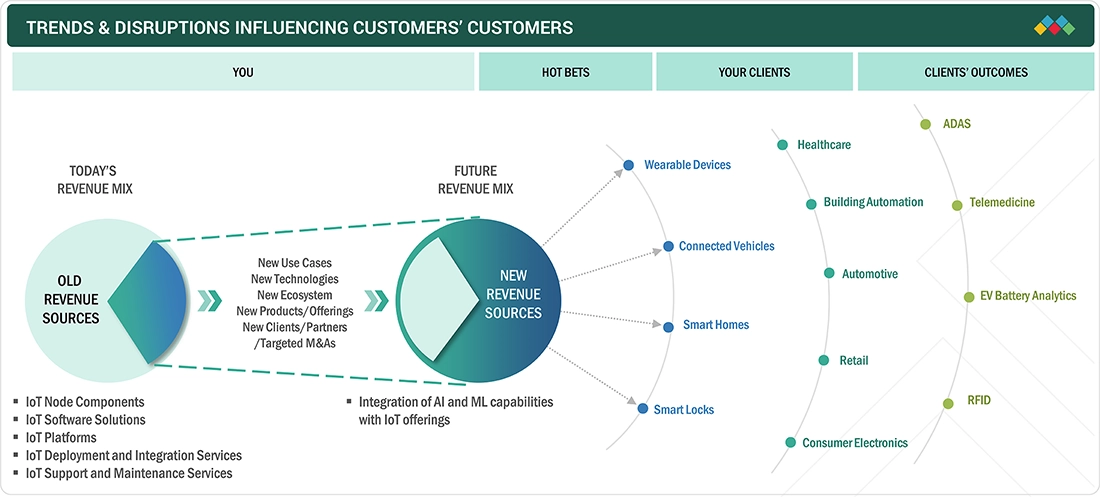

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The visual highlights how disruptive trends are reshaping customer business models in North America, driving a shift in revenue from traditional to emerging sources. While the current revenue mix remains largely anchored in established IoT components, platforms, and services, future growth in the region is expected to come from areas such as wearable devices, smart homes, and connected vehicles. These “hot bets” are prompting enterprises to adapt to evolving priorities across key North American industries, including healthcare, automotive, building automation, and retail. As this transition accelerates, revenue will increasingly be driven by advanced applications such as ADAS, telemedicine, EV battery analytics, and RFID, underscoring the need for alignment with future-ready technologies to capture new value streams.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Demand for Real-Time Insights and Automation

Level

-

Data Security and Privacy Concerns

Level

-

Expansion of Advanced IoT Use Cases

Level

-

Interoperability and System Integration

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Demand for Real-Time Insights and Automation

The primary driver of IoT technology growth is the rising demand for real-time data and automation across industries. Organizations are increasingly deploying connected devices to enhance operational efficiency, improve asset tracking, and inform decision-making. The integration of IoT with cloud, AI, and analytics further enhances its value proposition.

Data Security and Privacy Concerns

Data security and privacy concerns remain a major restraint for IoT adoption. The large number of connected endpoints increases vulnerability to cyberattacks and data breaches. Additionally, the lack of standardized security frameworks across devices limits enterprise-scale deployment.

Expansion of Advanced IoT Use Cases

IoT presents significant opportunities through advanced use cases such as smart cities, connected healthcare, and industrial IoT. The rollout of 5G and edge computing enables low-latency, high-reliability IoT applications. These advancements open new revenue streams for solution providers and platform vendors.

Interoperability and System Integration

Interoperability and integration across diverse IoT devices and platforms remain a key challenge. Enterprises often face complexity in managing heterogeneous systems from multiple vendors. This increases deployment costs and slows down large-scale IoT implementation.

NORTH AMERICA IOT TECHNOLOGY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cisco IoT networking and security platforms deployed in smart manufacturing plants, connected utilities, and logistics operations to securely connect sensors, machines, and vehicles across dispersed sites in North America. | Enhanced operational visibility and uptime through real-time monitoring, reduced downtime via predictive maintenance, and improved cybersecurity for critical infrastructure and industrial assets |

|

AWS IoT Core and related services are used by enterprises for connected asset tracking, fleet management, and smart building automation, integrating device data with cloud analytics and AI workloads. | Scalable, pay-as-you-go infrastructure, faster deployment of IoT applications, improved asset utilization, and lower total cost of ownership through centralized management and automation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

