Plant-based Supplements Market

Plant-based Supplements Market by Product Type (Protein, Vitamins & Minerals, Superfood & Functional, Prebiotics & Probiotics, Ready-to-Drink (RTD), Snacks), Supplement Form, Age Group, End-use, Distribution Channel, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The plant-based supplements market is projected to reach USD 42.27 billion by 2030 from USD 27.52 billion in 2025, at a CAGR of 9.0% during the same period. The market is undergoing a significant shift as consumers are adopting plant-centric lifestyles, driving demand for natural, ethically produced supplements that support immunity, digestion, energy, and mental health.

KEY TAKEAWAYS

- North America is expected to account for a 44.0% share of the plant-based supplements market in 2025.

- By product type, the snacking/plant-based protein snacks segment is expected to register the highest CAGR of 9.7%.

- By supplement form, the powder segment is projected to grow at a significant rate from 2025 to 2030.

- By age group, the adults (18–64 years) segment is expected to dominate the market.

- By distribution channel, the online retail segment is expected to dominate the market, growing at a higher CAGR of 9.4%.

- Nestlé, Herbalife Ltd., and H&H Group were identified as some of the star players in the plant-based supplements market, given their strong market share and product footprint.

- Aloha, PlantFusion, and Ritua, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The plant-based supplements market is witnessing significant growth, propelled mainly by the increasing consumer focus on preventive healthcare and wellness, the rising preference for age-related nutritional support & supplements in the older population, and advancements in extraction & formulation technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are new distribution platforms of plant-based supplements, and plant-based supplement product suppliers are clients of plant-based supplement product manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of plant-based supplement product manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing consumer focus on preventive healthcare and wellness

-

Advancements in extraction and formulation technologies

Level

-

High product costs

-

Risk of adulteration or contamination

Level

-

Traction among athletes and fitness enthusiasts

-

Growing demand for safe, allergen-free supplements for children and infants

Level

-

Intense market competition

-

Consumer mistrust of label claims

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing consumer focus on preventive healthcare and wellness

Rising consumer demand for wellness and preventive healthcare is significantly boosting the market for plant-based supplements, including botanicals, functional foods, herbal extracts, and vitamins. These products are considered holistic, safe, and natural for enhancing immunity, digestion, energy, and overall health. The clean-label trend—favoring products without synthetic additives or animal-derived ingredients—is particularly popular among younger, health-conscious consumers and vegetarians.

Restraint: High product costs

High production costs continue to be a significant limitation in the market for plant-based supplements, presenting challenges for both consumers and producers. Plant-based raw materials, especially exotic or high-quality botanicals, often cost more than mainstream ingredients, such as synthetic molecules or animal-based alternatives.

Opportunity: Traction among athletes and fitness enthusiasts

The support of fitness enthusiasts presents a significant growth opportunity for players in the plant-based supplements market. As the sports nutrition industry continues to expand, more fitness enthusiasts turn to plant-based nutrition to enhance their performance, reduce recovery time, and promote long-term health.

Challenge: Intense market competition

Intense competition is a significant challenge for the plant-based supplement industry, as more companies enter the market in response to consumer demand for natural, eco-friendly products. Established players like Herbalife, GNC, and Nestlé’s Garden of Life have strong footholds, while smaller niche brands are emerging.

Plant-based Supplements Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

In February 2022, Nestlé Health Science acquired a majority stake in Orgain, a leading brand in plant-based nutrition. | This strategic investment, made in partnership with Orgain’s founder and private equity firm Butterfly Equity, significantly strengthens Nestlé’s position in the health and wellness sector. |

|

In December 2023, Pharmavite LLC, a US subsidiary of Otsuka Holdings Co., Ltd., announced the acquisition of Bonafide Health, LLC. | The acquisition, finalized on November 30, adds to Pharmavite’s growing lineup of women's health solutions, which already includes brands like Uqora and Equelle. Bonafide offers long-term support for issues ranging from hormonal imbalance to those related to menopausal health. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The plant supplement ecosystem is structured with key players at each stage, from raw material procurement to customer distribution. Raw material suppliers provide essential botanical extracts and natural ingredients, while regulatory authorities ensure that all ingredients and products are healthy, safe, and properly labeled. Product manufacturers then produce final plant-based supplements using these approved ingredients, which are distributed through supermarkets, pharmacies, specialty stores, and online platforms.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Plant-based Supplements Market, By Product Type

Pea protein is highly valued in the plant-based supplement market for its balanced nutrient profile and growing demand for allergen-free products. It is rich in essential amino acids, particularly branched-chain amino acids (BCAAs), which support muscle growth and repair. Being hypoallergenic, pea protein suits those with soy, gluten, or lactose intolerances.

