Preclinical Imaging Market Size, Growth, Share & Trends Analysis

Preclinical Imaging Market by Product (Optical Imaging (Bioluminescence), Nuclear Imaging (PET, SPECT), MRI, Reagents (Luciferins, Infrared Dyes), Software), Application (Onco, Cardio), End User (Pharma, Biotech, Academic, CRO) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global preclinical imaging market, valued at US$3.36 billion in 2024, stood at US$3.53 billion in 2025 and is projected to advance at a resilient CAGR of 4.5% from 2024 to 2030, culminating in a forecasted valuation of US$4.39 billion by the end of the period. The growth of this market is driven by the increasing adoption of advanced in vivo imaging technologies, rising pharmaceutical and biotechnology R&D spending, and the expanding use of non-invasive imaging for drug discovery, biomarker development, and translational research. Additionally, technological advancements in multimodal imaging, the growing availability of research funding, and the rapid expansion of CRO-based preclinical services further support the market’s strong growth trajectory.

KEY TAKEAWAYS

- The North America plant-based supplements market dominated, with a share of 44.0% in 2024.

- By product type, the plant-based protein snacks segment is expected to register the highest CAGR of 9.7%.

- By age group, the children (3-12 years) segment is projected to grow at the fastest rate from 2025 to 2030.

- By supplement form, the powder segment is expected to dominate the market.

- Nestlé, Herbalife Ltd., and H&H Group were identified as Star players in the plant-based supplements market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

- Aloha, PlantFusion, and Ritual have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The preclinical imaging market is experiencing steady growth, driven by increasing demand for high-resolution, non-invasive imaging technologies that accelerate drug discovery, biomarker validation, and translational research. Advancements in modalities such as PET, SPECT, MRI, CT, optical imaging, and multimodal hybrid systems are enhancing sensitivity, quantification accuracy, and in vivo visualization of biological processes. New deals and developments, including collaborations between imaging system manufacturers and pharmaceutical research groups, investments in AI-enabled image analysis, and innovations in compact, high-throughput, and radiation-free imaging platforms, are reshaping the competitive landscape and improving the efficiency of preclinical R&D workflows.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The preclinical imaging market is evolving as pharmaceutical companies, biotech firms, CROs, and academic centers increasingly rely on advanced imaging systems to accelerate drug discovery and translational research. Growing expectations for faster, more quantitative, and reproducible imaging driven by AI-enabled analysis, multimodal integration, high-sensitivity detectors, and automation are reshaping how end users design studies, validate targets, and evaluate therapeutic responses. These shifts directly impact R&D efficiency, decision-making accuracy, and early-stage development timelines, creating strong demand for next-generation preclinical imaging platforms, software, and reagents that deliver higher sensitivity, streamlined workflows, and improved translational relevance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased R&D spending & focus on personalized medicine

-

Technological advancements in molecular imaging

Level

-

Stringent regulations governing preclinical research

-

Significant installation and operational costs associated with preclinical imaging modalities

Level

-

Emerging markets to offer growth opportunities

-

Expansion of radiochemistry and tracer supply networks

Level

-

Technological and procedural limitations associated with standalone preclinical imaging systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased R&D spending & focus on personalized medicine

R&D organizations are under increasing pressure to accelerate drug development and improve translational success. Rising investments in preclinical research, driven by the shift toward personalized and precision medicine, are pushing researchers to adopt high-resolution, quantitative imaging systems that enable deeper biological insights. Advanced modalities such as PET, MRI, CT, and optical imaging help characterize disease mechanisms, assess therapeutic responses, and stratify models with greater accuracy. As pharma, biotech, and academic institutes intensify their focus on targeted therapies and individualized treatment pathways, demand for sophisticated preclinical imaging platforms continues to grow, supporting faster decision-making and more predictive preclinical outcomes.