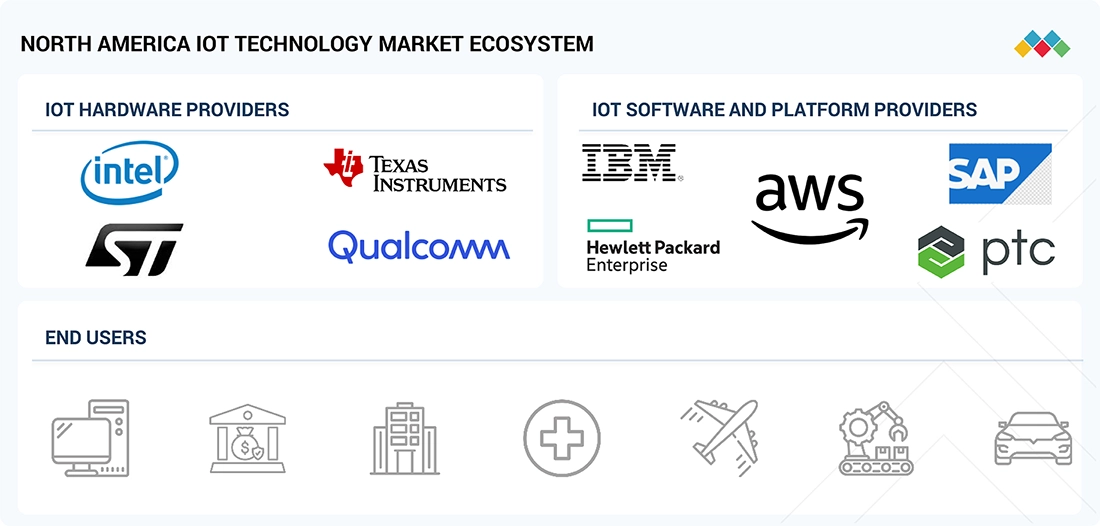

The IoT technology ecosystem comprises key hardware providers, including Intel, Qualcomm, Texas Instruments, and STMicroelectronics, which supply the essential semiconductor components and devices that enable connectivity and sensing. On the software and platform side, major players such as IBM, AWS, SAP, Hewlett Packard Enterprise, and PTC offer cloud services, data analytics, and IoT management platforms that are critical for device orchestration and data processing. This ecosystem supports a diverse range of end users across various sectors, including smart homes, banking, commercial buildings, aviation, industrial manufacturing, agriculture, and automotive. The integration of hardware, software, and diverse applications illustrates the interconnected and multi-layered nature of the IoT industry, driving innovation and adoption across industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

IoT Technology Market, By Region

The US is expected to hold the largest share of the North American IoT technology market in 2024 due to its high concentration of hyperscale cloud providers, leading tech vendors, and advanced network infrastructure. Strong enterprise digitalization, early adoption of 5G, and significant investments in smart manufacturing, smart cities, and connected healthcare further accelerate large-scale IoT deployments. Supportive innovation ecosystems, including venture funding and R&D programs, also encourage rapid commercialization of IoT platforms, devices, and services.

IoT Technology Market, By Node Component

In the North American IoT technology market, the processor segment within node components is expected to account for the largest share over the forecast period. IoT device deployments are accelerating across various sectors, including smart homes, industrial automation, healthcare, agriculture, and smart city projects. Each connected device relies on a processor to handle local data processing, connectivity, and key device functions. As North American IoT applications become more advanced and data-intensive, demand is rising for processors that can support higher levels of on-device analytics, security, and real-time decision-making.

IoT Technology Market, By Software Solution

In the North American IoT technology market, the data management software segment accounts for the largest share. Software platforms are specifically developed to address interoperability issues created by diverse, heterogeneous connected devices and to manage the large volumes of data they generate, while ensuring security and privacy. As the number of connected endpoints increases, the amount of largely unstructured data produced daily grows rapidly, creating a strong demand for tools that can organize, protect, and govern this information. By enabling organizations to store, process, and analyze these massive datasets for actionable insights, data management software has become a critical foundation of North American IoT deployments.

IoT Technology Market, By Platform

The network management segment accounts for the largest share of the platform layer. Network management platforms in this context provide critical capabilities such as device authentication and provisioning, configuration, monitoring, routing, and remote software and firmware updates, including bug fixes and security patches. These functions are typically delivered as network services within IoT deployments and are essential for sustaining high and reliable network performance across large fleets of heterogeneous devices. A robust North American IoT network management solution is device-agnostic, allowing enterprises to seamlessly integrate multi-vendor hardware, protocols, and data models into their IoT workflows through a unified and simplified management interface.

