North America LiDAR Market

North America LiDAR Market by Installation (Airborne, Ground-based), Type (Mechanical, Solid-state), Range (Short, Medium, Long), Service (Aerial Surveying, Asset Management, Ground-based Surveying, and Other Services) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

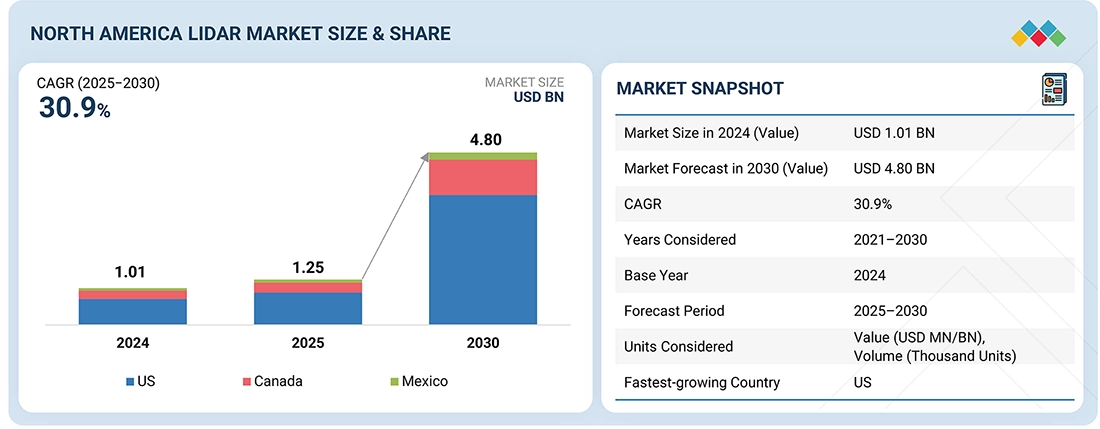

The LiDAR market in North America is projected to reach USD 4.8 billion by 2030 from USD 1.25 billion in 2025, growing at a CAGR of 30.9% from 2025 to 2030. The regional market is primarily driven by the rising deployment of autonomous and ADAS-enabled vehicles, as automotive OEMs and technology companies increasingly integrate LiDAR through supply agreements and partnerships. For instance, Luminar’s production contracts with global automakers and Ouster’s collaborations with robotics and mobility players play a major role in market expansion in the region.

KEY TAKEAWAYS

-

By CountryThe US LiDAR market accounted for a 71.3% revenue share in 2024.

-

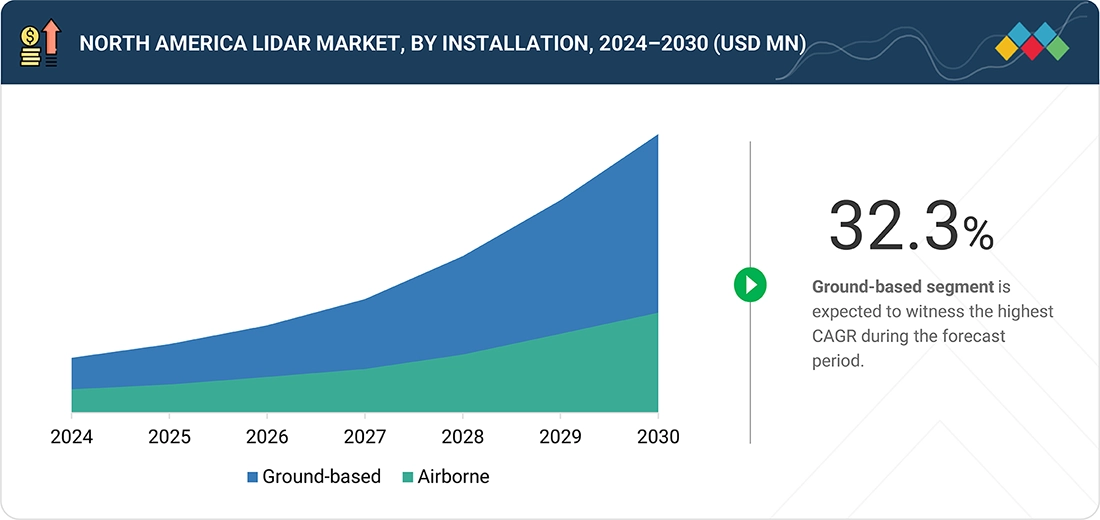

By InstallationBy installation, the ground-based segment is expected to register the highest CAGR during the forecast period.