Restraint: Stringent regulations governing preclinical research

Strict regulations governing preclinical research can act as a restraint for preclinical imaging. Adhering to stringent regulatory requirements can be time-consuming and complex. Researchers must ensure that their imaging protocols and animal handling procedures comply with all relevant legal and ethical standards, which often involves extensive documentation, obtaining multiple approvals, and undergoing periodic inspections. Regulatory compliance can significantly increase the costs of preclinical research. This includes costs associated with obtaining necessary certifications, conducting regular audits, training staff to adhere to regulations, and implementing and maintaining compliance systems. These additional financial burdens can limit the resources available for actual research activities and technology investments. While strict regulations are essential to ensure the ethical treatment of animals and the integrity of research data, they also pose significant challenges and constraints for preclinical imaging. Balancing the need for rigorous oversight with the flexibility to innovate is crucial for advancing preclinical research and imaging technologies.

Opportunity: Emerging markets to offer growth opportunities

Emerging economies across the Asia Pacific, Latin America, and the Middle East are rapidly expanding their biomedical research and pharmaceutical manufacturing capabilities, creating strong demand for advanced preclinical imaging systems. Growing investments in drug discovery, government-backed life science initiatives, and the rise of new CRO hubs are driving wider adoption of MRI, PET, CT, and optical imaging technologies. As research institutions and biotech startups in these regions scale up capabilities for oncology, metabolic, and infectious disease studies, preclinical imaging vendors gain access to a fast-growing customer base. Additionally, the increasing focus on precision medicine and translational research in these markets opens new opportunities for multimodal and AI-enabled imaging platforms, strengthening future growth potential.

Challenge: Technological and procedural limitations associated with standalone preclinical imaging systems

Standalone imaging systems are typically designed for a single imaging modality, such as MRI, PET, or CT. Each modality has its own strengths and limitations, and relying on just one can result in incomplete or less accurate data. For instance, MRI provides excellent soft tissue contrast but lacks the functional information that PET can provide. Combining data from different standalone imaging systems can be technically challenging and time-consuming. Researchers often need to manually align and correlate images from different modalities, which can introduce errors and reduce the overall accuracy of the results. Operating different standalone imaging systems requires specialized training and expertise. Ensuring that staff are proficient in using multiple modalities can be challenging and resource-intensive. A lack of expertise can lead to suboptimal use of the systems and affect the quality of the data collected. Addressing these challenges requires investment in integrated imaging solutions, advanced data management systems, and comprehensive training programs to optimize the use of preclinical imaging technologies.

Preclinical Imaging Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of PET/MRI, PET/SPECT/CT, and micro-MRI systems for oncology, neurology, and cardiovascular preclinical research. | High-resolution multimodal imaging enables the detection of biomarkers earlier, improves disease modeling, and reduces animal usage. |

|

Optical/bioluminescence/fluorescence imaging for tracking tumor burden, cell trafficking, and gene expression in vivo. | Real-time molecular imaging accelerates drug discovery, reduces study timelines, and allows non-terminal longitudinal studies. |

|

In vivo confocal endomicroscopy for preclinical tissue micro-architecture assessment. | Provides cellular-level imaging without the need for invasive biopsy, thereby improving tissue-level validation in drug toxicology. |

|

Ultra-high-frequency ultrasound & photoacoustic imaging for cardiovascular, oncology, and developmental biology. | Enables non-invasive functional imaging (blood flow, oxygenation) with unmatched resolution for small animals. |

|

Preclinical PET/CT and PET/SPECT platforms for high-sensitivity molecular imaging. | High detector sensitivity supports low-dose protocols and cost-efficient radiotracer studies. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The preclinical imaging market ecosystem includes system manufacturers (Bruker, Revvity, FUJIFILM VisualSonics, United Imaging, and Optiscan) that develop high-resolution PET, MRI, CT, and optical imaging platforms for drug discovery and disease modeling. Innovative startups and SMEs (Analytik Jena, IVIM Technology, Hawkcell, and Miltenyi Biotec) contribute niche imaging technologies and software enhancements that accelerate research workflows. Regulatory agencies (FDA, PMDA, NMPA) oversee product approvals, quality standards, and compliance across global markets. End users (Pfizer, Merck, RIKEN, NIH – National Institute of Neurological Disorders and Stroke, Medigen) drive adoption by integrating advanced imaging systems into preclinical studies to improve therapeutic development and translational outcomes. Together, collaboration among vendors, innovators, regulators, and research institutions fuels technological advancement and overall market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Preclinical Imaging Market , By Product