IoT Technology Market, By End-use Application

In the North American IoT technology market, the industrial segment is projected to post the fastest CAGR as enterprises ramp up connected solutions for automation, predictive maintenance, and end-to-end process optimization. Industrial IoT adoption is being driven by Industry 4.0 programs and broader digital transformations across manufacturing, logistics, and energy, resulting in large-scale rollouts of connected equipment and sensorized infrastructure. As these deployments are increasingly combined with AI, robotics, and advanced analytics, industrial operators achieve significant efficiency gains and cost reductions, further accelerating IoT adoption across North American industrial ecosystems.

REGION

Mexico to be fastest-growing region in the IoT Technology market during forecast period

Mexico is projected to be the fastest-growing market in North America due to strong government digital initiatives, such as the National Digital Strategy, and substantial investments in connectivity and smart city projects, which create a solid foundation for IoT adoption. The rapid expansion of industrial automation, energy, and utilities IoT deployments, combined with high growth in IoT devices and sensors, is driving above-average demand compared to more mature markets. In addition, improving 4G/5G coverage and increasing the use of cloud and AI in manufacturing, transportation, and urban infrastructure are accelerating large-scale IoT rollouts nationwide

The Asia Pacific IoT technology market is projected to reach USD 351.03 billion by 2030 from USD 260.76 billion in 2025, at a CAGR of 6.1%. The market in the Asia Pacific region is witnessing robust growth, driven by the rising adoption of smart devices, the accelerated rollout of 5G networks, and the large-scale implementation of smart city and digital infrastructure projects across the region

The Europe IoT Technology market is projected to reach USD 272.11 billion by 2030 from the estimated USD 246.63 billion in 2025, at a CAGR of 2.0% from 2025 to 2030. The IoT technology market in Europe is experiencing strong growth due to increased adoption of smart devices, the rollout of 5G, and the deployment of smart cities..

