Virtual Production Market Size, Share & Trends

Virtual Production Market by Hardware, Software, Rental Services, Pre-production, Production, Post-production, Movies, Television Series, Commercial Advertisements, Online Videos, Events, Theatres, Music Concerts - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The virtual production market is projected to grow from USD 2.10 billion in 2025 to USD 8.76 billion in 2030, at a CAGR of 33.1%. Expanding use of large-scale LED volumes for in-camera VFX and rising adoption of AI-driven real-time rendering are the major factors driving market growth. In addition, expansion into corporate storytelling, education, and virtual training, and rising adoption of cloud-based virtual production workflows enabling remote collaboration will provide ample opportunities for market players.

KEY TAKEAWAYS

-

BY OFFERINGThe market is segmented into hardware, software, and rental services. Hardware held the largest market share in 2024, driven by the growing adoption of advanced cameras, LED walls, and real-time graphics processing systems. The rising demand for immersive and high-quality visual effects in media production is accelerating hardware investments.

-

BY TYPEThe market for virtual production is categorized into pre-production, production, and post-production types. The production segment accounts for the largest share, as filmmakers and studios increasingly rely on real-time visualization, on-set virtual environments, and VFX integration to reduce costs and improve efficiency.

-

BY END USERThe market spans movies, television series, commercial advertisements, online videos, and others (events, theaters, and music concerts). Movies dominate the segment, as major studios are adopting virtual production to deliver large-scale, visually rich content while optimizing shooting time and production budgets.

-

BY REGIONAsia Pacific is projected to hold the largest share during the forecast period, supported by rising film production activities in China, India, and South Korea, along with government support for creative industries. The region’s fast adoption of LED stage technology and real-time rendering platforms further strengthens growth.

-

COMPETITIVE LANDSCAPEKey players include Sony Group Corporation (Japan), NEP Group, Inc. (US), Nikon Corporation (Japan), Adobe Inc. (US), and PRG (US). These companies focus on high-resolution imaging systems, LED stage setups, real-time rendering, and integrated production services. Strategic collaborations with studios, streaming platforms, and gaming companies enhance their competitive edge.

The virtual production market is projected to witness robust growth in the coming years, fueled by the rising demand for immersive content and the integration of real-time technologies in filmmaking and media production. Studios and broadcasters are increasingly adopting LED walls, advanced cameras, and real-time rendering engines to streamline workflows, reduce production costs, and enhance creative flexibility. The surge in demand for high-quality content from streaming platforms, coupled with rapid technological advancements in visualization and VFX, is further accelerating adoption. Virtual production is becoming a transformative force in the global entertainment and media landscape due to its ability to optimize production efficiency, enable remote collaboration, and enhance storytelling.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The virtual production industry is experiencing a significant transformation as the film, television, and content creation industries transition from traditional production methods to immersive, real-time, and LED-based virtual production solutions. Increasing investments in LED wall stages, real-time rendering engines, and volumetric capture technologies, combined with rising demand for high-quality content across film, streaming, and gaming sectors, are fueling the adoption of advanced VP solutions. Leading virtual production (VP) solution and rental service providers are offering LED volume stages, Unreal Engine-powered real-time rendering, motion tracking camera systems, and virtual set scouting tools to support diverse applications from previsualization and live performance capture to AR/VR content integration, enhancing creative flexibility, production efficiency, and cost optimization. Major clients, including Walt Disney Studios (US), Sony Pictures Digital Productions (US), Wilder Films (US), Jellyfish Pictures (UK), and Universal Pictures (US), are increasingly leveraging these services, driving market growth. This evolution reflects a broader shift toward digitally integrated production ecosystems, where automation, virtual collaboration, and real-time visualization are critical, creating new opportunities and redefining content creation in a more efficient and visually sophisticated manner.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding use of large-scale LED volumes for in-camera VFX

-

Growing demand from streaming platforms, live events, and advertising beyond traditional film/TV

Level

-

High upfront investment costs

-

Limited pool of professionals skilled in advanced technologies

Level

-

Expansion into corporate storytelling, education, and virtual training

-

Adoption of cloud-based virtual production workflows for remote collaborations

Level

-

Production and Revenue Losses from Unplanned Downtime of Detection Equipment

-

Interoperability issues and lack of standardized protocols

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding Use of Large-Scale LED Volumes for In-Camera VFX