Plant-based Supplements Market, By Distribution Channel

Online purchasing is quickly becoming the preferred method for obtaining plant-based supplements due to its convenience, accessibility, and broader product selection. Consumers can search and compare products from anywhere, benefiting from extensive information, ingredient transparency, and customer reviews. The growth of internet access and digital literacy has fueled e-commerce adoption. Additionally, online retailers often provide subscription plans and auto-replenishment options, helping customers maintain regular supplement routines and encouraging repeat purchases and brand loyalty.

Plant-based Supplements Market, By End-use Application

The sports & performance nutrition segment will dominate the plant-based supplements market due to increasing consumer focus on fitness, endurance, and muscle recovery through clean and sustainable nutrition. Athletes, gym-goers, and active individuals are increasingly choosing plant-based alternatives to avoid allergens, support digestive health, and align with ethical or environmental values. Plant-based protein powders, amino acids, and recovery supplements are favored for their effectiveness and lower environmental impact. The segment also benefits from endorsements by professional athletes and influencers promoting plant-powered performance. Innovations in formulation & taste and the rising demand for non-GMO and vegan-certified products also contribute to market growth.

Plant-based Supplements Market, By Form

The powders segment is projected to dominate the plant-based supplements market due to its versatility, convenience, and cost-effectiveness. Powders offer customizable dosage, easy mixing with various beverages or meals, and longer shelf life than capsules or liquids. Fitness enthusiasts and health-conscious consumers prefer powders for pre- and post-workout routines, especially in protein and superfood blends

Plant-based Supplements Market, By Age Group

Adults (18–64 years) are expected to dominate the plant-based supplements market due to their heightened focus on health, wellness, and preventive care. This demographic is more likely to adopt plant-based diets to manage lifestyle-related conditions such as obesity, diabetes, and cardiovascular diseases. Additionally, adults increasingly seek clean-label, natural supplements that are free from allergens and synthetic additives.

REGION

Asia Pacific market is projected to grow at a competitive rate during the forecast period

The plant-based supplements market in the Asia Pacific region is experiencing significant growth, driven by increased health consciousness, a rising population of vegans and vegetarians, and growing disposable incomes. Countries like China, India, Japan, and Australia are leading the market, where consumers actively seek natural, clean-label supplements for immunity, energy, and overall wellness. Regulatory support for health claims and organic certifications further enhances consumer trust in these products. The market is projected to continue expanding, fueled by innovations in plant-based proteins, vitamins, and pet supplements that align with regional health and environmental priorities.

Plant-based Supplements Market: COMPANY EVALUATION MATRIX

In the plant-based supplements market matrix, Nestlé (Switzerland) (Star) leads with a strong market share and extensive product offerings. Recognizing the growing consumer demand for clean-label, sustainable, and plant-derived nutrition, Nestlé has positioned itself as a key player by offering a diverse portfolio of plant-based products tailored to various health and wellness needs. NAVITAS ORGANICS (Emerging Leader) is gaining visibility with its plant-based supplement offerings, strengthening its position through innovation and niche portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 25.40 BN |

| Market Forecast in 2030 (Value) | USD 42.27 BN |

| Growth Rate | CAGR of 9.0% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Kiloton) |

| Report Coverage | Revenue forecast, market share, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, Rest of the World (Middle East & Africa) |

WHAT IS IN IT FOR YOU: Plant-based Supplements Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Plant-based Supplement Manufacturer |

|

|

| Supplement Form Segment Assessment |

|

|

RECENT DEVELOPMENTS

- December 2023 : US-based Pharmavite, LLC, a subsidiary of Otsuka Holdings (Japan), acquired Bonafide Health, LLC (US). The acquisition expanded Pharmavite's offerings with women's health products; Pharmavite already offers brands such as Ugora and Equelle

- August 2023 : Herbalife (US) launched Herbalife V, a new line of plant-based supplements developed through robust research and innovation. The portfolio includes five USDA Organic, non-GMO, and vegan-certified products: protein shakes with 20 g of plant-based protein, a nutrient-dense greens booster, and specialized formulas for immune and digestive support.

- June 2022 : Jamieson Wellness Inc. bought US company Nutrawise Health & Beauty for USD 210 million to fuel its growth in the US supplement industry. The acquisition was anticipated to boost Jamieson's earnings by strengthening its presence in the largest market globally for vitamins and supplements.