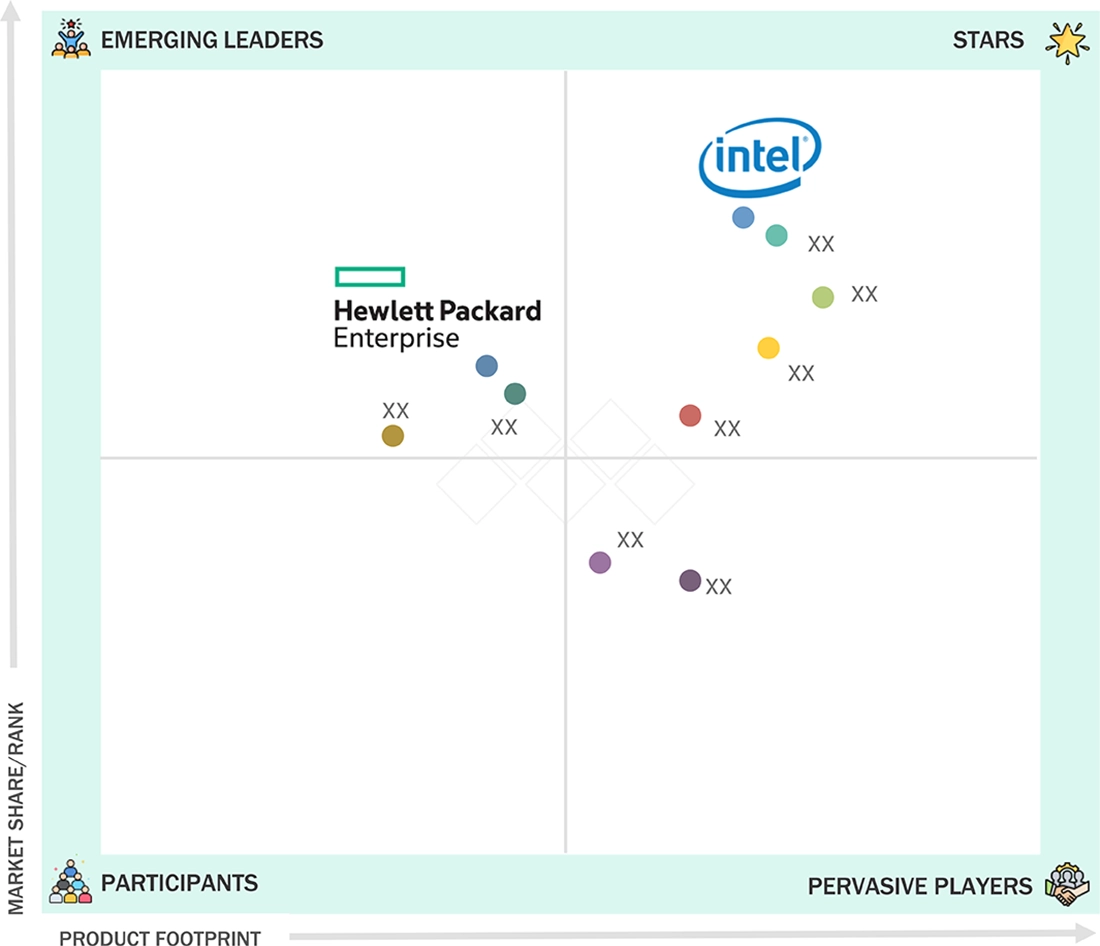

NORTH AMERICA IOT TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX

Stars are the leading market players in new developments, such as product launches, innovative technologies, and the adoption of growth strategies. These players have a broad portfolio, innovative product offerings, and a global presence. They have well-established channels throughout the value chain. These companies are well-known in the market. Intel Corporation (US) comes under this category. Emerging Leaders demonstrate more substantial product innovations than their competitors. Companies are investing more in R&D to launch several products in the market. A few players have a unique portfolio, while others have heavily invested in R&D or recently launched several innovative products. Emerging leaders in the IoT technology market include Hewlett Packard Enterprise Development LP (US).

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Intel Corporation (US)

- Qualcomm Technologies (US)

- Texas Instruments Incorporated (US)

- STMicroelectronics (Switzerland)

- IBM (US)

- Hewlett Packard Enterprise (HPE) (US)

- Cisco Systems (US)

- Microsoft Corporation (US)

- PTC (US)

- Amazon Web Services (AWS) (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 274.84 Billion |

| Market Forecast in 2030 (Value) | USD 314.75 Billion |

| Growth Rate | CAGR of 2.4% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America (US, Canada, Mexico) |

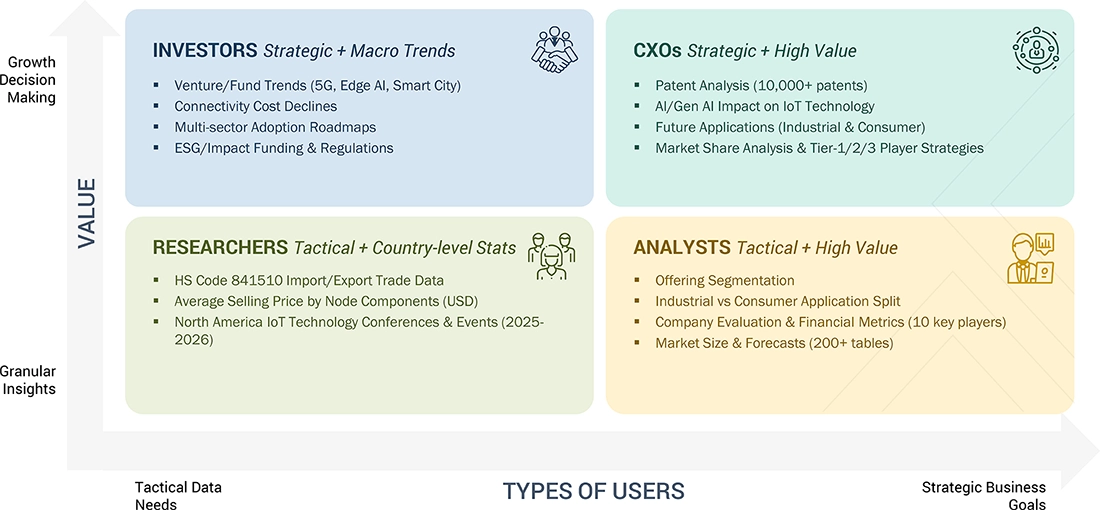

WHAT IS IN IT FOR YOU: NORTH AMERICA IOT TECHNOLOGY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Enterprise & Industrial Clients | Competitive benchmarking of IoT hardware, connectivity modules, edge gateways, and cloud platforms; assessment of use-case feasibility for asset tracking, predictive maintenance, energy management, and smart factory deployments across North America. | Enables enterprises to select cost-effective and scalable IoT solutions, reduce downtime through predictive maintenance, improve operational efficiency and energy usage, and accelerate Industry 4.0 and digital transformation initiatives across North American operations. |

RECENT DEVELOPMENTS

- March 2025 : Qualcomm announced its agreement to acquire Edge Impulse, a leader in edge AI platforms, thereby expanding capabilities for developer enablement and further powering AI-enabled IoT solutions for critical sectors, including retail, energy, security, and manufacturing.

