Permanent Magnet Market

Permanent Magnet Market by Type (NdFeB, SmCo, Ferrite, AlNiCo), Operating Temperature (Standard, High, Ultra-High), Manufacturing Process (Sintered, Bonded), End-use Industry, and Region - Global Forecast to 2030

PERMANENT MAGNET MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global permanent magnet market was valued at USD 58.87 billion in 2025 and is projected to reach USD 88.51 billion by 2030, growing at 8.5% cagr from 2025 to 2030. With the increasing demand for motors, generators, sensors, loudspeakers, wearable technology, smart appliances, and MRI machines, the market for permanent magnets is expected to grow rapidly during the forecast period. Neodymium Iron Boron magnets make up the largest share of the permanent magnet market. The major end-use industries for permanent magnets are consumer electronics, general industrial, automotive, medical technology, environment & energy, and aerospace & defense industries

KEY TAKEAWAYS

-

BY TYPEThe permanent magnet market comprises neodymium iron boron, ferrite, samarium cobalt, aluminum nickel cobalt, and other magnet types. These diverse magnet types serve different industrial requirements, balancing factors such as cost, strength, and temperature resistance.

-

BY OPERATING TEMPERATUREPermanent magnets are classified by operating temperature into standard (up to about 80-150°C), high (up to around 180-300°C), and ultra-high (above 300°C, sometimes exceeding 500°C) segments, depending on the magnet material and grade. This classification ensures the right magnet type is used for applications requiring specific thermal stability and performance.

-

BY MANUFACTURING PROCESSPermanent magnets are classified into two main manufacturing processes: sintered and bonded. Each process influences the magnet's physical properties, cost, and application suitability, with sintered magnets offering higher performance and bonded magnets providing design flexibility.

-

BY END-USE INDUSTRYPermanent magnets are widely used in end-use industries such as consumer electronics, general industrial, automotive, medical technology, environment & energy, aerospace & defense, and others. The demand is driven by miniaturization trends, the rise of EVs, and renewable energy adoption, making magnets critical for electric drive trains, MRI systems, and wind turbines.

-

BY REGIONThe permanent magnet market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is the largest market for permanent magnet due to China’s dominant production capabilities and strong demand from automotive, consumer electronics, renewable energy, and industrial sectors. The region’s leadership is supported by abundant rare earth resources, government support, and a robust manufacturing ecosystem.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Proterial, Ltd. (Japan), Arnold Magnetic Technologies (US), and TDK Corporation (Japan) have entered into a number of agreements and partnerships to cater to the growing demand for permanent magnets across innovative applications.

The demand for permanent magnets is increasing rapidly due to the growth of electric vehicles (EVs), renewable energy technologies, and the miniaturization of consumer electronics. These magnets are essential for high-performance applications that require energy efficiency. Additionally, manufacturers are focusing on sustainability and innovative materials to tackle supply challenges related to rare earth elements.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of permanent magnet suppliers, which, in turn, impacts the revenues of permanent magnet manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PERMANENT MAGNET MARKET DYNAMICS

Level

-

Rise in new installations of wind turbines

-

Rapidly growing automotive industry in Asia Pacific

Level

-

Fluctuating raw material prices

-

Environmental constraints and recycling hurdles in rare earth mining

Level

-

Elevated demand for permanent magnets in electric and hybrid vehicles

-

Push for environmentally friendly magnets

Level

-

Heavy reliance on China for raw materials

-

Need for substantial R&D investments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in new installations of wind turbines

The increasing demand for offshore wind turbines in the environment & energy industry is driving companies to develop advanced magnet-based generators. According to GWEC, China leads with 46% of the global wind installations in 2024. This is followed by the US, which has 15%, Germany, which has 6%, and India, which has 5% of the total wind installations. New wind power installations are projected to grow at an average rate of 8.8% from 2024 to 2030. Countries and regions worldwide are heavily investing in the wind sector to secure a substantial market share in renewable energy.

Restraint: Fluctuating raw material prices

Fluctuating raw material costs present significant challenges for the permanent magnet industry, particularly concerning rare earth magnets like neodymium. These price fluctuations can affect production costs, squeezing profit margins for manufacturers. When prices spike, it becomes challenging to maintain competitive pricing without sacrificing product quality. Conversely, if prices drop sharply, manufacturers may face increased inventory costs, making it difficult to compete in the market.

Opportunity: Elevated demand for permanent magnets in electric and hybrid vehicles

The growing global population is driving an increased demand for permanent magnets, particularly within the automotive industry. As consumer preferences shift and technology advances, spending on electric and hybrid vehicles is on the rise. To comply with stringent government regulations that support clean energy initiatives, established players in the permanent magnet market are turning to electrification. Major automotive manufacturers like Audi and MG Motors have adopted permanent magnet synchronous motors (PMSMs) in their electric and hybrid models because these motors offer approximately 15% greater efficiency compared to traditional induction motors.