The expanding adoption of large-scale LED volumes for in-camera visual effects (ICVFX) is a major driver of the virtual production market. LED stages allow filmmakers to create immersive, photorealistic environments, reducing reliance on green screens and post-production. They enhance lighting accuracy, reflections, and real-time interaction between actors and digital backdrops, accelerating production while cutting costs. Supported by real-time rendering engines such as Unreal Engine from Epic Games, this technology boosts creative flexibility. With rising adoption in China, Japan, and South Korea, LED volumes are reshaping global content creation and driving market growth.

Restraint: High Upfront Investment Costs

High upfront investment costs remain a key restraint in the virtual production market. Establishing a virtual production setup demands heavy spending on LED volumes, camera tracking systems, rendering engines, and supporting infrastructure. LED walls alone involve costly panels, processors, and calibration tools, making adoption difficult for smaller studios. Ongoing maintenance, upgrades, and the need for skilled staff add further financial pressure. ROI realization is often slow, especially in emerging economies with limited budgets. Despite falling costs, high initial expenditure continues to restrict broader adoption among smaller creators.

Opportunity: Rising Adoption of Cloud-based Virtual Production Workflows Enabling Remote Collaboration

Cloud-based virtual production workflows are creating strong market opportunities by enabling real-time collaboration across dispersed teams. Directors, VFX artists, and crews can work remotely through cloud rendering, asset management, and review platforms, reducing reliance on local hardware. These workflows offer secure storage, scalability, and cost efficiency, minimizing travel and production delays. Hyperscale providers including AWS, Microsoft Azure, and Google Cloud are expanding media-focused solutions, making advanced tools accessible at lower upfront costs. This democratizes virtual production, empowering small and mid-tier studios to adopt high-quality workflows affordably.

Challenge: Production and Revenue Losses from Unplanned Downtime of Detection Equipment

Despite their benefits, LED walls face challenges in color accuracy and brightness, restricting realism in virtual production. They struggle with high-contrast scenes such as daylight, leading to unnatural visuals and greater reliance on post-production fixes. Inconsistent color reproduction across panels may cause mismatched tones or seams, lowering visual fidelity. Technical issues such as moiré patterns, refresh mismatches, and limited viewing angles add complexity. While innovations in microLED and high-brightness panels are improving performance, costs remain prohibitive. Hybrid workflows using LED and CGI persist until panel technology matures further for cinematic-quality results.

Virtual Production Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses large-scale LED volumes and in-camera VFX for blockbuster franchises such as The Mandalorian and Marvel films | Reduces reliance on on-location shoots | Accelerates post-production | Improves creative control with immersive environments |

|

Employs cloud-based virtual production workflows and LED stages for original series and films | Enables remote collaboration | Shortens production timelines | Ensures consistent quality | Lowers global filming costs |

|

Integrates virtual production hardware and rental LED stages for Prime Video originals | Enhances storytelling flexibility | Scales productions efficiently | Reduces the carbon footprint of international shoots |

|

Deploys VP software and LED wall rentals in hybrid productions across films and advertising | Improves cost efficiency | Supports creative experimentation | Enables faster turnaround of high-quality content |

|

Uses VP solutions for television series and live broadcasting | educes set-building costs | Enhances broadcast visuals | Supports more sustainable production workflows |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major players operating in the virtual production companies ecosystem with a significant global presence include Sony Group Corporation (Japan), NEP Group, Inc. (US), Nikon Corporation (Japan), Adobe (US), PRG (US), ROE Visual (US), Autodesk Inc. (US), NVIDIA Corporation (US), Epic Games (US), and Perforce (US). The virtual production ecosystem comprises hardware and software providers, rental service providers, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Virtual Production Market, by Offering

The hardware segment accounted for the largest share in 2024, driven by the rising deployment of advanced cameras, LED walls, and real-time graphics processing systems. These solutions are essential for creating immersive, high-resolution content, enabling filmmakers and studios to achieve realistic environments with greater efficiency. Hardware adoption is further supported by the demand for scalable visual effects in large-scale productions. Meanwhile, software innovations such as real-time rendering engines and workflow management platforms are gaining momentum, particularly with the integration of AI and cloud-based tools. Rental services are also expanding, catering to smaller studios seeking cost-effective access to advanced systems.

