Precision Forestry Market Size, Share & Trends

Precision Forestry Market by Harvesters & Forwarders, UAVs/Drones, RFID and Sensors, Variable Rate Controllers, Smart Harvesting/CTL, Fire Detection, Inventory & Yield Monitoring, Geospatial and Harvesting & Operations - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The precision forestry market is projected to reach USD 4,701.07 million by 2030 from USD 3,540.3 million in 2025, at a CAGR of 5.8%. The growth of the precision forestry market is driven by increasing adoption of advanced technologies, sustainable forestry practices, and AI-enabled solutions that enhance efficiency, productivity, and carbon management.

KEY TAKEAWAYS

-

BY OFFERINGThe precision forestry market, by offering, is segmented into hardware, software, and services. The hardware segment holds the larest market share in 2024, due to the need for high-value equipment for harvesting, monitoring, and forest data collection.

-

BY TECHNOLOGYThe precision forestry market, by technology, is segmented into smart harvesting/CTL, inventory & yield monitoring, fire detection, geospatial, IoT, robotics & sensors, and other technologies. The smart harvesting/CTL segment is expected to experience the highest CAGR during the forecast period, driven by the growing adoption of automated harvesting machinery and data-driven systems that improve efficiency, accuracy, and sustainability in forest operations.

-

BY APPLICATIONThe precision forestry market, by application, is segmented into forest management & planning, harvesting & operations, silviculture, fire management & detection, inventory & logistics management, environmental & conservation, reforestation & afforestation, pest & disease management, soil testing, wildlife habitat management, genetics, and other applications. The harvesting & operations segment held the largest market share in 2024, driven by the widespread use of advanced mechanized equipment and digital tools that improve timber extraction efficiency, reduce costs, and enhance overall operational productivity.

-

BY SYSTEM ARCHITECTUREThe precision forestry market, by system architecture, is segmented into fixed/stationary systems and mobile/handheld systems. The fixed/stationary systems segment is projected to register a higher CAGR during the forecast period, driven by increasing deployment of automated monitoring stations, sensor networks, and control systems that enable continuous data collection and enhance operational accuracy in forest management.

-

BY OWNERSHIP TYPEThe precision forestry market, by ownership type, is segmented into industrial forestry companies, commercial forest owners, and small landowners/private forest owners. The industrial forestry companies segment holds the largest market share in 2024, driven by large-scale operations, higher capital investment in advanced technologies, and a strong focus on efficiency, sustainability, and resource optimization across extensive forest areas.

-

BY END USERThe precision forestry market, by end user, is segmented into government agencies, forestry companies, agriculture and farming cooperatives, non-profit organizations, and other end users. The non-profit organizations segment is projected to register the highest CAGR during the forecast period, driven by increasing participation in forest conservation, carbon sequestration initiatives, and biodiversity restoration projects supported by international sustainability programs and environmental funding.

-

BY REGIONThe precision forestry market, by region, is segmented into North America, Europe, Asia Pacific, and Rest of the world (RoW). North America secured the largest market share in 2024, driven by early adoption of advanced forestry technologies, strong government support for sustainable forest management, and the presence of leading market players with well-established digital forestry infrastructures.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including product launches, partnerships, and collaborations. For instance, Deere & Company (US), Ponsse Oyj (Finland), and Komatsu Ltd. (Japan) have entered into a number of agreements and partnership deals to cater to the growing demand for precision forestry solutions across innovative applications.

The precision forestry market is experiencing strong growth, driven by the increasing adoption of advanced technologies, such as AI, remote sensing, GIS, and IoT sensors, to enhance forest productivity, sustainability, and operational efficiency. New developments, including collaborations between equipment manufacturers and software providers, integration of AI-driven analytics, and the use of unmanned aerial vehicles for forest monitoring and data collection, are transforming the forestry industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the precision forestry market arises from evolving needs and industry disruptions. Forestry companies, government agencies, and non-profits increasingly adopt automation, AI-driven analytics, and IoT-enabled monitoring to improve efficiency, sustainability, and forest management outcomes. These changes drive demand for advanced hardware, software, and services, shaping the market’s growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of remote sensing and GIS technologies

-

Rising requirement for sustainable forestry practices

Level

-

High initial investment and operational costs

-

Geographical and environmental limitations

Level

-

Inclination toward AI-driven predictive analytics for forest management

-

Integration of blockchain technology to ensure transparency in wood supply chain

Level

-

Limited awareness of benefits offered by precision forestry solutions

-

Delayed ROI in precision forestry technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of remote sensing and GIS technologies

The precision forestry market is driven by growing adoption of remote sensing and GIS technologies, enabling real-time monitoring, mapping, and analysis of forest resources. These tools improve decision-making, optimize resource use, enhance operational efficiency, and support sustainable forest management, driving increased demand across forestry companies, government agencies, and conservation organizations.

