Photoelectric Sensor Market Size, Share Analysis 2030

Photoelectric Sensor Market by Sensing Mode (Through-beam, Retroreflective, Diffuse Reflective), Structural (Interrupter, Fiber-optic, Multi-beam), Mounting (Cylindrical, Rectangular, Threaded Barrel, Fork), Source (Laser, LED) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global photoelectric sensor market is projected to grow from USD 2.18 billion in 2024 to USD 4.02 billion by 2032, registering a CAGR of 8.1%. The market is growing rapidly due to the increasing adoption of automation and robotics across manufacturing, packaging, and logistics industries. These sensors enable precise, non-contact object detection, improving operational efficiency and safety. Additionally, advancements in smart sensing, IoT integration, and miniaturization are expanding their use in modern industrial and consumer applications, driving sustained market demand.

KEY TAKEAWAYS

- Asia Pacific accounted for a 50.1% share of the photoelectric sensor market in 2024.

- By sensing mode, the diffuse reflective segment is projected to grow at the highest CAGR of 8.9% from 2025 to 2032.

- By structural type, the slot/fork/interrupter sensor segment accounted for a 50.9% share of the photoelectric sensor market in 2024.

- By sensing range, the mid range (100 MM–1 M) segment held the largest share of the photoelectric sensor market in 2024.

- By mounting type, the slot/fork modules segment is projected to grow at the highest CAGR from 2025 to 2032.

- By beam source, the LED segment captured the largest market share in 2024.

- The packaging printing & e-commerce logistics segment is projected to grow at the highest CAGR between 2025 and 2032.

- Schneider Electric (France), Rockwell Automation (US), OMRON Corporation (Japan), KEYENCE CORPORATION (Japan), and SICK AG (Germany) were identified as star players in the photoelectric sensor market, recognized for their advanced automation technologies, and strategic partnerships with leading photoelectric sensor manufacturers to enhance production efficiency and scalability.

- Banner Engineering Corp., Baumer, and TMSS France fall under the Progressive category in the photoelectric sensor market, leveraging advanced optical sensing technologies, robust industrial designs, and smart connectivity features to enhance detection accuracy, process reliability, and automation efficiency across manufacturing, packaging, and logistics applications.

The photoelectric sensor industry is growing rapidly due to the increasing adoption of automation and robotics across manufacturing, packaging, and logistics industries. These sensors enable precise, non-contact object detection, improving operational efficiency and safety. Additionally, advancements in smart sensing, IoT integration, and miniaturization are expanding their use in modern industrial and consumer applications, driving sustained market demand.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business on the photoelectric sensor market stems from the growing demand for automation, precision sensing, and safety across industrial and consumer applications. End users, such as automotive, packaging, food & beverages, pharmaceuticals, and semiconductor industries, are increasingly integrating photoelectric sensors to enable real-time object detection, quality inspection, and automated control systems. The adoption of Industrial IoT, 3D sensing, and connected vehicle technologies drives sensor performance innovation, emphasizing miniaturization, energy efficiency, and digital connectivity. These advancements are transforming operational productivity, reducing defects, and enabling autonomous and data-driven manufacturing ecosystems, positioning photoelectric sensors as a critical enabler of next-generation industrial automation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Extensive use of photoelectric sensors in different industries

-

Increased adoption of retroreflective photoelectric sensors in various applications

Level

-

US-China trade war

-

Easy availability of competent alternative sensors

Level

-

Increasing demand for photoelectric sensors for packaging applications from food & beverages industry

-

Ongoing digitization and emerging connected industries

Level

-

Unavailability of raw materials

-

High maintenance costs of photoelectric sensors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased adoption of retroreflective photoelectric sensors in various applications

Retroreflective photoelectric sensors, which integrate the emitter and receiver within a single housing, are gaining traction across diverse applications. For example, Pepperl+Fuchs (Germany) provides retroreflective sensors equipped with polarization filters (MLV12-54/47/92) utilized in theme parks to detect the precise position of rollercoaster carriages. These sensors facilitate the accurate removal and placement of carriages on tracks, ensuring reliable detection and enhancing the overall safety and efficiency of ride operations.

Restraint: Easy availability of competent alternative sensors

The growth of the photoelectric sensor market is challenged by the availability of alternative sensing technologies, such as inductive, capacitive, and ultrasonic sensors, which offer cost-effective object detection solutions. Ultrasonic sensors, in particular, can detect objects using sound waves, unaffected by color or transparency, and are capable of 3D zone detection. Their lower cost and reliable performance in short-range applications make them a preferred choice in several industries, restraining the wider adoption of photoelectric sensors.