-

By RangeBy range, the medium-range segment is projected to grow at the fastest rate from 2025 to 2030.

-

By ServiceBy service, the ariel surveying segment is expected to dominate the market during the forecast period.

-

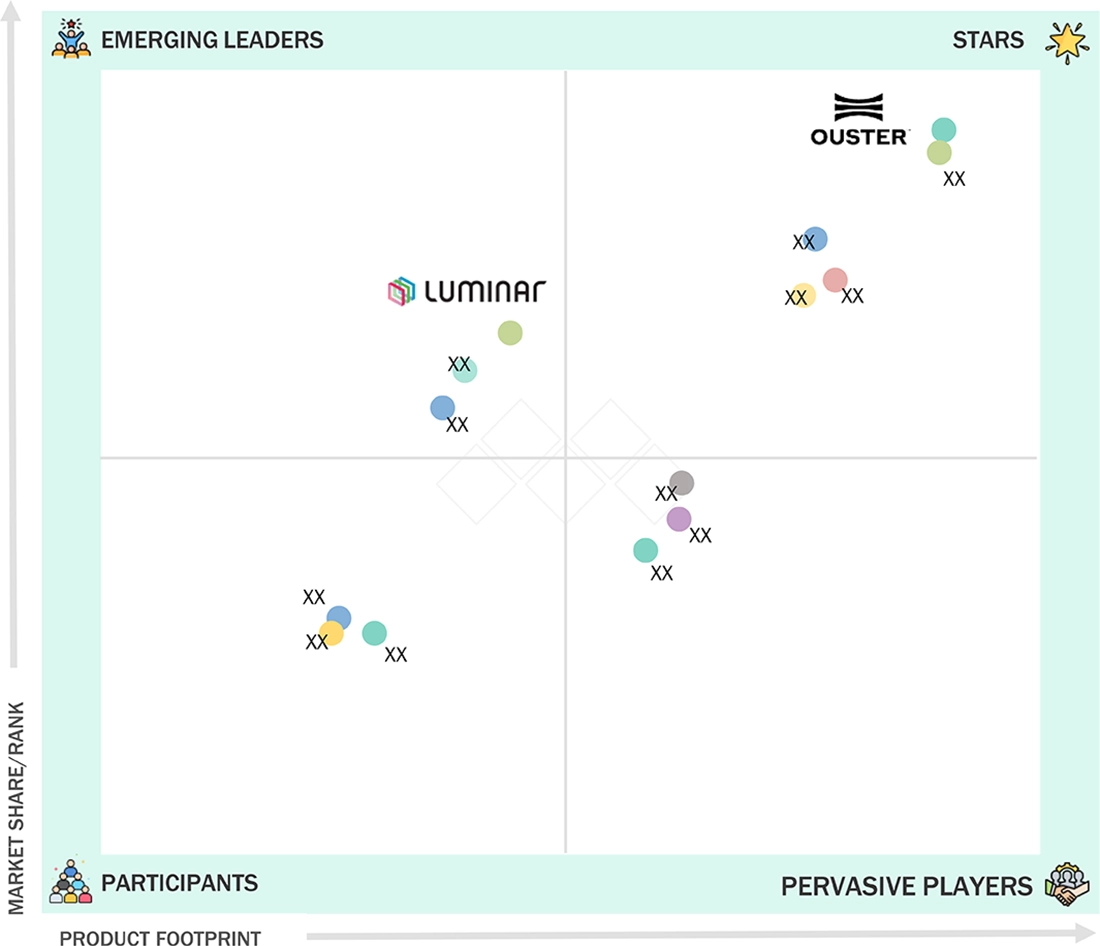

Competitive LandscapeLuminar and Teledyne were identified as some of the star players in the LiDAR market in North America, given their strong market share and product footprint.

