Healthcare BPO Market: Growth, Size, Share, and Trends

Healthcare BPO Market by Size, Share, Trends by Outsourcing Models, Life Science (R&D, Manufacturing, Supply Chain, Sales & Marketing (Analytics)), Provider (Patient Care, RCM), Payer (Claims Management, Billing & Accounts), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global healthcare BPO market is projected to reach USD 694.35 billion by 2030, up from USD 417.68 billion in 2025, growing at a CAGR of 10.7% during the forecast period. The growth of this market is primarily driven by rising cost-control pressures, transitions to ICD-10 and upcoming ICD-11 standards, expanding outsourcing in pharma and biopharma, and the shortage of skilled in-house professionals.

KEY TAKEAWAYS

- The North America healthcare BPO market accounted for a 51.4 % revenue share in 2024.

- By life sciences service, the R&D segment is expected to register the highest CAGR of 11.0%.

- By payer service, the Product Development & Business Acquisition segment is projected to grow at the fastest rate of 14.1% from 2025 to 2030.

- By provider service, the Revenue Cycle Management segment is expected to dominate the market.

- Accenture plc.,Cognizant Technology Solutions Corporation, WNS, and Tata Consultancy Services Limited were identified as some of the star players in the healthcare BPO market, given their strong market share and product footprint.

- Invensis Technologies, Access Healthcare, Vee Healthtek, Inc, and AGS Health LLC, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The healthcare BPO market is expanding steadily, driven by rising adoption of ICD-10 and the impending ICD-11 coding standards, increased outsourcing by pharmaceutical and biopharmaceutical companies, growing demand for claims processing, medical billing, and revenue cycle management, and the shortage of in-house coding and compliance specialists. Recent developments, including strategic collaborations between healthcare providers and BPO vendors, investments in AI-driven automation and data analytics, and the adoption of cloud-based platforms and robotic process automation (RPA), are transforming the competitive landscape and further reshaping operational efficiency and cost structures.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers' customers emerges from evolving healthcare trends and technological disruptions. Healthcare providers, payers, and pharmaceutical companies are clients of service providers. Key shifts towards AI-powered automation, intelligent revenue cycle management, integrated service delivery, and technology-enabled solutions are transforming client operations. As clients prioritize outcome-based pricing and end-to-end transformation, healthcare BPO providers must evolve from traditional labor arbitrage to technology-enabled, multi-service platforms delivering predictive, proactive intelligent operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Pressure to reduce the rising healthcare cost

-

Shift to ICD-10 coding standards and upcoming ICD-11 standards

Level

-

Concerns related to losing visibility and control over the business process

-

Hidden outsourcing costs

Level

-

Advanced data analytics

-

Growing adoption of artificial intelligence-based tools for drug discovery

Level

-

Data security concerns

-

Limitations in data capturing process in Medicaid services

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift to ICD-10 coding standards and upcoming ICD-11 standards

The US mandated ICD-10 implementation under HIPAA by October 2015, expanding codes from 13,000 diagnoses and 11,000 procedures in ICD-9 to ~68,000 diagnoses and 72,000 procedures, increasing coding complexity. This drove demand for skilled medical coders, HR, accounting, and technical support, with outsourcing favored due to insufficient in-house expertise. ICD-10 addressed ICD-9’s limitations, enabling precise coding essential for reimbursement and claims processing, making BPO providers critical partners. With ICD-11 approved by WHO in 2019 and effective from January 2022, healthcare organizations are preparing for another transition, incorporating new diagnoses and refined criteria. BPO firms are investing in training, technology, and infrastructure, positioning themselves to support ICD-11 adoption, further boosting the global healthcare BPO market.

Restraint: Concerns related to losing visibility and control over the business process

While offshoring business processes can offer cost savings, healthcare organizations often hesitate due to potential loss of visibility and control. Outsourcing may reduce oversight of daily operations, raising concerns about work quality, adherence to standards, and service consistency. Vendor goals may not fully align with clients, affecting accuracy, flexibility, and timeliness. Sensitive patient data shared with third-party providers also increases risks of breaches, regulatory violations, and reputational damage, as seen in 145 reported healthcare data breaches in early 2023. Fragmented communication can cause misunderstandings, delays, and misalignment of expectations. Even with customized solutions, discrepancies between BPO providers and clients are common, making the potential loss of control a significant deterrent to outsourcing healthcare processes.