Restraint: High initial investment and operational costs

The precision forestry market faces restraint due to the high initial investment required for advanced machinery, IoT devices, drones, and GIS-enabled systems. Additionally, operational costs for maintenance, software updates, and skilled personnel add to the financial burden, particularly for small and medium-sized forest owners, limiting widespread adoption.

Opportunity: Inclination toward AI-driven predictive analytics for forest management

The precision forestry market presents significant opportunity with the growing inclination toward AI-driven predictive analytics. By leveraging artificial intelligence, forestry companies and agencies can forecast tree growth, detect disease outbreaks, optimize harvesting schedules, and manage resources more efficiently. This enhances operational efficiency, reduces losses, and promotes sustainable forest management, driving adoption of advanced analytics solutions globally.

Challenge: Limited awareness of benefits offered by precision forestry solutions

A key challenge for the precision forestry market is the limited awareness among forest owners, small-scale operators, and other stakeholders regarding the benefits of precision forestry solutions. This lack of understanding slows adoption of advanced technologies such as drones, AI analytics, and IoT-enabled monitoring, restricting market growth and delaying the realization of operational efficiency and sustainability gains.

Precision Forestry Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Stora Enso (Finland) introduced its precision forestry program to overcome inefficiencies in traditional forest management. Using drones, satellites, LiDAR, and AI-driven harvesting machines, it developed a Digital Twin of its forests, enabling real-time data collection, precise mapping, and informed decision-making for sustainable and efficient forestry operations. | The precision forestry program improved Stora Enso’s resource efficiency, biodiversity management, and sustainability performance | Real-time data enhanced decision-making | Optimized harvesting and regeneration planning |Reduced operational waste | The initiative demonstrated how advanced digital technologies can modernize forest management, aligning productivity with ecological preservation and long-term sustainability goals |

|

Holmen (Sweden) partnered with AI Sweden (Sweden) and Arboair to implement an AI-driven Precision Forestry platform addressing challenges in biodiversity and forest regeneration. The solution utilized synthetic digital twins to create high-resolution datasets, enabling precise tree-level analysis and enhancing data-driven decision-making for sustainable forest management. | The implementation allowed Holmen to achieve more accurate and timely forest management decisions, improving biodiversity conservation and regeneration planning |The AI-based approach enhanced operational efficiency | It provided scalable analytical capabilities |It showcased how synthetic data and machine learning can transform forestry into a more sustainable and precise practice |

|

Emerson & Sons Logging, Inc. (US) partnered with Deere & Company (US) to modernize its operations through precision forestry technologies. The solution included Intelligent Boom Control (IBC) for enhanced boom precision and TimberMatic Maps for real-time data sharing, route optimization, and efficient logging operation management. | The adoption of Deere & Company’s precision forestry technologies improved operational efficiency, sustainability, and productivity for Emerson & Sons Logging, Inc. | IBC reduced operator fatigue and improved precision | TimberMatic Maps optimized resource use and reduced environmental impact, demonstrating the transformative potential of digital forestry innovations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The precision forestry market ecosystem consists of hardware manufacturers (Deere & Company, Topcon, and Trimble, Inc.) and software providers (Stora Enso, Treemetrics, and Field Truth Inc.). The precision forestry ecosystem relies on hardware manufacturers providing machinery and sensors, while software providers enable data analysis, AI-driven insights, and forest management, together enhancing efficiency, sustainability, and operational optimization.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Precision Forestry Market, By Offering

The software segment in precision forestry is projected to register the highest CAGR due to growing adoption of cloud-based platforms, AI-driven analytics, and IoT-enabled monitoring. These solutions enable real-time data integration, predictive decision-making, and efficient forest management, appealing to industrial, commercial, and non-profit forestry stakeholders globally.