Opportunity: Ongoing digitization and emerging connected industries

The rise of the Industrial Internet of Things (IIoT) and big data is transforming manufacturing by enabling miniaturized, intelligent, and networked sensors. Photoelectric sensors with IO-Link connectivity now offer real-time data sharing, self-adjustment, and seamless integration across automated systems. These advancements enhance process efficiency, defect detection, and customization in smart factories, driving the demand for connected and intelligent photoelectric sensing solutions.

Challenge: High maintenance costs of photoelectric sensors

Long-range photoelectric sensors are relatively expensive and require high maintenance, as their performance can be affected by dust, steam, or smoke. In industries such as electronics, where detecting small or reflective components is complex, installation becomes more intricate due to the need for reflectors and additional protective measures, increasing overall system cost and complexity.

Photoelectric Sensor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Photoelectric sensors for material handling and conveyor line detection in food & beverage packaging facilities | Ensures reliable object detection in dusty/wet environments, reducing false triggers and downtime while complying with hygiene standards for efficient throughput |

|

Fiber-optic photoelectric sensors for high-precision inspection and edge detection in semiconductor production | Achieves sub-millimeter accuracy with fast response times, enabling defect-free processes and real-time analytics for superior yield and compliance |

|

Through-beam photoelectric sensors for position monitoring and safety zoning in automotive assembly lines | Provides high-speed, accurate sensing with IIoT integration, enabling predictive maintenance and seamless automation for enhanced productivity and safety |

|

Diffuse photoelectric sensors for object recognition and hazard avoidance in logistics and warehouse automation | Offers compact, rugged design for harsh conditions, with background suppression for reliable detection, improving operational efficiency and worker safety |

|

Retro-reflective photoelectric sensors for proximity detection in electronics manufacturing and robot guarding | Delivers long-range, non-contact monitoring with adjustable sensitivity, minimizing errors and supporting dynamic workflows for precise quality control |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The photoelectric sensor ecosystem consists of a collaborative network of manufacturers, suppliers and distributors, and end users, collectively driving advancements in industrial automation, safety, and precision detection. Leading manufacturers, such as Schneider Electric (France), Omron Corporation (Japan), SICK AG (Germany), and Rockwell Automation (US), play a key role in developing innovative photoelectric sensing technologies integrated with IoT and smart factory solutions. Suppliers and distributors, including Apple Automation and Sensor (India), Aeron Automation (India), and Photonics Marketplace (US), enable efficient global distribution and application customization across industries. Prominent end users, such as Volkswagen Group (Germany), DHL Group (Germany), and TOYOTA MOTOR CORPORATION (Japan), leverage these sensors to enhance production efficiency, logistics automation, and quality control, fostering the continued growth of intelligent sensing ecosystems across manufacturing and industrial sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Photoelectric Sensor Market, By Sensing Mode

The diffuse reflective segment is expected to hold the largest market share due to its cost-effective design, easy installation, and ability to detect objects without requiring a separate reflector. Its versatility in detecting varied object surfaces and colors makes it ideal for automated production lines, packaging, and material handling applications across multiple industries.

Photoelectric Sensor Market, By Structural Type

The slot/fork/interrupter sensor segment captured the largest market share in 2024 due to its high accuracy, simple installation, and reliable object detection in confined spaces. These sensors are widely used in packaging, labeling, and electronics manufacturing for detecting small parts or edges, offering consistent performance and minimal alignment requirements compared to other sensor types.

Photoelectric Sensor Market, By Sensing Range

The mid range (100 mm–1 m) segment is expected to account for the largest market share due to its optimal balance between detection distance, accuracy, and cost, making it suitable for a range of industrial and commercial applications. These sensors are extensively used in assembly lines, packaging systems, and robotics for reliable object detection and positioning in medium-range environments.

Photoelectric Sensor Market, By Mounting Type

The cylindrical segment is projected to hold the largest market share during the forecast period owing to its versatile design, easy installation, and compatibility with various industrial setups. These sensors are widely adopted in automation and packaging applications due to their durability, compact structure, and cost efficiency, making them ideal for diverse sensing environments.

Photoelectric Sensor Market, By Beam Source

The LED segment is expected to account for the largest market share during the forecast period due to its low power consumption, cost-effectiveness, and long operational life. LED-based photoelectric sensors offer stable performance and high reliability across diverse industrial environments, making them the preferred choice for general-purpose object detection and automation applications.