Opportunity: Growing adoption of artificial intelligence-based tools for drug discovery

Artificial intelligence (AI) and machine learning (ML) are transforming drug discovery by increasing efficiency and improving early-stage success rates. AI algorithms can rapidly analyze vast datasets to identify potential drug candidates, while deep learning generates molecules targeting specific diseases with minimal side effects. This has driven adoption of AI by pharmaceutical and biotech companies, accelerating development of treatments for chronic diseases like cancer and reducing time-to-market. Collaborations between pharma firms and AI-driven companies are increasing, enhancing drug design and discovery. Notable milestones include FDA orphan drug approval for an AI-discovered medication, AI-created antibodies by AbSci, and Insilico Medicine initiating Phase I trials for an AI-identified molecule—achievements achieved faster and at lower cost than traditional methods, boosting the healthcare BPO and CRO markets.

Challenge: Global isotope supply chain instability

Healthcare data, including patient records, treatment histories, and insurance information, is highly sensitive and valuable, making healthcare organizations and BPO firms prime targets for cyberattacks. Threats such as ransomware, malware, phishing, and insider attacks can disrupt operations, compromise data integrity, and result in identity theft, financial fraud, legal liabilities, and reputational damage. In 2023, the healthcare sector experienced a record 725 major breaches, compromising 133 million records, a 156% increase over 2022. Contributing factors include inadequate internal controls, outdated policies, insufficient management support, and lack of personnel training. These challenges heighten concerns over patient privacy, requiring stricter compliance, enhanced cybersecurity, secure communication platforms, and increased operational investment, significantly impacting the healthcare BPO market.

Healthcare BPO Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Services spanning claims, member, and provider management, population health, and life sciences, leveraging digital workflows and automation. | Enhanced operational efficiency and claims accuracy, faster turnaround, streamlined care coordination, and accelerated biopharma growth. |

|

Services leveraging AI, automation, and managed digital platforms across enrollment, claims, provider data, revenue cycle management, virtual health, pharmacy benefits, and life sciences | Faster processing, improved accuracy, enhanced patient/provider experience, regulatory compliance, and accelerated life sciences outcomes. |

|

Utilizing Cognitive assistants, pharmacovigilance, clinical data management, medical writing, genomics research, and advisory services to optimize data management and operational workflows across healthcare, pharma, diagnostics, and medical device sectors. | Reduced administrative costs, improved data accuracy, streamlined operations, and accelerated R&D outcomes. |

|

Healthcare provider, payer, and life sciences BPO services leveraging digital CX, revenue cycle management, clinical programs, member services, analytics, and business transformation to optimize operations | Improved financial outcomes, faster claims/billing, enhanced regulatory compliance, streamlined operations, and increased commercial effectiveness. |

|

End-to-end Pharmaceutical, Life Sciences, Healthcare, Medical Device, and Payer BPO solutions leveraging predictive analytics, digital platforms, clinical and operational services, revenue cycle management, patient engagement, and compliance frameworks | Enhanced clinical/operational outcomes, improved financial performance, faster claims/billing, better patient/provider engagement, and streamlined diagnosis/treatment. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The healthcare BPO market ecosystem includes data center providers, cloud service vendors, contract research and manufacturing organizations, medical institutions, healthcare providers and payers, government regulators, medical device companies, pharmaceutical firms, and consultants. Healthcare BPOs deliver intelligent health operations that enhance patient outcomes, reduce costs, increase engagement, and offer tailored applications. Vendors provide access to skilled professionals and large technical teams at lower costs, leveraging advanced technologies such as AI, ML, analytics, and cloud to drive efficiency and productivity. Key strategies include partnerships, collaborations, and agreements, enabling end-to-end solutions across healthcare operations and services for diverse clients.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Healthcare BPO Market, by Life Science Service

In 2024, the manufacturing segment held the largest share of the healthcare BPO market for life science services, driven by cost savings, regulatory compliance, and expertise in life sciences. Pharmaceutical companies increasingly outsource functions like API production, formulations, and packaging to contract manufacturing organizations (CMOs) to reduce costs, accelerate drug development, and maintain quality. BPO providers offer specialized knowledge, advanced facilities, and regulatory support, enabling faster time-to-market while ensuring safety. The combination of cost pressures, regulatory complexity, and demand for efficient drug development solidifies manufacturing services as the dominant segment.