Precision Forestry Market, By Technology

In 2024, the smart harvesting/CTL segment holds the largest share of the precision forestry market, by technology, and continues to dominate throughout the forecasting period. Its widespread adoption is driven by automated harvesting machinery and data-driven systems that enhance operational efficiency, accuracy, and sustainability in forest management activities.

Precision Forestry Market, By Application

In the precision forestry market, the fire management & detection application is expected to register the highest CAGR during the forecasting period, driven by increasing demand for early fire detection systems, automated monitoring, and AI-enabled predictive solutions that enhance forest safety, reduce losses, and support sustainable forest management practices.

Precision Forestry Market, By System Architecture

In 2024, the fixed/stationary systems segment held the largest share of the precision forestry market and is expected to maintain its dominance throughout the forecasting period. This growth is driven by widespread deployment of automated monitoring stations, sensor networks, and control systems that enable continuous data collection and improve operational accuracy in forest management.

Precision Forestry Market, By Ownership Type

In the precision forestry market, the industrial forestry companies segment is expected to register the highest CAGR during the forecasting period, driven by large-scale operations, higher capital investments in advanced technologies, and a strong focus on efficiency, sustainability, and optimized resource management across extensive forest areas.

Precision Forestry Market, By End User

Government agencies accounted for the largest share of the precision forestry market in 2024 due to their active involvement in sustainable forest management, conservation initiatives, and reforestation programs. These agencies widely adopt precision forestry technologies such as remote sensing, GIS, and UAVs to enhance forest monitoring, biodiversity assessment, and resource planning. Additionally, supportive government policies, environmental regulations, and large-scale public investments in forest digitalization further strengthen their dominance in the market.

REGION

Asia Pacific to be fastest-growing region in global precision forestry market during forecast period

The Asia Pacific region is projected to register the highest CAGR in the precision forestry market during the forecasting period due to increasing adoption of advanced forestry technologies, rapid digitalization of forest management, rising investments in sustainable and commercial forestry, and supportive government initiatives promoting carbon management and resource optimization across countries such as China, India, and Japan.

Precision Forestry Market: COMPANY EVALUATION MATRIX

In the precision forestry market matrix, Deere & Company (Star) leads with a strong market share and extensive product footprint, driven by its advanced harvesting machinery, smart forestry equipment, and integrated solutions widely adopted by industrial and commercial forestry operators. Bobcat Company (Emerging Leader) is gaining visibility with its innovative compact equipment and automated solutions for forestry operations, strengthening its position through technological upgrades and niche offerings. While Deere & Company dominates through scale and a diverse portfolio, Bobcat Company shows significant potential to move toward the leaders’ quadrant as demand for efficient, automated, and sustainable forestry solutions continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3,649.8 Million |

| Market Forecast in 2030 (Value) | USD 4,701.7 Million |

| Growth Rate | CAGR of 5.8% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Thousand) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: Precision Forestry Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Industrial Forestry Companies | Competitive profiling of precision forestry solution providers (financials, certifications, hardware/software portfolio) and benchmarking of technology adoption across large-scale forest operations | Identify qualified technology partners, detect gaps in current solution adoption, and highlight opportunities for operational efficiency and sustainable forest management |

| Forestry Equipment Manufacturers | Ecosystem analysis and market adoption benchmarking across industrial, commercial, and smallholder forestry segments; switching cost analysis between traditional and precision forestry systems | Pinpoint areas for automation and digital tool integration, enable targeting of high-growth forestry programs, and identify cross-sector collaboration opportunities |

| Software Providers | Technical and operational benefits of AI-driven analytics, GIS (Geographic Information System), and IoT-enabled forest management platforms; forecast adoption of predictive analytics and smart harvesting solutions | Strengthen positioning in next-gen forest management platforms, identify long-term opportunities in AI and automation, and support entry into sustainable forestry solutions ecosystem |

| Hardware Suppliers | Global and regional production capacity benchmarking for harvesters, forwarders, drones, and sensor systems; mapping of new equipment launches and certifications; customer profiling across forestry companies and cooperatives | Strengthen forward integration, identify high-demand end users for long-term contracts, and assess supply-demand gaps for competitive advantage |

| Government Agencies & Non-profit Organizations | Policy, funding, and sustainability program mapping; competitive benchmarking of technology adoption in conservation and reforestation projects | Support backward integration into policy-driven initiatives, identify future applications for carbon monitoring and biodiversity programs, and secure early-mover advantage in sustainable forestry projects |

RECENT DEVELOPMENTS

- September 2025 : Komatsu Forest introduced the 951XC-1 harvester, offering enhanced stability, eight-wheel drive, and an advanced operator-focused design for accurate and efficient forestry operations. This launch promotes precision forestry by boosting productivity and operational control, even in challenging terrains.

