Precision Harvesting Market Size, Share & Trends, 2025 To 2030

Precision Harvesting Market by Combine Harvesters, Self-Propelled Forage Harvesters, Harvesting Robots, Guidance & Steering System, GPS, Yield Monitoring System, Robotic Arm, Sensors, Cameras and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The precision harvesting market is projected to grow from USD 21.52 billion in 2025 to USD 29.79 billion in 2030, at a CAGR of 6.7%. Rising labor costs and shortages, strong ROI from yield optimization, government subsidies and smart farming initiatives, and integration of AI, IoT, and imaging technologies are the major factors driving market growth. In addition, growing demand from high-value crops and expansion via leasing models in emerging economies provide ample opportunities for the market players.

KEY TAKEAWAYS

-

BY REGIONThe Americas are estimated to dominate the precision harvesting market with a share of 46.0% in 2025.

-

BY OFFERINGBy offering, the software segment is projected to grow at a CAGR of 10.6% during the forecast period.

-

BY FARM SIZEBy farm size, the medium farm segment accounted for the largest market size in 2024.

-

BY APPLICATIONBy application, the crops segment accounted for a share of 74.7% in terms of value in 2024.

-

COMPETITIVE LANDSCAPE (KEY PLAYERS)Deere & Company, CNH Industrial N.V., CLAAS KGaA mbH, AGCO Corporation, and KUBOTA Corporation were identified as star players in the precision harvesting market, given their broad industry coverage and strong operational & financial strength.

-

COMPETITIVE LANDSCAPE (STARTUPS/SMES)Bonsai Robotics, Ripe Robotics Pty Ltd., Harvest CROO Robotics LLC, MetoMotion, and Sentera have distinguished themselves among startups due to their well-developed marketing channels and extensive funding to build their product portfolios.

The precision harvesting market is set for growth due to increased automation and data technologies. Demand for efficient machines that reduce crop loss is driving this change, with advancements in GPS, IoT, and AI enhancing farming practices for better efficiency and sustainability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The precision harvesting market is transforming as revenue shifts from traditional equipment sales to advanced technology ecosystems. Manufacturers are moving toward AI-powered autonomous harvesters, digital platforms, and subscription-based analytics services. This growth is fueled by various technology providers catering to different customer segments, including commercial farms and AgTech platforms. End-user demands for yield optimization, labor shortage solutions, real-time quality assessments, sustainability, and data-driven decision-making are driving the market's evolution from a product-centric model to an integrated technology ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising wage rates and labor shortage

-

Growing emphasis on optimizing agricultural yield and reducing waste

Level

-

High upfront and ownership costs

-

Limited interoperability and equipment compatibility

Level

-

Surging demand for high-value crops

-

Expansion of leasing models and custom hiring centers in emerging economies

Level

-

Lack of skilled operators and technical expertise

-

Uneven adoption across geographies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Labor Costs and Shortages in Agriculture

Increasing labor costs and the shortage of skilled agricultural workers, particularly in North America, Europe, and certain parts of Asia, are prompting farmers to adopt automation. Precision harvesting technologies such as autonomous harvesters, robotic arms, and AI-driven machines reduce dependence on manual labor while improving efficiency and yield quality. These solutions ensure consistent performance, lower operational costs, and enable scalable, sustainable farming, addressing one of agriculture’s most pressing workforce challenges.

Restraint: High Initial Investment and Ownership Cost

Despite clear benefits, precision harvesting technologies involve high upfront costs for equipment, maintenance, and skilled operation. Small and medium farms, especially in developing regions, often lack access to financing or subsidies, limiting adoption. Advanced tools like self-driving harvesters and AI-based systems remain affordable mainly for large farms. Without broader financial support or cooperative models, high ownership costs continue to slow the widespread deployment of precision harvesting solutions.

Opportunity: Surging Demand from High-Value Crop Segments

Rising global demand for premium fruits, vegetables, and vineyard crops is creating strong opportunities for precision harvesting technologies. These high-value crops require delicate handling to preserve quality and reduce post-harvest losses, which traditional methods often fail to achieve. Increasing preference for organic and fresh produce is encouraging investment in specialized harvesting machines. Early adoption in Europe, North America, and Asia Pacific is driving steady market growth, improving efficiency and crop profitability.