Challenge: Heavy reliance on China for raw materials

China plays a pivotal role in the global market for Rare Earth Elements (REEs), being the dominant producer and key supplier to many countries. The dominance extends to the production of permanent magnets, which are crucial for various technological applications. This heavy dependency raises concerns regarding supply chain vulnerabilities and geopolitical tensions, prompting countries to seek diversification strategies for their rare earth and magnet supplies.

Permanent Magnet Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of neodymium-iron-boron (NdFeB) permanent magnets in electric vehicle (EV) motors | Higher power density, longer driving range, improved motor efficiency, and reduced energy loss |

|

Application of permanent magnets in direct-drive wind turbine generators | Increased reliability (fewer moving parts), lower maintenance, higher energy capture |

|

Use of rare earth magnets in medical MRI scanners | Produces high-field strength for clearer imaging, enables compact system design |

|

Use of permanent magnets in unmanned aerial vehicles (UAVs) and defense radar systems | Lightweight design, high endurance, and improved stealth and precision capabilities |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PERMANENT MAGNET MARKET ECOSYSTEM

Ecosystem analysis of the permanent magnet market examines the interconnected network of stakeholders, including raw material suppliers, composite manufacturers, tooling providers, technology innovators, and end users. This analysis highlights how collaboration, innovation, and strategic partnerships within this ecosystem drive advancements in permanent magnet production, while integrating efficiency and sustainability. Understanding the dynamics of this ecosystem is essential for identifying growth opportunities and addressing challenges in the evolving permanent magnet industry.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PERMANENT MAGNET MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Permanent Magnet Market, by Type

As of 2024, the Neodymium Iron Boron (NdFeB) magnet led the market due to its remarkable strength and efficiency. It is characterized by its high residual induction (Br), coercivity (Hc), and maximum energy product (BHmax), making it 18 times stronger than traditional ferrite magnets. These magnets are available in various sizes, shapes, and grades, making them suitable for a wide range of applications. Their exceptional magnetic properties have led to their widespread use in consumer electronics, general industry, automotive technology, medical devices, environmental applications, and the aerospace and defense industry.

Permanent Magnet Market, by Operating Temperature

In 2024, the standard operating temperature segment dominated the permanent magnet market. Permanent magnets operating at standard temperature retain their magnetism without needing an external power source. These magnets are made from materials like NdFeB, SmCo, AlNiCo, or ferrite, each selected for its ability to maintain strong magnetic properties under diverse environmental conditions. At standard temperatures, the alignment of magnetic domains within the material remains stable, allowing the magnet to produce a consistent magnetic field.

Permanent Magnet Market, by Manufacturing Process

The sintered process is expected to dominate the permanent magnet market. In the sintered manufacturing process, fine magnetic powders, often made of rare earth elements like neodymium, samarium, or alloys, are produced through atomization or mechanical alloying. These powders are then pressed into a desired shape using a die, often with a magnetic field to align the grains and maximize magnetic orientation. The shaped compact, known as a green compact, is then heated at high temperatures in a vacuum or inert gas atmosphere. This step fuses the particles without fully melting them, creating a dense, solid magnet.

Permanent Magnet Market, by End-use Industry

In 2024, the consumer electronics segment led the market. Permanent magnets are widely used in the magnetic heads of hard disk drives (HDDs) and CDs, as well as in the motors of peripheral devices such as printers, fax machines, scanners, and photocopiers. The rise of cloud computing and its related advancements has resulted in an increasing demand for data centers to handle the growing volume of data. This surge in data has led to a higher requirement for HDDs, thus boosting the demand for permanent magnets.

REGION

Asia Pacific to be fastest-growing region in global permanent magnet market during forecast period

The Asia Pacific permanent magnet market is expected to register the highest CAGR during the forecast period, driven by its dominant position as the largest rare-earth material producer, rapid industrialization, and strong manufacturing capabilities. Expanding electric vehicle (EV) production, rising wind energy installations, and rising demand from consumer electronics and industrial automation sectors is fueling the adoption of permanent magnets. Government support, product innovation, and investments in magnet recycling technologies further bolster the region's market growth and leadership globally.

Permanent Magnet Market: COMPANY EVALUATION MATRIX

In the permanent magnet market matrix, Proterial, Ltd. (Star) leads with a strong market share and extensive product footprint, driven by its high-performance permanent magnets, used widely in automotive, electronics, and home appliances. Bunting Magnetics Co. (Emerging Leader) is gaining visibility with its wide range of permanent magnets for automotive applications, strengthening its position through innovation and niche product offerings. While Proterial, Ltd. dominates through scale and a diverse portfolio, Bunting Magnetics Co. shows significant potential to move toward the leaders’ quadrant as demand for high-performance permanent magnets continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PERMANENT MAGNET MARKET PLAYERS

PERMANENT MAGNET MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 53.51 Billion |

| Market Forecast in 2030 (Value) | USD 88.51 Billion |

| Growth Rate | CAGR of 8.5% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Permanent Magnet Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based Rare Earth Permanent Magnet Manufacturer |

|

|

| Rare Earth Magnet Recycler |

|

|

| Aerospace & Defense Magnet Supplier |

|

|

| EV & Wind OEM Customer |

|

|

RECENT DEVELOPMENTS

- June 2025 : TDK Corporation signed a memorandum of understanding (MoU) with Siemens Gamesa Renewable Energy to supply permanent magnets for wind turbines. Japan’s Ministry of Economy, Trade and Industry (METI) oversees this agreement, which is part of a larger effort to develop a wind turbine supply chain.