Photoelectric Sensor Market, By End User

The automotive manufacturing segment is expected to hold the largest market share due to the extensive use of photoelectric sensors in automation, assembly, and quality inspection processes. These sensors enable precise object detection, position sensing, and safety control in robotic and conveyor systems, enhancing production efficiency and ensuring consistent quality in modern automotive manufacturing facilities.

REGION

Asia Pacific to be fastest-growing region in global photoelectric sensor market during forecast period

Asia Pacific is projected to grow at the highest CAGR in the photoelectric sensor market during the forecast period, driven by the rapid expansion of industrial automation, electronics manufacturing, and automotive production in China, Japan, South Korea, and India. Increasing investments in smart factories, robotics, and IoT-enabled manufacturing systems boost the sensor adoption. Moreover, the cost-effective manufacturing capabilities and strong government support for industrial digitalization further accelerate market growth.

Photoelectric Sensor Market: COMPANY EVALUATION MATRIX

In the photoelectric sensor market matrix, OMRON Corporation (Star) leads with a broad and technologically advanced portfolio covering diffuse, retro-reflective, through-beam, and smart IO-Link photoelectric sensors. Its strong R&D capabilities, global manufacturing footprint, and deep integration with factory automation ecosystems position it as a key enabler of high-precision, high-speed industrial sensing. ifm electronic gmbh (Emerging Leader) is rapidly strengthening its market presence through innovation in smart sensors, robust industrial designs, and expanding distribution across automotive, packaging, and process industries, steadily moving toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS - Top Photoelectric Sensor Companies

- OMRON Corporation (Japan)

- KEYENCE CORPORATION (Japan)

- SICK AG (Germany)

- Schneider Electric (France)

- Rockwell Automation (US)

- Panasonic Corporation (Japan)

- Eaton (Dublin)

- ifm electronic gmbh (Germany)

- Pepperl+Fuchs (Germany)

- Balluff GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.18 Billion |

| Market Forecast in 2032 (Value) | USD 4.02 Billion |

| Growth Rate | CAGR of 8.1% from 2025-2030 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, and RoW |

WHAT IS IN IT FOR YOU: Photoelectric Sensor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| Logistics & Packaging Companies |

|

|

| Electronics & Semiconductor Manufacturers |

|

|

RECENT DEVELOPMENTS

- May 2025 : ifm electronic gmbH announced a strategic partnership and minority investment by global investment firm KKR, aimed at accelerating its global scale and innovation in automation and Industry 4.0 technologies. The partnership supports ifm’s long-term growth ambitions while allowing the founding families to retain majority ownership and remain committed to their core values.

- February 2025 : Schneider Electric announced a new range of multi-parameter sensors, combining CO2, temperature, humidity, VOCs and particulate matter monitoring into a single unit to enhance indoor air quality and improve energy efficiency in buildings.

- December 2024 : KEYENCE CORPORATION introduced the FS-N40 Series Digital Fibre Optic Sensor, which features an ultra-clear OLED display and simplified setup, enabling fast calibration and intuitive operations. It supports over 200 fiber units for extreme flexibility and includes alignment indicators and built-in status alerts to boost reliability in automated detection tasks.

Table of Contents

Methodology

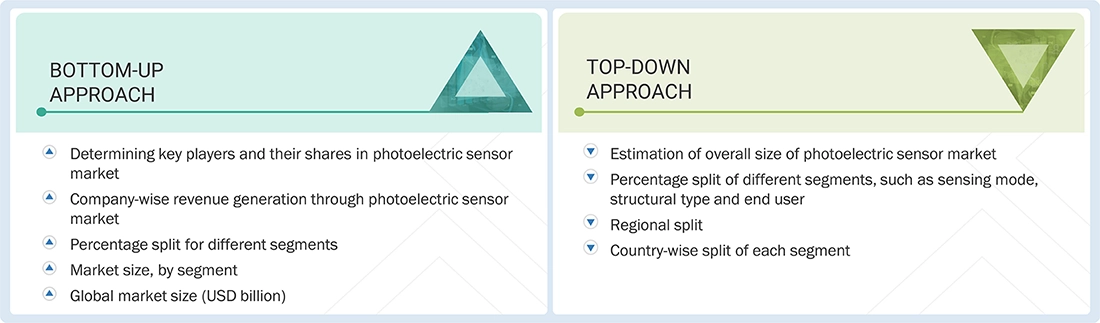

The study involved four major activities in estimating the current size of the photoelectric sensor market. Exhaustive secondary research was conducted to gather information on the market, adjacent markets, and the overall photoelectric sensor landscape. These findings, along with assumptions and projections, were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the photoelectric sensor market.