Challenge: Lack of Skilled Operators and Technical Expertise

A major challenge for the precision harvesting market is the shortage of skilled operators capable of handling advanced technologies. While automation and AI-driven machines are becoming more accessible, effective operation requires training in calibration, data interpretation, and maintenance. In developing and rural regions, limited awareness and technical education hinder adoption. Expanding training programs and farmer outreach initiatives are essential to unlock the full potential and efficiency of precision harvesting systems.

Precision Harvesting Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses John Deere’s S-Series combines with integrated GPS, AutoTrac guidance, and yield mapping for large-scale row crop harvesting | Improved yield consistency, reduced fuel use, and optimized harvest timing |

|

Employs FarmWise’s AI-powered Vulcan implement for precision harvesting and weeding of leafy vegetables | Lower labor costs, minimal crop damage, and enhanced harvest quality |

|

Utilizes New Holland CR Revelation combines with real-time yield mapping and moisture sensors for salad and vegetable crops | Efficient crop tracking, better yield forecasting, and resource optimization |

|

Deploys Case IH Axial-Flow combines equipped with AFS Harvest Command automation across large cotton and grain operations | Increased throughput, reduced grain loss, and improved cost efficiency |

|

Uses John Deere precision harvesting systems integrated with soil and crop analytics for organic carrot harvesting | Enhanced soil management, reduced waste, and sustainable harvesting practices |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major players operating in the precision harvesting market with a significant global presence include Deere & Company (US), CLAAS KGaA mbH (Germany), CNH Industrial N.V. (Netherlands), AGCO (US), KUBOTA Corporation (Japan), TOPCON CORPORATION (Japan), Ag Leader Technology (US), Trimble Inc. (US), SDF Group (Italy), and Pellenc (France). The precision harvesting ecosystem comprises R&D institutes/universities/labs, hardware component providers, software providers, and precision harvesting OEMs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Precision Harvesting Market, by Offering

The hardware segment accounted for the largest share in 2024, primarily due to the rapid integration of automation, robotics, and sensor-based technologies in harvesting equipment. Farmers are increasingly investing in combine harvesters, robotic arms, GPS-based guidance systems, and yield monitoring tools to improve operational efficiency, reduce dependency on manual labor, and ensure accurate crop collection. Continuous advancements in machine vision, connectivity, and AI-driven control systems are enhancing the precision and reliability of harvesting operations. The software segment is growing steadily as data analytics and predictive maintenance tools enable real-time monitoring, performance optimization, and yield forecasting. Meanwhile, services such as equipment calibration, maintenance, and training are expanding with the adoption of connected farming solutions, ensuring long-term efficiency and technology integration across diverse agricultural environments.

Precision Harvesting Market, by Farm Size

The medium farm segment dominated the market in 2024, as mid-scale farms increasingly adopt precision harvesting solutions to improve productivity and manage rising labor costs. These farms are leveraging cost-effective automation, GPS-guided systems, and IoT-enabled devices to balance efficiency with affordability. Large farms continue to be early adopters of autonomous machinery, advanced robotics, and data-driven fleet management systems that maximize yield and minimize waste. On the other hand, small farms are gradually transitioning toward mechanization, supported by cooperative ownership models, leasing programs, and government subsidies for modern equipment. The growing availability of modular and scalable precision harvesting systems is encouraging adoption across various farm sizes, helping farmers optimize yield potential, resource allocation, and overall profitability.

Precision Harvesting Market, by Application

The crops segment held the largest share in 2024, fueled by the widespread implementation of precision technologies for grain, cereal, and oilseed harvesting. The demand for higher-quality produce and reduced post-harvest losses is driving the adoption of smart combine harvesters, sensor-equipped machines, and AI-based yield monitoring systems. In horticulture, precision harvesting robots designed for delicate produce, such as fruits and vegetables, are gaining momentum, ensuring minimal damage and extending shelf life. Greenhouse applications are also expanding, supported by compact, automated systems optimized for confined environments. The adoption of data-driven insights to plan harvest timing and optimize labor allocation is transforming productivity across all applications, contributing to higher efficiency and sustainability in the agricultural supply chain.

REGION

Asia Pacific to be fastest-growing region in global near-eye display market during forecast period

Asia Pacific is projected to emerge as the fastest-growing region in the precision harvesting market, driven by the rapid adoption of automation, robotics, and data-driven agricultural technologies across China, India, Japan, and Australia. The rising demand for high-efficiency harvesting solutions is supported by government initiatives promoting smart agriculture, digital farming, and mechanization to enhance crop productivity and reduce labor dependency. China’s strong agricultural machinery manufacturing base, India’s push for farm modernization, Japan’s expertise in robotics and precision equipment, and Australia’s large-scale mechanized farming operations are key contributors to growth. Additionally, collaborations between precision harvesting equipment manufacturers, agritech startups, and software developers are accelerating technology integration, enhancing operational efficiency, and positioning the region as a hub for advanced and sustainable farming solutions.