-

Competitive LandscapeCompanies Quanergy Systems and PreAct Technologies, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The LiDAR market in North America is experiencing strong momentum, fueled by the rising adoption across autonomous vehicles, smart infrastructure, robotics, and geospatial applications. Demand for high-resolution, real-time 3D sensing is accelerating as industries prioritize safety, automation, and precision mapping. The landscape is reshaped by notable developments, including partnerships between LiDAR manufacturers and automotive OEMs, technology collaborations in smart-city and transportation projects, and product launches featuring next-generation solid-state and long-range LiDAR. Strategic deals—Luminar’s supply agreements with automakers, Ouster’s deployments in smart-infrastructure networks, and Trimble’s innovations in airborne LiDAR solutions—highlight the market’s shift toward scalable, cost-effective, and high-performance sensing platforms.

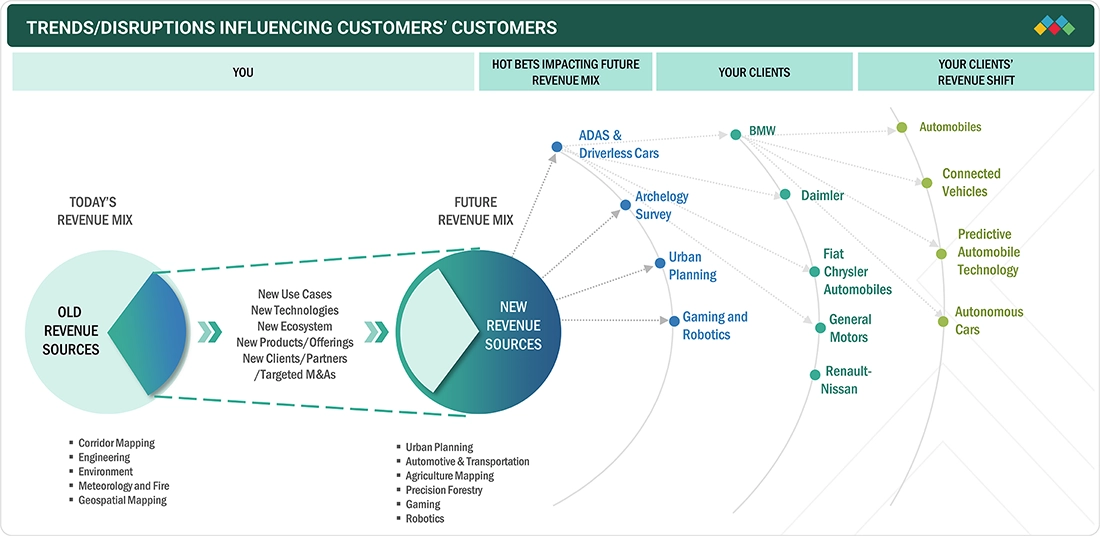

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The visual highlights how disruptive trends are reshaping customer business models, shifting revenue from traditional to emerging sources. Adopting mechanical LiDAR solutions in autonomous vehicles is expected to disrupt the LiDAR market in North America over the coming years. LiDAR is being incorporated into advanced driver assistance systems to enhance the safety features of some semi-autonomous cars. Apart from this, the emergence of LiDAR technology has offered huge growth potential to a range of enterprises engaged in R&D and working toward introducing innovative solutions in the LiDAR market in the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of UAV LiDAR systems to capture accurate evaluation data

-

Surging demand for 3D imaging solutions areas

Level

-

Availability of low-cost and lightweight alternatives

Level

-

Rising investments in ADAS systems by automotive giants

-

Increasing development of quantum dot detectors

Level

-

High cost of post-processing LiDAR software

-

Complexities related to miniaturized LiDAR sensing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of UAV LiDAR systems to capture accurate evaluation data

The adoption of UAV-mounted LiDAR systems in North America is accelerating as industries increasingly require highly accurate, fast, and cost-effective evaluation data for applications such as land surveying, infrastructure inspection, forestry assessment, mining, and environmental monitoring. UAV LiDAR enables detailed 3D mapping in areas that are challenging or costly to access using traditional ground-based methods. Its ability to generate high-resolution point clouds with greater precision and shorter turnaround times drive the demand from government agencies, engineering firms, and geospatial service providers across the region.