Healthcare BPO Market, by Payer Service

In 2024, the claims management service segment held the largest share of the healthcare BPO market for payers. These services encompass the entire claims lifecycle, including filing, verification, assessment, negotiation, settlement, investigation, and dispute resolution. Outsourcing claims management helps payers reduce operational costs, improve turnaround times, minimize errors, and enhance customer satisfaction. BPO providers bring expertise, advanced technologies, and scalability to handle complex, high-volume claims efficiently.

Healthcare BPO Market, by Provider Service

In 2024, the revenue cycle management (RCM) segment dominated the healthcare provider BPO market, driven by increased outsourcing of medical billing and coding due to limited in-house expertise. RCM manages administrative and clinical functions across the entire patient account lifecycle, from appointment scheduling to final payment. It encompasses claim submission, follow-up, billing, and coding. Electronic medical records streamline these processes, improving accuracy. Outsourcing provides access to skilled coders, ensures regulatory compliance, reduces operational costs, and allows providers to focus on core patient care, making RCM outsourcing a strategic, efficient, and scalable solution for healthcare organizations.

REGION

Asia Pacific to be fastest-growing region in global healthcare BPO market during forecast period

The Asia-Pacific region is the fastest-growing healthcare BPO market, driven by increasing outsourcing of clinical and non-core functions like finance, accounting, and customer service to improve efficiency and reduce errors. Rising health insurance demand, cost-containment needs, and pharmaceutical challenges such as patent expirations are fueling adoption. Countries such as India, the Philippines, Singapore, and Malaysia are emerging as key outsourcing and medical tourism hubs. Healthcare organizations leverage BPO to streamline revenue cycle management, minimize claims denials, and enhance operational agility. The integration of big data, cloud computing, and robotic process automation (RPA) is transforming healthcare BPO into a more scalable, intelligent, and compliant model across the Asia Pacific region.

Healthcare BPO Market: COMPANY EVALUATION MATRIX

In the healthcare BPO market, Accenture Plc (Star) maintains a leading position, leveraging its extensive global presence, deep industry expertise, and comprehensive service offerings across claims management, member and provider services, utilization management, and population health programs. Its strategic acquisitions, including consus.health and Health Unlimited, enhance its digital transformation capabilities, AI-driven insights, and patient-centric solutions across Europe and the UK. Accenture’s integrated approach combines operational efficiency, clinical and administrative expertise, and advanced analytics, enabling improved outcomes for providers, payers, and patients alike. IQVIA (Emerging Leader) is gaining recognition through its Technology & Analytics and R&D solutions, offering flexible, data-driven healthcare BPO services. Collaborations with NVIDIA and Argenx underscore its focus on AI, real-world evidence, and innovative pharmacovigilance solutions, positioning IQVIA to expand its influence in global life sciences and healthcare operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Accenture plc (Ireland)

- Cognizant Technology Solutions Corporation (US)

- Tata Consultancy Services (India)

- Conduent Incorporated (US)

- WNS (Holdings) Limited (India)

- NTT DATA Group Corporation (Japan)

- Iqvia Holdings Inc. (US)

- Mphasis (India)

- Genpact Limited (US)

- Wipro Limited (India)

- Infosys BPM (India)

- Firstsource Solutions Limited (India)

- International Business Machine Corporation (US)

- GeBBS (US)

- Capgemini SE (France)

- UnitedHealth Group (US)

- HCL Technologies Limited (India)

- Parexel International (MA) Corporation (US)

- Sutherland Global (US)

- Omega Healthcare Management Services (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 377.65 Billion |

| Market Forecast in 2030 (value) | USD 694.35 Billion |

| Growth Rate | CAGR of 10.7% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Healthcare BPO Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape |

|

Enables competitive benchmarking, identification of technology and portfolio gaps, and strategic planning for partnership opportunities |

RECENT DEVELOPMENTS

- March 2025 : WNS (Holdings) Limited acquired Kipi.ai. Kipi.ai offers end-to-end capabilities, including strategy, execution, and managed services across data engineering, advanced analytics, and data science. The company primarily serves US-based clients and brings deep domain expertise in sectors such as banking and financial services, insurance, manufacturing and retail, high tech and professional services, as well as healthcare and life sciences.