Virtual Production Market, by Type

The production segment dominated the market in 2024, as it represents the critical point where virtual environments and real-time visualization converge with live filming. Studios increasingly rely on on-set LED stages, motion capture, and VFX integration during production to accelerate workflows, reduce location costs, and improve creative flexibility. While pre-production benefits from virtual scouting and previsualization tools, and post-production leverages CGI enhancements, the production phase offers the greatest value by minimizing reshoots and aligning creative teams in real time. The adoption of advanced rendering software and AI-driven scene optimization is further strengthening the role of production in virtual workflows.

Virtual Production Market, by End User

The movies segment held the largest share in 2024, supported by widespread adoption of virtual production by major film studios to deliver visually rich and large-scale projects. Virtual environments allow directors to film complex scenes with high realism while significantly reducing shooting time and budgets. Television series are also rapidly embracing these technologies, particularly for episodic content requiring quick turnarounds. Commercial advertising and online video creators are adopting virtual sets to enhance brand storytelling with cost efficiency. Beyond traditional media, events, theatre, and live concerts are increasingly exploring virtual production for immersive, interactive audience experiences and new revenue models.

REGION

Asia Pacific to be fastest-growing region in global virtual production market during forecast period

Asia Pacific is expected to emerge as the fastest-growing region in the virtual production market. The surge in domestic film and OTT content production, particularly in China and India, is creating strong demand for advanced virtual studios and real-time rendering platforms. Government-backed initiatives to support digital media ecosystems, such as China’s push for high-tech filmmaking zones and India’s incentives for VFX and animation, are accelerating adoption. South Korea is leveraging its thriving gaming and K-drama industries to integrate immersive virtual sets, while Japan explores virtual production in anime and live entertainment. Cross-border collaborations and rising investments in LED stage infrastructure further strengthen Asia Pacific’s leadership in this market.

Virtual Production Market: COMPANY EVALUATION MATRIX

In the virtual production market matrix, Sony Group Corporation (Star) leads with its strong market presence, offering advanced digital cinema cameras, LED display technologies, and integrated production solutions. Sony’s end-to-end ecosystem, coupled with its global reach and established partnerships with major studios, positions it as a dominant force driving large-scale adoption of virtual production workflows. NVIDIA (Emerging Leader) is rapidly gaining traction with its AI-powered graphics processing, real-time rendering platforms, and cloud-based collaboration tools. While Sony dominates through hardware excellence and industry relationships, NVIDIA shows strong potential to advance toward the leaders’ quadrant by scaling its GPU-driven innovations and accelerating adoption across film, gaming, and immersive media sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.52 Billion |

| Market Forecast in 2030 (Value) | USD 8.76 Billion |

| Growth Rate | CAGR of 33.1% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (In thousand units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Rest of the World |

WHAT IS IN IT FOR YOU: Virtual Production Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Virtual Production Studios & Content Creation Solutions | • Competitive benchmarking of hardware (LED walls, cameras, tracking systems) and software platforms (real-time rendering engines) • End-user segmentation by application (movies, TV series, commercials, online videos) | • Identify gaps in production technology portfolios • Highlight emerging opportunities in content workflows • Support strategic investments and partnership models for scalability |

| Streaming Platforms | • Analysis of virtual production adoption for streaming content (original series, films, short-form videos) • Benchmarking of production efficiency and cost per project | • Enable content strategy optimization • Identify high-growth content segments - Improve ROI forecasting |

| Hardware & Software Manufacturers | • Competitive benchmarking of LED stage hardware, motion capture systems, and real-time rendering software • Insights into adoption trends across studios, OTT platforms, and live events | • Expand service offerings • Diversify revenue streams • Capture emerging non-film opportunities • Guide R&D and roadmap planning • Strengthen market positioning and strategic partnerships |

| Event Production Companies | • Market mapping for virtual production adoption in live events, concerts, and theater • Analysis of equipment rental vs. ownership models | • Guided R&D, product positioning, and investment decisions. |

| Advertising & Creative Agencies | • Evaluation of virtual production applications for commercials, branded content, and experiential campaigns • End-user and content-type segmentation | • Optimize creative workflows • Enhance campaign quality and speed • Unlock new client engagement opportunities |