Restraint: Availability of low-cost and lightweight alternatives

The LiDAR market in North America is hindered by the presence of lower-cost and lightweight alternative technologies, such as photogrammetry, radar, and camera-based vision systems. These alternatives are often preferred in cost-sensitive applications where ultra-high precision is not essential, making LiDAR less attractive for small businesses and municipal projects. Additionally, improvements in computer vision and advanced imaging algorithms continue to enhance the performance of these cheaper solutions, further slowing LiDAR adoption in segments that prioritize budget efficiency over data density and accuracy.

Opportunity: Rising investments in ADAS systems by automotive giants

Major North America automotive manufacturers are increasing investments in advanced driver-assistance systems (ADAS), creating significant opportunities for LiDAR suppliers. As automakers push toward higher levels of autonomy and improved safety performance, the demand for high-resolution, long-range LiDAR sensors is rising. Partnerships between LiDAR companies and OEMs, pilot deployments in next-generation vehicle platforms, and regulatory momentum toward safety-enhancing sensors are accelerating market growth. This surge in ADAS spending is opening large-scale commercialization pathways for automotive-grade LiDAR across the region.

Challenge: High cost of post-processing LiDAR software

A major challenge in the LiDAR market in North America is the high cost associated with post-processing and interpreting LiDAR data. Advanced software tools are required to convert raw point clouds into actionable 3D models, maps, or analytics, and these solutions often involve expensive licenses, specialized hardware, and skilled operators. Industries such as construction, surveying, and infrastructure management face additional burdens due to processing time, data storage requirements, and the need for continuous software updates. These factors increase overall project costs and slow down adoption among small and mid-sized organizations.

NORTH AMERICA LIDAR MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

LiDAR sensors for autonomous vehicles to enable safe navigation and object detection | Enhanced accuracy in obstacle detection | Improved safety | Reliable performance in diverse environments |

|

Long-range LiDAR systems for ADAS and self-driving applications | 250 m+ detection range | High-resolution mapping | Better night and adverse weather visibility |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