As of 2024, imaging systems held the largest share of the preclinical imaging market. The large share of this segment can be attributed to the rising prevalence of chronic diseases, the growth of the pharmaceutical and biotechnology industries, the expansion of imaging modalities, and the increasing use of imaging in personalized medicine.

Preclinical Imaging Market , By Application

In 2024, the oncology segment registered the fastest growth in the preclinical imaging market. This can be attributed to the rising incidence of cancer and the increasing research and development efforts on models for the development of oncology therapeutics.

Preclinical Imaging Market , By End User

The pharmaceutical & biotechnology companies segment accounted for the largest share of the preclinical imaging market. The large share of this segment can primarily be attributed to the increasing demand in the pharmaceutical and biotech sectors due to the proliferation of emerging and re-emerging infectious diseases. This demand highlights the critical need for advanced preclinical imaging to enhance the understanding of pathogens and to facilitate the development of novel therapeutics and vaccines.

REGION

Asia Pacific to be fastest-growing region in global preclinical imaging market during forecast period

The Asia Pacific preclinical imaging market is expected to record the fastest growth during the forecast period, driven by expanding pharmaceutical and biotechnology R&D, government-backed investments in life-science infrastructure, and the rapid rise of regional CRO hubs. Countries such as China, India, South Korea, Japan, and Singapore are increasingly adopting advanced PET, MRI, CT, and optical imaging systems to support drug discovery, oncology research, and precision medicine initiatives. The growing demand for translational research, large patient populations enabling robust preclinical studies, and strong academic–industry collaborations are further accelerating the adoption of preclinical imaging technologies across the region.

Preclinical Imaging Market: COMPANY EVALUATION MATRIX

In the preclinical imaging market matrix, Bruker (Star) leads with a dominant market share and a broad technology portfolio, supported by its industry-leading MRI, PET, CT, and multimodal imaging platforms that are widely adopted across pharmaceutical, biotechnology, and academic research environments. Mediso (Emerging Leader) is gaining strong momentum with its innovative hybrid imaging systems and flexible modular designs, offering high-performance PET/CT and SPECT/CT solutions tailored to evolving research needs. While Bruker maintains its leadership through scale, technological depth, and global penetration, Mediso is steadily advancing toward the leaders’ quadrant as demand for integrated, high-resolution, and cost-efficient imaging systems continues to rise across translational and preclinical research settings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Bruker Corporation (US)

- Revvity, Inc. (US)

- FUJIFILM VisualSonics, Inc. (Canada)

- Optiscan Imaging Ltd (Australia)

- Mediso Ltd. (Hungary)

- Aspect Imaging Ltd. (US)

- MR Solutions (UK)

- TriFoil Imaging (US)

- MILabs B.V. (Netherlands)

- Cubresa Inc. (Canada)

- Berthold Technologies GmbH & Co. KG (Germany)

- Advanced Molecular Vision, Inc. (UK)

- SOFIE (US)

- Iconeus (France)

- LI-COR Biotech, LLC (US)

- Shanghai United Imaging Healthcare Co., Ltd. (China)

- KUB Technologies (US)

- Medikors Inc. (South Korea)

- Vieworks Co., Ltd. (South Korea)

- AI4R (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.36 BN |

| Market Forecast in 2030 (Value) | USD 4.39 BN |

| Growth Rate | 4.5% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Preclinical Imaging Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping |

|

|

| Market Entry & Growth Strategy | Regional analysis of preclinical research spending, imaging technology adoption, modality preference (e.g., optical vs. PET/CT), academic vs. industry procurement trends, grant/funding drivers, and competitive intensity across North America, Europe, and APAC research clusters | Reduces go-to-market risk, accelerates adoption strategies through localized demand mapping, and supports expansion planning into emerging high-research-output regions and academic networks |

| Regulatory & Operational Risk Analysis |

|

Strengthens regulatory readiness, enhances operational credibility for GLP-compliant imaging studies, and ensures alignment with evolving preclinical study governance and radiological safety mandates |