Table of Contents

Methodology

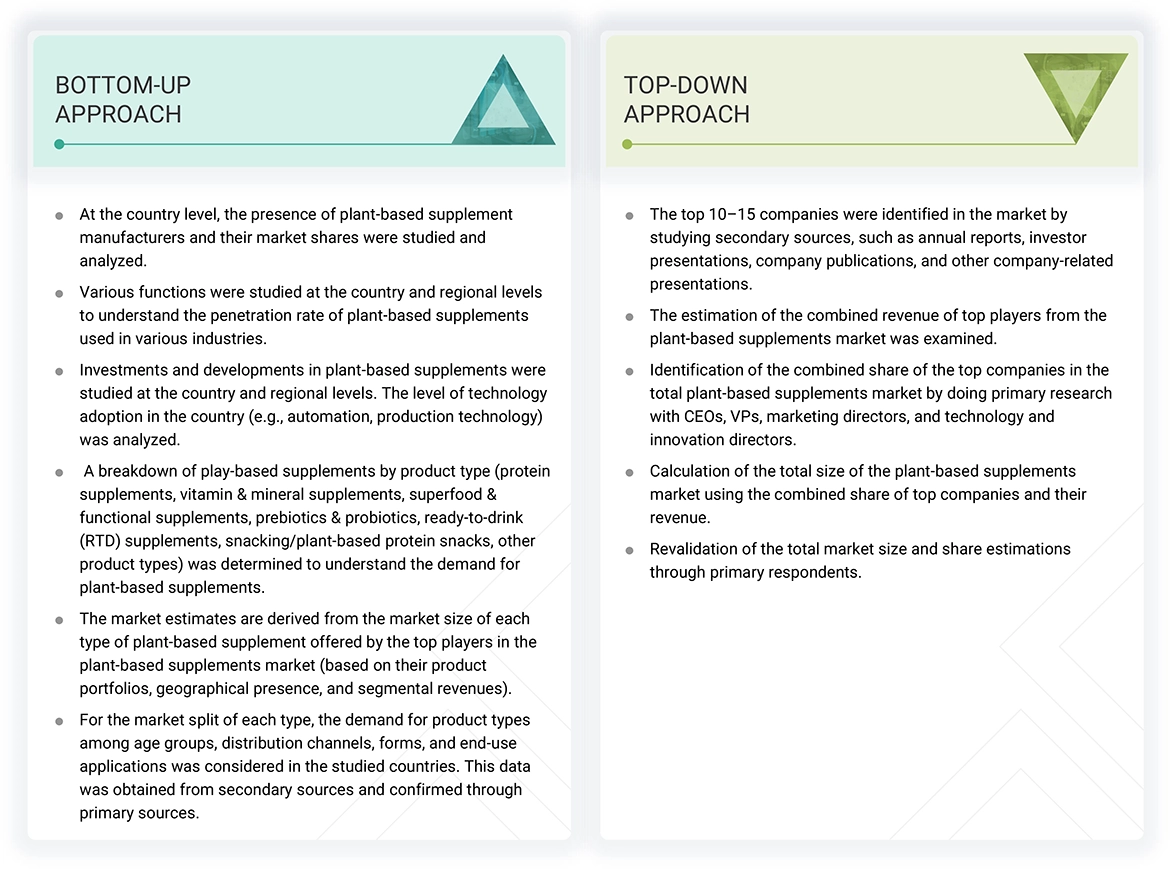

The study involved two major approaches in estimating the current size of the plant-based supplements market. Exhaustive secondary research was done to collect information on the market, product types, age group, distribution channel, form, and end-use application segments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial market study. In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

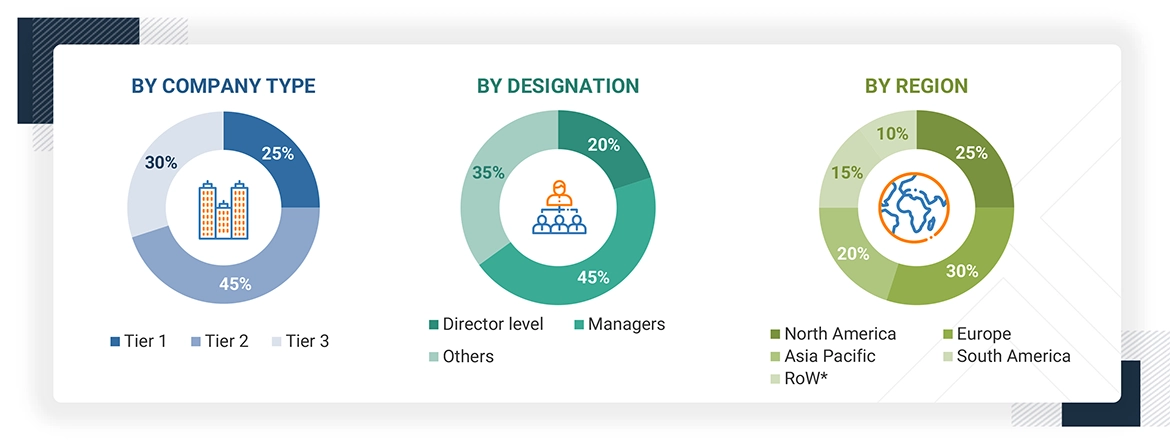

Extensive primary research was conducted after obtaining information regarding the plant-based supplements market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to product type, age group, distribution channel, form, end-use application, and region. Stakeholders from the demand side, such as plant-based supplement manufacturers, were interviewed to understand the buyers’ perspective on the suppliers, products, and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per the

availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million

= revenue = USD 1 billion; Tier 3: Revenue < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Nestlé (Switzerland) |