- June 2025 : Deere & Company (US) introduced its H Series forestry machines, comprising harvesters and forwarders, with upgraded booms, Intelligent Boom Control, enhanced serviceability, and longer service intervals, delivering higher productivity and fuel efficiency. The series also improves operator comfort, visibility, and stability, ensuring more efficient forestry operations.

- February 2024 : Ponsse Oyj collaborated with Tamtron Group Plc to integrate Tamtron’s One Timber weighing link into its new crane scale system, improving timber handling precision and efficiency. This partnership enables real-time data collection and operational optimization, supporting the adoption of precision forestry practices.

Table of Contents

Methodology

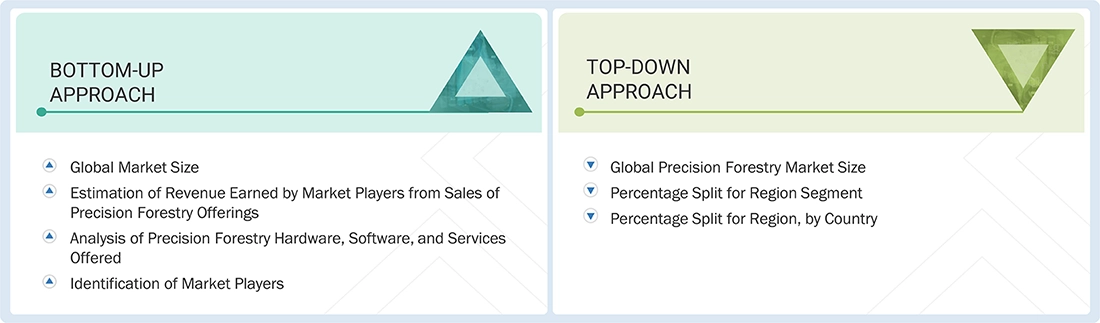

The study involved major activities in estimating the current size of the precision forestry market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the supply chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Following this, market breakdown and data triangulation methods were employed to determine the market size of each segment and its subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the precision forestry market.

Secondary Research

Secondary research for this study involved gathering information from various credible sources, such as company reports, white papers, journals, and industry publications. This process helped in understanding the supply and value chains, identifying key players, analyzing market segmentation and regional trends, and tracking major market and technology developments. The data collected was used to estimate the overall market size, which was later validated through primary research.

Primary Research

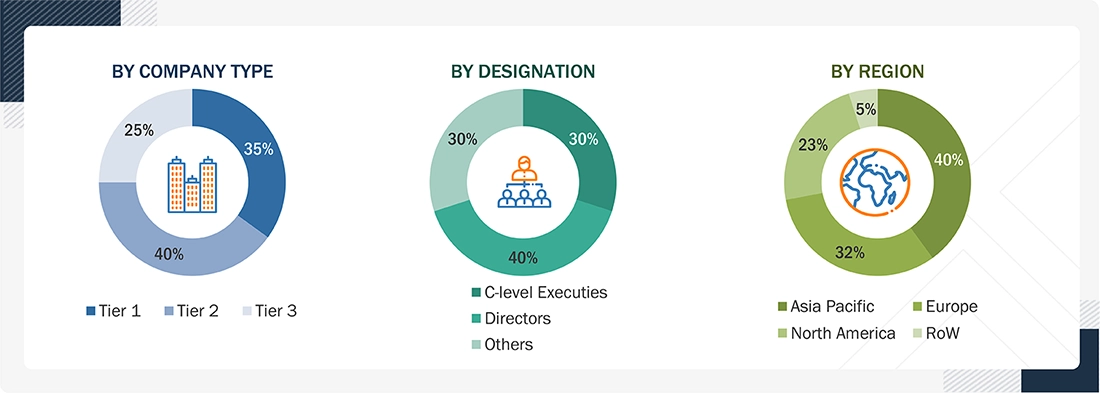

Extensive primary research was conducted after gaining knowledge about the current scenario of the precision forestry market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions: North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephone interviews.

Notes: RoW mainly comprises the Middle East, Africa, and South America.