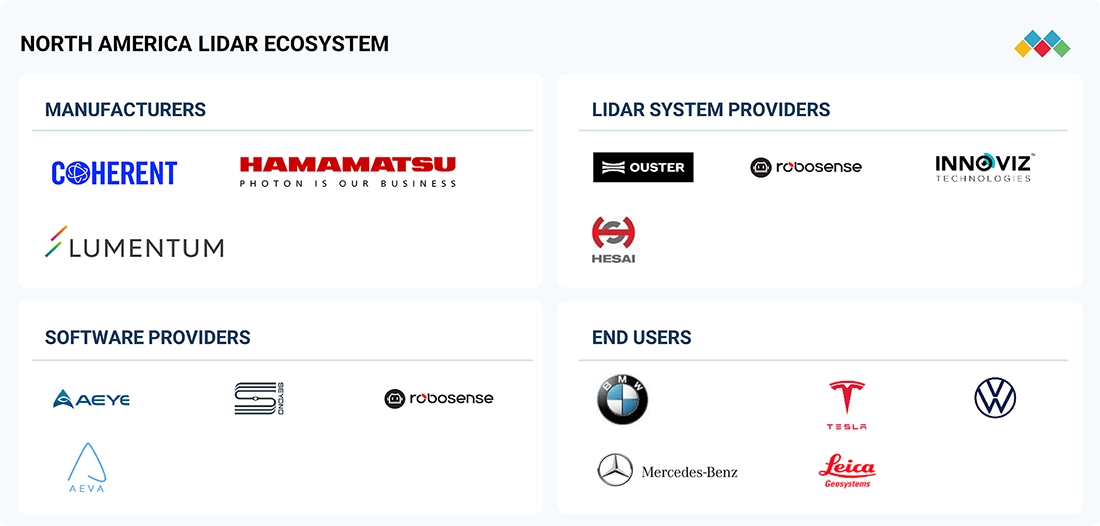

MARKET ECOSYSTEM

The North America LiDAR market ecosystem comprises sensor manufacturers, LiDAR system integrators, software and analytics providers, and a broad base of end users across automotive, mapping, defense, and industrial sectors. The region is marked by strong collaboration between LiDAR technology developers, automotive OEMs, autonomous vehicle startups, and cloud and AI platform providers, enabling rapid commercialization and large-scale deployment. North American players are actively expanding their footprint through advanced product launches, long-term supply agreements, and strategic partnerships with mobility companies, logistics operators, and government agencies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America LiDAR Market, By Installation

In North America, ground-based LiDAR systems are witnessing strong adoption due to their versatility, lower installation costs, and suitability for applications such as land surveying, urban planning, environmental monitoring, and infrastructure inspection. Ground-based LiDAR is increasingly preferred for corridor mapping, utility assessments, and construction site evaluation, where high accuracy and ease of deployment are critical. Meanwhile, airborne LiDAR continues to gain traction in large-area mapping, forestry analysis, and disaster management but grows at a slightly slower pace due to higher operational costs and regulatory complexities.

North America LiDAR Market, By Type

The mechanical LiDAR segment dominates the LiDAR market in North America owing to its established use in automotive prototyping, robotics, and geospatial operations. Mechanical LiDAR’s mature technology, wide field of view, and ability to operate over long distances make it a widely adopted choice for surveying, volumetric mapping, and autonomous vehicle testing. However, solid-state LiDAR is rapidly emerging as a high-growth segment, driven by its compact design, enhanced reliability, and increasing integration into ADAS and next-generation autonomous vehicle platforms.

North America LiDAR Market, By Range

Short-range LiDAR systems hold significant market share in North America due to their widespread use in automotive safety functions, robotics navigation, warehouse automation, and perimeter security applications. These systems offer high-resolution object detection at close distances, supporting collision avoidance and environment mapping. Medium-range LiDAR is expected to grow rapidly as adoption increases in engineering surveys, construction monitoring, and smart infrastructure projects. Long-range LiDAR continues to be essential for airborne mapping, autonomous highway driving, and large-scale terrain modeling where extended detection capability is required.

North America LiDAR Market, By Service

Aerial LiDAR services hold a substantial share of the North America market due to their critical role in large-scale mapping, environmental assessments, infrastructure planning, and disaster management. Organizations increasingly rely on manned aircraft and UAV-based LiDAR systems to capture high-resolution terrain and structural data across vast areas with speed and accuracy. Government agencies, survey firms, and utility operators frequently use aerial LiDAR for applications such as flood modeling, forest inventory, pipeline monitoring, and urban development planning. The growing demand for precise geospatial intelligence and the expansion of drone regulations are further supporting the growth of aerial LiDAR services across the region.

North America LiDAR Market, By End-use Application

The automotive and ADAS segment represents one of the fastest-growing LiDAR end-use applications in North America, driven by rising investments from major OEMs and the development of Level 2+ and Level 3 autonomous driving capabilities. Automakers are increasingly integrating solid-state and long-range LiDAR into next-generation vehicle platforms to enhance safety, object detection, and navigation reliability. Beyond automotive, industries such as construction, mining, utilities, and smart-city infrastructure are rapidly adopting LiDAR for 3D mapping, asset monitoring, and automation. As more sectors recognize the operational benefits of high-precision sensing, LiDAR is transitioning from specialized use cases to mainstream deployment across the region.