Precision Harvesting Market: COMPANY EVALUATION MATRIX

In the precision harvesting market matrix, Deere & Company (US) leads with a strong market presence, offering advanced harvesting machinery, autonomous equipment, and AI-enabled guidance systems. Deere’s extensive product portfolio, coupled with strategic partnerships with software providers and agritech firms, positions it as a dominant player driving large-scale adoption of precision harvesting solutions globally. Topcon Corporation (Japan), as an emerging leader, is gaining traction with innovative GPS-based guidance systems, sensor technologies, and farm management software. While Deere dominates through product performance, integrated solutions, and global reach, Topcon demonstrates strong potential to move toward the leaders’ quadrant by expanding its hardware innovations and adoption across diverse agricultural applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 19.57 Billion |

| Market Forecast, 2030 (Value) | USD 29.79 Billion |

| Growth Rate | CAGR of 6.7% from 2025 to 2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | Americas, Europe, Asia Pacific, Rest of the World |

WHAT IS IN IT FOR YOU: Precision Harvesting Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Precision Harvester Manufacturers | Benchmarking of harvesting machinery performance |

|

| Farm & Agritech Solution Providers |

|

|

| Component & Sensor Suppliers |

|

|

| Agri Software & Data Analytics Providers |

|

|

| Investors & Venture Capital Firms |

|

|

RECENT DEVELOPMENTS

- June 2024 : Case IH (US) (subsidiary of CNH Industrial N.V.) introduced the Axial-Flow 260 series combine, featuring integrated Harvest Command automation. This system automatically adjusts settings to optimize throughput and grain quality.

- March 2024 : Deere & Company (US) launched the S7 Series combines, designed to boost harvest efficiency and improve operator experience. These new models lay the foundation for future autonomous systems.

- November 2023 : Kubota Corporation (Japan) unveiled its new telematics solution, IsoMatch FarmCentre, at the Agritechnica trade fair. This innovative technology provided farmers with real-time data and insights, enhancing efficiency, productivity, and sustainability in agricultural operations.

Table of Contents

Methodology

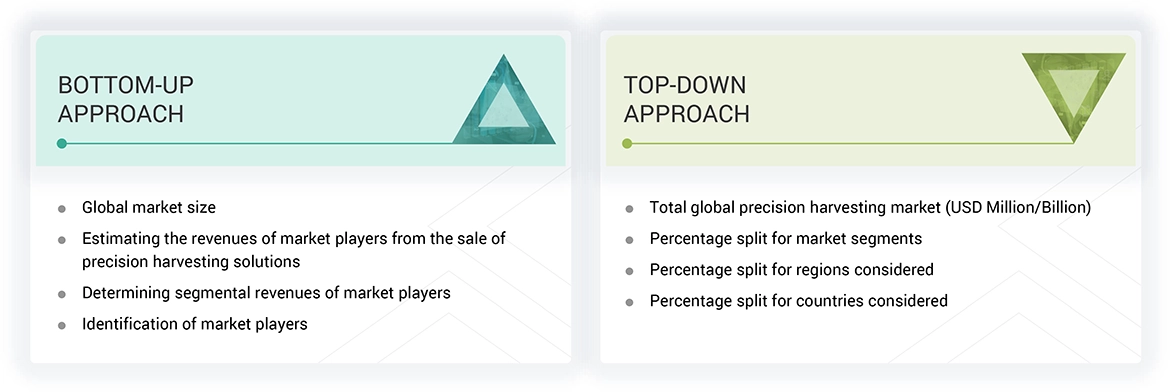

The research study involved four major activities in estimating the size of the precision harvesting market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

The precision harvesting market report estimates the global market size using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