Other designations include product managers, sales managers, and marketing managers.

Three tiers of companies have been defined based on their total revenue as of 2024: Tier 3, with revenue less than USD 500 million; Tier 2, with revenue between USD 500 million and 1 billion; and Tier 1, with revenue more than USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, were used to estimate and validate the size of the precision forestry market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

Approach to arrive at market size using bottom-up analysis (demand side):

- Identified major companies in the precision forestry market who are technology providers, equipment manufacturers, software developers, and consulting/service providers across the supply chain

- Analyzed the total revenue and key offerings, including hardware products such as harvesters & forwarders, UAVs/drones, GPS/GNSS devices, cameras, RFID devices, sensors, variable rate controllers, along with software solutions and services, offered by the key players

- Understood the segmental revenue and scope revenue of the key players

- Arrived at the global precision forestry market size by adding the scope revenue of the key players in the market

- Studied the trend of precision forestry adoption across ownership types, applications, and regions, based on products, technologies, and end users

- Tracked recent market developments, including technology upgrades, strategic collaborations, product launches, facility expansions, and developments of key players, to forecast market size and growth trends accurately

- Conducted multiple discussions with key opinion leaders across equipment manufacturers, forestry companies, service providers, and regulatory authorities to understand real-time adoption dynamics, operational challenges, and the shift toward data-driven, automated, and sustainable forest management practices

- Validated market estimates through in-depth consultations with industry experts, from R&D heads of leading forestry technology providers to forest management officers and technical advisors, ensuring alignment with domain insights for robust and accurate market projections

Approach to arrive at market size using top-down analysis (supply side):

- Estimated the global precision forestry market size by aggregating revenue from key players of the precision forestry market

- Breaking down the global market into regional segments (North America, Europe, Asia Pacific, and RoW (Middle East & Africa, South America)) based on forest acres, adoption rate, and growth potential

- Further segmented each region into country-level markets, analyzed adoption trends, technology penetration, and operational scale for precision forestry

- Evaluating regional and country-specific drivers, restraints, and regulatory frameworks to refine market sizing and ensure accuracy in regional forecasts

- Cross-verifying market projections with historical trends, government policies, and expert insights to ensure consistency and reliability in forecasting from global to country-level

Precision Forestry Market: Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was classified into several segments and subsegments. To complete the entire market engineering process and obtain precise statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed as applicable. The data was triangulated by examining various factors and trends from both the demand and supply sides of the precision forestry market.

Market Definition

The precision forestry market refers to the industry focused on the adoption and integration of advanced digital and automation technologies to improve the accuracy, efficiency, and sustainability of forest management operations. It involves the application of technologies such as smart harvesting/CTL, inventory and yield monitoring, fire detection, geospatial, IoT, robotics, and sensors to collect and analyze real-time forest data. These technologies support key functions including forest mapping, growth assessment, resource planning, harvesting optimization, and risk management. Overall, the precision forestry market enables data-driven decision-making to enhance timber productivity, reduce operational costs, promote sustainable forestry practices, and ensure environmental preservation.

Key Stakeholders

- Forest owners and landholders

- Forestry companies

- Government agencies and regulatory bodies

- Technology providers

- Equipment manufacturers

- Software developers

- Research and academic institutions

- Consulting and service providers

- Environmental and conservation organizations

- Investors and financial institutions

- Supply chain partners

- End users

Report Objectives

- To describe and forecast the precision forestry market by offering, application, technology, ownership type, system architecture, end user, and region, in terms of value

- To describe and forecast the precision forestry market for harvesters & forwarders, in terms of volume

- To forecast the market size for various segments across the main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide industry-specific information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the precision forestry market

- To study the complete supply chain and related industry segments for the precision forestry market

- To identify key precision forestry equipment manufacturers and analyze their product offerings in the market

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To analyze trends/disruptions impacting customer business; pricing analysis; patents analysis; trade analysis (export and import scenario); tariff and regulatory landscape; Porter's five forces analysis; case studies; investment and funding scenario; key stakeholders and their buying criteria; technology analysis; ecosystem mapping; impact of artificial intelligence; impact of 2025 US tariff; and key conferences and events related to the precision forestry market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position regarding ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as product launches/enhancements, expansions, partnerships, collaborations, and research and development (R&D) activities carried out by players in the precision forestry market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Precision Forestry Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Precision Forestry Market