- February 2025 : Cognizant Technology Solutions Corporation announced a three-year strategic partnership with Upsource by Solutions, a leading business process outsourcing (BPO) provider in Saudi Arabia. This collaboration combines Upsource’s extensive local expertise with Cognizant’s global capabilities to enhance operational efficiency and deliver exceptional customer satisfaction for clients in the region. Through this partnership, businesses across the region will gain access to Cognizant’s advanced Intuitive Operations & Automation (IOA) solutions, including a Gen AI-powered financial suite, automation frameworks, and improved operational controls.

- January 2025 : IQVIA collaborated with NVIDIA Corporation to help realize the potential of AI in healthcare and life sciences. The collaboration will combine IQVIA’s unparalleled information assets, analytics, and domain expertise, known as IQVIA Connected Intelligence, with the NVIDIA AI Foundry service to help transform life science processes from R&D through commercialization.

Table of Contents

Methodology

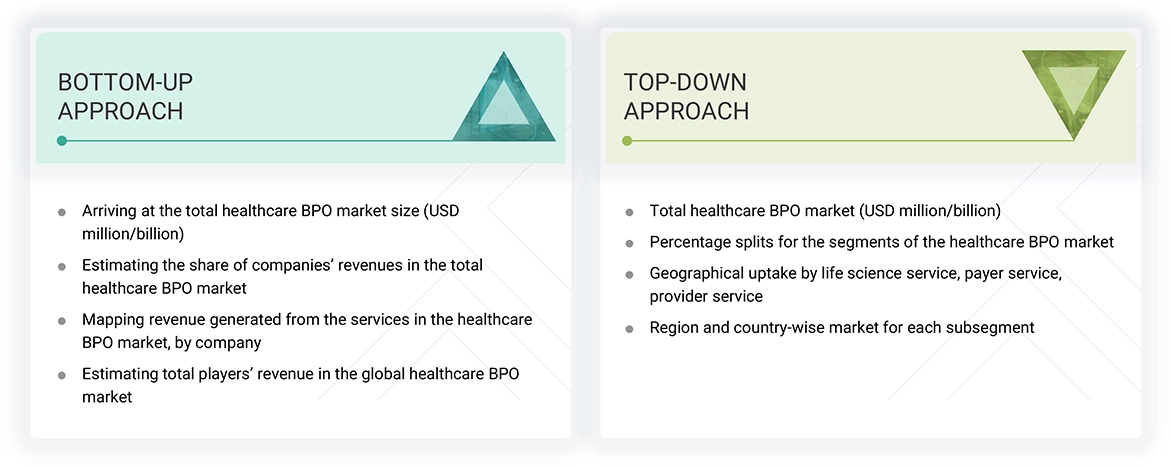

The study consisted of four key activities to estimate the current size of the healthcare BPO market. Comprehensive secondary research was conducted to gather information on the market and its various subsegments. The next step involved validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation procedures were applied to determine the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations from companies, white papers, certified publications, articles by recognized authors, and gold-standard and silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referenced to identify and collect information for the study of the healthcare BPO Market. This research also provided crucial insights about the top players, market classification, and segmentation according to industry trends down to the most granular level, geographic markets, and key developments related to the market. A database of the key industry leaders was also compiled using secondary research.

Primary Research

Extensive primary research was conducted following the acquisition of information concerning the healthcare BPO market scenario through secondary research. Several primary interviews were carried out with market experts from both the demand and supply sides across source and destination geographies. Primary data was gathered through questionnaires, emails, and phone interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, along with key executives from manufacturers, distributors operating in the healthcare BPO market, and key opinion leaders.

Primary interviews aimed to collect insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also facilitated an understanding of various trends related to technology, application, vertical, and region. Stakeholders from the demand side, including customers and end users of infection control products, were interviewed to gain insights into the buyer’s perspective on suppliers, products, their current usage, and the future outlook of their business, which will impact the overall market.