REGION

US to be fastest-growing country in LiDAR market in North America during forecast period

The US is expected to grow at a fastest rate in the LiDAR market in North America due to strong adoption across autonomous vehicles, defense modernization, smart-infrastructure projects, and large-scale geospatial programs. Major LiDAR manufacturers, automotive OEMs, and tech companies are headquartered or heavily invested in the US, accelerating innovation and commercialization. Government spending on transportation safety, climate monitoring, and infrastructure mapping further boosts the demand. Additionally, rapid integration of LiDAR in robotics, agriculture, and industrial automation strengthens the market momentum

The Europe LiDAR market is projected to reach USD 3.16 billion by 2030 from USD 0.87 billion in 2025, at a CAGR of 29.6% during the period from 2025 to 2030. The proliferation of LiDAR technology in Europe is attributable to the robust adoption of autonomous driving, smart mobility solutions, and advanced mapping initiatives endorsed by European Union regulations. Furthermore, the expanding range of applications in environmental monitoring, agriculture, and infrastructure planning is fostering increased deployment throughout the region

The Asia Pacific LiDAR market is projected to reach USD 4.01 billion by 2030 from USD 0.92 billion in 2025, at a CAGR of 34.1% from 2025 to 2030. Segments, such as automotive (ADAS), corridor mapping, and urban planning, positively influence the market expansion. Growth is further supported by rising investments in autonomous and electric vehicles, large-scale smart city and infrastructure development programs across China, Japan, and Southeast Asia, and increasing adoption of LiDAR in industrial automation, robotics, and drone-based surveying applications across the region..

NORTH AMERICA LIDAR MARKET: COMPANY EVALUATION MATRIX

In the North America LiDAR market matrix, Ouster (Star) leads with a strong foothold driven by its digital LiDAR architecture, scalable product portfolio, and broad adoption across automotive, industrial automation, robotics, and smart-infrastructure applications. The company’s high-performance, cost-efficient sensors and expanding deployments position it as a dominant force serving multiple high-growth sectors. Luminar (Emerging Leader) is gaining significant traction through its advanced long-range LiDAR technology, deep partnerships with major automotive OEMs, and its strategic focus on enabling next-generation ADAS and autonomous driving platforms. While Ouster maintains market leadership through scale, application diversity, and technology standardization, Luminar demonstrates strong momentum and clear potential to move into the leaders’ quadrant as LiDAR integration accelerates across automotive, mobility, and intelligent transportation systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Hesai Group (China)

- RoboSense Technology Co., Ltd. (China)

- Sick AG (Germany)

- Ouster, Inc. (US)

- Luminar Technologies (US)

- Leica Geosystems AG (Sweden)

- Trimble Inc. (US)

- Teledyne Optech (Canada)

- FARO Technologies, Inc. (US)

- RIEGL Laser Measurement Systems GmbH (Austria)

- NV5 Geospatial (US)

- Beijing SureStar Technology Co., Ltd. (China)

- YellowScan (France)

- China Ansteel Group Corporation Limited (China)

- Precision Castparts Corp. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.01 Billion |

| Market Forecast in 2030 (Value) | USD 4.80 Billion |

| Growth Rate | CAGR of 30.9% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | US, Canada, Mexico |