RECENT DEVELOPMENTS

- June 2025 : Sony Electronics introduced the Crystal LED CAPRI Series, a cost-effective LED display solution for virtual production. Featuring a 2.5 mm pixel pitch and compatibility with Brompton SX40 processing, the CAPRI series delivers up to 1,500 nits brightness at 7680 Hz, tailored for immersive LED stages with efficient calibration and color matching.

- April 2024 : Disguise released Porta 2.3 Broadcast Platform, a major update supporting Unreal Engine 5.4 integration. The solution allows creators to build and control real-time 3D graphics for virtual production, with offline capability for flexible content management and scheduling both on-site and in the cloud.

- September 2023 : Sony Electronics launched the Crystal LED VERONA Series, a set of advanced LED panels designed for virtual production. Offering true black, anti-reflective surfaces, and brightness levels up to 1,500 nits, the panels enhance in-camera VFX by minimizing unwanted reflections and optimizing color accuracy for film and television production.

- September 2023 : Mo-Sys Engineering launched MultiViewXR, a real-time multi-camera workflow solution for LED volumes. The system enables simultaneous synchronization of multiple tracked camera views, allowing production teams to achieve accurate in-camera compositing across multiple angles during virtual shoots.

- January 2022 : Sony introduced the B-series Crystal LED display, purpose-built for virtual production environments. Developed in close collaboration with Sony Pictures Entertainment, it features high brightness, wide color gamut, and anti-reflection coating, making it ideal for in-camera visual effects.

Table of Contents

Methodology

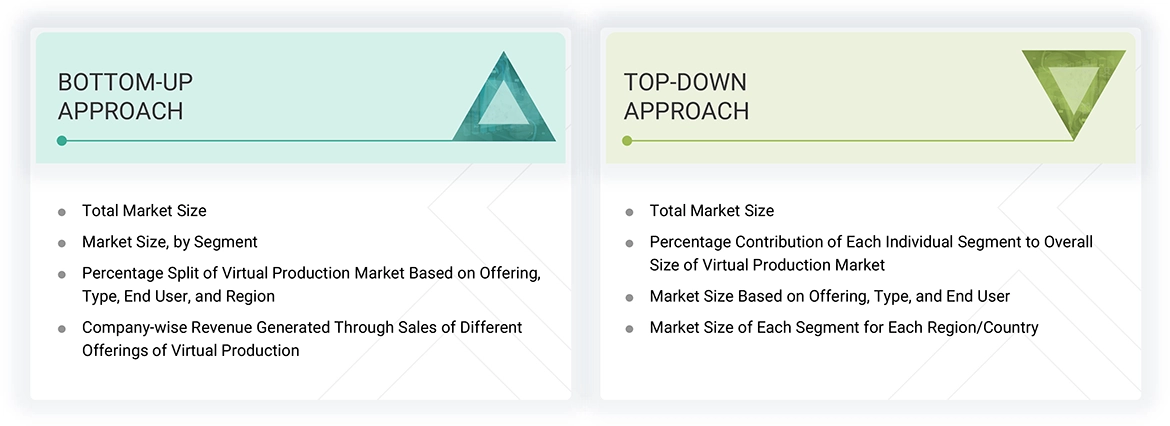

The research study involved four main activities in estimating the size of the virtual production market. Extensive secondary research was conducted to gather important information about the market and related markets. The validation of these findings, assumptions, and sizing was then carried out through primary research with industry experts across the entire value chain. Both top-down and bottom-up approaches were used to estimate the market size. The market segmentation and data triangulation were employed to determine the market sizes of different segments sub-segments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and gather information for this study. These sources include annual reports, press releases, investor presentations, white papers, and articles by reputable authors. The secondary research mainly aimed to gather key information about the market’s value chain, leading market players, market segmentation based on industry trends, regional outlooks, and developments in both market and technology perspectives.