RECENT DEVELOPMENTS

- September 2025 : Revvity launched its Synergy AI software to unify preclinical in vivo imaging analysis across optical, microCT, ultrasound, and other modalities. Using AI-driven segmentation and ROI quantification, it reduces manual effort, improves reproducibility, and increases throughput helping researchers derive faster, more consistent insights.

- April 2025 : Bruker Corporation introduced a benchtop live single-cell functional analysis system using OEP microfluidics and machine-learning automation. It enables linking live-cell functional assays to downstream genomic/proteomic analysis, lowering cost-of-entry for translational labs in immuno-oncology, cell-therapy, and infectious-disease research.

- May 2025 : MR Solutions collaborated with Houston Methodist and reported the installation of the world’s first 7 T SPECT/MR system with a PET insert at Houston Methodist, enhancing their preclinical modality portfolio and demonstrating leadership in multimodal high-field imaging.

Table of Contents

- 4.1 INTRODUCTION

-

4.2 MARKET DYNAMICSDRIVERS- Technological advancements in molecular imaging- Rising need for translational imaging biomarkers- Increasing R&D spending and focus on personalized medicine- Increased number of global clinical trials dataRESTRAINTS- Stringent regulations governing preclinical research- Significant installation and operational costs associated with preclinical imaging modalitiesOPPORTUNITIES- Emerging markets to offer growth opportunities- Expansion of radiochemistry and tracer supply networksCHALLENGES- Technological and procedural limitations associated with standalone preclinical imaging systems

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNTIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.1 PORTER’S FIVE FORCES ANALYSIS

-

5.2 MACROECONOMIC OUTLOOKINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN GLOBAL HEALTHCARE IT INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGION (2022-2025)AVERAGE SELLING PRICE TREND, BY PRODUCT (2022-2025)

-

5.7 TRADE ANALYSISIMPORT SCENARIO (HSN CODE 901813)EXPORT SCENARIO (HSN CODE 901813)

- 5.8 KEY CONFERENCES AND EVENTS, 2025–2027

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

-

5.12 IMPACT OF 2025 US TARIFF – PRECLINICAL IMAGINIG MARKETINTRODUCTIONKEY TARIFF RATESPRICE IMPACT ANALYSISIMPACT ON COUNTRIES/REGIONS- US- EUROPE- APACIMPACT ON END-USE INDUSTRIES

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

-

6.6 IMPACT OF AI/GEN AI ON PRECLINICAL IMAGING MARKETTOP USE CASES AND MARKET POTENTIALBEST PRACTICES IN PRECLINICAL IMAGINGCASE STUDIES OF AI IMPLEMENTATION IN THE PRECLINICAL IMAGING MARKETINTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERSCLIENTS’ READINESS TO ADOPT GENERATIVE AI IN PRECLINICAL IMAGING MARKET

-

7.1 REGIONAL REGULATIONS AND COMPLIANCEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSINDUSTRY STANDARDS

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 IMAGING SYSTEMSOPTICAL IMAGING SYSTEMS- BIOLUMINESCENCE IMAGING SYSTEMS- FLUORESCENCE IMAGING SYSTEM- OTHER OPTICAL IMAGING SYSTEMSNUCLEAR IMAGING SYSTEMS- MICRO-PET IMAGING SYSTEMS- MICRO-SPECT IMAGING SYSTEMS- TRIMODALITY (SPECT/PET/CT) IMAGING SYSTEMSMICRO-MRI SYSTEMSMICRO-ULTRASOUND SYSTEMSMICRO-CT SYSTEMSPHOTOACOUSTIC IMAGING SYSTEMSMAGNETIC PARTICLE IMAGING SYSTEMS