Secondary Research

The secondary research process referred to various secondary sources to identify and collect necessary information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data was collected and analyzed to determine the overall market size, which is further validated through primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the photoelectric sensor market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

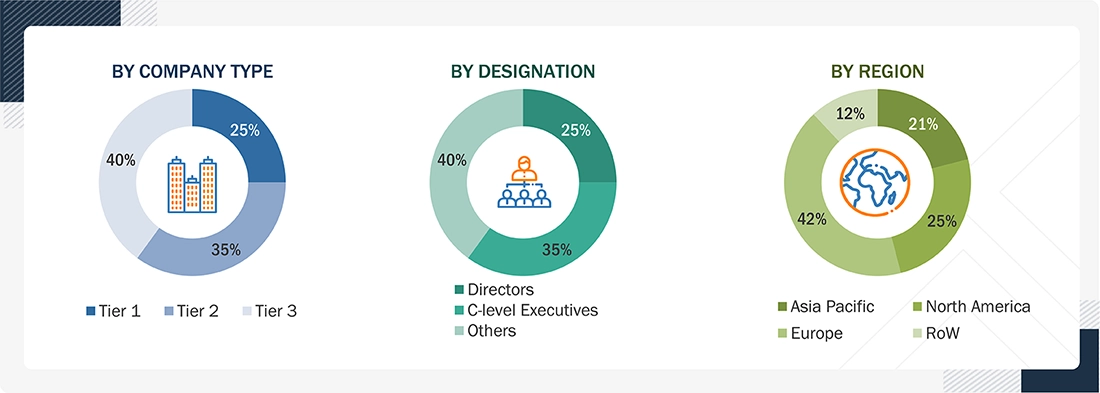

Breakdown of Primary Interviews

Notes: Three tiers of companies have been defined based on their total revenue as of 2024

Tier 1: >USD 500 million, Tier 2: USD 100 million–USD 500 million, and Tier 3: < USD 100 million.

Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the photoelectric sensor market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology was used to estimate the market size:

- Major players in the markets were identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

The market sizing includes the following:

Data Triangulation

After arriving at the overall size of the photoelectric sensor market using the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

Photoelectric sensors detect objects, as well as changes in surface conditions, through their optical properties. They emit light beams (visible or infrared) from their emitters (light-emitting elements) and receive them at receivers (light-receiving elements). When emitted light is interrupted or reflected by the objects to be sensed, the amount of light that arrives at the receivers is changed. These receivers detect this change and convert it to an electrical output. Photoelectric sensors are not limited to detecting metal objects only. For instance, proximity sensors operate on the principle of light being interrupted or reflected by the targeted objects, which can be glass, plastic, wood, or liquid. Various types of photoelectric sensors, including through beam, retroreflective, and reflective, are used in numerous applications, such as consumer electronics, industrial manufacturing, and food & beverages. The photoelectric sensor market is diversified, with the presence of various established, as well as emerging players operating across its value chain.

Stakeholders

- Photoelectric sensor manufacturers

- Automotive and consumer electronics companies

- Semiconductor component suppliers

- Photoelectric sensor distributors and sales firms

- Electronic system assemblers

- Technology solution providers and design contractors

- Electronics and semiconductor companies

- Photoelectric sensor material suppliers

- Technology standards organizations, forums, alliances, and associations

- Universities and research organizations

- Government bodies

Report Objectives

- To describe and forecast the photoelectric sensor market, by sensing mode, structural type, sensing range, mounting type, beam source, end user, and region, in terms of value

- To describe and forecast the market with regard to four main regions: North America, Europe, Asia Pacific, and RoW, along with their respective countries, in terms of value

- To forecast the photoelectric sensor market, by sensing mode, in terms of volume

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the market growth

- To provide a detailed overview of the photoelectric sensor value chain

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the photoelectric sensor market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the photoelectric sensor market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches and developments, adopted by key players in the photoelectric sensor market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Photoelectric Sensor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Photoelectric Sensor Market

Ford

May, 2020

Would like to know the trends and business opportunities world wide for various technologies this industry. Also would like to know the feasibility of a start-up in the Photoelectric sensors industry..

Allen

May, 2020

Have you included Laser Beam Photoelectric sensors in your study ? Would be interested in knowing major companies manufacturing these type of sensors?.

Thomas

May, 2020

I am interested to learn if the application segmentation in the Photoelectric sensors report goes one level deeper in building automation application.

Lisa

May, 2020

Which is the leading application for Photoelectric sensors and who are the major players? .