- October 2024 : Qualcomm launched the industrial-grade IQ series platform for extreme IIoT applications, focused on AI performance (up to 100 TOPS), safety-grade operations, and power efficiency for robots, drones, and advanced inspection systems.

- March 2024 : Texas Instruments launched the IoT Cloud Ecosystem, a third-party platform connecting developers and manufacturers with certified cloud service providers to accelerate IoT solution development and deployment. This ecosystem aims to simplify seamless integration for end users seeking scalable, secure cloud-connected IoT architectures.

- February 2024 : Intel launched a new Edge Platform, a modular, open software solution for enterprises to efficiently develop, deploy, manage, and secure edge and AI applications at scale. This platform enables cloud-like simplicity for edge deployments, bringing improved cost savings and streamlined operations for IoT environments.

- January 2024 : Texas Instruments introduced new semiconductors designed to improve automotive safety and intelligence. The AWR2544 77GHz millimeter-wave radar sensor chip is the industry's first for satellite radar architecture, enabling higher levels of autonomy by improving sensor fusion and decision-making in ADAS.

Table of Contents

Methodology

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the North America IoT technology market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the North America IoT technology market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the North America IoT technology market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; North America IoT technology products-related journals; certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification, and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the North America IoT technology market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

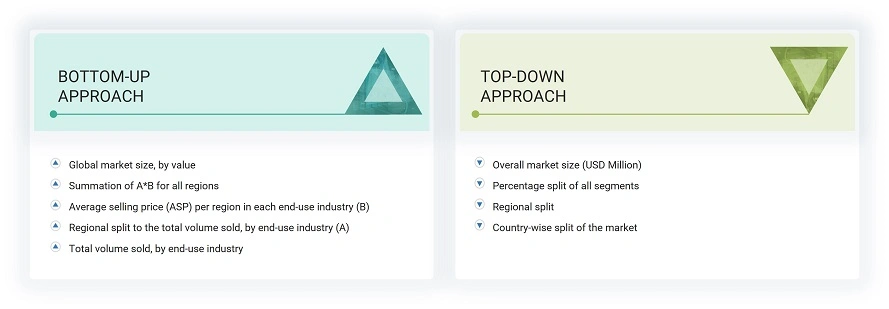

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the North America IoT technology market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

North America IoT Technology Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the North America IoT technology market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

IoT is a key digital transformation technology, enabling businesses to increase their operational efficiency. Other technologies, such as edge computing, digital twin, Wi-Fi, and big data analytics, are spurring the demand for the digital transformation of businesses. Various application areas, such as retail, manufacturing, transportation, and healthcare, are undergoing digital transformation. Hence, the growing demand for IoT-based digital transformation of businesses is expected to provide growth opportunities for the IoT technology market during the forecast period.

Key Stakeholders

- Original Technology Designers and Suppliers

- System Integrators

- Electronic Hardware Equipment Manufacturers

- Technical Universities

- Government Research Agencies and Private Research Organizations

- Research Institutes and Organizations

- Market Research and Consulting Firms

- Sensor Manufacturers

- Technology Standard Organizations, Forums, Alliances, and Associations

- Raw Material and Manufacturing Equipment Suppliers

- Semiconductor Wafer Vendors

- Fabless Players

- EDA and IP Core Vendors

- Foundry Players

- Original Equipment Manufacturers (OEMs)

- Original Design Manufacturers (ODM) and OEM Technology Solution Providers

- Distributors and Retailers

- Technology Investors

- Operating System (OS) Vendors

- Content Providers

- Software Providers

Report Objectives

- To define and forecast the North America IoT technology market size, by node component, software solution, platform, service, and end-use application, in terms of value.

- To describe and forecast the global North America IoT technology market, by node components, in terms of volume.

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze the supply chain, trends/disruptions impacting customer business, market/ecosystem map, pricing analysis, and regulatory landscape pertaining to the North America IoT technology market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To describe in brief the value chain of North America IoT technology solutions

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To profile key players and comprehensively analyze their market position in terms of their ranking and core competencies, along with the detailed competitive landscape of the market.

- To analyze competitive developments, such as product launches and developments, partnerships, agreements, expansions, acquisitions, contracts, alliances, and research & development (R&D), undertaken in the North America IoT technology market.

- To benchmark market players using the proprietary ‘Company Evaluation Matrix,’ which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio.

- To analyze the probable impact of the recession on the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America IoT Technology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America IoT Technology Market