- June 2025 : Electron Energy Corporation, along with two major rare earth magnet companies, Dexter Magnetic Technologies and Magnetic Component Engineering, rebranded as Permag to lead the world in the procurement, design, and manufacturing of rare earth magnets. These companies will continue to operate under their current names, providing new levels of synergy to deliver greater value to customers and the overall market.

- May 2025 : Bunting Magnetics Co. established a new state-of-the-art manufacturing facility in Newton, Kansas, to expand its global production of magnetic cylinders used in aluminum beverage can printing.

Table of Contents

Methodology

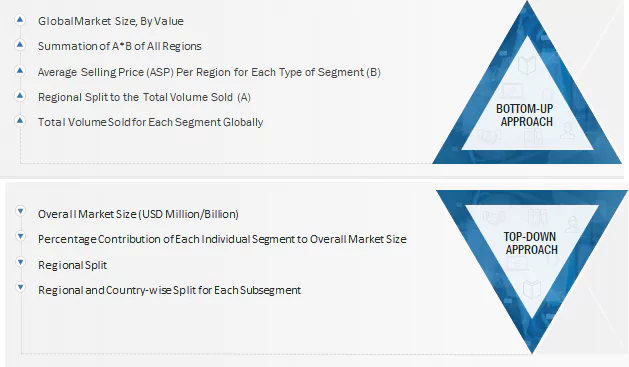

The study involves two major activities in estimating the current market size for the permanent magnet market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering permanent magnet products and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the permanent magnet market, which was validated by primary respondents.

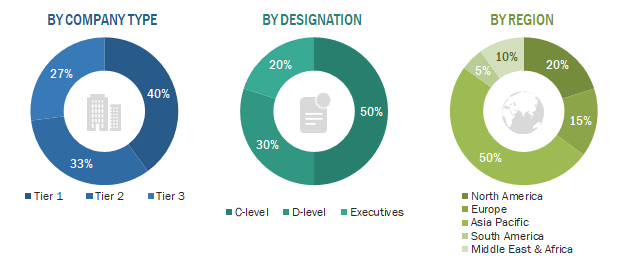

Primary Research

Extensive primary research was conducted after obtaining information regarding the permanent magnet market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of Asia Pacific, Europe, North America, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from permanent magnet industry vendors, system integrators, component providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, operating temperature, manufacturing process, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using permanent magnet products were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of permanent magnets and outlook of their business which will affect the overall market.

Breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the permanent magnet market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on procurements and modernizations in permanent magnet products in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the permanent magnet industry for each end-use industry. For each end-use industry, all possible segments of the permanent magnet market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Permanent magnets are materials that generate a magnetic field due to their internal structure. They keep their magnetic properties for a long time even after the external magnetic force is removed. These magnets are made of ferromagnetic materials like iron, boron, or nickel and have maximum energy product, high remanence, and coercivity. Permanent magnets are used in a wide range of applications such as hard drives, CDs, speakers, microphones, motors, MRI machines, generators, and sensors.

Stakeholders

- Permanent magnet manufacturers

- Permanent magnet suppliers

- Raw material suppliers

- End-use industries

- Government bodies

- Universities, governments, and research organizations

- Research and consulting firms

- R&D institutions

- Investment banks and private equity firms

- Magnet and permanent magnet associations

Report Objectives

- To define, describe, and forecast the permanent magnet market size in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global permanent magnet market by type, operating temperature, manufacturing process, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely Asia Pacific, Europe, North America, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as acquisitions, agreements, contracts, and product developments/launches, to draw the competitive landscape

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which are the major companies in the permanent magnet market?

Proterial, Ltd. (Japan), Arnold Magnetic Technologies (US), TDK Corporation (Japan), Yantai Dongxing Magnetic Materials Inc. (China), Shin-Etsu Chemical Co., Ltd. (Japan)

What are the drivers and opportunities for the permanent magnet market?

Major driver: Growing demand due to new wind energy installations.

Which region is expected to hold the highest market share?

Asia Pacific holds the highest market share and sees significant industry demand.

What is the total CAGR expected to be recorded for the permanent magnet market during 2025–2030?

The CAGR is expected to be 8.5% from 2025 to 2030.

How is the permanent magnet market aligned?

The market is stable with strong demand from consumer electronics, industrial, automotive, medical, energy, and defense sectors. Dominated by well-established firms.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Permanent Magnet Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Permanent Magnet Market

Subramaniyan

May, 2015

General information on Permanent Magnet Market for Energy industry.