-

9.3 REAGENTSOPTICAL IMAGING REAGENTS- BIOLUMINESCENCE IMAGING REAGENTS- FLUORESCENCE IMAGING REAGENTSNUCLEAR IMAGING REAGENTS- PET TRACERS- SPECT PROBESMRI CONTRAST AGENTS- GADOLINIUM-BASED CONTRAST AGENTS- IRON-BASED CONTRAST AGENTS- MANGANESE-BASED CONTRAST AGENTSULTRASOUND CONTRAST AGENTSCT CONTRAST AGENTS- IODINE-BASED CONTRAST AGENTS- BARIUM-BASED CONTRAST AGENTS- GOLD NANOPARTICLES- GASTROGRAFIN-BASED CONTRAST AGENTS

- 9.4 ACCESSORIES & ANCILLARY EQUIPMENT

- 9.5 SOFTWARE

- 10.1 INTRODUCTION

- 10.2 ONCOLOGY

- 10.3 CARDIOLOGY

- 10.4 NEUROLOGY

- 10.5 INFECTIOUS DISEASES

- 10.6 IMMUNOLOGY & INFLAMMATION

- 10.7 OTHER APPLICATIONS

- 11.1 INTRODUCTION

- 11.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 11.3 ACADEMIC & RESEARCH CENTERS

- 11.4 CONTRACT RESEARCH ORGANIZATION (CRO)

- 11.5 OTHER END USERS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAUSCANADA

-

12.3 EUROPEGERMANYFRANCEUKITALYSPAINREST OF EUROPE

-

12.4 ASIA PACIFICCHINAJAPANINDIAAUSTRALIASOUTH KOREAREST OF ASIA PACIFIC

-

12.5 LATIN AMERICABRAZILMEXICOREST OF LATIN AMERICA

-

12.6 MIDDLE EAST & AFRICAGCC COUNTRIES- Saudi Arabia- UAE- Rest of GCC countriesSOUTH AFRICAREST OF MIDDLE EAST & AFRICA

- 13.1 OVERVIEW

- 13.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS , 2024

- 13.5 BRAND/PRODUCT COMPARISON

-

13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company footprint- Region footprint- Product footprint- Application footprint- End-user industry footprint

-

13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

-

13.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONS

-

14.1 KEY PLAYERSBRUKER CORPORATIONREVVITY, INC.OPTISCAN IMAGING LTDMEDISO LTD.ASPECT IMAGING LTD.MR SOLUTIONSTRIFOIL IMAGING LLCMILABS B.V.CUBRESA INC.BERTHOLD TECHNOLOGIES GMBH & CO. KGADVANCED MOLECULAR VISION, INC.SOFIEICONEUSFUJIFILM VISUALSONICS, INC.LI-COR BIOTECH, LLCSHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.KUB TECHNOLOGIES (KUBTEC)MEDIKORS INC.VIEWORKS CO., LTD.AI4R SAS

-

14.2 OTHER PLAYERSANALYTIK JENA GMBH + CO. KGIMAVITA S.A.S.IVIM TECHNOLOGY CORP.HAWKCELL SASMILTENYI BIOTEC

-

15.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key primary participants- Breakdown of primary interviews- Key industry insights

-

15.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACHTOP-DOWN APPROACHBASE NUMBER CALCULATION

-

15.3 MARKET FORECAST APPROACHSUPPLY SIDEDEMAND SIDE

- 15.4 DATA TRIANGULATION

- 15.5 FACTOR ANALYSIS

- 15.6 RESEARCH ASSUMPTIONS

- 15.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

Methodology

This market research study utilized extensive secondary sources, directories, and databases to identify and collect information relevant to this technical, market-oriented, and financial analysis of the preclinical imaging market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to gather and verify critical qualitative and quantitative information, as well as to assess market prospects. The size of the preclinical imaging market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was employed to identify and collect information relevant to the comprehensive, technical, market-oriented, and commercial study of the preclinical imaging market. It was also used to obtain important information about key players, market classification, and segmentation according to industry trends, as well as key developments related to market and technology perspectives, down to the most detailed level. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring a basic understanding of the global preclinical imaging market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (hospital personnel, department heads, hospital directors, corporate personnel) and supply side (such as C-level and D-level executives, technology experts, software developers, marketing and sales managers, among others) across five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