In the virtual production market report, the global market size has been estimated using both top-down and bottom-up approaches, along with several other related submarkets. The major players in the market were identified through extensive secondary research, and their presence was confirmed using both secondary and primary research. All percentage shares, splits, and breakdowns have been determined from secondary sources and verified through primary sources.

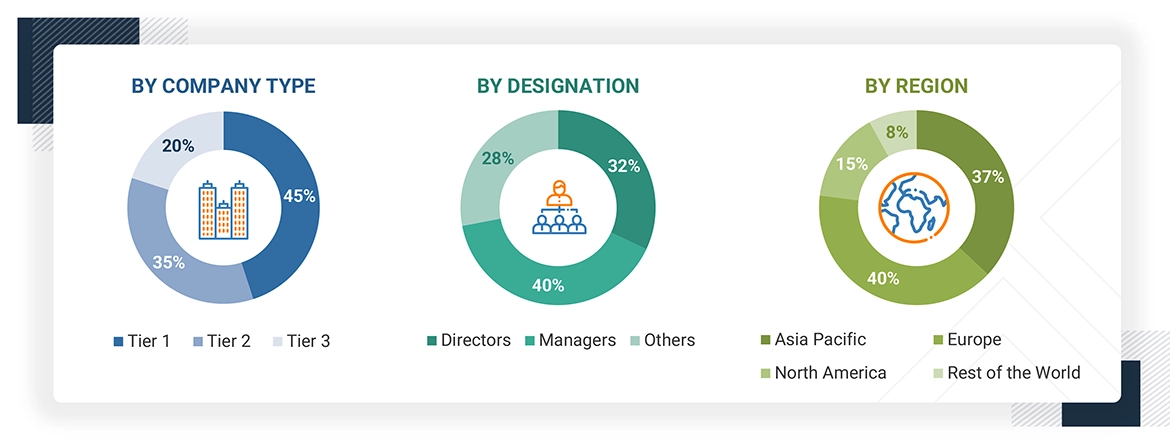

Primary Research

Extensive primary research has been conducted after gaining an understanding of the virtual production market scenario through secondary research. Several primary interviews have been carried out with key opinion leaders from demand- and supply-side vendors across four major regions—Americas, Europe, Asia Pacific, and the Rest of the World. About 25% of the primary interviews have involved demand-side vendors, while 75% have involved supply-side vendors. Most primary data collection has been done through telephonic interviews, accounting for 80% of all primary interviews; questionnaires and emails have also been used to gather information data.

After successful interactions with industry experts, brief sessions were held with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the opinions of in-house subject matter experts, has led us to the findings described in the report.

Note: Others include sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, are used to estimate and validate the size of the virtual production market and other related areas submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and significant market developments

- Identifying different stakeholders in the virtual production market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and rental service providers in the virtual production market and studying their product portfolio

- Analyzing trends related to the adoption of virtual production products

- Monitoring recent and upcoming market developments, including investments, R&D activities, product launches, expansions, acquisitions, partnerships, collaborations, agreements, and investments, as well as projecting the market size based on these developments and other critical factors

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of virtual production

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operations managers, and finally with the domain experts at MarketsandMarkets

Virtual Production Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the estimation process described in the previous section, the virtual production market has been divided into multiple segments and subsegments. To complete the whole market analysis and obtain precise statistics for all segments, data triangulation and market breakdown methods have been applied where suitable. The data has been triangulated by analyzing various factors and trends from both demand and supply perspectives. In addition to data triangulation and market breakdown, the market has been validated through top-down and bottom-up approaches.

Market Definition

The virtual production market includes the ecosystem of technologies, solutions, and services that combine real-time computer graphics with traditional filmmaking methods to create a seamless blend of physical and digital worlds in content creation. Instead of using conventional green screens, virtual production employs LED walls or volumes, where hyper-realistic, computer-generated environments respond dynamically to camera movements, enabling directors and cinematographers to capture final-quality shots during filming.