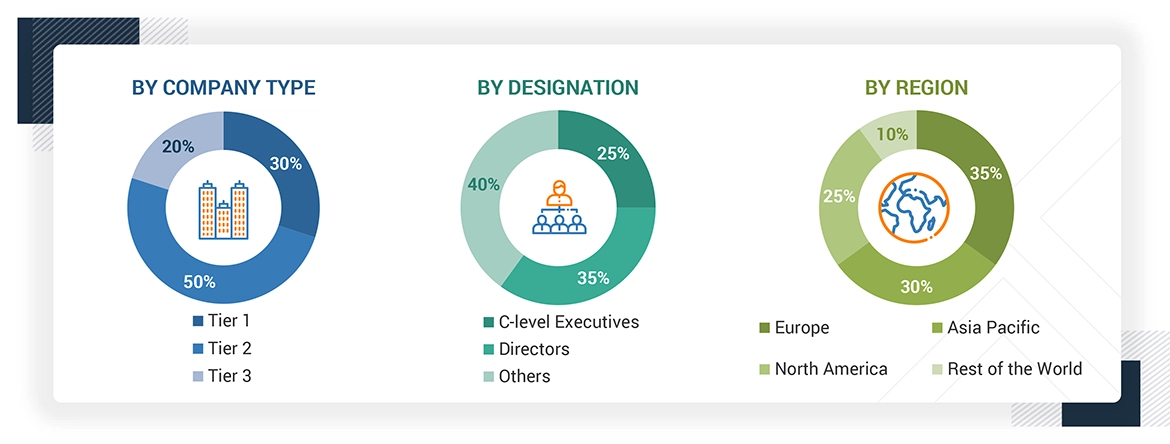

Extensive primary research has been conducted after understanding the precision harvesting market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—Americas, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the precision harvesting market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

- Identifying different stakeholders in the precision harvesting market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers in the precision harvesting market and studying their product portfolio

- Analyzing trends related to the adoption of precision harvesting products

- Tracking recent and upcoming market developments, including investments, R&D activities, product launches, expansions, acquisitions, partnerships, collaborations, agreements, and investments, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of precision harvesting

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Precision Harvesting Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall precision harvesting market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Precision harvesting harnesses the tools of modern technology such as GPS, sensors, artificial intelligence, data analysis, and automation in agricultural harvesting. It relates to discovering the best way to harvest crops and the best time to harvest crops to maximize yield, reduce waste, and improve efficiency.

Precision harvesting techniques typically involve unmanned harvesting machines, robotic harvesting arms, yield monitoring devices, and real-time data-supported decision-making tools, providing farmers useful insights on field and crop conditions throughout the season. This approach supports sustainable agriculture by removing the need for labor, reducing costs, and enhancing crop quality.

The precision harvesting industry is segmented based on offering, farm size, application, and region. By offering, the market includes hardware, software, and services. The hardware segment is further divided into harvesters and aftermarket hardware components. The hardware segment is further divided into harvesters and various types of aftermarket hardware components. Moreover, the harvesters are categorized by combine harvesters, self-propelled forage harvesters, and harvesting robots. Steering systems, GPS, yield monitors, robotic arms, sensors, cameras, and various precision components are included in aftermarket hardware. Both software and services target data analysis, field mapping, system running, and user assistance. The technology is embraced by small, medium, and large farms, depending on their capacity and how many resources they have. Many farming activities, such as crop production, horticulture, greenhouses, and specialty farming, use precision harvesting. Similarly, combining hardware, software, and services allows for custom strategies to improve performance, lower the amount of labor used, and boost crop output.

Key Stakeholders

- Original Equipment Manufacturers (OEMs)

- Software & Data Analytics Providers

- Hardware Component Providers

- Government Bodies & Policy Makers

- Research Institutes / Universities

- Farm Operators and Growers

- Leasing and Financing Companies

- Service Providers

- Distributors and Dealers

Report Objectives

- To describe and forecast the overall precision harvesting market, by offering, farm size, and application in terms of value

- To forecast the market for harvester, in terms of volume

- To evaluate the market for four key regions: Americas, Europe, Asia Pacific, and the Rest of the World, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To give a detailed overview of the supply chain of the precision harvesting market ecosystem.

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, expansions, partnerships, collaborations, and agreements in the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies2

- To strategically analyze the impact of the US tariff 2025 on the precision harvesting market.

- To analyze the impact of AI/Gen AI on the precision harvesting market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for Americas, Europe, Asia Pacific, and Rest of the World

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

The impact is as follows:

|

Real-Time Crop Maturity Detection & Optimal Harvest Timing |

9 |

|

Autonomous Harvesting and Navigation Optimization |

8 |

|

Predictive Maintenance of Harvesting Equipment |

7 |

|

Generative AI for Field Planning & Data Simulation |

6 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Precision Harvesting Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Precision Harvesting Market

Kamaljit

Feb, 2019

Kindly inform what is the demand of these agri machines in Punjab/ India for next 5 yrs and how are indigenous/ made in Punjab machines doing in local market? .