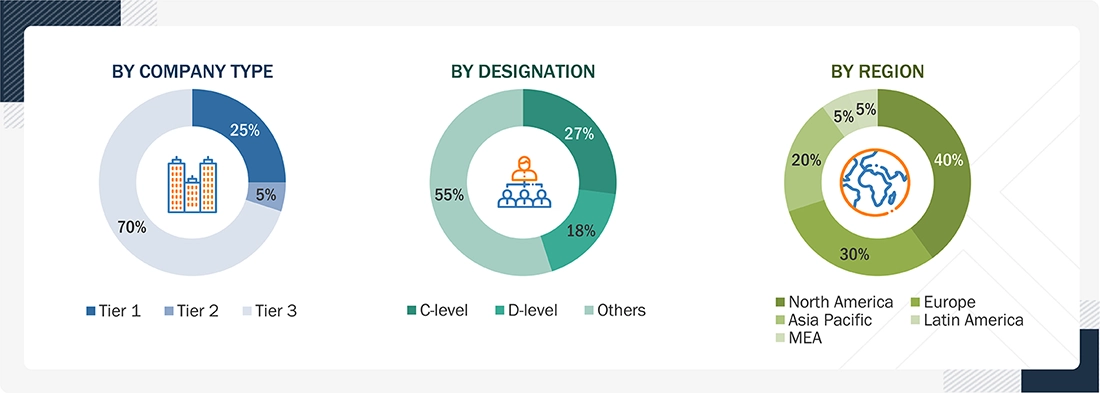

Breakdown of Primary Interviews

Note: Tiers are defined based on the total revenues of companies. As of 2024, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global preclinical imaging market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the global preclinical imaging market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports and regulatory filings, data books of major market players, and interviews with industry experts for detailed market insights.

- All percentage shares, splits, and breakdowns for the global preclinical imaging market were determined by using secondary sources and verified through primary sources.

- All key macroindicators affecting the revenue growth of market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs and analysis and presented in this report.

Global Preclinical Imaging Market: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the preclinical imaging market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the preclinical imaging market.

Market Definition

Preclinical imaging involves the application of molecular imaging for the assessment of anatomical, physiological, and functional parameters in live animal models during preclinical studies. Preclinical imaging systems and reagents are utilized to visualize living animals in order to assess the safety and efficacy of novel drug procedures or other medical treatments for human applications. During preclinical studies, a variety of different imaging modalities are utilized, such as optical imaging systems, nuclear imaging systems (micro-PET and micro-SPECT), micro-MRI, micro-ultrasound systems, and micro-CT imaging systems.

Stakeholders

- Preclinical Imaging Instrument Manufacturers, Suppliers, and Imaging Software Providers

- Pharmaceutical and Biotechnology Companies

- Preclinical Imaging Reagent Manufacturers and Suppliers

- Contract Research Organizations (CROs)

- Research and Development (R&D) Companies

- Government Research Laboratories

- Independent Research Laboratories

- Government and Independent Regulatory Authorities

- Medical Research Laboratories

- Academic Medical Institutes and Universities

- Market Research and Consulting Service Providers

Report Objectives

- To define, describe, and forecast the preclinical imaging market by product type, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze the opportunities in the market for stakeholders and provide details of

the competitive landscape for preclinical imaging market leaders - To profile the key players in the market and comprehensively analyze their market shares and core competencies

-

To forecast the size of the market segments with respect to five main regions:

North America, the Asia Pacific, Europe, Latin America, and the Middle East & Africa - To track and analyze competitive developments, such as partnerships, acquisitions, product launches & approvals, and expansions

- To benchmark players within the preclinical imaging market using the Competitive Evaluation Matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Preclinical Imaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Preclinical Imaging Market