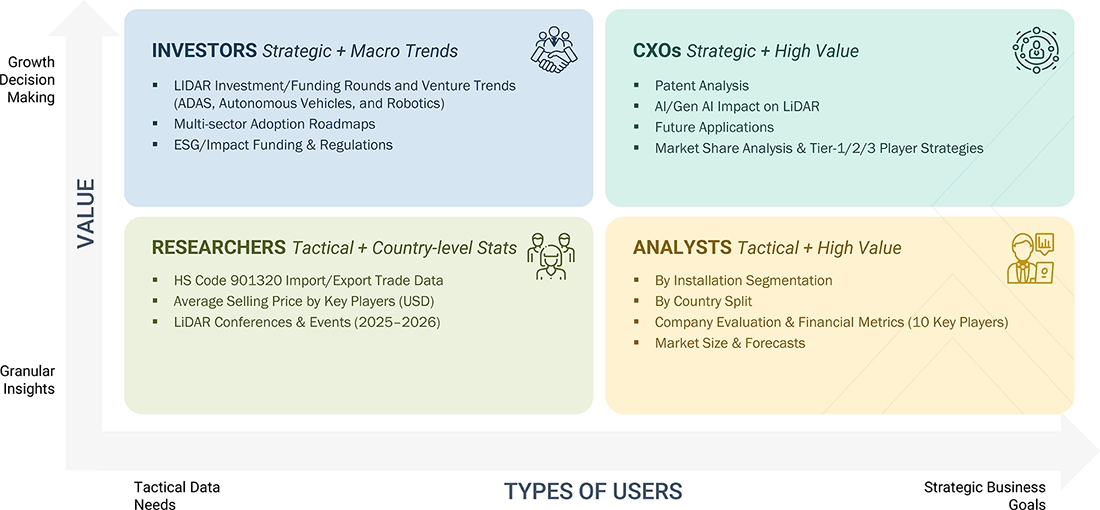

WHAT IS IN IT FOR YOU: NORTH AMERICA LIDAR MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM (ADAS & Autonomous Vehicle Programs) |

|

|

| Geospatial & Surveying Solution Provider |

|

|

| Smart Infrastructure / City Government Agency |

|

|

| Industrial Robotics & Automation Firm |

|

|

| Defense & Security Contractor |

|

|

RECENT DEVELOPMENTS

- June 2024 : Luminar announced a major expansion of its long-term supply agreement with Mercedes-Benz, confirming that Luminar’s next-generation LiDAR will be integrated into additional vehicle platforms for enhanced L3 autonomous capabilities, strengthening its position in the North American automotive LiDAR ecosystem.

- January 2024 : Ouster completed the full post-merger integration of Velodyne Lidar, consolidating product portfolios, engineering teams, and distribution channels. This merger significantly expanded Ouster’s customer base across robotics, industrial, smart-infrastructure, and automotive markets in North America.

- September 2023 : Teledyne Optech launched upgraded airborne LiDAR sensors (the Optech Galaxy and CLS-series enhancements), offering higher point density and improved terrain-mapping accuracy. These systems were adopted by North American surveying and environmental agencies for large-area mapping and infrastructure assessments.

Table of Contents

Methodology

The study involved four major activities in estimating the size of the North America LiDAR market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the North America LiDAR Market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the North America LiDAR Market scenario through secondary research. Several primary interviews have been conducted with experts from both the demand (end users) and supply (LiDAR solution providers) sides across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand sides, respectively. These primary data have been collected through questionnaires, emails, and telephone interviews.

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the North America LiDAR Market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Asia Pacific LiDAR Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

LiDAR, or light detection and ranging, works on the time of flight principle. The system uses light waves or a light source as a pulsed laser to measure the distance between objects. Measuring distances helps create 3D maps of terrains or earth surfaces that are not visible to the human eye or cannot be created through photogrammetry. The light waves are combined with other data recorded by the system (airborne or ground-based) to generate precise 3D information about the shape and characteristics of the targeted object.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To describe, segment, and forecast the overall size of the North America LiDAR Market by type, installation, range, service, end-use application, and region, in terms of value

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze the supply chain, trends/disruptions impacting customer business, market/ecosystem map, pricing analysis, and regulatory landscape pertaining to the North America LiDAR Market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To briefly describe the value chain of light detection and ranging (LiDAR) solutions

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To profile key players and comprehensively analyze their market position in terms of their ranking and core competencies, along with the detailed competitive landscape of the market

- To analyze competitive developments, such as product launches and developments, partnerships, agreements, expansions, acquisitions, contracts, alliances, and research & development (R&D)undertaken in the North America LiDAR Market

- To benchmark market players using the proprietary ‘Company Evaluation Matrix,’ which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To analyze the probable impact of the recession on the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America LiDAR Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America LiDAR Market