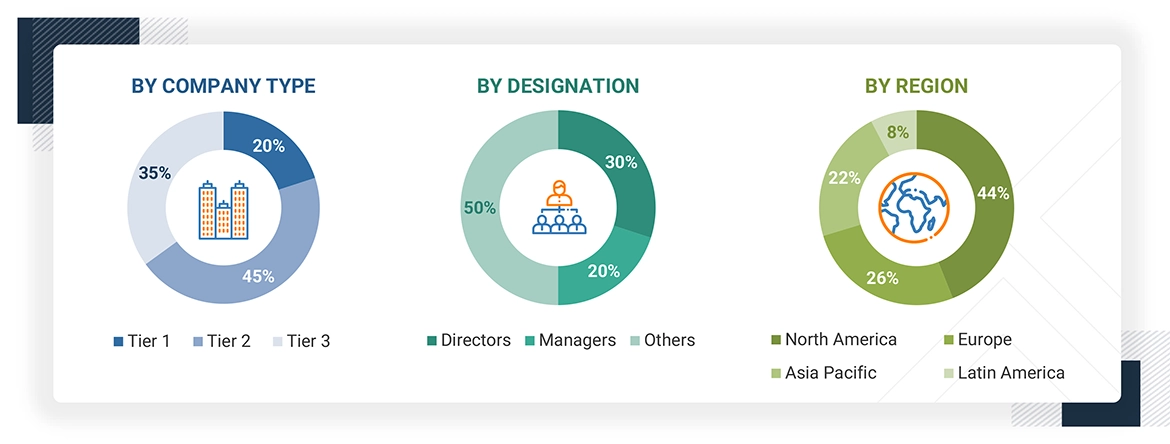

The following is a breakdown of the primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue.

As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a combination of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (evaluation of utilization, adoption, and penetration trends across life science services, payer services, provider services, and regions).

Data Triangulation

After arriving at the overall market size through market size estimation processes, the market was divided into various segments and subsegments. To complete the overall market engineering process and obtain the precise statistics for each market segment and sub-segment, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by analyzing various factors and trends from both the demand and supply sides of the healthcare BPO industry.

Market Definition

Healthcare BPO involves healthcare institutions outsourcing their business operations to external entities. These services aim to reduce administrative costs for healthcare providers while enhancing patient outcomes. By outsourcing ancillary tasks such as medical billing and marketing, healthcare facilities and hospitals can focus on their core responsibilities.

Stakeholders

- Vendors/service providers

- Healthcare service providers

- Health insurance companies

- Business research and consulting service providers

- Technology partners

- Venture capitalists

- Research institutions

Report Objectives

- To define, describe, and forecast the healthcare BPO market based on provider service, payer service, life science service, and region

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall healthcare BPO market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the healthcare BPO market in five main regions (along with their respective key countries): North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To profile the key players and analyze their market share and core competencies.

- To analyze competitive developments such as partnerships, agreements, collaborations, expansions, and acquisitions in the overall healthcare BPO market

- To benchmark players within the healthcare BPO market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offerings

Frequently Asked Questions (FAQ)

Which are the top industry players in the healthcare BPO market?

Prominent players include Accenture plc (Ireland), Cognizant Technology Solutions Corporation (US), Tata Consultancy Services Limited (India), WNS (Holdings) Limited (India), NTT Data Corporation (Japan), UnitedHealth Group (US), Wipro Limited (India), Infosys BPM (India), and Iqvia Holdings, Inc (US), among others.

Which provider services have been included in the healthcare BPO market report?

Revenue cycle management, patient enrolment, patient care, and other provider services.

Which region is expected to grow fastest in the global healthcare BPO market during the forecast period?

The Asia Pacific region is expected to grow at the highest CAGR during the forecast period.

Which payer service segments have been included in the healthcare BPO market report?

Claims management services, member management services, provider management services, human resources (HR) services, integrated front-end services and back-office operations, analytics and fraud management services, product development & business acquisition (PDBA), and billing & account services.

What is the total CAGR expected to be recorded for the healthcare BPO market during 2025–2030?

The market is expected to record a CAGR of 10.7% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Healthcare BPO Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Healthcare BPO Market

Dennis

Mar, 2022

Looking forward to gain more insights on the global Healthcare BPO Industry.

Jerry

Mar, 2022

What are the growth opportunities in Healthcare BPO Market?.

Tyler

Mar, 2022

Can you enlighten us on the end users in Healthcare BPO Market?.