Product Development Manager |

|

Abbott (US) |

Senior R&D Scientist |

|

Glanbia PLC (Germany) |

Global Marketing Director |

|

Otsuka Holdings Co., Ltd. (Japan) |

Sales Head |

|

Herbalife Ltd. (US) |

Senior Research Scientist |

|

Nutricost (US) |

Business Development Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the plant-based supplements market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Plant-based Supplements Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall plant-based supplements market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to Global Healing Blog, Plant-based supplements are made from fruits, vegetables, nuts, seeds, spices, bark, flowers, leaves, and other botanical ingredients. The exact source depends on which vitamin or mineral is needed. Typically, the process starts with a plant already naturally high in the desired nutrient. From there, manufacturers use various methods to extract the desired nutrients and create a plant-based supplement to provide the full Recommended Dietary Allowance (RDA) of multiple vitamins and minerals.

The NIH's Office of Dietary Supplements (ODS) describes a botanical dietary supplement as a product made from a plant or plant part valued for its medicinal or therapeutic properties, flavor, and/or scent. These products are intended to supplement the diet and are typically taken by mouth in forms such as pills, capsules, tablets, or liquids. To be classified as a dietary supplement, a botanical must meet the definition outlined in the Dietary Supplement Health and Education Act of 1994, including being labeled as a dietary supplement containing one or more dietary ingredients.

Stakeholders

- Plant-based supplements manufacturers

- Contract Supplement Manufacturers/OEMs

- Encapsulation & tablet pressing service providers

- Packaging suppliers

- Plant-based supplements importers and exporters

- Raw material suppliers (Ingredients)

- Plant-based supplements processors

- Plant-based protein supplement processors

-

Regulatory bodies and associations

- Organizations such as the US Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- Food Safety and Standards Authority of India (FSSAI)

- EUROPA

- Codex Alimentarius

- Food Safety Australia and New Zealand (FSANZ)

- ISO and GMP certification bodies

- Government agencies

- Intermediary suppliers, such as traders, distributors, suppliers, and E-commerce platforms of Plant-based supplements

Report Objectives

- To determine and project the size of the plant-based supplements market based on product type, age group, form, end-use application, distribution channel, and regions during the forecast period (2025–2030)

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the plant-based supplements market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe plant-based supplements market into key countries

- Further breakdown of the Rest of Asia Pacific plant-based supplements market into key countries

- Further breakdown of the Rest of South America plant-based supplements market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the plant-based supplements market?

The plant-based supplements market is valued at USD 25.40 billion in 2024 and is projected to reach USD 42.27 billion by 2030, at a CAGR of 9.0% from 2025 to 2030.

Which are the key players in the food & beverage industry plant-based supplement market, and how intense is the competition?

Key players include Nestlé (Switzerland), Abbott (US), Glanbia PLC (Germany), Otsuka Holdings Co., Ltd. (Japan), and Herbalife Ltd. (US). The market competition is intense, with continuous R&D investments, mergers, acquisitions, and innovations in encapsulation technologies.

What are the growth prospects for the plant-based supplements market in the next five years?

The plant-based supplements market is expected to witness robust growth over the next five years, driven by the global shift toward healthier lifestyles and the rising vegan and vegetarian populations. This trend is further supported by growing incidences of lifestyle-related health issues such as obesity, diabetes, and cardiovascular diseases.

What kind of information is provided in the company profiles section?

The company profiles offer valuable information, such as a comprehensive business overview, including details on the company’s various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company’s product offerings, significant milestones, and expert analyst perspectives to further explain the company’s potential.

How is the Asia Pacific region contributing to market growth?

The Asia Pacific region is becoming a key driver of growth for the plant-based supplements market, driven by rising health awareness, urbanization, and increasing disposable incomes. Consumers in countries like China, India, Japan, and South Korea are adopting plant-based diets for cultural, environmental, and health reasons, particularly among younger, urban populations. Government initiatives promoting wellness and a rise in lifestyle-related health issues are boosting demand. Moreover, the growth of e-commerce and mobile health platforms is improving product accessibility, allowing more consumers to explore plant-based options.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Plant-based Supplements Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Plant-based Supplements Market