The virtual production market is divided based on offering, type, end user, and region. By offering, it includes hardware, software, and rental services. Hardware consists of LED volumes, advanced cameras, and motion capture systems that form the main infrastructure of immersive workflows, while software features real-time rendering engines, tracking solutions, and editing platforms that seamlessly combine digital and physical elements. Rental services increase access by offering short-term use of high-cost equipment to smaller studios and independent creators. By type, the market is categorized into pre-production, production, and post-production. Pre-production is gaining popularity with tools like virtual location scouting, digital set design, and pre-visualization, which enable cost savings and creative flexibility. The production phase holds the largest share, driven by the use of LED walls, real-time rendering, and tracking systems that reduce reshoots and speed up filming schedules. Post-production also benefits from virtual workflows through real-time editing, VFX integration, and collaborative pipelines. By end user, the market includes movies, television series, commercial advertisements, online videos, and others, such as live events, theater, and concerts. Movies lead the market due to extensive VP adoption in blockbuster filmmaking. Television series are quickly increasing their use to meet the demand for cinematic-quality episodic content, while advertising, online videos, and live entertainment segments are increasingly using VP for faster turnaround and immersive experiences.

Key Stakeholders

- System Integrators

- Original Equipment Manufacturers (OEMs)

- Integrated Device Manufacturers (IDMs)

- Original Design Manufacturers (ODMs)

- Content Studios and Production Houses

- Suppliers and Distributors

- Governments and Other Regulatory Bodies

- Research Institutes and Organizations

- Market Research and Consulting Firms

Report Objectives

- To describe and forecast the size of the virtual production market based on offering, type, and end user in terms of value

- To describe and forecast the size of the market based on hardware offerings in terms of value and volume

- To describe and forecast the size of various segments of the market for four main regions, namely, North America, the Asia Pacific, Europe, and the Rest of the World, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete supply chain and related industry segments and perform a supply chain analysis of the market landscape

- To strategically analyze the ecosystem, Porter’s Five Forces, key stakeholders & buying criteria, technology analysis, key conferences & events, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To analyze the impact of AI/Gen AI and the impact of the 2025 US tariff on the virtual production market.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities for the stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the market

- To analyze strategic approaches adopted by the leading players in the market, including product launches/developments and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, the Asia Pacific, and the Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the global virtual production market size in 2024, and at what CAGR will it grow during the forecast period?

The virtual production market is 2.10 billion in 2025 and is projected to reach USD 8.76 billion by 2030, at a CAGR of 33.1% from 2025 to 2030.

Who are the key players in the global virtual production market?

Sony Group Corporation (Japan), NEP Group, Inc. (US), Nikon Corporation (Japan), Adobe (US), and PRG (US) are the key market players.

Which region is expected to hold the largest market share and why?

North America is expected to dominate the virtual production market in 2025, thanks to its well-established film, television, and streaming industries, along with widespread adoption of advanced production technologies. The US, in particular, leads investment in LED volume stages, real-time rendering engines, motion tracking systems, and volumetric capture technologies. A strong studio presence, favorable infrastructure, and government incentives for digital media production further promote adoption. Additionally, collaboration between hardware and software providers, along with high demand for immersive content, supports ongoing growth in the region.

What are the primary forces fueling growth and the significant opportunities within the virtual production market?

The virtual production market is growing due to increased use of large-scale LED volumes for in-camera VFX, rising demand from streaming platforms, live events, and advertising outside of traditional film and TV, and greater adoption of AI-powered real-time rendering. Advances in real-time engines, motion tracking, and volumetric capture are opening new opportunities in film, TV, streaming, gaming, and live events. These innovations allow for faster production schedules, lower costs, and more immersive visual experiences, fueling market growth.

What are the prominent strategies adopted by market players?

The key players have adopted product launches, acquisitions, collaborations, partnerships, investments, agreements, and expansions to strengthen their position in the virtual production market.

What is the impact of Gen AI/AI on the virtual production market on a scale of 1–10 (1 - least impactful and 10 - most impactful)?

The impact is as follows:

|

AI-Driven Real-Time Scene Rendering and Environment Generation |

9 |

|

Generative AI for Script-to-Scene Pre-Visualization |

8 |

|

Automated Camera Tracking and Intelligent Shot Composition |

7 |

|

Enhanced Post-Production with AI-Powered VFX and Editing |

6 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Virtual Production Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Virtual Production Market